Attached files

| file | filename |

|---|---|

| 8-K - HOWARD BANCORP, INC. 8-K - Howard Bancorp Inc | a51860687.htm |

Exhibit 99.1

vestor PresentationSeptember 2018

Forward-Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements often use words such as “anticipate,” “believe,” “contemplate,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “should” “will,” or other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. Such statements include, without limitation, references to Howard Bancorp, Inc.'s (“Howard”) beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intensions and future performance, including our growth strategy and expansion plans, including potential acquisitions. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

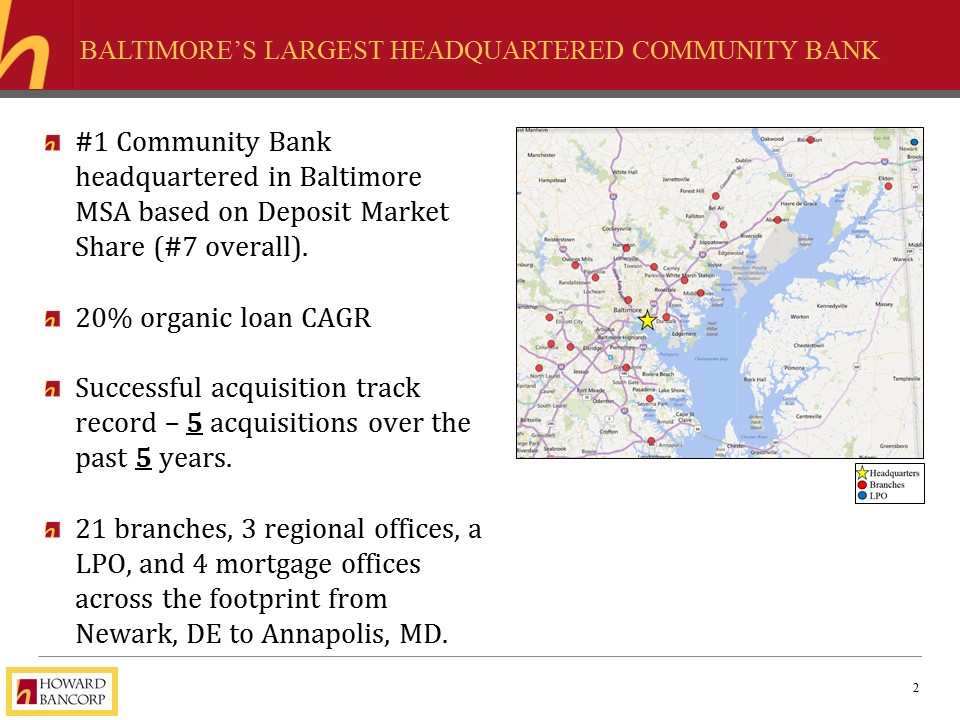

Baltimore’s largest headquartered community bank #1 Community Bank headquartered in Baltimore MSA based on Deposit Market Share (#7 overall).20% organic loan CAGRSuccessful acquisition track record – 5 acquisitions over the past 5 years.21 branches, 3 regional offices, a LPO, and 4 mortgage offices across the footprint from Newark, DE to Annapolis, MD.

Future results driven by operating leverage Sources: FRED, Baltimore Business Journal, SBA Future results driven by operating leverage Project BBBB Pro Forma Franchise Baltimore MSA demographics Median income in the counties we serve exceed the Maryland average by 10% and the national average by 37%.Unemployment stands at 4.6% in the Baltimore MSA as of June 2018 with over 1.5 million in the workforce.Overall GDP for the Baltimore MSA is approximately $180B annually Johns Hopkins UniversityJohns Hopkins APLUniversity of Maryland Medical CenterNorthrop GrummanNSA/Fort MeadeAberdeen Proving GroundsMedStar HealthUSNACutting edge technologies with significant growth in BaltimoreBio-healthAdvanced ManufacturingCybersecurityOver 580,000 small businesses based in Maryland employing over 1 million Marylanders. 2017 – 2022 Projected Population Growth 2017 Projected Average Household Income / Growth

Future results driven by operating leverage Source: SNL FinancialNote: Deposit data as of June 30, 2017. Future results driven by operating leverage Project BBBB Pro Forma Franchise the leading Baltimore franchise Largest State HQ Bank based on market share

Howard bank story #1 local business bank in the Baltimore MSABuilt on consistent growth – balance sheet, revenue, returns – since founding Strong commercial bank focused on SME’s provides an excellent growth platform with significant acquisition and cross sell opportunitiesFuture Growth will emphasize the key points of competitive advantage for the Howard franchise:Focus on continued growth of transaction fundingRelentless focus on GROWTH, both organic and acquiredMeaningful controlled non-interest income sources

Strong growth over the past 5 years 2018 Numbers are adjusted to exclude one-time merger related expenses net of taxes, but not residual operating expenses as outlined in the second quarter press release.

