Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlueLinx Holdings Inc. | august2018investorpresenta.htm |

BlueLinx Investor Presentation August 30, 2018

Forward-Looking Statements Forward-Looking Statements. This presentation includes “forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance, liquidity levels or achievements, and may contain the words "believe," "anticipate," "expect,” "estimate," "intend," "project," "plan," "will be," "will likely continue," "will likely result" or words or phrases of similar meaning. The forward-looking statements in this presentation include statements regarding our potential for growth; our positioning and ability to capitalize on housing trends; the amount, composition and timing of potential synergies, cost savings, and costs to achieve that may or are expected to result from the combination with Cedar Creek; our capital structure and its ability to support growth and future deleveraging; the potential benefits of the acquisition of Cedar Creek; our outlook for the housing market, single family housing starts, residential construction and repair and remodeling spending; our strategic initiatives; the success and timing of plans for the integration of Cedar Creek; and our plans and expectations for our existing real estate portfolio. These forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties, including the factors described in the "Risk Factors" section in our Annual Report on Form 10-K for the year ended December 30, 2017, our Quarterly Reports on Form 10-Q, and in our other periodic reports filed with the Securities and Exchange Commission from time to time. Given these risks and uncertainties, you are cautioned not to place undue reliance on forward-looking statements. Unless otherwise indicated, all forward-looking statements are as of the date they are made, and we undertake no obligation to update these forward-looking statements, whether as a result of new information, the occurrence of future events, or otherwise. Non-GAAP Financial Measures and Supplementary Financial Information. BlueLinx reports Its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). We also believe that presentation of certain non-GAAP measures, such as Adjusted EBITDA, Net Debt, and the ratio of Net Debt to Adjusted EBITDA, as well as GAAP-based and non- GAAP supplemental financial measures, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Explanations of these non-GAAP measures and these GAAP-based and non-GAAP supplemental financial measures are included in the accompanying Appendix to this presentation. And any non-GAAP measures used herein are reconciled herein or in the financial tables in the Appendix to their most directly comparable GAAP measures. We caution that non-GAAP measures and supplemental financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. 2

Executive Management Highly experienced executive team with proven leadership in the building products industry Executive Years Experience Past Experience Mitchell B. Lewis 30+ CEO, President and Director CEO President Attorney Susan C. O’Farrell 30+ CFO and Treasurer Associate Vice President, Finance Director Partner Alex Averitt 20+ Chief Operating Officer CEO, COO, Vice President General Manager Shyam K. Reddy 15+ Chief Administrative Officer, General Regional Chief Transformation Officer Partner Counsel & Corporate Secretary Administrator D. Wayne Trousdale 30+ Vice Chairman, Operating Companies CEO / Founder Ron Herrin 30+ VP, Procurement Director, Sales General Manager Libby Wanamaker Chief Human Resources Officer 20+ SVP, Human Resources Manager, Business Consulting Justin Heineman 20+ General Counsel 3 VP, Chief Corporate Counsel Partner

BlueLinx Provides A Compelling Opportunity Industry leader with opportunity to continue transformative profitable growth STRONG FOUNDATION FOR SUCCESS • A leading building products distributor with a strong geographic presence East of the Rockies and over 700 sales associates • Comprehensive product and services portfolio provides opportunity for accelerated growth • Diversified and established customer base offers efficient growth potential • Well-positioned to capitalize on a continued recovery in the U.S. housing market • Synergies from Cedar Creek acquisition estimated to be at least $50 million annually • Capital structure provides financial flexibility to support growth and long term deleveraging plan 4

