Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TILLY'S, INC. | d591245d8k.htm |

Exhibit 99.1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, any accompanying prospectus and the documents incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Also, documents we subsequently file with the Securities and Exchange Commission, or the SEC, and incorporate by reference will contain forward-looking statements. These statements are subject to risks and uncertainties. All statements other than statements of historical or current fact are forward-looking statements. Forward-looking statements refer to our current expectations and projections relating to our financial condition, results of operations, plans, objectives, strategies, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate”, “estimate”, “expect”, “project”, “plan”, “intend”, “believe”, “may”, “might”, “will”, “should”, “can have”, “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected earnings, revenues, comparable store sales, operating income, earnings per share, costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

| • | our ability to successfully open new stores and profitably operate our existing stores; |

| • | our ability to attract customers to our e-commerce website; |

| • | our ability to efficiently utilize our e-commerce fulfillment center; |

| • | effectively adapting to new challenges associated with our expansion into new geographic markets; |

| • | our ability to establish, maintain and enhance a strong brand image; |

| • | generating adequate cash from our existing stores to support our growth; |

| • | identifying and responding to new and changing customer fashion preferences and fashion-related trends; |

| • | competing effectively in an environment of intense competition both in stores and online; |

| • | containing the increase in the cost of mailing catalogs, paper and printing; |

| • | the success of the malls, power centers, neighborhood and lifestyle centers, outlet centers and street-front locations in which our stores are located; |

| • | our ability to attract customers in the various retail venues and geographies in which our stores are located; |

| • | our ability to adapt to downward trends in traffic for our stores and changes in our customers’ purchasing patterns; |

| • | failure of our information technology systems to support our current and growing business, before and after our planned upgrades; |

| • | the future potential impact of legal settlements on our results of operations; |

| • | adapting to declines in consumer confidence and decreases in consumer spending; |

1

| • | our ability to adapt to significant changes in sales due to the seasonality of our business; |

| • | our ability to compete in social media marketing platforms; |

| • | price reductions or inventory shortages resulting from failure to purchase the appropriate amount of inventory in advance of the season in which it will be sold; |

| • | natural disasters, unusually adverse weather conditions, boycotts and unanticipated events; |

| • | changes in the competitive environment in our industry and the markets we serve, including increased competition from other retailers; |

| • | our dependence on third-party vendors to provide us with sufficient quantities of merchandise at acceptable prices; |

| • | increases in costs of energy, transportation or utility costs and in the costs of labor and employment; |

| • | our ability to balance proprietary branded merchandise with the third-party branded merchandise we sell; |

| • | most of our merchandise is made in foreign countries, making price and availability of our merchandise susceptible to international trade conditions; |

| • | failure of our vendors and their manufacturing sources to use acceptable labor or other practices; |

| • | our dependence upon key executive management or our inability to hire or retain the talent required for our business; |

| • | our ability to effectively adapt to our rapid expansion in recent years and our planned expansion; |

| • | disruptions in our supply chain and distribution center; |

| • | our indebtedness and lease obligations, including restrictions on our operations contained therein; |

| • | our reliance upon independent third-party transportation providers for certain of our product shipments; |

| • | our ability to increase comparable store sales or sales per square foot, which may cause our operations and stock price to be volatile; |

| • | disruptions to our information systems in the ordinary course or as a result of systems upgrades; |

| • | our inability to protect our trademarks or other intellectual property rights; |

| • | acts of war, terrorism or civil unrest; |

| • | the impact of governmental laws and regulations and the outcomes of legal proceedings; |

| • | our ability to secure the personal financial information of our customers and comply with the security standards for the credit card industry; |

| • | our failure to maintain adequate internal controls over our financial and management systems; and |

| • | continuing costs incurred as a result of being a public company. |

2

There is no guarantee that any of the events anticipated by the forward-looking statements in this prospectus supplement, any accompanying prospectus and the documents that we incorporate by reference will occur, or if any of the events occur, there is no guarantee what effect it will have on our operations, financial condition or share price. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Our past performance, and past or present economic conditions in the retail market, are not indicative of future performance or conditions. Investors are urged not to place undue reliance on forward-looking statements. We will not, and undertake no obligation to, update or revise forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events or changes to projections over time unless required by federal securities laws.