Expanded commercial presence (1) Source: SNL Financial. Bank level data as of March 2018. Pro forma for pending acquisitions.Does not include purchase accounting adjustments.(1) Local peers include Maryland based $1B banks with a presence in the Baltimore-Columbia-Townson MSA. Commercial Lending vs. Local Peers(1)

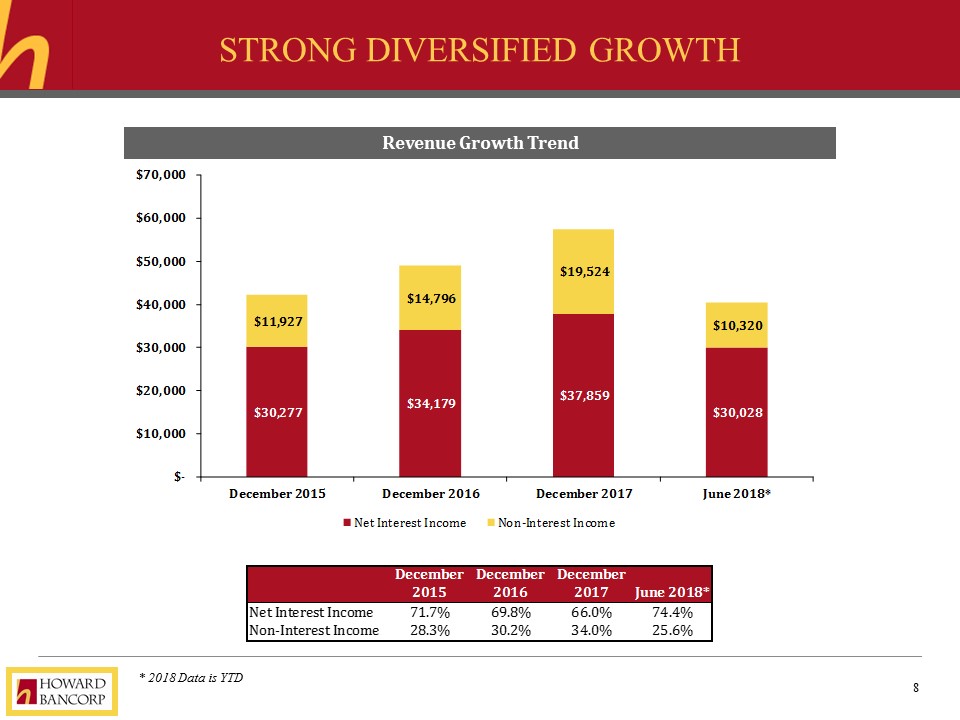

Future results driven by operating leverage Revenue Growth Trend Future results driven by operating leverage Project BBBB Pro Forma Franchise strong diversified growth * 2018 Data is YTD

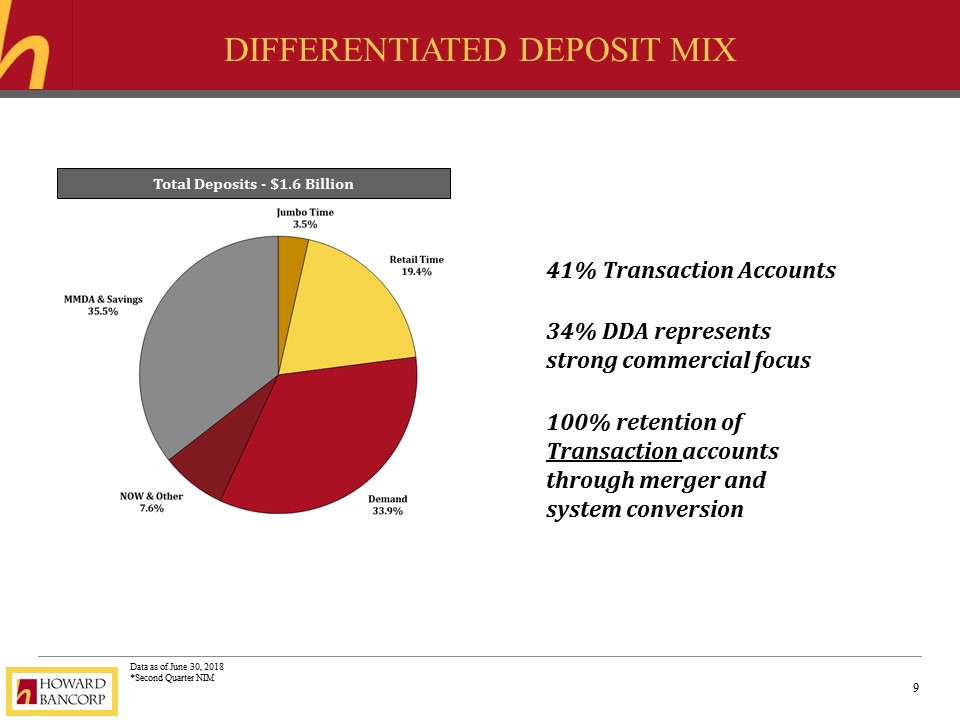

Differentiated deposit mix Data as of June 30, 2018*Second Quarter NIM Total Deposits - $1.6 Billion 41% Transaction Accounts 100% retention of Transaction accounts through merger and system conversion 34% DDA represents strong commercial focus

