Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ClearSign Technologies Corp | tv501880_8k.htm |

Exhibit 99.1

The Future of Combustion: Clean Air, Low Cost, Rapid Payback NASDAQ: CLIR

Cautionary Note on Forward - Looking Statements This presentation contains forward - looking statements. These statements include statements about our plans, strategies, financia l performance, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, the actual results, performance or achievements of ClearSign Combustion Corporation (“ ClearSign ,” “we,” “us,” “our,” and, together with our subsidiaries, the “Company”) may differ materially from those expressed or implied by these forward - looking statements. In some cases, you can identify forwa rd - looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” an d variations of these terms and similar expression, or the negative of these terms or similar expressions. Such forward - looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management team based on their experience are inherently uncertain. All statements in this presentation regarding our business strategy, future operations, fin ancial position, prospects, business plans and objectives, as well as information concerning industry trends and expected actions of third parties, are forward - looking statements. All forward - looking statements speak only as of the date as of which they are made. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions concerning future events that are d iff icult to predict. • The following factors, among others, could cause actual results to differ materially from those set forth in this presentatio n: • We are a company with a limited operating history and our future profitability is uncertain. We anticipate future losses and neg ative cash flow and we may never be profitable; • If we do not receive additional financing when and as needed in the future, we may not be able to continue our research and d eve lopment efforts or commercialization efforts and our business may fail; • Market acceptance of our technology and business is difficult to predict. If our technology does not achieve market acceptan ce, our business could fail; • Our efforts may never demonstrate the feasibility of our product; • Changes to environmental regulations could make our technology less desirable; • We may fail to adequately protect our proprietary technology, which would allow our competitors to take advantage of our rese arc h and development efforts; • We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual prope rty rights; • We cannot guarantee that any research and development partnership we enter into will be successful; • If we are unable to keep up with rapid technological changes, our products may become obsolete; • Our technology and its industrial applications have not yet been safety tested; • We will depend on approval from various local, state and federal agencies to implement and operate our technology. There is n o a ssurance that these agencies will approve our technology; • Because our technology has not yet been fully developed or implemented, we are uncertain of our profit margins and whether su ch profit margins, if achieved, will be able to sustain our business; • Many of our potential competitors have greater resources, and it may be difficult to compete against them; • The loss of the services of our key management and personnel or the failure to attract additional key personnel could adverse ly affect our ability to operate our business; • The public market for our securities is volatile. This may affect not only the ability of our investors to sell their securit ies , but the price at which they can sell their securities; • We have the right to issue shares of preferred stock. If we were to issue preferred stock, it is likely to have rights, prefe ren ces and privileges that may adversely affect the common stock; • We may be required to raise additional financing by issuing new securities, which may have terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock and our business; • We have not paid dividends in the past and have no immediate plans to pay dividends; • We have incurred and will incur significant costs as a result of being a public company that reports to the Securities and Ex cha nge Commission and our management is required to devote substantial time to meet compliance obligations; and • Our charter documents and Washington law may inhibit a takeover that shareholders consider favorable. We caution you not to place undue reliance on any forward - looking statements, which are made as of the date hereof or as otherwi se specified herein. The Company undertakes no obligation to update any of these forward - looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward - looking statements, except to the extent required by applicable law. If we update one or more forward - looking statements, no inference should be drawn that we will make additional updates with respect to those or other forwarding - looking statements. 2

