Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lincolnway Energy, LLC | form8k.htm |

The Energy Forum Volume XIV, Issue II September 2018 59511 W. Lincoln Highway Nevada, Iowa 50201Office: 515-232-1010Fax: 515-663-9335www.lincolnwayenergy.com This has been a tough year for the ethanol industry, with a knock on impact to the corn market and farmers in general. The majority of the pain being handed down is from the federal government. In particular, the EPA unilaterally watering down the RFS to the benefit of oil interests and to the detriment of agriculture. This was not supposed to have happened. Agriculture, in general, was a major supporter of the current administration. As a candidate, President Trump was specifically vocal in his support of agriculture and corn based ethanol. His appointments have made our life very difficult. President Trump appointed Scott Pruitt as the head of the EPA. Long before the current administration was ever conceived, I would say, “No ECONOMIC IMPACT OF ETHANOL POLICYFROM WASHINGTON good news comes to ethanol by way of Oklahoma.” At that time, I was referring to the powerful Senator Jim Inhofe, who chairs the Environment and Public Works Committee, and generally does what “Big Oil” needs him to do in Washington. Mr. Pruitt took that as his mission. He proactively tried to do us harm, and I believe only his ineptitude saved us from real jeopardy. He has since resignedandheadedbacktoOklahoma to await his reemergence as a lobbyist for “Big Oil.” Unfortunately, many of his policies remain the law of the land much to the detriment of agriculture in general and Iowa in particular. The indication from Washington is that there will be no change for ethanol with the new leadership. IN THIS EDITIONEconomic Impact of Ethanol... Forward Looking Statements Diversify Financial Review New Technology Update Harvest Hours Member Appreciation Picnic 1-2 UNIT TRADING February 2018:March 2018: April 2018:May 2018:June 2018: July 2018: 50 Units @ $500/Unit 50 Units @ $690/Unit 100 Units @ $675/Unit 25 Units @ $500/Unit 6 Units @ $650/Unit No Sales30 Units @ $700/Unit 41 Units @ $625/Unit 50 Units @ $480/Unit 5 Units @ $700/Unit 1 3 5 By Eric Hakmiller, President and CEO continued on page 2FORWARD LOOKING STATEMENTS Some of the information in this newsletter may contain forward looking statements that express Lincolnway Energy’s current beliefs, projections and predictions about future results or events, such as statements with respect to financial results and condition; future trends in the industry or in business, revenues or income; litigation or regulatory matters; business and operating plans and strategies; competitive position; and opportunities that may be available to Lincolnway Energy. Forward looking statements are necessarily subjective in nature and are made based on numerous and varied estimates, projections, beliefs, strategies and assumptions, and are subject to numerous risks and uncertainties. Forward looking statements are not guarantees of future results, performance or business or operating conditions, and no one should place undue reliance on any forward looking statements because actual results, performance or conditions could be materially different. Lincolnway Energy undertakes no obligation to revise or update any forward looking statements. The forward looking statements contained in this newsletter are included in the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended.1 Lincolnway EnergyNEVADA, IOWA 3-4 5 5 Exhibit 99.1

