Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SmartStop Self Storage REIT, Inc. | ck0001585389-8k_20180911.htm |

Second Quarter Update Strategic Storage Trust II, Inc. H. Michael Schwartz – Founder, Chairman & CEO Exhibit 99.1

Disclaimer & Risk Factors This investor presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties related to the timing and availability of distributions; and other risk factors as outlined in the Company’s public filings with the Securities and Exchange Commission. This is neither an offer nor a solicitation to purchase securities. See our Form 10-K and recent Form 10-Q for specific risks associated with an investment in Strategic Storage Trust II, Inc. As of June 30, 2018, our accumulated deficit was approximately $61 million and it is possible that our operations may not be profitable in 2018. We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering and our distribution reinvestment plan (DRP offering). We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. For the years ended December 31, 2014, 2015 and 2016, we funded 100% of our distributions using proceeds from our offering. For the year ended December 31, 2017, we funded 59% of our distributions using cash flow from operations and 41% using proceeds from our offering and DRP offering. If we continue to pay distributions from sources other than cash flows from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flows from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and there may never be one. Therefore, it will be difficult for our stockholders to sell their shares. Our charter does not require us to pursue a liquidity transaction at anytime. If you sell your shares, it will likely be at a substantial discount. We may only calculate the value per share for our shares annually and, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis. We cannot assure our stockholders that we will be successful in the marketplace. We have no employees and are dependent on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. There are substantial conflicts of interest among us and our sponsor, advisor, property manager and dealer manager. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with Strategic Storage Growth Trust, Inc. and Strategic Storage Trust IV, Inc., and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We will pay substantial fees and expenses to our advisor and its affiliates for the services they provide to us, which will reduce cash available for investment and distribution. We may be required to pay our advisor a significant distribution if our advisory agreement is involuntarily terminated. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without your consent.

Additional Information Regarding NOI, FFO & MFFO Funds from Operations (“FFO”) and Modified Funds from Operations (“MFFO”) Due to certain unique operating characteristics of real estate companies, the National Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, has promulgated a measure known as funds from operations, or FFO, which SST II believes to be an appropriate supplemental measure to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental performance measure. FFO is not equivalent to SST II’s net income (loss) as determined under GAAP. SST II defines FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004, or the White Paper. The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of property and asset impairment write downs, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. SST II’s FFO calculation complies with NAREIT’s policy described above. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Diminution in value may occur if such assets are not adequately maintained or repaired and renovated as required by relevant circumstances or other measures necessary to maintain the assets are not undertaken. However, SST II believes that, since real estate values historically rise and fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation may be less informative. In addition, in the determination of FFO, SST II believes it is appropriate to disregard impairment charges, as this is a fair value adjustment that is largely based on market fluctuations and assessments regarding general market conditions which can change over time. An asset will only be evaluated for impairment if certain impairment indications exist and if the carrying value, or book value, exceeds the total estimated undiscounted future cash flows (including net rental revenues, net proceeds on the sale of the property, and any other ancillary cash flows at a property or group level under GAAP) from such asset. Testing for impairment is a continuous process and is analyzed on a quarterly basis. Investors should note, however, that determinations of whether impairment charges have been incurred are based partly on anticipated operating performance, because estimated undiscounted future cash flows from a property, including estimated future net rental revenues, net proceeds on the sale of the property, and certain other ancillary cash flows, are taken into account in determining whether an impairment charge has been incurred. While impairment charges are excluded from the calculation of FFO as described above, investors are cautioned that due to the fact that impairments are based on estimated future undiscounted cash flows and that SST II intends to have a relatively limited term of operations; it could be difficult to recover any impairment charges through the eventual sale of the property. To date, SST II has not recognized any impairments. Historical accounting for real estate involves the use of GAAP. Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP. Nevertheless, SST II believes that the use of FFO, which excludes the impact of real estate related depreciation and amortization and impairments, assists in providing a more complete understanding of SST II’s performance to investors and to management, and when compared year over year, reflects the impact on SST II’s operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income (loss). However, FFO or modified funds from operations (“MFFO”), discussed below, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income (loss) or in its applicability in evaluating SST II’s operating performance. The method utilized to evaluate the value and performance of real estate under GAAP should be considered a more relevant measure of operational performance and is, therefore, given more prominence than the non-GAAP FFO and MFFO measures and the adjustments to GAAP in calculating FFO and MFFO. Changes in the accounting and reporting rules under GAAP that were put into effect and other changes to GAAP accounting for real estate subsequent to the establishment of NAREIT’s definition of FFO have prompted an increase in cash-settled expenses, specifically acquisition fees and expenses.

