Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☑ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended June 30, 2018

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 0-5151

FLEXSTEEL INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 42-0442319 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 385 Bell Street, Dubuque, Iowa | 52001 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code: | (563) 556-7730 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $1.00 Par Value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one). Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock held by non-affiliates, computed by reference to the last sales price on December 31, 2017 (which was the last business day of the registrant’s most recently completed second quarter) was $297,116,387.

Indicate the number of shares outstanding of each of the registrant’s classes of Common Stock, as of the latest practicable date. 7,872,150 Common Shares ($1 par value) as of August 28, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

In

Part III, portions of the registrant’s 2018 Proxy Statement to be filed with the Securities and Exchange Commission within

120 days of the Registrant’s fiscal year end.

1

PART I

Cautionary Statement Relevant to Forward-Looking Information for the Purpose of “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

The Company and its representatives may from time to time make written or oral forward-looking statements with respect to long-term goals or anticipated results of the Company, including statements contained in the Company’s filings with the Securities and Exchange Commission and in its reports to stockholders.

Statements, including those in this Annual Report on Form 10-K, which are not historical or current facts, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. There are certain important factors that could cause the Company’s results to differ materially from those anticipated by some of the statements made herein. Investors are cautioned that all forward-looking statements involve risk and uncertainty. Some of the factors that could affect results are the cyclical nature of the furniture industry, supply chain disruptions, litigation, the effectiveness of new product introductions and distribution channels, the product mix of sales, pricing pressures, the cost of raw materials and fuel, retention and recruitment of key employees, actions by governments including laws, regulations, taxes and tariffs, the amount of sales generated and the profit margins thereon, competition (both U.S. and foreign), credit exposure with customers, participation in multi-employer pension plans and general economic conditions. For further information regarding these risks and uncertainties, see the “Risk Factors” section in Item 1A of this Annual Report on Form 10-K.

The Company specifically declines to undertake any obligation to publicly revise any forward-looking statements that have been made to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

| Item 1. | Business |

General

Flexsteel Industries, Inc. and Subsidiaries (the “Company”) incorporated in 1929 is celebrating its 125th anniversary of the Company’s founding in 1893. Flexsteel Industries, Inc. is one of the oldest and largest manufacturers, importers and marketers of residential and contract upholstered and wooden furniture products in the United States. Over the generations the Company has built a committed retail and consumer following based on its patented, guaranteed-for-life Blue Steel SpringTM – the all-riveted, high-carbon, steel-banded seating platform that gives upholstered and leather furniture the strength and comfort to last a lifetime. With offerings for use in home, hotel, healthcare, recreational vehicle, marine and office, the Company distributes its furniture throughout the United States & Canada through the Company’s sales force and various independent representatives.

In April 2018, Flexsteel Industries, Inc. merged its wholly owned subsidiary, DMI Furniture, Inc. into the parent company. In June 2018, the DMI Management, Inc. subsidiary was dissolved. The Company expects to reduce administrative and compliance expenses with these corporate structure changes.

The Company operates in one reportable segment, furniture products. The Company’s furniture products business involves the distribution of manufactured and imported products consisting of a broad line of upholstered and wooden furniture for residential and contract markets. Set forth below is information for the past three fiscal years showing the Company’s net sales attributable to each of the areas of application:

| (in thousands) | FOR THE YEARS ENDED JUNE 30, | |||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Residential | $ | 413,664 | $ | 396,099 | $ | 420,884 | ||||||

| Contract | 75,516 | 72,665 | 79,222 | |||||||||

| $ | 489,180 | $ | 468,764 | $ | 500,106 | |||||||

Manufacturing and Offshore Sourcing

The Company operates manufacturing facilities located in Arkansas, California, Georgia, Iowa, Mississippi and Juarez, Mexico. These manufacturing operations are integral to the Company’s product offerings and distribution strategy by offering smaller and more frequent product runs of a wider product selection. The Company identifies and eliminates manufacturing inefficiencies and adjusts manufacturing schedules on a daily basis to meet customer requirements. The Company has established relationships with key suppliers to ensure prompt delivery of quality component parts. The Company’s production includes the use of selected component parts sourced offshore to enhance value in the marketplace.

The Company integrates manufactured products with finished products acquired from offshore suppliers who can meet quality specifications and scheduling requirements. The Company will continue to pursue and refine this blended strategy, offering customers manufactured goods, products manufactured utilizing imported component parts, and ready-to-deliver imported products. This blended focus on products allows the Company to provide a wide range of price points, styles and product categories to satisfy customer requirements.

2

Competition

The furniture industry is highly competitive and includes a large number of U.S. and foreign manufacturers and distributors, none of which dominates the market. The Company competes in markets with a large number of relatively small manufacturers; however, certain competitors have substantially greater sales volumes than the Company. The Company’s products compete based on style, quality, price, delivery, service and durability. The Company believes its patented, guaranteed-for-life Blue Steel Spring, manufacturing and sourcing capabilities, facility locations, commitment to customers, product quality, delivery, service, value and experienced production, sales, marketing and management teams, are some of its competitive advantages.

Seasonality

The Company’s business is not considered seasonal.

Foreign Operations

The Company makes minimal export sales. At June 30, 2018, the Company had approximately 100 employees located in Asia to ensure Flexsteel’s quality standards are met and to coordinate the delivery of purchased products. The Company leases and operates a 225,000 square foot production facility in Juarez, Mexico utilizing contracted labor. The Company also leases a 39,000 square foot bonded warehouse in Binh Duong, Vietnam to facilitate efficient consolidation and shipment to its U.S. warehouses and customers.

Customer Backlog

The approximate backlog of customer orders believed to be firm as of the end of the current fiscal year and the prior two fiscal years were as follows (in thousands):

| June 30, 2018 | June 30, 2017 | June 30, 2016 | ||

| $53,700 | $55,000 | $46,700 |

Raw Materials

The Company utilizes various types of wood, fabric, leather, filling material, high carbon spring steel, bar and wire stock, polyurethane and other raw materials in manufacturing furniture. While the Company purchases these materials from numerous outside suppliers, both U.S. and foreign, it is not dependent upon any single source of supply. The costs of certain raw materials fluctuate, but all continue to be readily available.

Working Capital Practices

For a discussion of the Company’s working capital practices, see “Liquidity and Capital Resources” in Item 7 of this Annual Report on Form 10-K.

Industry Factors

The Company has exposure to actions by governments, including tariffs, see “Risk Factors” in Item 1A of this Annual Report on Form 10-K.

Government Regulations

The Company is subject to various local, state, and federal laws, regulations and agencies that affect businesses generally, see “Risk Factors” in Item 1A of this Annual Report on Form 10-K.

Environmental Matters

The Company is subject to environmental laws and regulations with respect to product content and industrial waste, see “Risk Factors” in Item 1A and “Legal Proceedings” in Item 3 of this Annual Report on Form 10-K.

3

Trademarks and Patents

The Company owns the American and Canadian improvement patents to its Flexsteel guaranteed-for-life Blue Steel Spring – the all-riveted, high-carbon, steel-banded seating platform that gives upholstered and leather furniture the strength and comfort to last a lifetime, as well as patents on convertible beds. The Company has patents and owns certain trademarks in connection with its furniture products which are due to expire on dates ranging from 2019-2035.

