Attached files

| file | filename |

|---|---|

| 8-K - Parkway Acquisition Corp. | pacform8k09062018.htm |

Exhibit 99.1

Parkway Acquisition Corp. HOLDING COMPANY FOR Presentation to Raymond James Emerging Bank SymposiumSeptember 6, 2018 Allan Funk, CEOBlake Edwards, CFO

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934 as amended. These include statements of expectations regarding our future results and performance, including expectations regarding the merger with Great State Bank, future plans and strategies, and any other statements that are not historical facts. Forward-looking statements are generally identified by the use of words such as "believe," "expect," "intend," "anticipate," "estimate," or "project" or similar expressions. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of these safe harbor provisions. These forward-looking statements involve risk and uncertainty, and a variety of facts could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed in these forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to significant risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Our ability to predict results, or the actual effect of future plans or strategies, is inherently uncertain. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: the risk that the business of Great State Bank will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the merger may not be fully realized or realized within the expected time frame; revenues following the merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the merger; changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality and composition of the loan and securities portfolios; demand for loan products; deposit flows; competition; demand for financial services in our market area; the implementation of new technologies; the ability to develop and maintain secure and reliable electronic systems; and accounting principles, policies, and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or clarify these forward‐looking statements, whether as a result of new information, future events or otherwise. Forward Looking Statement Disclaimer Use of Non-GAAP Financial Measures: This presentation includes certain financial information that is calculated and presented on the basis of methodologies that are not in accordance with U.S. Generally Accepted Accounting Principles, or GAAP. These non-GAAP financial measures include adjusted results of operations, return on average assets, and return on average equity, excluding certain non-recurring items, as well as book value excluding goodwill and other intangible assets. We believe that these non-GAAP financial measures allow management, as well as certain investors, to evaluate our current and future financial performance and facilitates comparisons with other banks. The non-GAAP financial measures included in this presentation do not replace the presentation of our GAAP financial results. These measurements provide supplemental information to assist investors in analyzing our financial position and results of operations. We have chosen to provide this information to investors to enable them to perform meaningful comparisons of past, present and future operating results and as a means to emphasize the results of core ongoing operations. Reconciliations of the non-GAAP financial measures provided in this presentation to the most directly comparable GAAP measures can be found in the appendix of this presentation.