Volume XIV, Issue II September 2018 Economic Impact of Ethanol Policy continued from page 1 These policies can be demonstratively proven to harm the ethanol industry to the advantage of “Big Oil.” “Big Oil” who does not need the help. Ethanol is built on the Renewable Fuels Standard, as it is the only way that “Big Oil” will sell ethanol through its supply chain. The RFS originally was designed to change the behavior of major fuel suppliers in the U.S., adding more ethanol to the transportation system. The system works by putting a price on not using ethanol in gasoline. This policy, as most legislation, has a labyrinth of loopholes, which Mr. Pruitt systematically used to enrich some of the richest companies in America. He did this by devising ways to reduce the obligation of petroleum companies to use ethanol. Thus, reducing the demand and decreasing the profitability of our markets. Mr. Pruitt expanded the Small Refineries Exemption to include some of the biggest, most profitable companies in the industry, including Exxon and Carl Ichon’s CVR Energy, costing us over a billion gallons of demand. Mr. Pruitt waived RINS for Philadelphia Energy Solutions while in bankruptcy, mere weeks after they had paid their new owners a massive dividend payment. This effectively eliminated 400 million gallons of demand. Mr. Pruitt dealt another blow to the ethanol industry when he refused and ignored the court ruling to reallocate gallons, which had been pulled from the 2016 Renewable Volume Obligation, amounting to 500 million lost gallons. He has essentially pulled 2.25 billion gallons of demand from the market and picked who would be allowed to win and who would lose. The impact of his policies can be seen in two factors which the market uses to stimulate demand from the retailer and ultimately, from the consumer. First, the price of RINS. The higher the price of RINS, the higher the penalty the oil companies have to pay not to blend ethanol. The RINS price is the oil company’s share of the cost to access the consumer. Second, the spread, or difference between ethanol and gasoline prices. The smaller the spread between ethanol and gasoline, the more the ethanol world has to discount ethanol to stimulate sales. The ethanol to gasoline spread is the ethanol industry’s share of the cost to access the consumer. To be clear the government has given the oil companies a monopoly on the consumer channels. This chart shows the impact of the policy pursued by the EPA. The market still receives roughly $1.00 of value to use ethanol ($0.10 per gallon for an E10 blend) but those who carry the burden has shifted. A year ago, the majority of the cost of blending was carried by the oil companies, as the legislation requires. Remember, oil companies can always get RINS free by buying ethanol (which is cheaper than gasoline). This has decreased the interest oil companies have in complying with the law. The U.S. fuel system is an immensely complicated market. Gasoline, as the consumer knows it, is not uniform across the country with different blends being offered in different areas. Ethanol does provide a hotter, cleaner fuel, which is a cheap form of octane and produces a cleaner burning engine. Ethanol is also made in America. We have elections every four years and have an opportunity to ask candidates about what they are going to do to policies we vote for. In this case, we asked President Trump what he would do to ethanol and he said he would support it. What we did not do was ask a little known Attorney General in Oklahoma what he would do, as he has tried to kill it. The questions we need to ask the current administration is why they allowed this to happen, and do they understand what this kind of administrative change does to our industry, our corn farmers and our state? 2

FINANCIAL REVIEW Lincolnway Energy reported a net loss of approximately$1.0 million for the nine months ended June 30, 2018, compared to net income of $1.8 million for the previous year. Revenue decreased by $5.8 million, or 7.1 percent, as the industry continues to struggle with poor margins. Ethanol revenues decreased $8.3 million, or 12.5 percent, as ethanol prices decreased due to relatively high inventories in the domestic market coupled with ongoing record production of ethanol. DDGS revenue increased 25.9 percent when compared to the previous year as market prices climbed in response to increased export demand as Argentina, the world’s biggest meal exporter, suffers from continued drought. While we continue to hit record yields, corn oil revenue decreased $0.2 million as market prices continue to drop with uncertainty in the biodiesel industry. Cost of goods sold decreased by 3.1 percent or $2.4 million for the nine months ended June 30, 2018, from the nine months ended June 30, 2017. The decrease was primarily due to decreases in corn costs, natural gas and railcar expense offset by increases in ingredients costs as well as repairs and maintenance. By Kris Strum, Director of Finance Volume XIV, Issue II September 2018DIVERSIFY By Blair Picard, Commercial ManagerIn my years of schooling as a Certified Financial Planner, one of the primary investment lessons I was taught was the value of diversification. We learned that the most efficient portfolio for an investor included enough disparate investments such that the risk of a sizeable loss on one investment in the portfolio was reduced to an acceptable level so as to not inflict an unsustainable loss on the entire portfolio. If you own Apple for example, you probably also want to own a dozen other stocks in a variety of industries. In this way, if the price of Apple collapses, the other stocks in the portfolio, if they are properly diversified, will insulate your portfolio from a crippling loss. Or as Aunt Violet used to say, “Don’t put all your eggs in one basket.” 3 At Lincolnway Energy, we also practice a degree of diversification. There are 56 pounds in a bushel of corn. Out of that bushel, we obtain 56 pounds of saleable products. That 56 pounds is our portfolio. By adding different technologies and/or adjusting our process, we can attempt to change the components of our portfolio to make it more efficient, or valuable, than our competitors’ portfolios. For Lincolnway Energy, and our competition, by far the primary product in terms of volume and in terms of total value is ethanol. Next in the lineup come Dried Distillers Grain Solubles, or DDGS, and then corn oil. We also produce CO2, but suffice it to say that it produces a very small sliver of our revenues. A few years ago, our first effort at diversification, or in a different vein, our first effort at OPTIMIZATION, was to expand our production of corn oil. At 24 to 28 cents per pound, corn oil was our most valuable product in terms of price. To get more, we had to squeeze it out of DDGS worth 6 cents per pound. Corn oil is used in making biodiesel, with local company REG of Ames, the leading biodiesel producer. Some of it also finds its way into animal feed. But we, like most of the industry, were making very little. It represented less than 2 percent of our revenue stream. By employing new and somewhat novel technologies, we have been able to increase our corn oil production to where it now adds up to 5 percent of revenue. Our production of this product has tripled and our extraction rate tops the industry. We consciously diversified away from cheap DDGS production to higher value corn oil production. In DDGS (mid protein animal feed), we are diversifying away from the market standard product into an entirely new high protein animal feed somewhat akin to hi-pro soybean meal. Soybean meal currently trades at nearly three times the price of DDGS. At present, 15 percent of our revenue stream is garnered by selling mid protein DDGS. Again, by applying new technology, we think we will be able to enhance a portion of our animal feed stream into a much higher protein feed which will obtain significantly higher prices, similar to those paid for soybean meal. With this new product mix, we should see animal feed sales rise to over 20 percent of revenues. And this will come with no reduction in corn oil or ethanol revenues. We are not neglecting our primary product - ethanol. Our ethanol yield and production continues to grow as a result of process enhancements. We are moving into the upper echelons of industry ethanol yields. But due to very low growth in gasoline demand, and a hostile environment in Washington, DC, ethanol’s price and its share of our revenues have been shrinking. Our diversification efforts have helped us remain competitive in an increasingly more difficult industry. By moving up the value chain with increased production of the highest priced product, or by creating a new and much more valuable hi-pro feed product, we are spreading our risk, distinguishing ourselves from our competition, and improving our bottom line.

