Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Baker Hughes Co | dp95436_8k.htm |

Exhibit 99.1

Confidential. Not to be copied, distributed, or reproduced without prior approval. 2018 Barclays CEO Energy - Power Conference Lorenzo Simonelli Chairman & CEO September 6, 2018 © 2018 Baker Hughes, a GE company - All rights reserved

Good morning. It is great to be back here at the Barclays CEO conference and I would like to thank Barclays and Dave Anderson for inviting me to speak this morning.

© 2018 Baker Hughes, a GE company - All rights reserved Caution Concerning Forward - Looking Statements This presentation (and oral statements made regarding the subjects of this presentation) may contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, (each a “forwa rd - looking statement”). The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “project,” “foresee,” “forecasts,” “predict,” “outlo ok, ” “aim,” “will,” “could,” “should,” “potential,” “would,” “may,” “probable,” “likely,” and similar expressions, and the negative thereof, are intended to identify forward - lookin g statements. There are many risks and uncertainties that could cause actual results to differ materially from our forward - looking statements. These forward - looking st atements are also affected by the risk factors described in the Company’s annual report on Form 10 - K for the annual period ended December 31, 2017; and those set forth from time to time in other filings with the Securities and Exchange Commission (“SEC”). The documents are available through the Company’s website at: ww w.i nvestors.bhge.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval (“EDGAR”) system at: www.sec.gov. We undertake no obligation to pu bli cly update or revise any forward - looking statement. On July 3, 2017, we closed our previously announced transaction to combine the Oil & Gas business of General Electric Company (" GE Oil & Gas") and Baker Hughes Incorporated ("Baker Hughes"). The Company presents its financial results in accordance with generally accepted accoun tin g principles (“GAAP”) which includes the results of Baker Hughes and GE Oil & Gas from the transaction closing date of July 3, 2017. However, management bel ieves that using additional non - GAAP measures on a "Combined Business Basis" will enhance the evaluation of the profitability of the Company and its ongoing ope rations. Combined business results combine the results of GE Oil & Gas with Baker Hughes as if the closing date had occurred on the first day of all per iod s presented. All financials presented prior to the transaction closing date of July 3, 2017 are on a combined business basis. The business combination impacts only th e Oilfield Services and Digital Solutions segments. Accordingly, no reconciliation is presented for our other segments, Oilfield Equipment and Turbomachinery & Process Solutions. All combined business results presented in this News Release are unaudited. Such combined business results are not prepared in accordance wit h Article 11 of Regulation S - X. See Exhibit 99.2 in our Current Report on Form 8 - K filed with the Securities and Exchange Commission (“SEC”) on October 20, 2017 , January 24, 2018, and April 20, 2018, which includes a reconciliation of the combined business information from financial results prepared in accordance wit h GAAP, and see Exhibit 99.1 in our Current Report on Form 8 - K filed with the SEC on April 5, 2018 for the impact of Accounting Standards Codification Topic 606, Re venue from Contracts with Customers. Any non - GAAP financial measures should be considered in addition to, and not as an alternative for, or superior to, n et income (loss), income (loss) from continuing operations, cash flows or other measures of financial performance prepared in accordance with GAAP as more fu lly discussed in the Company’s financial statements, including the notes thereto, and filings with the SEC. 2

Before I begin, let me remind you that some of the statements I will be making today are forward-looking, and involve risks and uncertainties that could cause results to differ materially from those projected in these statements.

I therefore refer you to our latest 10-K filing and our other SEC filings.

© 2018 Baker Hughes, a GE company - All rights reserved One year in … CEO thoughts 3 • Formed BHGE as the first fullstream company in the sector … differentiated investment opportunity • Opportunity to unlock significant value … synergies, running the company better • Broad, diversified portfolio … provides greater earnings stability • Clear priorities from day 1: ✓ Grow market share … improve commercial capabilities, processes ✓ Increase margin rates … execute on synergies, improve efficiency ✓ Above peer group cash conversion … lower capital intensity portfolio, improve processes

12 months ago, I talked to you about the vision for BHGE, a company that spans the oil and gas value chain and the industry’s first fullstream provider. Our vision was to leverage leading technology, global scale and an integrated offering to provide fullstream solutions to our customers. For our shareholders, it was to deliver value through synergy execution and to generate top-tier shareholder returns through the cycle. Our vision is unchanged and we have made substantial progress already.

We have a unique opportunity to unlock significant value.

We are executing on our synergy programs, and are enhancing our operations to improve margins, cash conversion, and ultimately, shareholder returns.

Our broad and complementary portfolio of businesses benefits from multiple growth drivers. The mix of shorter- and longer-cycle businesses, supported by our large aftermarket services backlog, improves visibility into revenue and provides greater earnings stability.

From day one, we have had 3 clear priorities: growing market share, increasing margin rates and delivering strong free cash flow. We are making solid progress on each of these, and we remain fully committed to executing on all three.

We continue to grow our market share and have revamped our sales processes and incentives, pushed our teams to be closer to our customers, and given them the tools they need to compete and win in the market.

We are intensely focused on improving margin rates, especially in Oilfield Services. Year-over-year, OFS margins are up more than 550 basis points. Our synergy execution plan is driving significant improvements in this business. In the first half of 2018, we delivered more than $330 million of synergies, and we remain committed to the $700 million target for the year.

