Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR Refining, LP | cvrr8-kseptember2018invest.htm |

Investor Relations September 20181

Forward-Looking Statements The following presentation contains forward-looking statements which are protected as forward-looking statements under the PSLRA, and which are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. The assumptions and estimates underlying forward-looking statements are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective information. Accordingly, there can be no assurance that we will achieve the future results we expect or that actual results will not differ materially from expectations. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements”. These statements include, but are not limited to, statements regarding future: crude oil capacities, quality and price advantages, pricing and gathering system capacity; access to shale fields and/or domestic, locally gathered and/or Canadian crude oils; conversion and distillate yields; fertilizer facility flexibility, marketing agreements and netbacks; cost of operations; throughput and production; favorability of the macro environment including global crude oil supply, increased shale oil production, takeaway capacity, product demand, growth of global economies sustainably or at all, price environment, impacts of IMO 2020 and political and legislative landscapes; crude oil and condensate differentials; crack spreads; strategic initiatives including EHS improvements, ability to deliver high quality and profitable crude oil to our refineries, reduction of RINs exposure, biodiesel blending, development of wholesale or retail businesses, expansion of optionality to process WCS, light share oil and/or natural gas, improvement of liquid yield at Wynnewood by 3.5% or at all, reduction of SG&A casts, headcount reductions, ERP utilization, reduction of lost opportunities and improved capture rates; capital expenditures and turnaround expense; the Benfree, Isom and crude oil optionality projects including the costs, timing, returns, benefits and impacts thereof; ability to serve Southern Plains and Corn Belt areas; ability to minimize distribution costs and maximize netbacks; global fertilizer demand and nitrogen consumption; corn applications, uses, production, stocks, pricing and crops; ethanol consumption; population growth; decrease in farmland; biofuel consumption; diet evolution in developing countries; nitrogen capacity, supply and demand; on stream factors; feedstock costs; sales revenue; continued safe and reliable operations; and other matters.Youarecautionednottoputunduerelianceonsuchforward- looking statements (including forecasts and projections regarding our future performance) because actual results may vary materially from those expressed or implied as a result of various factors, including, but not limited to those set forth under “Risk Factors” in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any other filings with the Securities and Exchange Commission by CVR Energy, Inc. (“CVI”), CVR Refining, LP (“CVRR”) or CVR Partners, LP (“UAN”). These forward-looking statements are made only as of the date hereof. Neither CVI, CVRR nor UAN assume any obligation to, and they expressly disclaim any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 2

CVR Energy, Inc. (NYSE: CVI) Our mission is to be a top‐tier North American petroleum refining and nitrogen‐based fertilizer company as measured by safe and reliable operations, superior financial performance and profitable growth. Our core values define the way we do business every day to accomplish our mission. The foundation of our company is built on these core values. We are responsible to apply our core values in all the decisions we make and actions we take. Safety ‐ We always put safety first. The protection of our employees, contractors and communities is paramount. We have an unwavering commitment to safety above all else. If it’s not safe, then we don’t do it. Environment ‐ We care for our environment. Complying with all regulations and minimizing any environmental impact from our operations is essential. We understand our obligation to the environment and that it’s our duty to protect it. Integrity ‐ We require high business ethics. We comply with the law and practice sound corporate governance. We only conduct business one way—the right way with integrity. Corporate Citizenship ‐ We are proud members of the communities where we operate. We are good neighbors and know that it’s a privilege we can’t take for granted. We seek to make a positive economic impact through our financial donations and the contributions of time, knowledge and talent of our employees to the places where we live and work. Continuous Improvement ‐ We believe in both individual and team success. We foster accountability under a performance‐driven culture that supports creative thinking, teamwork and personal development so that employees can realize their maximum potential. We use defined work practices for consistency 3 3

CVR Energy, Inc. (NYSE: CVI) CVR Energy is a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in two limited partnerships, CVR Refining, LP and CVR Partners, LP. CVR Energy and its subsidiaries serve as the general partner and own 81 percent of the common units of CVR Refining. CVR Energy subsidiaries serve as the general partner and own 34 percent of the common units of CVR Partners. CVR Refining, LP CVR Partners, LP (NYSE: CVRR) (NYSE: UAN) • 2 strategically located mid‐ • 2 strategically located continent refiners close to facilities serving the Cushing, Oklahoma Southern Plains and Corn • Approximately 206,500 bpcd Belt markets of crude processing • Facility flexibility due to • Directly coupled to the storage capabilities at the SCOOP / STACK shale oil facilities and offsite fields • Complimentary logistic assets • Freight advantaged with potential EBITDA of marketing channels approximately $75 million resulting in higher net back per year prices • Access to quality and price • Marketing agreement with advantaged crude – 100% of LSB Industries Pryor, OK, crude purchased is WTI based facility’s UAN production • 92% conversion to light products & 42% distillate yield 4 4

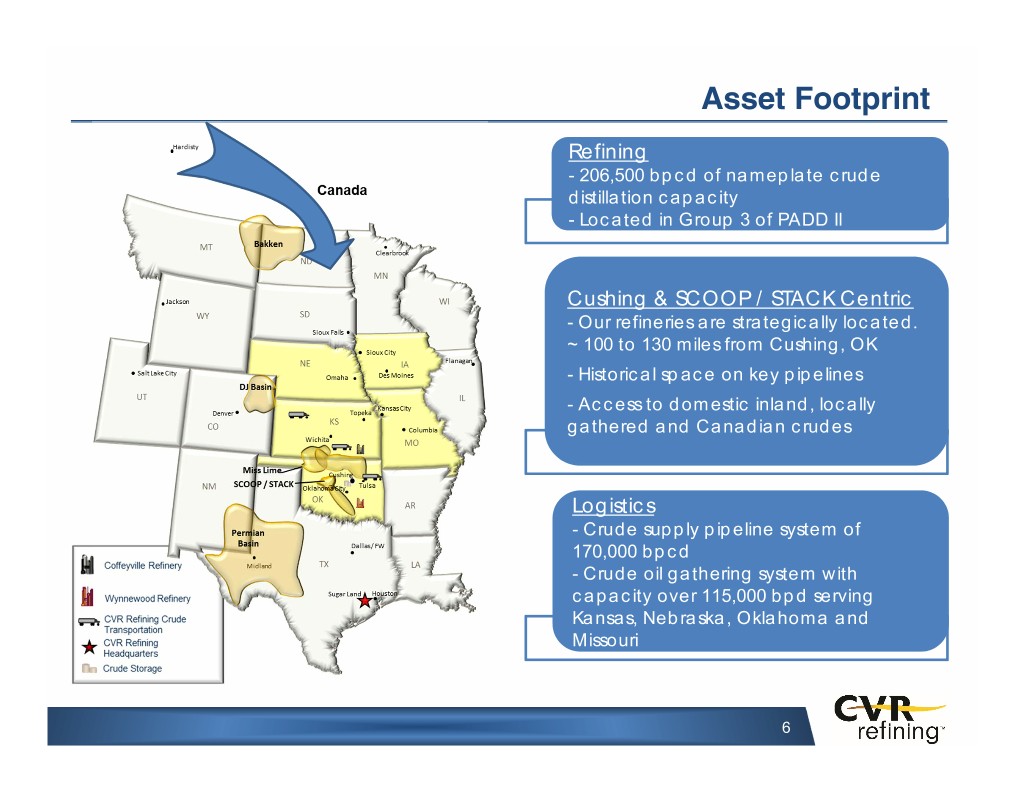

Asset Footprint Refining - 206,500 bpcd of nameplate crude distillation capacity - Located in Group 3 of PADD II Cushing & SCOOP / STACK Centric - Our refineries are strategically located. ~ 100 to 130 miles from Cushing, OK - Historical space on key pipelines - Access to domestic inland, locally gathered and Canadian crudes Logistics - Crude supply pipeline system of 170,000 bpcd - Crude oil gathering system with capacity over 115,000 bpd serving Kansas, Nebraska, Oklahoma and Missouri 6