BlueLinx Overview ▪ BlueLinx is a leading wholesale two-step distributor of building NATIONAL FOOTPRINT and industrial products in the United States ▪ BlueLinx operates 68 warehouses East of the Rockies with approximately 2,500 employees ▪ Completed transformative acquisition of Cedar Creek in April 2018 ▪ Revenue generated from the sale of structural and specialty products Denotes corporate ▪ headquarters in Structural and specialty products are utilized in home Atlanta, Georgia construction ▪ The company offers over 50,000 branded and private- label products STRUCTURAL PRODUCTS Representative ▪ BlueLinx also provides a wide range of value-added services, Products including: ▪ Milling & fabrication services Lumber Remesh ▪ “Less-than-truckload” delivery services Plywood Oriented Strand Board ▪ Inventory stocking & automated order processing Rebar Particleboard ▪ Backhaul services SPECIALTY PRODUCTS Representative ▪ Several end markets including new residential and light Products commercial construction, industrial OEM, and residential repair & remodel Outdoor Living Molding Cedar Roofing & Siding ▪ Bluelinx’s product suite provides a “one-stop” shopping Insulation Engineered Lumber experience for its customers 5

Wholesale Distributors Critical to the Supply Chain WHOLESALE DISTRIBUTOR ▪ Key path to market for most of the lumber building products industry ▪ Fill the necessary step between building products manufacturers and "pro dealers", local lumberyards, specialty distributors and big box retailers ▪ Particularly value–added with specialty products, with higher inventory and service requirements 6

Diversified Customer Base BlueLinx has an extensive roster of high-quality national and regional customers Regional National Home Improvement Industrial Manufactured Dealers Dealers Centers Manufacturers Housing Contractors, builders, Contractors, builders, Retailers with national Makers of furniture, Makers of mobile renovators and other renovators and other scale sheds, crates and other homes, prefab homes end-users end-users wood-based products and RVs 7

Market Demand Drivers Create a Long Runway for Ongoing Value Creation Room To Run: Single family housing growth of 20% just to reach historical average annual growth rates ▪ The Company is well-positioned to continue to grow market share as leading economic indicators continue to paint a favorable picture for building products and its distribution RESIDENTIAL CONSTRUCTION REPAIR & REMODELING SPENDING ▪ Meaningful multi-year growth projected ▪ Strong and consistent recovery expected in R&R spending ▪ Supportive population demographics combined with aging housing stock ▪ Powerful ongoing, long-term demand drivers such as home ownership and housing prices ▪ Favorable credit availability ▪ Consumer trends rebounding after prolonged period ▪ Economics of buying remain favorable to renting of “austerity” during the downturn SINGLE FAMILY HOUSING STARTS CONSTRUCTION MARKET 2.0 1.5 1969-2018 median SFH starts: 1.03M 1.0 SFHS SFHS (inMs) 0.5 0.0 2020E 1969A 1971A 1973A 1975A 1977A 1979A 1981A 1983A 1985A 1987A 1989A 1991A 1993A 1995A 1996A 1998A 2000A 2002A 2004A 2006A 2008A 2010A 2012A 2014A 2016A 2018A Source: U.S. Census Bureau. (2018, July 18). Monthly New Residential Construction 8

Two Industry Leaders Merge 2017 After holding May 2004 its investment 1954 Cerberus for 13 years, Formed as a purchased Dec. 2004 2014 Cerberus division of BlueLinx from Initial Public New senior conducts Georgia-Pacific G-P Offering executive secondary team put in offering of its place shares BlueLinx April 2018 Completed transformative acquisition of Cedar Creek 2016 2010 2010 - 2016 New painting 1977 1982 Acquired by 9 Acquisitions facility for Founded in First Charlesbank prefinished Tulsa, OK expansion Capital siding line beyond initial Partners completed location 9

