Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GUGGENHEIM CREDIT INCOME FUND 2019 | gcif2019form8-k2018q2overv.htm |

| Exhibit 99.1 | |

GUGGENHEIM CREDIT INCOME FUND

SECOND QUARTER 2018 OVERVIEW

This overview contains details about the portfolio and operating results for the quarter ended June 30, 2018 of Guggenheim Credit Income Fund ("GCIF" or the "Company") and its feeder funds, Guggenheim Credit Income Fund 2019 ("GCIF 2019") and Guggenheim Credit Income Fund 2016 T ("GCIF 2016 T") (together, the "Feeder Funds"). This overview should be read in conjunction with the GCIF 2019 and GCIF 2016 T Quarterly Reports on Form 10-Q, which each incorporate the GCIF Quarterly Report on Form 10-Q, as filed with the U.S. Securities and Exchange Commission (the "SEC") on August 9, 2018.

Six Months Ended June 30, 2018 Highlights

• | GCIF 2019’s net asset value per share as of the end of the period was $25.68, compared to $25.68 as of December 31, 2017. |

• | GCIF 2016 T’s net asset value per share as of the end of the period was $9.07, compared to $9.05 as of December 31, 2017. |

• | GCIF's gross debt portfolio yield was 9.1%, compared to 8.9% as of December 31, 20171. |

• | GCIF 2019 paid distributions of $0.92 per share and GCIF 2016 T paid distributions of $0.33 per share all of which were covered by estimated taxable income. |

• | GCIF's portfolio investments at fair value totaled $385 million, of which 93% was in senior debt investments. The portfolio consisted of 123 investments across 82 portfolio companies. |

• | GCIF invested $131 million with sales and paydowns totaling $121 million. |

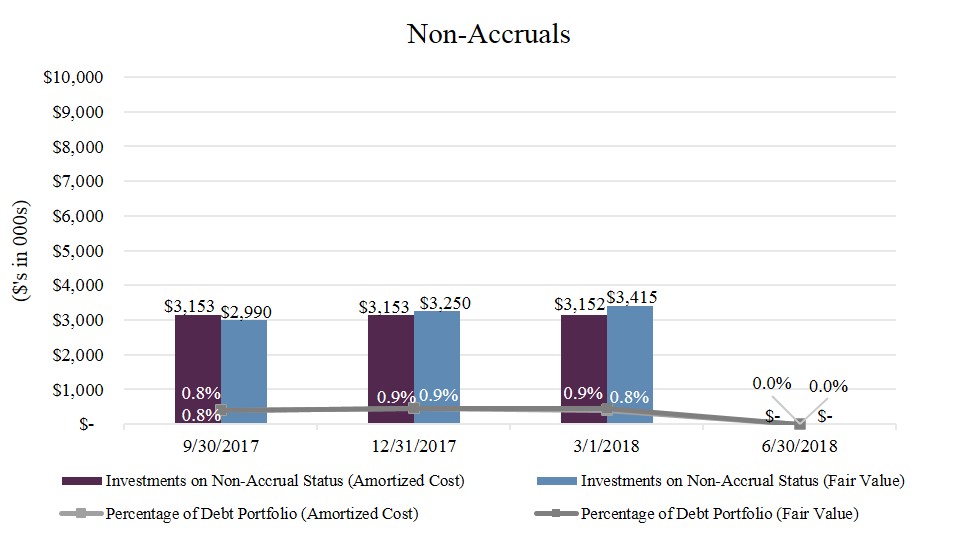

• | GCIF had no debt investment on non-accrual status. |

• | GCIF 2019 filed a Form N-2 Registration Statement for a follow-on offering, which is was declared effective by the SEC on June 13, 2018. |

• | Please see below for feeder fund specific highlights: |

Six Months Ended June 30, 2018 | |||||

GCIF 2019 | GCIF 2016 T | ||||

Distributions paid per share | $0.92 | $0.33 | |||

Total investment return-net asset value (non-annualized) 2 | 3.62 | % | 3.94 | % | |

Total assets ($ in thousands) | $41,891 | $162,583 | |||

Net asset value per share | $25.68 | $9.07 | |||

________________________

(1) Weighted average effective yield of the total debt portfolio is calculated as the effective yield of each investment and weighted by its amortized cost as compared to the aggregate amortized cost of all debt investments. Effective yield is the return earned on an investment net of any discount, premium, or issuance costs. Effective portfolio yield for the total debt portfolio is calculated before considering the impact of leverage or any operating expenses, and cash, restricted cash, non-income producing assets and equity investments are excluded.

