Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - A10 Networks, Inc. | exhibit991pressreleaseq218.htm |

| 8-K - FORM 8-K - A10 Networks, Inc. | a8-kpressreleaseq218.htm |

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 1 | Page

Thank you all for joining us today. This call is being recorded and webcast live and may be accessed for one year via the A10 Networks website, www.a10networks.com. Members of A10's management team joining me today are, Lee Chen, Founder & CEO; Tom Constantino, CFO; and Chris White, EVP of worldwide sales. Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its preliminary second quarter and first half 2018 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 2 | Page

During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our future operating results, our expectations for future revenue growth and market opportunities, the performance of our products, our future strategies, our ability to penetrate certain markets, anticipated customer benefits from use of our products, expected product launches and the general growth of our business. These statements are based on current expectations and beliefs as of today, August 30, 2018. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially and you should not rely on them as predictions of future events. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. For a more detailed description of these risks and uncertainties, please refer to our most recent 10-Q and 10-K. Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. The non-GAAP financial measures are not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP, and may be different from non-GAAP financial measures presented by other companies. A reconciliation between GAAP and non- GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the third quarter of 2018 on a non-GAAP basis. However, we are unable to make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Before I turn the call over to Lee, I’d like to announce that in September, management will present at the Dougherty Institutional Investor Conference in Minneapolis and we look forward to seeing many of you there. Now I would like to turn the call over to Lee Chen, Founder and CEO of A10 Networks. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 3 | Page

Thank you, Maria and thank you all for joining us. We are pleased to be here with you today and on behalf of the entire A10 team, I would like to thank you for your support and patience as we worked through our internal investigation and restatement. We are glad to have that behind us and with this call we are looking forward to beginning the process of reengaging with the investment community. We have a lot to discuss today. There are a number of trends in the market that we believe play to A10's strengths and we are leveraging our proven platform to enable intelligent automation with deep machine learning to ensure business critical applications are protected, reliable and always available. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 4 | Page