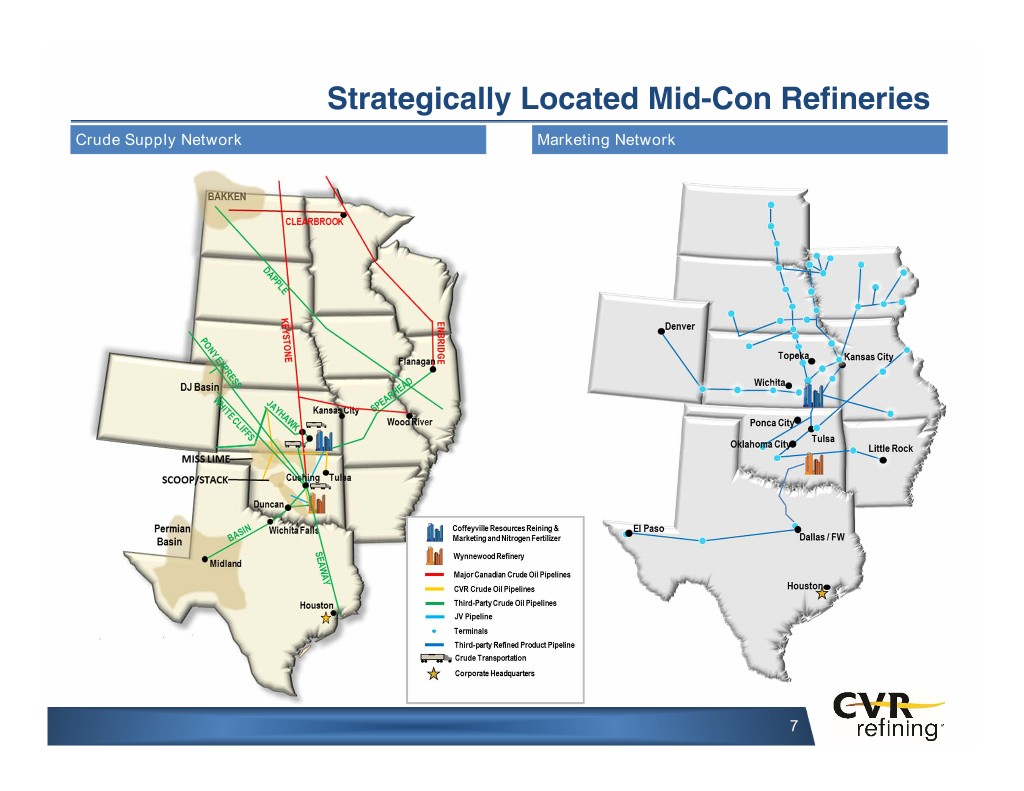

Strategically Located Mid-Con Refineries Crude Supply Network Marketing Network 7

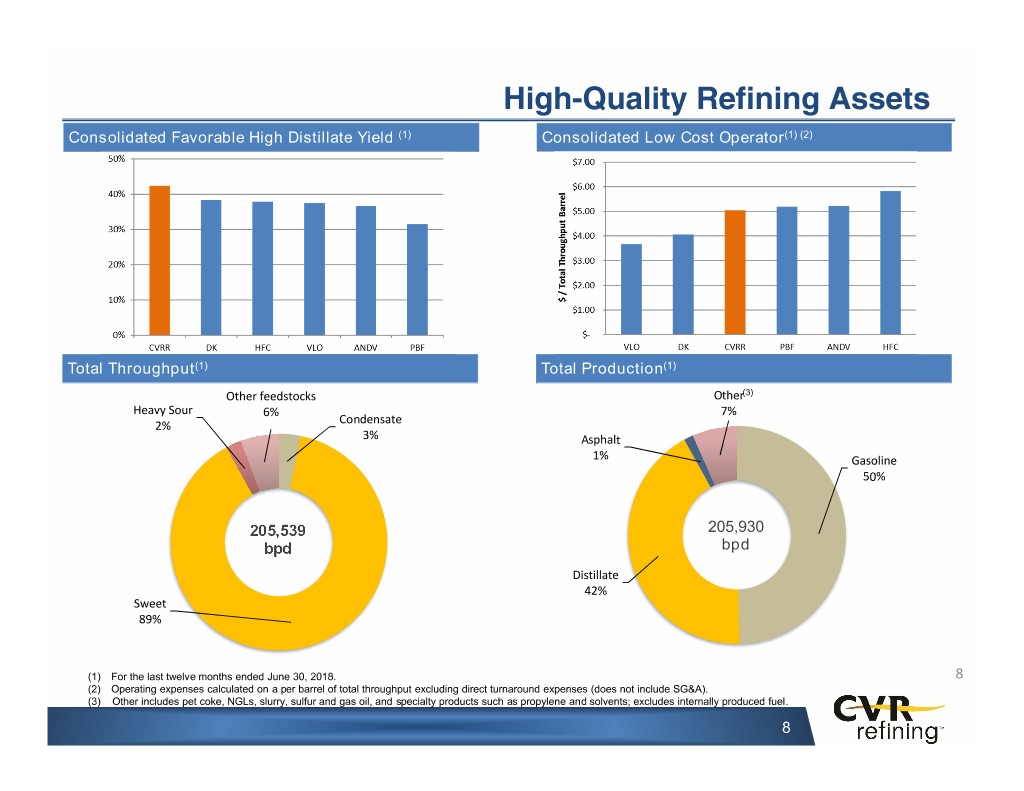

High-Quality Refining Assets Consolidated Favorable High Distillate Yield (1) Consolidated Low Cost Operator(1) (2) Total Throughput(1) Total Production(1) Other feedstocks Other(3) Heavy Sour 6% 7% Condensate 2% 3% Asphalt 1% Gasoline 50% 205,539 205,930 bpd bpd Distillate 42% Sweet 89% (1) For the last twelve months ended June 30, 2018. 8 (2) Operating expenses calculated on a per barrel of total throughput excluding direct turnaround expenses (does not include SG&A). (3) Other includes pet coke, NGLs, slurry, sulfur and gas oil, and specialty products such as propylene and solvents; excludes internally produced fuel. 8