Urgent, Global Problem 3 From Los Angeles… … to Beijing

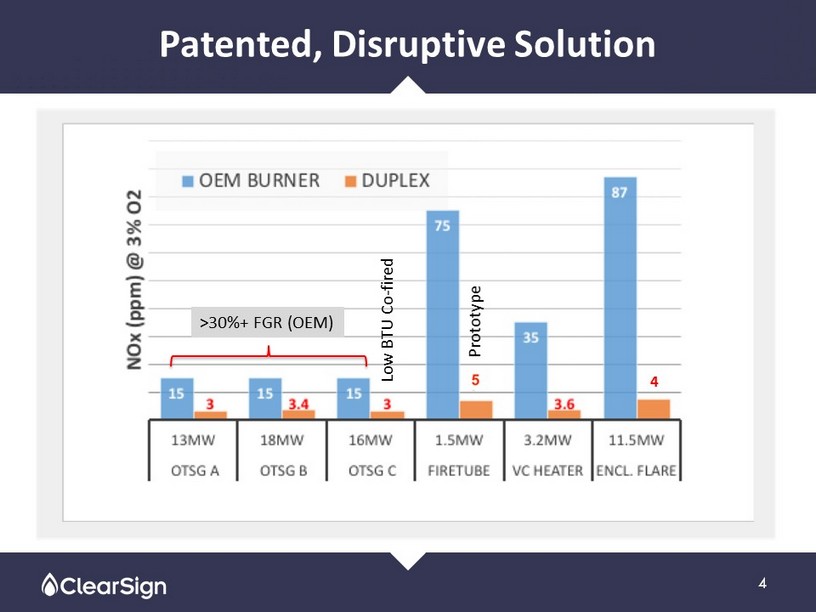

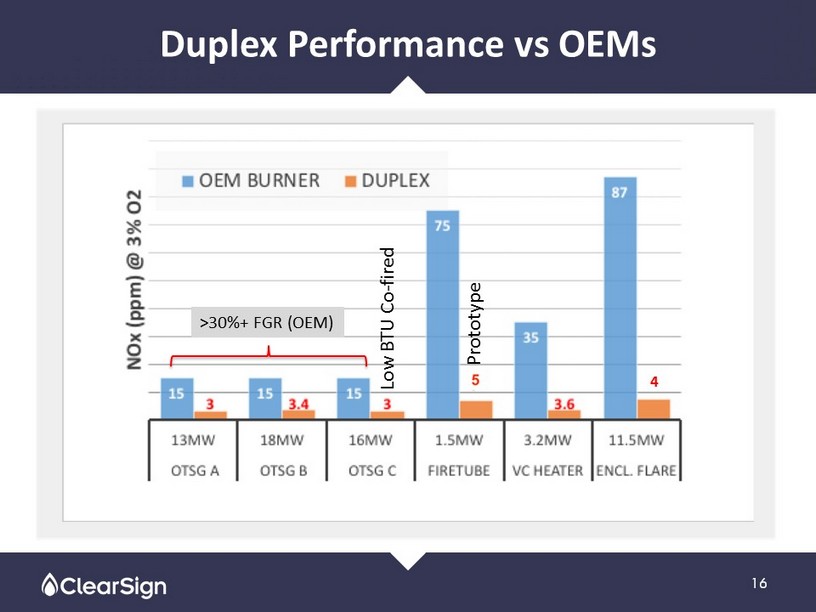

Patented, Disruptive Solution 4 >30%+ FGR (OEM) Low BTU Co - fired Prototype 4

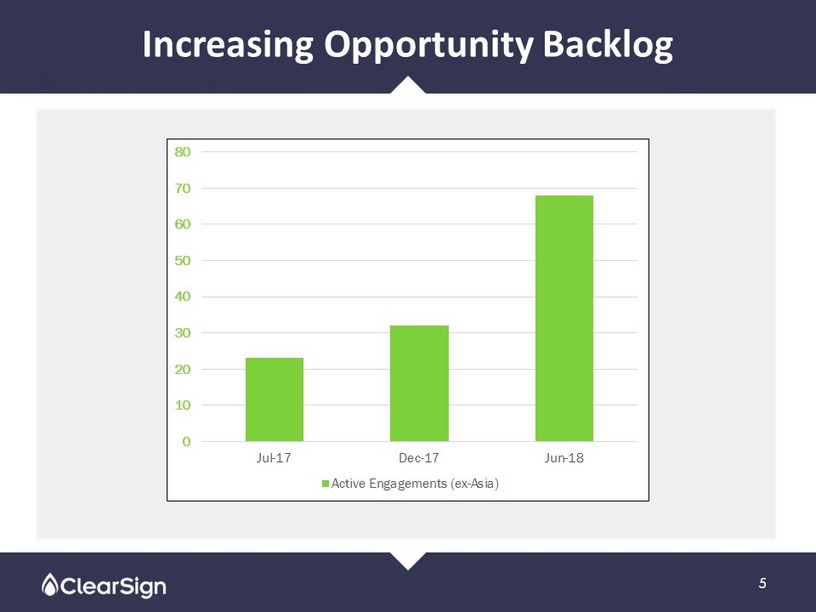

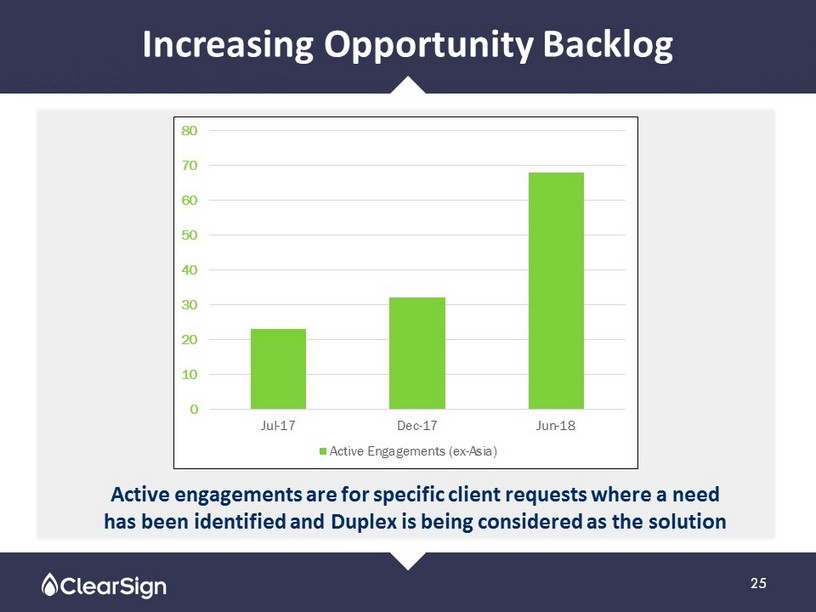

Increasing Opportunity Backlog 5 0 10 20 30 40 50 60 70 80 Jul-17 Dec-17 Jun-18 Active Engagements (ex-Asia)

Investment Highlights 6 • Large, growing global addressable market ($3.6B+) [Frost & Sullivan] • Patented and proven technology provides transformational improvement in emissions and overall operating costs – 200 patents filed (73 issued, 117 pending) – Demonstrated to reduce NOx emissions below toughest requirements (5 PPM) – Provides a return on investment for a traditional “cost of compliance” • Rapid scale - up potential via “plug & play” product introductions and key strategic partnerships • “Asset - lite” model with attractive margins • Proven management team with deep industry experience • Well - capitalized with growing commercial pipeline

Combustion Market Opportunity 7 x Fundamental: The lighting of a flame and the resulting heat (i.e. – combustion) is a fundamental energy conversion process x Ubiquitous: 2/3 of energy used in U.S. manufacturing converted via combustion in CLIR’s core market of boilers, furnaces and process heaters¹ x Plentiful Upgrade Activity : Operators continually installing, maintaining and upgrading equipment to maximize energy efficiency and comply with increasingly strict emissions regulations 1 U.S. Department of Energy, 2011 Combustion systems operate everywhere and represent a multi - billion dollar global and growing market for ClearSign

ClearSign: U.S. Targeted Markets 8 Refinery Segment • up to $826M ¹ Enhanced Oil Recovery (EOR) Segment • up to $100M ² Large Industrial Segment • up to $802M ¹ Institutional Commercial and Industrial (ICI) Boiler Segment • up to $1,723M ¹ Flare Segment • up to $201M ¹ Targeted 10 - Year Addressable U.S. Market of $3.6 Billion ¹ Frost & Sullivan Market Assessment Report, June 2016 ² The EOR Segment includes Western Canada 10 yr. estimate by ClearSign of $45M as well as the U.S. market of $79M determined by Frost & Sullivan Market Assessment Report, June 2016