It is not common in the furniture industry to obtain a patent for a furniture design. If a particular design of a furniture manufacturer is well accepted in the marketplace, it is common for other manufacturers to imitate the same design without recourse by the furniture manufacturer who initially introduced the design. Furniture products are designed by the Company’s own design staff and through the services of third-party designers. New models and designs of furniture, as well as new fabrics, are introduced continuously. In the last three fiscal years, these design activities involved the following expenditures (in thousands):

| Fiscal Year Ended June 30, | Expenditures | |

| 2018 | $3,910 | |

| 2017 | $3,700 | |

| 2016 | $4,170 |

Employees

The Company had 1,530 employees as of June 30, 2018, including 180 employees that are covered by collective bargaining agreements. Management believes it has good relations with employees.

Website and Available Information

The Company’s website is located at www.flexsteel.com. Information on the website does not constitute part of this Annual Report on Form 10-K.

A copy of the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (“SEC”), other SEC reports filed or furnished and its Guidelines for Business Conduct are available, without charge, on the Company’s website at www.flexsteel.com or by writing to the Office of the Secretary, Flexsteel Industries, Inc., P. O. Box 877, Dubuque, IA 52004-0877.

Executive Officers

The executive officers of the Company, their ages, positions (in each case as of August 10, 2018), and the year they were first elected or appointed an officer of the registrant, are as follows:

| Name (age) | Position (date first became officer) | |

| Karel K. Czanderna (62) | President & Chief Executive Officer (2012) | |

| Marcus D. Hamilton (44) | Chief Financial Officer, Secretary & Treasurer (2018) | |

| Steven K. Hall (48) | Senior Vice President Global Supply Chain (2014) | |

| Richard J. Stanley (46) | Senior Vice President Contract Group & Home Styles (2014) |

| Item 1A. | Risk Factors |

The Company is subject to a variety of risks. You should carefully consider the risk factors detailed below in conjunction with the other information contained in this Annual Report on Form 10-K. Should any of these risks actually materialize, the Company’s business, financial condition, and future prospects could be negatively impacted. There may be additional factors that are presently unknown to the Company or that the Company currently believes to be immaterial that could affect its business.

Business information systems could be impacted by disruptions and security breaches.

The Company employs information technology systems to support global business. Security breaches and other disruptions to the Company’s information technology infrastructure could interfere with operations, compromise information belonging to the Company and its customers and suppliers and expose the Company to liability which could adversely impact the Company’s business and reputation. In the ordinary course of business, the Company relies on information technology networks and systems to process, transmit and store electronic information, and to manage or support a variety of business processes and activities. Additionally, the Company collects and stores certain data, including proprietary business information, and may have access to confidential or personal information in certain areas of its businesses that is subject to privacy and security laws, regulations and customer-imposed controls. While security breaches and other disruptions to the Company’s information technology networks and infrastructure could happen, none have occurred to date that have had a material impact to the Company. Any such events could result in legal claims or proceedings, liability or penalties under privacy laws, disruption in operations, and damage to the Company’s reputation, which could adversely affect the Company’s business.

4

The implementation of a new business information system could disrupt the business.

The Company completed the first of two deployments of its new business information system, SAP S/4 HANA in fiscal fourth quarter of 2018 retiring one of the Company’s legacy systems. The second deployment is expected during fiscal year 2020. Once fully implemented, SAP S/4 HANA will enable the Company to better meet market conditions, customer requirements and increase operating efficiency.

An ineffective implementation of the new business information system may result in the following:

| ● | Disruption of the Company’s domestic and international supply chain; |

| ● | Inability to fill customer orders accurately and on a timely basis; |

| ● | Inability to process payments to suppliers and vendors; |

| ● | Negative impact on financials; |

| ● | Inability to fulfill federal, state and local tax filing requirements in a timely and accurate matter; and |

| ● | Increased demands of management and associates to the detriment of other corporate initiatives. |

Future success depends on the Company’s ability to manage its global supply chain.

The Company acquires raw materials, component parts and certain finished products from external suppliers, both U.S. and foreign. Many of these suppliers are dependent upon other suppliers in countries other than where they are located. This global interdependence within the Company’s supply chain is subject to delays in delivery, availability, quality, pricing, and changes in international trade policies including tariffs. The delivery of goods from these suppliers may be delayed by customs, labor issues, changes in political, economic and social conditions, weather, laws and regulations. Unfavorable fluctuations in price, international trade policies, quality, delivery and availability of these products could adversely affect the Company’s ability to meet demands of customers and cause negative impacts to the Company’s cost structure, profitability and its cash flow.

Competition from U.S. and foreign finished product manufacturers may adversely affect the business, operating results or financial condition.

The furniture industry is very competitive and fragmented. The Company competes with U.S. and foreign manufacturers and distributors. As a result, the Company may not be able to maintain or raise the prices of its products in response to competitive pressures or increasing costs. Also, due to the large number of competitors and their wide range of product offerings, the Company may not be able to significantly differentiate its products (through styling, finish and other construction techniques) from those of its competitors. As a result, the Company is continually subject to the risk of losing market share, which may lower its sales and earnings.

Future costs of complying with various laws and regulations may adversely impact future operating results.

The Company’s business is subject to various laws and regulations which could have a significant impact on operations and the cost to comply with such laws and regulations could adversely impact the Company’s financial position, results of operations and cash flows. In addition, inadvertently failing to comply with such laws and regulations could produce negative consequences which could adversely impact the Company’s operations.

The Company’s participation in multi-employer pension plans may have exposures under those plans that could extend beyond what its obligations would be with respect to its employees.

The Company participates in, and makes periodic contributions to, three multi-employer pension plans that cover union employees. Multi-employer pension plans are managed by trustee boards comprised of participating employer and labor union representatives, and the employers participating in a multi-employer pension plan are jointly responsible for maintaining the plan’s funding requirements. Based on the most recent information available to the Company, the present value of actuarially accrued liabilities in one of the multi-employer pension plans substantially exceeds the value of the assets held in trust to pay benefits. As a result of the Company’s participation, it could experience greater volatility in the overall pension funding obligations. The Company’s obligations may be impacted by the funded status of the plans, the plans’ investment performance, changes in the participant demographics, financial stability of contributing employers and changes in actuarial assumptions. See Note 9 to the consolidated financial statements.

Future results may be affected by various legal proceedings and compliance risk, including those involving product liability, environmental, or other matters.

The Company faces the risk of exposure to product liability claims in the event the use of any of its products results in personal injury or property damage. In the event any of the Company’s products prove to be defective, it may be required to recall or redesign such products. The Company is also subject to various laws and regulations relating to environmental protection and the discharge of materials into the environment. The Company could incur substantial costs, including legal expenses, as a result of the noncompliance with, or liability for cleanup or other costs or damages under, environmental laws. Given the inherent uncertainty of litigation, these various legal proceedings and compliance matters could have a material impact on the business, operating results and financial condition. See Note 11 to the consolidated financial statements.

5

The Company’s success depends on its ability to recruit and retain key employees and highly-skilled workers in a competitive labor market.

If the Company is not successful in recruiting and retaining key employees and highly-skilled workers or experiences the unexpected loss of those employees, the operations may be negatively impacted.

Failure to anticipate or respond to changes in consumer or designer tastes and fashions in a timely manner could adversely affect the Company’s business and decrease sales and earnings.

Furniture is a styled product and is subject to rapidly changing consumer and end-user trends and tastes and is highly fashion oriented. If the Company is not able to acquire sufficient fabric variety or if the Company is unable to predict or respond to changes in fashion trends, it may lose sales and have to sell excess inventory at reduced prices.

The Company’s products are considered deferrable purchases for consumers during economic downturns. Prolonged negative economic conditions could impact the business.

