Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED AUGUST 28, 2018 - HERSHEY CO | a8-k08282018digitaltransfo.htm |

EXHIBIT 99.1 WINNING IN DIGITAL COMMERCE AUGUST 28, 2018

MICHELE BUCK CHIEF EXECUTIVE OFFICER

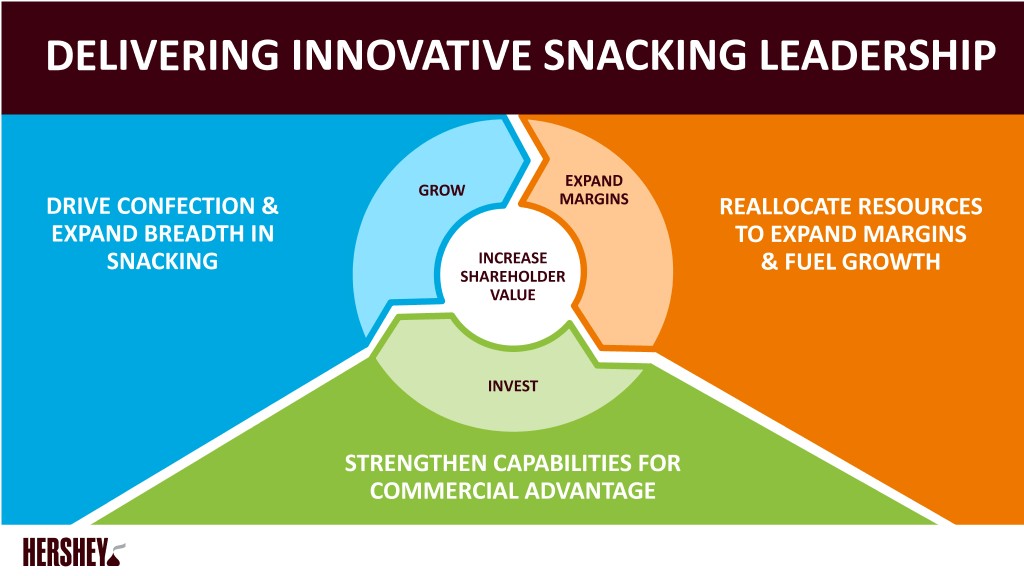

DELIVERING INNOVATIVE SNACKING LEADERSHIP EXPAND GROW DRIVE CONFECTION & MARGINS REALLOCATE RESOURCES EXPAND BREADTH IN TO EXPAND MARGINS SNACKING INCREASE & FUEL GROWTH SHAREHOLDER VALUE INVEST STRENGTHEN CAPABILITIES FOR COMMERCIAL ADVANTAGE

SOLID PROGRESS AGAINST KEY PRIORITIES RESET INTERNATIONAL EXPAND GROW CORE CMG GROWTH MARGINS BUSINESS MODEL INCREASE PORTFOLIO EVOLUTION SHAREHOLDER REDUCE FOUNDATIONAL VALUE COST STRUCTURE INVEST CORE CAPACITY ERP DIGITAL TRANSFORMATION

RIGHT DATA RIGHT TECHNOLOGY RIGHT CULTURE

DIGITAL TRANSFORMATION POWERING EVERY PART OF THE ORGANIZATION Marketing Sales CREATE Finance COMMERCIAL ADVANTAGE Strategy IS Supply Chain Media