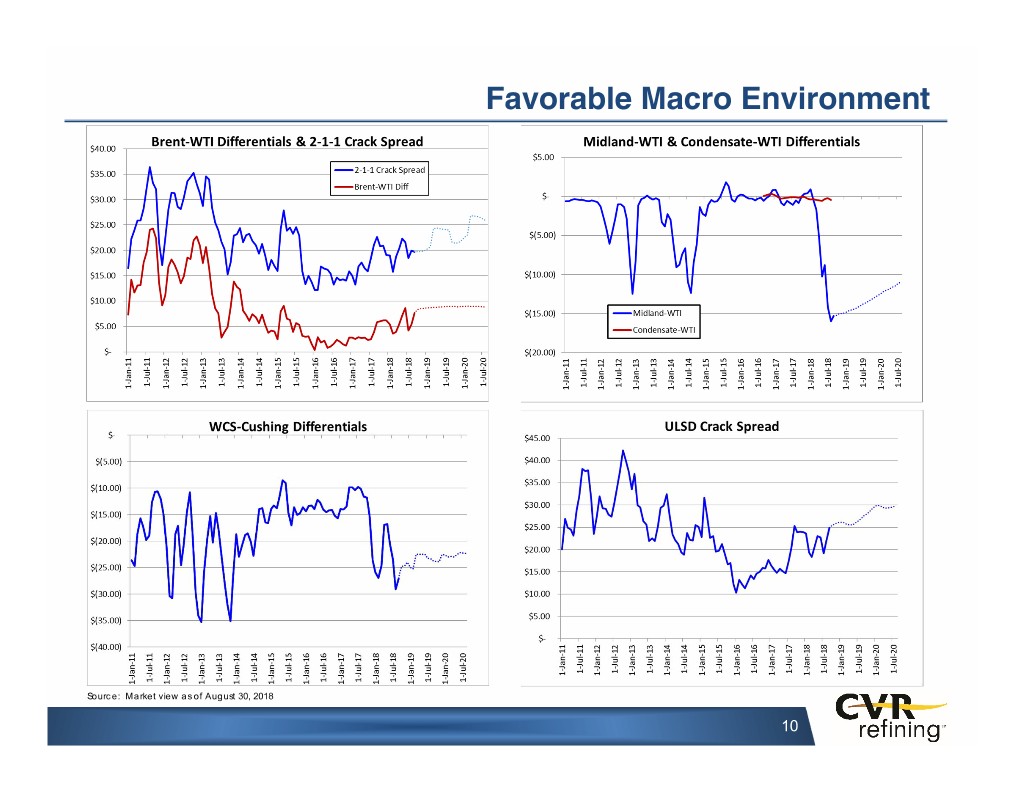

Favorable Macro Environment Feedstock Supply • Abundant global supply of crude oil • Increased U.S. shale‐oil production • Limited Canadian pipeline takeaway capacity Product Demand • Global economies aligned for sustainable growth • Sustained product demand driven by: • lower price environment • IMO 2020 Regulatory Landscape • Constructive U.S. legislative landscape • Improved political landscape on RFS • Positive Energy development in the U.S. 9

Favorable Macro Environment Source: Market view as of August 30, 2018 10

Strategic Initiatives • To continue and improve in all Environmental, Health and Safety matters. Safety is Job 1. Safe operation is generally a reliable operation • Leverage our strategic location and our proprietary gathering system to deliver high quality and profitable crude to our refineries. • Reduce our Renewable Identification Number exposure. • Biodiesel blending facilities at all of our racks. • Build a wholesale / retail business. • Expand our optionality to process WCS, light‐ shale oil, and natural gasoline at the Coffeyville Refinery. • Improve Liquid Yield recovery at the Wynnewood Refinery by 3.5%. • Reduce SG&A costs via ERP utilization and headcount reductions. • Reduce lost opportunities and improve capture rates. 11

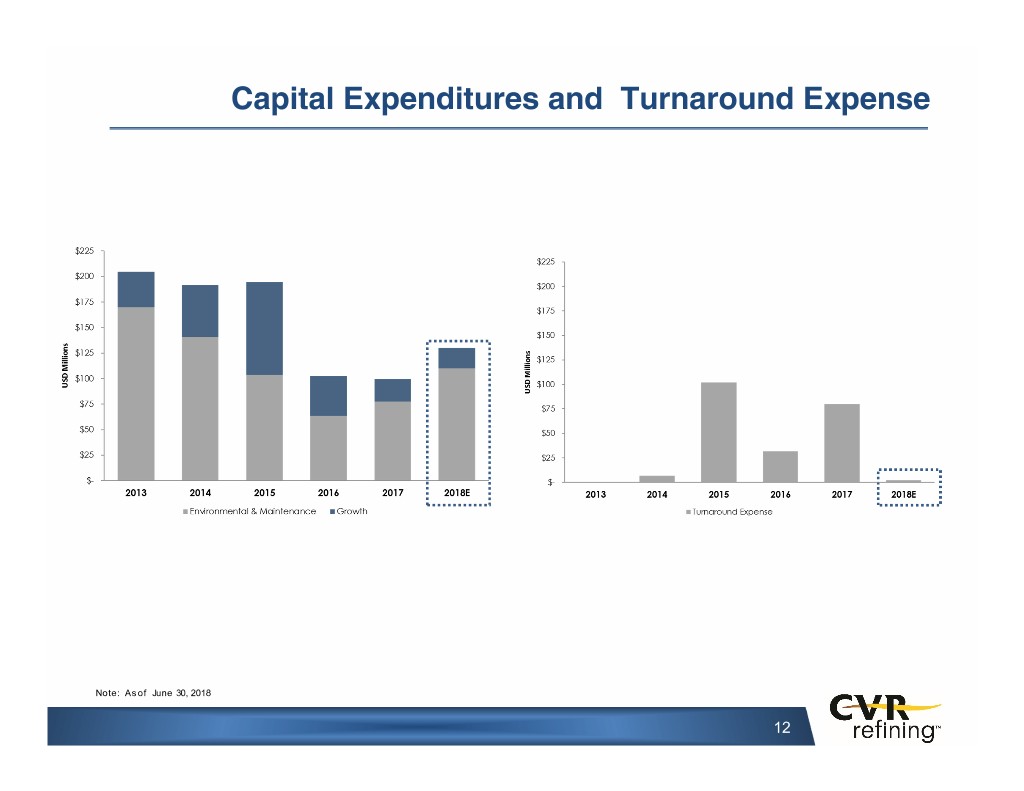

Capital Expenditures and Turnaround Expense Note: As of June 30, 2018 12

Long-Term Value Creation Projects Benfree Unit Repositioning at Wynnewood • Expected to improve liquid yield by 1% or 750 bpd of high octane gasoline • Total capital cost of $12 million • Expected return of 90‐plus percent at $65 per barrel priced crude oil • Project completion expected during spring 2019 turnaround • In construction –Board approved 13

Long-Term Value Creation Projects Isomerization Unit at Wynnewood • Run more SCOOP / STACK condensate crude • Improvement in liquid volume yield • Increased capability to generate premium gasoline • Reduced benzene content of gasoline • Total capital cost of approximately $90 million • Expected return greater than 25 percent • Project completion expected 2021 14

Long-Term Value Creation Projects Crude Optionality Phase 1 at Coffeyville • Identified changes required to allow running price advantaged crudes and / or Natural Gasoline Additional Naphtha Hydrotreating Additional Isomerization Tier III Gasoline Flexibility • Expected return greater than 30% • Timing for project completion is 2022 15