Additional Information Regarding NOI, FFO & MFFO Prior to January 1, 2018, when SST II adopted new accounting guidance, such costs were entirely expensed as operating expenses under GAAP. Subsequent to January 1, 2018, certain of such costs continue to be expensed. SST II believes these fees and expenses do not affect SST II’s overall long-term operating performance. Publicly registered, non-traded REITs typically have a significant amount of acquisition activity and are substantially more dynamic during their initial years of investment and operation. The purchase of properties, and the corresponding expenditures associated with that process, is a key feature of SST II’s business plan in order to generate operational income and cash flow in order to make distributions to investors. While other start-up entities may also experience significant acquisition activity during their initial years, SST II believes that publicly registered, non-traded REITs are unique in that they typically have a limited life with targeted exit strategies within a relatively limited time frame after the acquisition activity ceases. SST II has used the proceeds raised in its offering, including its DRP offering, to acquire properties, and expects to begin the process of achieving a liquidity event (i.e., listing of their shares of common stock on a national securities exchange, a merger or sale, the sale of all or substantially all of their assets, or another similar transaction) within three to five years after the completion of their primary offering, which is generally comparable to other publicly registered, non-traded REITs. Thus, they do not intend to continuously purchase assets and intend to have a limited life. The decision whether to engage in any liquidity event is in the sole discretion of SST II’s board of directors. Due to the above factors and other unique features of publicly registered, non-traded REITs, the Investment Program Association, or the IPA, an industry trade group, has standardized a measure known as MFFO, which the IPA has recommended as a supplemental measure for publicly registered, non-traded REITs and which SST II believes to be another appropriate supplemental measure to reflect the operating performance of a publicly registered, non-traded REIT having the characteristics described above. MFFO is not equivalent to net income (loss) as determined under GAAP, and MFFO may not be a useful measure of the impact of long-term operating performance on value if SST II does not ultimately engage in a liquidity event. SST II believes that, because MFFO excludes any acquisition fees and expenses that affect their operations only in periods in which properties are acquired and that they consider more reflective of investing activities, as well as other non-operating items included in FFO, MFFO can provide, on a going-forward basis, an indication of the sustainability (that is, the capacity to continue to be maintained) of their operating performance after the period in which they are acquiring their properties and once their portfolio is in place. By providing MFFO, they believe they are presenting useful information that assists investors and analysts to better assess the sustainability of their operating performance after their primary offering has been completed and their properties have been acquired. SST II also believes that MFFO is a recognized measure of sustainable operating performance by the publicly registered, non-traded REIT industry. Further, they believe MFFO is useful in comparing the sustainability of their operating performance after their primary offering and acquisitions are completed with the sustainability of the operating performance of other real estate companies that are not as involved in acquisition activities. Investors are cautioned that MFFO should only be used to assess the sustainability of SST II’s operating performance after their primary offering has been completed and properties have been acquired, as it excludes any acquisition fees and expenses that have a negative effect on SST II’s operating performance during the periods in which properties are acquired. SST II defines MFFO, a non-GAAP measure, consistent with the IPA’s Guideline 2010-01, Supplemental Performance Measure for Publicly Registered, Non-Listed REITs: Modified Funds From Operations (the “Practice Guideline”) issued by the IPA in November 2010. The Practice Guideline defines MFFO as FFO further adjusted for the following items included in the determination of GAAP net income (loss): acquisition fees and expenses; amounts relating to straight line rents and amortization of above or below intangible lease assets and liabilities; accretion of discounts and amortization of premiums on debt investments; non-recurring impairments of real estate related investments; mark-to-market adjustments included in net income; non-recurring gains or losses included in net income from the extinguishment or sale of debt, hedges, foreign exchange, derivatives or securities holdings where trading of such holdings is not a fundamental attribute of the business plan, unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity accounting, adjustments relating to contingent purchase price obligations included in net income, and after adjustments for consolidated and unconsolidated partnerships and joint ventures, with such adjustments calculated to reflect MFFO on the same basis. The accretion of discounts and amortization of premiums on debt investments, unrealized gains and losses on hedges, foreign exchange, derivatives or securities holdings, unrealized gains and losses resulting from consolidations, as well as other listed cash flow adjustments are adjustments made to net income (loss) in calculating cash flows from operations and, in some cases, reflect gains or losses which are unrealized and may not ultimately be realized. SST II’s MFFO calculation complies with the IPA’s Practice Guideline described above. In calculating MFFO, SST II excludes acquisition related expenses, the amortization of fair value adjustments related to debt, mark to market adjustments recorded in net income related to their derivatives, and the adjustments of such items related to noncontrolling interests. The other adjustments included in the IPA’s Practice Guideline are not applicable to SST II for the periods presented. Acquisition fees and expenses are paid in cash by SST II, and they have not set aside or put into escrow any specific amount of proceeds from their offering to be used to fund acquisition fees and expenses. SST II does not intend to fund acquisition fees and expenses in the future from operating revenues and cash flows, nor from the sale of properties and subsequent re-deployment of capital and concurrent incurrence of acquisition fees and expenses. Acquisition fees and expenses include payments to SST II’s advisor and third parties. Certain acquisition related expenses under GAAP are considered operating expenses and as expenses included in the determination of net income (loss) and income (loss) from continuing operations, both of which are performance measures under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to investors, the potential for future distributions, and cash flows generated by SST II, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase price of the property, these fees and expenses and other costs related to such property. In the future, if SST II is not able to raise additional proceeds from their DRP offering or other offerings, this could result in them paying acquisition fees or reimbursing acquisition expenses due to its advisor, or a portion thereof, with net proceeds from borrowed funds, operational earnings or cash flows, net proceeds from the sale of properties, or ancillary cash flows. As a result, the amount of proceeds available for investment and operations would be reduced, or may incur additional interest expense as a result of borrowed funds.

