Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - MEI Pharma, Inc. | d533269dex321.htm |

| EX-31.2 - EX-31.2 - MEI Pharma, Inc. | d533269dex312.htm |

| EX-31.1 - EX-31.1 - MEI Pharma, Inc. | d533269dex311.htm |

| EX-23.1 - EX-23.1 - MEI Pharma, Inc. | d533269dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 000-50484

MEI Pharma, Inc.

(Exact name of registrant as specified in its charter)

| DELAWARE | 51-0407811 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3611 Valley Centre Drive, Suite 500, San Diego, CA 92130

(Address of principal executive offices) (Zip Code)

(858) 369-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.00000002 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

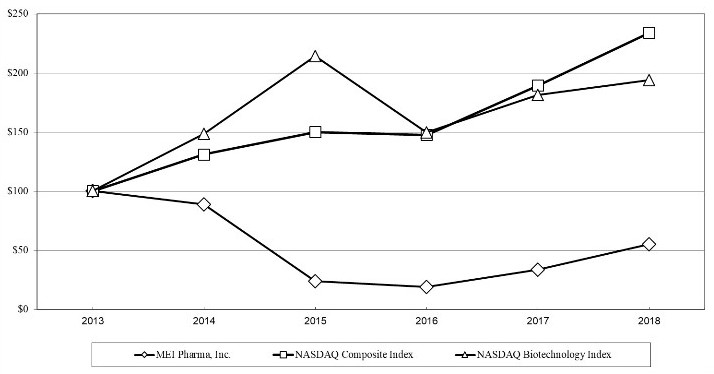

The aggregate market value of the voting common equity held by non-affiliates of the registrant was approximately $77.7 million as of December 31, 2017, based on the closing price of the registrant’s Common Stock as reported on the NASDAQ Capital Market on such date. For purposes of this calculation, shares of the registrant’s common stock held by directors and executive officers have been excluded. This number is provided only for purposes of this Annual Report on Form 10-K and does not represent an admission that any particular person or entity is an affiliate of the registrant.

As of August 27, 2018, there were 71,086,404 shares of the registrant’s common stock, par value $0.00000002 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report on Form 10-K is incorporated by reference from the registrant’s definitive proxy statement for the annual meeting of stockholders to be held in November 2018, which will be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year ended June 30, 2018.

Table of Contents

MEI PHARMA, INC.

2

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K, or Annual Report, includes forward-looking statements, which involve a number of risks and uncertainties. These forward-looking statements can generally be identified as such because the context of the statement will include words such as “may,” “will,” “intend,” “plan,” “believe,” “anticipate,” “expect,” “estimate,” “predict,” “potential,” “continue,” “likely,” or “opportunity,” the negative of these words or other similar words. Similarly, statements that describe our future plans, strategies, intentions, expectations, objectives, goals or prospects and other statements that are not historical facts are also forward-looking statements. Discussions containing these forward-looking statements may be found, among other places, in “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report. For such statements, we claim the protection of the Private Securities Litigation Reform Act of 1995. Readers of this Annual Report are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the time this Annual Report was filed with the Securities and Exchange Commission, or SEC. These forward-looking statements are based largely on our expectations and projections about future events and future trends affecting our business, and are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. These risks and uncertainties include, without limitation, those discussed in “Risk Factors” and in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. In addition, past financial or operating performance is not necessarily a reliable indicator of future performance, and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law, we undertake no obligation to update publicly or revise our forward-looking statements to reflect events or circumstances that arise after the filing of this Annual Report or documents incorporated by reference herein that include forward-looking statements.

Unless the context requires otherwise, references in this Annual Report to “MEI Pharma,” “we,” “us” and “our” refer to MEI Pharma, Inc.

MEI Pharma, Inc. and our corporate logo are registered service marks of MEI Pharma. Any other brand names or trademarks appearing in this Annual Report are the property of their respective holders.

| Item 1. | Business |

Overview

We are a pharmaceutical company focused on leveraging our extensive development and oncology expertise to identify and advance new therapies intended to meaningfully improve the treatment of cancer. Our portfolio of drug candidates contains four clinical-stage candidates, including one candidate in an ongoing Phase 3 global registration trial and another candidate that is anticipated to advance, in the fourth calendar quarter of calendar year 2018, into a Phase 2 clinical trial that we intend to submit to the U.S. Food and Drug Administration (“FDA”) as support for accelerated approval of a marketing application. Our common stock is listed on the NASDAQ Capital Market under the symbol “MEIP”.

Our Strategy

Our focus is on developing and commercializing cancer treatments intended to effectively leverage the potential of a mechanism of action to provide increased benefit to patients. Since each of our drug candidates utilizes a different mechanism of action, we are able to approach cancer treatment through multiple pathways; this creates opportunities across various cancer indications. Our candidates are intended to demonstrate potency and safety as standalone treatments with the potential to deliver synergies in combination with existing medicines.

We emphasize efficient clinical translation of our drug candidates by implementing development paths designed to expeditiously validate therapeutic potential and clinical utility. We also prioritize efficient resource allocation, seeking to advance and commercialize drug candidates either independently or via partnership to strategically and optimally build value.

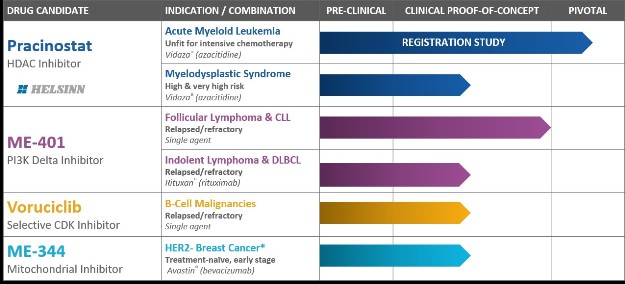

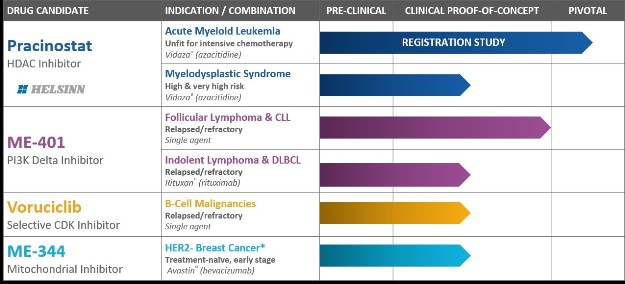

Clinical Development Programs

Cancer is an intractable and highly adaptable disease capable of evading the body’s defenses and resisting treatment to grow and spread. Despite new treatments that leverage actionable insights into cancer biology, effective treatments remain elusive and even the most cutting-edge therapies still struggle to balance potency with safety. As a result, the oncology community strives to improve on existing therapies and search for new and better options to optimize benefits for patients. This approach includes medicines that not only act alone, but also work well in combination with other therapies to deliver the best-possible outcomes.

We currently have four clinical-stage development programs with diverse approaches to inhibiting cancer, including epigenetics, cell signaling and cancer metabolism:

| • | Pracinostat, an oral histone deacetylase (“HDAC”) inhibitor; |

| • | ME-401, an oral phosphatidylinositol 3-kinase (“PI3K”) delta inhibitor; |

| • | Voruciclib, an oral cyclin-dependent kinase (“CDK”) inhibitor; and |

| • | ME-344, a mitochondrial inhibitor targeting the OXPHOS complex. |

3

Table of Contents

Each of our four clinical-stage oncology programs is in active development, one of which is in a pivotal registration clinical trial and one that is anticipated to advance, in the fourth calendar quarter of calendar year 2018, into a Phase 2 clinical trial that we intend to submit to the FDA as support for accelerated approval of a marketing application.

