Attached files

| file | filename |

|---|---|

| 8-K - PMT FORM 8-K (09-12-18) - PennyMac Mortgage Investment Trust | pmt-8k_20180912.htm |

PennyMac Mortgage Investment Trust September 13, 2018 Barclays Global Financial Services Conference Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in our investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject us to additional risks; volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets specifically, whether the result of market events or otherwise; events or circumstances which undermine confidence in the financial markets or otherwise have a broad impact on financial markets, such as the sudden instability or collapse of large depository institutions or other significant corporations, terrorist attacks, natural or man-made disasters, or threatened or actual armed conflicts; changes in general business, economic, market, employment and political conditions, or in consumer confidence and spending habits from those expected; declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy our investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and our success in doing so; the concentration of credit risks to which we are exposed; the degree and nature of our competition; our dependence on our manager and servicer, potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at our manager, servicer or their affiliates; the availability, terms and deployment of short-term and long-term capital; the adequacy of our cash reserves and working capital; our ability to maintain the desired relationship between our financing and the interest rates and maturities of our assets; the timing and amount of cash flows, if any, from our investments; unanticipated increases or volatility in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; the ability of our servicer, which also provides us with fulfillment services, to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties; our indemnification and repurchase obligations in connection with mortgage loans we purchase and later sell or securitize; the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which we invest; increased rates of delinquency, default and/or decreased recovery rates on our investments; our ability to foreclose on our investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying our mortgage-backed securities or relating to our mortgage servicing rights , excess servicing spread and other investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of operations; our failure to maintain appropriate internal controls over financial reporting; technologies for loans and our ability to mitigate security risks and cyber intrusions; our ability to obtain and/or maintain licenses and other approvals in those jurisdictions where required to conduct our business; our ability to detect misconduct and fraud; our ability to comply with various federal, state and local laws and regulations that govern our business; developments in the secondary markets for our mortgage loan products; legislative and regulatory changes that impact the mortgage loan industry or housing market; changes in regulations or the occurrence of other events that impact the business, operations or prospects of government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such entities; the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations and regulatory agencies, and any other legislative and regulatory changes that impact the business, operations or governance of mortgage lenders and/or publicly-traded companies; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of homeownership; changes in government or government-sponsored home affordability programs; limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a real estate investment trust (REIT) for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes, as applicable, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws governing the taxation of REITs, or the exclusions from registration as an investment company); the effect of public opinion on our reputation; the occurrence of natural disasters or other events or circumstances that could impact our operations; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. 2018 Barclays Global Financial Services Conference

