Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - GENWORTH FINANCIAL INC | d620007dex993.htm |

| EX-99.2 - EX-99.2 - GENWORTH FINANCIAL INC | d620007dex992.htm |

| 8-K - 8-K - GENWORTH FINANCIAL INC | d620007d8k.htm |

Exhibit 99.1

Consent Solicitation Statement

September 14, 2018

GENWORTH HOLDINGS, INC.

Solicitation of Consents Relating to the Indenture Governing its Notes set forth below

| Outstanding Principal Amount |

Description of Securities |

CUSIP Number | ||

| $397,000,000 | 7.700% Senior Notes due 2020 (the “2020 Notes”) | 37247DAM8 | ||

| $381,703,000 | 7.20% Senior Notes due 2021 (the “February 2021 Notes”) | 37247DAN6 | ||

| $698,319,000 | 7.625% Senior Notes due 2021 (the “September 2021 Notes”) | 37247DAP1 | ||

| $400,000,000 | 4.900% Senior Notes due 2023 (the “2023 Notes”) | 372491AA8 | ||

| $400,000,000 | 4.800% Senior Notes due 2024 (the “2024 Notes”) | 372491AB6 | ||

| $300,000,000 | 6.500% Senior Notes due 2034 (the “2034 Notes”) | 37247DAB2 |

| • | The purpose of this Consent Solicitation is to eliminate the possibility that a regulatory action directed at a U.S. life insurance subsidiary of the Company (which we currently do not anticipate) would constitute an event of default with respect to the Notes and thereby have an overall negative impact on the Company that could be viewed negatively by China Oceanwide Holdings Group Co., Ltd. in connection with its pending acquisition of the Company. Accordingly, now that the decision has been made not to “unstack” our U.S. life insurance subsidiary from one of our long-term care insurance subsidiaries, the Consent Solicitation would clarify that our U.S. life insurance subsidiary (known as Genworth Life and Annuity Insurance Company) is included in the class of subsidiaries which was previously removed from bankruptcy, insolvency and similar events of default with respect to the Notes. |

| • | The Proposed Amendments do not modify principal or interest payable on the Notes or the guarantee of the Notes by Genworth Financial. |

| • | Holders who consent to the Proposed Amendments will be eligible to receive a Consent Fee of $2.50 per $1,000 in principal amount of notes, subject to the conditions described in this Statement. |

| • | Holders who do not consent to the Proposed Amendments will not receive a Consent Fee, even if this Consent Solicitation is successful, but will still be bound by the terms of the Proposed Amendments. |

| • | In order to participate in this Consent Solicitation, a beneficial owner must promptly instruct its broker, dealer, custodian or other intermediary to deliver a Consent in accordance with the consent procedures described herein. |

| • | You must act in advance of the Expiration Time, which is 5:00 p.m., New York City time, on October 3, 2018 (unless extended or terminated by the Company), if you intend to participate. Your broker, dealer, custodian or other intermediary will require an earlier deadline for you to give it instructions. |

| • | Any requests for assistance in submitting a Consent or requests for additional copies of this document or other related documents should be directed to the Information Agent at the address or telephone numbers set forth on the back cover page of this document. |

| • | Any questions concerning the terms of this Consent Solicitation should be directed to the Solicitation Agent at the telephone number set forth on the back cover page of this document. |

| • | The Solicitation Agent for the Consent Solicitation is: |

BofA Merrill Lynch

THIS CONSENT SOLICITATION WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON OCTOBER 3, 2018 (SUCH DATE AND TIME, AS THE SAME MAY BE EXTENDED OR EARLIER TERMINATED, WITH RESPECT TO ANY OR ALL SERIES OF NOTES, THE “EXPIRATION TIME”). HOLDERS (AS DEFINED BELOW) MUST VALIDLY DELIVER CONSENTS AT OR BEFORE THE EXPIRATION TIME IN ORDER TO BE ELIGIBLE TO RECEIVE THE CONSENT FEE (AS DEFINED BELOW). CONSENTS MAY BE REVOKED AT OR PRIOR TO THE EARLIER OF THE EFFECTIVE DATE (AS DEFINED BELOW) AND THE EXPIRATION TIME. GENWORTH HOLDINGS, INC. MAY, IN ITS SOLE DISCRETION, TERMINATE, EXTEND OR AMEND THE CONSENT SOLICITATION AT ANY TIME.

Genworth Holdings, Inc. (“Genworth Holdings” or the “Company”), a wholly owned subsidiary of Genworth Financial, Inc. (“Genworth Financial” and, together with its consolidated subsidiaries, “Genworth”), is proposing to amend the indenture, dated as of June 15, 2004, between Genworth Holdings and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee”), as successor to JP Morgan Chase Bank, N.A., as supplemented from time to time (as so supplemented, the “Indenture”), with respect to the Company’s 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes, 2024 Notes and 2034 Notes (collectively, the “Notes”).

Specifically, we propose to confirm the Company’s position that Genworth Life and Annuity Insurance Company and the subsidiaries of Genworth Life Insurance Company, Genworth Life and Annuity Insurance Company and Genworth Life Insurance Company of New York are excluded from the class of subsidiaries for which a bankruptcy, insolvency or other similar proceeding would result in an event of default under the Indenture (the “Proposed Amendments”).

Upon the Proposed Amendments in respect of a series of Notes becoming operative, the Company will pay the Consent Fee (as defined below) to the Holders (as defined below) of Notes of such series who have delivered a valid Consent (as defined below) (not previously revoked) at or prior to the Expiration Time. The Consent Fee will be a cash payment of $2.50 per $1,000 principal amount of such series of Notes for which Consents have been delivered by such Holder (the “Consent Fee”).

In connection with the Proposed Amendments described above and herein, the Company is furnishing this Consent Solicitation Statement (as it may be amended or supplemented from time to time, the “Statement”).

The Proposed Amendments are being sought in order to eliminate the possibility that a regulatory action directed at a U.S. life insurance subsidiary of the Company (which we currently do not anticipate) would constitute an event of default with respect to the Notes and thereby have an overall negative impact on the Company that would be viewed negatively by China Oceanwide Holdings Group Co., Ltd. (“China Oceanwide”) in connection with its pending acquisition of the Company. Accordingly, now that the decision has been made not to “unstack” our U.S. life insurance subsidiary from one of our long-term care insurance subsidiaries, the Consent Solicitation would clarify that our U.S. life insurance subsidiary (known as Genworth Life and Annuity Insurance Company) is included in the class of subsidiaries which was previously removed from bankruptcy, insolvency and similar events of default with respect to the Notes.

For a further discussion and a description of certain other considerations applicable to Holders, see the sections entitled “Questions and Answers About the Proposed Amendments,” “Summary” and “Certain Significant Considerations.”

By this Statement, the Company is soliciting (the “Consent Solicitation”) consents (the “Consents”) from holders of each series of Notes (each, a “Holder” and, collectively, the “Holders”) to approve the Proposed Amendments to the Indenture relating to such series.

If Notes are registered in the name of a broker, dealer, commercial bank, trust company or other intermediary and the ultimate beneficial owner of such Notes (the “Beneficial Owner”) wishes to consent to the Proposed Amendments, such Beneficial Owner must promptly contact and instruct such registered Holder to deliver a Consent on the Beneficial Owner’s behalf. The Depository Trust Company (“DTC”) has confirmed that the Consent Solicitation is eligible for DTC’s Automated Tender Offer Program (“ATOP”). Accordingly, consenting participants in DTC (“DTC Participants”) must electronically deliver a Consent by causing DTC to temporarily transfer and surrender their Notes to the Tabulation Agent in accordance with DTC’s ATOP procedures described herein. See “The Solicitation—How to Consent” for more information.