Pracinostat: HDAC Inhibitor Candidate in a Phase 3 Global Registration Clinical Trial

Pracinostat is an oral HDAC inhibitor being evaluated in a pivotal Phase 3 global registration clinical trial for the treatment of adults with newly diagnosed acute myeloid leukemia (“AML”) who are unfit to receive intensive chemotherapy. Pracinostat is also being evaluated in a Phase 2 study in patients with high or very high-risk myelodysplastic syndrome (“MDS”). In August 2016, we entered into an exclusive worldwide license, development, manufacturing and commercialization agreement with Helsinn Healthcare SA, a Swiss pharmaceutical corporation (“Helsinn”) for pracinostat in AML, MDS and other potential indications (the “Helsinn Agreement). As compensation for such grant of rights, we received upfront payments of $20.0 million in fiscal 2017. We are also eligible to receive up to $444 million in potential regulatory and sales-based milestones, along with royalty payments on the net sales of pracinostat, which, in the U.S., are tiered and begin in the mid-teens. Under the agreement, Helsinn is primarily responsible for funding global development and commercialization costs for pracinostat. We are responsible for conducting the Phase 2 MDS study, the cost of which will be shared equally with Helsinn.

Breakthrough Therapy Designation for pracinostat was granted by the FDA in 2016, and in January 2018 the European Medicines Agency (“EMA”) granted Orphan Drug Designation to pracinostat for the treatment of AML. The designations in the US and European Union (“EU”) are supported by data from a Phase 2 study of pracinostat plus azacitidine in elderly patients with newly diagnosed AML who are not candidates for induction chemotherapy. The study showed a median overall survival of 19.1 months and a complete remission (“CR”) rate of 42% (21 of 50 patients). These data compare favorably to an international Phase 3 study of azacitidine (AZA-001; Dombret et al. Blood. 2015 May 18), which showed a median overall survival of 10.4 months with azacitidine alone and a CR rate of 19.5% in a similar patient population. The combination of pracinostat and azacitidine was generally well tolerated, with no unexpected toxicities. The most common grade 3/4 treatment-emergent adverse events included febrile neutropenia, thrombocytopenia, anemia and fatigue.

Pracinostat Scientific Overview; Epigenetics

HDACs play a key role in epigenetic regulation of gene expression by regulating chromatin structure. Acetylation of positively charged lysine residues present in histone proteins by the histone acetyltransferase (“HATs”) reduces the affinity between histones and negatively charged DNA, resulting in the opening of the chromatin structure. This makes it easier for the transcriptional machinery to access the DNA, enhancing RNA transcription. Conversely, deacetylation by the HDACs closes the chromatin structure leading to a repression of gene transcription. In normal cells, HDACs and HATs together control histone acetylation levels to maintain a balance. In diseases such as cancer, this regulation can be disturbed. HDAC inhibitors cause accumulation of acetylated histones, enhance transcription and result in changes to a variety of cellular responses including differentiation, proliferation, migration, survival and response to metabolic and hypoxic stress. In general, tumor cells are more susceptible than normal cells to the anti-proliferative and pro-apoptotic effects of HDAC inhibitors.

There are currently three HDAC inhibitors, one oral and two injectable, approved by the FDA for the treatment of T-cell lymphoma and a fourth orally administered HDAC inhibitor approved for multiple myeloma. Other HDAC inhibitors are being evaluated in clinical trials as single agents and in combination for the treatment of various hematologic diseases and solid tumors.

Pracinostat is an orally available, potent HDAC inhibitor with potentially improved physicochemical, pharmaceutical and pharmacokinetic properties when compared to other compounds of this class, including increased bioavailability and increased half-life.

4

Table of Contents

Clinical Program

The ongoing pivotal Phase 3 registration study, which is being run by Helsinn and initiated in June of 2017, is a randomized, double-blind, placebo-controlled study that will enroll worldwide approximately 500 adults with newly diagnosed AML who are unfit to receive intensive chemotherapy. Patients are randomized 1:1 to receive pracinostat or placebo with azacitidine as background therapy. The primary endpoint of the study is overall survival. Secondary endpoints include morphologic CR rate, event-free survival and duration of CR.

Additionally, pracinostat is being investigated in a Phase 2 dose optimization study evaluating patients with high and very high-risk MDS who are previously untreated with hypomethylating agents. This patient group represents the highest unmet need in MDS, with median survival estimates of 1.6 years and 0.8 years, respectively. The ongoing Phase 2 open-label study is evaluating a 45mg dose of pracinostat in combination with the standard dose of azacitidine. The study is designed to improve tolerability and retain patients in the study longer than in an earlier Phase 2 study evaluating a 60 mg dose. A prolonged treatment may result in a systemic exposure to pracinostat sufficient to achieve the desired treatment effect; data from the earlier Phase 2 study suggested that insufficient exposure to treatment may have limited overall efficacy of the combination.

A successful pre-planned interim analysis of the Phase 2 MDS study demonstrated a 10% discontinuation rate among the first 20 evaluable patients treated, beating the predefined threshold in the first 3 treatment cycles. The 10% rate is consistent with the established discontinuation rate for azacitidine given as a monotherapy. Having met this threshold, the study expanded open-label enrollment to 60 patients. Patients will be followed for one year to evaluate safety and efficacy. If the expanded open-label study is successful, a global registration study is anticipated. The primary endpoints of the study are 1) safety and tolerability and 2) overall response rate, defined as CR, partial remission (“PR”) and marrow CR. Secondary endpoints include CR rate, overall hematologic improvement (“HI”) response rate, clinical benefit rate (defined as rate of CR + PR + HI + Marrow CR), rate of cytogenetic complete response/remission, duration of response, rate of leukemic transformation, event-free survival, progression-free survival and overall survival.

Pracinostat has been previously investigated in more than 300 patients in multiple Phase 1 and Phase 2 clinical trials and found to be generally well tolerated with manageable side effects often associated with drugs of this class, including fatigue, myelosuppression and gastrointestinal toxicity.

ME-401: PI3K Delta Inhibitor Entering Phase 2 Study to Support Accelerated Approval in Relapsed or Refractory Follicular Lymphoma

We own exclusive worldwide rights to ME-401, a selective oral inhibitor of PI3K delta. In the fourth quarter of calendar year 2018, we plan to initiate an ME-401 single-agent Phase 2 clinical trial for the treatment of adults with relapsed or refractory follicular lymphoma (“FL”). We intend to submit the results of this trial to the FDA for accelerated approval of the marketing application under 21CFR314, Subpart H.

We believe ME-401 holds best-in-class potential as a PI3K delta inhibitor based on clinical data observed to date. Clinical data from an ongoing Phase 1b, open-label, dose-escalation study in relapsed/refractory FL, chronic lymphocytic leukemia (“CLL”) and small lymphocytic lymphoma (“SLL”) demonstrate an objective response rate of 90%. ME-401 was generally well-tolerated in the Phase 1b trial and no dose-limiting toxicities were identified at any dose level.