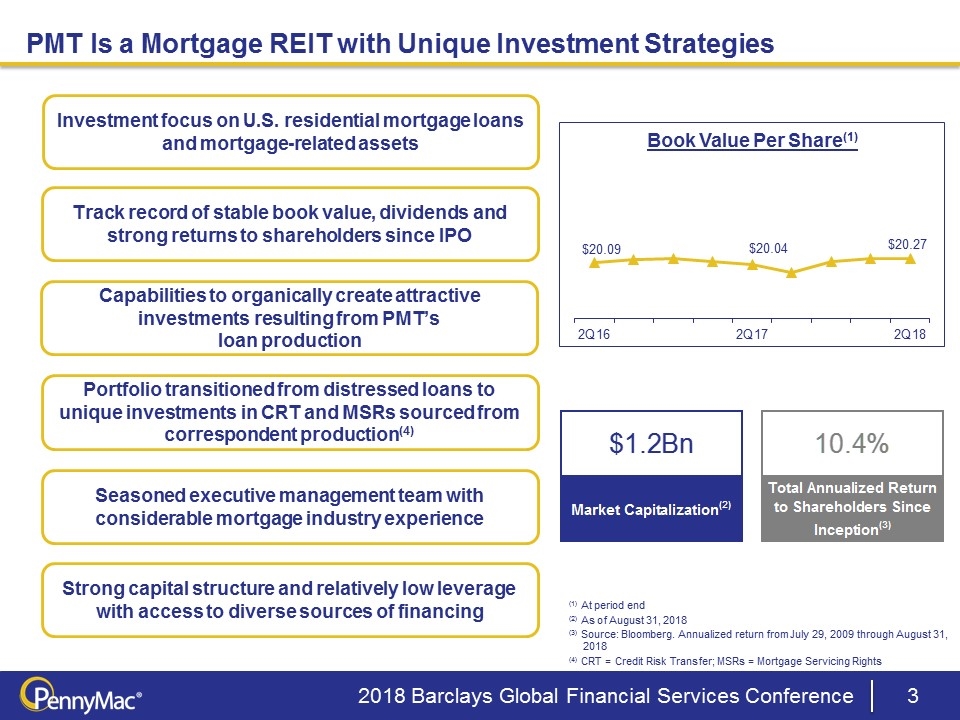

PMT Is a Mortgage REIT with Unique Investment Strategies 2018 Barclays Global Financial Services Conference Investment focus on U.S. residential mortgage loans and mortgage-related assets Capabilities to organically create attractive investments resulting from PMT’s loan production Portfolio transitioned from distressed loans to unique investments in CRT and MSRs sourced from correspondent production(4) Track record of stable book value, dividends and strong returns to shareholders since IPO Seasoned executive management team with considerable mortgage industry experience Strong capital structure and relatively low leverage with access to diverse sources of financing (1) At period end (2) As of August 31, 2018 (3) Source: Bloomberg. Annualized return from July 29, 2009 through August 31, 2018 (4) CRT = Credit Risk Transfer; MSRs = Mortgage Servicing Rights Book Value Per Share(1) $1.5Bn $6.7Bn Shareholders' Equity(1) Total Assets(1) $1.2Bn Market Capitalization(2) 3.3202233341335128 0.104 Debt-to-Equity Ratio(1) Total Annualized Return to Shareholders Since Inception(3) 5131362 1545487 3.3202233341335128 $1.5Bn $6.7Bn Shareholders' Equity(1) Total Assets(1) $1.2Bn Market Capitalization(2) 3.3202233341335128 0.104 Debt-to-Equity Ratio(1) Total Annualized Return to Shareholders Since Inception(3) 5131362 1545487 3.3202233341335128