As we have stated previously, we expect to spend about 5% of revenues on CAPEX. Our portfolio is less capital intensive compared to some of our peers and this is an important element of our aggressive cash conversion targets. Our target is 90% of free cash flow conversion over time.

In order to achieve that, we are improving our working capital processes, and have updated our incentive programs to include cash metrics for our commercial and operational teams.

Our focus on cash, and our strong balance sheet, allow us to invest into the right growth areas within our business and at the same time return capital to shareholders.

None of what we have accomplished would be possible without the dedication and skill of our employees around the globe. I am incredibly proud to lead such a motivated team that drives the change needed to improve our performance and provides the highest levels of service to our customers.

As I told you on this stage last year, our priorities are clear and unchanged. We have made a tremendous amount of progress in our first year as BHGE and have seen some great wins from our team, but we know there is more work to be done.

© 2018 Baker Hughes, a GE company - All rights reserved 500 750 1,000 1,250 1,500 2014 2015 2016 2017 2018 2019 2020 2021 100 150 200 250 300 350 2014 2015 2016 2017 2018 2019 2020 2021 0 50 100 150 200 2014 2015 2016 2017 2018 2019 2020 2021 200 300 400 500 600 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Macro environment positive with multiple growth trajectories … speed of recovery varies by segment 4 Global E&P spend ($B, CAPEX+OPEX) Sources: Rystad IHS Markit NAM onshore spend ($B, E&P CAPEX) Global LNG Supply / Demand (MTPA) +9% CAGR ’19 - ’21 +12% CAGR ’19 - ’21 Shale Non - Shale +11% CAGR ’19 - ’21 135 MTPA shortfall by 2030 Demand Supply (on - stream + under construction) Global offshore spend ($B, E&P CAPEX)

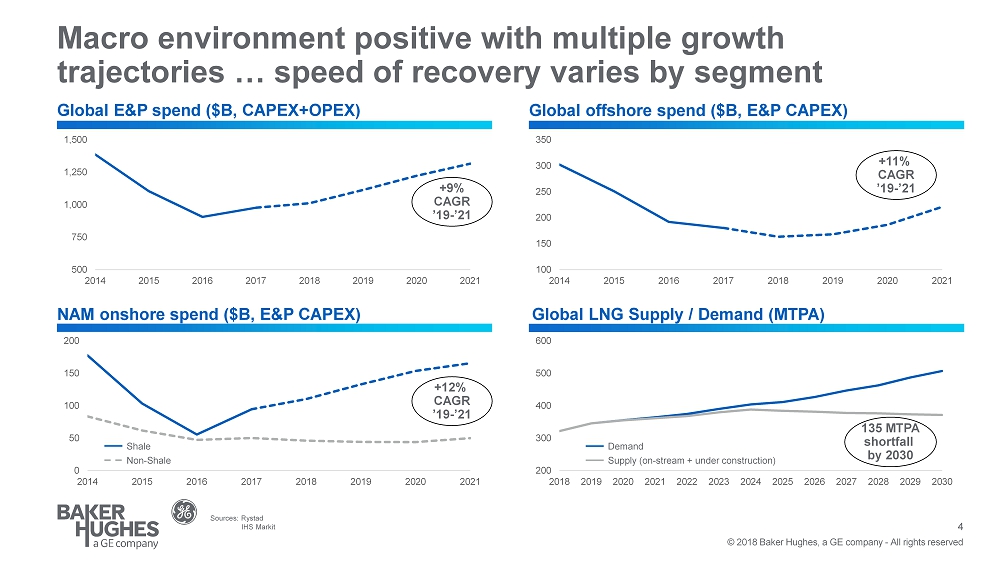

Now I'd like to spend a moment on the macro environment. Overall, there are encouraging signs that contribute to a more positive outlook, where customers can move ahead with larger project final investment decisions.

Global E&P spend is expected to grow at a healthy pace over the next three to four years, driven primarily by growth in North America shale. We are also seeing the beginnings of a recovery in the international markets.

We’re expecting offshore activity to see a healthy rebound as well. It will likely remain significantly below prior-cycle peak levels but at the same time we see improving activity, and importantly, more stability as we look into the next few years.

On LNG, we see the supply-demand gap growing through the next decade if no new capacity is built out. Our customers are positioning to move forward with new projects in order to provide new supply from 2022 and beyond. Industry data shows the potential for 65 million tons per annum of new projects to be sanctioned through 2020.

These growth dynamics impact our businesses differently. In our shorter cycle OFS and Digital Solutions businesses, we continue to benefit from the ongoing recovery and solid spend growth in North America, and the beginnings of an international recovery.

In Oilfield Equipment, new project FIDs will drive better volume, and therefore improve our ability to absorb fixed costs.

In our Turbomachinery segment, we expect LNG orders to pick up in the second half of 2018 and contribute to 2019 revenues, while on and offshore production orders should pick up in 2019, contributing to revenue in 2020.

The combination of our short- and long-cycle businesses positions us well for a balanced growth trajectory that captures near-term upside and, importantly, extends well into the future as the next wave of customer projects comes into view and as we mature our fullstream model.