See “Risk Factors,” as well as those factors or conditions described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case in our annual report on Form 10-K for the year ended February 3, 2018, in our quarterly reports on Form 10-Q for the quarters ended May 5, 2018 and August 4, 2018, and in any other filings with the SEC incorporated by reference in this prospectus supplement for a more complete discussion of the risks and uncertainties mentioned above and for discussion of other risks and uncertainties. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements as well as others made in this prospectus supplement, the accompanying prospectus and the documents incorporated herein, and hereafter in our other SEC filings and public communications. You should evaluate all forward-looking statements made by us in the context of these risks and uncertainties.

We caution you that the risks and uncertainties identified by us may not be all of the factors that are important to you. Furthermore, the forward-looking statements included in this prospectus supplement and the accompanying prospectus are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

3

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains basic information about our business and this offering and highlights selected information contained elsewhere in this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether or not to invest in the shares of Class A common stock offered hereby. For a more complete understanding of our business and this offering, you should read this entire prospectus supplement, the accompanying prospectus and any related free writing prospectus carefully, including the risks of investing in our Class A common stock discussed under “Risk Factors,” the consolidated financial statements and notes and other information included elsewhere or incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus before making an investment decision.

Our Business

Tillys is a leading destination specialty retailer of casual apparel, footwear and accessories for young adults, teens, and children. We believe we bring together an unparalleled selection of iconic global, emerging and proprietary brands rooted in an active and outdoor lifestyle. Through our 226 stores across 31 states as of August 4, 2018, combined with a growing and profitable online business that reaches consumers nationally, we operate a dynamic omni-channel platform that allows consumers to shop with us how, when and where they want. Our stores and website are designed to be a seamless extension of our consumers’ lifestyles and the stimulating environment in which they live.

We believe our broad selection of relevant brands, styles, colors, sizes and price points ensures that we have what our customers want when they visit our stores. Our selection of over 400 third-party lifestyle brands offered over the course of a year, complemented by our proprietary merchandise, allows us to identify and address trends more quickly, offer a great range of price points, and manage our inventories more dynamically. We strive to keep our merchandise mix current by continuously introducing emerging brands and styles not available at many other specialty retailers in order to identify and respond to the evolving desires of our customers. No single third-party brand exceeded 7% of our total annual sales in fiscal 2017, and over 100 of these brands each generated annual sales greater than $0.5 million for us in the same period. Our goal is to serve as a destination for the most relevant merchandise and brands important to our customers at any given time.

We have a flexible real estate strategy across real estate venues and geographies. As of August 4, 2018, our store base was composed of 226 stores (including three pop-up stores) in 31 states. Of those stores, approximately half are located in a mix of malls, with the remaining stores located in lifestyle centers, ‘power’ centers, community centers, outlet centers and street-front locations. We believe our experiential marketing efforts in our stores foster an environment that is vibrant, stimulating and authentic, serving as an extension to our customers’ individuality and passion for an active, connected lifestyle. We accomplish this by blending the most relevant brands and styles with music videos, product-related visuals and a dedicated team of passionate store associates. We continuously think of fun, creative ways to drive consumers to our stores, including augmented and virtual reality experiences, various social events, and partnerships with some of our vendors, all of which are posted on various social media platforms, further driving brand awareness. Additionally, in order to improve the look and feel of our stores, we have remodeled or refreshed nearly 90% of our stores in the last three years. In addition to our traditional stores, we have also opened three pop-up stores under our private label brand, RSQ by Tillys, which has served as an effective branding vehicle and allows us to make our way into desirable new markets. We believe we have a portable and flexible store model that supports our existing stores, and our ability to open new stores and try new store concepts in a disciplined manner.

Following our IPO in 2012, we opened 91 stores between fiscal 2012 and fiscal 2015 in both new and existing markets. During this period, we faced challenges with respect to brand awareness in new markets and

4

inconsistent merchandising offerings, and, as a result, we experienced declines in in-store traffic, sales and operating margins. Beginning in 2015, under the leadership of Edmond Thomas, who rejoined Tillys in October 2015 with over 30 years of retail experience, including serving as President and Co-Chief Executive Officer of Tillys from October 2005 to October 2007, we focused on slowing new store growth, and improving the merchandising selection and inventory management across the fleet to stabilize sales and improve profitability. Under Mr. Thomas’ leadership, we implemented several strategic initiatives, including taking a more conservative and strategic approach to new store growth and closing selected stores, as well as executing various merchandising initiatives within our stores and on our website to improve sales performance. Through these initiatives, we delivered seven consecutive quarters of year-over-year store traffic growth, flat to positive comparable store net sales for nine consecutive quarters, consistently healthy product margins and improved year-over-year operating margins for fiscal 2016, 2017 and the first half of fiscal 2018.

