Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HollyFrontier Corp | hfc-form8xkseptember2018ir.htm |

HOLLYFRONTIER INVESTOR PRESENTATION September 2018

Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing strategies, HollyFrontier's and Holly Energy Partners’ efficiency in carrying out construction projects, HollyFrontier's ability to acquire refined product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2

Executive Summary Positioned for Value Creation Across all Segments REFINING MIDSTREAM SPECIALTY LUBRICANTS . Inland merchant refiner . Operate Crude and Product Pipelines, . Integrated specialty lubricants . loading racks, terminals and tanks in and producer 5 refineries in the Mid Continent, around HFC’s refining assets Southwest and Rockies regions . Sells finished lubricants & specialty . . HFC owns 57% of the LP Interest in products in over 80 countries under Flexible refining system with fleet wide HEP and the non-economic GP interest the Petro-Canada Lubricants & HF discount to WTI . LSP brands . IDR simplification transaction lowers Premium niche product markets versus HEP’s cost of capital . Lubricant production facilities in Gulf Coast . Mississauga, Ontario & Tulsa, . Over 80% of revenues tied to long term Oklahoma Organic initiatives to drive growth and contracts and minimum volume enhance returns commitments . Combined, fourth largest North . American base oil producer with Disciplined capital structure & 28,000 barrels per day of lubricants allocation production . HollyFrontier Lubricants & Specialty Products is the largest North American group III base oil producer 3