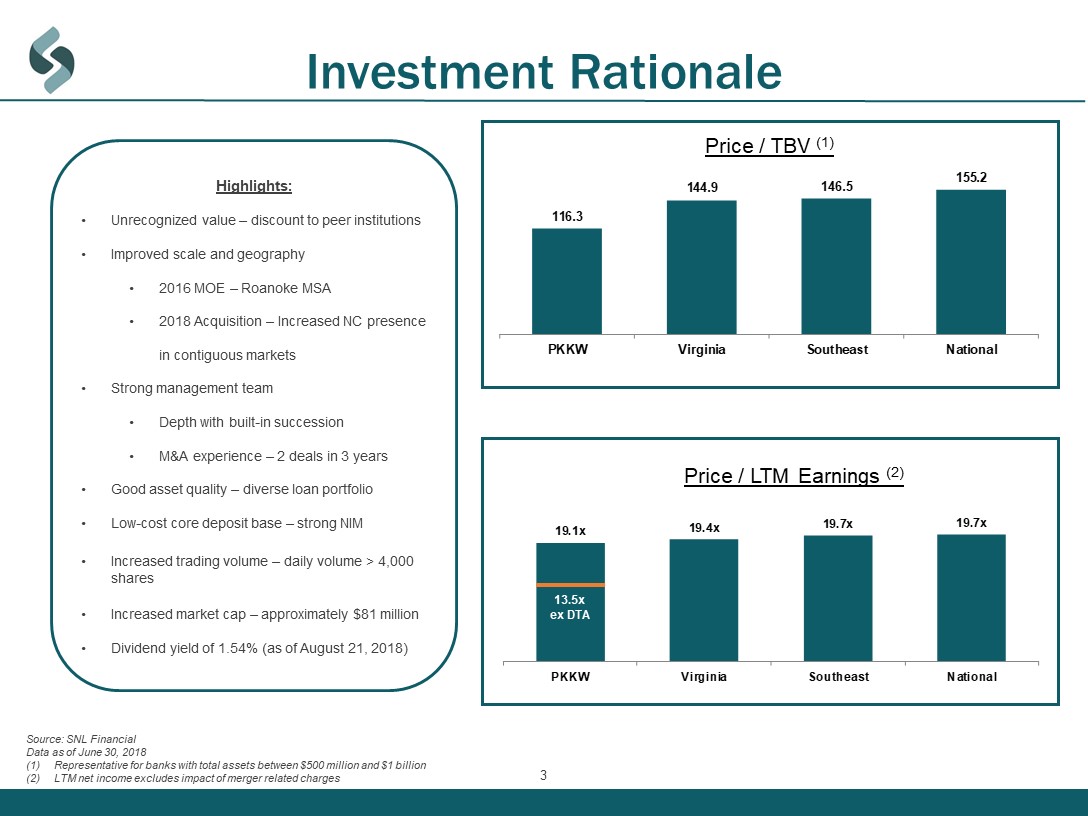

Investment Rationale Source: SNL FinancialData as of June 30, 2018(1) Representative for banks with total assets between $500 million and $1 billion(2) LTM net income excludes impact of merger related charges 3 Price / TBV (1) Price / LTM Earnings (2) Highlights:Unrecognized value – discount to peer institutionsImproved scale and geography2016 MOE – Roanoke MSA2018 Acquisition – Increased NC presence in contiguous marketsStrong management teamDepth with built-in successionM&A experience – 2 deals in 3 yearsGood asset quality – diverse loan portfolioLow-cost core deposit base – strong NIMIncreased trading volume – daily volume > 4,000 sharesIncreased market cap – approximately $81 million Dividend yield of 1.54% (as of August 21, 2018) 13.5x ex DTA

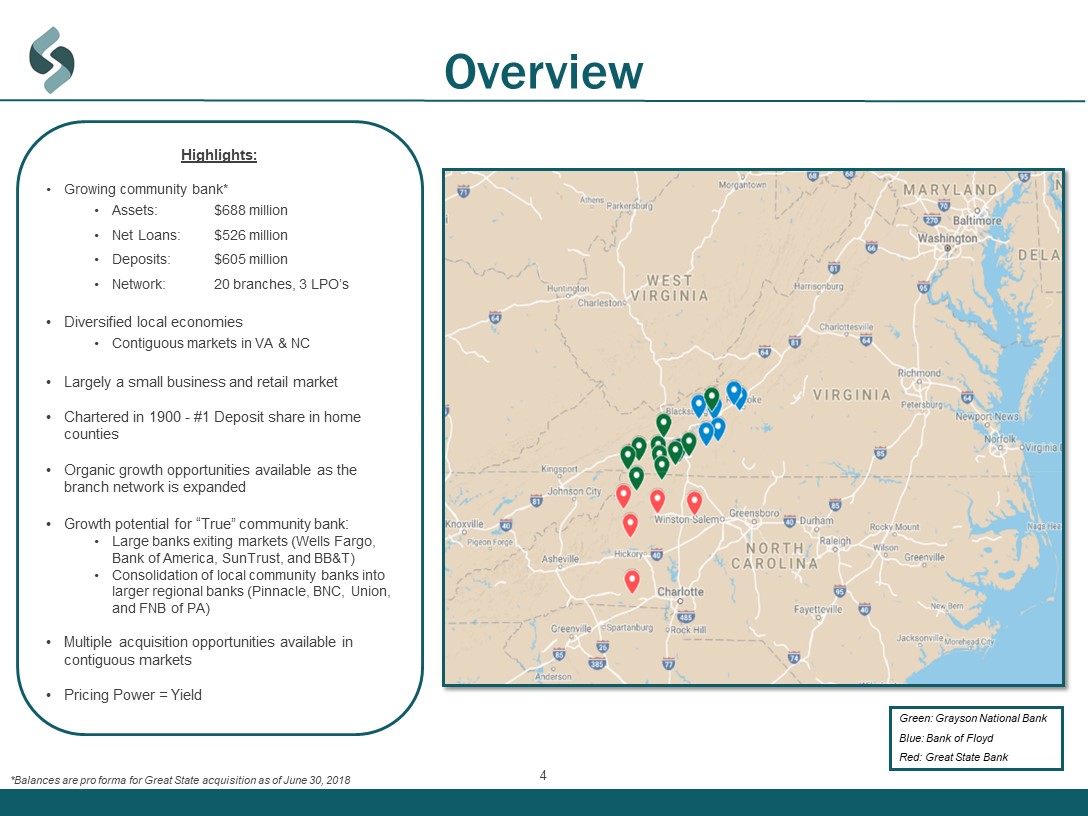

Overview *Balances are pro forma for Great State acquisition as of June 30, 2018 4 Green: Grayson National BankBlue: Bank of FloydRed: Great State Bank Highlights:Growing community bank*Assets: $688 millionNet Loans: $526 millionDeposits: $605 millionNetwork: 20 branches, 3 LPO’sDiversified local economiesContiguous markets in VA & NCLargely a small business and retail marketChartered in 1900 - #1 Deposit share in home countiesOrganic growth opportunities available as the branch network is expandedGrowth potential for “True” community bank:Large banks exiting markets (Wells Fargo, Bank of America, SunTrust, and BB&T)Consolidation of local community banks into larger regional banks (Pinnacle, BNC, Union, and FNB of PA)Multiple acquisition opportunities available in contiguous marketsPricing Power = Yield