We believe, as we continue to execute on our core strategies, that we can continue to grow sales and improve profitability through positive comparable store sales, driven by increased traffic and e-commerce sales growth, as well as approaching store growth in a disciplined manner and effectively leveraging fixed costs. Our goal is to open new stores in attractive markets with strong economics in order to drive profitability in the first year. We plan to open approximately 12 new full-size stores during fiscal 2018, five of which have already opened. Our RSQ pop-up stores also provide short-term options for us to test new markets and increase our brand awareness.

We believe our customer-focused strategy and experienced, passionate team have placed the Company in a strong market position with meaningful room for future growth. Recent financial highlights include:

| Net Sales ($mm) | Comparable Store Sales (%) | |

|

| |

| Operating Income (Loss) ($mm) & Operating Margin (%) (1)(2) |

Net Income (Loss) ($mm) (2) | |

|

| |

| (1) | Operating margin represents operating income (loss) as a percentage of net sales for the corresponding period. |

| (2) | Operating income (loss), operating margin and net income (loss) for fiscal 2017 and the first half of fiscal 2017 were impacted by a non-recurrent $6.2 million provision related to a legal settlement. Operating income (loss), operating margin and net income (loss) for the first half of fiscal 2018 were impacted by a non-recurrent credit of $1.5 million against such provision as a result of the final settlement of such legal matter in early August 2018. |

5

Our Strengths

We believe that the following competitive strengths contribute to our success and distinguish us from our competitors:

| • | Destination retailer with a unique store experience and a broad and differentiated assortment. We believe the combined depth and breadth of apparel, footwear and accessories offered at our stores exceeds the selection offered at many other specialty retailers. We offer an extensive selection of over 400 third-party lifestyle brands over the course of a given year, which are complemented by our proprietary brands. Our merchandise includes a wide assortment of brands, styles, colors, sizes and price points to ensure we have what our customers want every time they visit our stores. We offer a balanced mix of merchandise across the apparel, footwear and accessories categories serving young adults, teens and children. We believe that by combining proven and emerging fashion trends and core style products with a vibrant blend of carefully selected music and visuals, we provide an in-store experience that is authentic, fun, and engaging for our core customers. Having a diverse assortment of brands and merchandise ensures that we are not overly dependent on any one brand or trend at any point in time. We also believe that our differentiated in-store environment, evolving selection of relevant brands, and broad and deep assortment encourages customers to visit our stores more frequently and positions us as a leading destination retailer that appeals to a large demographic. |

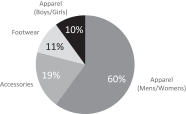

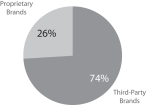

| Sales by Category (%)(1) | Sales by Brand Type (%)(1) | |

|

| |

| (1) | For fiscal 2017. |

| • | Dynamic merchandise model. We believe our extensive selection of third-party and proprietary merchandise allows us to identify and offer several trends simultaneously, offer a broad range of price points, and manage our inventories more dynamically. By closely monitoring trends and shipping product to our stores multiple times per week, we are able to adjust our merchandise mix based on store size and location. Different trends are applicable to different geographies, requiring us to analyze and adjust to what trends are best suited for each store. We believe our dynamic merchandise model allows us to do this efficiently, helping us to stay relevant to all of our customers across the country. We also keep our merchandise mix relevant by introducing emerging brands not available at many other retailers. We believe a significant percentage of our apparel offerings are unique to us due to the mix of our proprietary brands, emerging brands not offered at many other retailers, and special make-ups from popular brands that are not offered elsewhere or are offered only on a limited basis. Our merchandising capabilities also enable us to adjust our merchandise mix with a frequency that promotes a current look to our stores and website, and encourages frequent visits. |

| • | Flexible real estate strategy across real estate venues and geographies. Our stores have generally proven to be successful in different real estate venues and geographies. We operate stores in malls, |