HollyFrontier Asset Footprint 4

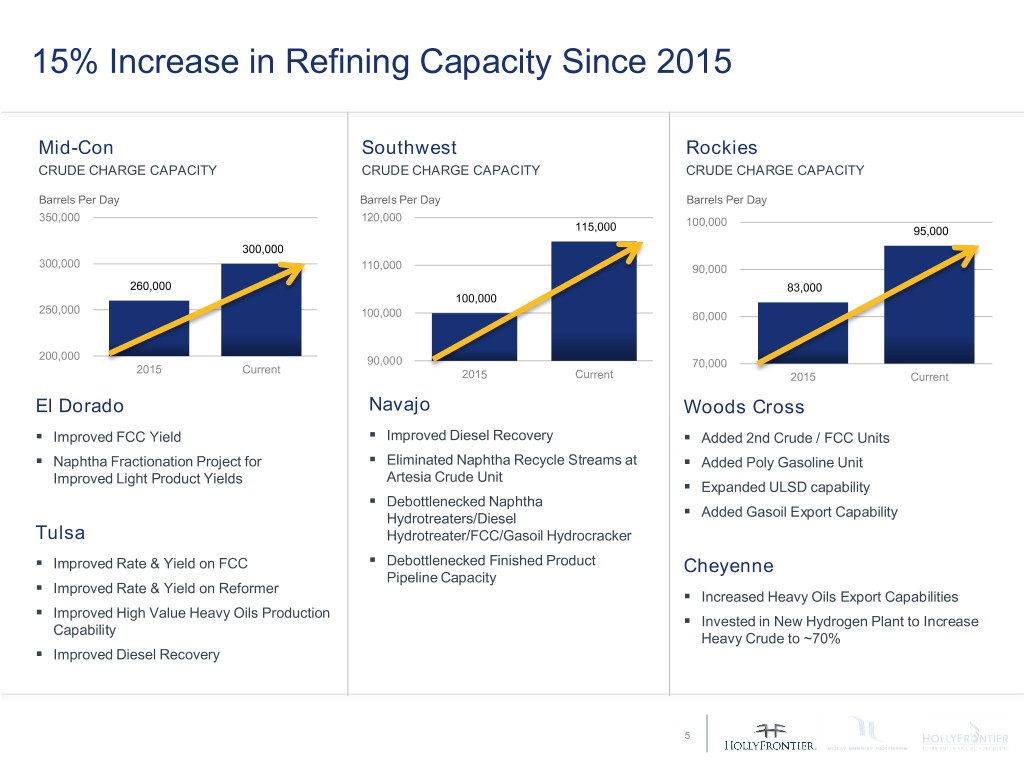

15% Increase in Refining Capacity Since 2015 Mid-Con Southwest Rockies CRUDE CHARGE CAPACITY CRUDE CHARGE CAPACITY CRUDE CHARGE CAPACITY Barrels Per Day Barrels Per Day Barrels Per Day 350,000 120,000 100,000 115,000 95,000 300,000 300,000 110,000 90,000 260,000 83,000 100,000 250,000 100,000 80,000 200,000 90,000 70,000 2015 Current 2015 Current 2015 Current El Dorado Navajo Woods Cross . . Improved FCC Yield Improved Diesel Recovery . Added 2nd Crude / FCC Units . . Naphtha Fractionation Project for Eliminated Naphtha Recycle Streams at . Added Poly Gasoline Unit Improved Light Product Yields Artesia Crude Unit . . Expanded ULSD capability Debottlenecked Naphtha . Hydrotreaters/Diesel Added Gasoil Export Capability Tulsa Hydrotreater/FCC/Gasoil Hydrocracker . . Improved Rate & Yield on FCC Debottlenecked Finished Product Cheyenne Pipeline Capacity . Improved Rate & Yield on Reformer . Increased Heavy Oils Export Capabilities . Improved High Value Heavy Oils Production . Invested in New Hydrogen Plant to Increase Capability Heavy Crude to ~70% . Improved Diesel Recovery 5

Refinery Operations Annual Crude Charge Rate 450,000 – 470,000 BPD Consolidated Crude Charge Opex Per Throughput Barrel1 $/throughput BBL Barrels Per Day $6.25 450,000 $5.75 $5.56 $5.43 $5.84 $5.50 Target $5.25 425,000 $4.75 2015 2016 2017 Opex/throughput BBL Mid-Cycle Opex Target 400,000 Cost Saving Initiatives . Turnaround Execution . Procurement Opportunities 375,000 . Maintenance Costs 2012 2013 2014 2015 2016 2017 . Organizational Structure 1. During the fourth quarter of 2017, the refining segment operating data computations were revised. These measurements are now inclusive of all refining segment activities including HFC asphalt operations and revenues and costs related to 6 products purchased for resale and excess crude oil sales.

Proximity to North American Crude Production Laid in Crude Advantage . Beneficiary of inland coastal crude discount across entire refining system 2017 Average Crude Slate . 100% of HFC’s purchased crude barrels are “WTI” price based 4% . 7% Refinery location and configuration enables a fleet-wide crude slate Sweet discounted to WTI 16% Sour 48% . Approximately 80,000 - 100,000 barrels per day Canadian, primarily Heavy Heavy sour crude Black Wax 25% Other . Approximately 140,000 – 160,000 barrels per day of Permian crude Laid in Crude Advantage under WTI1 Discount to WTI $/bbl 3Q17 4Q17 1Q18 2Q18 $1 -$1 -$3 -$5 -$7 -$9 -$11 Rockies MidCon Southwest Consolidated 1) Data from quarterly earnings calls 7 7

High Value Premium Product Markets Product Pricing vs. Gulf Coast Regional Gasoline Pricing vs Gulf Coast1 $/bbl $20 2013 2014 2015 2016 2017 Average $15 $8.17 $11.08 $10 $7.60 $6.54 $3.38 $5 $2.67 $- Group 3 vs GC Chicago vs GC Salt Lake vs GC Denver vs GC Phoenix vs GC Las Vegas vs GC Regional ULSD Pricing vs Gulf Coast2 $/bbl $15 2013 2014 2015 2016 2017 Average $10 $7.32 $4.42 $5.02 $5 $3.56 $1.71 $1.72 $- Chicago vs GC Group 3 vs GC Denver vs GC Phoenix vs GC Las Vegas vs GC SLC vs GC 1) Gulf Coast: CBOB Unleaded 84 Octane Spot Price, Group 3: Unleaded 84 Octane Spot Price, Chicago: Unleaded CBOB 84 Octane Spot Price, Denver: CBOB 81.5 Octane Rack Price, Phoenix: CBG 84 Octane Rack Price, SLC: CBOB 81.5 Octane Rack Price, Las Vegas: CBOB 84 Octane Rack Price. Source: GlobalView 2) Source: GlobalView 8 8

