Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PAR PACIFIC HOLDINGS, INC. | d618214dex991.htm |

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | d618214d8k.htm |

Hawaii Business Expansion August 2018 Exhibit 99.2

Forward-Looking Statements / Disclaimers The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation constitute forward-‐looking statements. Such forward-looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results implied or expressed in such forward-‐looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including, without limitation, estimates and assumptions related to our anticipated DHT project, anticipated potential benefits from IMO 2020, our anticipated hiring plan associated with the Hawaii business expansion transaction with IES, assumptions regarding contracts related to the Hawaii business expansion transaction with IES, assumptions related to IES’ anticipated use of assets not being sold in the Hawaii business expansion transaction with IES, our ability to finance and to close the Hawaii business expansion transaction with IES and the timing of any such closing, estimates and assumptions related to the financial and operational impact of the Hawaii business expansion transaction with IES, including anticipated capital expenditures, provision of working capital, and synergies and other benefits related to the acquisition, and anticipated financial and operating results of the acquired assets and their effect on the company’s operating metrics, earnings profile, cash flows and profitability (including Adjusted EBITDA, free cash flow and Adjusted earnings per share), and other known and unknown risks (all of which are difficult to predict and many of which are beyond the company's control), some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions with respect to future business decisions that are subject to change. There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Recipients are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

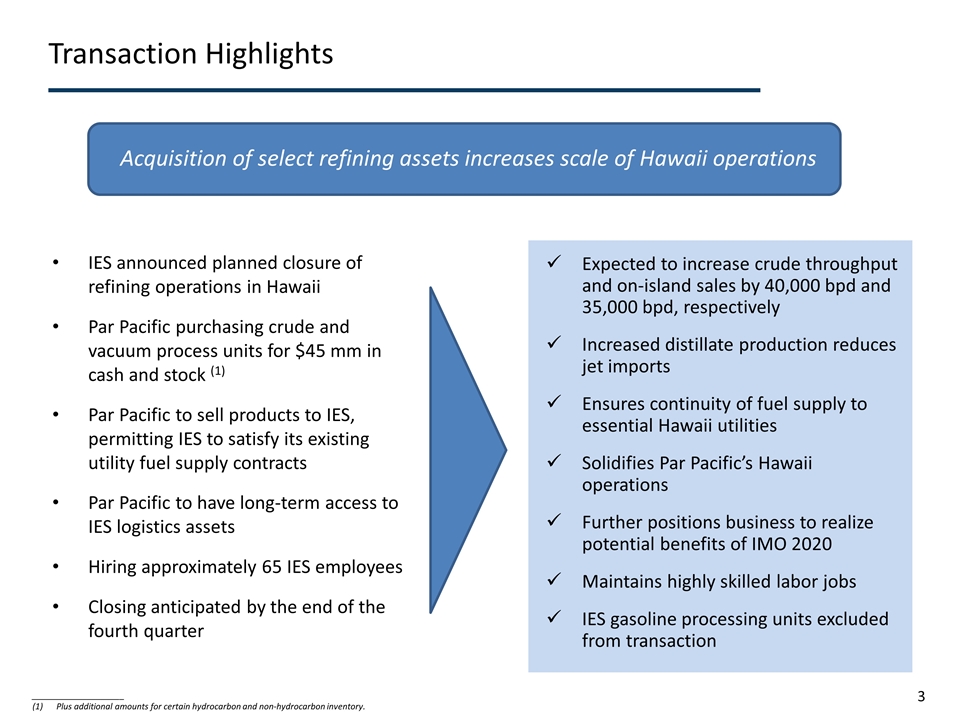

IES announced planned closure of refining operations in Hawaii Par Pacific purchasing crude and vacuum process units for $45 mm in cash and stock (1) Par Pacific to sell products to IES, permitting IES to satisfy its existing utility fuel supply contracts Par Pacific to have long-term access to IES logistics assets Hiring approximately 65 IES employees Closing anticipated by the end of the fourth quarter Expected to increase crude throughput and on-island sales by 40,000 bpd and 35,000 bpd, respectively Increased distillate production reduces jet imports Ensures continuity of fuel supply to essential Hawaii utilities Solidifies Par Pacific’s Hawaii operations Further positions business to realize potential benefits of IMO 2020 Maintains highly skilled labor jobs IES gasoline processing units excluded from transaction Transaction Highlights Acquisition of select refining assets increases scale of Hawaii operations ____________________ Plus additional amounts for certain hydrocarbon and non-hydrocarbon inventory.