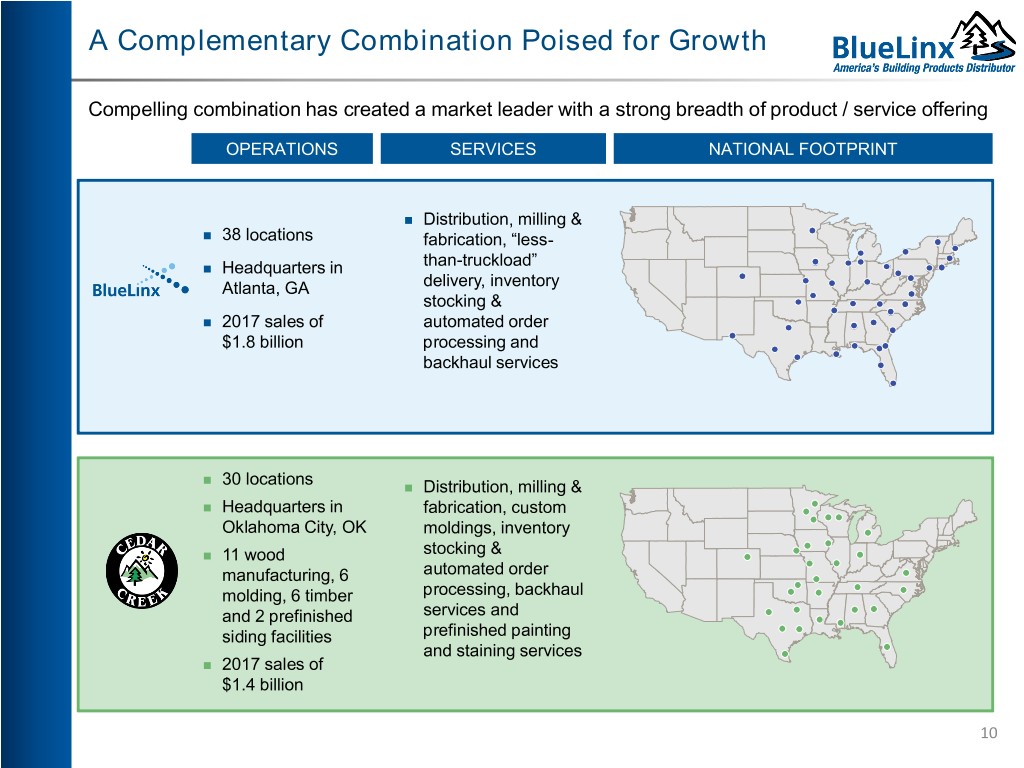

A Complementary Combination Poised for Growth Compelling combination has created a market leader with a strong breadth of product / service offering OPERATIONS SERVICES NATIONAL FOOTPRINT Distribution, milling & 38 locations fabrication, “less- Headquarters in than-truckload” Atlanta, GA delivery, inventory stocking & 2017 sales of automated order $1.8 billion processing and backhaul services 30 locations Distribution, milling & Headquarters in fabrication, custom Oklahoma City, OK moldings, inventory 11 wood stocking & manufacturing, 6 automated order molding, 6 timber processing, backhaul and 2 prefinished services and siding facilities prefinished painting and staining services 2017 sales of $1.4 billion 10