Refining Segment Earnings Power HFC Consolidated 3-2-1 Index Mid-Cycle Refining EBITDA $1.0B – $1.2B $/Barrel $25 Gulf Coast 3-2-1 Crack $10.00 Brent/WTI Spread $4.00 $21.22 Product Transportation to HFC $3.00 $20.06 Markets $20 HFC Index $17.00 $18.41 $17.93 Capture Rate 75% Realized Gross Margin Per Barrel $12.75 $15 Operating Expense Per Barrel $5.50 $13.86 Target Throughput 460,000 Refining SG&A (millions) $110 $10 Mid-Cycle Refining EBITDA $1.1B 2013 2014 2015 2016 2017 9

Holly Energy Partners Business Profile Operate a system of petroleum product and Consistent Distribution Growth Despite crude pipelines, storage tanks, distribution Crude Price Volatility terminals and loading rack facilities located near HFC’s refining assets in high growth markets Distribution $/LP Unit WTI Price $0.80 $160 . Revenues are nearly 100% fee-based with DPU* WTI limited commodity risk . Major refiner customers have entered into $0.60 $120 long-term contracts . Contracts require minimum payment obligations for volume and/or revenue commitments $0.40 $80 . Over 80% of revenues tied to long term contracts and minimum commitments . Earliest contract up for renewal in 2019 (approx. $0.20 $40 13% of total commitments) . 55 consecutive quarterly distribution increases since IPO in 2004 $0.00 $0 . Target 1.0 – 1.2x distribution coverage *Distribution Per Unit - Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split. 10

Ownership Structure IDR Simplification Provides Lower Cost of Capital for HEP HOLLYFRONTIER CORPORATION (HFC) 100% Interest GENERAL PARTNER (GP) HOLLY LOGISTIC SERVICES, L.L.C. PUBLIC Non-economic GP Interest 59.6mm HEP units1 57% LP Interest $1.9B Value2 45.8mm HEP units1 43% LP Interest $1.5B Value2 HOLLY ENERGY PARTNERS, L.P. (HEP) 11 1. Unit Count as of June 30, 2018 2. Based on HEP unit closing price on August 10, 2018 11

HEP Historical Growth Committed to Continuing Track Record of Increasing Distribution 50% JV with Acquired Holly Tulsa Holly Corporation Plains for remaining dropdown of and Frontier Oil Crude gathering Frontier interests in SLC / Holly intermediate loading rack Corporation system pipeline Frontier pipelines feedstock pipeline (Tulsa West) complete merger expansion (Aug 2015) (Oct 2017) dropdown (Aug 2009) (July 2011) (2014) (July 2005) 25% JV with HFC Plains for Sale of 70% dropdown of Acquisition of SLC pipeline 50% JV with MLP IPO interest in Rio El Dorado & El Dorado (Mar 2009) Plains for (July 2004) Grande to Cheyenne tank farm Cheyenne Enterprise assets (Mar 2015) pipeline (Dec 2009) (Nov 2011) (June 2016) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Purchase of additional Holly 16” HEP purchases intermediate Tulsa tanks & racks and 75% interest in pipeline UNEV from HFC Alon pipeline Lovington rack facilities (July 2012) and terminal Holly South acquisition (Mar 2010) HFC asset Line expansion (June 2009) HEP purchases dropdown of acquisition project 50% interest in Woods Cross (Feb 2005) (2007-2008) Osage from HFC processing Tulsa units Tulsa East (Feb 2016) interconnect (Oct 2016) Holly crude oil acquisition & and tankage pipelines HFC dropdown Roadrunner / IDR assets (Aug 2011) of El Dorado Purchase of Beeson Simplification dropdown processing Tulsa West dropdown (Oct 2017) (Feb 2008) (Dec 2009) units Tanks (Nov 2015) (March 2016) 12