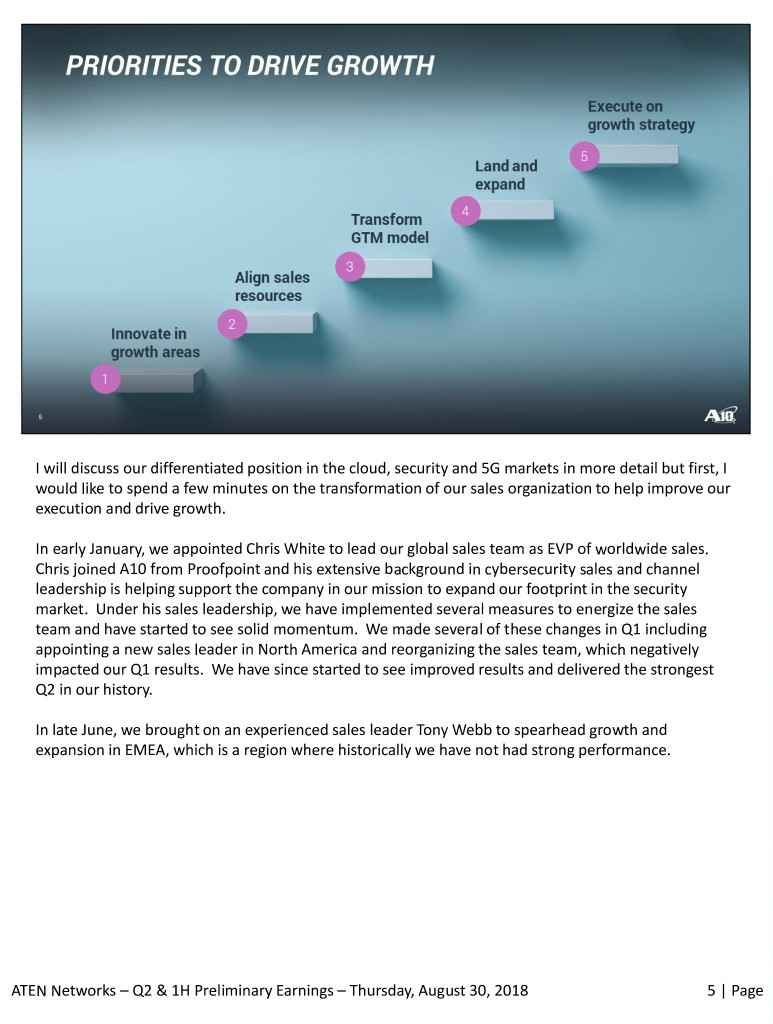

I will discuss our differentiated position in the cloud, security and 5G markets in more detail but first, I would like to spend a few minutes on the transformation of our sales organization to help improve our execution and drive growth. In early January, we appointed Chris White to lead our global sales team as EVP of worldwide sales. Chris joined A10 from Proofpoint and his extensive background in cybersecurity sales and channel leadership is helping support the company in our mission to expand our footprint in the security market. Under his sales leadership, we have implemented several measures to energize the sales team and have started to see solid momentum. We made several of these changes in Q1 including appointing a new sales leader in North America and reorganizing the sales team, which negatively impacted our Q1 results. We have since started to see improved results and delivered the strongest Q2 in our history. In late June, we brought on an experienced sales leader Tony Webb to spearhead growth and expansion in EMEA, which is a region where historically we have not had strong performance. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 5 | Page

Now let me take you through some of the exciting opportunities we see in Cloud, Security and 5G. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 6 | Page

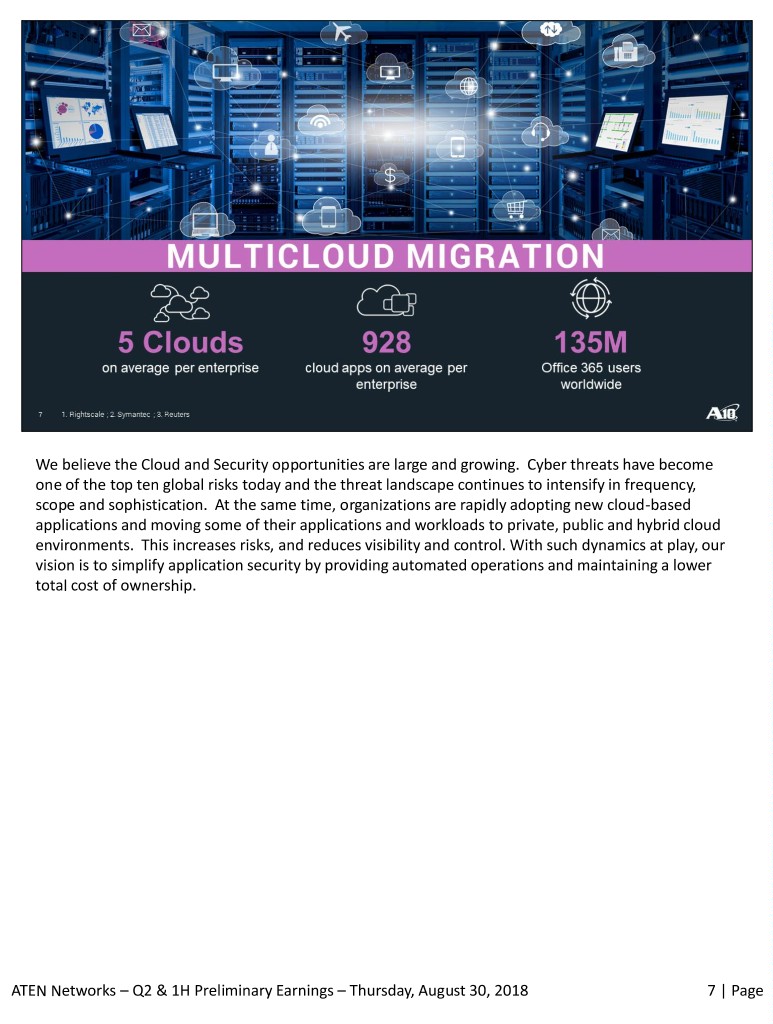

We believe the Cloud and Security opportunities are large and growing. Cyber threats have become one of the top ten global risks today and the threat landscape continues to intensify in frequency, scope and sophistication. At the same time, organizations are rapidly adopting new cloud-based applications and moving some of their applications and workloads to private, public and hybrid cloud environments. This increases risks, and reduces visibility and control. With such dynamics at play, our vision is to simplify application security by providing automated operations and maintaining a lower total cost of ownership. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 7 | Page