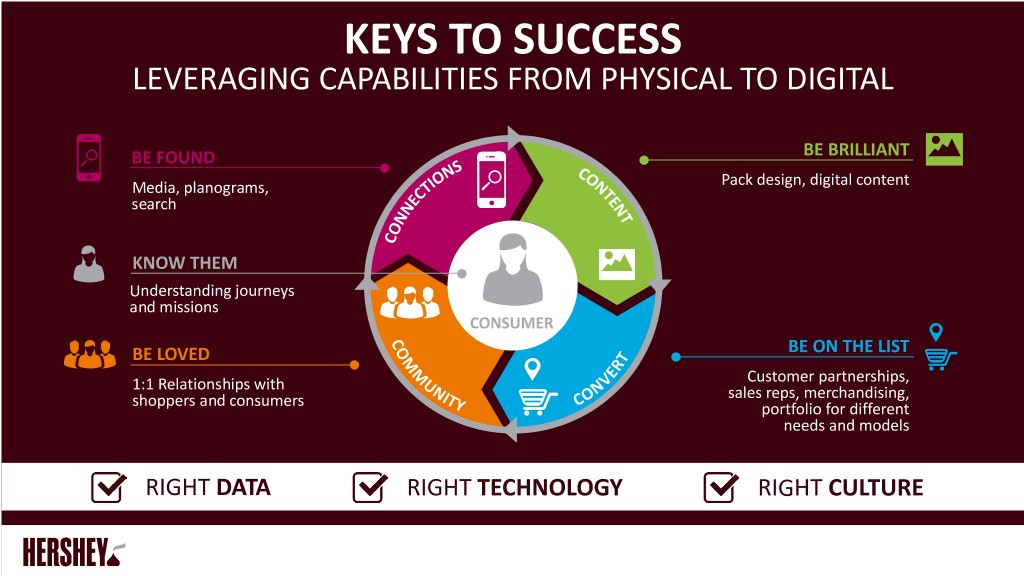

KEYS TO SUCCESS LEVERAGING CAPABILITIES FROM PHYSICAL TO DIGITAL BE FOUND BE BRILLIANT Media, planograms, Pack design, digital content search KNOW THEM Understanding journeys and missions CONSUMER BE LOVED BE ON THE LIST Customer partnerships, 1:1 Relationships with sales reps, merchandising, shoppers and consumers portfolio for different needs and models RIGHT DATA RIGHT TECHNOLOGY RIGHT CULTURE

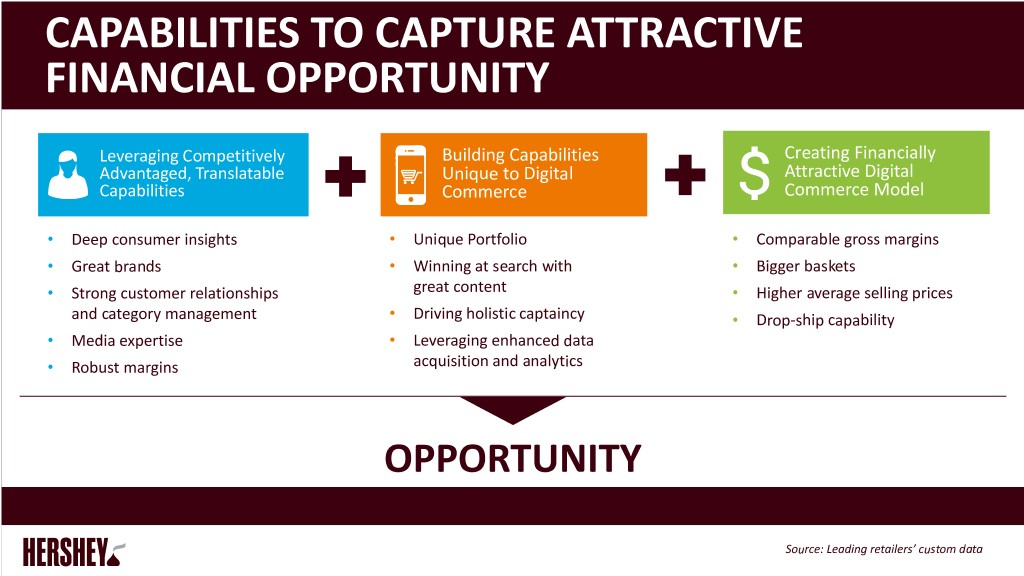

CAPABILITIES TO CAPTURE ATTRACTIVE FINANCIAL OPPORTUNITY Leveraging Competitively Building Capabilities Creating Financially Advantaged, Translatable Unique to Digital Attractive Digital Capabilities Commerce Commerce Model • Deep consumer insights • Unique Portfolio • Comparable gross margins • Great brands • Winning at search with • Bigger baskets • Strong customer relationships great content • Higher average selling prices and category management • Driving holistic captaincy • Drop-ship capability • Media expertise • Leveraging enhanced data • Robust margins acquisition and analytics OPPORTUNITY Source: Leading retailers’ custom data