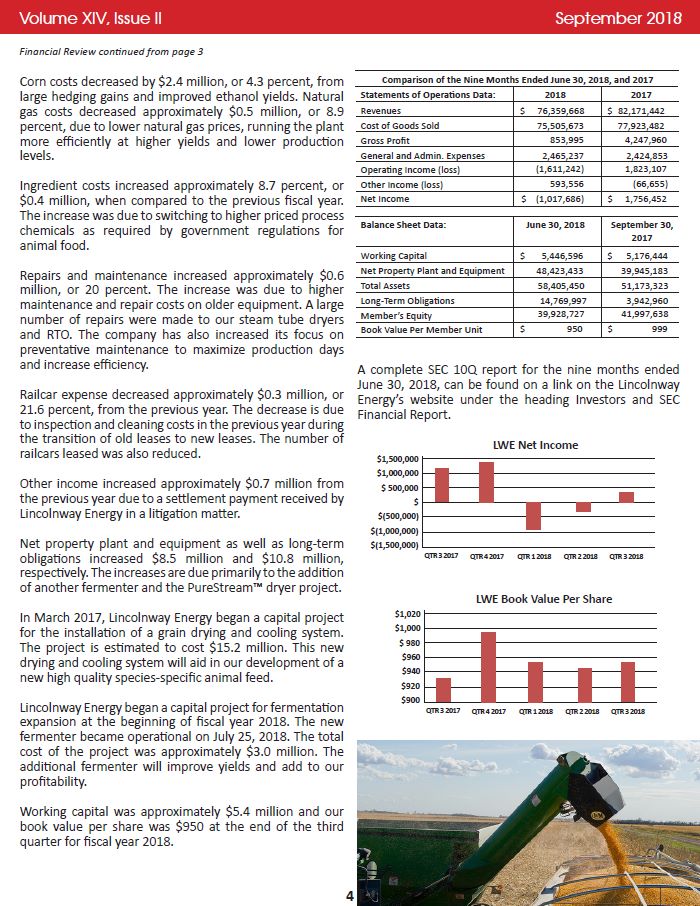

Volume XIV, Issue II September 2018 Corn costs decreased by $2.4 million, or 4.3 percent, from large hedging gains and improved ethanol yields. Natural gas costs decreased approximately $0.5 million, or 8.9 percent, due to lower natural gas prices, running the plant more efficiently at higher yields and lower production levels. Ingredient costs increased approximately 8.7 percent, or$0.4 million, when compared to the previous fiscal year. The increase was due to switching to higher priced process chemicals as required by government regulations for animal food. Repairs and maintenance increased approximately $0.6 million, or 20 percent. The increase was due to higher maintenance and repair costs on older equipment. A large number of repairs were made to our steam tube dryers and RTO. The company has also increased its focus on preventative maintenance to maximize production days and increase efficiency. Railcar expense decreased approximately $0.3 million, or21.6 percent, from the previous year. The decrease is due to inspection and cleaning costs in the previous year during the transition of old leases to new leases. The number of railcars leased was also reduced. Other income increased approximately $0.7 million from the previous year due to a settlement payment received by Lincolnway Energy in a litigation matter. Net property plant and equipment as well as long-term obligations increased $8.5 million and $10.8 million, respectively. The increases are due primarily to the addition of another fermenter and the PureStream™ dryer project. In March 2017, Lincolnway Energy began a capital project for the installation of a grain drying and cooling system. The project is estimated to cost $15.2 million. This new drying and cooling system will aid in our development of a new high quality species-specific animal feed. Lincolnway Energy began a capital project for fermentation expansion at the beginning of fiscal year 2018. The new fermenter became operational on July 25, 2018. The total cost of the project was approximately $3.0 million. The additional fermenter will improve yields and add to our profitability. Working capital was approximately $5.4 million and our book value per share was $950 at the end of the third quarter for fiscal year 2018. LWE Net Income $1,500,000$1,000,000$ 500,000$$(500,000)$(1,000,000)$(1,500,000) QTR 3 2017 QTR 4 2017 QTR 1 2018 QTR 2 2018 QTR 3 2018 $1,020$1,000$ 980$960$940$920$900 QTR 3 2017 QTR 4 2017 QTR 1 2018 QTR 2 2018 QTR 3 2018 LWE Book Value Per Share A complete SEC 10Q report for the nine months ended June 30, 2018, can be found on a link on the Lincolnway Energy’s website under the heading Investors and SEC Financial Report. Comparison of the Nine Months Ended June 30, 2018, and 2017 Statements of Operations Data: 2018 2017 Revenues $ 76,359,668 $ 82,171,442 Cost of Goods Sold 75,505,673 77,923,482 Gross Profit 853,995 4,247,960 General and Admin. Expenses 2,465,237 2,424,853 Operating Income (loss) (1,611,242) 1,823,107 Other Income (loss) 593,556 (66,655) Net Income $ (1,017,686) $ 1,756,452 Balance Sheet Data: June 30, 2018 September 30,2017 Working Capital $ 5,446,596 $ 5,176,444 Net Property Plant and Equipment 48,423,433 39,945,183 Total Assets 58,405,450 51,173,323 Long-Term Obligations 14,769,997 3,942,960 Member’s Equity 39,928,727 41,997,638 Book Value Per Member Unit $ 950 $ 999 Financial Review continued from page 3 4