© 2018 Baker Hughes, a GE company - All rights reserved Focused on sustainable improvements … Aligning incentives. Reducing costs. Increasing productivity Delivering better outcomes is more critical than ever in this new environment 5 While breakevens have decreased >40% since 2013 … $0 $25 $50 $75 $100 ’15 ’17 ’16 ’18E ’14 Other Onshore Deepwater Permian Midland Permian Delaware Break - even price ($/bbl) Source: Rystad , IHS BHGE focused on strategic steps to drive sustainable productivity in the O&G industry … the question about sustainability remains MARKET LEADING PRODUCT COMPANIES INTEGRATED SERVICE MODULES FULLSTREAM 50 50 50 Increase margin and competitiveness by reducing product and service cost Create value through integrated equipment and service technologies Drive value creation through outcome - performance solutions

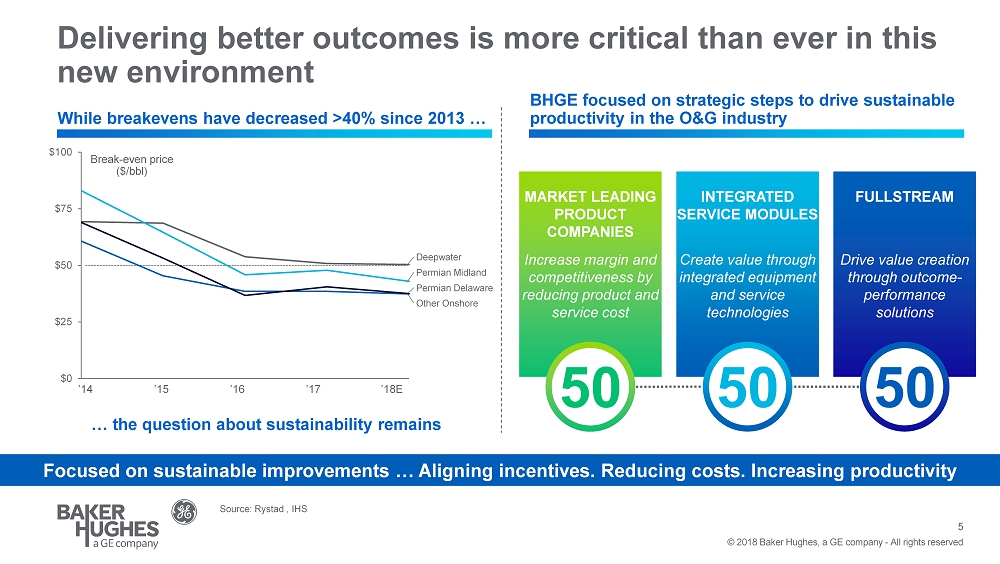

In this new, more stable, environment, delivering better outcomes for our customers is more critical than ever.

Throughout the past couple of years, we have seen breakevens decrease significantly. While some of these decreases were driven by structural productivity, some are cyclical in nature, and questions on the sustainability of these productivity gains persist.

Our belief is that the industry has gone - and is going - through a paradigm shift where partners have to work more collaboratively across the value chain to ensure productivity levels continue to improve.

At BHGE, we have developed a comprehensive strategy to drive sustainable productivity gains in the oil and gas industry for the next decade and beyond. We are calling it the 50-50-50 strategy.

For us, it all begins with our products and services. We need to make sure we have the most competitive solutions available for our customers. That means lowering input costs and driving best-in-class efficiency in our internal processes. It also means reducing unnecessary complexity and design variations that do not create value for our customers.

The second component is around integrated service modules. We’re focused on creating more value by reducing the number of interfaces as we deliver projects and services. This reduces complexity, drives speed and increases execution efficiency.

The last component is really around stronger partnerships with our customers, our suppliers, and within our own teams. There is still too much silo thinking within our industry and large value pools remain untapped. When we ensure we integrate solutions, and align incentives to overall outcome and performance, we can collectively achieve the next level of productivity.

It’s a simple concept: if a project delivers ahead of schedule and at lower cost, everyone who contributes to the success of the project benefits. This is what we call fullstream.