HEP Avenues for Growth ORGANIC ACQUISITIONS DROPDOWNS FROM HFC . Leverage HEP’s existing . Pursue logistics assets in HEP’s . Partnering with HFC to build footprint, specifically in current geographic region and/or acquire new assets / Permian Basin businesses . Replace incumbent HFC service . Diesel Truck Loading providers with HEP . Target high tax basis assets with Rack in Orla, TX durable cash flow characteristics . Leverage HFC refining and that also add to HFC EBITDA . Contractual PPI/FERC commercial footprint Escalators . Participate in expected MLP sector consolidation 13

HF Lubricants & Specialty Products The World’s Machinery is Driving Towards Greater Efficiency, Reliability and Longevity Advanced lubricants are a crucial requirement in the drive HF LSP is a to develop more reliable, efficient and environmentally leading producer compliant industrial machinery worldwide. of high-margin These lubricants command higher margins by: premium lubricants, specialty products and Meeting more Providing exceptional Allowing for exacting standards wear protection over a extended top-quality base oils. of purity and wider range of drain viscosity temperatures and harsh intervals environments 14

• • revenues from customers Rack captures Forward between base the value Rack Value Opportunity HF LSP VGO/HCB Back Back captures the value between RACKBACK PCLI & Tulsa PCLI &Tulsa Refineries & Feedstock Feedstock Production - RackRack Back vs Forward RACKFORWARD & Blending Blending Packaging (Lubeplex) Customer Customer Order Fulfillment & Transportation) Distribution (Warehousing (Warehousing feedstock feedstock cost and base market oil prices oil market market oil sales prices product and R&D 15 Marketing Fluids Base Products Specialty Oils White Waxes & Lubricants Finished Greases Sales Cash

Rack Forward EBITDA Margin Stability 2018 Rack Forward – EBITDA Margin1 2 Guidance EBITDA ($ in millions) EBITDA Margin % 80 20% EBITDA $190 – 210MM 17% 16% 16% 16% EBITDA Margin 60 14% 14% 15% 10-15% 13% 13% 12% 12% 10% 9% 9% 40 9% 10% 69 58 58 56 55 53 52 45 48 47 20 38 40 5% 29 30 0 0% 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 EBITDA EBITDA Margin HF LSP’s Rack Forward business has consistently generated EBITDA margins of 10-15% 1. EBITDA Margin calculated by dividing EBITDA by Revenue for the period 2. 2018 Guidance includes planned turnarounds at the Tulsa and Mississauga plants 16

Acquisition of Red Giant Oil Asset Description • Red Giant Oil (“RGO”) is one of the largest suppliers of locomotive engine oil in North America • Headquartered in Council Bluffs, IA, RGO has a blending and packaging facility in Joshua, TX and storage facilities in Idaho, Utah and Wyoming Deal Highlights • Acquisition closed August 1, 2018 • Expected to generate approximately $7 - $8 million in annual EBITDA for HF LSP’s Rack Forward segment • HF LSP well-positioned to increase North American market share of locomotive lubricants and expand into other strategic markets • Opportunity for supply synergies using Group I Base Oil from Tulsa 17

HF Lubricants & Specialty Products Rack Forward EBITDA Mid-Cycle EBITDA $200 ($ in millions) . EBITDA Margin 10-15% . Annual SG&A $125 - $135MM Target Multiple 10x . Annual DD&A $30 - $35MM . Enterprise Value Upside with Organic Growth and M&A $2,000 ($ in millions) Opportunities 10x multiple in-line with peer group Mid-Cycle Capex: $50 – $60MM 18

