Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Finward Bancorp | tv502238_8-k.htm |

Fall 2018 Investor Presentation Filed by NorthWest Indiana Bancorp pursuant to Rule 425 under the Securities Act of 1933 and deemed filed Pursuant to Rule 14a - 12 of the Securities Exchange Act of 1934 Subject Company: NorthWest Indiana Bancorp Commission File No. 000 - 26128 Exhibit 99.1

Forward - Looking Statements This presentation may contain forward - looking statements regarding the financial performance, business prospects, growth and operating strategies of NorthWest Indiana Bancorp (“NWIN”), as well as those of AJS Bancorp, Inc. (“AJSB”), with which NWIN has entered into a previously announced Agreement and Plan of Merger dated July 30 , 2018, providing for the proposed merger of AJSB with and into NWIN. For these statements, each of NWIN and AJSB claims the protections of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about NWIN and AJSB, including the information in the filings NWIN makes with the SEC, including its Annual Report on Form 10 - K for the year ended December 31, 2017. Forward - looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward - looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward - looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and simi lar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by AJSB’s shareholders; delay in closing the merger; difficulties and delays in integrating NWIN’s and AJSB’s businesses or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of NWIN’s and AJSB’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Fall 2018 2

Additional Information For Shareholders In connection with the proposed merger, NorthWest Indiana Bancorp (“NWIN”) will file with the SEC a Registration Statement on Form S - 4 that will include a Proxy Statement of AJSB and a Prospectus of NWIN (the “proxy statement/prospectus”) as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement/prospectus and other relevant materials (when they become available) and any other documents NWIN has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents NWIN has filed with the SEC from NWIN at www.ibankpeoples.com in the link for “Investor Relations – SEC Filings - Documents.” Alternatively, these documents, when available, can be obtained free of charge from NWIN upon written request to NorthWest Indiana Bancorp, Attn: Corporate Secretary, 9204 Columbia Avenue, Munster, Indiana 46321. The information available through NWIN’s website is not and shall not be deemed part of this presentation or incorporated by reference into other filings NWIN makes with the SEC. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. NWIN and AJSB and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of AJSB in connection with the proposed merger. Information about the directors and executive officers of NWIN is set forth in NWIN’s Annual Report on Form 10 - K filed with the SEC on February 20, 2018, and in the proxy statement for NWIN’s 2018 annual meeting of shareholders, as filed with the SEC on March 12, 2018. Additional information regarding the interests of these participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Fall 2018 3

Disclosures Regarding Non - GAAP Measures This presentation refers to certain financial measures that are identified as non - GAAP. The Bancorp believes that these non - GAAP measures are helpful to investors to better understand the Bancorp’s assets , earnings, and shareholders’ equity at the date of this presentation. This supplemental information should not be considered in isolation or as a substitute for the related GAAP measures. See the attached table at the end of this presentation for a reconciliation of the non - GAAP measures identified herein and their most comparable GAAP measures. Fall 2018 4

SUSTAINED PERFORMANCE Fall 2018 5

Over 3 Decades of Performance Converted to Stock Institution Munster Converted to Federal Stock Savings Bank Schererville NorthWest Indiana Bancorp formed East Chicago (new) Broadway Hobart Corporate Center Crown Point Gary Valparaiso St. John First Federal Acquisition Liberty Savings Acquisition 0 100 200 300 400 500 600 700 800 900 1,000 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Recession Assets Net Income $ in millions Fall 2018 2018: Announced and Closed First Personal Acquisition; Announced AJ Smith Acquisition 6

Value - Driven Culture • To help our customers and communities be more successful Mission • Stability • Integrity • Community • Excellence Values • Shareholders • Customers • Employees • Communities Stakeholders Fall 2018 7

Strategic Focus Fall 2018 8 Market Expansion • M&A • Organic Growth Market Penetration • Products • Teams Operational Efficiency • Consistency • Resources Strategic Goals - Service - based value proposition - Performance and Profitability - Community Bank serving Northwest Indiana and South Suburban Chicagoland

2018 PERFORMANCE SUMMARY Fall 2018 9

2018 Performance Summary Asset quality • Strong, stable loan portfolio • Non - performing loans at 0.65% of total loans Growth • Total assets at $959.0mn, 4.1% growth over last 12 months • Capital supports pro forma assets of $1.3bn Sales • Added bankers to the Mortgage, Commercial, and Retail areas of the Bank Fall 2018 * See the table at the end of this presentation for a reconciliation to the most directly - comparable GAAP measure . 10