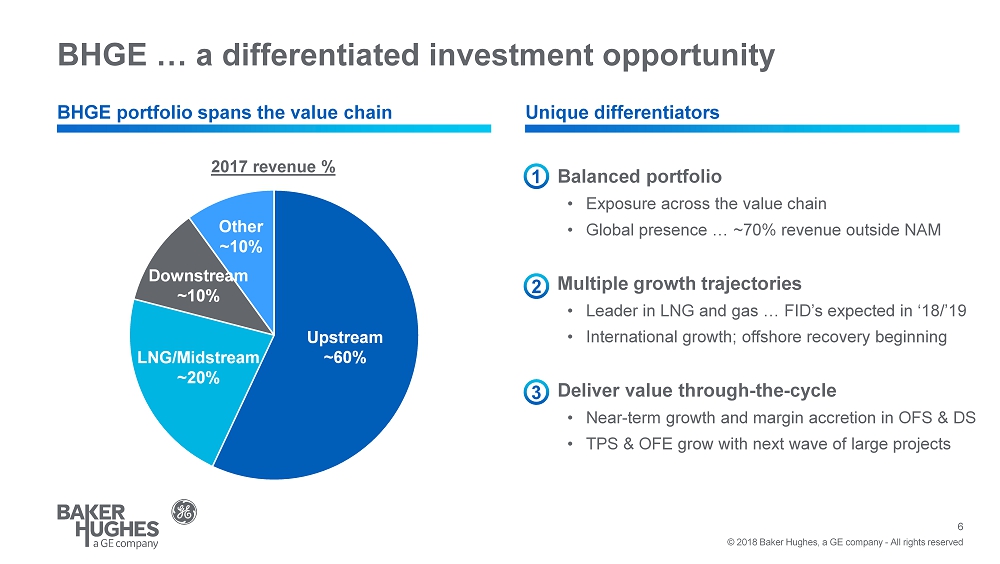

© 2018 Baker Hughes, a GE company - All rights reserved BHGE … a differentiated investment opportunity 6 BHGE portfolio spans the value chain Upstream ~60% LNG/Midstream ~20% Downstream ~10% Other ~10% Unique differentiators 1 2 3 Balanced portfolio • Exposure across the value chain • Global presence … ~70% revenue outside NAM Multiple growth trajectories • Leader in LNG and gas … FID’s expected in ‘18/’19 • International growth; offshore recovery beginning Deliver value through - the - cycle • Near - term growth and margin accretion in OFS & DS • TPS & OFE grow with next wave of large projects 2017 revenue %

Let me shift gears a bit and explain why we believe BHGE represents a differentiated investment opportunity. It really centers around the strength and unparalleled breadth of our portfolio.

About 60% of our business is upstream with a balanced mix between onshore and offshore, and also between international and North America.

We are a truly global company, about 70% of our revenues are outside of North America.

This allows us to benefit from multiple growth drivers.

For example, 20% of our revenues are driven by LNG and midstream. As I said earlier, we expect new LNG projects to move forward in the second half of 2018 and for this to be a significant driver of revenue and profits for us in 2019 and beyond.

We also expect higher international growth, and the offshore recovery to impact us favorably as we move into 2019.

As you can see, we have a portfolio of businesses that can deliver value through the cycle. It is unique in the industry. Our shorter cycle businesses are kicking into gear now, and our longer cycle businesses are at an inflection point. All this is backed by $15 billion of after-market service backlog.

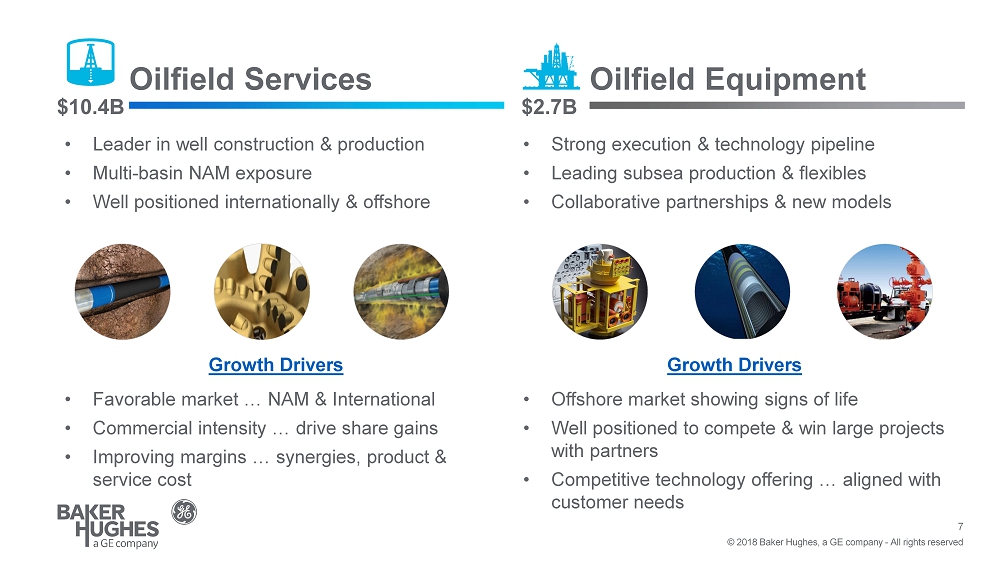

© 2018 Baker Hughes, a GE company - All rights reserved 7 Oilfield Services $10.4B Oilfield Equipment $2.7B • Leader in well construction & production • Multi - basin NAM exposure • Well positioned internationally & offshore • Strong execution & technology pipeline • Leading subsea production & flexibles • Collaborative partnerships & new models • Favorable market … NAM & International • Commercial intensity … drive share gains • Improving margins … synergies, product & service cost • Offshore market showing signs of life • Well positioned to compete & win large projects with partners • Competitive technology offering … aligned with customer needs Growth Drivers Growth Drivers

Now, diving into each of the businesses in a bit more detail.

Our largest segment, Oilfield Services, is effectively the legacy Baker Hughes business, an industry leading products and solutions provider to the upstream oil and gas sector. In this segment we have a long history of innovation and technology differentiation, resulting in strong positions in both well construction and production.

In North America, market conditions continue to improve, and we are focused on expanding our presence here. The Permian is a critical area for us, but we also have great presence in other key basins such as the Marcellus, the Bakken, and the Eagle Ford.

Internationally, we are growing the business in critical regions such as the Middle East and the North Sea.

We are driving commercial intensity and pushing our teams to be closer to our customers. Our focus on synergies is driving significant margin improvement in this business, and over time our efforts to reduce product and service cost should drive further improvements in profitability.

I will provide you more details in a few moments but we have made solid progress on our key priorities, with revenues outgrowing rig activity and margins expanding by 550 basis points over the past 12 months.

Our Oilfield Equipment segment offers a suite of leading subsea production systems, flexibles, and BOP’s. The business has a strong track record of execution and we continue to invest in technology to enhance our offerings.