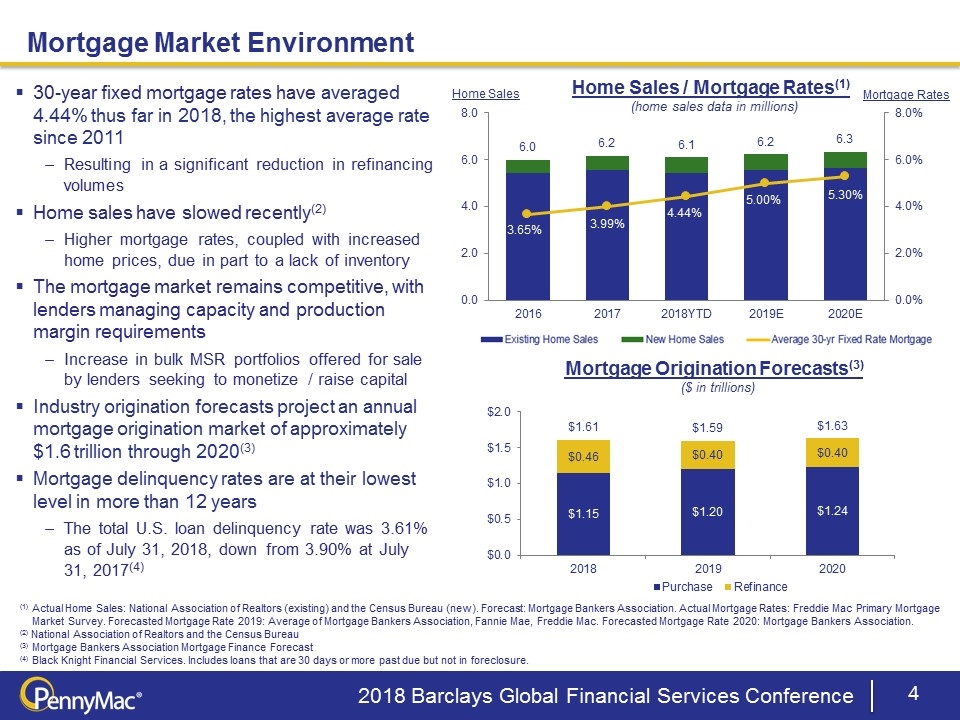

Mortgage Market Environment 2018 Barclays Global Financial Services Conference Mortgage Origination Forecasts(3) ($ in trillions) 30-year fixed mortgage rates have averaged 4.44% thus far in 2018, the highest average rate since 2011 Resulting in a significant reduction in refinancing volumes Home sales have slowed recently(2) Higher mortgage rates, coupled with increased home prices, due in part to a lack of inventory The mortgage market remains competitive, with lenders managing capacity and production margin requirements Increase in bulk MSR portfolios offered for sale by lenders seeking to monetize / raise capital Industry origination forecasts project an annual mortgage origination market of approximately $1.6 trillion through 2020(3) Mortgage delinquency rates are at their lowest level in more than 12 years The total U.S. loan delinquency rate was 3.61% as of July 31, 2018, down from 3.90% at July 31, 2017(4) Home Sales / Mortgage Rates(1) (home sales data in millions) (1) Actual Home Sales: National Association of Realtors (existing) and the Census Bureau (new). Forecast: Mortgage Bankers Association. Actual Mortgage Rates: Freddie Mac Primary Mortgage Market Survey. Forecasted Mortgage Rate 2019: Average of Mortgage Bankers Association, Fannie Mae, Freddie Mac. Forecasted Mortgage Rate 2020: Mortgage Bankers Association. (2) National Association of Realtors and the Census Bureau (3) Mortgage Bankers Association Mortgage Finance Forecast (4) Black Knight Financial Services. Includes loans that are 30 days or more past due but not in foreclosure. Home Sales Mortgage Rates