The clinical data generated to date, along with important differentiating pharmaceutical properties of ME-401, support its potential as a single-agent therapy and the potential to be used in combination with existing or emerging therapies to treat multiple difficult-to-treat oncology indications.

ME-401 Scientific Overview: Cell Cycle Signaling

The PI3K/AKT/mTOR pathway is an important signaling pathway for many cellular functions such as cell survival, cell cycle progression and cellular growth. PI3Ks are a family of enzymes within this pathway that have been shown to play a critical role in the proliferation and survival of certain cancer cells. There are several isoforms of PI3K that are expressed in different types of cells. The PI3K delta isoform is believed to be important for survival of certain B-cell leukemias and lymphomas.

PI3K delta Inhibitors and B-Cell Malignancies

As a class of therapies, PI3K delta inhibitors may have application across a range of B-cell malignancies and compare favorably to other therapeutic approaches.

PI3K delta inhibitors as a group demonstrate promise in the treatment of B-cell malignancies. However, the FDA and EMA approved oral PI3K delta inhibitor idealelisib (marketed as Zydelig ®), the FDA approved intravenous PI3K alpha/delta inhibitor copanlisib (marketed as Aliqopa ®), as well as other candidates in development, are challenged by treatment limiting toxicities which may compromise their overall efficacy. We believe this provides an opportunity for the development of a next generation candidate with superior pharmaceutical properties that can provide efficacy and that better maximizes the biological potential of PI3K delta without being limited by toxicities that reduce clinical utility.

Through our extensive pre-clinical and ongoing clinical work, we have demonstrated that ME-401 has important pharmaceutical properties, including prolonged target binding, preferential cellular accumulation, significant distribution throughout the body tissues, and a 28-hour half-life suitable for once daily oral administration. We believe these positive attributes support the promising clinical results observed to date and the continued clinical advancement of ME-401 as an attractive drug candidate with single-agent activity and the potential to be used in combination with existing or emerging therapies to treat multiple difficult-to-treat oncology indications.

5

Table of Contents

Clinical Program

ME-401 is being evaluated in an ongoing Phase 1b dose escalation study in patients with relapsed or refractory FL, CLL and SLL. In June 2018, at the American Society of Clinical Oncology (“ASCO”) Annual Meeting, we reported data indicating that ME-401 administered as a single-agent achieved a high response rate of 90% among 30 evaluable patients as well as a high response rate of 86% in the group of 21 patients with FL. In addition to the overall high response rate, other notable observations include:

| • | Responses that were generally early in treatment: 85% of responses (23/27) occurred at the first disease assessment after 2 cycles (56 days); |

| • | A 100% (10/10) objective response rate was observed in the group of FL patients with progression of disease within 24 months (POD24) of initial immunochemotherapy. While this group of patients generally received one prior line of therapy, progression of disease within 24 months after initial treatment is associated with very poor outcomes; only about 50% of POD24 patients survive for 5 years compared to about 90% of patients that do not have early disease progression. (“Casulo et al, JCO 2015); |

| • | High objective responses that were independent of the line of treatment: 86% (18/21) of patients treated in ³ 2nd line therapy and 82% (9/11) of FL patients treated in ³ 3rd line therapy; |

| • | Durable responses: median follow-up was 8 months (range: 2.4-16.5 months) and only 1 responder had disease progression, and 13 of 18 active patients had a response duration ongoing for more than 6 months. |

ME-401 was generally well-tolerated. No dose-limiting toxicities were identified at any dose level. Among the most common adverse events, Grade 3 adverse events of interest were diarrhea 19% (6/31), rash 13% (4/31), colitis 6% (2/31) and stomatitis 3% (1/31), all of which were reported in Cycle 3 or later cycles and all of which resolved with drug interruption and corticosteroids allowing multiple patients to resume treatment on an intermittent schedule without apparent loss of response. No opportunistic infections or non-infectious pneumonitis were reported. There have been no Grade 4-5 adverse events. Four patients discontinued due to an adverse event. Rates of adverse events across the doses studied were comparable.

Laboratory abnormalities were infrequent. Grade ³ 3 laboratory abnormalities reported were: neutropenia 10% (4/31) and AST/ALT increase 6% (2/31). Myelosuppression was not associated with febrile neutropenia. Based on the data, we determined that no further dose escalation was required. An expansion cohort of up to 30 patients with FL, CLL and SLL was added to further evaluate the safety and efficacy of ME-401 as a single agent at the 60 mg dose. An additional 15 patients are enrolled in the study arm evaluating ME-401 (60 mg) in combination with rituximab (marketed as Rituxan®) in patients with various B cell malignancies, including diffuse large B-cell lymphoma (“DLBCL”).

Accelerated Approval Registration Study

In July 2018 the Company discussed with FDA a ME-401 monotherapy accelerated approval strategy in patients with relapsed or refractory follicular lymphoma. The FDA communicated support for the Company’s proposed randomized Phase 2 trial. Accelerated approval of ME-401 will be subject to FDA review of the improvement provided by ME-401 over other therapies available at the time of the regulatory action.

Informed by our communications with the FDA, we are planning to initiate by the end of calendar year 2018, a global randomized Phase 2 study to evaluate the efficacy, safety, and tolerability of ME-401 in patients with FL after failure of at least two prior systemic therapies including chemotherapy and an anti-CD20 antibody. The study will evaluate two different ME-401 single agent dosing regimens; in one arm, ME-401 will be administered once daily continuously and in the other arm, ME-401 will be administered once daily for two cycles (i.e., eight weeks) followed by an intermittent schedule whereby ME-401 will be administered once daily for the first seven days of a 28 day cycle followed by 21 days placebo. Approximately 150 patients will be randomized in the study and the primary efficacy endpoint will be the rate of objective response to therapy.

Voruciclib: CDK Inhibitor with CDK9 Inhibition in Phase 1 Studies

In September 2017, we entered into a license agreement with Presage Biosciences, Inc. (“Presage”). Under the terms of such license agreement (the “Presage License Agreement”), Presage granted to us exclusive worldwide rights to develop, manufacture and commercialize voruciclib, a clinical-stage, oral and selective CDK inhibitor, and related compounds. Voruciclib is an orally administered CDK inhibitor differentiated by its potent in vitro inhibition of CDK9 in addition to CDK6, 4 and 1. Voruciclib is currently being evaluated in a Phase 1b dose ranging study in patients with B-cell malignancies.

Voruciclib Scientific Overview: Cell Cycle Signaling

The CDK family of proteins are important cell cycle regulators. CDK9 is a transcriptional regulator of the myeloid leukemia cell differentiation protein (“MCL1”), a member of the family of anti-apoptotic proteins which, when elevated, may prevent the cell from undergoing cell death. Inhibition of CDK9 blocks the production of MCL1, which is an established resistance mechanism to the B-cell lymphoma (“BCL2”) inhibitor venetoclax (marketed as Venclexta™).

In pre-clinical studies voruciclib shows dose-dependent suppression of MCL1; in December 2017 a study of voruciclib published in the journal Nature Scientific Reports reported that the combination of voruciclib plus the BCL-2 inhibitor venetoclax was capable of inhibiting two master regulators of cell survival, MCL-1 and BCL-2, and achieved synergistic antitumor efficacy in an aggressive subset of Diffuse Large B-cell Lymphoma (DLBCL) pre-clinical models. (Scientific Reports. (2017) 7:18007. DOI:10.1038/s41598-017-18368-w).

