Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - COCA COLA CO | a18-24104_1ex99d1.htm |

| 8-K - 8-K - COCA COLA CO | a18-24104_18k.htm |

2 FORWARD-LOOKING STATEMENTS This presentation may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “plan,” “seek” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from The Coca-Cola Company’s historical experience and our present expectations or projections. These risks include, but are not limited to, obesity and other health-related concerns; water scarcity and poor quality; evolving consumer preferences; increased competition; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non-nutritive sweeteners and biotechnology-derived substances, and of other substances present in our beverage products or packaging materials; an inability to be successful in our innovation activities; increased demand for food products and decreased agricultural productivity; an inability to protect our information systems against service interruption, misappropriation of data or breaches of security; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging and developing markets; fluctuations in foreign currency exchange rates; interest rate increases; an inability to maintain good relationships with our bottling partners; a deterioration in our bottling partners' financial condition; increases in income tax rates, changes in income tax laws or unfavorable resolution of tax matters; increased or new indirect taxes in the United States and throughout the world; failure to realize the economic benefits from or an inability to successfully manage the possible negative consequences of our productivity initiatives; inability to attract or retain a highly skilled and diverse workforce; increased cost, disruption of supply or shortage of energy or fuels; increased cost, disruption of supply or shortage of ingredients, other raw materials, packaging materials, aluminum cans and other containers; changes in laws and regulations relating to beverage containers and packaging; significant additional labeling or warning requirements or limitations on the marketing or sale of our products; unfavorable general economic conditions in the United States; unfavorable economic and political conditions in international markets; litigation or legal proceedings; failure to adequately protect, or disputes relating to, trademarks, formulae and other intellectual property rights; adverse weather conditions; climate change; damage to our brand image or corporate reputation from negative publicity, even if unwarranted, related to product safety or quality, human and workplace rights, obesity or other issues; changes in, or failure to comply with, the laws and regulations applicable to our products or our business operations; changes in accounting standards; an inability to achieve our overall long-term growth objectives; deterioration of global credit market conditions; default by or failure of one or more of our counterparty financial institutions; an inability to renew collective bargaining agreements on satisfactory terms, or we or our bottling partners experience strikes, work stoppages or labor unrest; future impairment charges; multi-employer pension plan withdrawal liabilities in the future; an inability to successfully integrate and manage our company-owned or -controlled bottling operations or other acquired businesses or brands; an inability to successfully manage our refranchising activities; failure to realize a significant portion of the anticipated benefits of our strategic relationship with Monster; global or regional catastrophic events; risks and uncertainties relating to the transaction, including the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected, which could result in additional demands on our resources, systems, procedures and controls, disruption of our ongoing business and diversion of management’s attention from other business concerns; the possibility that certain assumptions with respect to Costa or the transaction could prove to be inaccurate; the failure to receive, delays in the receipt of, or unacceptable or burdensome conditions imposed in connection with, all required regulatory approvals and the satisfaction of the closing conditions to the transaction; the potential failure to retain key employees as a result of the proposed transaction or during integration of the businesses and disruptions resulting from the proposed transaction, making it more difficult to maintain business relationships; the response of customers, policyholders, brokers, service providers, business partners and regulators to the announcement of the transaction and other risks discussed in our company’s filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2017 and our subsequently filed Quarterly Reports on Form 10-Q, which filings are available from the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Coca-Cola Company can give no assurance that the expectations expressed or implied in the forward-looking statements contained herein will be attained and undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. NON-GAAP MEASURES This presentation contains disclosure of the EBITDA, or underlying earnings before interest, tax, depreciation and amortization, excluding income from joint ventures, and revenue of Costa for the fiscal year 2018 (ending March 1, 2018), which may be deemed to be non-GAAP financial measures within the meaning of Regulation G promulgated by the SEC. Costa uses a range of measures to monitor its financial performance, which include both statutory measures in accordance with International Financial Reporting Standards ("IFRS") and alternative performance measures which are consistent with the way that business performance is measured internally and which are believed to provide both management and investors with useful additional information about the financial performance of Costa’s business. Underlying measures of profitability represent the equivalent IFRS measures adjusted for specific items that Costa considers relevant for comparison of the financial performance of Costa's business either from one period to another or with other similar businesses. Costa's calculation of EBITDA for the 52 weeks ended March 1, 2018, is as follows: The above unaudited historical financial information relating to Costa has been extracted without material adjustment from Whitbread PLC’s consolidated financial statements for the financial year ended March 1, 2018. EBITDA is not an earnings measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP; accordingly, EBITDA may not be comparable to similar measures presented by other companies. EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, cash flows, revenue, or other measures of financial performance prepared in accordance with GAAP. EBITDA is not a completely representative measure of either the historical performance or, necessarily, the future potential of Costa. £m Underlying profit before tax 158.3 Income from joint ventures (0.2) Net finance revenue 0.6 Underlying depreciation and amortization 79.5 Underlying EBITDA 238.2