Additional Information Regarding NOI, FFO & MFFO Further, under GAAP, certain contemplated non-cash fair value and other non-cash adjustments are considered operating non-cash adjustments to net income (loss) in determining cash flows from operations. In addition, SST II views fair value adjustments of derivatives and the amortization of fair value adjustments related to debt as items which are unrealized and may not ultimately be realized or as items which are not reflective of on-going operations and are therefore typically adjusted for when assessing operating performance. SST II uses MFFO and the adjustments used to calculate it in order to evaluate their performance against other publicly registered, non-traded REITs which intend to have limited lives with short and defined acquisition periods and targeted exit strategies shortly thereafter. As noted above, MFFO may not be a useful measure of the impact of long-term operating performance if SST II does not continue to operate in this manner. SST II believes that their use of MFFO and the adjustments used to calculate it allows them to present their performance in a manner that reflects certain characteristics that are unique to publicly registered, non-traded REITs, such as their limited life, limited and defined acquisition period and targeted exit strategy, and hence that the use of such measures may be useful to investors. For example, acquisition fees and expenses are intended to be funded from the proceeds of SST II’s offering and other financing sources and not from operations. By excluding any expensed acquisition fees and expenses, the use of MFFO provides information consistent with management’s analysis of the operating performance of the properties. Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to their current operating performance. By excluding such charges that may reflect anticipated and unrealized gains or losses, SST II believes MFFO provides useful supplemental information. Presentation of this information is intended to provide useful information to investors as they compare the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and MFFO the same way, so comparisons with other REITs may not be meaningful. Furthermore, FFO and MFFO are not necessarily indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as an indication of our performance, as an alternative to cash flows from operations, which is an indication of our liquidity, or indicative of funds available to fund SST II’s cash needs including their ability to make distributions to stockholders. FFO and MFFO should be reviewed in conjunction with other measurements as an indication of performance. MFFO may be useful in assisting management and investors in assessing the sustainability of operating performance in future operating periods, and in particular, after the offering and acquisition stages are complete. Neither the SEC, NAREIT, nor any other regulatory body has passed judgment on the acceptability of the adjustments that SST II uses to calculate FFO or MFFO. In the future, the SEC, NAREIT or another regulatory body may decide to standardize the allowable adjustments across the publicly registered, non-traded REIT industry and SST II would have to adjust their calculation and characterization of FFO or MFFO. Net Operating Income or (“NOI”) NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization, acquisition expenses and costs incurred in connection with the property management changes. We believe that NOI is useful for investors as it provides a measure of the operating performance of our operating assets because NOI excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

Strategic Storage Trust II, Inc. Greater Than 75% Portfolio Occupancy Institutional Management Strong Market Demographics

Strategic Storage Trust II, Inc. Greater Than 75% Portfolio Occupancy SmartStop® Self Storage – Pickering, Canada Targeting facilities with strong physical occupancy Potentially under occupied economically, increasing future cash flows Existing management unable to boost occupancy Management and marketing make a difference!