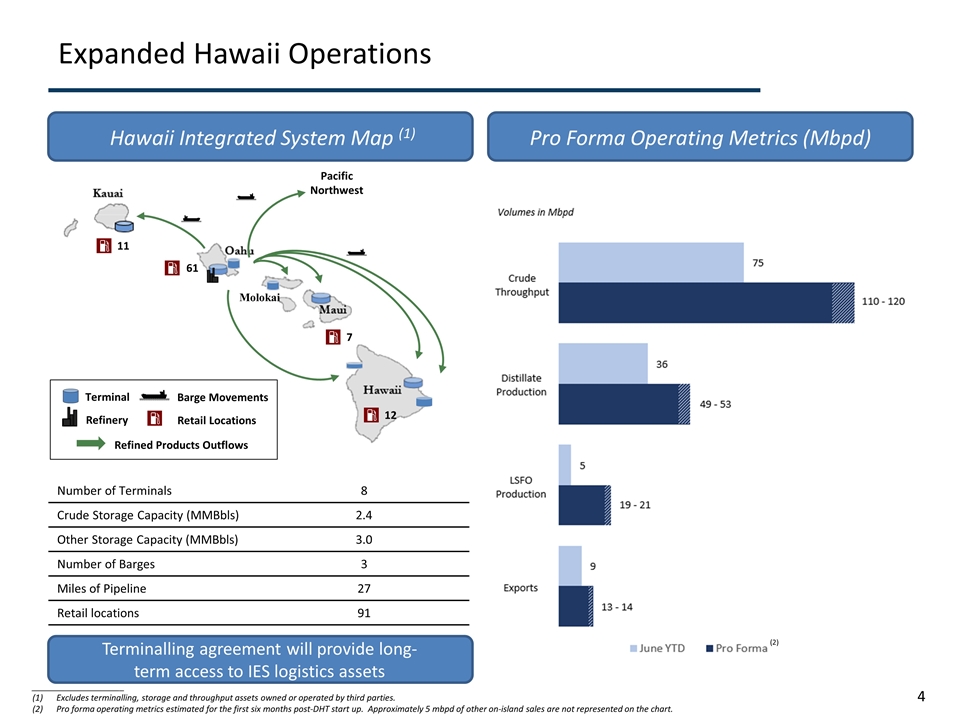

Expanded Hawaii Operations Pro Forma Operating Metrics (Mbpd) Number of Terminals 8 Crude Storage Capacity (MMBbls) 2.4 Other Storage Capacity (MMBbls) 3.0 Number of Barges 3 Miles of Pipeline 27 Retail locations 91 Refinery Terminal Barge Movements Refined Products Outflows Pacific Northwest Retail Locations 11 61 7 12 ____________________ Excludes terminalling, storage and throughput assets owned or operated by third parties. Pro forma operating metrics estimated for the first six months post-DHT start up. Approximately 5 mbpd of other on-island sales are not represented on the chart. Hawaii Integrated System Map (1) Molokai Terminalling agreement will provide long-term access to IES logistics assets (2)