Our ability to work in collaborative partnerships, including the continuation of our successful technical partnership with McDermott, and our new fullstream business models, set us apart from our competitors and provide significant value to customers.

Clearly the market is improving…the second quarter was our best orders quarter since 2015. You’ve seen us win projects like Gorgon, Shwe, BP Tortue, and just recently Buzzard Phase 2. These wins are a clear sign of our ability to compete successfully in the space. We remain confident in our positioning on a number of significant new FIDs that we expect to be awarded in the second half of the year and into 2019.

© 2018 Baker Hughes, a GE company - All rights reserved 8 Turbomachinery & Process Solutions $6.3B Digital Solutions $2.5B • Technology leader in LNG & upstream production • Significant installed base … $13B service backlog • Proven track record in the most critical projects • Best in class sensing & measurement technology • Differentiated software offerings • Leader in critical inspection technology • Strong LNG demand … upstream improving • $0.2B cost out program • Increasing service activity • Diverse end - market exposure; ~50% non - O&G • Secular growth in measurement & inspection • Traction with customers on software offerings Growth Drivers Growth Drivers

Moving to the Turbomachinery and Process Solutions segment. This is a highly differentiated equipment and aftermarket services business with an offering that spans upstream, midstream, and downstream applications.

We have a large installed base supporting a $13 billion after-market services backlog, and we have a long history of executing highly complex projects in the most challenging environments across the globe.

As you know, we operate in five segments within TPS – upstream production, LNG, pipelines, downstream, and industrial. The first two are the largest drivers of the business.

Our outlook on both is positive.

As additional LNG projects are sanctioned, we expect LNG orders to start to pick up in the second half of 2018, which will drive revenue growth in 2019 and beyond.

For the upstream production segment, we expect orders to ramp in 2019 as more large projects are sanctioned and offshore spend returns to more normalized levels. These orders will start generating revenues in 2020.

As we mentioned on our last earnings call, we have seen service orders begin to improve, which should contribute to revenue and margin improvements beginning in the second half of 2018, and more materially impact 2019.

We are also executing on our cost-out program which we expect will generate $0.2 billion of annualized savings by 2019. We began this process by rationalizing TPS' structure. We are also driving lower product and service costs by looking at everything from product design to manufacturing to installation. We are on track with these cost actions and expect these to materialize and to improve TPS margins in 2019.

The Digital Solutions business marries industry leading measurement and sensing technology with a world class software offering to provide data analytics capabilities to our customers.

Our hardware products range from vibration sensors to remote visual inspection tools, and we offer leading flow measurement and pipeline inspection solutions.

The business operates across a number of end markets and is well positioned to benefit from the secular trends of digitization and industrial connectivity.

We expect the industrial and oil and gas end markets to continue to improve and for the power market to remain a headwind.

We are gaining traction with customers on our digital and software offerings, and continue to see this as a long-term growth opportunity for the business.

As you can see, we have a differentiated set of businesses with broad capabilities.

© 2018 Baker Hughes, a GE company - All rights reserved 9 OFS OFE TPS DS Fullstream Siccar Point Chrysaor W&T Offshore Gorgon Ph 2 Corpus Christi T3 Mero & Sepia FPSOs Twinza Shwe Tortue / Ahmeyim Coral FLNG Zohr Halfaya Nigeria LNG Johan Castberg Haradh & Hawiyah NVIDIA Qatar Petroleum Kinder Morgan ESP Buzzard Ph II Equinor NCS Winning in the market … global commercial success Marjan

One of my top priorities as CEO is to ensure we are the most customer centric company we can be. This starts with listening to our customers and driving partnerships with them at every level.

What that means to us internally is a focus on commercial intensity … getting much closer to customers, understanding their challenges even better and aligning our offerings to their needs.

There are several wins here on the page that are a reflection of early success we have had with this approach. Our commercial teams have achieved these results in a very competitive environment, which demonstrates the breadth and global reach of our portfolio.

I want to now touch on a couple of these wins in more detail.

We feel good about our fullstream wins. Twinza, Siccar Point, Chrysaor, and W&T Offshore are all great demonstrations of the unique capability of our portfolio. This is a competitive advantage for us as we partner with customers and design novel and innovative commercial solutions that allow projects to move forward. These solutions align our incentives with our customers and enable us to deliver better outcomes. We will continue to leverage this approach where it makes sense.

In addition to these fullstream awards, we have had important wins for the businesses.

In Oilfield Equipment, we started with Zohr last year and just recently announced the win of Buzzard Phase 2. These wins – together with Coral, BP Tortue, Shwe and Gorgon – are critical to rebuilding backlog and will be beneficial for the oilfield equipment business as we move into 2019.

In Turbomachinery the equipment businesses are still muted, but winning Corpus Christi Train 3 and Coral FLNG were both important for our LNG franchise, and the wins in Brazil with the Mero and Sepia FPSO’s as well as Johan Castberg demonstrate how our on- and offshore production business is well positioned globally.

We continue to lead the way from a Digital standpoint. We won a number of large deals over the past 12 months and launched the partnership with NVIDIA, which will bring a step change in image recognition to the oil and gas space.

In Oilfield Services, I am excited about the progress we have made.

We won a very significant award from Equinor on the Norwegian Continental Shelf, where we will provide integrated services on the most prolific fields of Troll, Oseberg, and Grane, as well as completions on several additional fields. We have a long track record with Equinor, and our performance on the Johan Sverdrup project was critical to our success in securing this contract.