A10’s container-based Harmony Controller plays a strategic role in driving our vision in automated operations through data analysis and machine learning. Harmony Controller is a cloud native centralized management and traffic data analytics platform to manage A10’s product line through OpenAPI. It brings total visibility to multi-cloud and on-premises by providing network and application intelligence with a single pane of glass. Operations can troubleshoot faster, manage capacity planning, detect performance issues, enforce security policies and discover security anomalies in an automated manner. Over the past several months we have significantly enhanced Harmony Controller. In August, we added a key feature to Harmony Controller and it is now highly extensible by introducing a framework to run modular Apps. Using the framework, we introduced three new Apps: SSLi, GiFW and CGNAT. With the extensible framework in place, we plan to enable additional Apps for some of the popular third-party software as a service deployments. These modular Apps will provide cloud visibility and enable enterprises to monitor their SaaS deployments. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 8 | Page

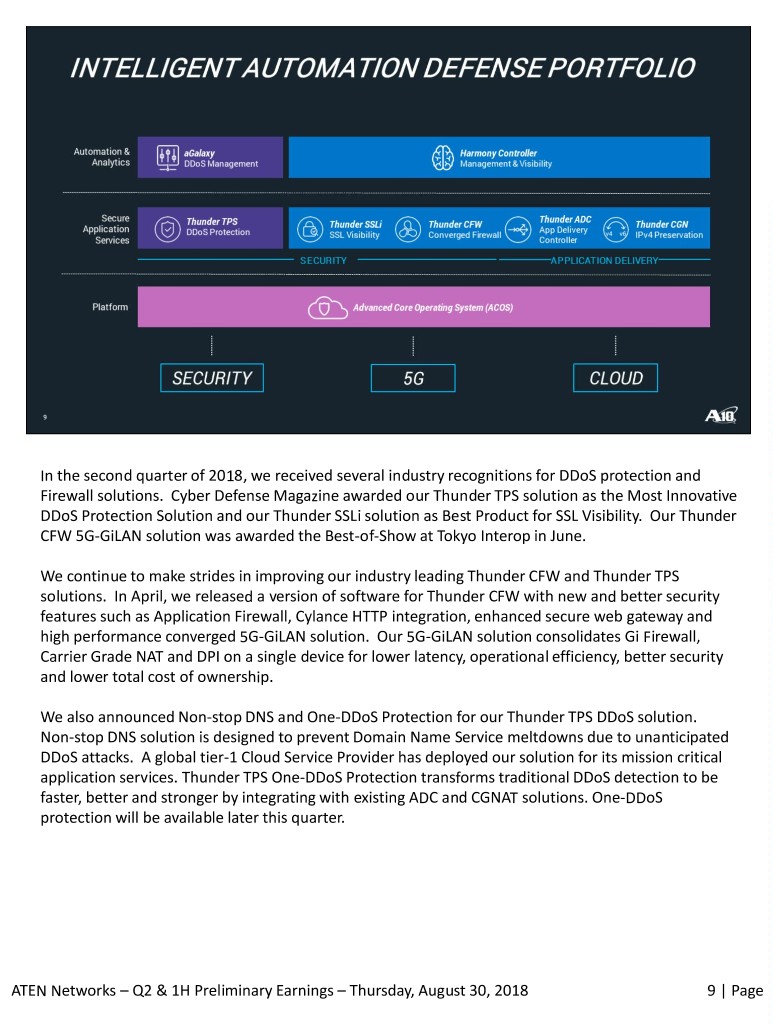

In the second quarter of 2018, we received several industry recognitions for DDoS protection and Firewall solutions. Cyber Defense Magazine awarded our Thunder TPS solution as the Most Innovative DDoS Protection Solution and our Thunder SSLi solution as Best Product for SSL Visibility. Our Thunder CFW 5G-GiLAN solution was awarded the Best-of-Show at Tokyo Interop in June. We continue to make strides in improving our industry leading Thunder CFW and Thunder TPS solutions. In April, we released a version of software for Thunder CFW with new and better security features such as Application Firewall, Cylance HTTP integration, enhanced secure web gateway and high performance converged 5G-GiLAN solution. Our 5G-GiLAN solution consolidates Gi Firewall, Carrier Grade NAT and DPI on a single device for lower latency, operational efficiency, better security and lower total cost of ownership. We also announced Non-stop DNS and One-DDoS Protection for our Thunder TPS DDoS solution. Non-stop DNS solution is designed to prevent Domain Name Service meltdowns due to unanticipated DDoS attacks. A global tier-1 Cloud Service Provider has deployed our solution for its mission critical application services. Thunder TPS One-DDoS Protection transforms traditional DDoS detection to be faster, better and stronger by integrating with existing ADC and CGNAT solutions. One-DDoS protection will be available later this quarter. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 9 | Page

For mobile carriers, 5G creates new business opportunities with unprecedented speed, machine to machine traffic growth, new mobile applications and proliferation of IoT. Given A10's stronghold in protecting and securing hundreds of mobile carriers around the world, we believe we are well positioned to benefit from the global transition to 5G networks between now and 2025 by expanding our footprint within those accounts, as well as growing our market reach into new accounts. We just launched Thunder CFW 5G-GiLAN solution in April and have already secured two large wins from major carriers to accelerate their initial 5G deployment. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 10 | Page