Group III Base Oil Opportunity Western Hemisphere Group III Base Oil: Production Capacity vs Demand¹ Increasing Demand for Higher ˜3% CAGR Demand Growth (2016-2026) Performance Finished KBD Lubricants & Specialty 25 Products . Higher industry standards driving demand for lubricants formulated 20 from Group III and III+ Base Oils . Western Hemisphere Group III 15 demand projected to be 3% CAGR from 2016-2026 . The U.S. is a large importer of 10 Group III/III+ Base Oils . Asian and Middle Eastern imports 5 fill North American supply deficit at transportation cost of ˜$5-10/bbl 0 HF LSP is the largest North 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 American producer of Group III Base Oils Americas Demand Americas Production Capacity 1. Source: Kline 2017 Data 19

Opportunity Across the Value Chain Upgrade Existing Base Oils into Finished Products Converting one barrel of Base Oil sales into Finished Product sales results in a margin uplift of ~$50/bbl HF LSP Margin Value $/bbl Product Sales 2017 Finished Lubricants & Greases Coproducts (Distillates, Intermediates Finished and LPGs) Waxes Lubricants, 24% Waxes, White Oils and Specialty Products 45% White Oils Base Oils 31% Specialty Products Base Oils 20

New Segment Reporting HF HF REFINING HOLLY LUBRICANTS CORPORATE, & & SPECIALTY MARKETING ENERGY OTHER & CONSOLIDATED PRODUCTS ELIMINATIONS (HF R&M) (HEP) (HF LSP) Rack Back Rack Forward . SG&A allocated to each segment . Rack Back includes transfer pricing based on Argus spot average for each base oil category 21

2018 Guidance . Refining & Marketing 2018E Capex - $5.50 Opex/bbl Segment Allocation - Turnaround Schedule - Tulsa – 1Q18 HEP - El Dorado – 4Q18 12% - Capex $380 – $440 million . HF LSP HF LSP - $190 – 210 million Rack Forward EBITDA 14% R&M - Mississauga Turnaround - 4Q18 74% - Capex $70 – $90 million . HEP - Target Distribution Coverage of 1.0x - 1.2x - Capex - $60 – $70 million 22

A P P E N D I X

Strong Track Record of Cash Returns Since the July 2011 merger HFC has returned approximately $4.6 billion, or approximately $25.97 per share1 to shareholders • Strong track record in returning excess cash to shareholders • Committed to maintaining competitive cash yield versus peers • Share repurchase program funded by Free Cash Flow generation and HEP drop down proceeds Regular Cash Yield2 Total Cash Yield3 % Yield % Yield 15% 4% 13.8% 11.0% 2.8% 2.8% 2.6% 9.2% 8.8% 2.3% 10% 2.0% 1.9% 2% 1.6% 6.3% 5.5% 5% 2.6% 0% 0% VLO PSX PBF MPC DK HFC ANDV 2011 2012 2013 2014 2015 2016 2017 1. Share Count as of June 30, 2018 2. Dividends are split adjusted reflecting HFC’s two-for-one stock split announced August 3, 2011. 3. Total Cash yield calculated using year end share count- includes regular dividends, special24 dividends and stock 24 buybacks. Data from public filings and press releases. As of August 20, 2018 NYSE closing prices.

HollyFrontier Capital Structure HFC Consolidated Capital Structure HFC Standalone Capital Structure As of June 30, 2018 (US$ millions) As of June 30, 2018 (US$ millions) Cash and Short Term Marketable Securities $980 Cash and Short Term Marketable Securities $973 HOLLYFRONTIER CORPORATION HFC LONG TERM DEBT HFC Credit Agreement $- HFC 5.875% Senior Notes due 2026 $1,000 HFC 5.875% Senior Notes due 2026 $1,000 HFC Long Term Debt $1,000 Total Debt $1,000 HOLLY ENERGY PARTNERS Stockholders Equity $5,843 HEP 6.00% Senior Notes due 2024 $500 HEP Credit Agreement $900 Total Capitalization $6,843 HEP Long Term Debt $1,400 HFC Standalone Debt / Capitalization 15% Consolidated Debt (excludes unamortized discount) $2,400 HFC Standalone Net Debt / Capitalization 1% Stockholders Equity $5,840 HFC Standalone Liquidity $2,323 Total Capitalization $8,240 Consolidated Debt / Capitalization 29% Consolidated Net Debt / Capitalization 17% Consolidated Total Liquidity1 $2,830 Maintain Investment Grade Rating from S&P (BBB-), Moody’s (Baa3), and Fitch (BBB-25) 1. Includes Availability from $1.35B HFC Revolver & $1.4B HEP Revolver. 25