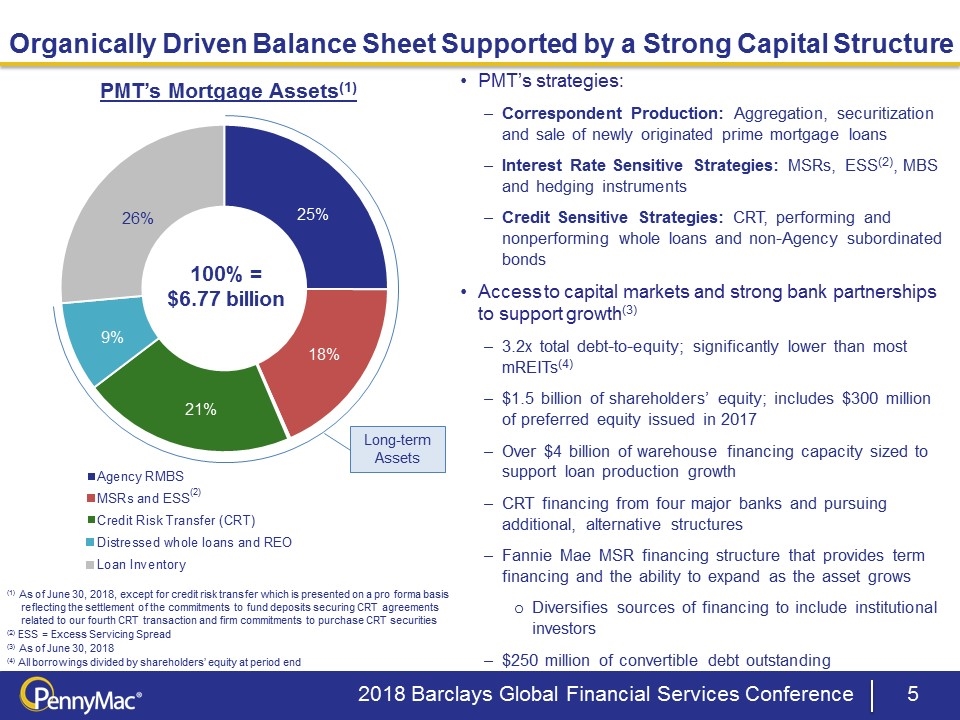

(1) As of June 30, 2018, except for credit risk transfer which is presented on a pro forma basis reflecting the settlement of the commitments to fund deposits securing CRT agreements related to our fourth CRT transaction and firm commitments to purchase CRT securities (2) ESS = Excess Servicing Spread (3) As of June 30, 2018 (4) All borrowings divided by shareholders’ equity at period end Organically Driven Balance Sheet Supported by a Strong Capital Structure 2018 Barclays Global Financial Services Conference PMT’s Mortgage Assets(1) 100% = $6.77 billion Long-term Assets PMT’s strategies: Correspondent Production: Aggregation, securitization and sale of newly originated prime mortgage loans Interest Rate Sensitive Strategies: MSRs, ESS(2), MBS and hedging instruments Credit Sensitive Strategies: CRT, performing and nonperforming whole loans and non-Agency subordinated bonds Access to capital markets and strong bank partnerships to support growth(3) 3.2x total debt-to-equity; significantly lower than most mREITs(4) $1.5 billion of shareholders’ equity; includes $300 million of preferred equity issued in 2017 Over $4 billion of warehouse financing capacity sized to support loan production growth CRT financing from four major banks and pursuing additional, alternative structures Fannie Mae MSR financing structure that provides term financing and the ability to expand as the asset grows Diversifies sources of financing to include institutional investors $250 million of convertible debt outstanding 25% 18% 21% 9% 26% (2)

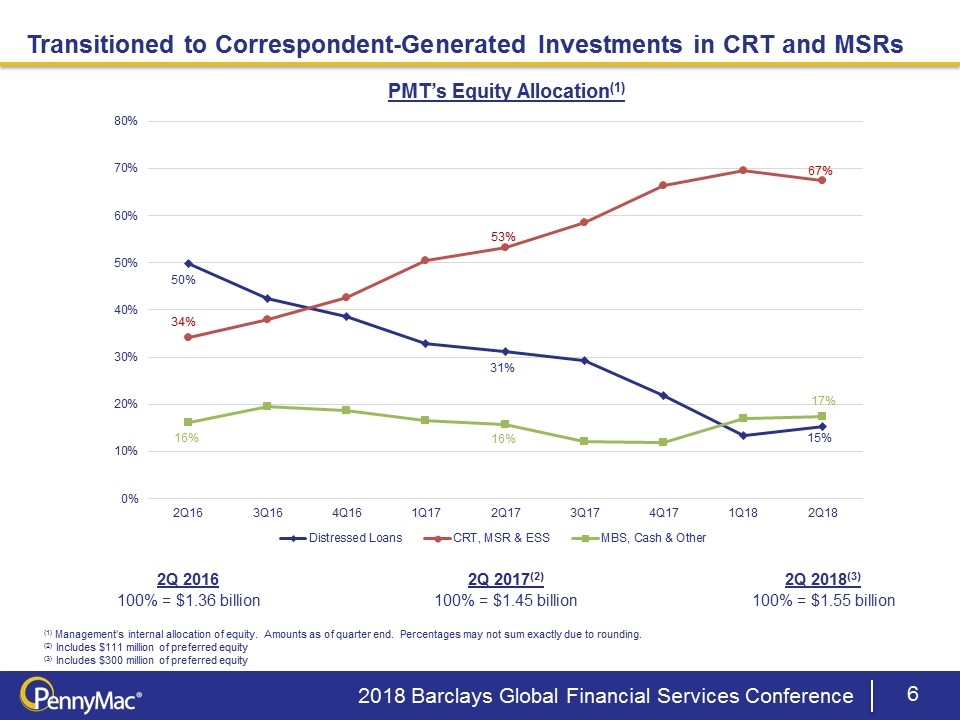

Transitioned to Correspondent-Generated Investments in CRT and MSRs 2018 Barclays Global Financial Services Conference 2Q 2016 100% = $1.36 billion 2Q 2018(3) 100% = $1.55 billion PMT’s Equity Allocation(1) (1) Management’s internal allocation of equity. Amounts as of quarter end. Percentages may not sum exactly due to rounding. (2) Includes $111 million of preferred equity (3) Includes $300 million of preferred equity 2Q 2017(2) 100% = $1.45 billion