Economic downturns and prolonged negative economic conditions could affect consumer spending habits by decreasing the overall demand for home furnishings and contract products. These events could impact retailers, offices, hospitality, recreational vehicle seating and healthcare businesses resulting in an impact on the Company’s business. A recovery in the Company’s sales could lag significantly behind a general economic recovery due to the deferrable nature and relatively significant cost of home furnishings and contract products purchases.

Terms of collective bargaining agreements and labor disruptions could adversely impact results of operations.

Terms of collective bargaining agreements that prevent the Company from competing effectively could adversely affect its financial condition, results of operations and cash flows. The Company is committed to working with those groups to avert or resolve conflicts as they arise. However, there can be no assurance that these efforts will be successful.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

The Company owns the following facilities as of June 30, 2018:

| Location | Approximate Size (square feet) | Principal Operations | ||

| Harrison, Arkansas | 221,000 | Manufacturing | ||

| Riverside, California | 236,000 | Manufacturing and Distribution | ||

| Dublin, Georgia | 315,000 | Manufacturing | ||

| Huntingburg, Indiana | 611,000 | Distribution | ||

| Dubuque, Iowa (1) | 719,000 | Manufacturing | ||

| Dubuque, Iowa (2) | 250,000 | Construction in process | ||

| Dubuque, Iowa | 40,000 | Corporate Office | ||

| Edgerton, Kansas | 500,000 | Distribution | ||

| Starkville, Mississippi | 349,000 | Manufacturing | ||

| Lancaster, Pennsylvania | 216,000 | Distribution |

| (1) | The Dubuque, Iowa manufacturing facility and land will be donated to a not-for-profit entity when vacated by the Company, which is expected to occur during fiscal year 2019. |

| (2) | The Company is constructing a 250,000 square foot manufacturing facility in Dubuque, Iowa and expects to occupy the facility during fiscal year 2019. |

6

The Company leases the following facilities as of June 30, 2018:

| Location | Approximate Size (square feet) | Principal Operations | ||

| Cerritos, California | 75,000 | Distribution | ||

| Riverside, California | 211,000 | Distribution | ||

| Dublin, Georgia | 50,000 | Distribution | ||

| Louisville, Kentucky | 10,000 | Administrative Offices | ||

| Juarez, Mexico | 225,000 | Manufacturing | ||

| Binh Duong, Vietnam | 39,000 | Warehouse |

The Company leases showrooms for displaying its products in the furniture markets in High Point, North Carolina and Las Vegas, Nevada.

The Company’s operating plants are well suited for their manufacturing purposes and have been updated and expanded from time to time as conditions warrant.

| Item 3. | Legal Proceedings |

Environmental Matters – In March 2016, the Company received a General Notice Letter for the Lane Street Groundwater Superfund Site (the “Lane Street Site”) located in Elkhart, Indiana from the U.S. Environmental Protection Agency (EPA). In April 2016, the EPA issued their proposed clean-up plan for groundwater pollution and request for public comment. The Company responded to the request for public comment in May 2016. The EPA issued a Record Decision selecting a remedy in August 2016 and estimated total costs to remediate of $3.6 million. In July 2017, the EPA issued a Special Notice Letter to the Company demanding that the Company perform the remedy selected and pay for the remediation cost and past response costs of $5.5 million. On October 12, 2017, the Company, after consultation with its insurance carriers, offered an amount, fully reimbursable by insurance coverage, to the EPA to resolve this matter. On November 6, 2017, the settlement offer extended on October 12, 2017 was rejected.

In April 2018, the EPA issued a Unilateral Administrative Order for Remedial Design and Remedial Action (the “Order”) against the Company. The Order was issued under Section 106(a) of the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), 42 U.S.C. §9606(a). The Order directs the Company to perform remedial design and remedial action for the Lane Street Site. The Order was to be effective May 29, 2018. To ensure completion of the remediation work, the EPA required the Company to secure financial assurance in the initial amount of $3.6 million, which as noted above, is the estimated cost of remedial work. The Company believes that financial assurance is not required because it meets the relevant financial test criteria as provided in the Order. In May 2018, the EPA agreed to suspend enforcement of the Order so that the Company could conduct environmental testing upgradient to its former manufacturing location pursuant to an Administrative Order on Consent (AOC). On July 5, 2018, the EPA proposed a draft AOC, to which the Company provided revisions. As of August 31, 2018, the Company has not finalized the AOC with the EPA. The Company maintains its position that it did not cause nor contribute to the contamination. However, in accordance with Financial Accounting Standards Board (FASB) issued Asset Retirement and Environmental Obligations (ASC 410-30), the Company accrued and reflected $3.6 million in the financial results for the fiscal year ended June 30, 2018. The Company continues to evaluate the Order, its legal options and insurance coverages to assert its defense and recovery of current and future expenses related to this matter.

Indiana Civil Litigation – In December 2013, the Company entered into a confidential agreement to settle the Indiana Civil Litigation. The Company paid $6.25 million to Plaintiffs to settle the matter without admission of wrongdoing. The Company received $1.2 million and $2.3 million during the fiscal years ended June 30, 2017 and 2016, respectively, for recovery of litigation settlement costs from insurers. These amounts are recorded as “Litigation settlement reimbursements” in the consolidated statements of income. The recovery of litigation settlement and defense costs from insurance carriers was completed during the fiscal year ended June 30, 2017.

Other Proceedings – During the quarter ended March 31, 2018, the Company initiated a voluntary field modification program for certain switches in residential motion furniture. The Company provided retailers with notice of the field modification, provided information on its website, reported its field modification actions with the Consumer Product Safety Commission (CPSC), and replaced switches in the field. The Company received notification from the CPSC in August 2018 that no further action was required by the CPSC and that it would not institute and oversee a recall.

From time to time, the Company is subject to various other legal proceedings, including lawsuits, which arise out of, and are incidental to, the conduct of the Company’s business. The Company does not consider any of such other proceedings that are currently pending, individually or in the aggregate, to be material to its business or likely to result in a material effect on its consolidated operating results, financial condition, or cash flows.

7

| Item 4. | Mine Safety Disclosures |

None.

PART II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Share Investment Performance

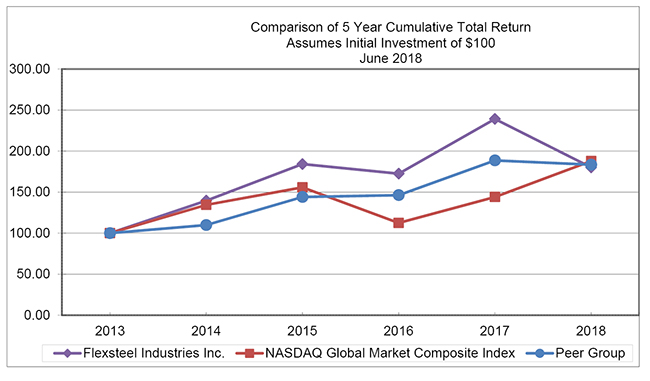

The following graph shows changes over the past five-year period in the value of $100 invested in: (1) Flexsteel’s common stock (FLXS); (2) The NASDAQ Global Market; and (3) an industry peer group of the following: American Woodmark Corp, Bassett Furniture Ind., Culp Inc., Dixie Group Inc., Ethan Allen Interiors Inc., Hooker Furniture Corp., Johnson Outdoors Inc., Kimball International, Knoll Inc., La-Z-Boy Inc., Lifetime Brands Inc., Patrick Industries Inc., and Sleep Number Corp.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||

| Flexsteel | 100.00 | 139.58 | 184.14 | 172.47 | 239.14 | 180.06 | ||||||

| Peer Group | 100.00 | 109.81 | 144.01 | 146.27 | 188.55 | 183.37 | ||||||

| NASDAQ | 100.00 | 134.35 | 155.73 | 112.30 | 143.96 | 187.74 |

The NASDAQ Global Select Market is the market on which the Company’s common stock is traded.