(2) Total investment return-net asset value is a measure of the change in total value for shareholders who held the Feeder Funds' common shares at the beginning and end of the period, including distributions declared during the period. Total investment return-net asset value is based on (i) net asset value per share on the first day of the period, (ii) the net asset value per share on the last day of the period, plus any shares issued in connection with the reinvestment of monthly distributions, and (iii) distributions payable relating to the ownership of shares, if any, on the last day of the period. The total investment return-net asset value calculation assumes that distributions are reinvested in accordance with the Feeder Funds' distribution reinvestment plan. Since there is no public market for the Feeder Funds' shares, terminal market value per share is assumed to be equal to net asset value per share on the last day of the period presented. Investment performance is presented without regard to sales load that may be incurred by shareholders in the purchase of the Feeder Funds' common shares. The Feeder Funds' performance changes over time and currently may be different than that shown above. Past performance is no guarantee of future results.

1

Investment Activity, Investment Performance, and Portfolio Update

During the second quarter of 2018, 63% of the Company's investments were sourced through direct origination channels and 37% were sourced through the syndicated channels. While we remain constructive on credit and will be opportunistic during times of technical dislocations in the syndicated markets, we believe that direct origination will be the primary source of opportunity in the near term.

The following table presents our investment activity as of and for the three months ended June 30, 2018 (dollars in thousands):

As of June 30, 2018 | |||

Total Assets | $ | 426,781 | |

Total Fair Value of Investments | $ | 385,225 | |

Gross Debt Portfolio Yield | 9.1 | % | |

Leverage ratio (borrowings/adjusted total assets) | 37.3 | % | |

Three Months Ended June 30, 2018 | |||

Investment activity segmented by access channel: | |||

Direct origination | $ | 34,548 | |

Syndicated | 20,296 | ||

Total investment activity | 54,844 | ||

Investments sold or repaid | (50,533 | ) | |

Net investment activity | $ | 4,311 | |

Portfolio companies at beginning of period | 76 | ||

Number of added portfolio companies | 13 | ||

Number of exited portfolio companies | (7 | ) | |

Portfolio companies at period end | 82 | ||

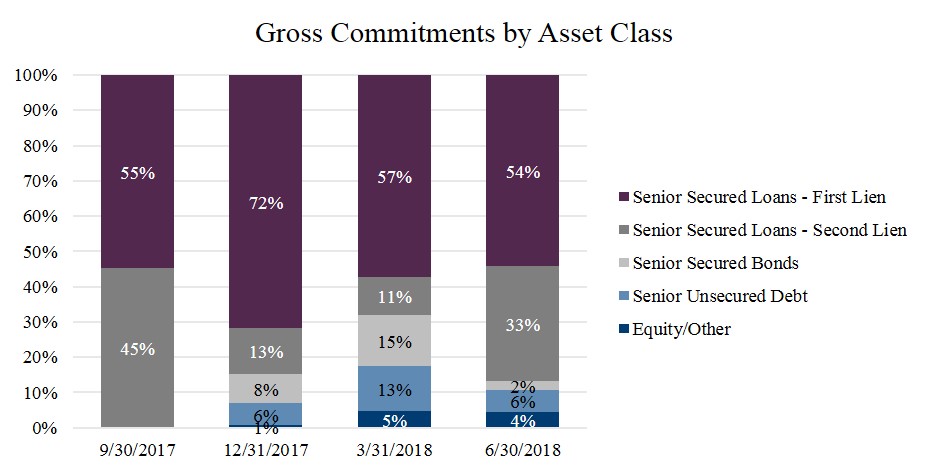

While we did find attractive opportunities in the syndicated loan market during the first quarter, GCIF's investment focus is concentrated in directly originated transactions that are also senior secured in order to seek to better protect investors against the downside when the market environment eventually shifts. During three months ended June 30, 2018, 96% of investment commitments were to senior debt investments.