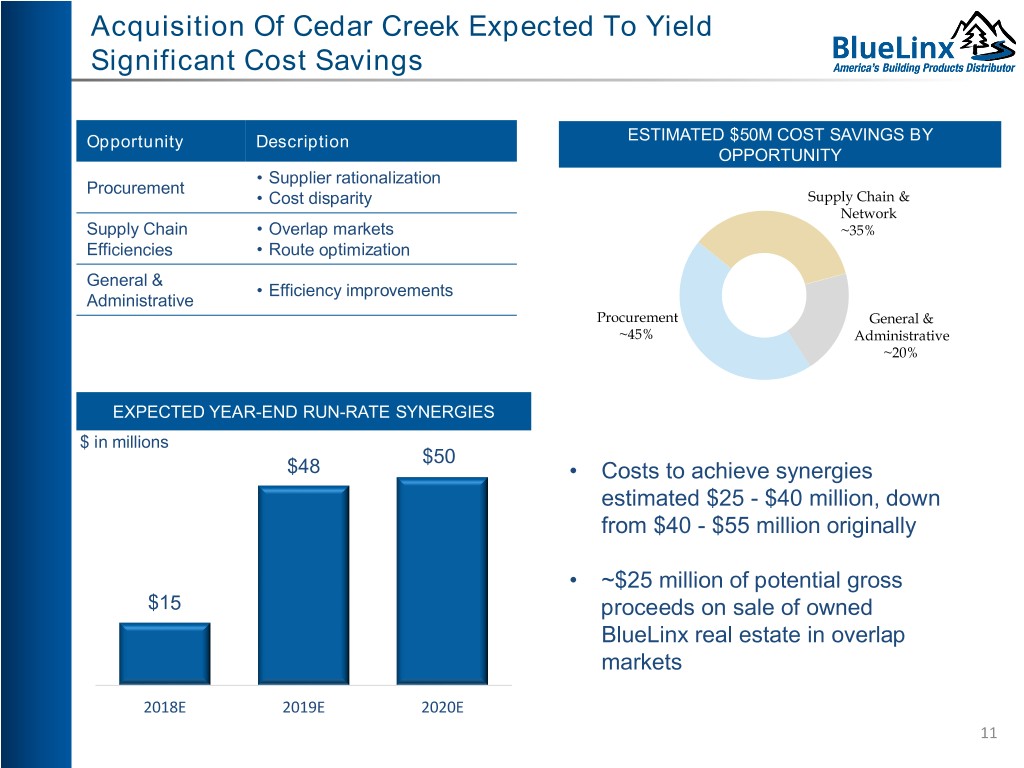

Acquisition Of Cedar Creek Expected To Yield Significant Cost Savings Opportunity Description ESTIMATED $50M COST SAVINGS BY OPPORTUNITY • Supplier rationalization Procurement • Cost disparity Supply Chain & Network Supply Chain • Overlap markets ~35% Efficiencies • Route optimization General & • Efficiency improvements Administrative Procurement General & ~45% Administrative ~20% EXPECTED YEAR-END RUN-RATE SYNERGIES $ in millions $50 $48 • Costs to achieve synergies estimated $25 - $40 million, down from $40 - $55 million originally • ~$25 million of potential gross $15 proceeds on sale of owned BlueLinx real estate in overlap markets 2018E 2019E 2020E 11