| Sale Price of Common Stock | Cash Dividends | |||||||||||||||||||||||

| Fiscal 2018 | Fiscal 2017 | Per Share | ||||||||||||||||||||||

| High | Low | High | Low | Fiscal 2018 | Fiscal 2017 | |||||||||||||||||||

| First Quarter | $ | 57.79 | $ | 43.25 | $ | 54.25 | $ | 37.93 | $ | 0.22 | $ | 0.20 | ||||||||||||

| Second Quarter | 53.00 | 45.04 | 62.99 | 39.98 | 0.22 | 0.20 | ||||||||||||||||||

| Third Quarter | 49.98 | 34.74 | 62.55 | 45.31 | 0.22 | 0.20 | ||||||||||||||||||

| Fourth Quarter | 40.87 | 36.23 | 57.48 | 48.44 | 0.22 | 0.20 | ||||||||||||||||||

The Company estimates there were approximately 4,600 holders of common stock of the Company as of June 30, 2018. There were no repurchases of the Company’s common stock during the fiscal year ended June 30, 2018. The payment of future cash dividends is within the discretion of the Company’s Board of Directors and will depend, among other factors, on its earnings, capital requirements and operating and financial condition.

8

| Item 6. | Selected Financial Data |

The selected financial data presented below should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in Item 8 of this Annual Report on Form 10-K and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this Annual Report on Form 10-K. The selected consolidated statements of income data of the Company are derived from the Company’s consolidated financial statements.

Five-Year Review

(Amounts in thousands, except certain ratios and per share data)

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| SUMMARY OF OPERATIONS | ||||||||||||||||||||

| Net sales | $ | 489,180 | $ | 468,764 | $ | 500,106 | $ | 466,904 | $ | 438,543 | ||||||||||

| Gross margin | 98,219 | 108,651 | 113,699 | 109,860 | 100,263 | |||||||||||||||

| Environmental remediation | (3,600 | ) | — | — | — | — | ||||||||||||||

| Litigation settlement reimbursements (costs) | — | 1,175 | 2,280 | 250 | (6,250 | ) | ||||||||||||||

| Operating income | 24,505 | 37,264 | 38,068 | 34,422 | 22,286 | |||||||||||||||

| Income before income taxes | 25,126 | 37,586 | 37,927 | 35,559 | 23,800 | |||||||||||||||

| Income tax provision | 7,460 | 13,800 | 13,690 | 13,260 | 8,810 | |||||||||||||||

| Net income | 17,666 | 23,786 | 24,237 | 22,299 | 14,990 | |||||||||||||||

| Net income, as a percent of sales | 3.6 | % | 5.1 | % | 4.8 | % | 4.8 | % | 3.4 | % | ||||||||||

| Weighted average diluted shares outstanding | 7,919 | 7,886 | 7,765 | 7,708 | 7,511 | |||||||||||||||

| Diluted earnings per common share | $ | 2.23 | $ | 3.02 | $ | 3.12 | $ | 2.89 | $ | 2.00 | ||||||||||

| Cash dividends declared per common share | $ | 0.88 | $ | 0.80 | $ | 0.72 | $ | 0.72 | $ | 0.60 | ||||||||||

| SELECTED DATA AS OF JUNE 30 | ||||||||||||||||||||

| Total assets | $ | 284,293 | $ | 270,045 | $ | 246,896 | $ | 244,619 | $ | 210,213 | ||||||||||

| Shareholders’ equity | 241,698 | 230,760 | 209,650 | 186,748 | 166,735 | |||||||||||||||

| Trade receivables, net | 41,253 | 42,362 | 44,618 | 45,101 | 38,536 | |||||||||||||||

| Inventories | 96,204 | 99,397 | 85,904 | 113,842 | 97,940 | |||||||||||||||

| Property, plant and equipment, net | 90,725 | 70,661 | 64,124 | 64,770 | 31,900 | |||||||||||||||

| Capital expenditures | 29,447 | 13,457 | 7,382 | 37,424 | 4,187 | |||||||||||||||

| Depreciation expense | 7,367 | 7,936 | 7,556 | 4,945 | 4,197 | |||||||||||||||

| Working

capital (current assets less current liabilities) | 148,705 | 158,055 | 143,086 | 115,682 | 128,644 | |||||||||||||||

| Current ratio | 4.6 to 1 | 5.2 to 1 | 5.3 to 1 | 3.3 to 1 | 4.5 to 1 | |||||||||||||||

| Return on ending shareholders’ equity | 7.3 | % | 10.3 | % | 11.6 | % | 11.9 | % | 9.0 | % | ||||||||||

| Average number of employees | 1,510 | 1,440 | 1,440 | 1,340 | 1,380 | |||||||||||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

General

The following analysis of the results of operations and financial condition of the Company should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Critical Accounting Policies

The discussion and analysis of the Company’s consolidated financial statements and results of operations are based on consolidated financial statements prepared in accordance with generally accepted accounting principles (GAAP) in the United States of America. Preparation of these consolidated financial statements requires the use of estimates and judgments that affect the reported results. The Company uses estimates based on the best information available in recording transactions and balances resulting from business operations. Estimates are used for such items as collectability of trade accounts receivable and inventory valuation. Ultimate results may differ from these estimates under different assumptions or conditions.

Accounts receivable allowances – the Company establishes accounts receivable allowances to reduce trade accounts receivable to an amount that reasonably approximates their net realizable value. The Company’s accounts receivable allowances consist of an allowance for doubtful accounts which is established through review of open accounts, historical collection, and historical write-off amounts and an allowance for estimated returns on sales of the Company’s products which is based on historical product returns, as well as existing product return authorizations. The Company records a provision against revenue for estimated returns on sales of its products in the same period that the related revenues are recognized. The amount ultimately realized from trade accounts receivable may differ from the amount estimated in the consolidated financial statements.

9

Inventories – the Company values inventory at the lower of cost or net realizable value. The Company’s inventory valuation reflects markdowns for the excess of the cost over the amount expected to be realized and considers obsolete and excess inventory. Markdowns establish a new cost basis for the Company’s inventory. Subsequent changes in facts or circumstances do not result in the reversal of previously recorded markdowns or an increase in that newly established cost basis.

Revenue recognition – is when both product ownership and the risk of loss have transferred to the customer, collectability is reasonably assured, and the Company has no remaining obligations. The Company’s ordering process creates persuasive evidence of the sale arrangement and the sales price is determined. The delivery of the goods to the customer completes the earnings process. Net sales consist of product sales and related delivery charge revenue, net of adjustments for returns and allowances. Shipping and handling costs are included in cost of goods sold.

Recently Issued Accounting Pronouncements

See Item 8. Note 1 to the Company’s consolidated financial statements.