Exurb and Rural Market Opportunities 5 Current Markets:Roanoke / Blacksburg / NRV:Healthcare-Carillion Clinic, Lewis Gale HospitalsEducation- Virginia Tech, Radford University, Roanoke CollegeIndustry-Ballast Point, Northfolk Southern, Volvo, PepsiCoBoone / Wilkes / Yadkin / Ashe:Healthcare- Appalachian Regional Healthcare SystemEducation- Appalachian State UniversityIndustry- Tyson, Lowes, GE Aviation, Unifi, LydallIndependence / Floyd:Skyline National Bank origin#1 Deposit share in home countiesLargely a small business and retail marketProvide a rural, low-cost deposit baseFuture Markets:Hickory:Healthcare- Catawba Valley Healthcare / Frye RegionalEducation- Lenoir Rhyne UniversityIndustry- Apple & Google data centers, MDI, CommScope Winston-Salem:Healthcare-Novant Health / Wake Forest Baptist HealthEducation- Wake Forest University, Winston Salem State, Salem College Industry- Lowe’s Foods, Hanesbrands Inc., Reynold’s American, BB&T

Stock Highlights Price Performance Since Trading on the OTC Exchange (8/31/2016) Highlights:Ticker: PKKWTraded: OTCQXBCurrent Shares Outstanding: 6,213,275Current Price: $13.00 (as of 8/21/18)TBV: $11.18 (as of 6/30/18)Price/TBV: 116.3% Shareholder Base:@ 1,780 registered holdersLargely retail3 of top 5 shareholders are on the board4 of top 20 s/h’s are institutional (aggregate ownership of 4.63%)Added PKKW stock as a 401k investment option in 2018 6 Source: SNL FinancialMarket data of at August 22, 2018