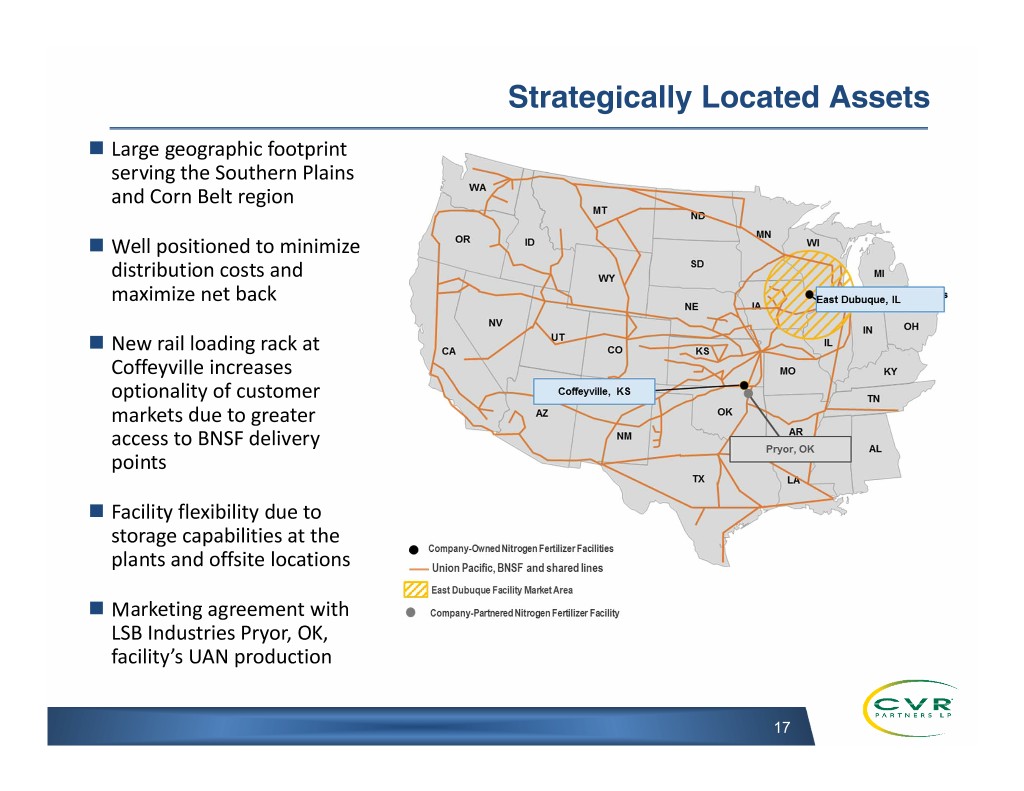

Strategically Located Assets Large geographic footprint serving the Southern Plains and Corn Belt region Well positioned to minimize distribution costs and maximize net back New rail loading rack at Coffeyville increases optionality of customer markets due to greater access to BNSF delivery points Facility flexibility due to storage capabilities at the plants and offsite locations Marketing agreement with LSB Industries Pryor, OK, facility’s UAN production 17

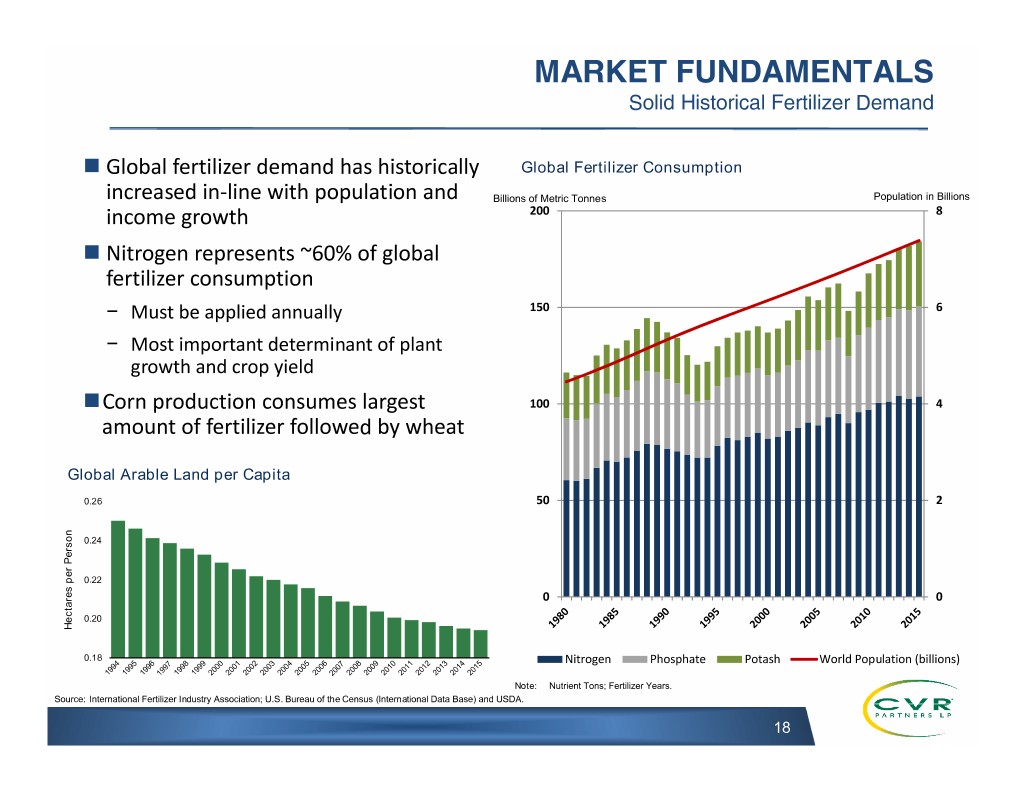

MARKET FUNDAMENTALS Solid Historical Fertilizer Demand Global fertilizer demand has historically Global Fertilizer Consumption increased in‐line with population and Billions of Metric Tonnes Population in Billions income growth 200 8 Nitrogen represents ~60% of global fertilizer consumption − Must be applied annually 150 6 − Most important determinant of plant growth and crop yield Corn production consumes largest 100 4 amount of fertilizer followed by wheat Global Arable Land per Capita 0.26 50 2 0.24 0.22 0 0 0.20 Hectares per Person Hectares per 0.18 Nitrogen Phosphate Potash World Population (billions) Note: Nutrient Tons; Fertilizer Years. Source: International Fertilizer Industry Association; U.S. Bureau of the Census (International Data Base) and USDA. 18