6

Table of Contents

CDK9 is also a transcriptional regulator of MYC, a transcription factor regulating cell proliferation and growth which contributes to many human cancers and is frequently associated with poor prognosis and unfavorable patient survival. Targeting MYC directly has historically been difficult, but CDK9 is a transcriptional regulator of MYC and is a promising approach to target this oncogene.

Clinical Program

In January 2018, we announced the FDA cleared the voruciclib Investigational New Drug Application (“IND”) for hematologic malignancies. In August 2018 we dosed our first patient in a dose ranging Phase 1b clinical trial of voruciclib as a single agent in patients with relapsed and/or refractory B-cell malignancies after failure of prior standard therapies to determine the safety, preliminary efficacy and maximum tolerated dose. We also plan to evaluate voruciclib in combination with venetoclax to assess synergies and the opportunity for combination treatments across multiple indications.

Voruciclib was previously evaluated in more than 70 patients in multiple Phase 1 studies with a tolerability profile consistent with other drugs in its class. In pre-clinical studies, voruciclib shows dose-dependent suppression of MCL1 at concentrations achievable with doses that appear to be generally well tolerated in earlier Phase 1 studies. Pre-clinical studies additionally show inhibition of MYC protein expression.

ME-344: Mitochondrial Inhibitor with Combinatorial Potential

ME-344 is our novel and tumor selective, isoflavone-derived mitochondrial inhibitor drug candidate. It directly targets the OXPHOS complex 1, a pathway involved in ATP production in the mitochondria. ME-344 is currently in an ongoing investigator-initiated, multi-center, randomized study in combination with the VEGF inhibitor bevacizumab (marketed as Avastin ® ) in a total of 40 patients with HER2 negative breast cancer.

ME-344 Scientific Overview: Cancer Metabolism

Tumor cells often display a high metabolic rate to support cell division and growth. This heightened metabolism requires a continual supply of energy in the form of adenosine triphosphate (“ATP”). The two major sources of ATP are the specialized cellular organelles termed mitochondria and through the metabolism of carbohydrates, proteins and lipids.

ME-344 was identified through a screen of more than 400 new chemical structures originally created based on the central design of naturally occurring plant isoflavones. We believe that some of these synthetic compounds, including our drug candidate ME-344, interact with specific mitochondrial enzyme targets, resulting in the inhibition of ATP generation. When these compounds interact with their target, a rapid reduction in ATP occurs, which leads to a cascade of biochemical events within the cell and ultimately to cell death.

Clinical Program

ME-344 demonstrated evidence of single agent activity against refractory solid tumors in a Phase 1 study, and in pre-clinical studies tumor cells treated with ME-344 resulted in a rapid loss of ATP and cancer cell death. In addition to single agent activity, ME-344 may also have significant potential in combination with antiangiogenic therapeutics. While antiangiogenics reduce the rate of glycolysis in tumors as a mechanism to block growth, tumor metabolism often shifts to mitochondrial metabolism to continue energy production to support continued tumor proliferation. In such cases of tumor plasticity in the presence of treatment with antiangiogenics, targeting the alternative metabolic source with ME-344 may open an important therapeutic opportunity.

We are investigating this approach in an ongoing, multicenter, investigator-initiated, randomized, open-label, clinical trial, which is evaluating ME-344 in a total of up to 40 patients with HER2-negative breast cancer in combination with the vascular endothelial growth factor inhibitor bevacizumab (marketed as Avastin®). Patients are randomized one-to-one to either ME-344 in combination with bevacizumab or saline in combination with bevacizumab. The interim data review was predefined to take place after 20 patients were randomized. The primary efficacy endpoint is inhibition of cell proliferation as measured by Ki-67 reductions.

Interim data presented from the study at the ASCO Annual Meeting in June 2018 demonstrate evidence of inhibition of tumor proliferation. Mean absolute (relative) Ki-67 decreases were 5.13 (29%) and 1.2 (9%) in the active versus control arms (P=0.06). Patients with standardized uptake values via PET scan ³ 10% experienced an absolute average Ki-67 decrease of 16.6 vs. 2.3 in the active versus control arms (P=0.19). Treatment was generally well tolerated; two Grade 3 adverse events (high blood pressure) were reported, one in each arm, and deemed related to bevacizumab. These interim data are consistent with pre-clinical results indicating ME-344’s potential to reverse resistance to anti-angiogenic therapy, thereby warranting the continuation of the ongoing study.

Results from our earlier, first-in-human, single-agent Phase 1 clinical trial of ME-344 in patients with refractory solid tumors were published in the April 1, 2015 issue of Cancer. The results indicated that eight of 21 evaluable patients (38%) treated with ME-344 achieved stable disease or better, including five who experienced progression-free survival that was at least twice the duration of their last prior treatment before entry into the study. In addition, one of these patients, a heavily pre-treated patient with small cell lung cancer, achieved a confirmed partial response and remained on study for two years. ME-344 was generally well tolerated at doses equal to or less than 10 mg/kg delivered on a weekly schedule for extended durations. Treatment-related adverse events included nausea, dizziness and fatigue. Dose-limiting toxicities were observed at both the 15 mg/kg and 20 mg/kg dose levels, consisting primarily of grade three peripheral neuropathy.

7

Table of Contents

In June 2016, pre-clinical data from a collaboration with the Spanish National Cancer Research Centre in Madrid showing mitochondria-specific effects of ME-344 in cancer cells, including substantially enhanced anti-tumor activity when combined with agents that inhibit the activity of VEGF, were published in Cell Reports. These data demonstrate that the anti-cancer effects when combining ME-344 with a VEGF inhibitor are due to an inhibition of both mitochondrial and glycolytic metabolism and provided a basis for commencement of the ongoing investigator-initiated study of ME-344 in combination with the VEGF inhibitor bevacizumab (marketed as Avastin®) in HER2 negative breast cancer patients.

Competition

The marketplace for our drug candidates is highly competitive. A number of other companies have products or drug candidates in various stages of pre-clinical or clinical development that are intended for the same therapeutic indications for which our drug candidates are being developed. Some of these potential competing drug candidates are further advanced in development than our drug candidates and may be commercialized sooner. Even if we are successful in developing products that receive regulatory approval, such products may not compete successfully with products produced by our competitors or with products that may subsequently receive regulatory approval.

Our competitors include pharmaceutical companies and biotechnology companies, as well as universities and public and private research institutions. In addition, companies active in different but related fields represent substantial competition for us. Many of our competitors developing oncology drugs have significantly greater capital resources, larger research and development staffs and facilities, and greater experience in drug development, regulation, manufacturing, marketing and commercialization than we do. They compete with us in recruiting sites and eligible patients to participate in clinical studies and in attracting development and/or commercialization partners. They also license technologies that are competitive with our technologies. As a result, our competitors may be able to more easily develop technologies and products that would render our technologies or our drug candidates obsolete or non-competitive.

Intellectual Property

We own, by assignment or exclusive license, worldwide rights to each of our current drug candidates. Our intellectual property portfolio includes approximately 29 issued U.S. patents, 186 issued foreign patents, 14 pending U.S. patent applications, and 61 pending foreign applications.