The Company intends to execute a new supplemental indenture to the Indenture in respect of each series of Notes upon obtaining the Requisite Consents (as defined below) and satisfaction of other conditions as set forth herein (each new supplemental indenture, a “New Supplemental Indenture” and, together, the “New Supplemental Indentures”). The date on which a New Supplemental Indenture is executed is referred to as the “Effective Date” with respect to such Supplemental Indenture. However, following execution and delivery of a New Supplemental Indenture in respect of a series of Notes, the Proposed Amendments contained therein will not become operative and the Consent Fee and the Soliciting Broker Fee (as defined below) in respect of a series of Notes, will not become payable unless the Additional Conditions (as defined below), including receipt of the Requisite Consents with respect to each other series of Notes, described in this Statement have been satisfied or waived.

The consummation of the Consent Solicitation in respect of a series of Notes is conditioned upon (i) receipt by the Tabulation Agent (as defined below) at or before the Expiration Time of the Requisite Consents (as defined below) with respect to such series of Notes, (ii) execution by the Company, Genworth Financial and the Trustee of the New Supplemental Indenture embodying the Proposed Amendments to the Indenture relating to such series of Notes and (iii) satisfaction of the General Conditions (as defined herein) upon the Effective Date. A New Supplemental Indenture becoming operative is conditioned upon (i) execution by the Company, Genworth Financial and the Trustee of the New Supplemental Indenture embodying the Proposed Amendments to the Indenture relating to each other series of Notes and (ii) satisfaction of the General Conditions upon such operative date (the “Additional Conditions”).

Holders of a series of Notes for which no Consent is delivered will not receive any Consent Fee, even though the Proposed Amendments, if they become operative with respect to such series of Notes, will be applicable and binding with respect to all Holders of such series of Notes and their transferees.

With respect to any Consent in respect of a series of Notes accepted by the Company, the Company will also pay the relevant soliciting broker a fee of $2.50 per $1,000 principal amount of Notes of such series to which the Consent relates, provided that such fee will only be paid with respect to the first $200,000 aggregate principal amount of each series of Notes for which a Consent is delivered by any individual Holder (the “Soliciting Broker Fee”). The payment of the Consent Fee and the Soliciting Broker Fee with respect to a series of Notes is subject to receipt of the Requisite Consents (as defined below) and satisfaction of the other conditions to the Consent Solicitation.

Notwithstanding anything to the contrary contained herein or in any other document related to the Consent Solicitation, the Company reserves the right, in its sole discretion, in respect of each and any series of Notes, to (i) terminate the Consent Solicitation for any reason, (ii) extend the Expiration Time or (iii) amend the terms of the Consent Solicitation, including to waive any of the conditions to the Consent Solicitation, with respect to any series of Notes.

The Company has appointed Global Bondholder Services Corporation as tabulation agent (the “Tabulation Agent”) and as information agent (the “Information Agent”) with respect to the Consent Solicitation. None of the Trustee, the Solicitation Agent (as defined below), the Information Agent or the Tabulation Agent makes any recommendation as to whether or not Holders should deliver Consents in response to the Consent Solicitation.

TABLE OF CONTENTS

| Page | ||||

| QUESTIONS AND ANSWERS ABOUT THE PROPOSED AMENDMENTS |

ii | |||

| IMPORTANT NOTICE |

vi | |||

| SUMMARY |

1 | |||

| PROPOSED AMENDMENTS TO THE INDENTURE |

4 | |||

| CERTAIN SIGNIFICANT CONSIDERATIONS |

7 | |||

| THE SOLICITATION |

9 | |||

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS |

14 | |||

| TABULATION AGENT AND INFORMATION AGENT |

22 | |||

| SOLICITATION AGENT |

22 | |||

| FEES AND EXPENSES |

23 | |||

| MISCELLANEOUS |

23 | |||

| STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

23 | |||

| WHERE YOU CAN FIND MORE INFORMATION |

23 | |||

| CONSENT SOLICITATION STATEMENT |

25 | |||

i

QUESTIONS AND ANSWERS ABOUT THE PROPOSED AMENDMENTS

The following are some questions and answers regarding the Proposed Amendments. This section does not contain all of the information that may be important to you. You should carefully read this Statement and any information incorporated by reference herein to fully understand the terms of the Proposed Amendments, as well as the other considerations that are important to you in deciding whether to deliver your Consent. All capitalized terms used but not defined in this section are defined in other sections of this Statement.

| Q: | What are the Proposed Amendments? |

| A: | The Proposed Amendments are changes that we propose to make to the Indenture that governs the terms of the Notes. Specifically, the Proposed Amendments will clarify that Genworth Life and Annuity Insurance Company and the subsidiaries of Genworth Life Insurance Company, Genworth Life and Annuity Insurance Company and Genworth Life Insurance Company of New York are excluded from the class of subsidiaries for which a bankruptcy, insolvency or other similar proceeding would result in an event of default under the Indenture. |

| Q: | How do I consent to the Proposed Amendments? |

| A: | By instructing your custodian (i.e., your broker) to deliver a Consent to the Proposed Amendments to the Tabulation Agent on your behalf, in accordance with the consent procedures set forth in the section of the Statement entitled “The Solicitation—How to Consent,” you will be deemed to have validly consented to the Proposed Amendments. |

| Q: | Who do I call if I have any questions about how to deliver a Consent or any other questions relating to the Consent Solicitation or the Proposed Amendments? |

| A: | Questions concerning the terms of the Consent Solicitation should be directed to the Solicitation Agent by telephone at (888) 292-0070 or collect (980) 388-4813. Requests for assistance in delivering Consents or requests for additional copies of this Statement or other related documents should be directed to the Information Agent by telephone at (212) 430-3774 (Banks and Brokers) or (866) 470-3900 (toll free), in writing at 65 Broadway – Suite 404, New York, New York 10006 and via email at contact@gbsc-usa.com. While these parties will be available to answer questions about the Consent Solicitation, none of the Trustee, the Solicitation Agent, the Information Agent or the Tabulation Agent will make any recommendation as to whether or not Holders should deliver Consents in response to the Consent Solicitation. |

| Q: | What changes will be made to the payment terms under the Notes if the Proposed Amendments become operative? |

| A: | None. The changes effected by the Proposed Amendments do not alter the Company’s contractual obligation to pay the principal of or interest on the Notes or the guarantee of the Notes by Genworth Financial. |

| Q: | What will I receive if I consent to the Proposed Amendments? |

| A: | If you validly consent to the Proposed Amendments to a series of Notes, and the related New Supplemental Indenture is executed and the Proposed Amendments with respect to such series of Notes become operative, you will receive an aggregate cash payment based on a Consent Fee of $2.50 per $1,000 principal amount of such series of Notes for which Consents were properly delivered by you. The Consent Fee will be paid promptly following the satisfaction or waiver of all of the conditions described herein, at which time the New Supplemental Indenture will become operative with respect to such series. |

| Q: | What vote is needed in order for the Proposed Amendments to be operative? |

| A: | In accordance with the terms of the Indenture, in order for a New Supplemental Indenture to be executed with respect to a series of Notes, valid and unrevoked Consents must be received from Holders of a majority in aggregate principal amount of such series of Notes then outstanding that is affected by such New Supplemental |

ii

| Indenture (the “Requisite Consents”). If the Requisite Consents are received with respect to such series of Notes and all other series of Notes, then the Proposed Amendments to the Indenture governing such series of Notes will become operative with respect to such series of Notes, but only upon satisfaction or waiver of all other conditions described in this Statement. If the Requisite Consents are not received with respect to a series of Notes, or other conditions described in this Statement are not satisfied or waived with respect to such series of Notes, the Proposed Amendments to the Indenture will not become operative with respect to such series of Notes. A New Supplemental Indenture becoming operative is conditioned upon receiving the Requisite Consents with respect to all series of Notes. However, the Company reserves the right to waive this condition. |

| Q: | In addition to receiving the necessary Consents from Holders, what are the other conditions to the Proposed Amendments? |

| A: | The conditions to the Proposed Amendments becoming operative and the Consent Fee becoming payable, in each case in respect of a series of Notes, are described in this Statement in “The Solicitation—Conditions to the Consent Solicitation and Payment of the Consent Fee” and include receipt of the Requisite Consents for each other series of Notes, the execution by the Company, Genworth Financial and the Trustee of the related New Supplemental Indenture and the absence of any legal impediment to effectiveness in respect of such series of Notes. In addition, the Company reserves the right, in its sole discretion, to terminate or modify the Consent Solicitation, including waiving the conditions to the Proposed Amendments becoming operative, for any reason. |