Results of Operations

The following table has been prepared as an aid in understanding the Company’s results of operations on a comparative basis for the fiscal years ended June 30, 2018, 2017 and 2016. Amounts presented are percentages of the Company’s net sales.

| FOR THE YEARS ENDED JUNE 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Net sales | 100 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of goods sold | (79.9 | ) | (76.8 | ) | (77.3 | ) | ||||||

| Gross margin | 20.1 | 23.2 | 22.7 | |||||||||

| Selling, general and administrative | (14.7 | ) | (15.5 | ) | (15.6 | ) | ||||||

| Environmental remediation | (0.8 | ) | — | — | ||||||||

| Gain on sale of facility | 0.4 | — | — | |||||||||

| Litigation settlement reimbursements (costs) | — | 0.2 | 0.4 | |||||||||

| Operating income | 5.0 | 7.9 | 7.5 | |||||||||

| Interest and other income | 0.1 | 0.1 | 0.0 | |||||||||

| Interest expense | — | — | 0.0 | |||||||||

| Income before income taxes | 5.1 | 8.0 | 7.5 | |||||||||

| Income tax provision | (1.5 | ) | (2.9 | ) | (2.7 | ) | ||||||

| Net income | 3.6 | % | 5.1 | % | 4.8 | % | ||||||

Fiscal 2018 Compared to Fiscal 2017

During preparation work for the July 1, 2018 adoption of Accounting Standards Codification Topic 606, Revenue from Contracts with Customers, the Company identified approximately $4.4 million fiscal year-to-date of variable consideration provided to its customers to increase brand awareness and incentivize growth recorded in Selling, General & Administrative (“SG&A”) expense consistent with prior years. Upon further review of these transactions, it is the opinion of the Company that these amounts should be reflected as a reduction in net sales. Although the error is immaterial to the prior years, the Company corrected the fiscal year-to-date amount of $4.4 million to decrease SG&A and decrease net sales in the quarter ended June 30, 2018. The impact to Residential net sales was $4.2 million and Contract net sales was $0.2 million. There was no impact to operating income, net income or EPS. The impacts to gross margin rate and SG&A are described below.

Net sales for fiscal year 2018 were $489.2 million compared to $468.8 million in the prior fiscal year, an increase of 4.4%. For the fiscal year ended June 30, 2018, residential net sales were $413.7 million compared to $396.1 million for the year ended June 30, 2017, an increase of 4.4%. Contract net sales were $75.5 million for the year ended June 30, 2018, an increase of 3.9% from net sales of $72.7 million for the year ended June 30, 2017. Fiscal year 2018 included an all-time record quarter for net sales in the second quarter, followed by a record third quarter. This result was primarily driven by high single-digit growth in Residential products sold to furniture retailers and greater than 20% growth in Contract products targeting the recreational and hospitality markets. These successes in the year were partially offset by a 13% decline in sales to e-commerce customers primarily driven by product placement disruption and the new business information system transition.

10

Gross margin for the fiscal year ended June 30, 2018 was 20.1% compared to 23.2% for the prior year period. Higher labor costs primarily drove the gross margin decline for fiscal year 2018 over the prior year. After rapid growth in certain core product categories, additional manufacturing associates were hired to support product delivery speeds customers have come to expect from the Company. The Company manufactures a majority of custom upholstered furniture in the United States with a highly skilled workforce and has experienced higher average wage rates and turnover from the tightening labor market. To bolster the Company’s success attracting and retaining skilled workers in the highly competitive labor market, during the fiscal second and third quarters of this year the Company changed its compensation approach for the U.S.-based manufacturing workforce. As this modified compensation structure was implemented, the Company experienced declines in productivity. The Company is working to return to productivity levels realized before the compensation structure changes. Long term, the Company expects these changes to result in skilled workforce attraction and retention, reduced turnover and training costs, and continued improvement in quality and productivity to support the long-term growth of the Company. Additionally, the Company experienced higher than expected cost originating from its Juarez, Mexico facility due to contracted employee wage rates increasing significantly due to Mexican government mandated wage increases.

Higher material costs primarily driven by the increased cost of polyfoam, plywood and to a lesser extent steel drove additional gross margin decline in fiscal year 2018 over the prior year. To date, steel has not had a significant cost impact. While the Company’s furniture is renowned for the comfort and quality from its “Heart of Steel”, Flexsteel’s Blue Steel Springs™ are manufactured in the United States from steel produced primarily in the United States. The Company was successful in mitigating the impact of these higher material costs through higher pricing and improved product mix in the fiscal year.

During implementation of the Company’s first deployment of its new business information system in the fiscal fourth quarter of 2018, the Company experienced higher than expected disruption to customers which resulted in service level penalties which also contributed to the overall margin decline of the Company during the fiscal year 2018.

Selling, general and administrative (SG&A) expenses for the twelve months ended June 30, 2018 were 14.7% of net sales compared to 15.5% of net sales in the prior year period inclusive of the $4.4 million year-to-date correction of expense from SG&A to net sales. This adjustment favorably impacted SG&A in fiscal year 2018. Offsetting the favorable impact of the correction was a $1.1 million increase in expense to support a strategic digital marketing investment aimed at directly influencing consumers as they dream and plan on-line for future furniture purchases.

The twelve months ended June 30, 2017 included $2.1 million offset to expense related to the Indiana litigation, with $0.9 million or 0.2% of net sales reported in “Selling, general & administrative,” and $1.2 million or $0.10 per share reported in “Litigation settlement reimbursements.” On April 25, 2018, the United States Environmental Protection Agency (“EPA”) issued a Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) 106(a) order (the “Order”) for the Lane Street Groundwater Superfund Site located in Elkhart, Indiana. The Company maintains its position that it did not cause nor contribute to the contamination. However, in accordance with FASB issued Asset Retirement and Environmental Obligations (ASC 410-30), the Company reflected a $3.6 million liability in its year ended June 30, 2018 consolidated financial statements. The after-tax basis reported in “Environmental remediation” is $2.5 million or $0.32 per share.

The Company completed a $6.5 million sale of a facility and recognized a pre-tax gain of $1.8 million during fiscal year 2018. The after-tax basis reported in “Gain on sale of facility” is $1.3 million or $0.16 per share.

For the twelve months ended June 30, 2018, the effective tax rate was 29.7% compared to 36.7% in the prior year period. The current fiscal year results were positively impacted by the passage of the Tax Cuts and Jobs Act (“Tax Reform”) resulting in a $0.22 per share increase in net income. Beginning in fiscal year 2019, the Company expects an effective tax rate range of 25% to 27%.

The above factors resulted in net income of $17.7 million or $2.23 per share for fiscal year 2018 compared to $23.8 million or $3.02 per share in the prior year period. All earnings per share amounts are on a diluted basis.

Fiscal 2017 Compared to Fiscal 2016

Net sales for fiscal year 2017 were $468.8 million compared to $500.1 million in the prior fiscal year, a decrease of 6.3%. For the fiscal year ended June 30, 2017, residential net sales were $396.1 million compared to $420.9 million for the year ended June 30, 2016, a decrease of 5.9%. The residential net sales decrease of $24.8 million for the year ended June 30, 2017 was substantially due to decreased sales volume in upholstered and ready-to-assemble products. Contract net sales were $72.7 million for the year ended June 30, 2017, a decrease of 8.2% from net sales of $79.2 million for the year ended June 30, 2016. The decrease in contract net sales was substantially due to volume.

Gross margin for the fiscal year ended June 30, 2017 was 23.2% compared to 22.7% for the prior fiscal year.

Selling, general and administrative (SG&A) expenses for the fiscal year ended June 30, 2017 were 15.5% of net sales compared to 15.6% of net sales in the prior fiscal year. The fiscal year end June 30, 2017 includes reductions in direct selling costs, professional fees and incentive compensation of $3.6 million, or 0.8% of net sales, offset by $2.9 million, or 0.6% of net sales, related to the business information system project. SG&A expenses for fiscal years 2017 and 2016 include reimbursements, net of recovery expenses, related to Indiana litigation of $0.9 million and $0.2 million, respectively.