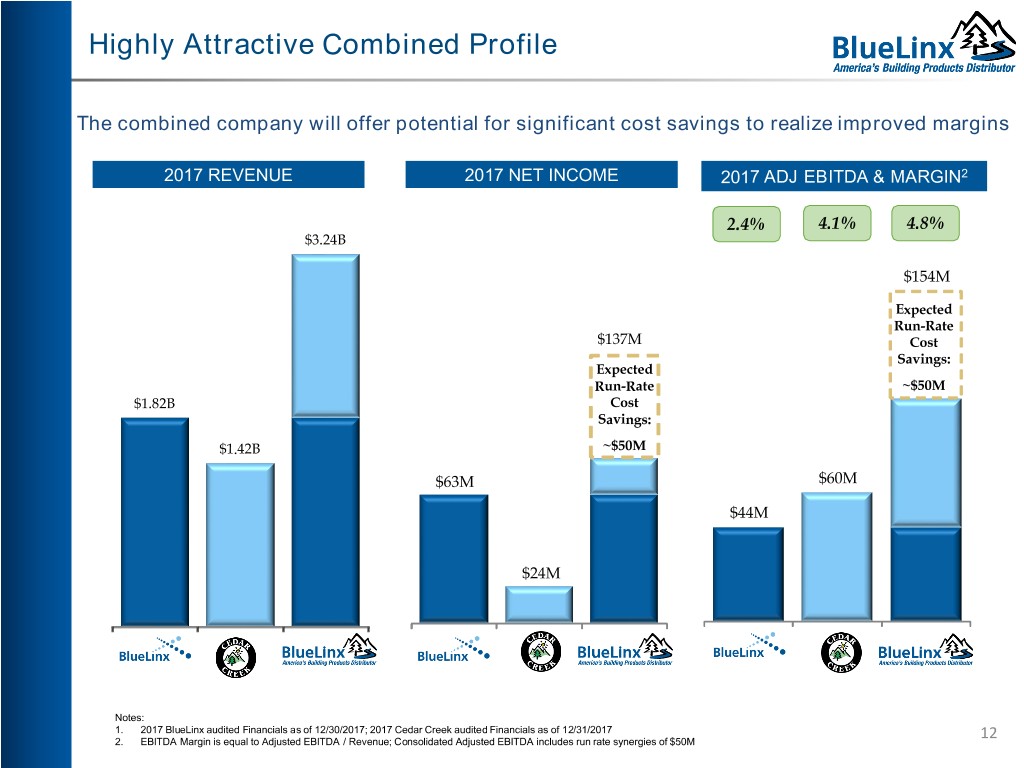

Highly Attractive Combined Profile The combined company will offer potential for significant cost savings to realize improved margins 2017 REVENUE 2017 NET INCOME 2017 ADJ EBITDA & MARGIN2 2.4% 4.1% 4.8% $3.24B $154M Expected Run-Rate $137M Cost Savings: Expected Run-Rate ~$50M $1.82B Cost Savings: $1.42B ~$50M $63M $60M $44M $24M Notes: 1. 2017 BlueLinx audited Financials as of 12/30/2017; 2017 Cedar Creek audited Financials as of 12/31/2017 2. EBITDA Margin is equal to Adjusted EBITDA / Revenue; Consolidated Adjusted EBITDA includes run rate synergies of $50M 12

Cash Flow Generation Supports Deleveraging The combined company is expected to generate significant cost savings with strong working capital and real estate to provide strong asset coverage and ability to quickly delever Based on publicly announced pro forma funded debt of ~$580 million at ENHANCED LEVERAGE PROFILE close1 Leverage o ~$400M drawn at close 6.4x o $180M First Lien Term Loan (with favorable call features) ▪ BlueLinx has high-quality ABL collateral, significantly exceeding the total net ABL debt ~4.0x o Inventory with quick turnover and low obsolescence o Low bad debt expense over the ~2.5x – 3.0x last three years Liquidity o Low customer concentration ~$150 - $160M value of owned real estate based on recent appraisals o Real estate appraised at ~4.0x 2017 year-end net book value BXC 2017 Combined Projected Excess availability plus cash of Year End2 Q1 20183 Q4 2019 $157M at closing Notes: 1. Pro Forma ABL Revolver and term loan debt as of Q1 2018 2. ABL debt of $183M plus $98M mortgage / 2017 Adj. EBITDA of $44M 3. Pro Forma ABL Revolver and term loan debt as of Q1 2018 /2017 Combined Adj. EBITDA plus run-rate cost savings of $50M 13

