Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PARK NATIONAL CORP /OH/ | ex991prkcabannouncementrel.htm |

| 8-K - 8-K - PARK NATIONAL CORP /OH/ | prk2018-09x138xkannounceme.htm |

Exhibit 99.2 and Strategic Partnership and Expansion into South Carolina NYSE AMERICAN: PRK | OTCQX: CABF September 13, 2018

Forward-looking Statement Disclosure Certain statements contained in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between Park National Corporation (“Park”) and CAB Financial Corporation (“CAB Financial” or “CABF”), including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of Park’s goals, intentions and expectations; statements regarding the Park’s business plan and growth strategies; statements regarding the asset quality of Park’s loan and investment portfolios; and estimates of Park’s risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of Park and CAB Financial will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of Park to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like Park’s affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; and changes in market, economic, operational, liquidity, credit and interest rate risks associated with the Park’s business. Please refer to Park’s Annual Report on Form 10-K for the year ended December 31, 2017, as well as its other filings with the Securities and Exchange Commission (the "SEC"), for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements. All forward-looking statements included in this communication are made as of the date hereof and are based on information available as of the date hereof. Except as required by law, neither Park nor CAB Financial assumes any obligation to update any forward-looking statement. 1

Important Information about the Merger In connection with the proposed merger, Park will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of and a Prospectus of Park, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS OF CAB FINANCIAL ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, CAB FINANCIAL AND THE PROPOSED TRANSACTION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Park and CAB Financial, may be obtained at the SEC’s website (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Park at the “Investor Relations” section of Park's website at www.parknationalcorp.com or from CAB Financial at the “Investor Relations” section of CAB Financial’s website at www.carolinaalliancebank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Park National Corporation, 50 North Third Street, P.O. Box 3500, Newark, OH 43058-3500, Attention: Brady Burt, Telephone: (740) 322-6844 or to CAB Financial Corporation, PO Box 932, Spartanburg, SC 29306, Attention: Lamar Simpson, Telephone: (864) 208-2265. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The communication is not a substitute for the Registration Statement that will be filed with the SEC or the Proxy Statement/Prospectus that will be sent to CAB Financial shareholders. Proxy Solicitation CAB Financial and certain of its directors, executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from CAB Financial’s shareholders in favor of the approval of the Merger. Information about the directors and executive officers of CAB Financial and their ownership of CAB Financial common stock, as well as information regarding the interests of other persons who may be deemed participants in the transaction, may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described above. 2

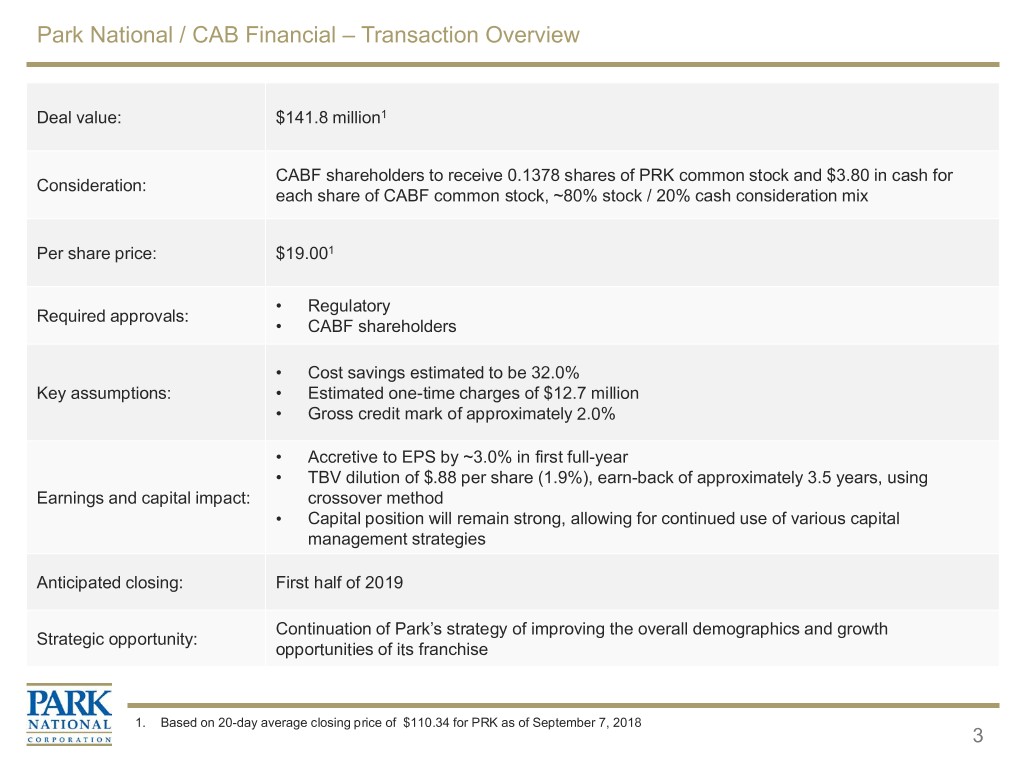

Park National / CAB Financial – Transaction Overview Deal value: $141.8 million1 CABF shareholders to receive 0.1378 shares of PRK common stock and $3.80 in cash for Consideration: each share of CABF common stock, ~80% stock / 20% cash consideration mix Per share price: $19.001 • Regulatory Required approvals: • CABF shareholders • Cost savings estimated to be 32.0% Key assumptions: • Estimated one-time charges of $12.7 million • Gross credit mark of approximately 2.0% • Accretive to EPS by ~3.0% in first full-year • TBV dilution of $.88 per share (1.9%), earn-back of approximately 3.5 years, using Earnings and capital impact: crossover method • Capital position will remain strong, allowing for continued use of various capital management strategies Anticipated closing: First half of 2019 Continuation of Park’s strategy of improving the overall demographics and growth Strategic opportunity: opportunities of its franchise 1. Based on 20-day average closing price of $110.34 for PRK as of September 7, 2018 3

Park National / CAB Financial – Selected Highlights CABF Financials Pro Forma Branch Map (as of and for the quarter ended 06/30/18) . Total assets: $730.7 million . Total gross loans: $567.0 million . Total deposits: $599.7 million . Total equity: $78.9 million . Tangible common equity / tangible assets: 10.18% . LTM efficiency ratio: 77.8% . LTM return on average assets: 0.70% . NPAs / assets: 0.58% . LTM NCOs (recoveries) / average loans: (0.01)% Transaction Metrics1 . Purchase price per share / TBVPS: 186% . Purchase price per share / 1st full-year EPS w/ cost saves: 12.3x . Approximate CAB Financial pro forma ownership: 6.2% Park Branches (110) Park LPO CAB Financial Branches (7) 1. Based on 20-day average closing price of $110.34 for PRK as of September 7, 2018 4

Park National / CAB Financial – Strategic Rationale . Consistent with Park’s strategy of adding attractive growth markets to its historical markets − CABF’s Asheville, North Carolina and Greenville and Spartanburg, South Carolina markets have superior demographic and employment trends relative to Park’s legacy markets − Complimentary market extension to the July 2018 completion of NewDominion Bank partnership in Charlotte, NC . CABF has a history of being very focused on personal service and community involvement – a hallmark of Park’s approach to banking − Principles and core values are closely aligned . Experienced management team that has built an attractive merger partner operating in a safe and sound manner . Partnership will increase CABF’s lending capacity providing additional lending opportunities in the middle-market and will diversify CABF’s wealth management business 5