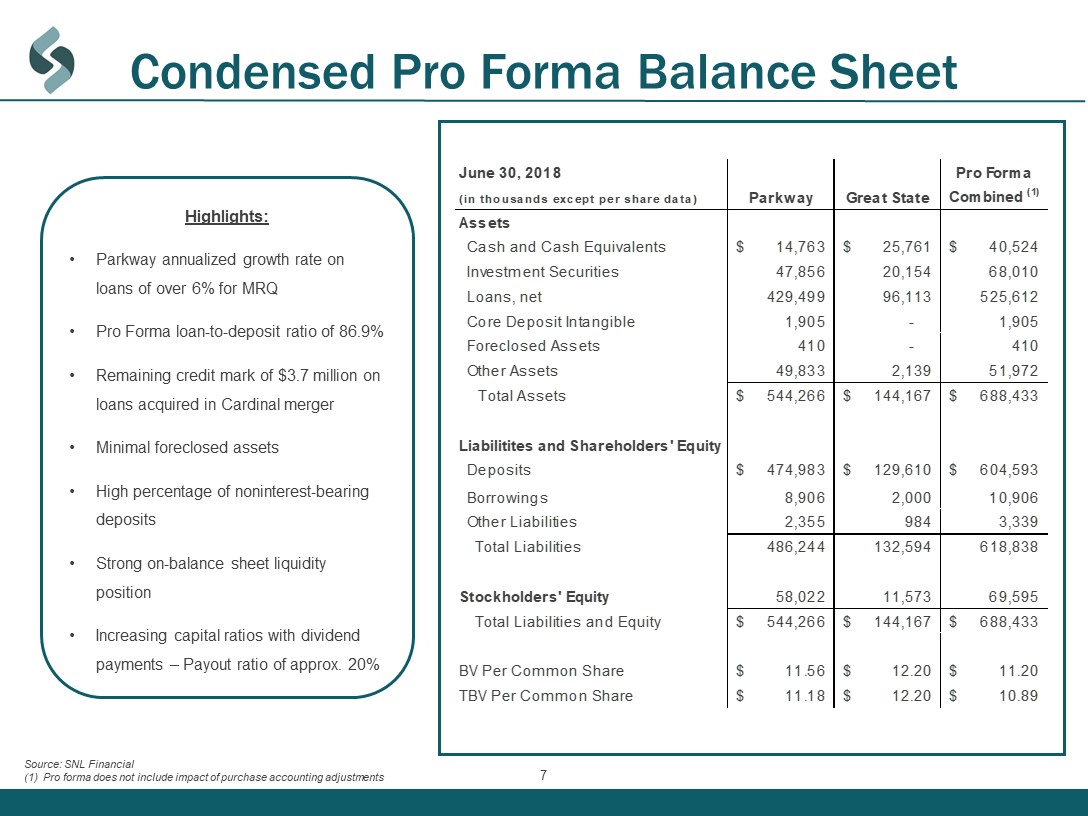

Condensed Pro Forma Balance Sheet 7 Highlights:Parkway annualized growth rate on loans of over 6% for MRQPro Forma loan-to-deposit ratio of 86.9%Remaining credit mark of $3.7 million on loans acquired in Cardinal mergerMinimal foreclosed assetsHigh percentage of noninterest-bearing depositsStrong on-balance sheet liquidity positionIncreasing capital ratios with dividend payments – Payout ratio of approx. 20% Source: SNL Financial(1) Pro forma does not include impact of purchase accounting adjustments

Condensed Income Statements 8 -without merger related costs

Loan Portfolio Total Balance: $ 530.1 Million Highlights:Diverse portfolio – by loan type, industry, and geographyParkway 69% variable – 31% fixed at 6/30/18Weighted average yield of 4.95%Granular small business and retail portfolio: Average balance 1-4 family RE is $82,353Average balance CRE loans is $252,470Locally focused lendersParticipations limited by policy (approximately 6% of total portfolio)Multi-family includes student housing at VT, RU, and ASUCommercial Real Estate (33% of portfolio):59% of CRE portfolio is Owner OccLow percentage in retail and hotels$3.7 MM remaining credit mark on acquired loans Data as of June 30, 2018Does not include impact of purchase accounting 9 Loan Portfolio(Pro Forma for Great State Acquisition) (1)

Deposit Mix Highlights:Cost of funds: 41 bps (FDIC peer group average 56 bps)Core deposits to total deposits: 84% (FDIC peer group average 77%)Core deposits to total assets: 74%Noninterest-bearing deposits: 24% (FDIC peer group average 16%)No brokered deposits or internet-based fundingWell positioned post-merger with competitive deposit products, including Online, Mobile Banking and ATM network 10 Total Balance: $ 606.1 Million (2) Data as of June 30, 2018Does not include impact of purchase accountingPro Forma deposits for Skyline National Bank and Great State Bank combined Deposit Composition (Pro Forma for Great State Acquisition) (1)

Selected Public Peer Group Source: SNL FinancialFinancial data is as of June 30, 2018Market Information is as of August 22, 2018(1) Parkway assets pro forma for acquisition of Great State Bank; all other stats standalone as of 6/30/18 11 Headquarters: Virginia & North CarolinaAssets: $500 million - $1 Billion LTM ROAA: >0.25%Excludes Merger Targets Does not exclude merger related costs

Leadership Age Experience Board of Directors:14 Members (annual terms)Independent Chair & Vice-Chair7 CommitteesManagement Team:Market knowledgeComplimentary skills in core functionsDepth, succession in placeAssociates:“Always our Best”Connected to our communitiesInternship program for future talentKey Partners:Legal: Williams Mullen, RichmondLegal: Gentry Locke, RoanokeAudit Firm: Elliott Davis Decosimo, CharlotteTransfer Agent: ComputershareCore System: FiServIndependent loan review: Risk Management Group, Charlotte 12 Thomas Jackson Chairman of the Board Hampden Sydney College, College of William and Mary, J.D. 60 16 James Shortt Vice-Chairman of the Board Virginia Tech, University of Richmond, J.D. 55 6 Allan Funk CEO Campbell University, Wake Forest University, MBA 55 34 Blake Edwards CFO Radford University 53 27 Rebecca Melton Risk Management Radford University 48 23 Lynn Murray HR & Marketing Ithaca College 62 25 Mary Tabor Credit Admin Virginia Tech 54 30 Rodney Halsey Technology & Ops Appalachian State University 49 26 Jonathan Kruckow Commercial Banking Virginia Tech 34 12 Milo Cockerham Retail Banking Emory and Henry College 31 9 Greg Edwards NC Regional Pres. Appalachian State University 61 39

Parkway Acquisition Corp. HOLDING COMPANY FOR Questions? Allan Funk, CEO – 276-773-2811 - afunk@skylinenationalbank.comBlake Edwards, CFO – 276-773-2811 - bedwards@skylinenationalbank.com www.SkylineNationalBank.com Follow Us: You’ll always receive our best,And that’s a promise.