TAKEAWAYS FROM TODAY Retail evolution changing how products are purchased, but consumers’ needs and desire for our brands remain We are translating our existing competitive advantages and building capabilities unique to digital commerce We have created a financially attractive digital commerce model and are seizing the opportunity with the right talent, capabilities and investment to succeed

DOUG STRATON CHIEF DIGITAL COMMERCE OFFICER

FOR TODAY UNDERSTANDING THE RETAIL ECOSYSTEM HERSHEY STRATEGY AND KEYS TO SUCCESS WHAT WINNING IN DIGITAL LOOKS LIKE WHERE WE ARE AND WHERE WE ARE HEADED Q&A

UNDERSTANDING THE RETAIL ECOSYSTEM

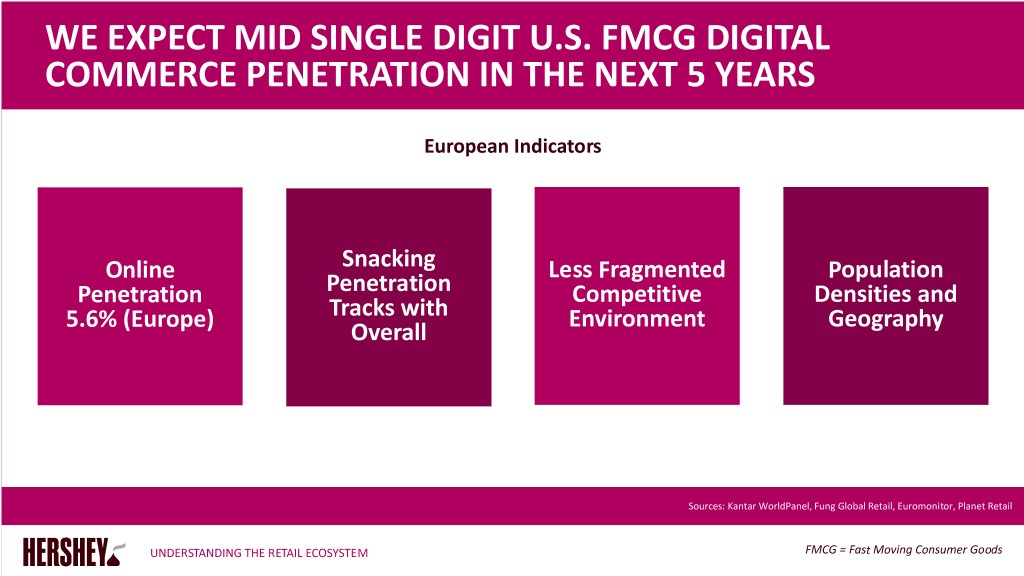

WE EXPECT MID SINGLE DIGIT U.S. FMCG DIGITAL COMMERCE PENETRATION IN THE NEXT 5 YEARS European Indicators Online Snacking Less Fragmented Population Penetration Penetration Competitive Densities and 5.6% (Europe) Tracks with Environment Geography Overall Sources: Kantar WorldPanel, Fung Global Retail, Euromonitor, Planet Retail UNDERSTANDING THE RETAIL ECOSYSTEM FMCG = Fast Moving Consumer Goods