China Market Opportunity 9 Mandatory • Govt. mandates drive investment and local participation • $300 billion spent to reduce air pollution (2013 - 2017) • Multi - billion dollar market with motivated local operating partners Multiple Duplex Markets • District Heating • Refinery • Steel • Pulp & Paper • Cement • Marine • Aerospace Urgent • Improving air quality a top govt. priority • NOx boiler emission standard for Beijing and key regions reduced to 15 ppm (April 2017) • Govt. considering 7.5 ppm in 2019

China: Targeted Entry Strategy 10 District Heating Area in China District Heating Area Non District Heating Area

China: Targeted Entry Strategy 11 • District heating represents critical market segment • Government mandates forcing rapid conversion to gas fired boilers (CLIR’s target market) • China’s ICI boiler market roughly double size of U.S. and growing Gas Fired Oil Fired Coal Fired Other 9,635 (82%) 655 1085 446 Total Boilers 11,821 3,030 units 9,635 units 2013 2016 218% 2015 (Actual) 670,000 units 720,000 2020 (Est) Operating Industrial Boilers District Heating Boilers

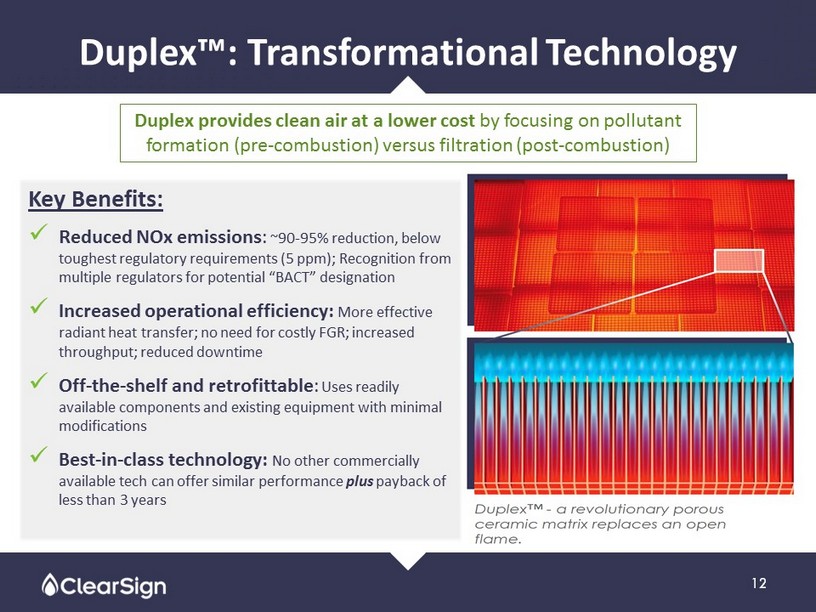

Duplex™: Transformational Technology 12 Key Benefits: x Reduced NOx emissions : ~90 - 95% reduction, below toughest regulatory requirements (5 ppm); Recognition from multiple regulators for potential “BACT” designation x Increased operational efficiency: More effective radiant heat transfer; no need for costly FGR; increased throughput; reduced downtime x Off - the - shelf and retrofittable : Uses readily available components and existing equipment with minimal modifications x Best - in - class technology: No other commercially available tech can offer similar performance plus payback of less than 3 years Duplex provides clean air at a lower cost by focusing on pollutant formation (pre - combustion) versus filtration (post - combustion)