Operating Results for the six months ended June 30, 2018 Income $5.5mn* 14.9% increase ROA 1.18%* 11 bp increase Assets $959.0mn 3.4% growth Nonint. Income $4.7mn 24.2% growth Cost of Funds 0.48% Efficient funding Named to “Best Places to Work in Indiana” 2013 - 2018 By the Best Companies Group Named a top 200 community bank 2004 – 2018 By U.S. Banker Magazine Named a “Best Bank to Work F or” 2016 - 2018 By American Banker *See the table at the end of this presentation for a reconciliation to the most directly - comparable GAAP measure. Fall 2018 11

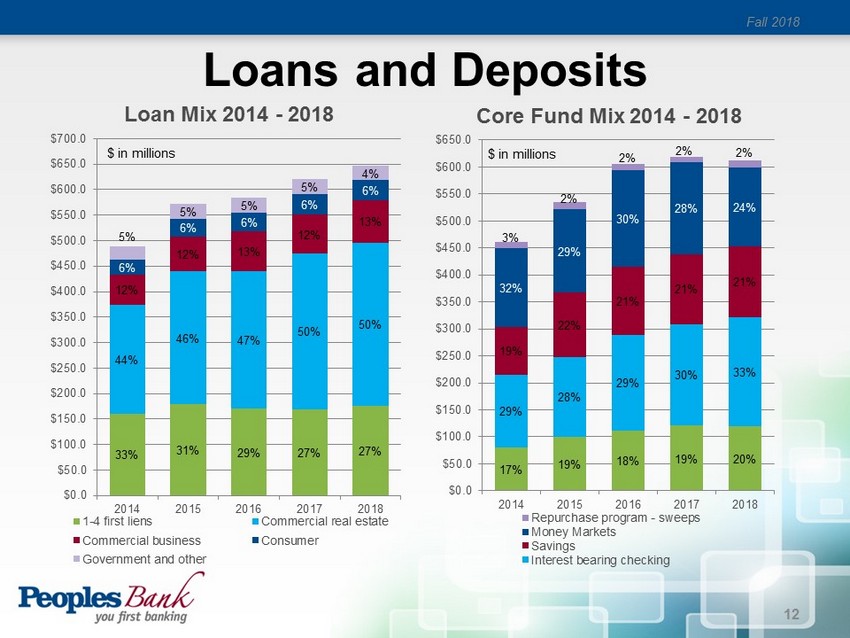

Loans and Deposits Fall 2018 12 33% 31% 29% 27% 27% 44% 46% 47% 50% 50% 12% 12% 13% 12% 13% 6% 6% 6% 6% 6% 5% 5% 5% 5% 4% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0 $600.0 $650.0 $700.0 2014 2015 2016 2017 2018 Loan Mix 2014 - 2018 1-4 first liens Commercial real estate Commercial business Consumer Government and other $ in millions 17% 19% 18% 19% 20% 29% 28% 29% 30% 33% 19% 22% 21% 21% 21% 32% 29% 30% 28% 24% 3% 2% 2% 2% 2% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0 $600.0 $650.0 2014 2015 2016 2017 2018 Core Fund Mix 2014 - 2018 Repurchase program - sweeps Money Markets Savings Interest bearing checking $ in millions

Assets Growth and Quality • Up $31.7mn in 2018 • 4.4% 5 year compound annual growth rate • $177.2mn in total loan originations resulting in $26.1mn of net loan growth for first six months of 2018 • Growth reflects focus on loan originations • Maintaining strong credit underwriting practices Fall 2018 13 775.0 864.9 913.6 927.3 959.0 $500.0 $550.0 $600.0 $650.0 $700.0 $750.0 $800.0 $850.0 $900.0 $950.0 $1,000.0 2014 2015 2016 2017 2018 NWIN Growth 2014 - 2018

Asset Quality ¹Nonaccruing loans + accruing loans 90 days past due Strong credit quality • Nonperforming loans stable at 0.65% • Texas Ratio 9.0% at midyear 2018 • Total classification ratio 10.6% at midyear 2018 • ALL reserves are proportionate to risk Fall 2018 14 1.10% 0.98% 1.05% 0.84% 0.65% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 2014 2015 2016 2017 2018 Asset Quality 2014 - 2018 Allowance for loan loss Nonperforming loans / loans¹ $ in millions