| Q: | What happens if I consent to the Proposed Amendments in respect of a series of Notes and the Requisite Consents for such series are not received or other conditions to the Proposed Amendments are not met? |

| A: | If you consent to the Proposed Amendments in respect of a series of Notes and the Company does not receive the Requisite Consents with respect to such series of Notes by the Expiration Time, or if the Consent Solicitation is terminated before the Expiration Time, or if other conditions to the Proposed Amendments are not met or waived by the Company, then your Consent will have no force and effect and no Consent Fee or Soliciting Broker Fee will be paid with respect to such Consent. |

| Q: | What if I do not consent to the Proposed Amendments and the Proposed Amendments become operative? |

| A: | Upon the execution of a New Supplemental Indenture and the Proposed Amendments contained therein becoming operative in respect of a series of Notes, all Holders of such series of Notes will be bound by the terms of such New Supplemental Indenture, even if they did not deliver their Consent. If you do not deliver a valid Consent, you will not receive a Consent Fee. |

| Q: | When is the Effective Date of the Proposed Amendments expected to occur? |

| A: | The date on which a New Supplemental Indenture with respect to a series of Notes is executed is referred to as the “Effective Date.” The Company intends to execute a New Supplemental Indenture with respect to a series of Notes promptly following the Expiration Time or, if earlier, the date upon which Requisite Consents have been received, provided that the other conditions to be satisfied as of the Effective Date have been satisfied or waived. However, the New Supplemental Indenture, and the Proposed Amendments contained therein, will not become operative and the Consent Fee and Soliciting Broker Fee will not become payable unless all conditions to the Consent Solicitation and payment of the Consent Fee described in this Statement are satisfied or waived. |

| Q: | How long will the solicitation for Consents remain open? |

| A: | The Consent Solicitation will remain open until the Expiration Time, which is defined with respect to any series of Notes as 5:00 p.m. New York City time on October 3, 2018, unless earlier terminated or extended with respect to such series. |

iii

| Q: | Can I revoke my Consent to the Proposed Amendments once it is submitted? |

| A: | You may revoke your Consent if the Tabulation Agent receives your notice of revocation of Consent through ATOP at or prior to the earlier of the Effective Date and Expiration Time in accordance with the procedures set forth in “The Solicitation—Revocation of Consents.” A Holder who has delivered a revocation at any time prior to the Expiration Time (or if earlier, the Effective Date) may thereafter deliver a new Consent until the Expiration Time in accordance with the procedures described in this Statement. |

| Q: | Can the Company terminate or modify the Consent Solicitation? |

| A: | Yes, notwithstanding anything to the contrary contained herein or in any other document related to the Consent Solicitation, the Company reserves the right, in its sole discretion to, in respect of each and any series of Notes (i) terminate the Consent Solicitation for any reason, (ii) extend the Expiration Time or (iii) amend the terms of the Consent Solicitation, including to waive any of the conditions to the Consent Solicitation, with respect to any series of Notes. Should the Company terminate the Consent Solicitation, any Holders who previously submitted their Consent would not receive a Consent Fee. |

| Q: | What risks should I consider in deciding whether to consent to the Proposed Amendments? |

| A: | In deciding whether to consent to the Proposed Amendments, you should carefully consider the discussion of risks and uncertainties affecting Genworth Financial, Genworth Holdings and their respective subsidiaries described in the section entitled “Statement Regarding Forward-Looking Statements,” which do not represent the only risks that we or you may face. Additional risks and uncertainties not currently known to us, or that we currently deem immaterial, may also affect your decision whether to consent to the Proposed Amendments. You should further review the section of this Statement entitled “Certain Significant Considerations” for a discussion of certain factors that you should consider in evaluating the consequences of the adoption of the Proposed Amendments. You should also review the section of this Statement entitled “Where You Can Find More Information” and the documents referenced therein. You should also carefully consider the other information included in this Statement for other risks that may affect you. |

| Q: | What tax consequences should I be aware of if I consent to the Proposed Amendments? |

| A: | 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes. If you are a consenting holder of the 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes and the Consent Solicitation is successful, on the Effective Date, your Notes of such series will be treated as exchanged for “new” Notes of such series for U.S. federal income tax purposes. Such exchange, however, should qualify as a tax-free recapitalization, and therefore you should not recognize any loss, and generally you should only recognize gain equal to the lesser of (i) any gain you have realized in the deemed exchange, and (ii) the amount of Consent Fee you receive. |

Based upon current trading prices, we expect that each of the “new” 2023 Notes and 2024 Notes will be treated as issued with original issue discount (“OID”), and that each of the “new” 2020 Notes, February 2021 Notes and September 2021 Notes will be treated as issued with amortizable bond premium. The terms and denominations of the “new” notes will be identical to the terms and denominations of the old notes. See “Certain U.S. Federal Income Tax Considerations.”

The “new” 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes will be identified by a new and separate CUSIP number for their life because, as a result of being treated as issued with OID, they will not be fungible for U.S. federal income tax purposes with old 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes with respect to which the Holders did not consent and receive the Consent Fee.

2034 Notes. We intend to take the position that the 2034 Notes will not be treated as exchanged for “new” Notes as a result of the adoption of either the Proposed Amendments or the payment of the Consent Fee. Assuming our position is respected, a consenting holder of 2034 Notes may have income in respect of the receipt of the Consent Fee but will not otherwise realize gain or loss as result of the Holder’s Consent. We anticipate that all 2034 Notes will continue to be identified by their existing CUSIP number, whether or not the Holders provide Consents.

iv

Consent Fee. The treatment of the Consent Fee for U.S. federal income tax purposes is uncertain. As a result, it is possible that Consent Fees paid to beneficial owners of Notes that are not U.S. persons are subject to a 30% U.S. withholding tax (subject to reduction or exemption where an applicable tax treaty so provides). Although not free from doubt, we believe that, other than as described below, the Consent Fee is not subject to withholding tax. The applicable withholding agent, however, will make the determination whether to withhold on the Consent Fee. It may do so in all events, but it would be prudent for beneficial owners of the Notes that are not U.S. persons to assume it will do so at least in the case of the 2034 Notes and any other Note in respect of which it determines a consent fee was not paid, or might not have been paid, in 2016.

For a discussion of certain U.S. federal income tax considerations relating the Consent Solicitation, including the payment of the Consent Fee, relevant to beneficial owners of Notes, see “Certain U.S. Federal Income Tax Considerations.”

v

IMPORTANT NOTICE

Holders are requested to read and carefully consider the information contained herein.

Recipients of this Statement and the accompanying materials should not construe the contents hereof or thereof as legal, business or tax advice. Each recipient should consult its own attorney, business advisor and tax advisor as to legal, business, tax and related matters concerning the Consent Solicitation.

This Statement does not constitute a solicitation of Consents in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such solicitation under applicable laws. Holders residing outside the United States who wish to deliver a Consent must satisfy themselves as to their full observance of the laws of the relevant jurisdiction in connection therewith. If the Company becomes aware of any state or foreign jurisdiction where the making of the Consent Solicitation is prohibited, the Consent Solicitation will not be made to (and Consents will not be accepted from or on behalf of) Holders in such state or foreign jurisdiction.

No broker, dealer, salesperson or other person has been authorized to provide any information or to make any representation not contained in this Statement and, if given or made, such information or representation may not be relied upon as having been authorized by the Company, Genworth Financial, the Trustee, the Solicitation Agent or the Information Agent. The Company, Genworth Financial, the Trustee, the Solicitation Agent and the Information Agent take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. The delivery of this Statement at any time after the date hereof does not imply that the information herein is correct as of any time subsequent to its date.