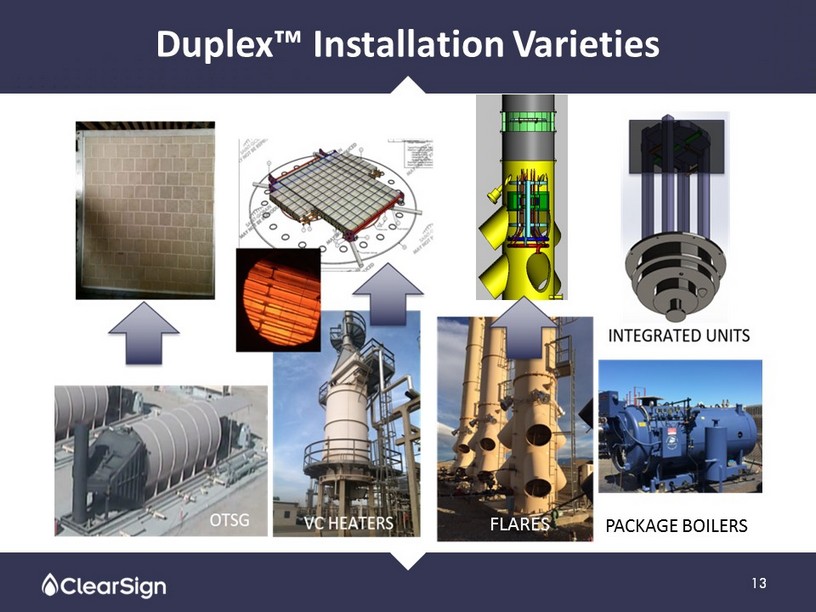

Duplex ™ Installation Varieties 13 FLARES PACKAGE BOILERS

Duplex Plug & Play™: Productized Solution Simple, pre - engineered, direct burner replacement from standardized components: x “Off - the - shelf” Quick and Easy Installation x Eliminates Flame Impingement x Eliminates Burner - to - Burner Interference x Ideal for Up - fired Heater Applications x "On - line” or “Hot - Swap” Replacement Potential x NOx level Reductions of ~ 90 - 95% x Ideal for licensing x More “plug & play” products coming 14

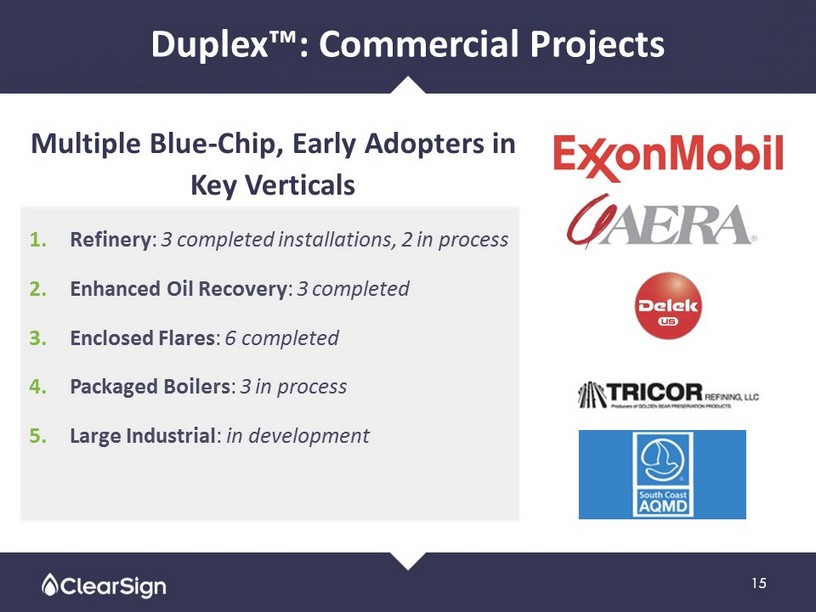

Duplex™: Commercial Projects Multiple Blue - Chip, Early Adopters in Key Verticals 1. Refinery : 3 completed installations, 2 in process 2. Enhanced Oil Recovery : 3 completed 3. Enclosed Flares : 6 completed 4. Packaged Boilers : 3 in process 5. Large Industrial : in development 15