Since 2017, we have been offering subscription-based services on select solutions, such as real-time threat intelligence. We also made Harmony Controller available through a subscription this year. While subscription revenue is still a small portion of our sales, it grew 187 percent in the first half of 2018 compared with the same period in 2017. We expect subscription revenue to continue to grow rapidly over the next couple of years. Going forward, while we continue to expect some variability in our total revenue quarter to quarter given large deals with our marquee customers, we see significant opportunity for growth when looking at the longer-term trend. We currently expect to grow in the second half of 2018 compared with the first half. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 11 | Page

We added approximately 340 new customers in the first half of this year and we now have approximately 6,500 customers. Let me share with you some recent customer engagements: • A Tier-1 mobile carrier in Asia selected our Thunder CFW 5G-GiLAN solution for its next generation 5G network rollout in a highly competitive bake-off. A10’s proven capabilities to consolidate GiFW and CGNAT, simultaneously with IPv6 migration technologies on the same device results in lower TCO, sustained scalability and exceptional performance. • A major Japanese mobile carrier selected our Thunder CFW 5G-GiLAN solution for the carrier’s 5G network rollout. A10’s 5G-GiLAN solution provides the mobile carrier with a highly scalable, consolidated and secured solution for a comprehensive network defense, with automation for improved business agility, faster network rollout and overall reduction of TCO. • We expanded our footprint within one of our large marquee enterprise customers, with a significant ADC win within their fast-growing cloud division. • The largest dental insurance company in America standardized on A10's Thunder ADC with the Harmony Controller. This company was looking to refresh their ADC infrastructure, requiring advanced SSL ciphers, and selected A10 because they found our platform extremely reliable, easy- to-use and they wanted to manage their ADC assets from a single pane of glass. • After experiencing increasing levels of frustration and disappointment with a traditional DDoS vendor’s product, a large gaming company chose A10’s Thunder TPS DDoS mitigation solution to cope with the growing volume of DDoS attacks that were impacting the experience of their users. • And lastly, a multinational consumer electronics retailer chose to deploy our Thunder SSLi after a competitor’s solution failed to deliver the performance and reliability needed to cope with their high network traffic demands. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 12 | Page