We have acquired, by assignment, patents and patent applications from S*Bio Pte Ltd (“S*Bio”) relating to a family of heterocyclic compounds, which include pracinostat, that inhibit histone deacetylases. The U.S. Patent and Trademark Office (“USPTO”) has issued six patents covering a number of these heterocyclic-based compounds, including pracinostat, and their composition of matter, pharmaceutical compositions, and methods of use to treat proliferative diseases. The composition of matter claims covering pracinostat are projected to expire in May 2028, not including patent term extension. In our License Agreement, we granted to Helsinn an exclusive (subject to certain retained rights to perform obligations under the agreement), sublicenseable, payment-bearing, license under and to certain patents and know-how controlled by us to develop, manufacture and commercialize pracinostat and any pharmaceutical product containing pracinostat for all human and animal indications.

We have acquired by assignment worldwide rights to ME-401 and other related compounds from Pathway Therapeutics, Inc. The USPTO has issued two patents covering the composition of matter and pharmaceutical compositions of ME-401 which are projected to expire in January 2031 and December 2032, not including any patent term extension. There are currently three U.S. and 15 foreign applications for ME-401 and related compounds pending.

Under the terms of the Presage License Agreement, we acquired, by assignment, exclusive worldwide rights to develop, manufacture and commercialize voruciclib. The USPTO has issued three patents covering the composition of matter and pharmaceutical compositions of voruciclib which are projected to expire in April 29, 2024 and September 2028, not including any patent term extension.

We have acquired, by assignment, patents and patent applications from Novogen, our former majority shareholder, which relate to a large family of isoflavonoid compounds, including ME-344. The USPTO has issued seven patents covering ME-344, including its composition of matter, pharmaceutical compositions and methods of use to treat cancer. The composition of matter and pharmaceutical composition claims covering ME-344 are expected to expire in March 2027 and November 2031, not including patent term extension.

8

Table of Contents

Our success depends in large part on our ability to protect our proprietary technologies, compounds and information, and to operate without infringing the proprietary rights of third parties. We rely on a combination of patent, trade secret, copyright, and trademark laws, as well as confidentiality, licensing and other agreements, to establish and protect our proprietary rights. We seek patent protection for our key inventions, including drug candidates we identify, routes for chemical synthesis and pharmaceutical formulations. There is no assurance that any of our pending patent applications will issue, or that any of our patents will be enforceable or will cover a drug or other commercially significant product or method. In addition, we regularly review our patent portfolio to identify patents and patent applications that we deem to have relatively low value to our ongoing business operations for potential abandonment. There is also no assurance that we will correctly identify which of our patents and patent applications should be maintained and which should be abandoned. The term of most of our other current patents commenced, and most of our future patents, if any, will commence, on the date of issuance and terminate 20 years from the earliest effective filing date of the patent application. Because any marketing and regulatory approval for a drug often occurs several years after the related patent application is filed, the resulting market exclusivity afforded by any patent on our drug candidates and technologies will likely be substantially less than 20 years.

As most patent applications in the U.S. are maintained as confidential until published by the USPTO at 18 months from filing for all cases filed after November 29, 2000, or at issue, for cases filed prior to November 29, 2000, we cannot be certain that we or Presage Biosciences, Inc. were the first to make the inventions covered by the patents and applications referred to above. Additionally, publication of discoveries in the scientific or patent literature often lags behind the actual discoveries. Moreover, pursuant to the terms of the Uruguay Round Agreements Act, patents filed on or after June 8, 1995 have a term of twenty years from the date of such filing except for provisional applications, irrespective of the period of time it may take for such patent to ultimately issue. This may shorten the period of patent protection afforded to therapeutic uses of pracinostat, ME-401, voruciclib or ME-344 as patent applications in the biopharmaceutical sector often take considerable time to issue. However, in some countries the patent term may be extended.

In order to protect the confidentiality of our technology, including trade secrets and know-how and other proprietary technical and business information, we require all of our consultants, advisors and collaborators to enter into agreements that prohibit the use or disclosure of information that is deemed confidential. These agreements also oblige our consultants, advisors and collaborators to assign to us, or negotiate a license to developments, discoveries and inventions made by such persons in connection with their work relating to our products. We cannot be sure that confidentiality will be maintained by those from whom we have acquired technology or disclosure prevented by these agreements. We also cannot be sure that our proprietary information or intellectual property will be protected by these agreements or that others will not independently develop substantially equivalent proprietary information or intellectual property.

The pharmaceutical industry is highly competitive, and patents may have been applied for by, and issued to, other parties relating to products competitive with pracinostat, ME-401, voruciclib, or ME-344. Use of these compounds and any other drug candidates may give rise to claims that they infringe the patents or proprietary rights of other parties, existing now and in the future. An adverse claim could subject us to significant liabilities to such other parties and/or require disputed rights to be licensed from such other parties. We cannot be sure that any license required under any such patents or proprietary rights would be made available on terms acceptable to us, if at all. If we do not obtain such licenses, we may encounter delays in product market introductions, or may find that the development, manufacture or sale of products requiring such licenses may be precluded.

Research and Development

The objective of our research and development program is the generation of data sufficient to achieve regulatory approval of our drug candidates in one or more dosage forms in major markets such as the U.S., to meet medical needs and develop a clinical and commercial profile with attractive attributes, and/or to allow us to enter into a development and/or commercial relationship with another party. The data are generated by our pre-clinical studies and clinical trial programs.

The key aspects of our research and development program are to provide more complete characterization of the following:

| • | the relevant molecular targets of action of our drug candidates; |

| • | the relative therapeutic benefits and indications for use of our drug candidates as a monotherapy or as part of combinational therapy with other agents; and |

| • | the most appropriate therapeutic indications and dosage forms for pracinostat, ME-401, voruciclib and ME-344. |

Government Regulation

U.S. Regulatory Requirements

The FDA, and comparable regulatory agencies in other countries, regulate and impose substantial requirements upon the research, development, pre-clinical and clinical testing, labeling, manufacture, quality control, storage, approval, advertising, promotion, marketing, distribution and export of pharmaceutical products including biologics, as well as significant reporting and record-keeping obligations. State governments may also impose obligations in these areas.

In the U.S., pharmaceutical products are regulated by the FDA under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and other laws, including in the case of biologics, the Public Health Service Act. We believe, but cannot be certain, that our products will be regulated as drugs by the FDA. The process required by the FDA before drugs may be marketed in the U.S. generally involves the following:

9

Table of Contents

| • | pre-clinical laboratory evaluations, including formulation and stability testing, and animal tests performed under the FDA’s Good Laboratory Practices regulations to assess pharmacological activity and toxicity potential; |

| • | submission and approval of an IND, including results of pre-clinical tests, manufacturing information, and protocols for clinical tests, which must become effective before clinical trials may begin in the U.S.; |

| • | obtaining approval of Institutional Review Boards (“IRB”), to administer the products to human subjects in clinical trials; |

| • | adequate and well-controlled human clinical trials to establish the safety and efficacy of the product for the product’s intended use; |

| • | development of manufacturing processes which conform to FDA current Good Manufacturing Practices (“cGMP”), as confirmed by FDA inspection; |

| • | submission of results for pre-clinical and clinical studies, and chemistry, manufacture and control information on the product to the FDA in a New Drug Approval Application (“NDA”); and |

| • | FDA review and approval of a NDA, prior to any commercial sale or shipment of a product. |

The testing and approval process requires substantial time, effort, and financial resources, and we cannot be certain that any approval will be granted on a timely basis, if at all.

