Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wheeler Real Estate Investment Trust, Inc. | f8k091118_wheelerreal.htm |

Exhibit 99.1

WHLR COMPANY PRESENTATION SEPTEMBER 2018 NASDAQ:WHLR www.whlr.us

All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. Safe Harbor This presentation may contain “forward - looking” statements as defined in the Private Securities Litigation Reform Act of 1995 . When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward - looking statements . Forward - looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward - looking statements . The Company’s expected results may not be achieved, and actual results may differ materially from expectations . Specifically, the Company’s statements regarding : ( i ) the Company’s ability to implement a strategic long - term plan ; (ii) the Company’s ability to reduce operating costs, including general and administrative expenses ; (iii) the Company's ability to decrease debt through asset dispositions ; (iv) the Company's ability to improve its balance sheet and cash flows ; (v) the Company’s ability to stabilize cash flows ; (vi) the Company’s ability to reduce the KeyBank line below $ 50 million ; (vii) the Company’s ability to payoff the Revere loan ; and (viii) the Company's ability to reinstate a common stock dividend are forward - looking statements . These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements . For these reasons, among others, investors are cautioned not to place undue reliance upon any forward - looking statements in this presentation . Additional factors are discussed in the Company's filings with the U . S . Securities and Exchange Commission, which are available for review at www . sec . gov . The Company undertakes no obligation to publicly revise these forward - looking statements to reflect events or circumstances that arise after the date hereof . Important Additional Information The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with matters to be considered at the Company’s 2018 Annual Meeting of Stockholders (the “ 2018 Annual Meeting”) . The Company has filed a definitive proxy statement and WHITE proxy card with the U . S . Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s stockholders . STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION . Information regarding the identities of the Company’s directors and executive officers, and their direct or indirect interests, by security holdings or otherwise, are set forth in the proxy statement and other materials filed with the SEC in connection with the 2018 Annual Meeting . Stockholders can obtain the proxy statement, any amendments or supplements to the proxy statement, and any other documents filed by the Company with the SEC at no charge at the SEC’s website at www . sec . gov . These documents are also available at no charge in the “SEC Filings” or “Proxy Materials” sections of the Company’s website at www . whlr . us . PAGE 2 www.whlr.us

WHLR Corporate Overview ▪ Internally managed REIT ▪ Primarily grocery - anchored shopping centers with strong demographics and supportive barriers to entry ▪ Portfolio acquired at a discount to replacement cost ▪ Concentrated in Southeast and Mid - Atlantic Markets ▪ 73 properties – 5.7 million square feet of GLA ▪ 66 shopping center/ retail properties; 6 undeveloped land parcels, 1 self - occupied office building ▪ New C - suite focused on shareholder value ▪ Proven operators with decades of REIT and retail experience ▪ Industry experience in owning, operating and leasing retail properties ▪ Income producing real estate ▪ $49.3 million annual base rent ▪ Over 90% leased ▪ Diversified tenant base 5.7 Million SF of GLA Necessity - Based Real Estate Industry Experts Focused on a Strong Capital Structure and Shareholder Value Solid Operating Platform All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 3 www.whlr.us

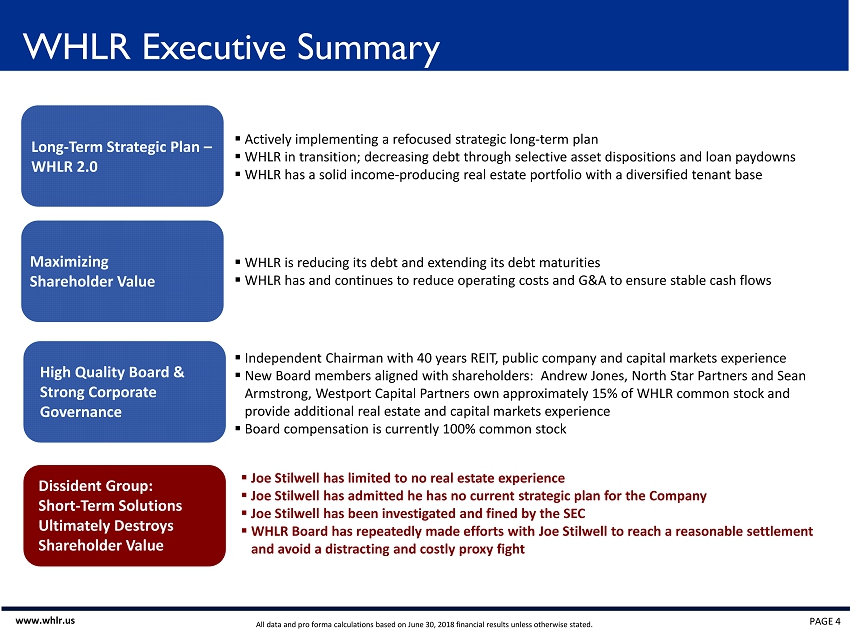

WHLR Executive Summary ▪ Actively implementing a refocused strategic long - term plan ▪ WHLR in transition; decreasing debt through selective asset dispositions and loan paydowns ▪ WHLR has a solid income - producing real estate portfolio with a diversified tenant base ▪ WHLR is reducing its debt and extending its debt maturities ▪ WHLR has and continues to reduce operating costs and G&A to ensure stable cash flows ▪ Independent Chairman with 40 years REIT, public company and capital markets experience ▪ New Board members aligned with shareholders: Andrew Jones, North Star Partners and Sean Armstrong, Westport Capital Partners own approximately 15% of WHLR common stock and provide additional real estate and capital markets experience ▪ Board compensation is currently 100% common stock ▪ Joe Stilwell has limited to no real estate experience ▪ Joe Stilwell has admitted he has no current strategic plan for the Company ▪ Joe Stilwell has been investigated and fined by the SEC ▪ WHLR Board has repeatedly made efforts with Joe Stilwell to reach a reasonable settlement and avoid a distracting and costly proxy fight Long - Term Strategic Plan – WHLR 2.0 Maximizing Shareholder Value High Quality Board & Strong Corporate Governance Dissident Group: Short - Term Solutions Ultimately Destroys Shareholder Value All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 4 www.whlr.us