HollyFrontier Credit Profile . Investment Grade Rating Peer Group Debt Metrics − 6/30/18 - S&P BBB- Debt Ratio % - Moody’s Baa3 50% - Fitch BBB- . $973 million cash as of 6/30/18 40% . $1 billion outstanding debt as of 6/30/18 - excludes non-recourse HEP debt 30% . Total debt to capital ratio 15% as of 6/30/18 20% . Target 1x Net Debt/EBITDA (ex HEP) 10% 0% HFC VLO PSX MPC ANDV PBF DK Debt/Cap Net Debt/Cap * Debt to Capital is calculated by taking total debt (excluding MLP debt) divided by total debt (excluding MLP debt) plus total equity (excluding non-controlling interest). Net Debt to Capital is calculated by taking total net debt (excluding MLP debt) divided by total debt 26 (excluding MLP debt) plus total equity (excluding non-controlling interest).

Our Business Plan Update Business Improvement Plan Progress Annual EBITDA in $ MM’s 2015 Analyst Day Target1 Full Year 2017E Acheived1 Refining Operations $245 $107 Reliability $90 $10 Cost $105 $58 Turnaround $50 $39 Optimization $90 $220 Planning $30 $113 Products $30 $64 Feedstock $30 $43 Capital Investment $365 $202 Large Capital $165 $83 Opportunity Investments $200 $119 Total $700 MM $529 MM 1. Target EBITDA using a 2014 baseline pricing 27

Definitions BPD: the number of barrels per calendar day of crude oil or petroleum products. Lubricant : A solvent neutral paraffinic product used in commercial heavy duty engine CAGR: The compound annual growth rate is calculated by dividing the ending value by oils, passenger car oils and specialty products for industrial applications such as heat transfer, metalworking, rubber and other general process oil. the beginning value, raise the result to the power of one divided by the period length, and subtract one from the subsequent result. CAGR is the mean annual growth rate of an Non GAAP measurements: We report certain financial measures that are not prescribed investment over a specified period of time longer than one year. or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss Debt-To-Capital: A measurement of a company's financial leverage, calculated as the management's reasons for reporting these non-GAAP measures below. Although company's long term debt divided by its total capital. Debt includes all long-term management evaluates and presents these non-GAAP measures for the reasons obligations. Total capital includes the company's debt and shareholders' equity. described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other Distributable Cash Flow: Distributable cash flow (DCF) is not a calculation based upon comparable operating measure prescribed by GAAP. In addition, these non-GAAP GAAP. However, the amounts included in the calculation are derived from amounts financial measures may be calculated and/or presented differently than measures with the separately presented in HEP’s consolidated financial statements, with the exception of same or similar names that are reported by other companies, and as a result, the non- excess cash flows over earnings of SLC Pipeline, maintenance capital expenditures and GAAP measures we report may not be comparable to those reported by others. distributable cash flow from discontinued operations. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an Rack Backward: business segment of HF LSP that captures the value between feedstock indication of HEP’s operating performance or as an alternative to operating cash flow as cost and base oil market prices (transfer prices to rack forward). a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly Rack Forward: business segment of HF LSP that captures the value between bas oil titled measures of other companies. Distributable cash flow is presented here because it market prices and product sales revenue from customers. is a widely accepted financial indicator used by investors to compare partnership RBOB: Reformulated Gasoline Blendstock for Oxygen Blending performance. We believe that this measure provides investors an enhanced perspective of the operating performance of HEP’s assets and the cash HEP is generating. HEP’s Sour Crude: Crude oil containing quantities of sulfur greater than 0.4 percent by weight, historical net income is reconciled to distributable cash flow in "Item 6. Selected while “sweet crude oil” means crude oil containing quantities of sulfur equal to or less than Financial Data" of HEP's 2017 10-K filed February 21, 2018. 0.4 percent by weight. EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer WCS: Western Canada Select crude oil, made up of Canadian heavy conventional and to as EBITDA, is calculated as net income plus (i) interest expense net of interest bitumen crude oils blended with sweet synthetic and condensate diluents. income, (ii) income tax provision, and (iii) depreciation, depletion and amortization. WTI: West Texas Intermediate, a grade of crude oil used as a common benchmark in oil EBITDA is not a calculation provided for under GAAP; however, the amounts included in pricing. WTI is a sweet crude oil and has a relatively low density. the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or WTS: West Texas Sour, a medium sour crude oil. operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2017 10-K filed February 21, 2018. Free Cash Flow: Calculated by taking operating cash flow and subtracting capital expenditures. IDR: Incentive Distribution Rights 28