The results of the pre-clinical studies, together with initial specified manufacturing information, the proposed clinical trial protocol, and information about the participating investigators are submitted to the FDA as part of an IND, which must become effective before we may begin human clinical trials in the U.S. Additionally, an independent IRB must review and approve each study protocol and oversee conduct of the trial. An IND becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day period, raises concerns or questions about the conduct of the trials as outlined in the IND and imposes a clinical hold. If the FDA imposes a clinical hold, the IND sponsor must resolve the FDA’s concerns before clinical trials can begin. Pre-clinical tests and studies can take several years to complete, and there is no guarantee that an IND we submit based on such tests and studies will become effective within any specific time period, if at all.

Human clinical trials are typically conducted in three sequential phases that may overlap.

| • | Phase 1: The drug is initially introduced into healthy human subjects or patients and tested for safety and dosage tolerance. Absorption, metabolism, distribution, and excretion testing is generally performed at this stage. |

| • | Phase 2: The drug is studied in controlled, exploratory therapeutic trials in a limited number of subjects with the disease or medical condition for which the new drug is intended to be used in order to identify possible adverse effects and safety risks, to determine the preliminary or potential efficacy of the product for specific targeted diseases or medical conditions, and to determine dosage tolerance and the optimal effective dose. |

| • | Phase 3: When Phase 2 studies demonstrate that a specific dosage range of the drug is likely to be effective and the drug has an acceptable safety profile, controlled, large-scale therapeutic Phase 3 trials are undertaken at multiple study sites to demonstrate clinical efficacy and to further test for safety in an expanded patient population. |

We cannot be certain that we will successfully complete clinical testing of our products within any specific time period, if at all. Furthermore, the FDA, the IRB or we may suspend or terminate clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk.

Results of pre-clinical studies and clinical trials, as well as detailed information about the manufacturing process, quality control methods, and product composition, among other things, are submitted to the FDA as part of a NDA seeking approval to market and commercially distribute the product on the basis of a determination that the product is safe and effective for its intended use. Before approving a NDA, the FDA will inspect the facilities at which the product is manufactured and will not approve the product unless cGMP compliance is satisfactory. If applicable regulatory criteria are not satisfied, the FDA may deny the NDA or require additional testing or information. As a condition of approval, the FDA also may require post-marketing testing or surveillance to monitor the product’s safety or efficacy. Even after a NDA is approved, the FDA may impose additional obligations or restrictions (such as labeling changes, or clinical post-marketing requirements), or even suspend or withdraw a product approval on the basis of data that arise after the product reaches the market, or if compliance with regulatory standards is not maintained. We cannot be certain that any NDA we submit will be approved by the FDA on a timely basis, if at all. Also, any such approval may limit the indicated uses for which the product may be marketed. Any refusal to approve, delay in approval, suspension or withdrawal of approval, or restrictions on indicated uses could have a material adverse impact on our business prospects.

Each NDA must be accompanied by a user fee, pursuant to the requirements of the Prescription Drug User Fee Act (“PDUFA”), and its amendments. According to the FDA’s fee schedule, the user fee for an application requiring clinical data, such as an NDA, is $2,421,495. PDUFA also imposes an annual product fee for prescription drugs and biologics $97,750, and an annual establishment fee $512,200 on facilities used to manufacture prescription drugs and biologics. The FDA adjusts the PDUFA user fees on an annual basis. A written request can be submitted for a waiver for the application fee for the first human drug application that is filed by a small business, but there are no waivers for product or establishment fees. We are not at the stage of development with our products where we are subject to these fees, but they are significant expenditures that may be incurred in the future and must be paid at the time of application submissions to the FDA.

10

Table of Contents

Satisfaction of FDA requirements typically takes several years. The actual time required varies substantially, based upon the type, complexity, and novelty of the pharmaceutical product, among other things. Government regulation imposes costly and time-consuming requirements and restrictions throughout the product life cycle and may delay product marketing for a considerable period of time, limit product marketing, or prevent marketing altogether. Success in pre-clinical or early stage clinical trials does not ensure success in later stage clinical trials. Data obtained from pre-clinical and clinical activities are not always conclusive and may be susceptible to varying interpretations that could delay, limit, or prevent marketing approval. Even if a product receives marketing approval, the approval is limited to specific clinical indications. Further, even after marketing approval is obtained, the discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market.

After product approval, there are continuing significant regulatory requirements imposed by the FDA, including record-keeping requirements, obligations to report adverse side effects in patients using the products, and restrictions on advertising and promotional activities. Quality control and manufacturing procedures must continue to conform to cGMPs, and the FDA periodically inspects facilities to assess cGMP compliance. Additionally, post-approval changes in ingredient composition, manufacturing processes or facilities, product labeling, or other areas may require submission of a NDA Supplement to the FDA for review and approval. New indications will require additional clinical studies and submission of a NDA Supplement. Failure to comply with FDA regulatory requirements may result in an enforcement action by the FDA, including Warning Letters, product recalls, suspension or revocation of product approval, seizure of product to prevent distribution, impositions of injunctions prohibiting product manufacture or distribution, and civil and criminal penalties. Maintaining compliance is costly and time-consuming. We cannot be certain that we, or our present or future suppliers or third-party manufacturers, will be able to comply with all FDA regulatory requirements, and potential consequences of noncompliance could have a material adverse impact on our business prospects.

The FDA’s policies may change, and additional governmental regulations may be enacted that could delay, limit, or prevent regulatory approval of our products or affect our ability to manufacture, market, or distribute our products after approval. Moreover, increased attention to the containment of healthcare costs in the U.S. and in foreign markets could result in new government regulations that could have a material adverse effect on our business. Our ability to commercialize future products will depend in part on the extent to which coverage and reimbursement for the products will be available from government and health administration authorities, private health insurers, and other third-party payers. European Union member states and U.S. government and other third-party payers increasingly are attempting to contain healthcare costs by consideration of new laws and regulations limiting both coverage and the level of reimbursement for new drugs. Our failure to obtain coverage, an adequate level of reimbursement, or acceptable prices for our future products could diminish any revenues we may be able to generate. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the U.S. or abroad.

Our activities also may be subject to state laws and regulations that affect our ability to develop and sell our products. We are also subject to numerous federal, state, and local laws relating to such matters as safe working conditions, clinical, laboratory, and manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future, and the failure to comply may have a material adverse impact on our business prospects.

The FDCA includes provisions designed to facilitate the development and expedite the review of drugs and biological products intended for treatment of serious or life-threatening conditions that demonstrate the potential to address unmet medical needs for such conditions. These provisions set forth a procedure for designation of a drug as a “fast track product”. The fast track designation applies to the combination of the product and specific indication for which it is being studied. A product designated as fast track is ordinarily eligible for additional programs for expediting development and review, but products that are not in fast track drug development programs may also be able to take advantage of these programs. These programs include priority review of NDAs and accelerated approval. Drug approval under the accelerated approval regulations may be based on evidence of clinical effect on a surrogate endpoint that is reasonably likely to predict clinical benefit. A post-marketing clinical study will be required to verify clinical benefit, and other restrictions to assure safe use may be imposed. We do not currently have fast track designation for any of our clinical programs. If we should seek such designation for any of our programs, however, we cannot be assured that it will be granted by the FDA.