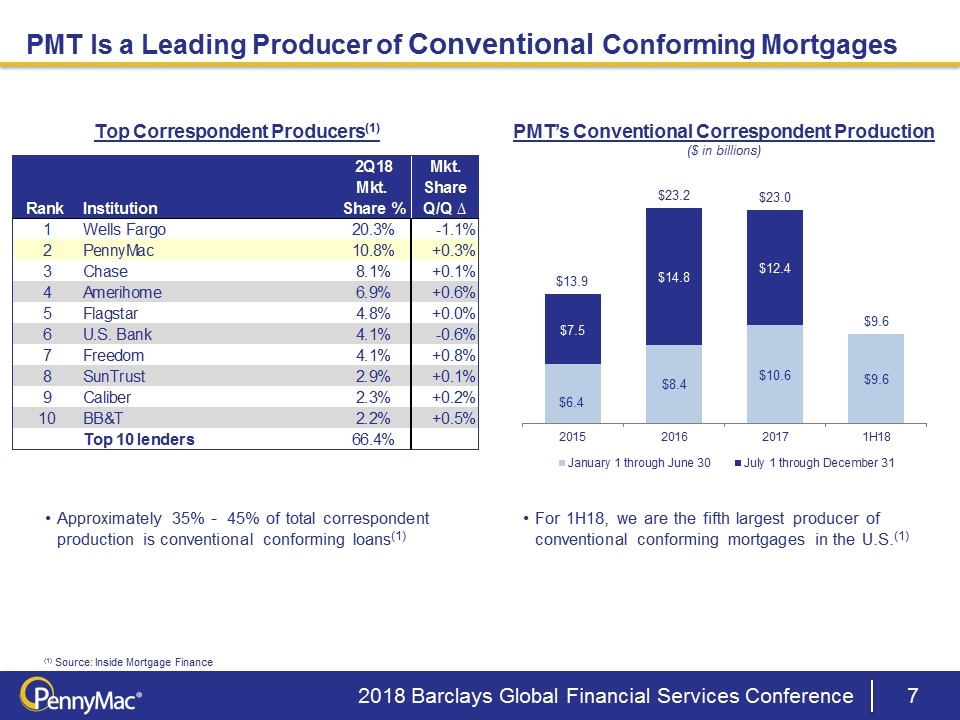

PMT Is a Leading Producer of Conventional Conforming Mortgages 2018 Barclays Global Financial Services Conference 7 PMT’s Conventional Correspondent Production ($ in billions) Top Correspondent Producers(1) For 1H18, we are the fifth largest producer of conventional conforming mortgages in the U.S.(1) (1) Source: Inside Mortgage Finance Approximately 35% - 45% of total correspondent production is conventional conforming loans(1) Top Correspondent Channel Lenders 2Q18 Mkt. Mkt. Mkt. Share Rank Institution Share % Share % Q/Q ∆ 1 Wells Fargo 0.20347826086956519 #REF! -1.11991585% 2 PennyMac 0.10834057971014494 #REF! .30502571% 3 Chase 8.6% #REF! 9184198223468748.91841982% 4 Amerihome 6.9% #REF! .63021272% 5 Flagstar 4.8% #REF! 46832632071060892.46832632% 6 U.S. Bank 4.9% #REF! -0.5540907% 7 Freedom 4.6% #REF! .75305049% 8 SunTrust 2.9% #REF! 95044413277232606.95044413% 9 Caliber 2.3% #REF! .18112436% 10 BB&T 2.2% #REF! .46529921% Top 10 lenders 0.66356521739130436