Interest Income (TE) Data Source: S&P Global Market Intelligence Competitive yields • Positive impact from increasing yields and improved economic conditions • Prior acquisitions continue to benefit interest income • Portfolio mix delivering increased earnings • Shorter duration positions the portfolio for continued growth Fall 2018 15 3.93% 4.17% 4.16% 3.84% 3.90% 3.6% 3.7% 3.8% 3.9% 4.0% 4.1% 4.2% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN Interest Income / Avg. Assets (Tax Equivalent)

Interest Expense Data Source: S&P Global Market Intelligence Fall 2018 16 0.49% 0.44% 0.51% 0.65% 0.43% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN Interest Expense / Avg. Assets Top Performer • Strong competitive advantage against peers • Continued focus on core funds has lessened the impact of increasing deposit rates • Consistently lead peers in balance sheet funding

Net Interest Margin (TE) Strong margin • Supported by increase in earning assets • Stability in retail core funding costs has helped support margin during • Main driver of ROA Data Source: S&P Global Market Intelligence Fall 2018 17 3.58% 3.92% 3.87% 3.37% 3.69% 2.5% 2.7% 2.9% 3.1% 3.3% 3.5% 3.7% 3.9% 4.1% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN Net Interest Margin (Tax Equivalent)

Noninterest Expense Strong expense management • Efficient operations ensure agility and low overhead • Investments back into the company have allowed for growth • Efficiency ratio of 65.5%* • Approximately $4.6mn assets per employee, up from $4.0mn in 2012 Data Source: S&P Global Market Intelligence Fall 2018 18 3.15% 3.53% 3.78% 5.12% 3.01% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN Noninterest Expense / Avg. Assets * See the table at the end of this presentation for a reconciliation to the most directly - comparable GAAP measure .

Return On Assets Competitive ROA • Management focus on ROA has resulted in enhanced earnings • NWIN midyear 2018 non - GAAP ROA 1.18%* • Long - term performance is the key to ROE and continued independence Data Source: S&P Global Market Intelligence Fall 2018 *See the table at the end of this presentation for a reconciliation to the most directly - comparable GAAP measure. 19 1.10% 0.92% 1.32% 1.47% 1.18% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN ROA

Building Capital Building capital for growth • Well capitalized at 9.7% tier 1 capital • Deployed capital in 2014 & 2015 through acquisitions • Continue to deploy capital for First Personal & AJSB acquisitions • Day 1 Tier 1 capital projected at 8.8% with First Personal acquisition Fall 2018 20 9.2% 9.0% 9.2% 9.6% 9.7% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% Dec 14 Dec 15 Dec 16 Dec 17 Jun 18 NWIN Tier 1 Capital 2014 - JUN18