Under the Drug Price Competition and Patent Term Restoration Act of 1984, a sponsor may obtain marketing exclusivity for a period of time following FDA approval of certain drug applications, regardless of patent status, if the drug is a new chemical entity or if new clinical studies were required to support the marketing application for the drug. This marketing exclusivity prevents a third party from obtaining FDA approval for an identical or nearly identical drug under an Abbreviated New Drug Application or a “505(b)(2) New Drug Application”. The statute also allows a patent owner to obtain an extension of applicable patent terms for a period equal to one-half the period of time elapsed between the filing of an IND and the filing of the corresponding NDA plus the period of time between the filing of the NDA and FDA approval, with a five year maximum patent extension. We cannot be certain that we will be able to take advantage of either the patent term extension or marketing exclusivity provisions of these laws.

The Best Pharmaceuticals for Children Act (“BPCA”), signed into law on January 4, 2002, was reauthorized and amended by the FDA Amendments Act of 2007 (“FDAAA”). The reauthorization of BPCA provides an additional six months of patent protection to NDA applicants that conduct acceptable pediatric studies of new and currently-marketed drug products for which pediatric information would be beneficial, as identified by the FDA in a Pediatric Written Request. The Pediatric Research Equity Act (“PREA”), signed into law on December 3, 2003, also was reauthorized and amended by the FDAAA. The reauthorization of PREA requires that most applications for drugs and biologics include a pediatric assessment (unless waived or deferred) to ensure the drugs’ and biologics’ safety and effectiveness in children. Such pediatric assessment must contain data, gathered using appropriate

11

Table of Contents

formulations for each age group for which the assessment is required, that are adequate to assess the safety and effectiveness of the drug or the biological product for the claimed indications in all relevant pediatric subpopulations, and to support dosing and administration for each pediatric subpopulation for which the drug or the biological product is safe and effective. The pediatric assessments can only be deferred provided there is a timeline for the completion of such studies. The FDA may waive (partially or fully) the pediatric assessment requirement for several reasons, including if the applicant can demonstrate that reasonable attempts to produce a pediatric formulation necessary for that age group have failed. The Food and Drug Administration Safety and Innovation Act signed into law on July 9, 2012, permanently renewed and strengthened BPCA and PREA.

Under the Orphan Drug Act, the FDA may grant orphan drug designation to drugs intended to treat a “rare disease or condition,” which generally is a disease or condition that affects fewer than 200,000 individuals in the U.S. Orphan drug designation does not convey any advantage in, or shorten the duration of, the regulatory review and approval process. If a product which has an orphan drug designation subsequently receives the first FDA approval for the indication for which it has such designation, the product is entitled to orphan exclusivity, i.e., the FDA may not approve any other applications to market the same drug for the same indication for a period of seven years, except in limited circumstances. Pracinostat has been granted orphan drug designation by the FDA for the treatment of AML, but it may not receive orphan designation for other indications. Our other products may not be eligible for orphan drug status or be designated as orphan drugs. Even if designated as orphan drugs, our products may not be approved before other applications or granted orphan drug exclusivity if approved.

Foreign Regulatory Requirements

Outside the U.S., our ability to market our products will also be contingent upon receiving marketing authorizations from the appropriate regulatory authorities and compliance with applicable post-approval regulatory requirements. Although the specific requirements and restrictions vary from country to country, as a general matter, foreign regulatory systems include risks similar to those associated with FDA regulation, described above.

Under European Union regulatory systems, marketing authorizations may be submitted either under a centralized or a national procedure. Under the centralized procedure, a single application to the EMA leads to an approval granted by the European Commission which permits the marketing of the product throughout the EU. The centralized procedure is mandatory for certain classes of medicinal products, but optional for others. For example, all medicinal products developed by certain biotechnological means, and those developed for cancer and other specified diseases and disorders, must be authorized via the centralized procedure. We assume that the centralized procedure will apply to our products that are developed by means of a biotechnology process or are intended for treatment of cancer. The national procedure is used for products that are not required to be authorized by the centralized procedure. Under the national procedure, an application for a marketing authorization is submitted to the competent authority of one member state of the EU. The holders of a national marketing authorization may submit further applications to the competent authorities of the remaining member states via either the decentralized or mutual recognition procedure. The decentralized procedure enables applicants to submit an identical application to the competent authorities of all member states where approval is sought at the same time as the first application, while under the mutual recognition procedure, products are authorized initially in one member state, and other member states where approval is sought are then requested to recognize the original authorization based upon an assessment report prepared by the original authorizing competent authority. Both the decentralized and mutual recognition procedures should take no longer than 90 days, but if one member state makes an objection, which under the legislation can only be based on a possible risk to human health, the application will be automatically referred to the Committee for Medicinal Products for Human Use (“CHMP”) of the EMA. If a referral for arbitration is made, the procedure is suspended. However, member states that have already approved the application may, at the request of the applicant, authorize the product in question without waiting for the result of the arbitration. Such authorizations will be without prejudice to the outcome of the arbitration. For all other concerned member states, the opinion of the CHMP, which is binding, could support or reject the objection or alternatively could reach a compromise position acceptable to all EU countries concerned. The arbitration procedure may take an additional year before a final decision is reached and may require the delivery of additional data.

As with FDA approval, we may not be able to secure regulatory approvals in Europe in a timely manner, if at all. Additionally, as in the U.S., post-approval regulatory requirements, such as those regarding product manufacture, marketing, or distribution, would apply to any product that is approved in Europe, and failure to comply with such obligations could have a material adverse effect on our ability to successfully commercialize any product.

The conduct of clinical trials in the European Union is governed by the European Clinical Trials Directive, which was implemented in May 2004. This Directive governs how regulatory bodies in member states control clinical trials. No clinical trial may be started without a clinical trial authorization granted by the national competent authority and favorable ethics approval. New legislation to revise and replace the European Clinical Trials Directive is currently proposed by the European Commission and is under consideration by EU institutions.

Accordingly, there is a marked degree of change and uncertainty both in the regulation of clinical trials and in respect of marketing authorizations which we face for our products in Europe.

Manufacturing

We do not have the facilities or capabilities to commercially manufacture any of our drug candidates. We are and expect to continue to be dependent on contract manufacturers for supplying our existing and future candidates for clinical trials and commercial scale manufacturing of our candidates in accordance with regulatory requirements, including cGMP. Contract manufacturers may utilize their own technology, technology developed by us, or technology acquired or licensed from third parties. FDA approval of the manufacturing procedures and the site will be required prior to commercial distribution.

12

Table of Contents

Employees

As of June 30, 2018, we had 32 employees, ten of whom hold a Ph.D. or M.D. degree. Other personnel resources are used from time to time as consultants or third party service organizations on an as-needed basis. All members of our senior management team have prior experience with pharmaceutical, biotechnology or medical product companies. We believe that we have been successful in attracting skilled and experienced personnel, but there can be no assurance that we will be able to attract and retain the individuals needed. None of our employees are represented by a collective bargaining agreement, nor have we experienced work stoppages. We believe that our relations with our employees are good.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed with or furnished to the Securities and Exchange Commission pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge through our website at www.meipharma.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission.

| Item 1A. | Risk Factors |

Investment in our securities involves a high degree of risk. You should consider carefully the risks described below, together with other information in this Annual Report and other public filings, before making investment decisions regarding our securities. If any of the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. Moreover, the risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business, operating results, prospects or financial condition.

Risks Related to Our Business and Industry

We will need substantial additional funds to progress the clinical trial program for our drug candidates, and to develop new compounds. The actual amount of funds we will need will be determined by a number of factors, some of which are beyond our control.