By Eric Hakmiller, President and CEOTechnology has been a forefront of the strategy that we have tried to execute at Lincolnway Energy. It has given us a leg up on our competition in terms of corn oil extraction and has set us up to produce higher protein animal feeds. This year we have made two steps forward with new unit operations, a new fermenter (bringing our fermenter count from four to five) and a new dryer. These were two big steps for us and I wanted to update the shareholders on the status of each.The fermenter was completed on July 25. The new fermenter was not installed to increase capacity, but rather to increase the length of time fermenters can “cook.” This allows the yeast to consume more of the sugar in each fermenter and increase yields. Adding a fifth fermenter increased the capacity of fermentation by 20 percent and increased the duration of fermentation, going from 10 hours to 13 hours. The new fermenter was installed on the northwest side of fermenter alley. The startup was seamless and we are already seeing better yields.The new dryer project was planned to start up in March. This project was to give us a higher protein animal feed that could compete with soy protein which trades at a premium to DDGS. It would not have converted 100 percent of our DDGS but rather about 20 percent. This project has hit a series of engineering issues centered around the dryer system that we installed. All the ancillary systems have checked out fine. After several weeks of working with the current system the supplier is rebooting the process and going to build and deliver a version 2 system. This system should fit in the current foot print, deliver the same output as the original but of a much simpler design. The new system should be installed between the first and second quarter of next fiscal year.This year clearly makes the case that all technology decisions have risk. We are strongly committed to the path of more efficiency, better separation and higher margin products. We see the new fermenter as demonstrating the strength of that direction. The engineering issue has been a setback but we are confident that high protein will turn out to be the right direction as well. HARVEST HOURSOctober 1 - 26 Monday - Friday7:00 a.m. to 5:00 p.m. MEMBER APPRECIATION PICNICThursday, September 27, 20184:00 p.m. to 7:00 p.m.RSVP to 515-817-0150kgammon@lincolnwayenergy.com Volume XIV, Issue II September 2018NEW TECHNOLOGY UPDATE 5

Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Volume XIV, Issue II September 2018 COME JOIN US ON THE WEB!If you haven’t already, please give us your e-mail address. This way you can receive the full color newsletter via e-mail and we can save on postage. E-mail your request to us at info@lincolnwayenergy.com. 6