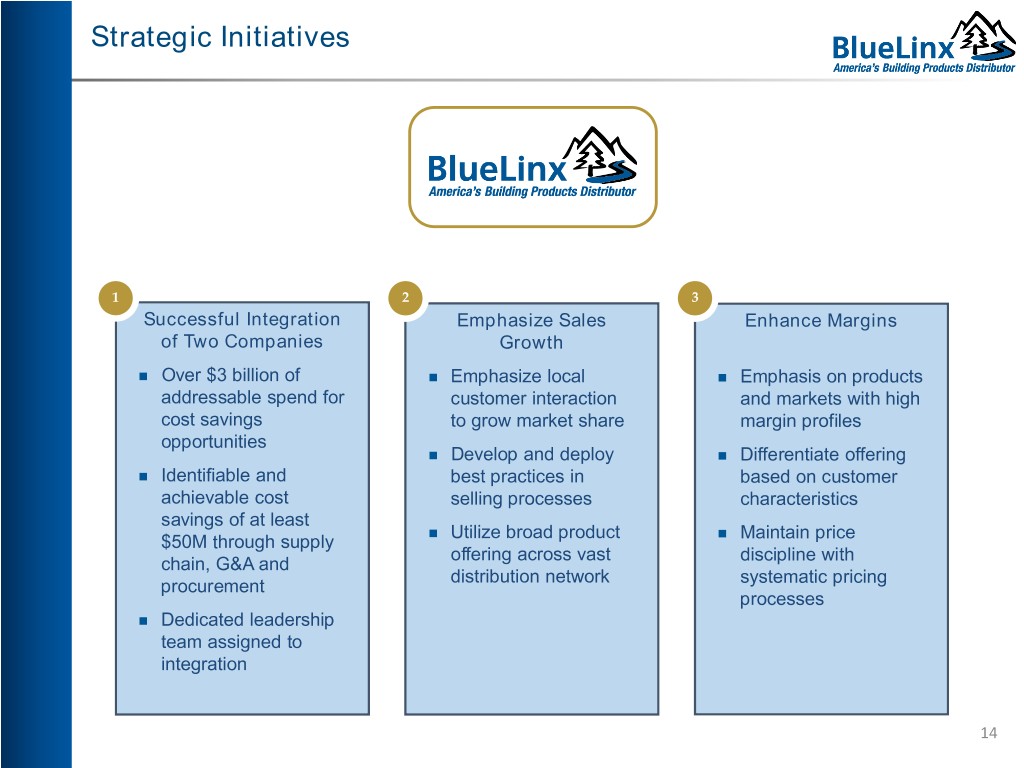

Strategic Initiatives 1 2 3 Successful Integration Emphasize Sales Enhance Margins of Two Companies Growth Over $3 billion of Emphasize local Emphasis on products addressable spend for customer interaction and markets with high cost savings to grow market share margin profiles opportunities Develop and deploy Differentiate offering Identifiable and best practices in based on customer achievable cost selling processes characteristics savings of at least Utilize broad product Maintain price $50M through supply offering across vast discipline with chain, G&A and distribution network systematic pricing procurement processes Dedicated leadership team assigned to integration 14

Investment Considerations 1 ABILITY TO CAPITALIZE ON STRONG HOUSING MARKET MOMENTUM 2 REALIZATION OF AT LEAST $50 MILLION IN SYNERGIES FROM CEDAR CREEK ACQUISITON 3 RECOGNIZED LEADER IN A CONSOLIDATING INDUSTRY 4 CAPITAL STRUCTURE PROVIDES FINANCIAL FLEXIBILITY AND LONG TERM DELEVERAGING 15

Appendix

Non-GAAP And Supplementary Financial Measures BlueLinx reports its financial results in accordance with GAAP, but we also believe that presentation of certain non-GAAP measures, as well as GAAP-based and non-GAAP supplemental financial measures, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. We caution that non-GAAP measures and supplemental financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Adjusted EBITDA. We define Adjusted EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted to exclude certain non-cash items, and other adjustments to Consolidated Net Income, including, as applicable, compensation expense from SARs, and one-time charges associated with the legal, consulting, and professional fees related to the Cedar Creek acquisition, and interest charges on debt modification fees under the CMBS mortgage payoff in the first quarter of fiscal 2018. We present Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance and, we believe, helps to enhance investors' overall understanding of the financial performance and cash flows of our business. We believe Adjusted EBITDA is helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. However, Adjusted EBITDA is not a presentation made in accordance with GAAP, and is not intended to present a superior measure of the financial condition from those determined under GAAP. Adjusted EBITDA, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. 17

Reconciliation of GAAP to Adjusted Measures 2017 Adjusted EBITDA Reconciliation BlueLinx Cedar Creek Combined Net income (loss) $63 $24 $87 Adjustments: Depreciation and amortization 9 14 23 Interest expense 21 10 31 Provision for (benefit from) income taxes (53) 8 (45) Other 4 4 8 Adjusted EBITDA $44 $60 $104 18

Please reference our Financial Information and SEC Filings available on our website www.BlueLinxCo.com