Investment commitments by quarter and by asset class as of each of the last four quarters was as follows:

2

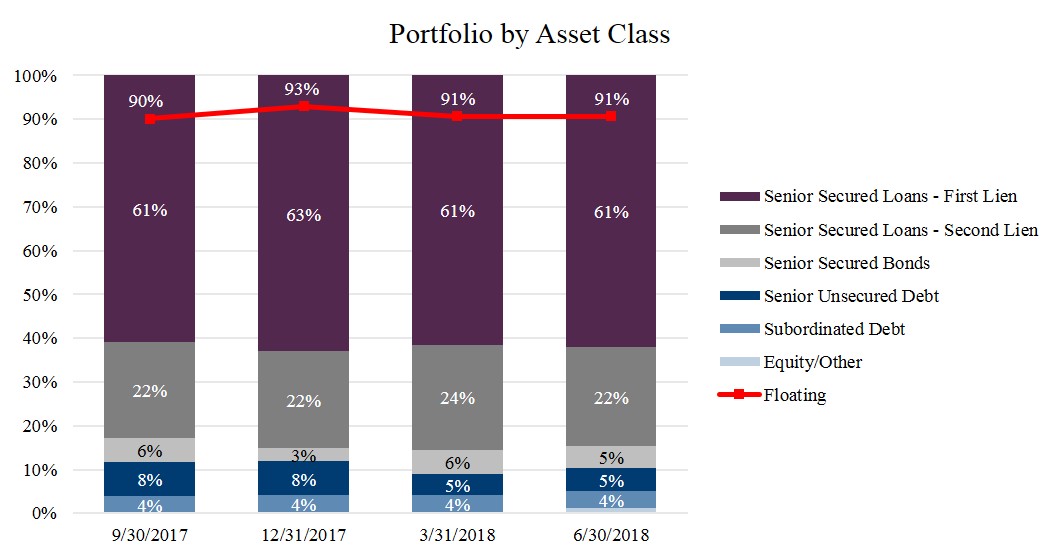

As of June 30, 2018, the portfolio consisted of $385 million of total investments at fair value and, consistent with prior quarters, our debt portfolio remains predominately invested in senior debt investments which represented 93% of the portfolio at fair value. We believe senior debt investments provide for downside protection which is particularly important given today's credit environment.

Set forth below is the composition of the portfolio by asset class for each quarter end based on fair value:

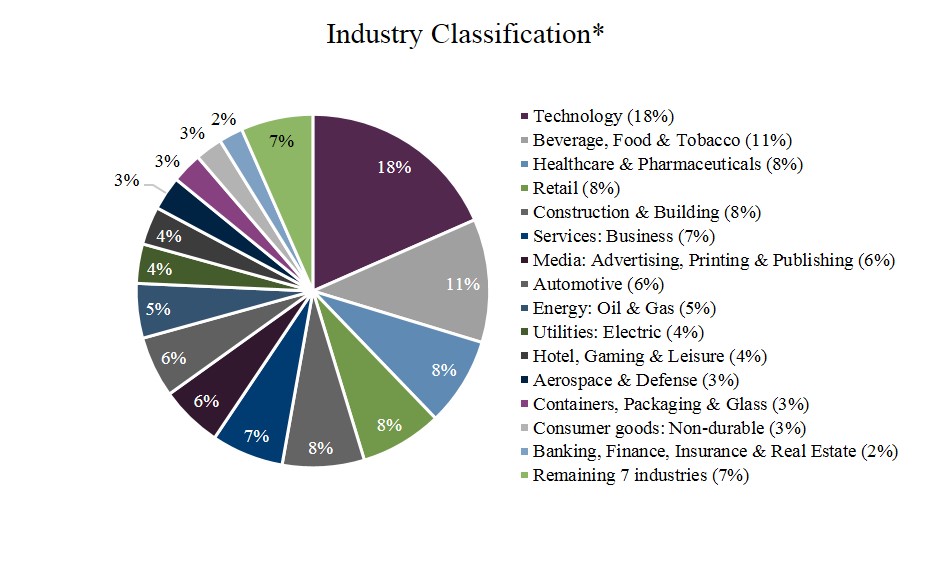

As of June 30, 2018, there were 82 portfolio companies in which GCIF held 123 investments. The weighted average portfolio company age, based on fair value, was 49 years as of June 30, 2018. Furthermore, and aligned with our strategy of seeking to mitigate industry specific risk, the companies comprising the GCIF portfolio were diversified across 22 industries. Set forth below are the industry concentrations in GCIF's portfolio as of June 30, 2018 by fair value:

________________________

(*) Industry classifications based upon Moody's standard industry classifications.