We will need substantial additional funds to progress the clinical trial program for our drug candidates and to develop any additional compounds. The factors that will determine the actual amount of funds that we will need to progress the clinical trial programs may include, but are not limited to, the following:

| • | the therapeutic indications for use being developed; |

| • | the clinical trial endpoint required to achieve regulatory approval; |

| • | the number of clinical trials required to achieve regulatory approval; |

| • | the number of sites included in the trials; |

| • | the length of time required to enroll suitable patients; |

| • | the number of patients who participate in the trials and the rate that they are recruited; |

| • | the number of treatment cycles patients complete while they are enrolled in the trials; |

| • | costs and potential difficulties encountered in manufacturing sufficient drug product for the trials; and |

| • | the efficacy and safety profile of the product. |

We have been opportunistic in our efforts to obtain cash, and we expect to continue to evaluate various funding alternatives from time to time. If we obtain additional funding, it may adversely affect the market price of our common stock and may be dilutive to existing stockholders. If we are unable to obtain additional funds on favorable terms or at all, we may be required to cease or reduce our operations. We may sell additional shares of common stock, and securities exercisable for or convertible into shares of our common stock, to satisfy our capital and operating needs; however, such transactions will be subject to market conditions and there can be no assurance any such transactions will be completed.

If Helsinn does not satisfy its obligations under our collaboration agreement or if it terminates the collaboration agreement, we may not be able to develop or commercialize pracinostat.

In August 2016, we entered into an exclusive license, development and commercialization agreement with Helsinn to collaborate on the global development, manufacturing and commercialization of pracinostat. In connection with this agreement, we granted to Helsinn certain rights regarding the use of our patents and technology with respect to pracinostat. Helsinn will be primarily responsible for the global development of pracinostat and, subject to certain exceptions, will be solely responsible for all costs related thereto, and will also be solely responsible for the global commercialization of pracinostat and shall be solely responsible for the costs related thereto.

Helsinn might not fulfill all of its obligations under the agreement. Our ability to receive revenue from pracinostat is dependent upon Helsinn’s efforts. If Helsinn fails to devote adequate resources or otherwise does not successfully develop and commercialize pracinostat, we may not receive the future milestone payments or royalties provided for in the agreement. In addition, under certain circumstances, including our failure to satisfy our obligations under the agreement, Helsinn has the right to terminate the agreement.

13

Table of Contents

We could also become involved in disputes with Helsinn, which could lead to delays in or termination of the agreement and time-consuming and expensive litigation or arbitration.

If Helsinn is unwilling or unable to fulfill its obligations or if the agreement is terminated, we may lack sufficient resources to develop and commercialize pracinostat on our own and may be unable to reach agreement with a suitable alternative collaborator. The failure to develop and commercialize pracinostat would have a material adverse effect on our business, operating results, prospects and financial condition.

We are subject to significant obligations to Presage in connection with our license of voruciclib, which could adversely affect the overall profitability of any products we may seek to commercialize, and our license of voruciclib, the development and commercialization of which we are solely responsible for, may never become profitable.

In September 2017, we entered into the Presage License Agreement. Under the terms of the agreement, Presage granted us exclusive worldwide rights to develop, manufacture and commercialize voruciclib, a clinical-stage, oral and selective CDK inhibitor, and related compounds. In exchange, we paid Presage $2.9 million and are obligated for additional potential payments of up to $181 million upon the achievement of certain development, regulatory and commercial milestones. We will also pay mid-single-digit tiered royalties on the net sales of any product successfully developed pursuant to such agreement. We may be obligated to make milestone or royalty payments when we do not have the cash on hand to make these payments or have available cash for our other development efforts. These milestone and royalty payments could adversely affect the overall profitability for us of any products that we may seek to commercialize. In addition, if we fail to comply with our obligations under the license agreement, Presage may have the right to terminate the agreement. In such a case, we would lose our rights to the intellectual property covered by the license agreement and we would not be able to develop, manufacture or commercialize voruciclib and may face other penalties.

The profitability of our license agreement with Presage depends on the successful development, regulatory approval and commercialization of voruciclib. We are solely responsible for the development and commercialization of voruciclib, including the related costs. Drug development is a long, expensive and uncertain process and delay or failure can occur at any stage of our clinical trials. We cannot be certain that we will ever receive regulatory approval for voruciclib or that it will be successfully commercialized, even if approved.

Negative U.S. and global economic conditions may pose challenges to our business strategy, which relies on funding from the financial markets or collaborators.

Negative conditions in the U.S. or global economy, including financial markets, may adversely affect our business and the business of current and prospective vendors, licensees and collaborators, and others with whom we do or may conduct business. The duration and severity of these conditions is uncertain. If negative economic conditions occur, we may be unable to secure funding on terms satisfactory to us to sustain our operations or to find suitable collaborators to advance our internal programs, even if we achieve positive results from our drug development programs.

We are a clinical research and development stage company and are likely to incur operating losses for the foreseeable future.

You should consider our prospects in light of the risks and difficulties frequently encountered by clinical research stage and developmental companies. We have incurred net losses of $214.4 million from our inception through June 30, 2018, including a net loss of $30.4 million for the year ended June 30, 2018 (excluding a $9.7 million non-cash expense resulting from a change in the fair value of our warrant liability), net income of $2.7 million for the year ended June 30, 2017, and a net loss of $20.9 million for the year ended June 30, 2016. We anticipate that we will incur operating losses and negative operating cash flow for the foreseeable future. We have not yet commercialized any drug candidates and cannot be sure that we will ever be able to do so, or that we may ever become profitable.

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current drug candidates may not have favorable results in later studies or trials.

Pre-clinical studies and Phase 1 and Phase 2 clinical trials are an expensive and uncertain process that may take years to complete. Pre-clinical studies and Phase 1 and Phase 2 clinical trials are not primarily designed to test the efficacy of a drug candidate, but rather to test safety, to study pharmacokinetics and pharmacodynamics, and to understand the drug candidate’s side effects at various doses and schedules. Favorable results in early studies or trials may not be repeated in later studies or trials, including ongoing pre-clinical studies, large-scale Phase 3 clinical trials, or other studies intended as registration trials, and our drug candidates in later-stage trials may fail to show desired safety and efficacy despite having progressed through earlier-stage trials. Unfavorable results from ongoing pre-clinical studies or clinical trials could result in delays, modifications or abandonment of ongoing or future clinical trials, or abandonment of a clinical program. Pre-clinical and clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals or commercialization. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be delayed, repeated or terminated, or a clinical program to be abandoned.

14

Table of Contents

Final approval by regulatory authorities of our drug candidates for commercial use may be delayed, limited or prevented, any of which would adversely affect our ability to generate operating revenues.

We will not generate any operating revenue until we, a licensee, or a potential collaborator successfully commercialize one of our drug candidates. Currently, we have drug candidates at different stages of development, and each will need to successfully complete certain clinical studies and obtain regulatory approval before potential commercialization.

The pre-clinical and clinical development, manufacturing, labeling, packaging, storage, recordkeeping, export, marketing and distribution, and other possible activities relating to our drug candidates are subject to extensive regulation by the FDA and other regulatory agencies. Failure to comply with applicable regulatory requirements may, either before or after product approval, subject us to administrative or judicially imposed sanctions that may negatively impact the approval of one or more of our drug candidates or otherwise negatively impact our business.