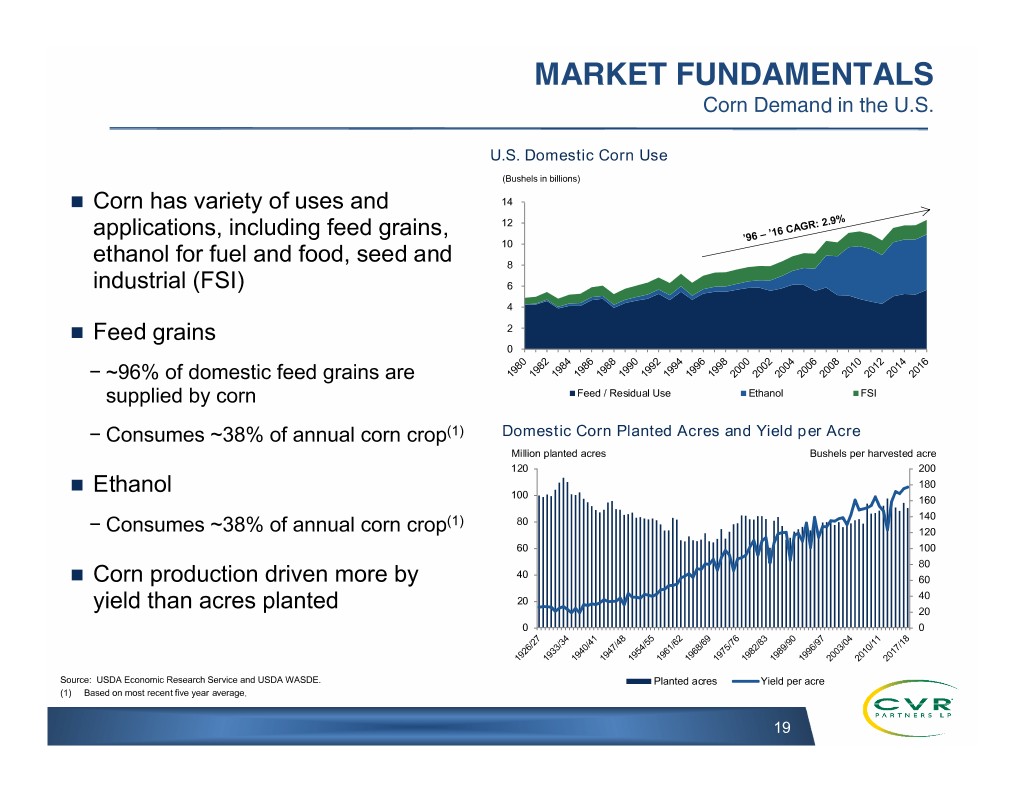

MARKET FUNDAMENTALS Corn Demand in the U.S. U.S. Domestic Corn Use (Bushels in billions) Corn has variety of uses and 14 applications, including feed grains, 12 10 ethanol for fuel and food, seed and 8 industrial (FSI) 6 4 Feed grains 2 0 − ~96% of domestic feed grains are supplied by corn Feed / Residual Use Ethanol FSI − Consumes ~38% of annual corn crop(1) Domestic Corn Planted Acres and Yield per Acre Million planted acres Bushels per harvested acre 120 200 180 Ethanol 100 160 140 (1) 80 − Consumes ~38% of annual corn crop 120 60 100 80 40 Corn production driven more by 60 40 20 yield than acres planted 20 0 0 Source: USDA Economic Research Service and USDA WASDE. Planted acres Yield per acre (1) Based on most recent five year average. 19

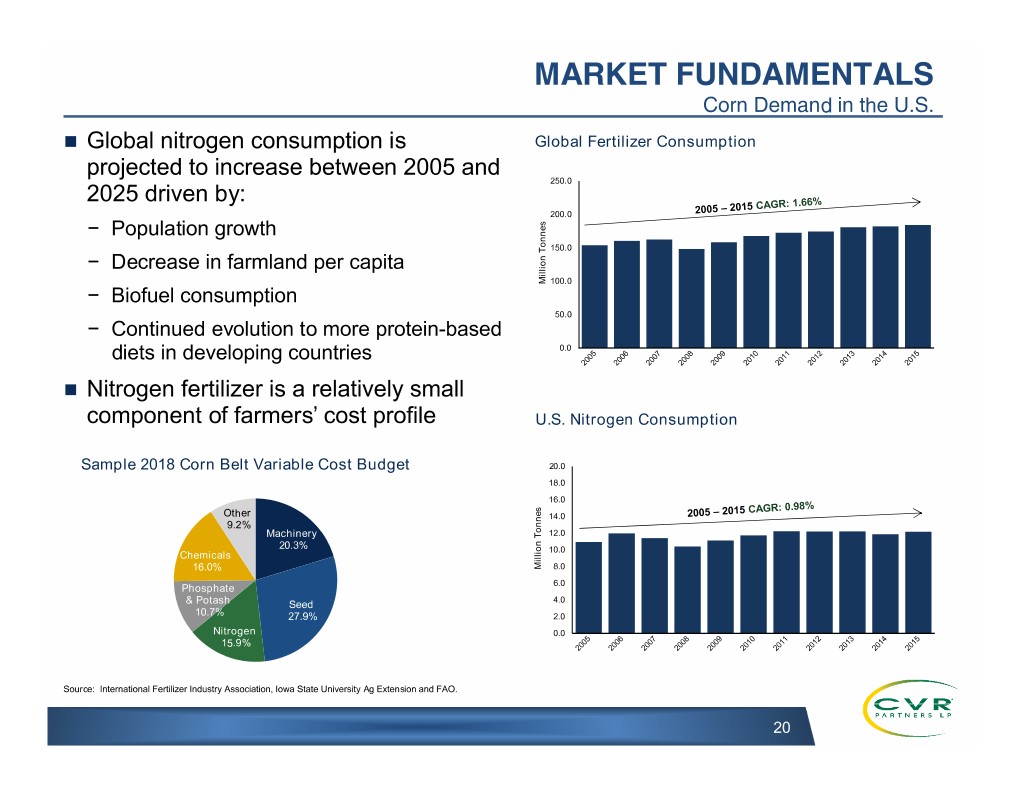

MARKET FUNDAMENTALS Corn Demand in the U.S. Global nitrogen consumption is Global Fertilizer Consumption projected to increase between 2005 and 250.0 2025 driven by: 200.0 − Population growth 150.0 − Decrease in farmland per capita Million Tonnes 100.0 − Biofuel consumption 50.0 − Continued evolution to more protein-based diets in developing countries 0.0 Nitrogen fertilizer is a relatively small component of farmers’ cost profile U.S. Nitrogen Consumption Sample 2018 Corn Belt Variable Cost Budget 20.0 18.0 16.0 Other 14.0 9.2% Machinery 12.0 20.3% 10.0 Chemicals 16.0% Million Tonnes 8.0 6.0 Phosphate & Potash Seed 4.0 10.7% 27.9% 2.0 Nitrogen 0.0 15.9% Source: International Fertilizer Industry Association, Iowa State University Ag Extension and FAO. 20