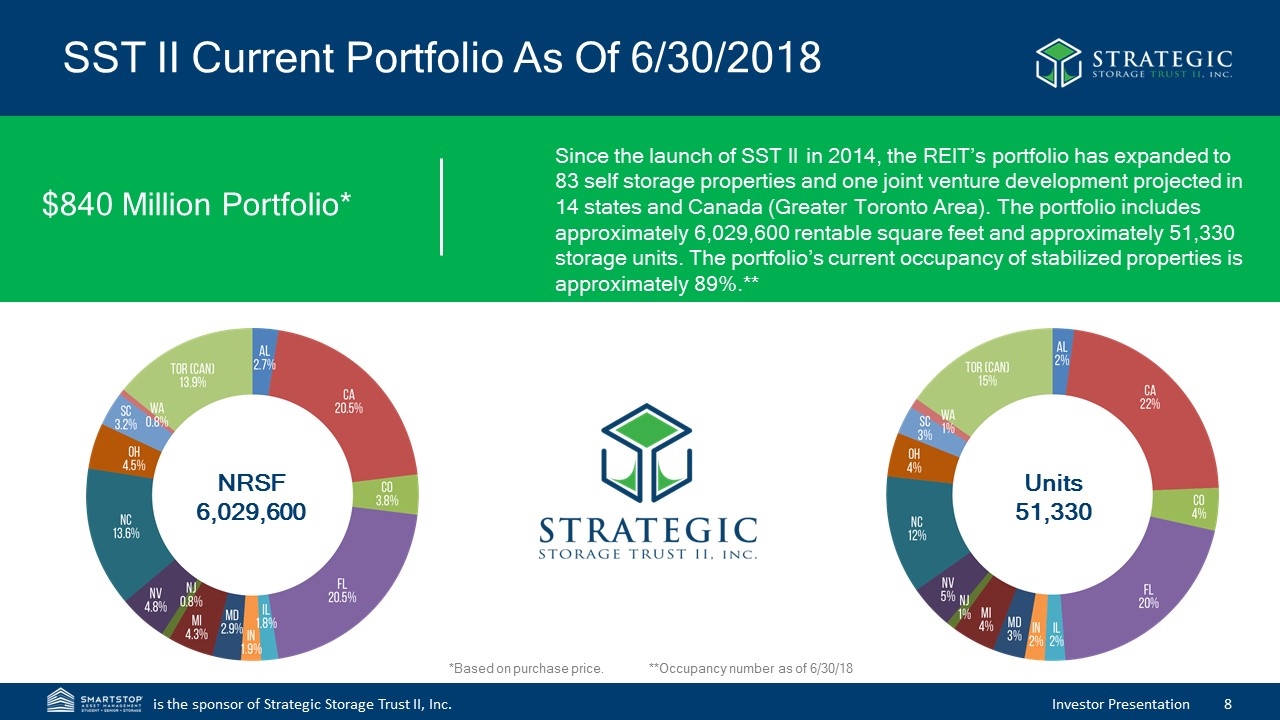

SST II Current Portfolio As Of 6/30/2018 $840 Million Portfolio* Since the launch of SST II in 2014, the REIT’s portfolio has expanded to 83 self storage properties and one joint venture development projected in 14 states and Canada (Greater Toronto Area). The portfolio includes approximately 6,029,600 rentable square feet and approximately 51,330 storage units. The portfolio’s current occupancy of stabilized properties is approximately 89%.** NRSF 6,029,600 Units 51,330 **Occupancy number as of 6/30/18 *Based on purchase price.