11

Litigation settlement reimbursements related to Indiana litigation were $1.2 million or $0.10 per share and $2.3 million or $0.18 per share during the fiscal years ended June 30, 2017 and 2016, respectively. The recovery of litigation settlement and defense costs from insurance carriers is complete.

The effective tax rate was 36.7% and 36.1% for fiscal years ended June 30, 2017 and 2016, respectively. The prior fiscal year rate decrease was primarily related to changes in the measurement of uncertain tax positions based on experiences with various state tax authorities.

The above factors resulted in net income of $23.8 million or $3.02 per share for the fiscal year ended June 30, 2017 compared to $24.2 million or $3.12 per share in the prior year period. All earnings per share amounts are on a diluted basis.

Liquidity and Capital Resources

Working capital (current assets less current liabilities) at June 30, 2018 was $148.7 million compared to $158.1 million at June 30, 2017. Significant changes in working capital during fiscal year 2018 included an increase in accrued liabilities of $3.3 million and decreases in inventory of $3.2 million and investments of $2.0 million. Accrued liabilities increased primarily due to the accrued environmental remediation liability of $3.6 million. For the fiscal year ended June 30, 2018, capital expenditures were $29.4 million including $13.8 million for the construction of a new manufacturing facility and $12.6 million invested to upgrade the business information system.

The Company’s main sources of liquidity are cash and cash equivalents, investments, cash flows from operations and credit arrangements. As of June 30, 2018 and 2017, the Company had cash and cash equivalents totaling $27.7 million and $28.9 million, respectively. The Company invested $16.0 million and $18.0 million in short-term investments as of June 30, 2018 and 2017, respectively. These investments consist of Treasury bills and U.S. Agencies that will mature within six months of purchase date. The Company entered into an unsecured credit agreement on June 30, 2018, that provides short-term working capital financing up to $10.0 million with interest of LIBOR plus 1%, including up to $4.0 million of letters of credit. Letters of credit outstanding at June 30, 2018 totaled $1.3 million. Other than the outstanding letters of credit, the Company did not utilize borrowing availability under the credit facility, leaving borrowing availability of $8.7 million as of June 30, 2018. The credit agreement expires June 30, 2019. At June 30, 2018, the Company was in compliance with all of the financial covenants contained in the credit agreement.

The Company maintains an additional unsecured $10.0 million line of credit, with interest at prime minus 2%. No amount was outstanding on the line of credit at June 30, 2018 or 2017. This line of credit matures December 31, 2018.

Net cash provided by operating activities was $27.3 million and $26.4 million in fiscal years 2018 and 2017, respectively. The Company had net income of $17.7 million that included $8.2 million in non-cash charges and cash provided by changes in operating assets and liabilities of $3.4 million in fiscal year 2018. Non-cash charges included depreciation of $7.4 million. In fiscal year 2017, the Company had net income of $23.8 million that included $9.0 million in non-cash charges, which were offset by cash utilized for operating assets and liabilities of $6.4 million. Non-cash charges included depreciation of $7.9 million.

Net cash used in investing activities was $21.4 million and $29.7 million in fiscal years 2018 and 2017, respectively. In fiscal year 2018, the Company had capital expenditures of $29.4 million, proceeds from the disposition of capital assets of $6.2 million and net proceeds of investments of $1.9 million. In fiscal year 2017, the Company had net purchases of investments of $18.1 million and capital expenditures of $13.5 million.

Net cash used in financing activities was $7.1 million in fiscal year 2018 which included dividend payments of $6.7 million. Net cash used in financing activities was $4.6 million in fiscal year 2017 which included dividend payments of $6.1 million, which was partially offset by excess stock benefits of $1.5 million and proceeds from issuance of common stock of $1.1 million.

Management believes that the Company has adequate cash and cash equivalents, investments, cash flows from operations and credit arrangements to meet its operating and capital requirements for fiscal year 2019. In the opinion of management, the Company’s liquidity and credit resources provide it with the ability to react to opportunities as they arise, to pay quarterly dividends to its shareholders, and to purchase productive capital assets that enhance safety and improve operations.

At June 30, 2018, the Company had no debt obligations and therefore, had no interest payments related to debt. The following table summarizes the Company’s contractual obligations at June 30, 2018 and the effect these obligations are expected to have on the Company’s liquidity and cash flow in the future (in thousands):

| Total | 1 Year | 2

- 3 Years | 4

- 5 Years | More

than 5 Years | ||||||||||||||||

| Operating lease obligations | $ | 11,370 | $ | 4,659 | $ | 5,720 | $ | 991 | $ | — | ||||||||||

12

At June 30, 2018, the Company had no capital lease obligations, and no purchase obligations for raw materials or finished goods. The purchase price on all open purchase orders was fixed and denominated in U.S. dollars. The Company has excluded the uncertain tax positions from the above table as the timing of payments, if any, cannot be reasonably estimated.

Financing Arrangements

See Note 6 to the consolidated financial statements of this Annual Report on Form 10-K.

Outlook

During fiscal 2019, the Company expects continued sales growth with inflationary pressure on raw materials and moderating labor cost increases. In addition, the Company is acutely aware of the impending tariff affecting all imported furniture and certain furniture components from China into the United States which represents a significant risk to earnings. Should these tariffs go into effect, the Company plans to pass through any incremental costs to customers during the time these tariffs are enforced. In addition, the Company is looking at supply chain options to mitigate the tariff impacts should they be implemented. The Company is focused and committed to driving gross margin expansion through improved operational execution, targeted sales price increases and enhanced service levels.

In the fiscal fourth quarter of 2018, the Company completed the first deployment of the new business information system. During the readiness phase, the Company determined that multiple deployments would ensure effective implementation. The first deployment is now operating in approximately 20% of the Company and one of the two legacy systems has been retired. After stabilization of the first deployment and documenting lessons learned, the Company has re-scheduled the final deployment in fiscal 2020 and incorporated the remaining 80% of the Company into this deployment. The additional time allotted de-risks the implementation and integration for the Company allowing for additional configuration and testing to be completed prior to launch and the subsequent retirement of the second legacy system. Once fully implemented, SAP S/4 HANA will enable the Company to better meet market conditions, customer requirements and increase operating efficiency.

During fiscal year 2019, the Company anticipates spending $9 million for capital expenditures and incurring $3 million of SG&A expenses related to the business information system project. The Company believes it has adequate working capital and borrowing capabilities to meet these requirements.

The Company remains committed to its core strategies, which include providing a wide range of quality product offerings and price points to the residential and contract markets, combined with a conservative approach to business. The Company strives for an agile business model and supply chain to adapt to changing customer requirements in all the markets it serves with the expectation that the Company grows faster than the market. The Company will maintain its focus on a strong balance sheet through emphasis on cash flow and increasing profitability. The Company believes these core strategies are in the best interest of its shareholders.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk |

General – Market risk represents the risk of changes in the value of a financial instrument, derivative or non-derivative, caused by fluctuations in interest rates, foreign exchange rates and equity prices. As discussed below, management of the Company does not believe that changes in these factors could cause material fluctuations in the Company’s results of operations or cash flows. The ability to import furniture products can be adversely affected by political issues in the countries where suppliers are located, as well as, disruptions associated with shipping distances and negotiations with port employees. Other risks related to furniture product importation include government imposition of regulations and/or quotas; duties, taxes or tariffs on imports; and significant fluctuation in the value of the U.S. dollar against foreign currencies. Any of these factors could interrupt supply, increase costs and decrease earnings.

Foreign Currency Risk – During fiscal years 2018, 2017, and 2016, the Company did not have sales, but has purchases and other expenses denominated in foreign currencies. The market risk associated with currency exchange rates and prices is not considered significant.