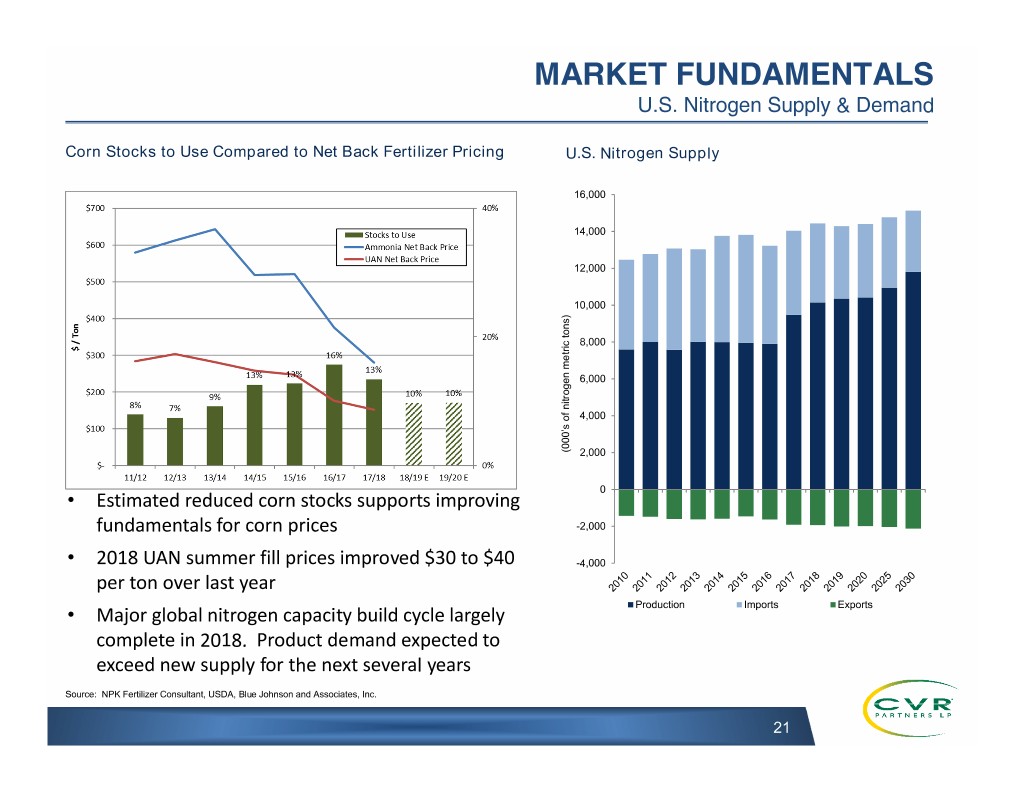

MARKET FUNDAMENTALS U.S. Nitrogen Supply & Demand Corn Stocks to Use Compared to Net Back Fertilizer Pricing U.S. Nitrogen Supply 16,000 14,000 12,000 10,000 8,000 6,000 4,000 (000’s of nitrogen tons) metric 2,000 0 • Estimated reduced corn stocks supports improving fundamentals for corn prices -2,000 • 2018 UAN summer fill prices improved $30 to $40 -4,000 per ton over last year Production Imports Exports • Major global nitrogen capacity build cycle largely complete in 2018. Product demand expected to exceed new supply for the next several years Source: NPK Fertilizer Consultant, USDA, Blue Johnson and Associates, Inc. 21

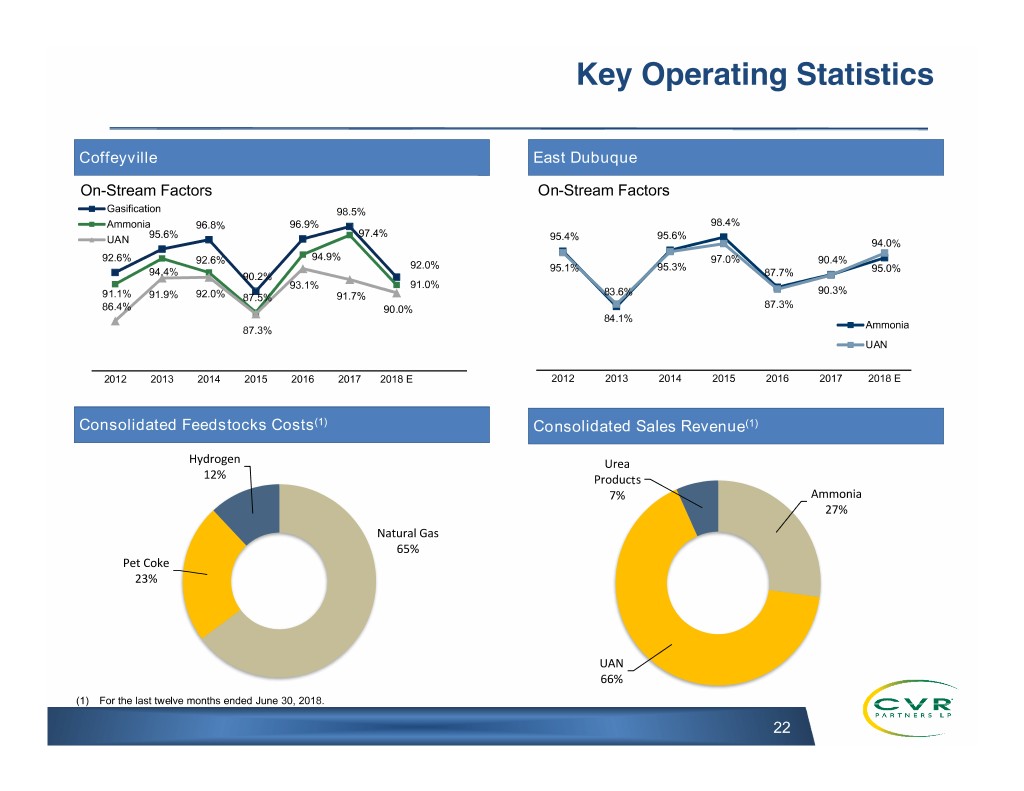

Key Operating Statistics Coffeyville East Dubuque On-Stream Factors On-Stream Factors Gasification 98.5% Ammonia 96.8% 96.9% 98.4% 95.6% 97.4% 95.4% 95.6% UAN 94.0% 92.6% 92.6% 94.9% 97.0% 90.4% 92.0% 95.1% 95.3% 95.0% 94.4% 90.2% 87.7% 93.1% 91.0% 83.6% 90.3% 91.1% 91.9% 92.0% 87.5% 91.7% 86.4% 90.0% 87.3% 84.1% Ammonia 87.3% UAN 2012 2013 2014 2015 2016 2017 2018 E 2012 2013 2014 2015 2016 2017 2018 E Consolidated Feedstocks Costs(1) Consolidated Sales Revenue(1) Hydrogen Urea 12% Products 7% Ammonia 27% Natural Gas 65% Pet Coke 23% UAN 66% (1) For the last twelve months ended June 30, 2018. 22

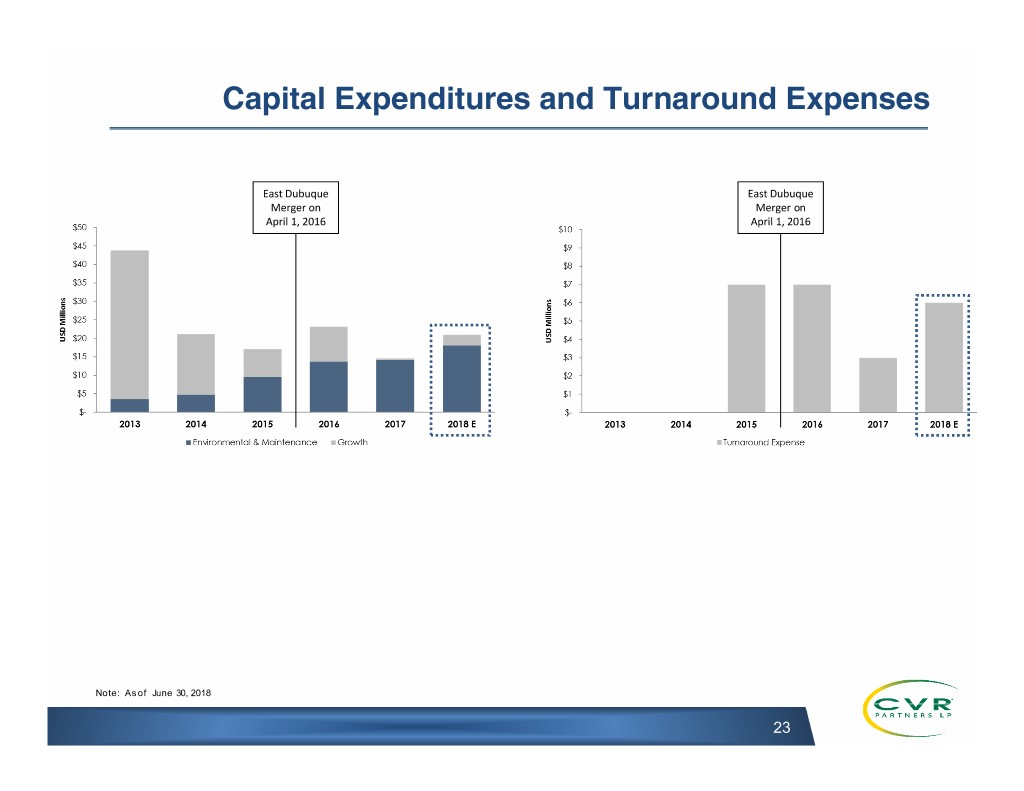

Capital Expenditures and Turnaround Expenses East Dubuque East Dubuque Merger on Merger on April 1, 2016 April 1, 2016 Note: As of June 30, 2018 23