Duplex Performance vs OEMs 16 >30%+ FGR (OEM) Low BTU Co - fired Prototype 4

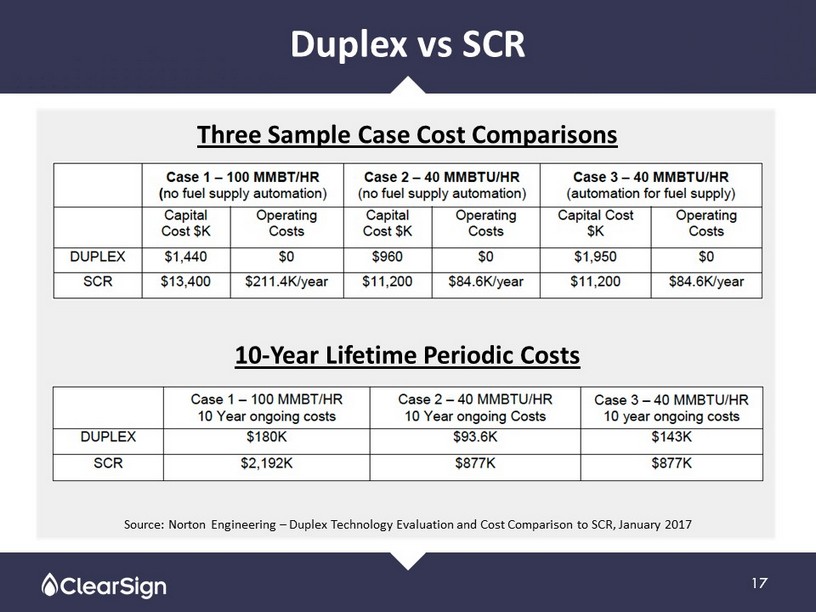

Duplex vs SCR 17 Source: Norton Engineering – Duplex Technology Evaluation and Cost Comparison to SCR, January 2017 Three Sample Case Cost Comparisons 10 - Year Lifetime Periodic Costs

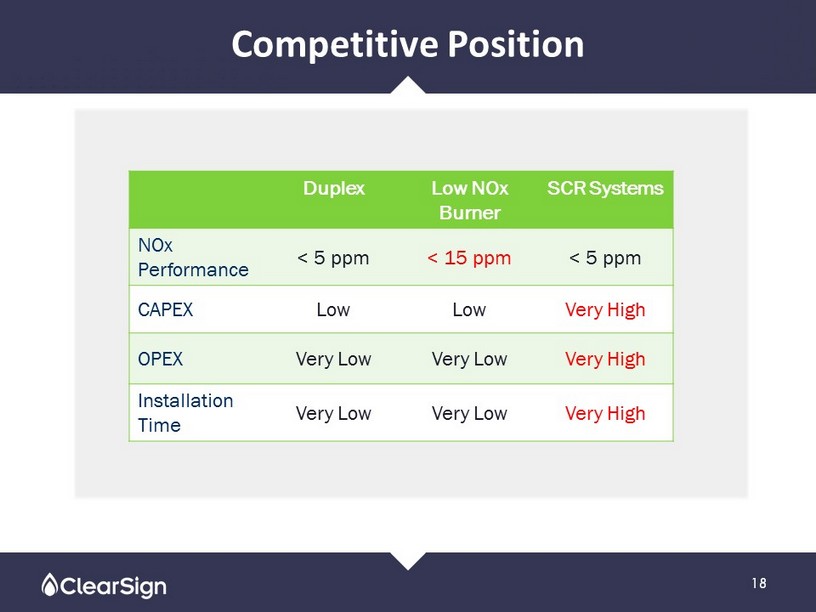

Competitive Position 18 Duplex Low NOx Burner SCR Systems NOx Performance < 5 ppm < 15 ppm < 5 ppm CAPEX Low Low Very High OPEX Very Low Very Low Very High Installation Time Very Low Very Low Very High

Duplex™: An “Asset - Lite” Business Model • Unique value proposition provides strong potential margins (> 50%) • Minimum working capital and CapEx requirements • Simple, cost - effective designs • Designs allow subcontracting or licensing through existing regional partners trusted by customers • Patented technology can be licensed through existing channel participants: ✓ Major players become partners not competitors ✓ Sales accelerate through existing channel infrastructure 19

Key Market Drivers • Mandatory Regulatory Compliance : Increasing regulation of NOx and other pollutants across the U.S.(Clean Air Act and Rule 4311), Canada, Europe and China – Operators in our target markets are under pressure to meet current and proposed federal, state, and local pollution emissions standards – We expect these standards to continue to become more stringent – ClearSign is well positioned to take advantage of these changes once finalized • California and Texas represent ~40% of total US refining capacity • 100% of ClearSign’s US projects in these areas • Operational Efficiency : Energy/Cost savings, Increased throughput, Reduced maintenance and downtime • Commodity Prices 20