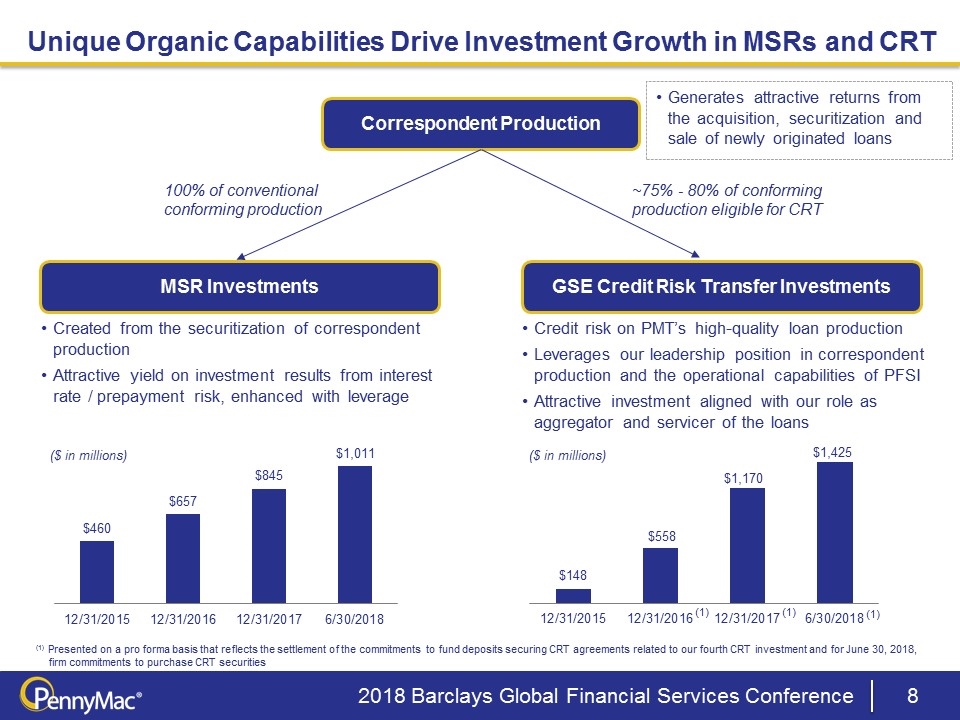

Correspondent Production 2018 Barclays Global Financial Services Conference Unique Organic Capabilities Drive Investment Growth in MSRs and CRT 100% of conventional conforming production ~75% - 80% of conforming production eligible for CRT GSE Credit Risk Transfer Investments Generates attractive returns from the acquisition, securitization and sale of newly originated loans MSR Investments Created from the securitization of correspondent production Attractive yield on investment results from interest rate / prepayment risk, enhanced with leverage Credit risk on PMT’s high-quality loan production Leverages our leadership position in correspondent production and the operational capabilities of PFSI Attractive investment aligned with our role as aggregator and servicer of the loans ($ in millions) ($ in millions) (1) Presented on a pro forma basis that reflects the settlement of the commitments to fund deposits securing CRT agreements related to our fourth CRT investment and for June 30, 2018, firm commitments to purchase CRT securities (1) (1) (1)