APPENDIX

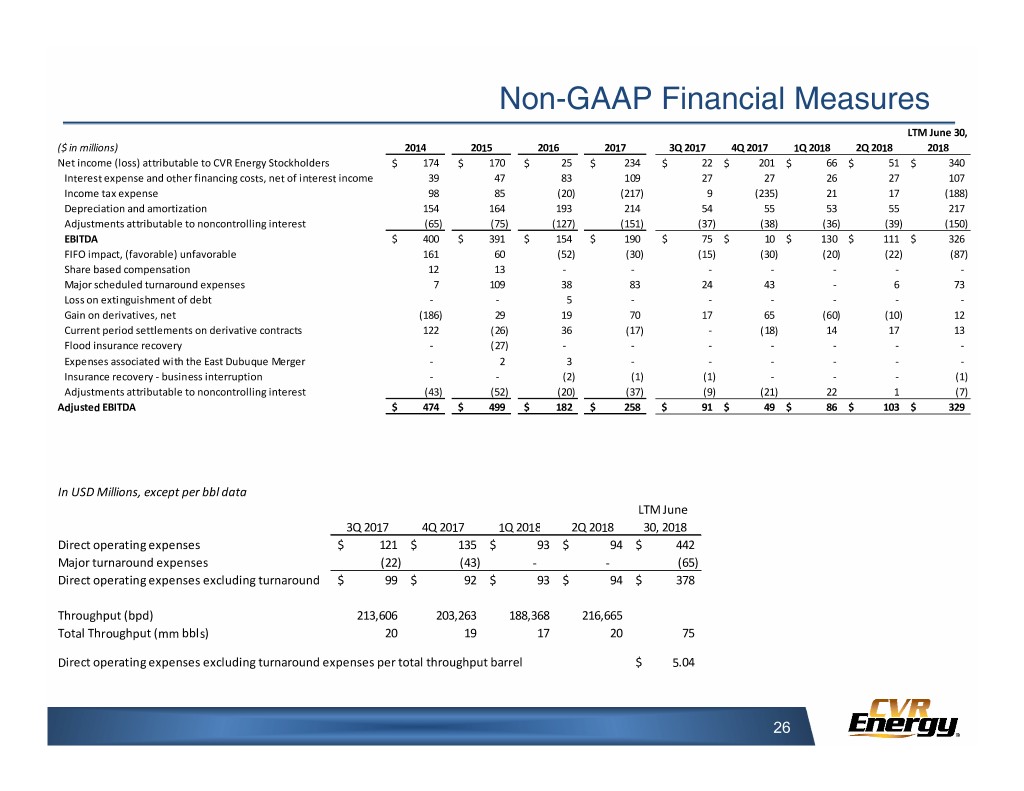

Non-GAAP Financial Measures EBITDA represents net income (loss) attributable to CVR Energy stockholders before consolidated (i) interest expense and other financing costs, net of interest income; (ii) income tax expense (benefit); and (iii) depreciation and amortization, less the portion of these adjustments attributable to noncontrolling interest. Adjusted EBITDA represents EBITDA adjusted for consolidated (i) FIFO impact (favorable) unfavorable; (ii) major turnaround expenses (that many of our competitors capitalize and thereby exclude from their measures of EBITDA and adjusted EBITDA); (iii) (gain) loss on derivatives, net; and (iv) current period settlements on derivative contracts. EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be substituted for net income (loss) or cash flow from operations. We believe that EBITDA and Adjusted EBITDA enable investors to better understand and evaluate our ongoing operating results and allow for greater transparency in reviewing our overall financial, operational and economic performance. EBITDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define these terms differently. EBITDA and Adjusted EBITDA represent EBITDA and Adjusted EBITDA that is attributable to CVR Energy stockholders. Direct operating expenses, excluding major turnaround expenses, per total throughput barrel. For both refining margin and refining margin adjusted for FIFO impact, we present these measures on a per total throughput barrel basis. In order to calculate these non-GAAP operating metrics, we utilize the total dollar figures for refining margin and refining margin adjusted for FIFO impact, as derived above and divide by the applicable number of total throughput barrels for the period. 25

Non-GAAP Financial Measures LTM June 30, ($ in millions) 2014 2015 2016 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 2018 Net income (loss) attributable to CVR Energy Stockholders$ 174 $ 170 $ 25 $ 234 $ 22 $ 201 $ 66 $ 51 $ 340 Interest expense and other financing costs, net of interest income 39 47 83 109 27 27 26 27 107 Income tax expense 98 85 (20) (217) 9 (235) 21 17 (188) Depreciation and amortization 154 164 193 214 54 55 53 55 217 Adjustments attributable to noncontrolling interest (65) (75) (127) (151) (37) (38) (36) (39) (150) EBITDA $ 400 $ 391 $ 154 $ 190 $ 75 $ 10 $ 130 $ 111 $ 326 FIFO impact, (favorable) unfavorable 161 60 (52) (30) (15) (30) (20) (22) (87) Share based compensation 12 13 ‐ ‐ ‐ ‐ ‐ ‐ ‐ Major scheduled turnaround expenses 7 109 38 83 24 43 ‐ 6 73 Loss on extinguishment of debt ‐ ‐ 5 ‐ ‐ ‐ ‐ ‐ ‐ Gain on derivatives, net (186) 29 19 70 17 65 (60) (10) 12 Current period settlements on derivative contracts 122 (26) 36 (17) ‐ (18) 14 17 13 Flood insurance recovery ‐ (27) ‐ ‐ ‐ ‐ ‐ ‐ ‐ Expenses associated with the East Dubuque Merger ‐ 2 3 ‐ ‐ ‐ ‐ ‐ ‐ Insurance recovery ‐ business interruption ‐ ‐ (2) (1) (1) ‐ ‐ ‐ (1) Adjustments attributable to noncontrolling interest (43) (52) (20) (37) (9) (21) 22 1 (7) Adjusted EBITDA$ 474 $ 499 $ 182 $ 258 $ 91 $ 49 $ 86 $ 103 $ 329 In USD Millions, except per bbl data LTM June 3Q 2017 4Q 2017 1Q 2018 2Q 2018 30, 2018 Direct operating expenses$ 121 $ 135 $ 93 $ 94 $ 442 Major turnaround expenses (22) (43) ‐ ‐ (65) Direct operating expenses excluding turnaround$ 99 $ 92 $ 93 $ 94 $ 378 Throughput (bpd) 213,606 203,263 188,368 216,665 Total Throughput (mm bbls) 20 19 17 20 75 Direct operating expenses excluding turnaround expenses per total throughput barrel$ 5.04 26