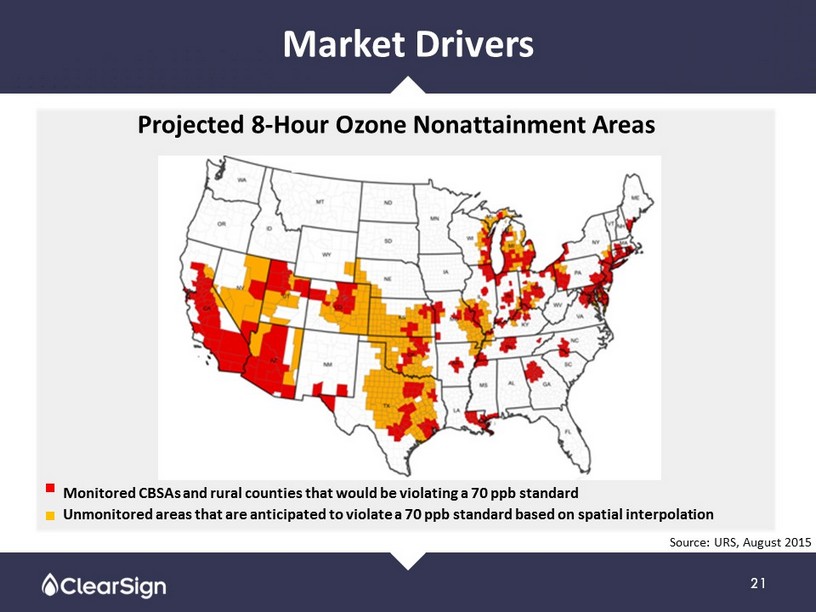

Market Drivers 21 Projected 8 - Hour Ozone Nonattainment Areas Source: URS, August 2015 Monitored CBSAs and rural counties that would be violating a 70 ppb standard Unmonitored areas that are anticipated to violate a 70 ppb standard based on spatial interpolation

Strong Intellectual Property Rapidly expanding patent portfolio & complete freedom to practice 22 117 Patents Pending 73 Patents Granted

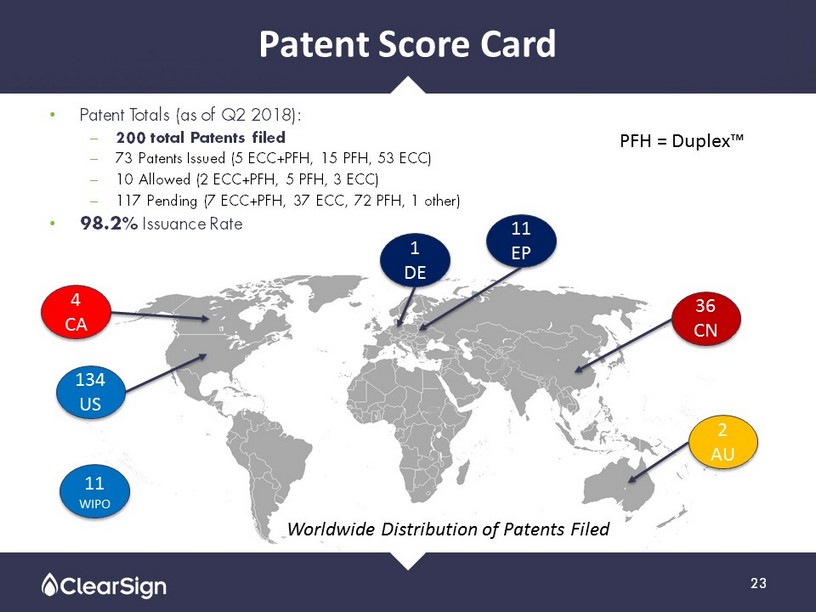

Patent Score Card • Patent Totals (as of Q2 2018): – 200 total Patents filed – 73 Patents Issued (5 ECC+PFH, 15 PFH, 53 ECC) – 10 Allowed (2 ECC+PFH, 5 PFH, 3 ECC) – 117 Pending (7 ECC+PFH, 37 ECC, 72 PFH, 1 other) • 98.2% Issuance Rate 23 134 US 4 CA 36 CN 2 AU 11 EP 1 DE 11 WIPO Worldwide Distribution of Patents Filed PFH = Duplex™