You are responsible for making your own examination of the Company and Genworth Financial and your own assessment of the merits and risks of participating in the Consent Solicitation. You may contact us at any time if you need additional information. By participating in the Consent Solicitation, you acknowledge that:

| • | you have reviewed this Statement; |

| • | you have had an opportunity to ask questions and request from us any additional information that you need from us and you have reviewed that additional information; and |

| • | none of the Company, Genworth Financial, the Trustee, the Solicitation Agent or the Information Agent or any of their respective affiliates, control persons, directors, officers, employees, agents or representatives (collectively, “Representatives”) is liable or responsible for, nor is making any representation, express or implied, to you concerning the Company’s or Genworth Financial’s future performance. |

None of the Company, Genworth Financial, the Trustee, the Solicitation Agent or the Information Agent or any of their respective Representatives makes any recommendation as to whether or not Holders should deliver Consents pursuant to the Consent Solicitation.

This Statement is solely for the purposes of the Consent Solicitation. Neither the Consent Solicitation nor the delivery of this Statement constitutes an offering of securities of the Company or Genworth Financial or any other person and this Statement may not be used for such purposes or in connection with the purchase or sale of any securities, including, without limitation, the Notes.

This Statement has not been approved or disapproved by the Securities and Exchange Commission (the “SEC”) or any state securities commission, nor has the SEC or any state securities commission passed upon the fairness or merits of such transaction nor upon the accuracy or adequacy of the information contained in this Statement. Any representation to the contrary is unlawful.

vi

Important Notice Regarding Consent Procedures

All of the Notes are held through DTC by DTC Participants. Any Beneficial Owner of Notes who is not a Holder of such Notes must arrange with the person who is the Holder or such Holder’s assignee or nominee to deliver their Consent on behalf of such Beneficial Owner.

DTC has confirmed that the Consent Solicitation is eligible for ATOP and has authorized DTC Participants to electronically deliver Consents by causing DTC to temporarily transfer and surrender their Notes and indicate delivery of a Consent to the Tabulation Agent, in accordance with DTC’s ATOP procedures. DTC will verify each temporary transfer and surrender of Notes and confirm the electronic delivery of such Consent by sending an Agent’s Message (as defined below) to the Tabulation Agent. DTC Participants must allow sufficient time for completion of the ATOP procedures during normal business hours of DTC. Beneficial Owners must contact the broker, dealer, commercial bank, custodian or DTC Participant who holds Notes for them if they wish to instruct such party to deliver a Consent with respect to the Beneficial Owner’s Notes.

After DTC submits the Agent’s Message with respect to a Consent, the CUSIP for the applicable Notes will be blocked, and a consenting Holder’s position cannot be sold or transferred until the earliest of (i) the Expiration Time, (ii) the date on which the DTC Participant properly revokes its Consent and (iii) the date on which the Consent Solicitation is terminated. The Tabulation Agent will instruct DTC to release the positions as soon as practicable but no later than three business days after either the Expiration Time or subsequent date following the Expiration Time and not exceeding forty-five calendar days from the date of this Statement. The Consent Fee will be paid promptly following the satisfaction of all of the conditions described herein, at which time the Proposed Amendments will become operative.

Consents may be delivered only in principal amounts equal to minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof except that Consents for the 6.50% Notes Due 2034 may be delivered only in principal amounts equal to minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. Holders who deliver consents that are less than all of their Notes must continue to hold Notes in at least the Minimum Authorized Denomination and integral multiples of $1,000 in excess thereof. To the extent the 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes are treated as exchanged for “new” Notes of such series that are deemed to have OID, Holders of such Notes that consent to the Proposed Amendments are expected to receive Notes with a new CUSIP when the Proposed Amendments become operative. The terms and denominations of the “new” notes will be identical to the terms and denominations of the old notes. See “Certain U.S. Federal Income Tax Considerations.”

See “The Solicitation—How to Consent” for additional information regarding Consent procedures.

vii

SUMMARY

The following summary is provided for the convenience of the Holders. This section does not contain all of the information that may be important to you. You should carefully read this Statement and the information incorporated by reference herein to fully understand the terms of the Proposed Amendments, as well as the other considerations that are important to you in deciding whether to deliver your Consent. All capitalized terms used but not defined in this section are defined in other sections of this Statement.

| The Company | Genworth Holdings, Inc. | |

| The Guarantor | Genworth Financial, Inc. | |

| The Notes | Outstanding Principal Amount |

Description of Securities |

CUSIP Number | |||

| $397,000,000 | 7.700% Senior Notes due 2020 | 37247DAM8 | ||||

| $381,703,000 | 7.20% Senior Notes due February 2021 | 37247DAN6 | ||||

| $698,319,000 | 7.625% Senior Notes due September 2021 | 37247DAP1 | ||||

| $400,000,000 | 4.900% Senior Notes due 2023 | 372491AA8 | ||||

| $400,000,000 | 4.800% Senior Notes due 2024 | 372491AB6 | ||||

| $300,000,000 | 6.500% Senior Notes due 2034 | 37247DAB2 |

| The Indenture | The Indenture, dated as of June 15, 2004 between Genworth Holdings (formerly Genworth Financial, Inc.) and The Bank of New York Mellon Trust Company, N.A., as successor to JP Morgan Chase Bank, N.A. (formerly JP Morgan Chase Bank), as Trustee, as supplemented by:

• Supplemental Indenture No.1, dated as of June 15, 2004,

• Supplemental Indenture No. 2, dated as of September 19, 2005,

• Supplemental Indenture No. 3, dated as of June 12, 2007,

• Supplemental Indenture No. 4, dated as of May 22, 2008,

• Supplemental Indenture No. 5, dated as of December 8, 2009,

• Supplemental Indenture No. 6, dated as of June 24, 2010,

• Supplemental Indenture No. 7, dated as of November 22, 2010,

• Supplemental Indenture No. 8, dated as of March 25, 2011,

• Supplemental Indenture No. 9, dated as of April 1, 2013,

• Supplemental Indenture No. 10, dated as of August 8, 2013,

• Supplemental Indenture No. 11, dated as of December 10, 2013 and

• Supplemental Indenture No. 12, dated as of March 18, 2016,

governing the Company’s 7.700% Senior Notes due 2020, 7.20% Senior Notes due 2021, 7.625% Senior Notes due 2021, 4.900% Senior Notes due 2023, 4.800% Senior Notes due 2024 and 6.500% Senior Notes due 2034. | |

| Holders | The Company is soliciting Consents from all Holders of the Notes. | |

| Trustee | The Bank of New York Mellon Trust Company, N.A. | |

1

| Consent Solicitation | The Company is soliciting Consents by Holders to the Proposed Amendments. See “Proposed Amendments to the Indenture.” | |

| Expiration Time | The Consent Solicitation will expire with respect to each series of Notes at 5:00 p.m. New York City time on October 3, 2018, unless earlier terminated or extended with respect to any such series. | |

| Consent Fee | Holders who consent to the Proposed Amendments will be eligible to receive a Consent Fee of $2.50 per $1,000 in principal amount of notes, subject to the conditions described in this Statement. | |

| Conditions to the Consent Solicitation and Payment of the Consent Fee | The consummation of the Consent Solicitation in respect of a series of Notes is conditioned upon (i) receipt by the Tabulation Agent at or before the Expiration Time of the Requisite Consents in respect of such series of Notes, (ii) execution by the Company, Genworth Financial and the Trustee of the New Supplemental Indenture embodying the Proposed Amendments to the Indenture relating to such series of Notes and (iii) satisfaction of the General Conditions (as defined herein) upon the Effective Date. In addition, following execution and delivery of a New Supplemental Indenture in respect of a series of Notes, the Proposed Amendments contained therein will not become operative and the Consent Fee and the Soliciting Broker Fee in respect of a series of Notes, will not become payable unless the following Additional Conditions have been satisfied or waived: (i) execution by the Company, Genworth Financial and the Trustee of the New Supplemental Indenture relating to each other series of Notes embodying the Proposed Amendments to the Indenture and (ii) satisfaction of the General Conditions upon such operative date. | |

| Requisite Consents | In accordance with the terms of the Indenture, in order for a New Supplemental Indenture to be approved with respect to a series of Notes, and the Proposed Amendments contained therein to become operative, valid and unrevoked Consents must be received from Holders of a majority in aggregate principal amount of each series (each series voting as a separate class) of Notes then outstanding that is affected by a New Supplemental Indenture. | |

| Consequences of Not Delivering a Consent | Upon the Proposed Amendments becoming operative in respect of a series of Notes, all Holders of Notes of such series will be bound by the terms of the New Supplemental Indenture embodying such Proposed Amendments, even if they did not deliver their Consent. Holders who do not deliver a Consent will not receive a Consent Fee. | |

| Procedures for Delivering Consent | Consents must be electronically delivered in accordance with DTC’s ATOP procedures. Any Beneficial Owner may instruct its broker, dealer, custodian or other intermediary to deliver a Consent to the Proposed Amendments.