THE AGENDA FOR TODAY 3 Strategic Context Value Creation Potential Transaction Overview Next Steps

THE ACQUISITION OF COSTA PROVIDES A COMPELLING STRATEGIC RATIONALE Coffee is significant, on-trend, fast-growing and profitable Costa has a strong consumer proposition Scalable coffee platform to engage with consumers across multiple formats and channels Opportunity for value creation via Costa’s capabilities and Coca-Cola’s marketing expertise and global reach 4

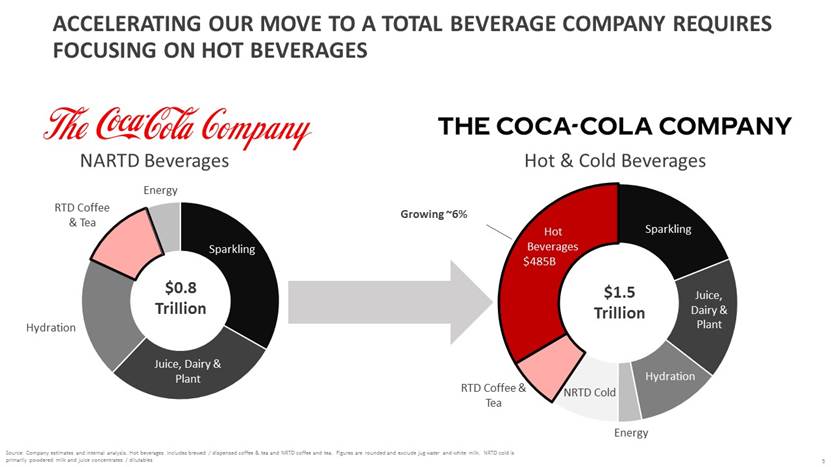

ACCELERATING OUR MOVE TO A TOTAL BEVERAGE COMPANY REQUIRES FOCUSING ON HOT BEVERAGES 5 Source: Company estimates and internal analysis. Hot beverages includes brewed / dispensed coffee & tea and NRTD coffee and tea. Figures are rounded and exclude jug water and white milk. NRTD cold is primarily powdered milk and juice concentrates / dilutables $0.8 Trillion $1.5 Trillion $485B Energy Growing ~6% Sparkling Juice, Dairy & Plant Hydration RTD Coffee & Tea Energy NARTD Beverages Sparkling Juice, Dairy & Plant Hydration NRTD Cold RTD Coffee & Tea Hot Beverages Hot & Cold Beverages

NRTD ~$125B Coffee Shops 20% Out of Home ~$360B Other Out of Home 80% RTD ~$85B WE HAVE BEEN COMPETING AND LEADING ONLY IN THE SMALLEST SEGMENT WITHIN THE HALF TRILLION DOLLAR GLOBAL COFFEE & TEA INDUSTRY * Hot & Cold, Includes other hot Source: RTD & Other OOH Brewed/Dispensed = Company estimates; NRTD = Euromonitor; Coffee Shops = Euromonitor GLOBAL COFFEE & TEA* ~$570B TCCC Market Share <1% ~15% 6 <1%

COSTA: A PROFITABLE BUSINESS WITH SCALE IN THE UK AND ATTRACTIVE GROWTH AREAS Multi-National Coffeehouse Based in the UK UK Stores $1.2B Sales 2,422 outlets International $210MM Sales 1,399 Stores 989 Express Machines UK Express $275MM Sales 7,248 Machines $1.7B Sales / $312MM EBITDA Retail Presence in 30+ Markets 3,821 Stores Increasing Sales Across Three Streams 12.5% CAGR Note: Total Costa EBITDA includes central costs of $52 million. £1.31 per US$ exchange rate Source: Whitbread PLC 7 *UK Costa Express not disclosed prior to 2017. Others 16 Markets Europe 14 Markets China UK 63% 12% 12% 13% Stores Mix (2018, % Excludes Express ) $928 $1,099 $1,279 $1,148 $1,207 $233 $275 $130 $148 $166 $194 $210 2014* 2015* 2016* 2017 2018 Revenue Trends ($MM) UK Stores UK Express Machines International

OUR VISION IS TO CREATE A WORLD CLASS LEADING COFFEE BUSINESS STARTS WITH DELIVERING THE BEST COFFEE, ACROSS WIDE-REACHING FORMATS USE STORES FOR BRAND-BUILDING LEVERAGE COCA-COLA’S MARKETING EXPERTISE AND GLOBAL REACH 8

THE COSTA ECOSYSTEM PROVIDES THE EDGE REQUIRED TO BUILD A GLOBAL LEADERSHIP POSITION IN COFFEE COFFEE EXPERTISE Sourcing, roasting Coffee Express (fresh beans, fresh milk) HOT CAPABILITY Perfect serve Temperature management Equipment & supplies RETAIL FOOTPRINT Second-largest coffee house in the world Format breadth Location scouting, management UK LEADERSHIP #1 in UK 35%+ share of coffee houses 10% top-line growth Growing international footprint EXPERIENCE-LED BRAND BUILDING Exceptional quality 5MM+ Costa Coffee Club members BRAND CREDENTIALS Strong heritage, European / Italian roots Unique mocha Italia blend Credibility to leverage with customers globally 9