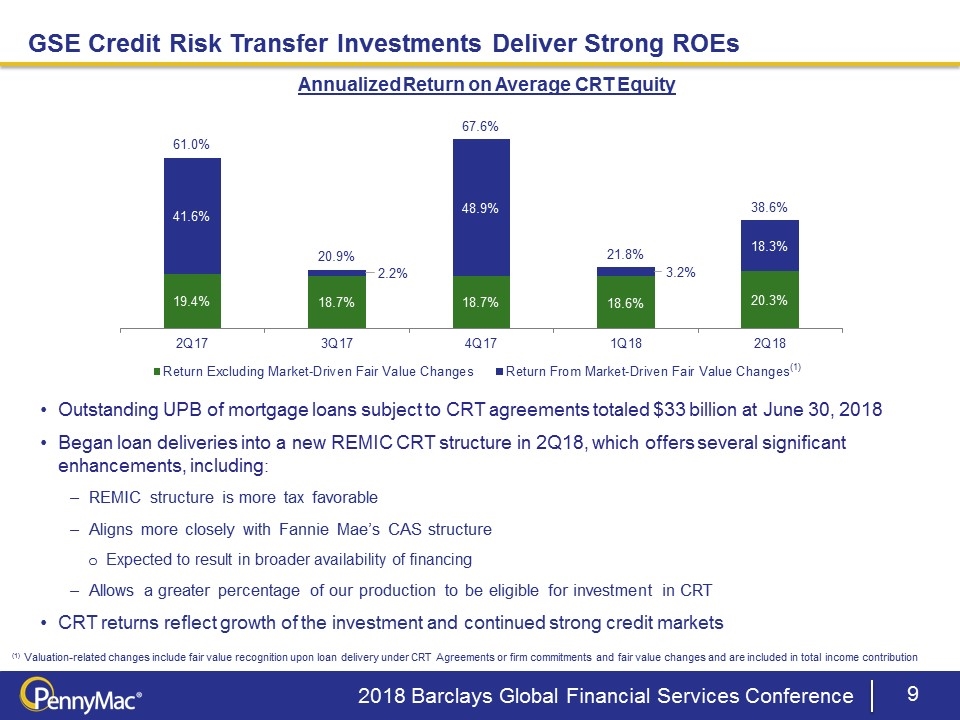

GSE Credit Risk Transfer Investments Deliver Strong ROEs 2018 Barclays Global Financial Services Conference Outstanding UPB of mortgage loans subject to CRT agreements totaled $33 billion at June 30, 2018 Began loan deliveries into a new REMIC CRT structure in 2Q18, which offers several significant enhancements, including: REMIC structure is more tax favorable Aligns more closely with Fannie Mae’s CAS structure Expected to result in broader availability of financing Allows a greater percentage of our production to be eligible for investment in CRT CRT returns reflect growth of the investment and continued strong credit markets Annualized Return on Average CRT Equity (1) Valuation-related changes include fair value recognition upon loan delivery under CRT Agreements or firm commitments and fair value changes and are included in total income contribution (1)