With respect to any Notes, in order to effectively consent to the Proposed Amendments and be eligible to receive the Consent Fee, the registered Holder of such Notes must properly deliver its Consent at or prior to the Expiration Time.

If Notes are registered in the name of a broker, dealer, commercial bank, trust company or other intermediary and the Beneficial Owner wishes to consent to the Proposed Amendments, the Beneficial Owner must promptly contact and instruct such registered Holder to deliver a Consent on the Beneficial Owner’s behalf. Any Beneficial Owner of Notes registered in the name of a DTC Participant may direct the DTC Participant through whom such Beneficial Owner’s Notes are held to deliver a Consent on such Beneficial Owner’s behalf.

For the avoidance of doubt, a Holder of more than one series of Notes may deliver Consents in respect of any and all series of Notes held by such Holder. | |

2

|

DTC Participants must electronically deliver a Consent by causing DTC to temporarily transfer and surrender their Notes to the Tabulation Agent in accordance with DTC’s ATOP procedures. The Notes will not be transferable to third parties until the earliest of (i) the Expiration Time, (ii) the date on which the DTC Participant revokes its Consent and (iii) the date on which the Consent Solicitation is terminated.

See “The Solicitation—How to Consent.” | ||

| Revocation of Consents | Consents with respect to a series of Notes may be revoked by a Holder if the Tabulation Agent receives a properly transmitted notice of revocation of Consent in accordance with DTC’s ATOP procedures at any time prior to the earlier of the Effective Date (of the New Supplemental Indenture embodying the Proposed Amendments with respect to such series of Notes) and the Expiration Time. Each Holder, by delivering its Consent, will agree not to revoke its Consent except in accordance with the conditions and procedures for revocation of Consents specified under “The Solicitation—Revocation of Consents.” | |

| Soliciting Broker Fee | With respect to any Consent in respect of a series of Notes accepted by the Company, the Company will also pay the relevant soliciting broker a fee of $2.50 per $1,000 principal amount of Notes of such series to which the Consent relates, provided that such fee will only be paid with respect to the first $200,000 aggregate principal amount of each series of Notes for which a Consent is delivered by any individual Holder. See “The Solicitation—Soliciting Broker Fee.” | |

| Certain Tax Considerations to Holders | For a discussion of certain U.S. federal income tax considerations relating to the Consent Solicitation, including the payment of the Consent Fee, relevant to the Beneficial Owners of Notes, see “Certain U.S. Federal Income Tax Considerations.” | |

| Solicitation Agent | Merrill Lynch, Pierce Fenner & Smith Incorporated | |

| Information Agent and Tabulation Agent | Global Bondholder Services Corporation | |

3

PROPOSED AMENDMENTS TO THE INDENTURE

Background

On October 21, 2016, we entered into a definitive agreement with China Oceanwide, under which China Oceanwide has agreed to acquire all of the outstanding common stock (the “China Oceanwide Transaction”) of Genworth Financial, Inc. In connection with that transaction, China Oceanwide has agreed to undertake a capital plan that would benefit our business and financial strength. The China Oceanwide Transaction is currently targeted to close in the fourth quarter of this year. However, no assurance can be given that we will complete the China Oceanwide Transaction in that time frame, on the same terms as those contemplated by the definitive agreement at announcement or at all. The China Oceanwide Transaction is subject to customary closing conditions, including the absence of any material adverse change in our business or financial condition.

As we work with China Oceanwide to complete the China Oceanwide Transaction, we have decided to no longer pursue an “unstacking” of our life insurance subsidiary, Genworth Life and Annuity Insurance Company, from one of our long-term care insurance subsidiaries, Genworth Life Insurance Company, regulatory approval of which was originally a condition to the closing of the China Oceanwide Transaction. As a result, we anticipate that Genworth Life and Annuity Insurance Company will for the foreseeable future remain a direct subsidiary of Genworth Life Insurance Company. Genworth Life Insurance Company is an indirect subsidiary of Genworth Holdings, Inc., which is the issuer of the Notes.

The Indenture currently provides, as a result of amendments adopted in March 2016, that none of the bankruptcy, insolvency or other similar events described in Sections 6.01(f) and 6.01(g) apply to Genworth Life Insurance Company, Genworth Life Insurance Company of New York and/or Brookfield Life and Annuity Insurance Company Limited or any respective property thereof. (emphasis added). The Proposed Amendments to be adopted through this Consent Solicitation would clarify that the phrase “or any respective property thereof” includes any subsidiary of the named companies, including Genworth Life and Annuity Insurance Company, which is now expected to remain a subsidiary of Genworth Life Insurance Company.

Purpose of the Consent

The purpose of this Consent Solicitation is to eliminate the possibility that a regulatory action directed at a U.S. life insurance subsidiary of the Company (which we currently do not anticipate) would constitute an event of default with respect to the Notes and thereby have an overall negative impact on the Company that would be viewed negatively by China Oceanwide in connection with the pending China Oceanwide Transaction. Accordingly, now that the decision has been made not to “unstack” our U.S. life insurance subsidiary from one of our long-term care insurance subsidiaries, the Consent Solicitation would clarify that our U.S. life insurance subsidiary, known as Genworth Life and Annuity Insurance Company, is included in the class of subsidiaries which was previously removed from bankruptcy, insolvency and similar events of default with respect to the Notes.

By clarifying that Genworth Life and Annuity Insurance Company would not be subject to bankruptcy, insolvency and other similar events of default with respect to the Notes, this would, among other things:

| • | eliminate a related default risk with respect to the Notes and any potential effects that such an event of default may have on the pending China Oceanwide Transaction; |

| • | make a clarification consistent with the interpretative position the Company would in any event expect to take with respect to the Indenture that, while Genworth Life and Annuity Insurance Company remains a subsidiary of Genworth Life Insurance Company, it is the “property of” Genworth Life Insurance Company for purposes of the Indenture; |

| • | mitigate the risk to the Company of preemptive actions by applicable insurance regulators which they might view as protective of Genworth Life and Annuity Insurance Company and its life insurance policy holders; and |

4

| • | have a potential positive credit ratings impact on the Company, as Moody’s Investor Services has publicly identified removing Genworth Life and Annuity Insurance Company from bankruptcy or insolvency and similar events of default under the Indenture as one of several factors that could lead to a ratings upgrade. |

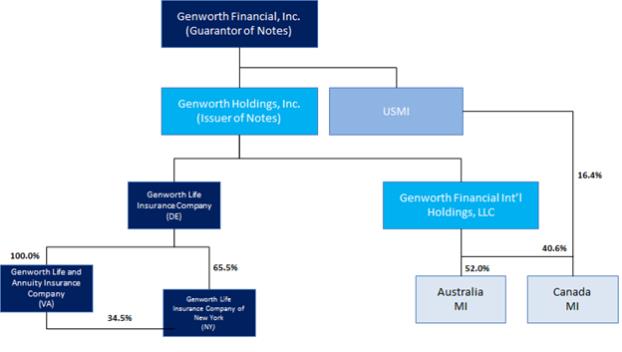

Simplified Organizational Chart

Proposed Amendments

If the Proposed Amendments are adopted, Section 6.01 of the Indenture would be amended with respect to each series of Notes by amending and restating the final paragraph of Section 6.01(h) to read as follows (with the proposed change underlined in bold):

For the avoidance of doubt, none of the bankruptcy, insolvency or other events described in Sections 6.01(f) and 6.01(g), if

they occur with respect to Genworth Life Insurance Company, Genworth Life and Annuity Insurance Company, and/or Genworth Life Insurance Company

of New York or any respective property thereof (including for the avoidance of doubt any subsidiary thereof), shall constitute an Event of Default.