Launch the brand in both ready-to-drink and at-home consumption products globally Capitalize on consumers’ preference for ‘third place’ experiences by enhancing the attributes of Costa coffee Leverage current Coffee Club membership base to build / expand our direct-to-consumer digital marketing capabilities BUILDING A GLOBAL COFFEE BUSINESS THROUGH MULTIPLE AVENUES Use Retail to Build Brand & Experience Expand Consumption Occasions (Cold Hot) Leverage Costa’s coffee supply chain capabilities to provide total beverage solutions to customers Multiple retail solutions available – Costa Express, beans, roast & ground, other Provide Total Beverage Solutions to Customers 10

USE THE RETAIL PRESENCE STRATEGICALLY TO BUILD THE BRAND AND EXPERIENCE Real-Time Ritual Building Lab for Understanding Consumers and Testing Innovation Reinforce Brand Reputation (e.g. crafting, sustainability) Source of Cash Flow for Reinvestment 11

COSTA PROVIDES A PLATFORM TO REIMAGINE OUR BEVERAGE SOLUTIONS FOR CHANNELS AND CUSTOMERS Leverage System’s Capabilities to Expand Total Beverage Solutions Convenience Stores, Cinemas, @Work, Transit Hotels, Cafes, Restaurants, Fine Dining Food Service Chains Vending Total Beverage Solutions Beans and Machines Sourcing and Roasting Modern Roasting Facility with Capacity Strong Sourcing Capabilities + 12 +

EXPAND INTO NEW CONSUMPTION OCCASIONS Energize Launch Globally as a Cold Hot RTD Coffee Brand, Extend Rapidly to New Formats & Products 13 Positioning Expand Cold RTD Coffee Launch Hot RTD Coffee @Home Solutions Portfolio Consumer Insights Marketing Capabilities to Define Brand Edge Launch in New Geographies Innovate in Hot RTD Packs Expand Beans, Roast & Ground, Pods & Others Potential to Extend to Hot Tea & Cocoa

TRANSACTION DETAILS Acquire all the issued and outstanding shares of Costa Limited, a wholly owned subsidiary of Whitbread Purchase price of £3.9 billion or $5.1 billion* (16.4x 2018 EBITDA) Expected to be slightly accretive to earnings in first full year Funded with existing cash on hand Net Debt Leverage** expected to increase 0.3x post-closing *Assumes GBP/US exchange rate of 1.31 **Non-GAAP, defined as net debt divided by trailing twelve month EBITDA. Net debt is calculated by subtracting total cash, cash equivalents and marketable securities from gross debt. 14

NEXT STEPS Whitbread to obtain shareholder approval, expected by end of October File required anti-trust documents for EU and China Transaction expected to close in the first half of 2019 15

Unlocks entrance into fast-growing, half trillion dollar beverage segment Costa is a strong brand with great-tasting coffee Costa has a platform that crosses multiple formats and channels Opportunity for value creation via Costa’s brand capabilities and Coca-Cola’s marketing expertise and global reach 16

APPENDIX

COSTA BY THE NUMBERS (2018) 23.5 million customers each month ~8,200 Costa Express vending machines across multiple countries ~3,800 stores in 32 countries 51% equity / owned / JVs 49% franchised >60% of stores in UK Voted U.K.’s favorite coffee shop for 8 consecutive years Preferred 2.8x vs. Starbucks in the UK >16,000 employees 5.4 million active Costa club members (loyalty program) ~40% of UK sales to Costa club members >1.7 million active Costa app users Source: Whitbread PLC 18

RETAIL COFFEE SHOP STORE FOOTPRINT PROVIDES BRAND BUILDING & FLAGSHIP STORE OPPORTUNITY UK 2,422 China449 Ireland 112 Poland 144 UK China Europe MEA Total Markets 1 1 14 16 32 Total Stores 2,422 449 472 478 3,821 UAE 147 3,821 Stores Across 32 Countries Source: Whitbread PLC 19

ROASTERY PROVIDES BEST IN CLASS SUPPLY CHAIN CAPABILITIES All Costa coffee sold globally* is roasted in a single, new roasting facility in the UK Expert coffee blenders and coffee tasters Production capacity offers ability to expand New packing lines being added to provide retail packs CSR credentials: first industrial processing building to BREEAM Outstanding to the latest 2014 standards. Sourcing All coffee sourced from Rainforest Alliance certified growers Sourced from highest quality beans across 10 countries Communities supported by Costa Foundation Coffee beans acquired to specs by brokers *Excluding India Source: Whitbread PLC 20