Also, just this quarter, we were awarded two significant OFS contracts in the Middle East. Firstly, we won the largest OFS contract ever in Qatar to provide drilling and wireline services. And secondly, I have just arrived from Saudi Arabia where Saudi Aramco awarded us the first large-scope integrated services contract for the Marjan oilfield. Both of these awards are good steps in expanding our offering to customers in the Middle East.

While I am proud of the wins on this page and what our team has accomplished over the past 12 months, we are focused to get to the next level. Deepening customer relationships takes time. We need to ensure we are the most customer centric company, which will enable commercial success well above and beyond just the next couple of years.

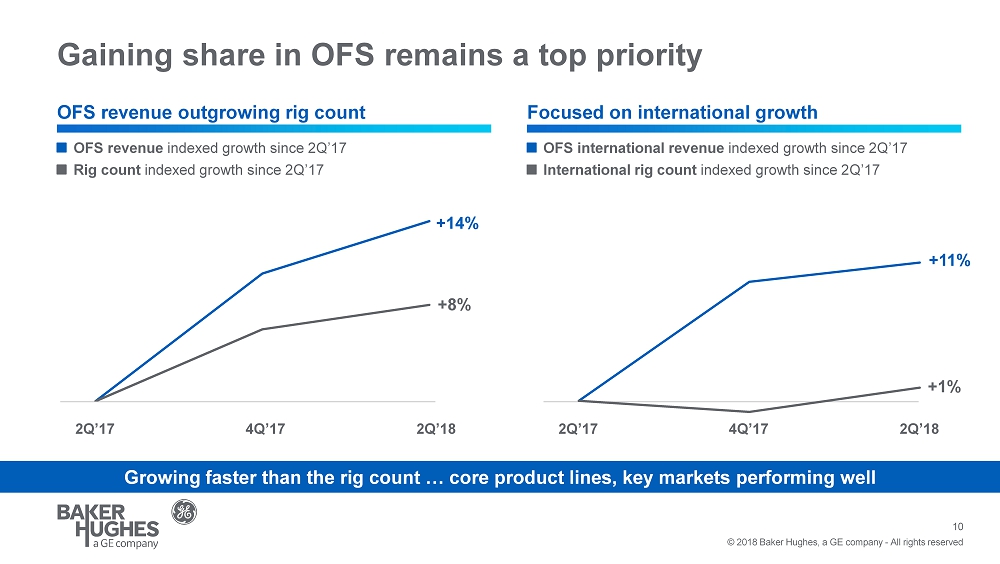

© 2018 Baker Hughes, a GE company - All rights reserved Gaining share in OFS remains a top priority 10 Growing faster than the rig count … core product lines, key markets performing well OFS revenue outgrowing rig count Focused on international growth Rig count indexed growth since 2Q’17 OFS revenue indexed growth since 2Q’17 International rig count indexed growth since 2Q’17 OFS international revenue indexed growth since 2Q’17 4Q’17 2Q’18 +8% +14% +1% +11% 2Q’17 4Q’17 2Q’18 2Q’17

A core part of this commercial focus and one of our top priorities is gaining share in OFS.

With a portfolio as broad as our Oilfield Services segment there are many activity drivers. Rig count growth is one of the most important ways in which we measure relative performance.

Since the second quarter of 2017 our total OFS revenue has grown 14% while global rig count has grown 8%. From a product line point of view, our core well construction product lines have grown 20% over this period.

Our production-driven product lines have grown 6% versus global crude production growth of 2% in the same timeframe.

We have outgrown rig activity in both North America and internationally.

Specifically, in the international markets, we have grown revenues by 11% compared to rig count growth of 1%. We have seen particular strength in Europe, the Middle East and Asia Pacific.

Looking at these metrics, we are performing well relative to industry activity.

Outgrowing the market continues to be one of our top priorities as we work with our customers and drive closer collaboration with them to execute on their projects.