Above peer nim Data as of June 30, 2018*Second Quarter NIM Net Interest Margin Strong than peer NIM driven by a focus on core funding and loan mix.

Cost of funds Data as of June 30, 2018*Through Second Quarter Core Deposit COF

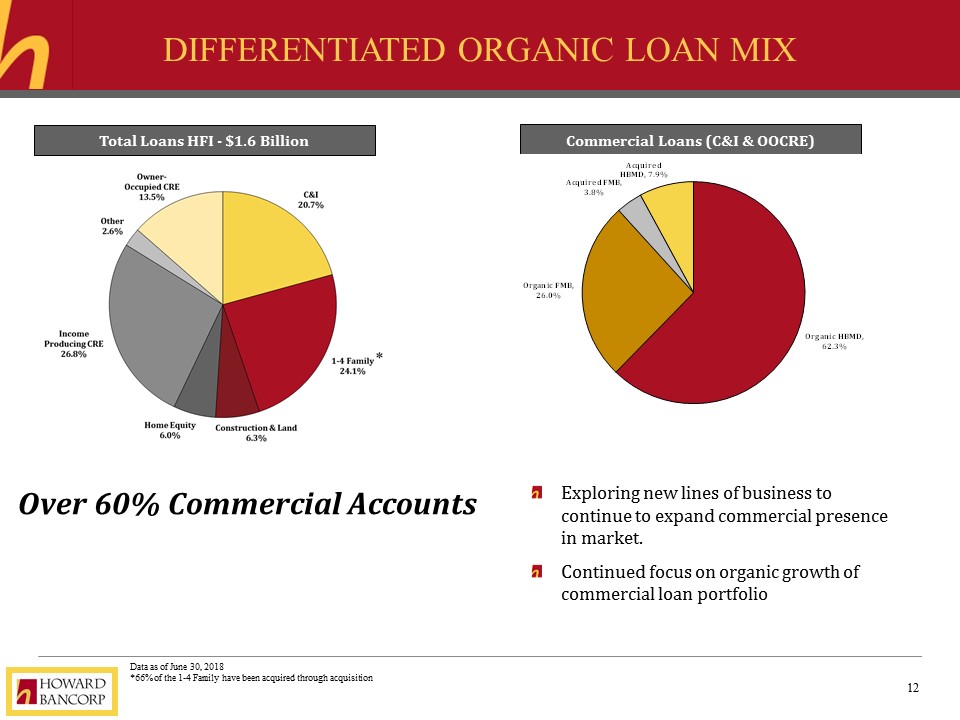

Differentiated organic loan mix Data as of June 30, 2018*66% of the 1-4 Family have been acquired through acquisition Total Loans HFI - $1.6 Billion Over 60% Commercial Accounts Commercial Loans (C&I & OOCRE) Exploring new lines of business to continue to expand commercial presence in market.Continued focus on organic growth of commercial loan portfolio

Consistent Loan Growth story *Data as of June 30, 2018 Historical Loans HFI ($M) CAGR of 20% over the last 4.5 years for Organic Loan Growth

Future results driven by operating leverage Mortgage Originations ($000) Future results driven by operating leverage Project BBBB Pro Forma Franchise Downsized mortgage focused on improving returns * 2018 Data is YTD Non-Interest Income – YTD 2018

closing Remarks EPS growth levers2.0x operating leverage37% net NIE cost savesCreated a stronger and more sustainable double digit commercial growth engine to permit expansion of existing relationships at both companies, penetration of new segments and customers by combining two companies uniquely focused on SME companies in Greater Baltimore.Deliver sophisticated Treasury Management products based on the selection of the “best of both” product sets and operating processes, and utilize larger, more efficient branch network to focus on small business deposits.Reduce the reliance of both companies on slightly oversized mortgage operations while maintaining an attractive level of non-spread income.Improve the efficiency of two sub-optimal operations through utilization of in market merger economics to rapidly improve scale.