Interest Rate Risk – The Company’s primary market risk exposure with regard to financial instruments is changes in interest rates. At June 30, 2018, the Company did not have any debt outstanding.

13

| Item 8. | Financial Statements and Supplementary Data |

14

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Flexsteel Industries, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Flexsteel Industries, Inc. and Subsidiaries (the “Company”) as of June 30, 2018 and 2017, the related consolidated statements of income, comprehensive income, changes in shareholders’ equity, and cash flows for each of the three years in the period ended June 30, 2018, the related notes to the consolidated financial statements, and the schedule listed in the Index at Item 15 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2018 and 2017, and the results of its operations and its cash flows for each of the three years in the period ended June 30, 2018, in conformity with accounting principles generally accepted in the United States of America.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s internal control over financial reporting as of June 30, 2018, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated September 6, 2018, expressed an unqualified opinion on the Company’s internal control over financial reporting.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Minneapolis, Minnesota

September 6, 2018

We have served as the Company’s auditor since 1965.

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Flexsteel Industries, Inc.

Opinion on Internal Control over Financial Reporting

We have audited the internal control over financial reporting of Flexsteel Industries, Inc. and subsidiaries (the “Company”) as of June 30, 2018, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of June 30, 2018, based on criteria established in Internal Control — Integrated Framework (2013) issued by COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements and financial statement schedule as of and for the year ended June 30, 2018, of the Company and our report dated September 6, 2018, expressed an unqualified opinion on those financial statements.

Basis for Opinion

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Annual Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ Deloitte & Touche LLP

Minneapolis, Minnesota

September 6, 2018

16

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

(Amounts in thousands, except share and per share data)

| June 30, | ||||||||

| 2018 | 2017 | |||||||

ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | 27,750 | $ | 28,874 | ||||

| Investments | 15,951 | 17,958 | ||||||

| Trade receivables - less allowances: 2018, $1,100; 2017, $1,200 | 41,253 | 42,362 | ||||||

| Inventories | 96,204 | 99,397 | ||||||

| Other | 8,476 | 6,659 | ||||||

| Total current assets | 189,634 | 195,250 | ||||||

| NONCURRENT ASSETS: | ||||||||

| Property, plant and equipment, net | 90,725 | 70,661 | ||||||

| Deferred income taxes | 1,455 | 1,740 | ||||||

| Other assets | 2,479 | 2,394 | ||||||

| TOTAL | $ | 284,293 | $ | 270,045 | ||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable - trade | $ | 17,228 | $ | 16,758 | ||||

| Accrued liabilities: | ||||||||

| Payroll and related items | 5,459 | 6,255 | ||||||

| Insurance | 4,439 | 5,423 | ||||||

| Advertising | 4,192 | 3,883 | ||||||

| Environmental remediation | 3,600 | — | ||||||

| Other | 6,011 | 4,876 | ||||||

| Total current liabilities | 40,929 | 37,195 | ||||||

| LONG-TERM LIABILITIES: | ||||||||

| Other liabilities | 1,666 | 2,090 | ||||||

| Total liabilities | 42,595 | 39,285 | ||||||

| COMMITMENTS AND CONTINGENCIES (Note 12) | ||||||||

| SHAREHOLDERS’ EQUITY: | ||||||||

| Common stock - $1 par value; authorized 15,000,000 shares; outstanding 2018, 7,868,298 shares; 2017, 7,822,080 shares | 7,868 | 7,822 | ||||||

| Additional paid-in capital | 26,321 | 26,186 | ||||||

| Retained earnings | 209,553 | 198,465 | ||||||

| Accumulated other comprehensive loss | (2,044 | ) | (1,713 | ) | ||||

| Total shareholders’ equity | 241,698 | 230,760 | ||||||

| TOTAL | $ | 284,293 | $ | 270,045 | ||||

See accompanying Notes to Consolidated Financial Statements.

17

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Amounts in thousands, except per share data)

| For the years ended June 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Net sales | $ | 489,180 | $ | 468,764 | $ | 500,106 | ||||||

| Cost of goods sold | (390,961 | ) | (360,113 | ) | (386,407 | ) | ||||||

| Gross margin | 98,219 | 108,651 | 113,699 | |||||||||

| Selling, general and administrative | (71,949 | ) | (72,562 | ) | (77,911 | ) | ||||||

| Environmental remediation | (3,600 | ) | — | — | ||||||||

| Gain on sale of facility | 1,835 | — | — | |||||||||

| Litigation settlement reimbursements | — | 1,175 | 2,280 | |||||||||

| Operating income | 24,505 | 37,264 | 38,068 | |||||||||

| Other income (expense): | ||||||||||||

| Other income (expense) | 621 | 322 | (72 | ) | ||||||||

| Interest expense | — | — | (69 | ) | ||||||||

| Total | 621 | 322 | (141 | ) | ||||||||

| Income before income taxes | 25,126 | 37,586 | 37,927 | |||||||||

| Income tax provision | (7,460 | ) | (13,800 | ) | (13,690 | ) | ||||||

| Net income | $ | 17,666 | $ | 23,786 | $ | 24,237 | ||||||

| Weighted average number of common shares outstanding: | ||||||||||||

| Basic | 7,848 | 7,782 | 7,595 | |||||||||

| Diluted | 7,919 | 7,886 | 7,765 | |||||||||

| Earnings per share of common stock: | ||||||||||||

| Basic | $ | 2.25 | $ | 3.06 | $ | 3.19 | ||||||

| Diluted | $ | 2.23 | $ | 3.02 | $ | 3.12 | ||||||

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Amounts in thousands)

| For the years ended June 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Net income | $ | 17,666 | $ | 23,786 | $ | 24,237 | ||||||

| Other comprehensive income (loss): | ||||||||||||

| Unrealized (losses) gains on securities | (197 | ) | (87 | ) | 741 | |||||||

| Reclassification of realized gains (losses) on securities to other income | 142 | 145 | (535 | ) | ||||||||

| Unrealized (losses) gains on securities before taxes | (55 | ) | 58 | 206 | ||||||||

| Income tax benefit (expense) related to securities gains (losses) | 17 | (22 | ) | (78 | ) | |||||||

| Net unrealized (losses) gains on securities | (38 | ) | 36 | 128 | ||||||||

| Minimum pension liability | 56 | 771 | (999 | ) | ||||||||

| Income tax (expense) benefit related to minimum pension liability | (15 | ) | (292 | ) | 379 | |||||||

| Net minimum pension asset (liability) | 41 | 479 | (620 | ) | ||||||||

| Other comprehensive gain (loss), net of tax | 3 | 515 | (492 | ) | ||||||||

| Comprehensive income | $ | 17,669 | $ | 24,301 | $ | 23,745 | ||||||

See accompanying Notes to Consolidated Financial Statements.