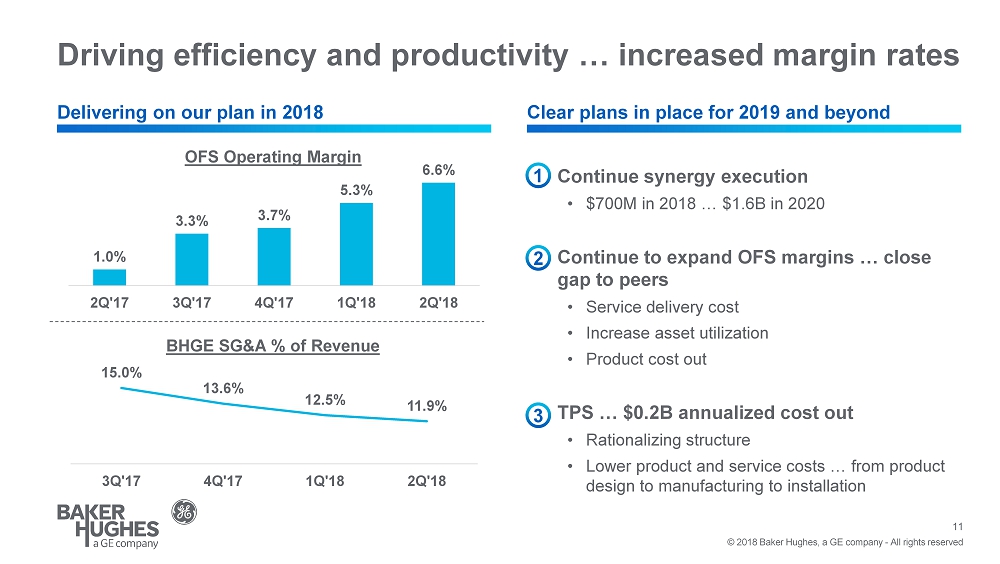

© 2018 Baker Hughes, a GE company - All rights reserved Driving efficiency and productivity … increased margin rates Delivering on our plan in 2018 Continue synergy execution • $700M in 2018 … $1.6B in 2020 Continue to expand OFS margins … close gap to peers • Service delivery cost • Increase asset utilization • Product cost out TPS … $0.2B annualized cost out • Rationalizing structure • Lower product and service costs … from product design to manufacturing to installation Clear plans in place for 2019 and beyond 11 1.0% 3.3% 3.7% 5.3% 6.6% 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 15.0% 13.6% 12.5% 11.9% 3Q'17 4Q'17 1Q'18 2Q'18 OFS Operating Margin BHGE SG&A % of Revenue 1 2 3

Another top priority is to increase margin rates.

In 2018 much of our margin improvement efforts are centered around structural cost reductions and executing on the first wave of synergies.

You can see the success of our efforts reflected in the margin progression in our OFS segment where we increased operating margin rates from 1% in the second quarter of 2017 to 6.6% in the second quarter of 2018.

You can also see our focus on structural cost reductions in how we have driven SG&A lower at the total company level. We have decreased SG&A as a percentage of revenue by 300 basis points from 15% to 11.9% over the course of the last 12 months.

I am pleased with our synergy execution in 2018 so far and we have clear plans in place for 2019 and beyond.

First, we will continue our synergy execution in line with the goals we laid out. Our focus will move from structural cost to product cost out and supply chain efficiencies.

Second, expanding our OFS margins remains a top priority for the team. We are focused on improving service delivery costs, managing our assets more efficiently to drive higher utilization, and improving our product cost. In order to achieve our targets we are revamping our job planning processes and centralizing asset management across the enterprise. We have benchmarked best-in-class operations to shorten our repair and maintenance cycle times and are working more closely with suppliers to drive efficiencies and improve on time delivery.

In addition to that, we are reducing the cost footprint of our TPS business by taking point two zero billion dollars of annualized cost out through rationalizing the structure and lowering product and service costs.

All that provides a clear path to continuing the margin expansion over the coming years.

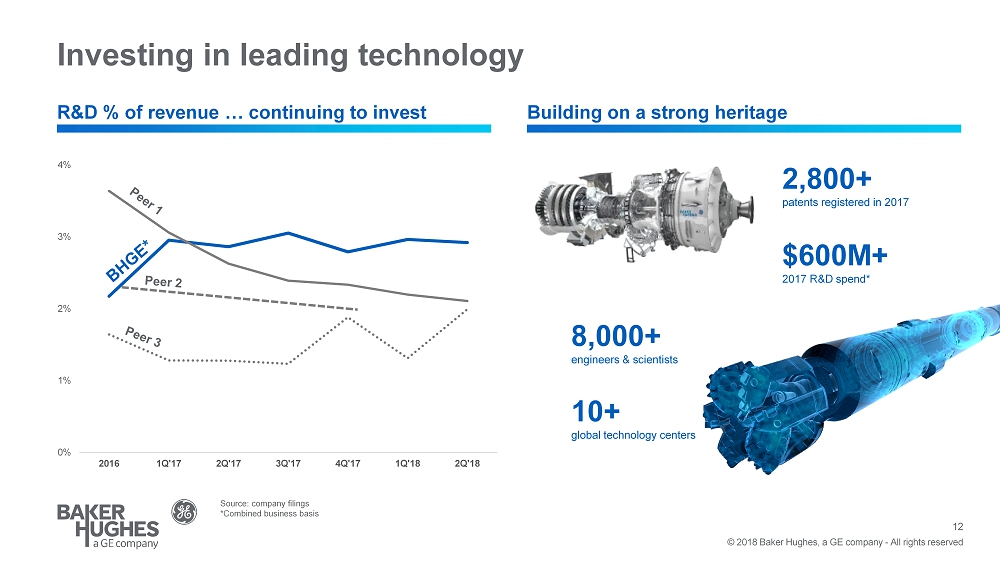

© 2018 Baker Hughes, a GE company - All rights reserved Investing in leading technology R&D % of revenue … continuing to invest 12 0% 1% 2% 3% 4% 2016 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 Source: company filings *Combined business basis 8,000+ engineers & scientists 10+ global technology centers 2,800+ patents registered in 2017 $600M+ 2017 R&D spend* Building on a strong heritage

While we are reducing structural cost, we are continuing to invest in leading technology. Technology is one of the key differentiators of our portfolio, and in many areas we have unmatched technical references and a broad offering.

Throughout the past couple of years, we have held our research and development investments steady as a percentage of revenue despite the challenging macro environment. It is critical to ensure that our products and solutions address our customer’s needs now and in the future.

Over the last twelve months we have been awarded more than 2,800 patents and won numerous industry awards.

An area of improvement for us is to always have a returns-driven mindset when it comes to technology development. We need to invest capital into areas where customers see the highest value, not solely our engineers. We are revamping our NPI processes to make sure we get the best products into the market in the shortest amount of time.