The reference to Brookfield Life and Annuity Insurance Company would be deleted because it has been merged with and into Genworth Life Insurance Company.

Section 10.02 of the Indenture provides for the amendment of any provision of the Indenture related to a series of Notes (except certain provisions not relevant to the Consent Solicitation) by execution of a supplemental indenture upon the consent of Holders of at a majority in aggregate principal amount of the outstanding Notes of each series (each series voting as a separate class) affected by such supplemental indenture.

In respect of a series of Notes, upon the execution of the New Supplemental Indenture and the Proposed Amendments affecting such series of Notes becoming operative and upon the satisfaction of the conditions set forth in this Statement, including the receipt of the Requisite Consents with respect to such series of Notes, all Holders of

5

Notes of such series will be bound by the terms of such New Supplemental Indenture, even if they did not deliver Consents with respect thereto. While the Company intends to execute the New Supplemental Indenture in respect of each series of Notes promptly following the Expiration Time or, if earlier, upon receipt of the Requisite Consents with respect to such series of Notes and satisfaction or waiver of the other conditions as set forth herein, such New Supplemental Indenture, and the Proposed Amendments contained therein, will not become operative unless all conditions to the Consent Solicitation and to payment of the Consent Fee described in this Statement are satisfied or waived.

Regardless of whether the Proposed Amendments become operative in respect of a series of Notes, the Notes of such series will remain outstanding in accordance with all other terms of the Indenture. The changes effected by the Proposed Amendments do not alter the Company’s contractual obligation to pay the principal of or interest on the Notes or the guarantee of the Notes by Genworth Financial and are effective only upon the terms and conditions contained herein. If the Consent Solicitation is terminated in respect of a series of Notes, the Proposed Amendments will have no effect on the Notes of such series or the Holders of Notes of such series.

In addition, if applicable, as described in “Certain U.S. Federal Income Tax Considerations,” consenting Holders of a series of Notes, to the extent such Notes are treated as exchanged, will receive notes represented by a new global certificate with a new CUSIP and applicable tax legends. The terms and denominations of the notes with new CUSIPs will be identical to the terms and denominations of the existing notes of the applicable series.

Copies of the Indenture and the New Supplemental Indentures are available to Holders of Notes of the series to which the respective New Supplemental Indenture relate upon request from the Information Agent. All statements in this Statement regarding the substance of the Proposed Amendments and the Indenture are qualified in their entirety by reference to the New Supplemental Indentures and the Indenture.

6

CERTAIN SIGNIFICANT CONSIDERATIONS

The following considerations, in addition to the other information described elsewhere in this Statement and incorporated by reference herein (including, in particular, those risk factors set out in our Annual Report on Form 10-K for the year ended December 31, 2017 and incorporated by reference herein), should be carefully considered by each Holder before deciding whether to consent to the Proposed Amendments.

Risks Following Approval of the Proposed Amendments

If the Proposed Amendments become operative, they will clarify that bankruptcy or insolvency proceedings involving Genworth Life and Annuity Insurance Company and the subsidiaries of Genworth Life Insurance Company, Genworth Life and Annuity Insurance Company and Genworth Life Insurance Company of New York will not constitute an event of default with respect to the Notes. As a result, if any of these entities experience a deterioration of capital or liquidity or some other event that would subject them to such proceedings, whether as a result of risks or trends previously identified or otherwise, Holders would not be able to declare an event of default and accelerate repayment of the Notes.

If the Consent Solicitation is successful, the 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes with respect to which a Consent has been delivered are expected to trade under separate CUSIP numbers from Notes of the same series held by a Holder of such Notes that does not deliver its Consent to the Proposed Amendments at or prior to the Expiration Time. This may adversely affect the liquidity of the both the “new” and old 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes. See “Certain U.S. Federal Income Tax Considerations.”

Risks to Holders Who Do Not Deliver Consents if the Proposed Amendments are Approved

If, in respect of a series of Notes, the Requisite Consents to the Proposed Amendments are received at or prior to the Expiration Time, but a Holder of Notes of such series does not deliver its Consent to the Proposed Amendments at or prior to the Expiration Time, such Holder will not receive any Consent Fee. In addition, if, in respect of a series of Notes, the Requisite Consents to the Proposed Amendments are provided prior to the Expiration Time, the Company and the Trustee will execute the New Supplemental Indentures relating to such series of Notes, and, if the other conditions described in this Statement are satisfied or waived, it will result in the Proposed Amendments becoming operative with respect to such series of Notes. Once the New Supplemental Indentures become operative, the rights of all Holders of the affected series of Notes will be affected by the Proposed Amendments, whether or not such Holder provided its Consent.

Risks to Consummation of the Consent Solicitation and Payment of the Consent Fees

The consummation of the Consent Solicitation and the payment of any Consent Fee in respect of a series of Notes are subject to the satisfaction or waiver by the Company of certain conditions, including the receipt by the Company of the Requisite Consents with respect to such Notes. See “The Solicitation—Conditions to the Consent Solicitation and Payment of the Consent Fee.” There can be no assurance that such conditions will be met or waived. If those conditions are not met or waived and the Consent Solicitation is not consummated, Holders of Notes of such series will not receive the Consent Fee.

Risks Related to Consent Procedures

Holders are responsible for complying with all of the procedures for submitting Consents. None of the Company, the Solicitation Agent, the Information Agent and Tabulation Agent or the Trustee or any of their respective directors, officers, employees, agents or affiliates assumes any responsibility for informing Holders of irregularities with respect to any Consent. All Consents delivered and not validly revoked by the Expiration Time will be irrevocable thereafter.

7

The Notes for which a Consent has been delivered through ATOP as part of the Consent Solicitation prior to the Expiration Time will be held under one or more temporary CUSIP numbers (i.e., Contra CUSIP) during the period beginning at the time the DTC Participant electronically delivers a Consent and ending on the earlier of (i) the Expiration Time, (ii) the date on which the DTC Participant revokes its consent and (iii) the date on which the Consent Solicitation is terminated. During the period that Notes are held under a temporary CUSIP number or numbers, such Notes will not be freely transferable to third parties and will be blocked. The Tabulation Agent will instruct DTC to release the positions as soon as practicable but no later than three business days after either the Expiration Time or subsequent date following the Expiration Time and not exceeding forty-five calendar days from the date hereof. It is expected that Holders of the 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes that consent to the Proposed Amendments will receive Notes with a new CUSIP when the Proposed Amendments become operative. See “Certain U.S. Federal Income Tax Considerations.”

Subsequent to the date on which the Notes are no longer blocked from trading, Holders may transfer the Notes in accordance with the terms thereof and in accordance with the procedures of DTC. However, the right to receive the Consent Fee is not transferable with any Notes. The Consent Fee will only be made to the Holder that provided and did not validly revoke its Consent prior to the Expiration Time. No subsequent Holder of the Notes will be entitled to receive any Consent Fee. In the period of time during which Notes are blocked pursuant to the foregoing procedures for delivering Consents, Holders may be unable to promptly liquidate their Notes or timely react to adverse trading conditions and could suffer losses as a result of these restrictions on transferability.

8

THE SOLICITATION

General

In order to approve a Proposed Amendment, the Company must receive the “Requisite Consents,” which, under the Indenture, means valid and unrevoked Consents of Holders of a majority in aggregate principal amount of each series (each series voting as a single class) of Notes then outstanding that is affected by the New Supplemental Indenture implementing such Proposed Amendment. The outstanding principal amount for each series of Notes issued and outstanding, as of the date hereof, is set forth in the table appearing on the front cover page of this Statement.

If a Proposed Amendment becomes operative in respect of a series of Notes, it will be binding on all Holders of Notes of such series relating to such Proposed Amendment and their successors and transferees, whether or not such Holders consented to the Proposed Amendments. Failure to deliver a Consent will have the same effect as if a Holder had voted “No” to the Proposed Amendments.