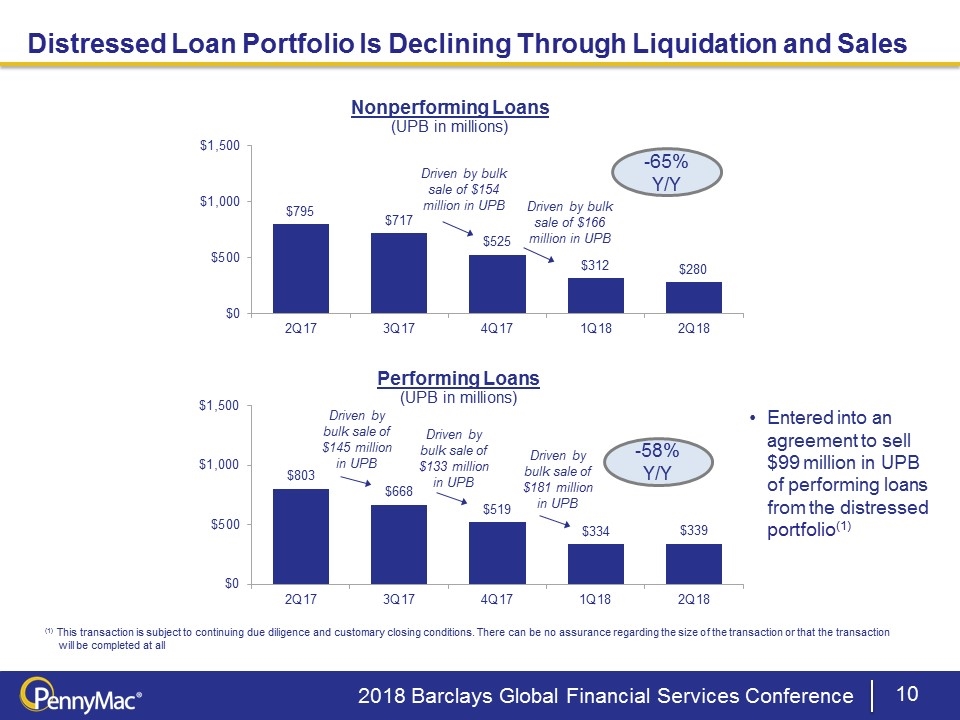

Entered into an agreement to sell $99 million in UPB of performing loans from the distressed portfolio(1) (1) This transaction is subject to continuing due diligence and customary closing conditions. There can be no assurance regarding the size of the transaction or that the transaction will be completed at all -65% Y/Y Driven by bulk sale of $145 million in UPB Driven by bulk sale of $133 million in UPB Driven by bulk sale of $166 million in UPB Driven by bulk sale of $181 million in UPB Driven by bulk sale of $154 million in UPB Distressed Loan Portfolio Is Declining Through Liquidation and Sales 2018 Barclays Global Financial Services Conference -58% Y/Y

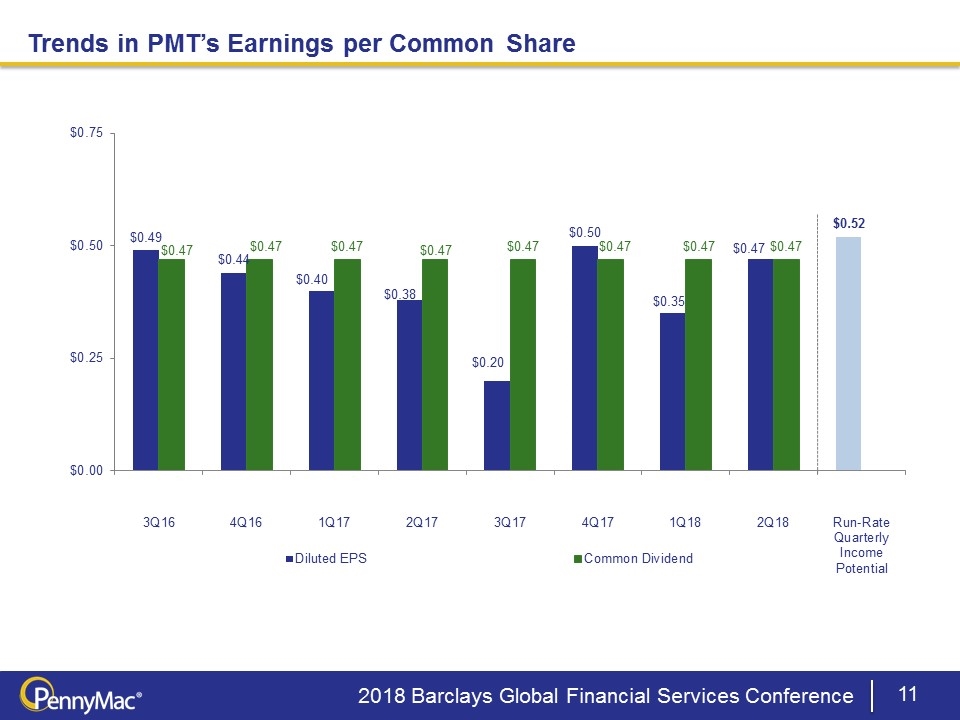

Trends in PMT’s Earnings per Common Share 2018 Barclays Global Financial Services Conference

2018 Barclays Global Financial Services Conference PMT’s Strategies for Long-Term Growth Business model focused on core strategies of organic investments in CRT and MSRs, with attractive returns and significant growth opportunities Balanced portfolio of interest rate and credit sensitive investments, driven by our conventional conforming production volumes Increase in hedge instruments and MBS positions to offset impact of interest rate volatility The U.S. residential mortgage market remains a large market with considerable growth opportunities for companies with the requisite expertise and access to operational capabilities, like PMT Growth strategies beyond CRT and MSRs reflect our mortgage market expertise and risk management capabilities, as well as access to the operational infrastructure of our manager and services provider, PennyMac Financial Non-Agency securitizations – subordinate credit tranches on non-Agency securitizations of prime loans Residual interests from HELOC securitizations We expect these strategies to result in meaningful growth in PMT’s balance sheet over time