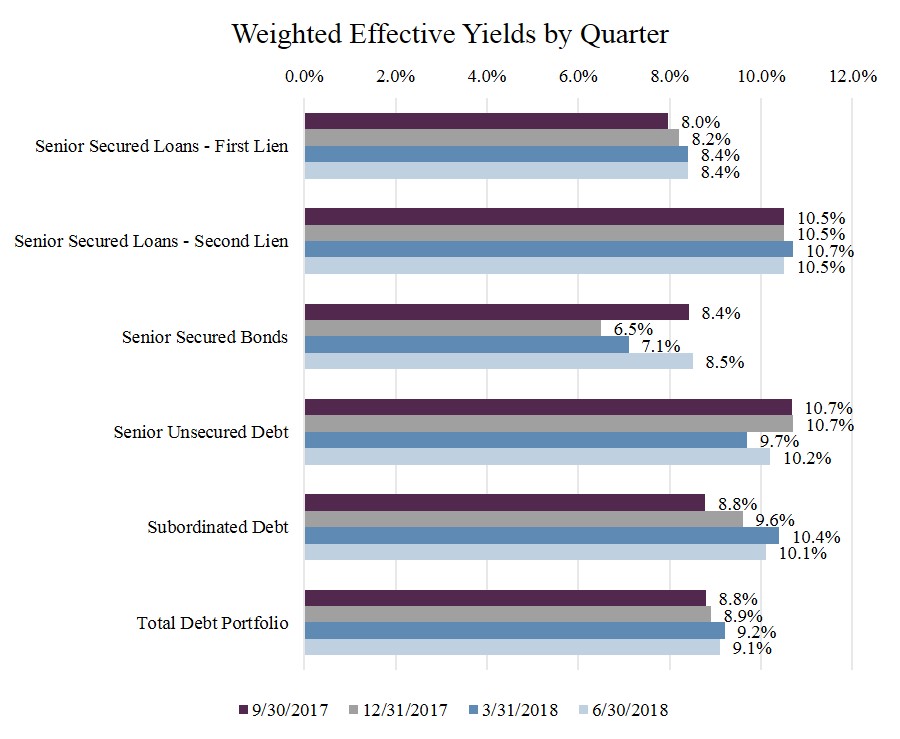

The gross debt portfolio yield was 9.1% as of June 30, 2018, compared to 8.9% as of December 31, 2017. The increase in the weighted average yield was primarily due to an increase in LIBOR during the period.

3

Set forth below are the weighted average effective yields, by investment type, as of each of the prior four quarters:

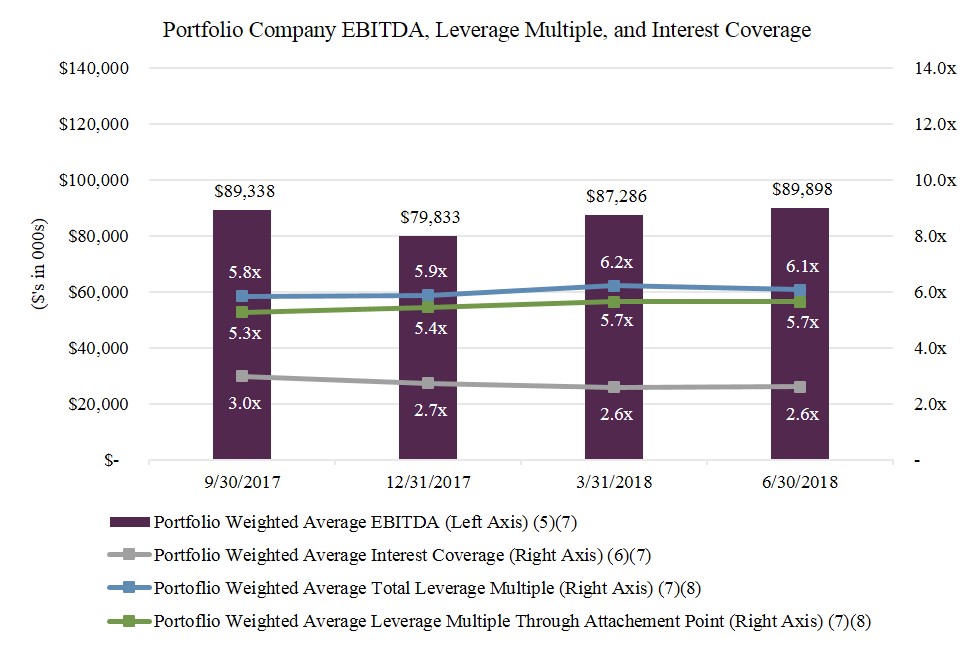

Set forth below are the weighted average EBITDA, weighted average total leverage multiple, and weighted average interest rate coverage of GCIF's portfolio companies.

4

________________________

(5) | Based on trailing twelve months EBITDA as most recently reported by portfolio companies. Weighted average portfolio company EBITDA is calculated using weights based on amortized cost. The inputs and computations of EBITDA are not consistent across all portfolio companies. EBITDA is a non-GAAP financial measure. For a particular portfolio company, EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization. EBITDA amounts are estimated from the most recent portfolio company's financial statements, have not been independently verified by GCIF or its Advisor, may reflect a normalized or adjusted amounts, typically exclude expenses deemed unusual or non-recurring, and typically include add backs for items deemed appropriate to present normalized earnings. Accordingly, neither GCIF nor its Advisor makes any representation or warranty in respect of this information. |

(6) | Weighted average interest coverage represents the portfolio company’s EBITDA as a multiple of interest expense. Portfolio company credit statistics are derived from the most recently available portfolio company financial statements, have not been independently verified by GCIF or its Advisors, and may reflect a normalized or adjusted amount. Accordingly, neither GCIF nor its Advisors makes any representation or warranty in respect of this information. |

(7) | Portfolio weighted average EBITDA, weighted average total leverage multiple, weighted average leverage multiple through tranche, and weighted average interest coverage ratio data includes information solely in respect of portfolio companies in which GCIF has a debt investment. |

(8) | Weighted average total leverage multiple represents the portfolio company’s total debt as a multiple of EBITDA. Weighted average leverage multiple through attachment point represents the portfolio company's debt through GCIF's position in the capital structure as a multiple of EBITDA. Portfolio company credit statistics are derived from the most recently available portfolio company financial statements, have not been independently verified by GCIF or its Advisors, and may reflect a normalized or adjusted amount. Accordingly, neither GCIF nor its Advisors makes any representation or warranty in respect of this information. |

As of June 30, 2018, there were no debt investments on non-accrual status.

The following chart shows debt investments on non-accrual status based on their amortized cost and fair value for each of the prior four quarters.

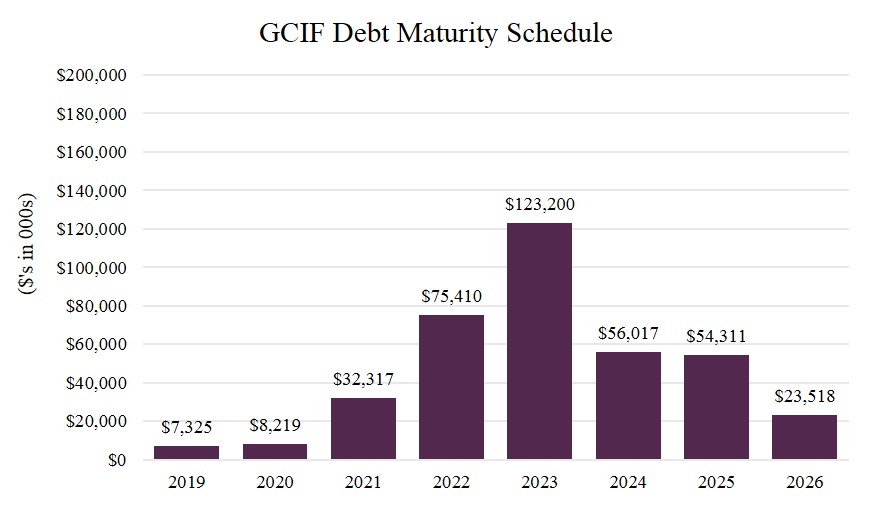

The following chart shows the maturity schedule of GCIF's debt investments, excluding unfunded commitments, based on their principal amount as of June 30, 2018.