HollyFrontier Index Crude Charge 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18* 444,000 432,000 371,000 467,000 455,000 461,000 415,000 463,000 420-430K *Anticipated crude charge based on guidance given on 8/2/18 earnings call Refining Index WTI Based 321 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Crack Jan Feb Mar 1Q18 Apr May Jun 2Q18 Jul Aug Sep 3Q18 Oct Nov Dec 4Q18 MidCon $16.05 $15.12 $15.50 $15.56 $16.36 $19.47 $18.61 $18.15 $16.78 $19.20 Rockies $13.94 $15.49 $17.55 $15.66 $25.55 $28.66 $31.65 $28.62 $28.25 $31.87 Southwest $11.51 $10.69 $18.90 $13.70 $27.32 $30.78 $32.58 $30.23 $19.93 $22.91 WTI Based 321 1Q 2017 2Q 2017 3Q 2017 4Q 2017 Crack Jan Feb Mar 1Q17 Apr May Jun 2Q17 Jul Aug Sep 3Q17 Oct Nov Dec 4Q17 MidCon $13.30 $11.75 $14.12 $13.06 $14.86 $14.56 $13.40 $14.27 $16.94 $20.25 $23.06 $20.08 $22.28 $19.29 $14.43 $18.67 Rockies $14.12 $15.48 $20.36 $16.65 $21.49 $21.91 $23.99 $22.46 $22.17 $27.86 $28.38 $26.14 $26.29 $22.58 $15.52 $21.46 Southwest $15.97 $15.03 $20.36 $17.12 $21.54 $21.30 $21.76 $21.53 $19.83 $22.03 $27.50 $23.12 $25.11 $23.59 $17.62 $22.11 Base Oil Index VGO Based 1Q 2018 2Q 2018 3Q 2018 4Q 2018 Base Oil Crack Jan Feb Mar 1Q18 Apr May Jun 2Q18 Jul Aug Sep 3Q18 Oct Nov Dec 4Q18 Group I $18.06 $25.73 $33.23 $25.67 $23.42 $22.42 $22.47 $22.77 $18.74 $16.88 Group II $15.47 $23.84 $31.71 $23.67 $21.53 $19.95 $19.52 $20.33 $16.91 $14.53 Group III $42.14 $49.88 $54.32 $48.78 $47.46 $46.59 $45.75 $46.60 $43.02 $42.03 VGO Based 1Q 2017 2Q 2017 3Q 2017 4Q 2017 Base Oil Crack Jan Feb Mar 1Q17 Apr May Jun 2Q17 Jul Aug Sep 3Q17 Oct Nov Dec 4Q17 Group I $6.26 $10.15 $20.12 $12.18 $24.91 $35.14 $41.34 $33.80 $41.27 $37.76 $31.94 $36.99 $34.65 $33.85 $28.09 $32.20 Group II $14.79 $18.74 $27.37 $20.30 $28.96 $35.91 $39.24 $34.70 $38.57 $34.69 $30.14 $34.47 $33.76 $32.14 $25.20 $30.37 Group III $52.76 $55.48 $68.61 $58.95 $70.54 $71.37 $66.33 $69.41 $63.00 $58.88 $54.80 $58.89 $53.60 $52.89 $50.12 $52.20 The preceding data is for informational purposes only and is not reflective or intended to be an indicator of HollyFrontier's past or future financial results. This data is general industry information and does not reflect prices paid or received by HFC. The data was compiled from publicly available information, various industry publications, other published industry sources, including OPIS and Argus, and our own internal data and estimates. Although this data is believed to be reliable, HFC has not had this information verified by independent sources. HFC does not make any representation as to the accuracy of the data and does not undertake any obligation to update, revise or continue to provide the data. Please see p. 30 for disclaimer and www.HollyFrontier.com/investor-relations for most current version. 29 29