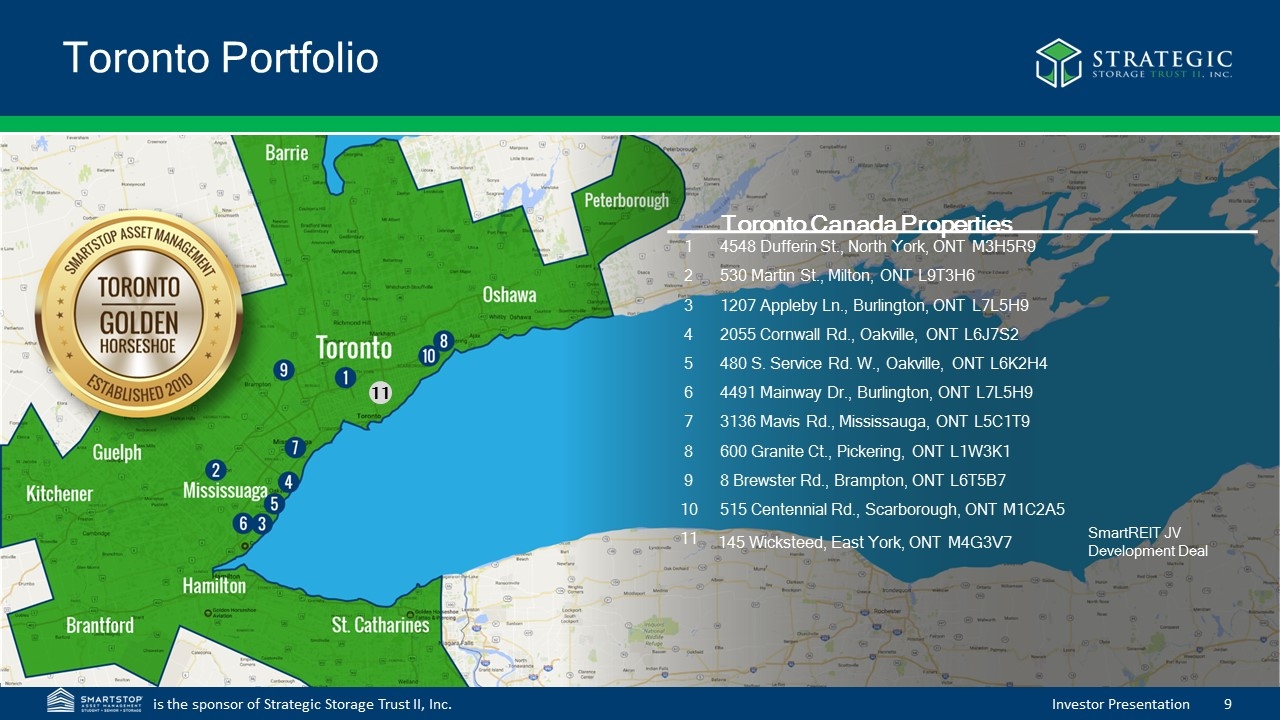

Toronto Portfolio Toronto Canada Properties 1 4548 Dufferin St., North York, ONT M3H5R9 2 530 Martin St., Milton, ONT L9T3H6 3 1207 Appleby Ln., Burlington, ONT L7L5H9 4 2055 Cornwall Rd., Oakville, ONT L6J7S2 5 480 S. Service Rd. W., Oakville, ONT L6K2H4 6 4491 Mainway Dr., Burlington, ONT L7L5H9 7 3136 Mavis Rd., Mississauga, ONT L5C1T9 8 600 Granite Ct., Pickering, ONT L1W3K1 9 8 Brewster Rd., Brampton, ONT L6T5B7 10 515 Centennial Rd., Scarborough, ONT M1C2A5 11 145 Wicksteed, East York, ONT M4G3V7 SmartREIT JV Development Deal 11

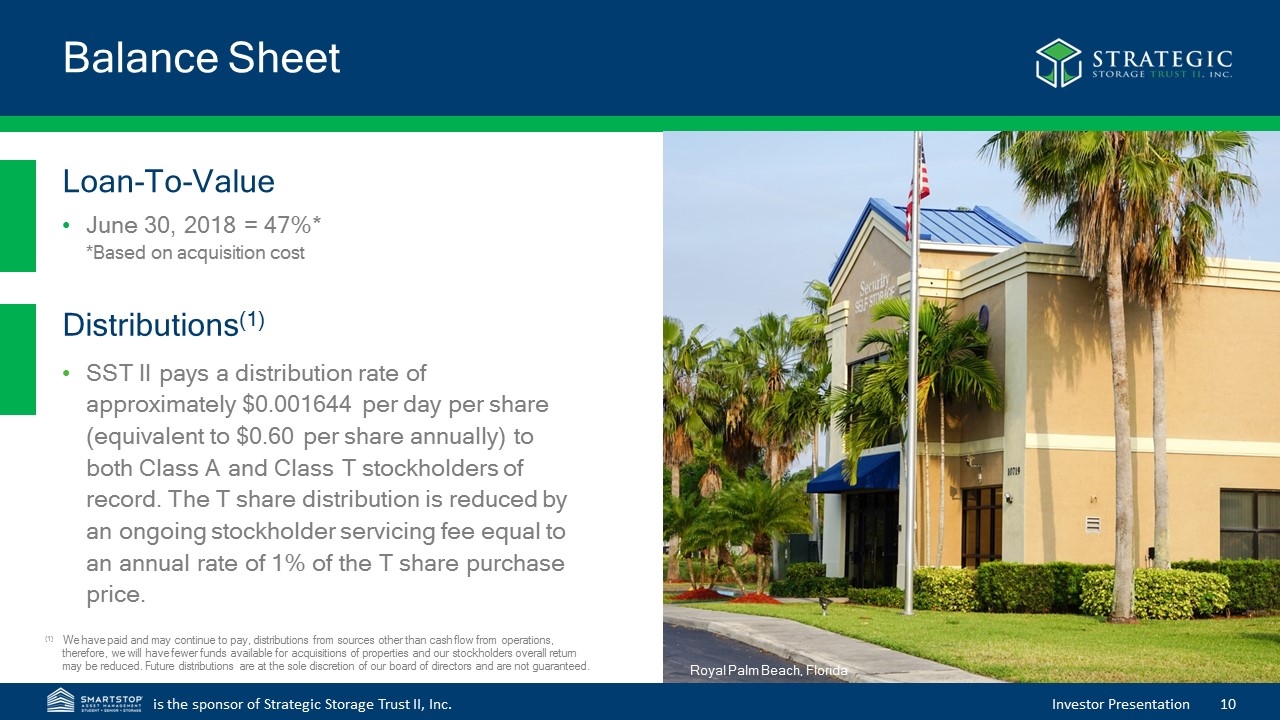

Balance Sheet Royal Palm Beach, Florida Loan-To-Value June 30, 2018 = 47%* *Based on acquisition cost Distributions(1) SST II pays a distribution rate of approximately $0.001644 per day per share (equivalent to $0.60 per share annually) to both Class A and Class T stockholders of record. The T share distribution is reduced by an ongoing stockholder servicing fee equal to an annual rate of 1% of the T share purchase price. (1) We have paid and may continue to pay, distributions from sources other than cash flow from operations, therefore, we will have fewer funds available for acquisitions of properties and our stockholders overall return may be reduced. Future distributions are at the sole discretion of our board of directors and are not guaranteed.