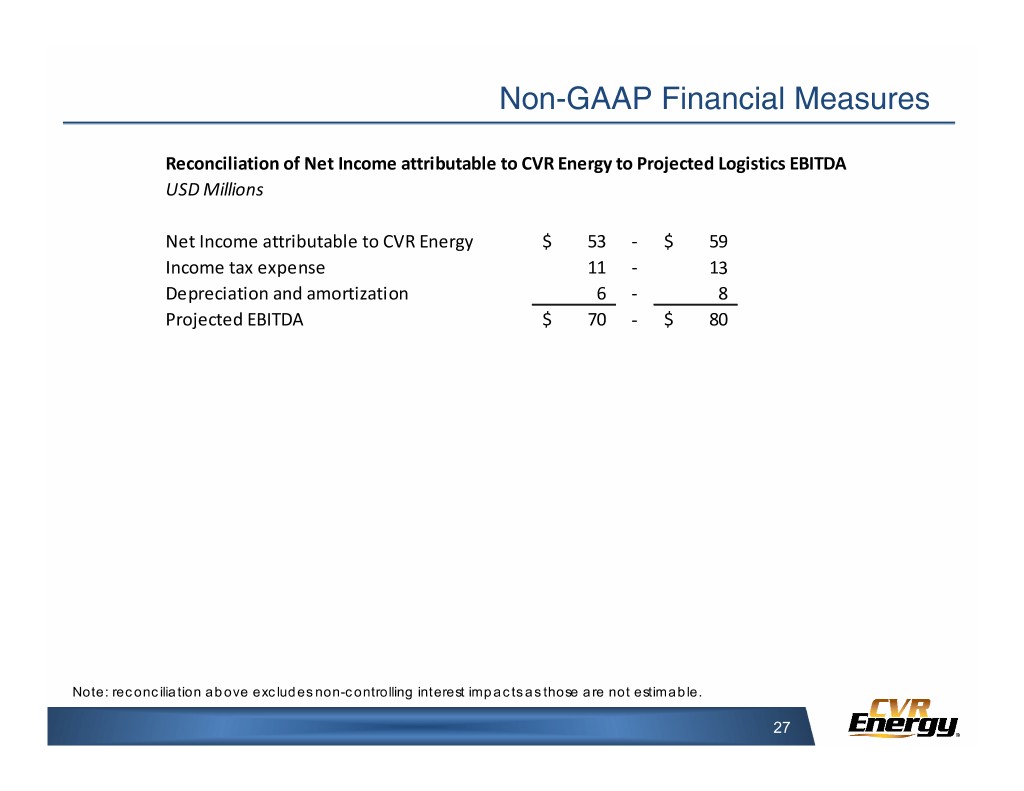

Non-GAAP Financial Measures Reconciliation of Net Income attributable to CVR Energy to Projected Logistics EBITDA USD Millions Net Income attributable to CVR Energy$ 53 ‐ $ 59 Income tax expense 11 ‐ 13 Depreciation and amortization 6 ‐ 8 Projected EBITDA$ 70 ‐ $ 80 Note: reconciliation above excludes non-controlling interest impacts as those are not estimable. 27

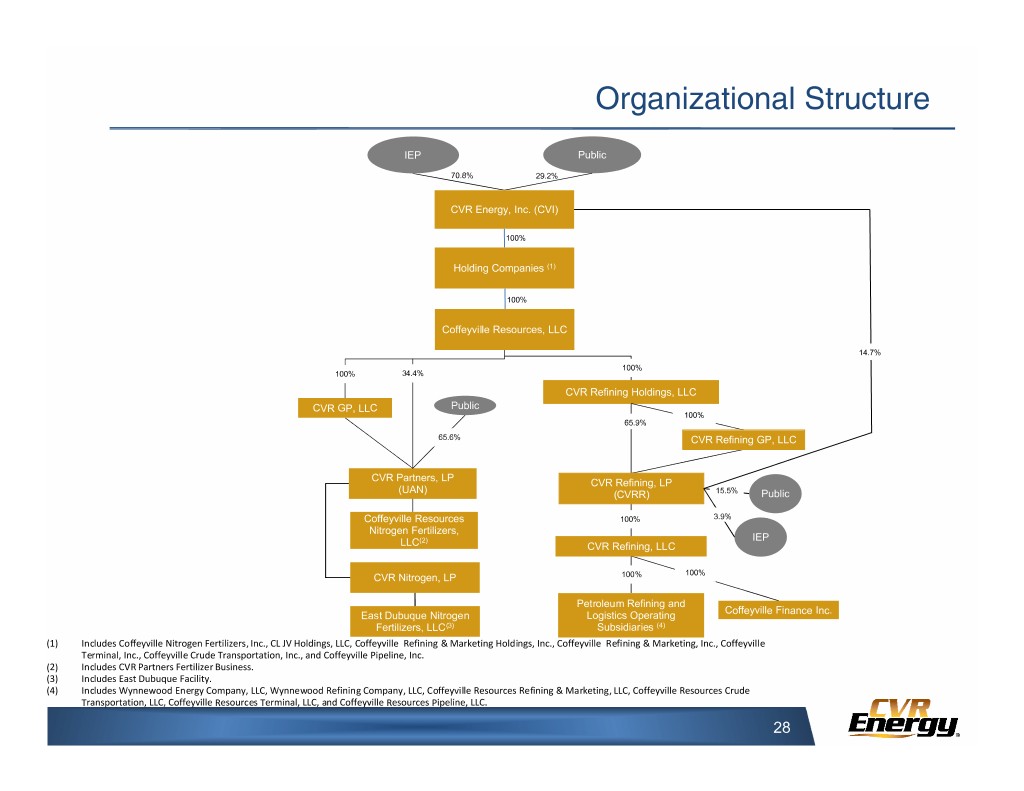

Organizational Structure IEP Public 70.8% 29.2% CVR Energy, Inc. (CVI) 100% Holding Companies (1) 100% Coffeyville Resources, LLC 14.7% 100% 100% 34.4% CVR Refining Holdings, LLC CVR GP, LLC Public 100% 65.9% 65.6% CVR Refining GP, LLC CVR Partners, LP CVR Refining, LP (UAN) (CVRR) 15.5% Public Coffeyville Resources 100% 3.9% Nitrogen Fertilizers, (2) IEP LLC CVR Refining, LLC CVR Nitrogen, LP 100% 100% Petroleum Refining and Coffeyville Finance Inc. East Dubuque Nitrogen Logistics Operating Fertilizers, LLC(3) Subsidiaries (4) (1) Includes Coffeyville Nitrogen Fertilizers, Inc., CL JV Holdings, LLC, Coffeyville Refining & Marketing Holdings, Inc., Coffeyville Refining & Marketing, Inc., Coffeyville Terminal, Inc., Coffeyville Crude Transportation, Inc., and Coffeyville Pipeline, Inc. (2) Includes CVR Partners Fertilizer Business. (3) Includes East Dubuque Facility. (4) Includes Wynnewood Energy Company, LLC, Wynnewood Refining Company, LLC, Coffeyville Resources Refining & Marketing, LLC, Coffeyville Resources Crude Transportation, LLC, Coffeyville Resources Terminal, LLC, and Coffeyville Resources Pipeline, LLC. 28