HFC Index Disclosure HFC's actual pricing and margins may differ from benchmark indicators due to many factors. For example: . Crude Slate differences – HFC runs a wide variety of crude oils across its refining system and crude slate may vary quarter to quarter. . Product Yield differences – HFC’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, crude slate, and operational downtime. . Other differences including but not limited to secondary costs such as product and feedstock transportation costs, purchases of environmental credits, quality differences, location of purchase or sale, and hedging gains/losses. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. MidCon Indicator: (100% Group 3: Sub octane and ULSD) – WTI Rockies Indicator as of July 1, 2016: 50% Cheyenne: ((100% Denver Regular Gasoline; 100% Denver ULSD) – WTI) 50% Woods Cross: ((60% Salt Lake City Regular Gasoline, 40% Las Vegas Regular Gasoline; 80% Salt Lake City ULSD, 20% Las Vegas ULSD) – WTI) Rockies Indicator 2011- July-2016: 60% Cheyenne: ((100% Denver Regular Gasoline; 100% Denver ULSD) – WTI) 40% Woods Cross: ((60% Salt Lake City Regular Gasoline, 40% Las Vegas Regular Gasoline; 80% Salt Lake City ULSD, 20% Las Vegas ULSD) – WTI) Southwest Indicator 2013-Current: (50% El Paso Subgrade, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI Southwest Indicator 2011-2012: (50% El Paso Regular, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI Lubricants Index Appendix HFC's actual pricing and margins differ from benchmark indicators due to many factors. For example: - Retail/Distribution- HFC and PCLI use commodity base oils to produce finished lubricants, specialty products and white oils that are sold into the retail market worldwide and have a wide variety of price ranges. - Feedstock differences – HFC runs a variety of vacuum gas oil streams and hydrocracker bottms across its refining system and feedstock slate may vary quarter to quarter. - Product Yield differences – HFC’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics and feedstocks. - Other differences including, but not limited to secondary costs such as product and feedstock transportation costs, quality differences and location of purchase or sale. Moreover, the presented indicators are generally based on spot commodity base oil sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. Group I Base Oil Indicator (50% Group I SN150, 50% Group I SN500)-VGO Group II Base Oil Indicator (33.3% Group II N100, 33.3% Group II N220, 33.3% Group II N600)-VGO Group III Base Oil Indicator (33.3% Group III 4cst, 33.3% Group III 6cst, 33.3% Group III 8cst)-VGO VGO (US Gulf Coast Low Sulfur Vacuum Gas Oil) 30 30

HollyFrontier Corporation (NYSE: HFC) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyfrontier.com Craig Biery | Director, Investor Relations investors@hollyfrontier.com 214-954-6510 Jared Harding | Investor Relations investors@hollyfrontier.com 214-954-6510