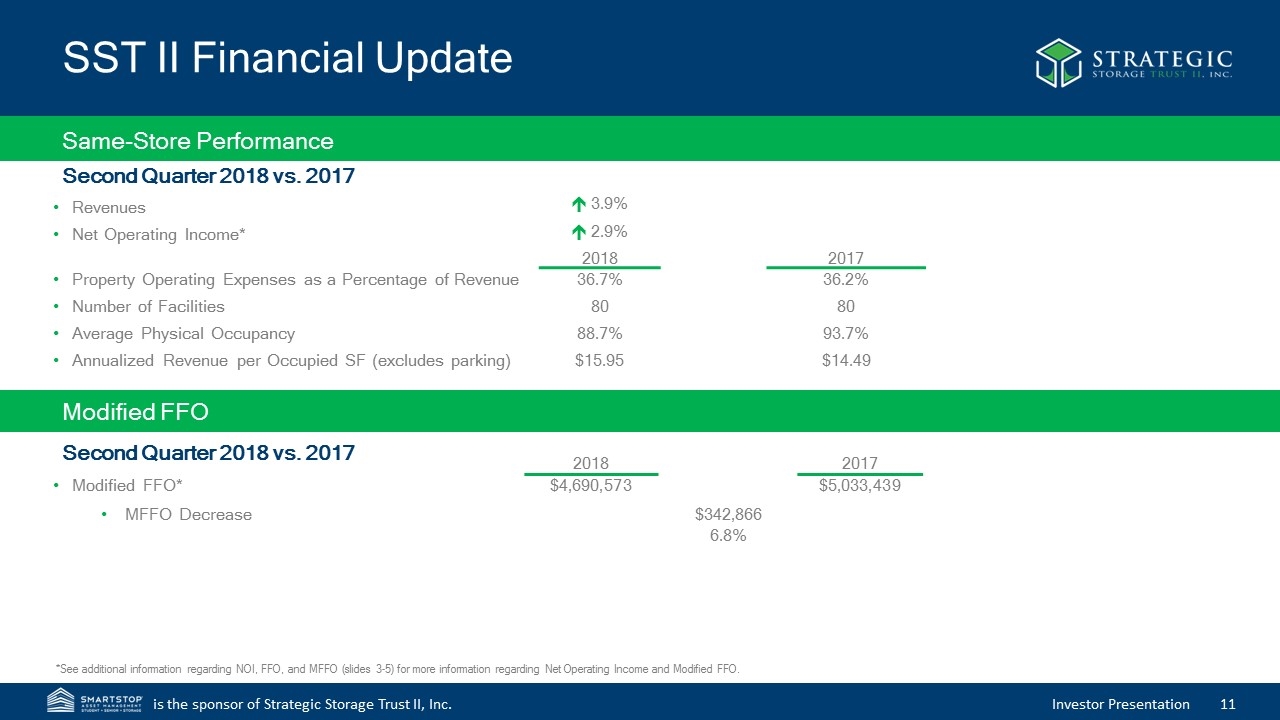

SST II Financial Update Second Quarter 2018 vs. 2017 Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities Average Physical Occupancy Annualized Revenue per Occupied SF (excludes parking) Same-Store Performance é 3.9% é 2.9% 2018 2017 36.7% 36.2% 80 80 88.7% 93.7% $15.95 $14.49 *See additional information regarding NOI, FFO, and MFFO (slides 3-5) for more information regarding Net Operating Income and Modified FFO. Modified FFO* MFFO Decrease Modified FFO Second Quarter 2018 vs. 2017 2018 2017 $4,690,573 $5,033,439 $342,866 6.8%