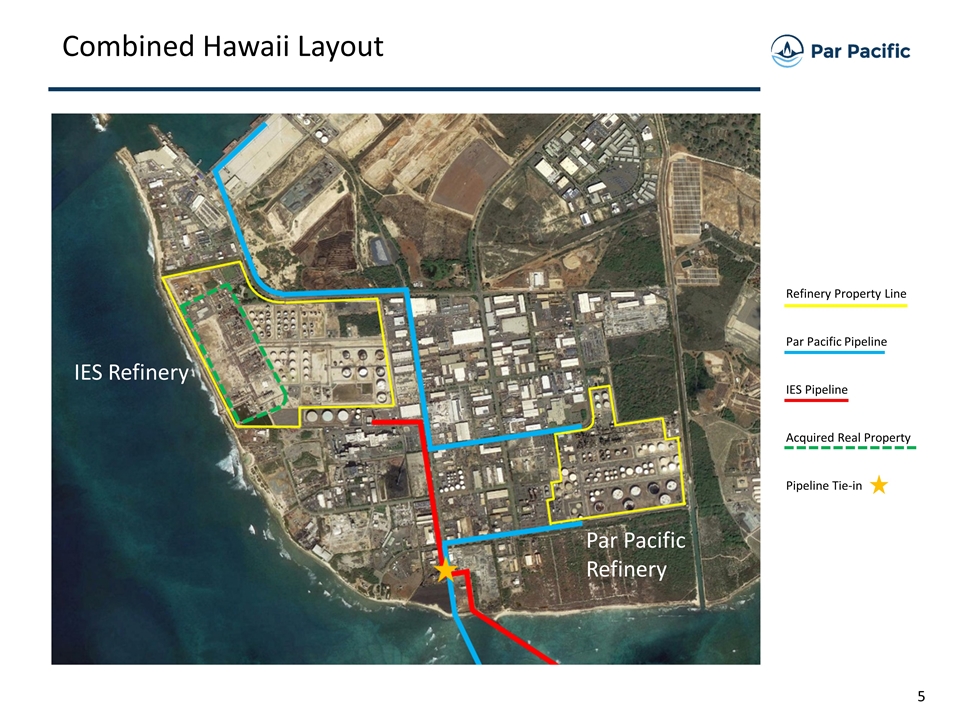

Refinery Property Line Par Pacific Pipeline IES Pipeline Acquired Real Property Pipeline Tie-in Combined Hawaii Layout Par Pacific Refinery \ IES Refinery

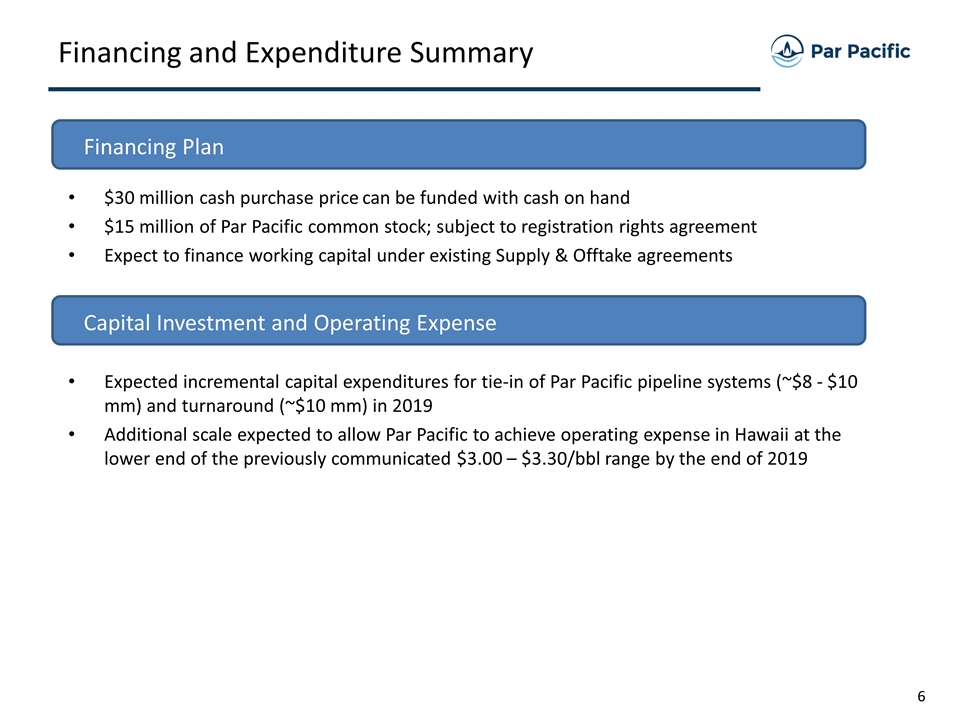

Financing and Expenditure Summary $30 million cash purchase price can be funded with cash on hand $15 million of Par Pacific common stock; subject to registration rights agreement Expect to finance working capital under existing Supply & Offtake agreements Financing Plan Capital Investment and Operating Expense Expected incremental capital expenditures for tie-in of Par Pacific pipeline systems (~$8 - $10 mm) and turnaround (~$10 mm) in 2019 Additional scale expected to allow Par Pacific to achieve operating expense in Hawaii at the lower end of the previously communicated $3.00 – $3.30/bbl range by the end of 2019