6

| power centers, neighborhood and lifestyle centers, outlet centers and street-front locations across 86 markets in 31 states. With roots as an off-mall concept in 1982, only approximately half of our current stores are located in malls and we continue to see positive traffic trends in all of our different venues. We believe our success operating in these different retail venues and geographies demonstrates the portability of the Tillys brand, and gives us flexibility in our real estate decisions. |

| • | Multi-pronged marketing approach to drive traffic and customer engagement. We utilize a multi-pronged marketing strategy to connect with our customers and drive traffic to our stores and online platforms. We distribute catalogs, newsletters and postcards to potential and existing customers from our proprietary database to familiarize them with the Tillys brand, our products, and to drive traffic to our stores and website. We offer an integrated digital platform between our online and mobile applications for our customers to shop how and when they like, and to drive further connection with them. We partner and collaborate with our vendors on exclusive, compelling in-store events and contests to build credibility with our target customers, actively involve them in our brands, and enhance the connection between Tillys and our customers’ active lifestyle. We use social media to communicate directly with our customers while also encouraging customers to interact with one another and provide feedback on our events and products. This also involves partnering with influencers and social media stars on certain campaigns to help increase the breadth of our marketing efforts. We have a customer loyalty program to further engage with our customers, build customer loyalty, reward loyal customers, and gain customer insights. All of these programs are complemented by digital and email marketing, as well as print advertising, to build customer awareness and loyalty, highlight key merchandise offerings, drive traffic to our stores and online platforms, and promote the Tillys brand. Also, through our “We Care Program”, we support and participate in various academic, art, and athletic programs at local schools and other organizations in communities surrounding our stores. |

| • | Significant investments made across stores, e-commerce, systems and distribution/fulfillment to bolster omni-channel capabilities. We have invested in our store base to keep the look and feel fresh, our systems to enhance our merchandising and omni-channel capabilities and our distribution and fulfillment to optimize our supply chain. Nearly 90% of our stores have been remodeled or refreshed within the last three years. We believe that this is a significant advantage, as we can focus on brand awareness and merchandising at our current locations while also looking for opportunities to grow the brand and store base. In fiscal 2017, we implemented new point-of-sale and order management systems and re-platformed our website. In fiscal 2018, we plan on updating our mobile application to function seamlessly with these new systems and provide enhanced customer engagement. Our systems enable us to respond to changing fashion trends, manage inventory in real time, and provide a customized selection of merchandise at each location. We believe this capability enables us to manage our inventory effectively despite the breadth of our assortment, react faster to changing trends, and emphasize new products in order to drive greater traffic and spending. Our distribution center allows us to quickly sort and process merchandise and deliver it to our stores in a floor-ready format for immediate display. We also have a dedicated e-commerce fulfillment center with ample capacity, minimizing any necessary physical changes to our supply chain to support our future online growth potential. We believe the investments we have made can support growth in existing stores, new stores and on our e-commerce platform while driving brand awareness with limited additional incremental capital investment. |

| • | Experienced management team. Our senior management team, led by Edmond Thomas and Mike Henry, has extensive experience across a wide range of disciplines in the specialty retail and direct-to-consumer industries, including store operations, merchandising, distribution, real estate, and finance. Mr. Thomas, our President and Chief Executive Officer, rejoined Tillys in October |

7

| 2015 with over 30 years of retail experience, including previously serving as our President and Co-Chief Executive Officer from September 2005 to October 2007. Mr. Henry, our Chief Financial Officer, joined the Company in 2015 and has 18 years of experience in specialty retail. Hezy Shaked, our Co-Founder, Executive Chairman of the Board of Directors, and Chief Strategy Officer, also plays an important role in developing our long-term growth initiatives and cultivating our unique culture. |