WHLR Rebuilding its Foundation – Version 2.0 Wheeler BEFORE – Version 1.0 (IPO – January 29, 2018) 1. Combined CEO & Chairman 2. Unsustainable Dividend 3. Building Debt 4. Rapid Growth Through Acquisitions 5. High G&A 6. Shareholder Dilution WHLR’s goals are to increase the Company’s shareholder value, enhance its real estate portfolio and shore up its balance sheet flexibility, to improve cash flows WHLR RESET – Version 2.0 (January 30, 2018 and On…) 1. Independent Chairman 2. Return a Sustainable Dividend 3. Reducing Debt 4. Selling Non - Core Assets 5. Reducing G&A, In Line with Peers 6. Focused on Shareholder Value All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 5 www.whlr.us

WHLR Competitive Advantages Real estate operations and asset management expertise leads to consistent cash flows, which provides significant value for WHLR shareholders Strong Corporate Governance with Independent Board Experienced Management Team Stabilized Real Estate Portfolio with Consistent Cash Flows • Insiders have not sold shares • Directors are currently paid 100% stock • Separate Chairman and CEO Roles • No active “Poison Pill” • Annual Election of all Directors • 7 of 8 Directors are Independent • Several decades combined commercial real estate & capital markets experience • Implementing long - term, strategic growth plan: • Decreasing G&A • Decreasing operating expenses • More diversified tenant base • Selling non - core assets • YTD Leasing spread of 3.6% on renewals • Executed >200k sf new leases YTD • Executed >320k sf renewed leases YTD • Sequential 3.6% Same - Store NOI Increase • $900k decrease in Corporate G&A, net of non - recurring transition expenses YTD All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 6 www.whlr.us

WHLR BOD and Executive Management Bios John Sweet Chairman • 40 years public company and capital markets experience • Co - founder Physicians Realty Trust (DOC: NYSE) • Co - founder Windrose Medical Properties Sean Armstrong, CFA Director • 24 years real estate experience and direct asset management experience • Represents approximately 9.1% of WHLR outstanding common shares through Westport Capital (as of 08/23/2018) • Served on Lodgian, Inc. Board of Directors Stewart Brown Director • 45 years financial and organization management experience • Extensive real estate expertise • Served as Chairman of the Board of Lodgian, Inc; and Chairman of the Credit/Risk Committee for Community and Southern Bank Andrew Jones, CFA Director • CEO of North Star Partners, an alternative investment vehicle • Represents approximately 5.6% of WHLR outstanding common shares through North Star Partners (as of 08/23/2018) • Prior Managing Director at Tweedy Browne, LP, and has served on previous Boards John McAuliffe Director • 39 years financial industry experience • Found his own public company consulting company – a private firm that advises public companies • Extensive capital markets experience, including strategic initiatives Carl McGowan Director • 30 years extensive financial services expertise • Serves as faculty distinguished professor of finance at Norfolk State University • Corporate finance and international finance expertise Jeffrey Zwerdling Director • Founder and Managing Partner of Zwerdling, Oppleman & Adams, formed in 1972 • Expertise in corporate law and commercial real estate • Served on the CSM and Supertel Hospitality boards David Kelly Chief Executive Officer Non - Independent Director • 25 years real estate experience • In - depth knowledge of WHLR real estate portfolio, underwriting • Previous Chief Investment Officer of the Company Matthew Reddy Chief Financial Officer • 10 years experience in various roles overseeing public accounting and compliance • Expertise in corporate forecasting, planning and analysis • Capital markets experience Andrew Franklin Chief Operating Officer • 18 years commercial real estate experience • Extensive expertise in asset management, operations and leasing • Capital markets and underwriting abilities All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 7 www.whlr.us

WHLR Balance Sheet Strategy High Leverage (>60%) Compared to Peers Revere & KeyBank Overhang Suspended Unsustainable Common Dividend Non - Core Asset Sales Low Leverage (<40%) Pay Off Revere Loan Reduce KeyBank Credit Facility Below $50M Reinstate a Sustainable Common Dividend GOALS All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 8 www.whlr.us

Vote with WHLR FOR AGAINST • WHLR continuing to implement a long - term strategic plan that seeks to maximize shareholder value • Joe Stillwell, who has not communicated a strategic plan for WHLR • Independent Board with diverse skill sets, as well as extensive public company, commercial real estate and capital markets experience. • Joe Stillwell, who has been fined and suspended by the SEC for violations of the Investment Advisers Act of 1940 • Executive management team that is fully engaged in creating shareholder value • Sitwell Group’s nominees – we believe they do not offer any additional skill sets to our board, and the their nominees have never operated a publicly traded real estate company • Operators who know WHLR’s real estate portfolio and know how to derive value through their network and operating expertise All data and pro forma calculations based on June 30, 2018 financial results unless otherwise stated. PAGE 9 www.whlr.us

WHLR Thank you NASDAQ:WHLR Investor Contact Mary Jensen investors@whlr.us 757.627.9088