18

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Shareholders’ Equity

(Amounts in thousands)

| Total Par | Accumulated | |||||||||||||||||||

| Value of | Additional | Other | ||||||||||||||||||

| Common | Paid-In | Retained | Comprehensive | |||||||||||||||||

| Shares ($1 Par) | Capital | Earnings | (Loss) Income | Total | ||||||||||||||||

| Balance at June 30, 2015 | $ | 7,480 | $ | 18,827 | $ | 162,176 | $ | (1,736 | ) | $ | 186,747 | |||||||||

| Issuance of common stock: | ||||||||||||||||||||

| Stock options exercised, net | 184 | 1,407 | — | — | 1,591 | |||||||||||||||

| Unrealized loss on available for sale investments, net of tax | — | — | — | 128 | 128 | |||||||||||||||

| Long-term incentive compensation | 27 | 858 | — | — | 885 | |||||||||||||||

| Stock-based compensation | 9 | 406 | — | — | 415 | |||||||||||||||

| Excess tax benefit from stock-based payment arrangements | — | 1,761 | — | — | 1,761 | |||||||||||||||

| Minimum pension liability adjustment, net of tax | — | — | — | (620 | ) | (620 | ) | |||||||||||||

| Cash dividends declared | — | — | (5,494 | ) | — | (5,494 | ) | |||||||||||||

| Net income | — | — | 24,237 | — | 24,237 | |||||||||||||||

| Balance at June 30, 2016 | $ | 7,700 | $ | 23,259 | $ | 180,919 | $ | (2,228 | ) | $ | 209,650 | |||||||||

| Issuance of common stock: | ||||||||||||||||||||

| Stock options exercised, net | 79 | 999 | — | — | 1,078 | |||||||||||||||

| Unrealized loss on available for sale investments, net of tax | — | — | — | 36 | 36 | |||||||||||||||

| Long-term incentive compensation | 35 | (213 | ) | — | — | (178 | ) | |||||||||||||

| Stock-based compensation | 8 | 647 | — | — | 655 | |||||||||||||||

| Excess tax benefit from stock-based payment arrangements | — | 1,494 | — | — | 1,494 | |||||||||||||||

| Minimum pension liability adjustment, net of tax | — | — | — | 479 | 479 | |||||||||||||||

| Cash dividends declared | — | — | (6,240 | ) | — | (6,240 | ) | |||||||||||||

| Net income | — | — | 23,786 | — | 23,786 | |||||||||||||||

| Balance at June 30, 2017 | $ | 7,822 | $ | 26,186 | $ | 198,465 | $ | (1,713 | ) | $ | 230,760 | |||||||||

| Issuance of common stock: | ||||||||||||||||||||

| Stock options exercised, net | 17 | 216 | — | — | 233 | |||||||||||||||

| Unrealized loss on available for sale investments, net of tax | — | — | — | (38 | ) | (38 | ) | |||||||||||||

| Long-term incentive compensation | 20 | (858 | ) | — | — | (838 | ) | |||||||||||||

| Stock-based compensation | 9 | 777 | — | — | 786 | |||||||||||||||

| Excess tax benefit from stock-based payment arrangements | — | — | — | — | — | |||||||||||||||

| Minimum pension liability adjustment, net of tax | — | — | — | 41 | 41 | |||||||||||||||

| Cash dividends declared | — | — | (6,912 | ) | — | (6,912 | ) | |||||||||||||

| Net income | — | — | 17,666 | — | 17,666 | |||||||||||||||

| Adoption of ASU 2018-02 | — | — | 334 | (334 | ) | — | ||||||||||||||

| Balance at June 30, 2018 | $ | 7,868 | 26,321 | 209,553 | (2,044 | ) | 241,698 | |||||||||||||

Cash dividends declared per common share were $0.88, $0.80 and $0.72 for fiscal years ended June 30, 2018, 2017 and 2016, respectively.

See accompanying Notes to Consolidated Financial Statements.

19

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Amounts in thousands)

| FOR THE YEARS ENDED JUNE 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| OPERATING ACTIVITIES: | ||||||||||||

| Net income | $ | 17,666 | 23,786 | $ | 24,237 | |||||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | ||||||||||||

| Depreciation | 7,367 | 7,936 | 7,556 | |||||||||

| Deferred income taxes | 286 | 1,606 | 2,731 | |||||||||

| Stock-based compensation expense | 501 | 1,609 | 1,470 | |||||||||

| Excess tax benefit from stock-based payment arrangements | — | (1,494 | ) | (1,761 | ) | |||||||

| Change in provision for losses on accounts receivable | (100 | ) | (100 | ) | (100 | ) | ||||||

| Gain on disposition of capital assets | (1,792 | ) | (512 | ) | (34 | ) | ||||||

| Gain on life insurance policies | — | — | (346 | ) | ||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Trade receivables | 1,209 | 2,356 | 584 | |||||||||

| Inventories | 3,193 | (13,492 | ) | 27,938 | ||||||||

| Other current assets | (1,299 | ) | 1,036 | (1,962 | ) | |||||||

| Other assets | 22 | 450 | 59 | |||||||||

| Accounts payable - trade | (1,874 | ) | 4,028 | (6,877 | ) | |||||||

| Accrued liabilities | 2,546 | 477 | 2,052 | |||||||||

| Other long-term liabilities | (431 | ) | (1,298 | ) | (1,180 | ) | ||||||

| Net cash provided by operating activities | 27,294 | 26,388 | 54,367 | |||||||||

| INVESTING ACTIVITIES: | ||||||||||||

| Purchases of investments | (42,230 | ) | (30,537 | ) | (3,100 | ) | ||||||

| Proceeds from sales of investments | 44,172 | 12,474 | 2,900 | |||||||||

| Proceeds from sale of capital assets | 6,152 | 1,848 | 76 | |||||||||

| Proceeds from life insurance policies | — | — | 2,814 | |||||||||

| Capital expenditures | (29,447 | ) | (13,457 | ) | (7,382 | ) | ||||||

| Net cash used in investing activities | (21,353 | ) | (29,672 | ) | (4,692 | ) | ||||||

| FINANCING ACTIVITIES: | ||||||||||||

| Dividends paid | (6,746 | ) | (6,062 | ) | (5,455 | ) | ||||||

| Proceeds from issuance of common stock | 233 | 1,078 | 1,591 | |||||||||

| Shares issued to employees, net of shares withheld | (552 | ) | (1,132 | ) | (170 | ) | ||||||

| Excess tax benefit from share-based payment | — | 1,494 | 1,761 | |||||||||

| Repayments of short-term notes payable, net | — | — | (11,904 | ) | ||||||||

| Net cash used in financing activities | (7,065 | ) | (4,622 | ) | (14,177 | ) | ||||||

| (Decrease) increase in cash and cash equivalents | (1,124 | ) | (7,906 | ) | 35,498 | |||||||

| Cash and cash equivalents at beginning of year | 28,874 | 36,780 | 1,282 | |||||||||

| Cash and cash equivalents at end of year | $ | 27,750 | 28,874 | $ | 36,780 | |||||||

| FOR THE YEARS ENDED JUNE 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| SUPPLEMENTAL INFORMATION | ||||||||||||

| Income taxes paid, net | $ | 8,460 | 9,780 | $ | 10,140 | |||||||

| Capital expenditures in accounts payable | $ | 4,084 | 1,740 | $ | 430 | |||||||

See accompanying Notes to Consolidated Financial Statements.

20

FLEXSTEEL INDUSTRIES, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

DESCRIPTION OF BUSINESS – Flexsteel Industries, Inc. and Subsidiaries (the “Company”) incorporated in 1929 is celebrating its 125th anniversary of the Company’s founding in 1893. Flexsteel Industries, Inc. is one of the oldest and largest manufacturers, importers and marketers of residential and contract upholstered and wooden furniture products in the United States. Over the generations the Company has built a committed retail and consumer following based on its patented, guaranteed-for-life Blue Steel SpringTM – the all-riveted, high-carbon, steel-banded seating platform that gives upholstered and leather furniture the strength and comfort to last a lifetime. With offerings for use in home, hotel, healthcare, recreational vehicle, marine and office, the Company distributes its furniture throughout the United States & Canada through the Company’s sales force and various independent representatives.