Growth Strategy

We are pursuing several strategies to drive long-term sales and profitability, including:

| • | Drive comparable store sales. We believe we can continue to drive comparable store sales growth by continuing to execute on our merchandising strategy, increasing e-commerce sales and leveraging the investments we have made in the business. We seek to maximize our comparable store sales by offering new, on-trend merchandise across a broad assortment of categories, increasing our brand awareness through our multi-pronged marketing approach, providing an authentic store and online experience for our core customers, and maintaining a high level of customer service. We also engage with our customers through our loyalty program to drive traffic to our stores and website. Additionally, we believe that our e-commerce sales growth positions us well to continue to drive our comparable store sales growth. Lastly, we have remodeled or refreshed nearly 90% our stores in recent years and intend to continue to do so in the future to keep the physical representation of the Tillys brand updated and compelling for our customers. We believe the combination of these factors, together with our other operating strategies, positions us well to drive our comparable store sales results over time. |

| • | Continue to grow our e-commerce business & leverage improvements in our omni-channel capabilities. In fiscal 2017, our e-commerce sales represented 13.1% of our total net sales, which we believe represents a significant growth opportunity for us. We believe our e-commerce platform is an extension of our brand and retail stores, providing our customers a seamless shopping experience. Our e-commerce platform allows us to provide our customers with the same assortment offered in our brick-and-mortar stores, reach new customers, and build our brand in markets where we currently do not have stores. In fiscal 2017, we implemented a new platform for our e-commerce website. We also invested in certain omni-channel capabilities, including shipping products to our customers from our stores, which have been implemented in all stores. We also intend to provide our customers with the ability to buy products online and pick them up in stores. Additionally, we are in the process of implementing same-day delivery from our brick-and-mortar stores and upgrading our mobile application ahead of the 2018 holiday season to enhance further our customers’ shopping experience and convenience. We believe these omni-channel capabilities can drive additional traffic to both our stores and our website, and help drive comparable store sales growth. |

| • | Open new stores. As of August 4, 2018, our store base was composed of 226 stores (including three RSQ pop-up stores) in 31 states. Of those stores, approximately half of those are located in traditional malls. We believe our footprint today is underpenetrated relative to other specialty apparel retailers, and we have meaningful opportunities to open new stores in attractive properties and locations that can deliver attractive economics, with the goal of having stores be profitable in their first year of operation or shortly thereafter. In fiscal 2018, we plan to open approximately 12 new stores, five of which we have already opened. We plan to remain disciplined in our store expansion, learning from the stores that we have opened, and primarily targeting existing markets where additional opportunities exist to expand Tillys’ brand recognition or new markets with high |

8

| population density, such as the Northeast, Chicago and Texas. In markets where we do not have a current presence, we typically seek to open an initial store in a strong regional mall to generate brand awareness and traffic that can grow quickly and steadily. Following the initial store opening, we often seek to increase our brand awareness in attractive markets through opening a cluster of new stores in that market. In fiscal 2018, we have also introduced three pop-up locations in strong regional malls under our private label denim brand, RSQ by Tillys, to drive brand awareness for both our RSQ brand and Tillys as a whole. We continue to see strong performance and positive feedback from both customers and landlords regarding these RSQ pop-ups. These RSQ pop-ups allow us flexibility to test out new markets for a limited period of time while also building brand awareness and loyalty. While we will remain disciplined regarding new store growth, we expect that our new stores will continue to contribute to our overall sales growth. |

| • | Drive brand awareness. We plan to continue to drive brand awareness by implementing effective marketing campaigns that target our core customers both in stores and online, including in-store events, co-branded promotions with third-party brands, influencers and social media personalities, which we believe will lead to increased traffic and comparable store sales. We are focused on broadening our customer reach and increasing engagement with our existing customers by leveraging our omni-channel capabilities. We believe that, as we increase market penetration through opening new stores in both existing and new markets, continue to grow our e-commerce business, and continue to implement compelling and fun marketing activities, our customer engagement and brand awareness will continue to expand, driving overall sales growth. |

| • | Increase our operating margins. We believe we have the opportunity to drive operating margin expansion through scale efficiencies and continued process improvements. We believe comparable store sales increases, including e-commerce growth, and new stores will permit us to better leverage largely fixed occupancy costs, store payroll, and corporate overhead. In addition, our goal is to improve operating margins and support growth by leveraging previous investments in infrastructure, including our dedicated e-commerce fulfillment center, upgraded e-commerce platform, and omni-channel capabilities. With regard to existing stores, we have an aggregate of approximately 120 lease decisions to make over the course of fiscal 2018 and 2019, covering a range of stores across many different markets with the goal of improving our profitability. We also intend to continue to use a disciplined approach to identify and execute initiatives focused on lowering our unit costs and improving operational efficiency throughout our organization. Due to the initiatives above, we have experienced improvement in our margins in each consecutive year from fiscal 2015 through 2017 as well as the first half of fiscal 2018. |

9