APPENDIX

Data as of June 2018 CRE Concentrations CRE NOO Asset Classes

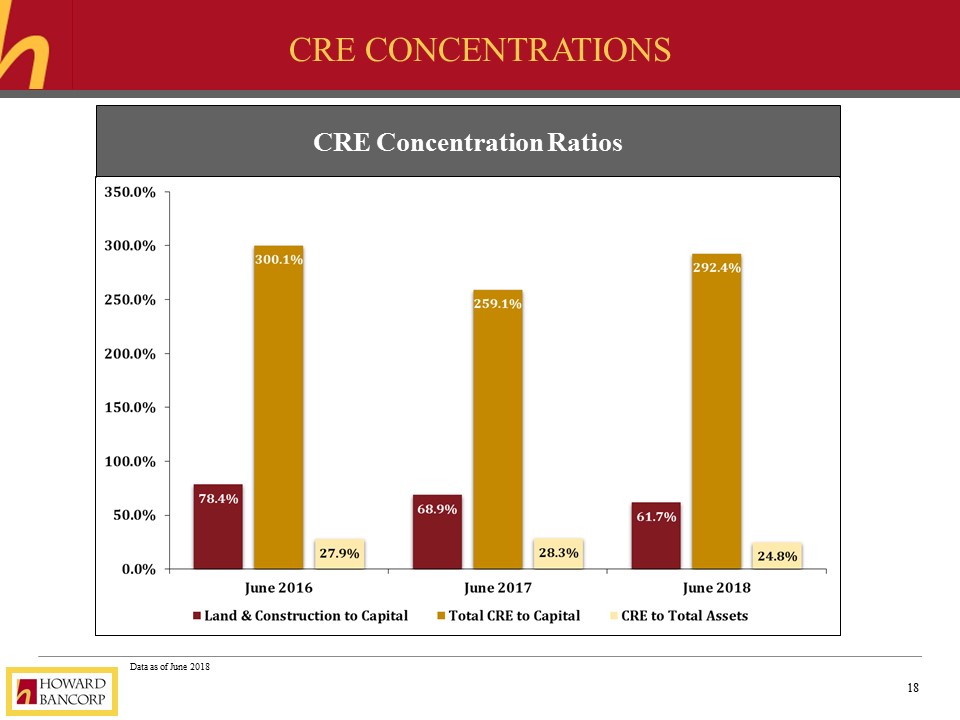

Data as of June 2018 CRE Concentrations CRE Concentration Ratios

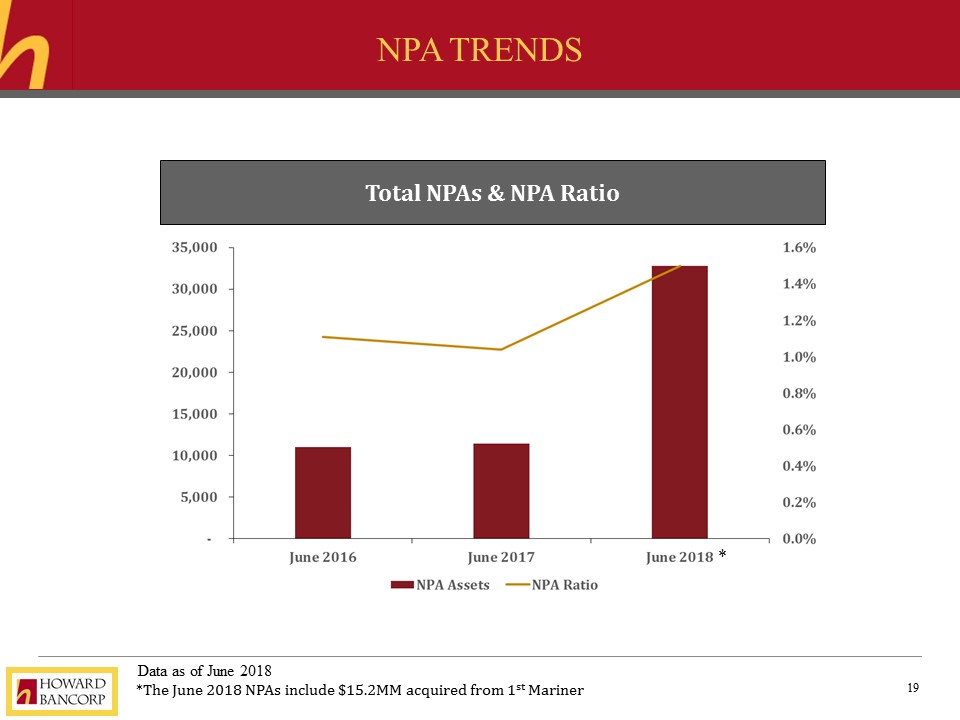

Data as of June 2018 NPA Trends Total NPAs & NPA Ratio *The June 2018 NPAs include $15.2MM acquired from 1st Mariner *