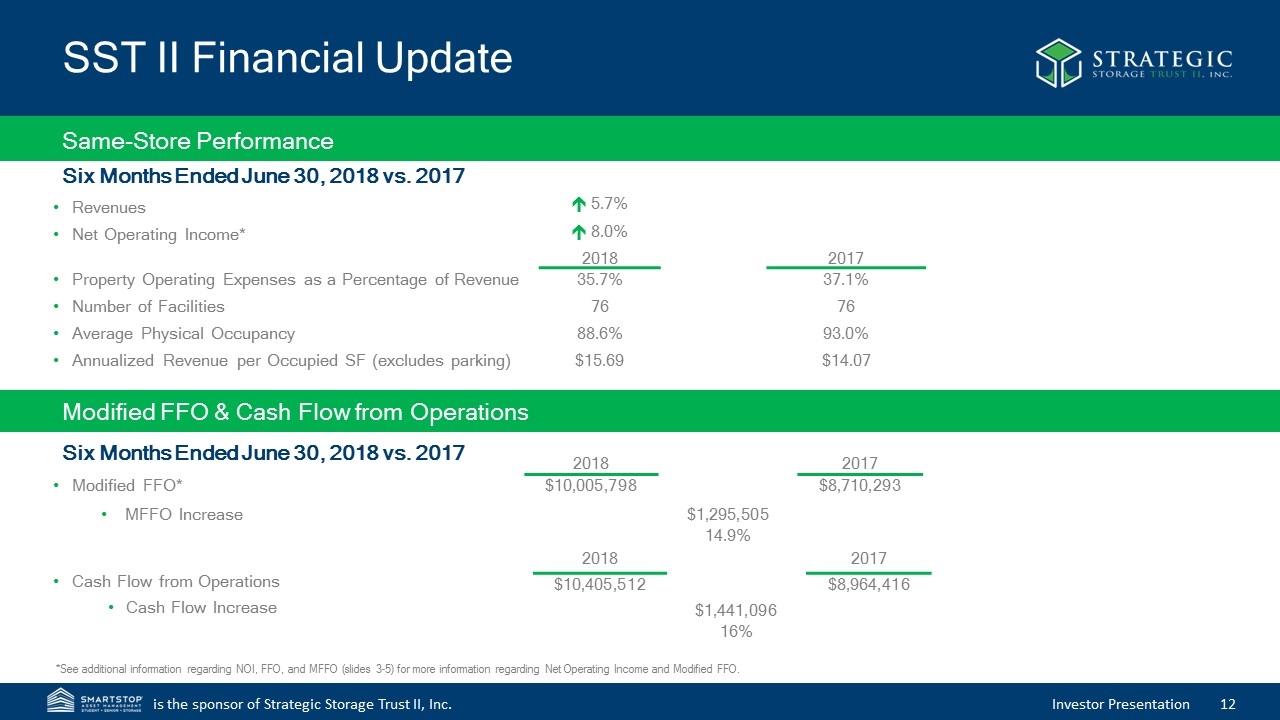

SST II Financial Update Six Months Ended June 30, 2018 vs. 2017 Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities Average Physical Occupancy Annualized Revenue per Occupied SF (excludes parking) Same-Store Performance Modified FFO* MFFO Increase Modified FFO & Cash Flow from Operations Six Months Ended June 30, 2018 vs. 2017 Cash Flow from Operations Cash Flow Increase é 5.7% é 8.0% 2018 2017 35.7% 37.1% 76 76 88.6% 93.0% $15.69 $14.07 2018 2017 $10,005,798 $8,710,293 $1,295,505 14.9% 2018 2017 $10,405,512 $8,964,416 $1,441,096 16% *See additional information regarding NOI, FFO, and MFFO (slides 3-5) for more information regarding Net Operating Income and Modified FFO.

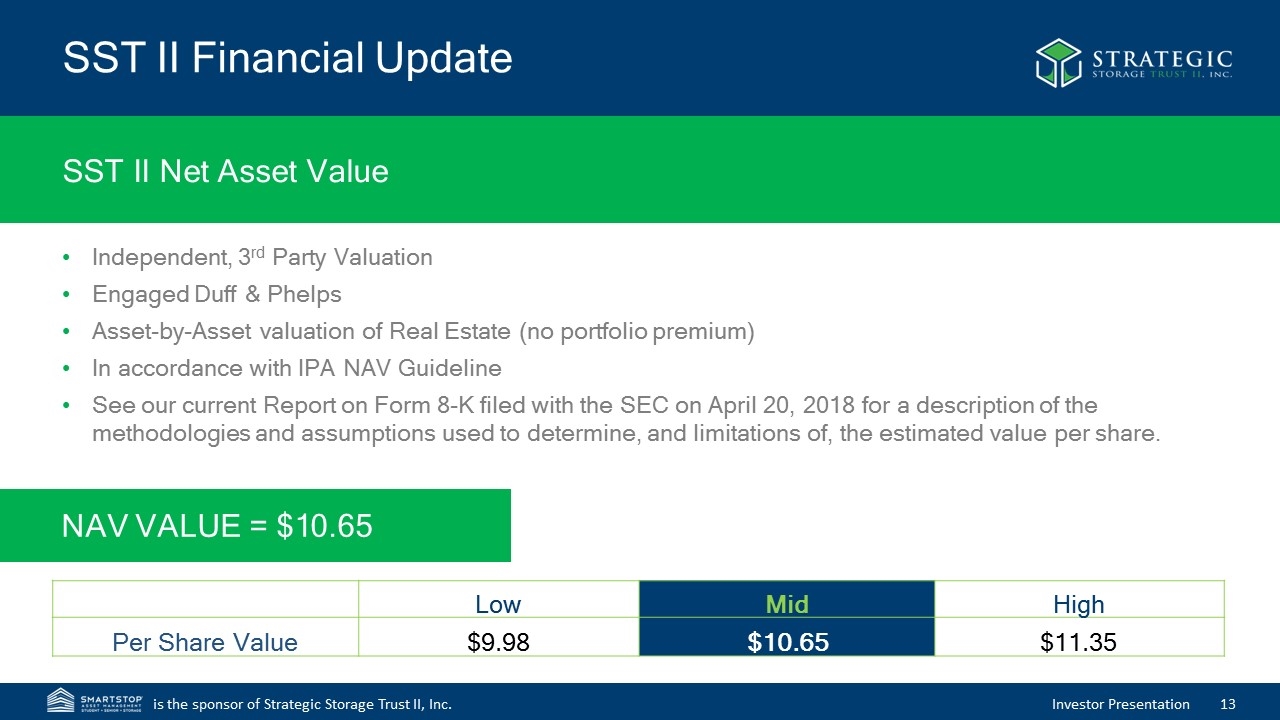

SST II Financial Update SST II Net Asset Value Independent, 3rd Party Valuation Engaged Duff & Phelps Asset-by-Asset valuation of Real Estate (no portfolio premium) In accordance with IPA NAV Guideline See our current Report on Form 8-K filed with the SEC on April 20, 2018 for a description of the methodologies and assumptions used to determine, and limitations of, the estimated value per share. NAV VALUE = $10.65 Low Mid High Per Share Value $9.98 $10.65 $11.35