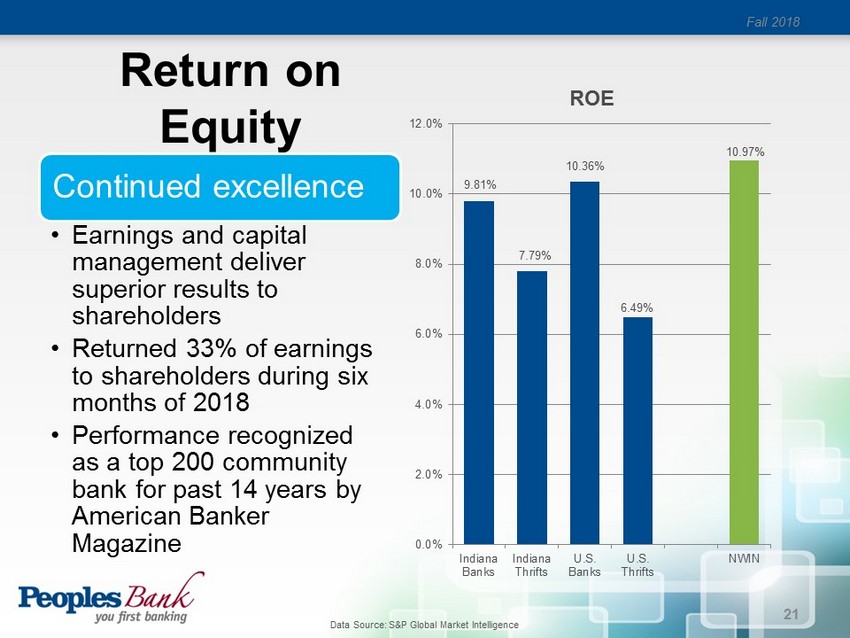

Return on Equity Continued excellence • Earnings and capital management deliver superior results to shareholders • Returned 33% of earnings to shareholders during six months of 2018 • Performance recognized as a top 200 community bank for past 14 years by American Banker Magazine Data Source: S&P Global Market Intelligence Fall 2018 21 9.81% 7.79% 10.36% 6.49% 10.97% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Indiana Banks Indiana Thrifts U.S. Banks U.S. Thrifts NWIN ROE

AJS BANCORP, INC. ACQUISITION HIGHLIGHTS 22 Fall 2018

Expanding Chicagoland Presence Acquisition of AJS Bancorp, Inc. and subsidiary, A.J. Smith FSB Financially Compelling with Strong Strategic and Cultural Fit • Adds additional scale in south suburban Chicagoland market • Institutions share focus on customers and communities • Strong core deposit franchise in growth market for NWIN – 90.1% core deposits/total deposits – 62.1% loans/deposits • Meaningfully accretive to earnings with short TBV earnback period • Pro - forma combined balance sheet of $1.3bn assets 1 Fall 2018 23 Target AJS Bancorp, Inc. Ticker OTC Pink: AJSB Industry Bank Location Midlothian, IL Asset Size ($mn) $191.8 # of Branches 3 Status Announced Buyer NorthWest Indiana Bancorp Ticker OTC Pink: NWIN Industry Bank Location Munster, IN Announcement Date 7/31/2018 Expected Completion Early 1 st Quarter 2019 1. Pro - forma for recently completed acquisition of First Personal Financial Corporation and announced acquisition of AJS Bancorp, I nc..

Peoples Banking Center Network Projected 22 full - service banking centers 24 1. NWIN branches include three branches in IL acquired in their recently completed acquisition of First Personal Financial Corpo rat ion. Fall 2018 NorthWest Indiana Bancorp 1 (19) AJS Bancorp, Inc. (3)

Deal Assumptions • 0.8% TBV per share day 1 dilution • Expected 6.0% EPS accretion for 2019 (excluding one - time deal related charges) and 6.4% in 2020 • Approximately 2.2 years TBV per share earn back • 20%+ projected IRR Shareholder Impact • $34.6 million purchase price (55% stock, 45% cash) 1 • 1.09x price to tangible book at close • 2.1% core deposit premium 2 Consideration • 2.9% gross credit mark ($2.8 million) • $1.5 million interest rate mark, accreted into earnings over four years • $89 thousand OREO mark • Core deposit intangibles created equal to 2.0% of AJSB’s core deposits, amortized over 10 years (straight - line method) Purchase Accounting Adjustments • Identified readily - achievable cost savings equal to approximately 40% of AJSB’s non - interest expense base (85% realized in 2019, 100% in 2020 and thereafter) • Total $3.3 million pre - tax estimated one time deal charges, 9.5% of aggregate deal value Synergies 25 Fall 2018 1. Transaction value includes unallocated shares held by the AJSB Employee Stock Ownership Plan (“ESOP”), a portion of which wil l be cancelled at closing in order to satisfy the ESOP’s outstanding loan balance. 2. Core deposits defined as total deposits less jumbo time deposits (time deposits greater than $100,000).

Thank you.

Fall 2018 Appendix (Reconciliation of GAAP and prospective, non - GAAP measures) 27 Thee Months Six Months Ended Ended 6/30/2018 6/30/2018 (Unaudited) (Unaudited) GAAP net Income 2,511$ 5,072$ GAAP income tax expense 365 780 GAAP income before income taxes 2,876 5,852 Acquisition costs 533 545 Pro forma income before income taxes 3,409 6,397 Pro forma income taxes 433 853 Pro forma net income 2,976$ 5,544$ Pro forma net income change 17.7% 14.9% Pro forma ROA 1.26% 1.18% Pro forma ROE 13.09% 12.15% Pro forma EPS 1.04$ 1.93$ Pro forma efficiency ratio 63.23% 65.45% Pro forma non-interest expense / average assets 2.87% 2.90%