In summary, although Q1 was impacted by our sales transformation, we are now making progress on our key initiatives to improve our sales execution. We are excited about many significant advancements to our solutions, and believe we are now well positioned to benefit from the industry trends. We still have more work ahead but believe we are on the right path. We have strengthened our team, increased our pace of innovation, and targeted our R&D investments in cloud, security and 5G. We have a very focused and aligned management team and we are excited about the opportunities in front of us. I will now turn the call over to Tom to walk you through our financials. Tom? ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 13 | Page

Thank you, Lee. I would like to echo Lee's comments that we are pleased to have the internal investigation behind us and we look forward to rebuilding an active cadence of communication with our investors going forward. I would also like to note that on August 29, 2018 we filed our 2017 10-K, including adjustments to our financial statements for prior periods. These adjustments are principally related to the timing of revenue recognition of certain transactions as we announced on July 2, 2018. The amended filings did not have an impact on the aggregate amount of revenue recognized by the company but the timing of recognition of revenue among certain quarterly periods did shift. Additional details regarding these restatements are contained in our Form 10-K filed with the SEC. Additionally, we currently plan to file our quarterly reports for Q1 and Q2 of 2018 in September. Lastly, I’d like to note that our 2018 results and guidance discussed on this call are on the new standard ASC606 that went into effect in January of this year, whereas the 2017 periods are on ASC605 standard. The effect of the new standard was minimal to our first half results and we expect it to be minimal for the year. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 14 | Page

Moving to our results, we reported 109.9 million dollars in revenue for the first half of 2018, compared with 117.9 million dollars last year. As Lee mentioned, we had a challenging start to the year as we restructured our North America and global sales teams and ramped our new sales leadership. This impacted our Q1 revenue results, but we are pleased with the steady progress we are making on our initiatives and improved momentum we saw in the second quarter. Second quarter revenue grew to 60.7 million dollars, which represented the strongest Q2 in our history. Improved execution and a significant new expansion win within a fast-growing division of our largest customer contributed to our strong Q2 revenue results. In total, sales to this customer accounted for 19.6 percent of our total revenue in Q2. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 15 | Page

I'm pleased to report that in Q2 we achieved year-over-year product revenue growth. Product revenue grew 19 percent year-over-year to 39.2 million dollars in Q2, bringing our total product revenue in the first half of the year to 67.4 million dollars, or 61 percent of total revenue. Our first half service revenue was 42.5 million dollars, or 39 percent of total revenue. Before moving on to our revenue mix by geography, I would like to note that for fiscal 2017 revenue from security was 26 percent of total product revenue and we expect that to be north of 30 percent of our revenue mix in 2018. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 16 | Page

Moving to our revenue from a geographic standpoint for the first half, revenue from the United States was 51 million dollars or 47 percent of total revenue, compared with 63 million dollars, or 54 percent in the same period last year. First half revenue from Japan was 25 million dollars, representing an increase of 17 percent year-over-year. First half revenue from APAC, excluding Japan, was 18 million dollars, compared with 18 million dollars in the same period last year. In EMEA, our first half revenue totaled approximately 12 million dollars. In other regions over the same period revenue increased to 4 million dollars. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 17 | Page

Enterprise revenue in Q2 increased 23 percent year-over-year to 38 million dollars, bringing our total enterprise revenue in the first half of the year to 66 million dollars. Service provider revenue in the first half of the year came in at 44 million dollars, compared with 51 million dollars in the prior year period. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 18 | Page