Consent Fee

In the event that the Proposed Amendments in respect of a series of Notes become operative, the Company will pay the Consent Fee to the Holders of Notes of such series who delivered a valid Consent (not subsequently revoked) at or prior to the Expiration Time. The Consent Fee will be paid promptly following the satisfaction of all of the conditions described herein, at which time the Proposed Amendments will become operative.

Consents in respect of a series of Notes will expire if the Requisite Consents to the Proposed Amendments have not been obtained at or before the Expiration Time (which term includes any extension of the original Expiration Time). Interest will not accrue on or be payable with respect to any Consent Fee.

How to Consent

Each Holder who delivers a Consent to the Proposed Amendments in accordance with the procedures set forth in this Statement will be deemed to have validly consented to the Proposed Amendments.

All of the Notes are held in book-entry form and registered in the name of Cede & Co., as the nominee of DTC. Only Holders are authorized to deliver Consents with respect to their Notes. Therefore, to deliver Consents with respect to the Notes that are held through a broker, dealer, commercial bank, trust company or other nominee, the Beneficial Owner thereof must instruct such nominee to deliver Consents on the Beneficial Owner’s behalf according to the procedures described below.

DTC has confirmed that the Consent Solicitation is eligible for ATOP. Accordingly, consenting DTC Participants must electronically deliver a Consent by causing DTC to temporarily transfer and surrender their Notes to the Tabulation Agent in accordance with DTC’s ATOP procedures. By making such transfer and delivery of a Note, DTC Participants will be deemed to have delivered a Consent with respect to any Notes so transferred and surrendered. DTC will verify each temporary transfer and surrender and confirm the electronic delivery of such Consent by sending an Agent’s Message to the Tabulation Agent.

The term “Agent’s Message” means a message transmitted by DTC and received by the Tabulation Agent, which states that DTC has received an express and unconditional acknowledgment from the DTC Participant delivering Consents that such DTC Participant (i) has received and agrees to be bound by the terms of the Consent Solicitation as set forth in this Statement and that the Company may enforce such agreement against such DTC Participant, and (ii) consents to the Proposed Amendments as described in this Statement.

The Tabulation Agent will seek to establish a new ATOP account or utilize an existing ATOP account with respect to each series of Notes at DTC promptly after the date of this Statement (to the extent that such arrangements have not been made previously by the Tabulation Agent), and a DTC Participant whose name appears on a security position listing as the owner of the Notes may make book-entry delivery of Consents by causing DTC to transfer Notes into the proper ATOP account or electronically deliver the Consents. Deliveries of Consents are effected through ATOP by delivery of an Agent’s Message by DTC to the Tabulation Agent.

9

The Notes for which a Consent has been delivered through ATOP as part of the Consent Solicitation prior to the Expiration Time will be held under one or more temporary CUSIP numbers (i.e., Contra CUSIP) during the period beginning at the time the DTC Participant electronically delivers a Consent and ending on the earliest of (i) the Expiration Time, (ii) the date on which the DTC Participant revokes its Consent and (iii) the date on which the Consent Solicitation is terminated. During the period that Notes are held under a temporary CUSIP number or numbers, such Notes will not be freely transferable to third parties and will be blocked. The Tabulation Agent will instruct DTC to release the positions as soon as practicable but no later than three business days after either the Expiration Time or subsequent date following the Expiration Time and not exceeding forty-five calendar days from the date hereof. It is expected that Holders of the 2020 Notes, February 2021 Notes, September 2021 Notes, 2023 Notes and 2024 Notes that consent to the Proposed Amendments will receive Notes with a new CUSIP when the Proposed Amendments become operative. See “Certain U.S. Federal Income Tax Considerations.”

Consents must be electronically delivered in accordance with DTC’s ATOP procedures.

A Beneficial Owner of Notes held through a broker, dealer, commercial bank, trust company or other intermediary must provide appropriate instructions to such person in order to cause a delivery of a Consent with respect to such Notes.

Holders desiring to deliver their Consents prior to the Expiration Time must allow sufficient time for completion of the ATOP procedures during the normal business hours of DTC on such respective date. Consents not delivered prior to the Expiration Time will be disregarded and of no effect.

The method of delivery of a Consent through ATOP and any other required documents to the Tabulation Agent is at the election and risk of the Holder, and, delivery will be deemed made only when made through ATOP in accordance with the procedures described herein.

All questions as to the validity, form, eligibility (including time of receipt), acceptance or payment and revocation of Consents will be determined by the Company in its sole discretion, which determination will be conclusive and binding. The Company reserves the absolute right in its sole discretion to reject any or all Consents that are not in proper form or the acceptance of which could, in the opinion of the Company or its counsel, be unlawful. The Company also reserves the absolute right in its sole discretion to waive any defects or irregularities in connection with deliveries of particular Consents, whether or not similar defects or irregularities are waived in the case of other Holders. Unless waived, any defects or irregularities in connection with deliveries of Consents must be cured within such time as the Company determines. Deliveries of Consents will not be deemed to have been made until any irregularities or defects therein have been cured or waived. None of the Company or Genworth Financial or any of their affiliates, the Solicitation Agent, the Information Agent, the Tabulation Agent, the Trustee or any other person shall be under any duty to give any notification of any such defects or irregularities or waiver, nor shall any of them incur any liability for failure to give such notification. The Company’s interpretations of the terms and conditions of the Consent Solicitation shall be conclusive and binding.

No consent form or letter of transmittal should be executed in relation to the Consent Solicitation or the Consents delivered through DTC. The valid electronic delivery of Consents through the temporary transfer and surrender of Notes in accordance with DTC’s ATOP procedures shall constitute a written Consent to the Consent Solicitation.

Revocation of Consents

Each properly completed and executed Consent will be counted unless the procedure for revocation of Consents described below has been followed. Consents may not be revoked after the earlier of the Expiration Time and the Effective Date.

10

Holders who wish to exercise their right of revocation with respect to a Consent must give a properly transmitted “Requested Message” through ATOP, which must be received by the Tabulation Agent through ATOP, prior to the earlier of the Expiration Time and the Effective Date. In order to be valid, a notice of revocation must specify the name of the Holder and the principal amount of the Notes with respect to which a Consent is being revoked. Validly revoked Consents may be redelivered by following the procedures described elsewhere in this Statement at any time prior to earlier of the Expiration Time and the Effective Date. Under no circumstances may Consents be revoked after the earlier of the Expiration Time and the Effective Date.

Any notice of revocation received after the Effective Date will not be effective, even if received prior to the Expiration Time. A revocation of a Consent to the Proposed Amendments by a Holder can only be accomplished in accordance with the foregoing procedures.

Only a Holder is entitled to revoke a Consent previously given by it. A Beneficial Owner of Notes who is not the Holder of such Notes must arrange with the Holder to revoke any Consent already given with respect to such Notes in accordance with the foregoing procedures. A Consent to the Proposed Amendments will bind the consenting Holder and every subsequent holder of such Holder’s Notes or any portion thereof, even if notation of the Consent is not made on such Notes.

The Company reserves the right to contest the validity of any revocation and all questions as to the validity (including time of receipt) of any revocation will be determined by the Company in its sole discretion, which determination will be conclusive and binding. None of the Company or Genworth Financial or any of their affiliates, the Solicitation Agent, the Information Agent, the Tabulation Agent, the Trustee or any other person will be under any duty to give notification of any defects or irregularities with respect to any revocation nor shall any of them incur any liability for failure to give such notification.