5

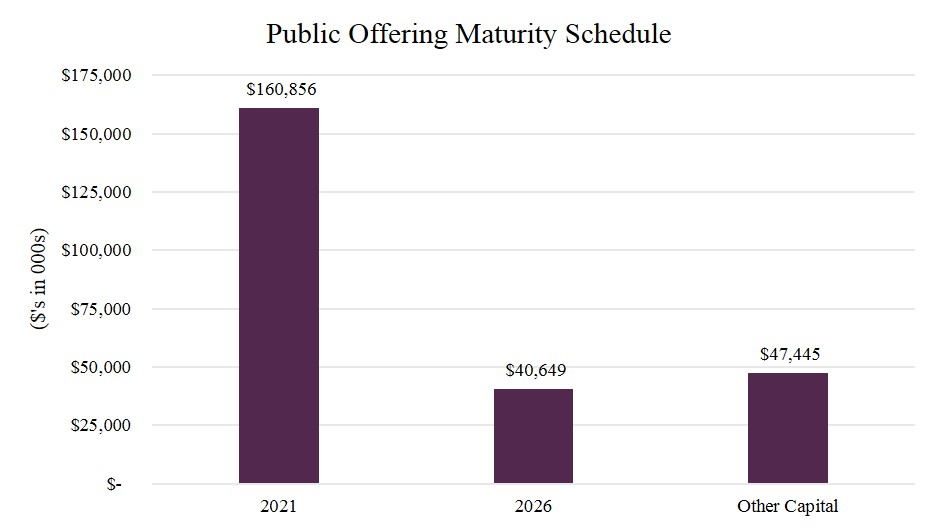

GCIF's publicly offered feeder funds, GCIF 2016 T and GCIF 2019, which have committed to seek liquidity events on or before December 31, 2021 and December 31, 2026, respectively, collectively represented 81% of GCIF's total ownership as of June 30, 2018. The following chart shows the liquidity schedule of GCIF's publicly offered feeder funds as of June 30, 2018 based on the net assets of GCIF.

About Guggenheim Credit Income Fund

GCIF is a non-traded business development company ("BDC") that invests primarily in large, privately negotiated loans to private middle market U.S. companies. GCIF is the master fund which pools investor capital raised through its feeder fund offerings, such as GCIF 2019 and GCIF 2016 T. GCIF is managed by Guggenheim and is designed to provide investors with current income, capital preservation, and, to a lesser extent, capital appreciation. GCIF and its feeder fund offerings share the same investment objectives and strategies and all portfolio investments and corporate borrowings are held at GCIF.

About Guggenheim Partners, LLC

Guggenheim Investments represents the investment management businesses of Guggenheim Partners and includes Guggenheim, an SEC-registered investment adviser. Guggenheim Partners is a privately-held, global financial services firm with over 2,300 employees and more than $265 billion in total assets under management as of June 30, 2018. It produces customized solutions for its clients, which include institutions, governments and agencies, corporations, insurance companies, investment advisors, family offices, and individual investors.

Guggenheim Investments manages more than $208 billion in assets across fixed income, equity, and alternatives as of June 30, 2018. Its 300+ investment professionals perform research to understand market trends and identify undervalued

6

opportunities in areas that are often complex and underfollowed. This approach to investment management has enabled Guggenheim to deliver long-term results to its clients.

Within Guggenheim Investments is the Guggenheim Corporate Credit Team, which is responsible for all corporate credit strategies and asset management of $79 billion. A unified credit platform is utilized for all strategies and is organized by industry as opposed to asset class, which increases its ability to uncover relative value opportunities and to identify and source opportunities. The scale of the platform, combined with the expertise across a wide range of industries and in-house legal resources, allows Guggenheim to be a solution provider to the market and maintain an active pipeline of investment opportunities.

Cautionary Statement Concerning Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Federal securities laws. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. GCIF, GCIF 2019, and GCIF 2016 T undertake no obligation to update any forward-looking statements contained herein to conform the statements to actual results or changes in their expectations. A number of factors may cause GCIF’s, GCIF 2019's and GCIF 2016 T's actual results, performance or achievement to differ materially from those anticipated. For further information on factors that could impact GCIF, GCIF 2019, and GCIF 2016 T performance, please review GCIF’s, GCIF 2019's, and GCIF 2016 T's respective filings at the SEC website at www.sec.gov.

7