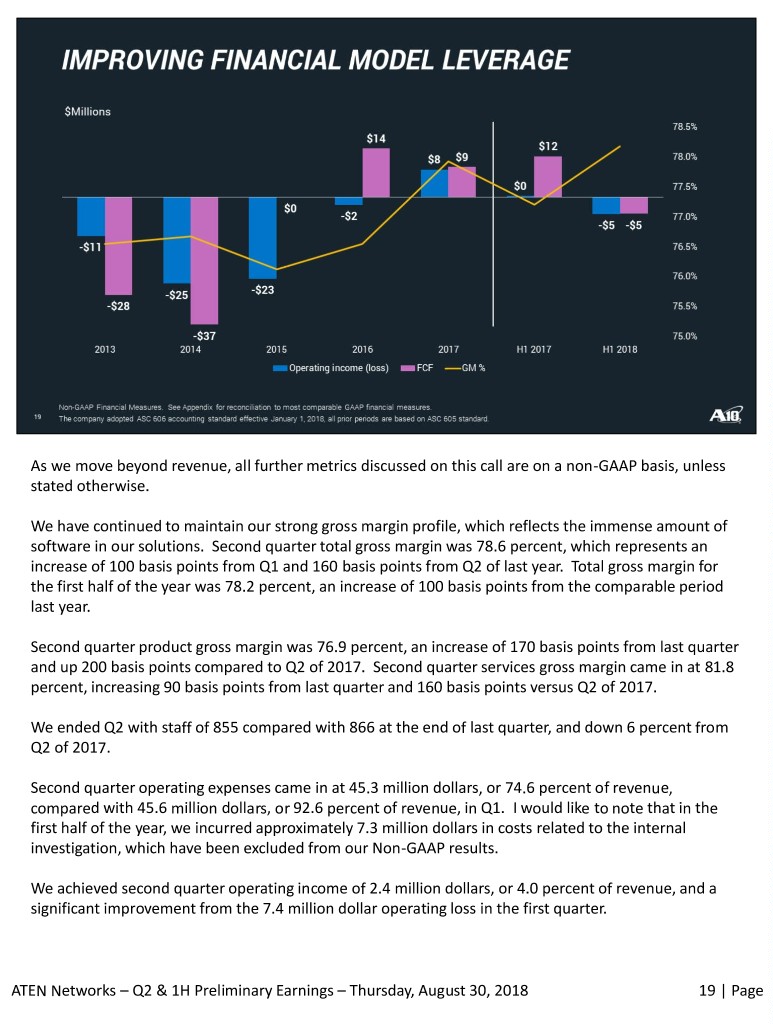

As we move beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless stated otherwise. We have continued to maintain our strong gross margin profile, which reflects the immense amount of software in our solutions. Second quarter total gross margin was 78.6 percent, which represents an increase of 100 basis points from Q1 and 160 basis points from Q2 of last year. Total gross margin for the first half of the year was 78.2 percent, an increase of 100 basis points from the comparable period last year. Second quarter product gross margin was 76.9 percent, an increase of 170 basis points from last quarter and up 200 basis points compared to Q2 of 2017. Second quarter services gross margin came in at 81.8 percent, increasing 90 basis points from last quarter and 160 basis points versus Q2 of 2017. We ended Q2 with staff of 855 compared with 866 at the end of last quarter, and down 6 percent from Q2 of 2017. Second quarter operating expenses came in at 45.3 million dollars, or 74.6 percent of revenue, compared with 45.6 million dollars, or 92.6 percent of revenue, in Q1. I would like to note that in the first half of the year, we incurred approximately 7.3 million dollars in costs related to the internal investigation, which have been excluded from our Non-GAAP results. We achieved second quarter operating income of 2.4 million dollars, or 4.0 percent of revenue, and a significant improvement from the 7.4 million dollar operating loss in the first quarter. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 19 | Page

In the second quarter, we achieved net income of 1.6 million dollars, or 2 cents per diluted share. Our net income performance this quarter represents a significant improvement from a net loss of 7.0 million dollars in Q1. Diluted weighted shares used for computing EPS for the second quarter were approximately 74.6 million shares, while basic shares outstanding for computing the net loss in Q1 were 72.2 million shares. Moving to the balance sheet. At June 30, 2018 we had 127.4 million dollars in total cash and marketable securities, compared with 130.7 million dollars at the end of March. Our cash balance reflects the use of approximately 3.2 million dollars in cash to fund operations during the quarter. Average days sales outstanding were 75 days, down from 87 in the prior quarter. DSO improved quarter over quarter due to increased sales in Q2 and an improvement in collections. ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 20 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 21 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 22 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 23 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 24 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 25 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 26 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 27 | Page

ATEN Networks – Q2 & 1H Preliminary Earnings – Thursday, August 30, 2018 28 | Page