Conditions to the Consent Solicitation and Payment of the Consent Fee

Notwithstanding any other provision of this Statement, the consummation of the Consent Solicitation in respect of a series of Notes is conditioned upon:

| • | receipt by the Tabulation Agent at or before the Expiration Time of the Requisite Consents with respect to such series of Notes; |

| • | execution by the Company, Genworth Financial and the Trustee of a New Supplemental Indenture embodying the Proposed Amendments affecting such series of Notes; and |

| • | satisfaction of the General Conditions (as defined below) upon the Effective Date. |

In addition, following execution and delivery of a New Supplemental Indenture in respect of a series of Notes, the Proposed Amendments contained therein will not become operative and the Consent Fee and the Soliciting Broker Fee in respect of a series of Notes, will not become payable unless the following Additional Conditions have been satisfied or waived:

| • | execution by the Company, Genworth Financial and the Trustee of a New Supplemental Indenture embodying the Proposed Amendments to the Indenture relating to each other series of Notes; and |

| • | satisfaction of the General Conditions upon such operative date. |

We may, in our sole discretion, waive any or all of the General Conditions or Additional Conditions. We may not, however, waive the condition with respect to the receipt of the Requisite Consents or the execution and delivery of a New Supplemental Indenture.

11

The “General Conditions,” as defined in respect of a series of Notes on the Effective Date or the date on which a New Supplemental Indenture becomes operative, shall be that, on or after the date hereof and before such time, there shall not have been instituted or threatened or be pending any action, suit or other proceeding or investigation by any governmental authority or agency or any other person that:

| • | questions the legality, validity, binding effect, enforceability or effectiveness of the Proposed Amendments or the entering into of the New Supplemental Indenture, in each case in respect of such series of Notes; |

| • | seeks to have the Notes of such series paid before maturity or which questions the accuracy or completeness of any of the statements made in this Statement or in any of the other documents referred to herein; or |

| • | if adversely determined, would make unlawful or invalid, would enjoin the implementation of, or would impose damages as a result of, any of the foregoing. |

Expiration Time; Extensions; Amendment

The Expiration Time with respect to any series of Notes shall occur at 5:00 p.m. New York City time, on October 3, 2018, unless earlier terminated or extended with respect to such series. The Company may, in its sole discretion, extend the Expiration Time in respect of one or more series of Notes. In order to extend the Expiration Time, the Company will notify the Information Agent and the Tabulation Agent of any extension by telephonic or written notice and will make a public announcement thereof, each at or before 9:00 a.m., New York City time, on the next business day following the previously scheduled Expiration Time. Such announcements may state that the Company is extending the Consent Solicitation for a specified period of time or on a daily basis. Failure of any Holder or Beneficial Owner of Notes to be so notified will not affect the extension of the Consent Solicitation.

Notwithstanding anything to the contrary set forth in this Statement, the Company reserves the right, in its sole discretion to, in respect of each and any series of Notes (i) terminate the Consent Solicitation for any reason, (ii) extend the Expiration Time, with respect to any series of Notes, or (iii) amend the terms of the Consent Solicitation, including to waive any of the conditions to the Consent Solicitation, with respect to any series of Notes.

Without limiting the manner in which the Company may choose to make a public announcement of any extension, amendment or termination of the Consent Solicitation, the Company shall have no obligation to publish, advertise, or otherwise communicate any such public announcement, other than by making a timely press release and complying with any applicable notice provisions of the Indenture.

Soliciting Broker Fee

With respect to any Consent in respect of a series of Notes accepted by the Company, the Company will also pay the relevant soliciting broker a fee of $2.50 per $1,000 principal amount of Notes of such series to which the Consent relates, provided that such fee will only be paid with respect to the first $200,000 aggregate principal amount of each series of Notes for which a Consent is delivered by any individual Holder. In order to be eligible to receive the Soliciting Broker Fee, a properly completed soliciting broker form must be delivered by the relevant soliciting broker to the Tabulation Agent at or prior to the Expiration Time. The Company will, in its sole discretion, determine whether a broker has satisfied the criteria for being eligible to receive a Soliciting Broker Fee (including, without limitation, the submission of the appropriate documentation without defects or irregularities and in respect of bona fide deliveries of Consents). The payment of the Soliciting Broker Fee to eligible brokers is subject to the same conditions as payment of the Consent Fee.

A soliciting broker is a retail broker designated in the soliciting broker form and is:

| • | a broker or dealer in securities which is a member of any national securities exchange in the United States or of the Financial Industry Regulatory Authority; or |

| • | a bank or trust company located in the United States. |

12

Soliciting brokers will include any of the organizations described above even when the activities of such organization in connection with the Consent Solicitation consist solely of forwarding to clients materials relating to the Consent Solicitation and delivering Consents as directed by Beneficial Owners thereof. Each soliciting broker will confirm that each Holder that it solicits has received a copy of this Statement, or concurrently with such solicitation provide the Holder with a copy of this Statement. No soliciting broker is required to make any recommendation to Holders as to whether to deliver Consent or refrain from delivering Consent in the Consent Solicitation. No assumption is made, in making payment to any soliciting broker, that its activities in connection with the Consent Solicitation included any activities other than those described in this paragraph. For all purposes noted in materials relating to the Consent Solicitation, the term “solicit” shall be deemed to mean no more than “processing Consents” or “forwarding to customers material regarding the Consent Solicitation.”

Soliciting brokers are not eligible to receive a Soliciting Broker Fee with respect to Notes beneficially owned by such soliciting broker or with respect to any Notes that are registered in the name of a soliciting broker unless such Notes are held by such soliciting broker as nominee and the related Consent is delivered on behalf of the Beneficial Owner of such Notes.

Soliciting brokers should take care to ensure that proper records are kept to document their eligibility to receive any Soliciting Broker Fee. The Company and the Tabulation Agent reserve the right to require additional information at our discretion, as deemed warranted.

Other than the foregoing, no fees or commissions have been or will be paid by us to any broker, dealer or other person, other than the Solicitation Agent, the Information Agent and the Tabulation Agent with respect to the Consent Solicitation.

13

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a general discussion of certain of the U.S. federal income tax considerations relating to the adoption of the Proposed Amendments and the receipt of the Consent Fee that may be relevant to a Beneficial Owner of the Notes. This discussion applies only to Notes that are held as capital assets for U.S. federal income tax purposes and does not describe all of the tax consequences that may be relevant to you in light of your particular circumstances, including the alternative minimum tax, the Medicare tax on certain investment income, the consequences to you if you are a taxpayer subject to special tax accounting rules under Section 451(b) of the Internal Revenue Code of 1986, as amended (the “Code”), the consequences to you if you sell your Notes prior to receiving the Consent Fee and the different consequences that may apply if you are subject to special rules that apply to certain types of investors, such as:

| • | financial institutions; |

| • | insurance companies; |

| • | dealers or traders subject to a mark-to-market method of tax accounting with respect to the Notes; |

| • | persons holding the Notes as part of a “straddle,” integrated transaction or similar transaction; |

| • | U.S. holders (as defined below) whose functional currency is not the U.S. dollar; |

| • | partnerships or other pass-through entities for U.S. federal income tax purposes; and |

| • | tax-exempt entities. |

If you are a partnership for U.S. federal income tax purposes, the U.S. federal income tax treatment of your partners will generally depend on the status of the partners and your activities.

This discussion is based on the Code, and administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations as of the date hereof, changes to any of which subsequent to the date hereof may affect the tax consequences described herein, possibly on a retroactive basis. This discussion does not address any aspect of state, local or non-U.S. taxation, or any U.S. federal taxes other than income taxes.

You are urged to consult your tax advisor with respect to the application of U.S. federal tax laws to your particular situation, as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

Modification of the Notes

General. A “modification” of the terms of a debt instrument, which for this purpose would include the Proposed Amendments, results in a deemed exchange of the original debt instrument for a new debt instrument for U.S. federal income tax purposes in which, subject to the recapitalization rules described below, gain or loss may be recognized by holders if the modification is “significant.” Subject to provisions applicable to certain categories of modifications, a modification is “significant” under the applicable Treasury regulations if, based on all facts and circumstances, the legal rights or obligations that are altered and the degree to which they are altered are “economically significant.” The applicable Treasury regulations provide that a modification that deletes or alters customary accounting or financial covenants is not a significant modification; the Treasury regulations, however, do not define “customary accounting or financial covenants.” We intend to take the position that the Proposed Amendments, without taking into account the Consent Fee, do not cause a significant modification of the terms of the Notes and, therefore, do not result in a deemed exchange of the Notes.