Experienced Leadership Steve Pirnat Chief Executive Officer • CEO, John Zink, div. Koch Ind. • Managing Dir. EMEA, Quest Integrity Group Steve Sock SVP Business Development • Business Development Manager, Burrow Global • VP Commercial, Amec Foster Wheeler Brian Fike Chief Financial Officer • Regional Controller, Darigold , Inc Roberto Ruiz, Ph.D. Chief Operating Officer • VP Commercial Development, John Zink • COO of Onquest , Inc. Donald Kendrick, Ph.D. Chief Technology Officer • CTO, Lean Flame Inc. • Operations Manager, UTC (Pratt & Whitney) 24 Manuel Menendez President – ClearSign Asia Ltd. • Founder, MCM Group Holdings Ltd • President & CEO, Great Eastern Development Ltd.

Increasing Opportunity Backlog 25 Active engagements are for specific client requests where a need has been identified and Duplex is being considered as the solution 0 10 20 30 40 50 60 70 80 Jul-17 Dec-17 Jun-18 Active Engagements (ex-Asia)

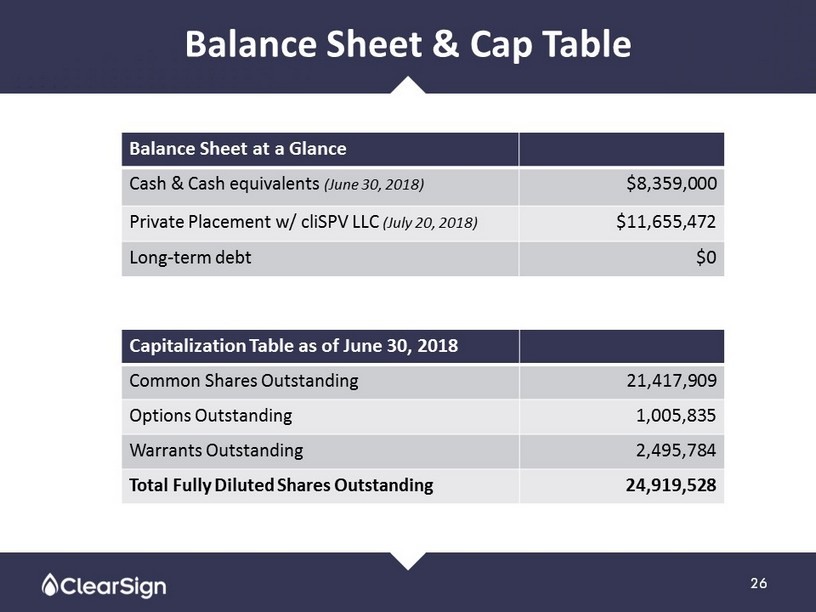

Balance Sheet & Cap Table 26 Capitalization Table as of June 30, 2018 Common Shares Outstanding 21,417,909 Options Outstanding 1,005,835 Warrants Outstanding 2,495,784 Total Fully Diluted Shares Outstanding 24,919,528 Balance Sheet at a Glance Cash & Cash equivalents (June 30, 2018) $8,359,000 Private Placement w/ cliSPV LLC (July 20, 2018) $11,655,472 Long - term debt $0

Investment Highlights 27 • Large, growing global addressable market ($3.6B+) [Frost & Sullivan] • Patented and proven technology provides transformational improvement in emissions and overall operating costs – 200 patents filed (73 issued, 117 pending) – Demonstrated to reduce NOx emissions below toughest requirements (5 PPM) – Provides a return on investment for a traditional “cost of compliance” • Rapid scale - up potential via “plug & play” product introductions and key strategic partnerships • “Asset - lite” model with attractive margins • Proven management team with deep industry experience • Well - capitalized with growing commercial pipeline

Questions?