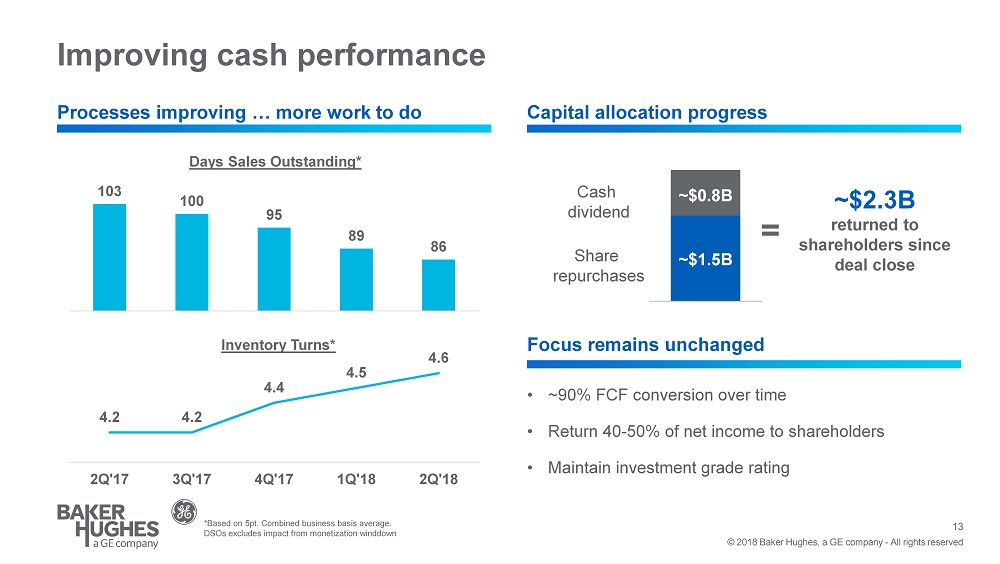

© 2018 Baker Hughes, a GE company - All rights reserved Improving cash performance 13 103 100 95 89 86 4.2 4.2 4.4 4.5 4.6 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 Days Sales Outstanding* Processes improving … more work to do Capital allocation progress *Based on 5pt. Combined business basis average. DSOs excludes impact from monetization winddown • ~90% FCF conversion over time • Return 40 - 50% of net income to shareholders • Maintain investment grade rating Focus remains unchanged Cash dividend Share repurchases = ~$2.3B returned to shareholders since deal close ~$0.8B ~$1.5B Inventory Turns*

As we have previously said, we expect to spend about 5% of revenues on capex, significantly less than most of the companies in our peer group. In addition, we have a best-in-class balance sheet.

When it comes to our operating cash flow performance, there are things we can do better.

We have made progress on our core working capital processes. DSO’s are down from 103 days to 86 days over the last twelve months, and our inventory turns are up from 4.2 to 4.6 in the same timeframe.

We are completely revamping how we look at receivables management, assigning individual targets, not only to finance teams, but also to sales and operational personnel. We have broken down our billing and invoicing processes to analyze where we need to be better and reduce cycle times.

To improve our inventory turns, we are better aligning our commercial processes with our inventory procurement and fulfillment organizations. We are also driving further collaboration with our supplier base to shorten lead times and improve on-time delivery.

We have made great progress, but there is still more work to do on working capital. We are committed to enhancing these metrics going forward.

We moved quickly to optimize our balance sheet and deliver on our capital allocation priorities. Since closing the deal, we have returned $2.3B to shareholders via dividends and share repurchases.

Our focus remains unchanged as we target up to 90% free cash flow conversion, returning 40-50% of net income to shareholders over time, and maintaining our investment grade credit rating.

© 2018 Baker Hughes, a GE company - All rights reserved Summary 14 • One year in … significant progress • Macro environment encouraging • Phase 1 complete … foundation of BHGE built • 4 focus areas for the next year … synergies, growth, continue optimizing internal processes, GE separation • Company priorities unchanged … gain share, grow margins, generate cash

In summary, after one year as the CEO of BHGE I believe we have made significant progress. I’m very proud of what the team has accomplished.

The macro environment is more encouraging than it was 12 months ago, despite some areas of uncertainty.

We have won a number of critical awards across the globe, reflecting our commitment to partnering with customers and growing market share.

We are delivering for our customers through a continued focus on execution and high-quality service delivery.

And we are delivering for our shareholders by doing what we said we would do: improve the operating performance of the company.

The last 12 months have been about building the foundation of BHGE. We have put in place a new leadership team and organization structure, set up core operating mechanisms, and executed on the first wave of synergies.

We are now entering into the next phase for BHGE where we will build on the foundation we have set up.

Specifically, over the next year we are focused on 4 areas:

First, we will continue to deliver on the synergy targets we have laid out and execute our cost out plans in TPS.

Second, it is essential that we capture the benefits of the improving macro environment in each of our businesses. Our increased commercial rigor must lead to solid share and revenue growth and continued margin expansion.

Third, we will continue to refine our operating mechanisms and organizational structures. Simplification and digitization are key to drive further efficiencies in our processes.

Fourth, while a lot of this work has already taken place, we will ensure our company is 100% prepared for the eventual separation from GE.

Executing on these four areas will be critical. They are fully aligned with our priorities: gain share, increase margin rates, and generate more cash.

Thank you, and I look forward to speaking with you all again soon.