SmartStop Self Storage – Property Management* *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

SmartStop Self Storage* – Branding Brand Awareness Strong, well-known brand name Brand protection Registered trademarks in U.S./Canada 125 U.S./Canadian domain names Processes in place to act upon potential brand infringement Store Branding Locations feature SmartStop signage and colors The SmartStop brand appears on: Moving supplies SmartStop website Advertising and marketing efforts Special events/team sponsorships Employee uniforms, name tags, etc. Flags, banners and printed materials *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

SmartStop Self Storage*– Website Website SmartStop.com State-of-the-art/responsive Multi-platform views Customer-intuitive user interface Full Integration Store operating system Reservation management system Call center Search engine optimization (SEO) Search engine marketing (SEM) / pay per click (PPC) campaigns Social media On-demand functionality with pricing and promotions *The SmartStop® Self Storage brand is owned by our sponsor, SmartStop Asset Management, LLC.

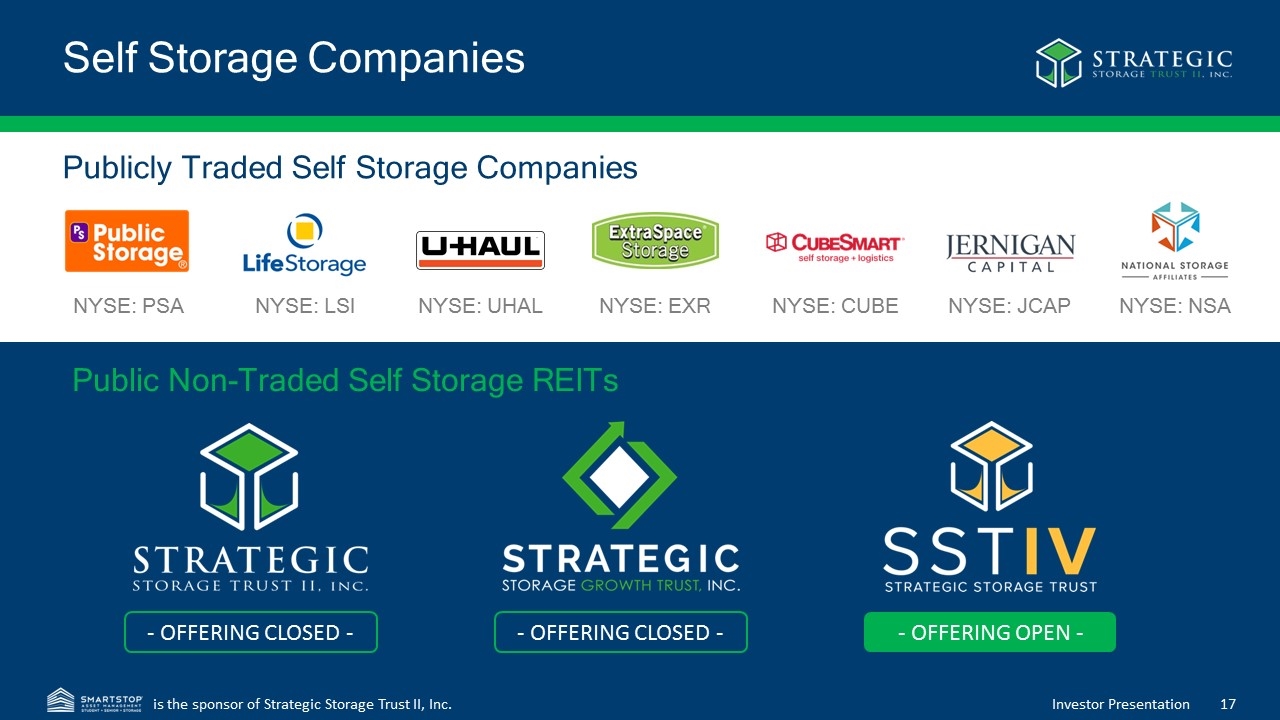

NYSE: EXR NYSE: PSA NYSE: CUBE NYSE: LSI NYSE: UHAL NYSE: JCAP NYSE: NSA Public Non-Traded Self Storage REITs - OFFERING CLOSED - - OFFERING CLOSED - - OFFERING OPEN - Publicly Traded Self Storage Companies Self Storage Companies

Questions?