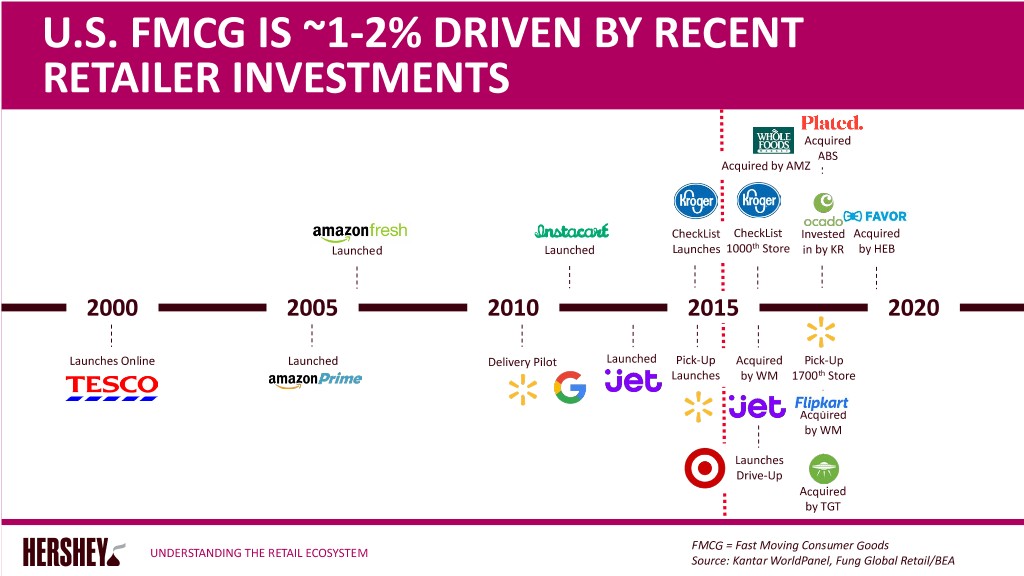

U.S. FMCG IS ~1-2% DRIVEN BY RECENT RETAILER INVESTMENTS Acquired ABS Acquired by AMZ CheckList CheckList Invested Acquired Launched Launched Launches 1000th Store in by KR by HEB 2000 2005 2010 2015 2020 Launches Online Launched Delivery Pilot Launched Pick-Up Acquired Pick-Up Launches by WM 1700th Store Acquired by WM Launches Drive-Up Acquired by TGT FMCG = Fast Moving Consumer Goods UNDERSTANDING THE RETAIL ECOSYSTEM Source: Kantar WorldPanel, Fung Global Retail/BEA

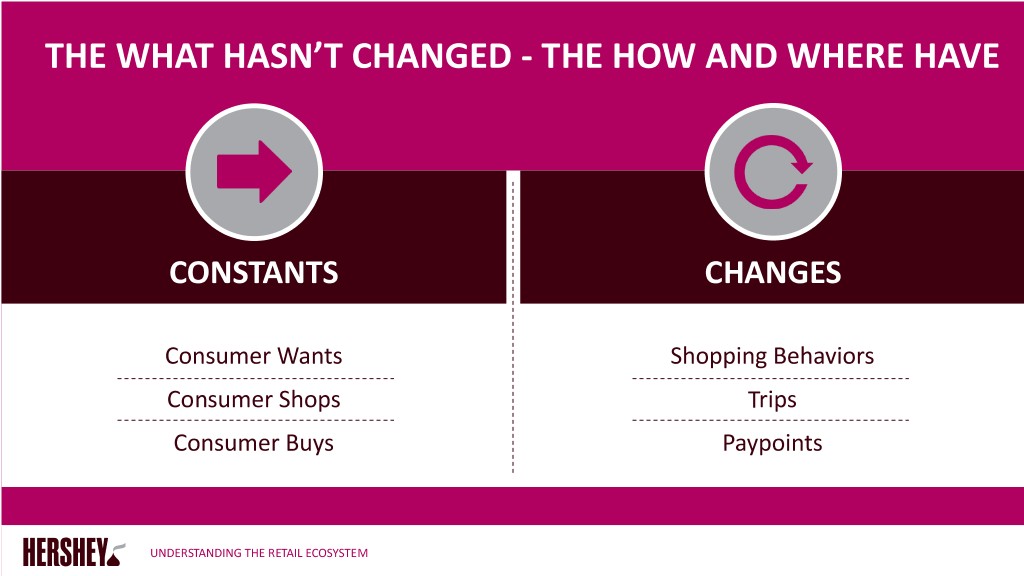

THE WHAT HASN’T CHANGED - THE HOW AND WHERE HAVE CONSTANTS CHANGES Consumer Wants Shopping Behaviors Consumer Shops Trips Consumer Buys Paypoints UNDERSTANDING THE RETAIL ECOSYSTEM

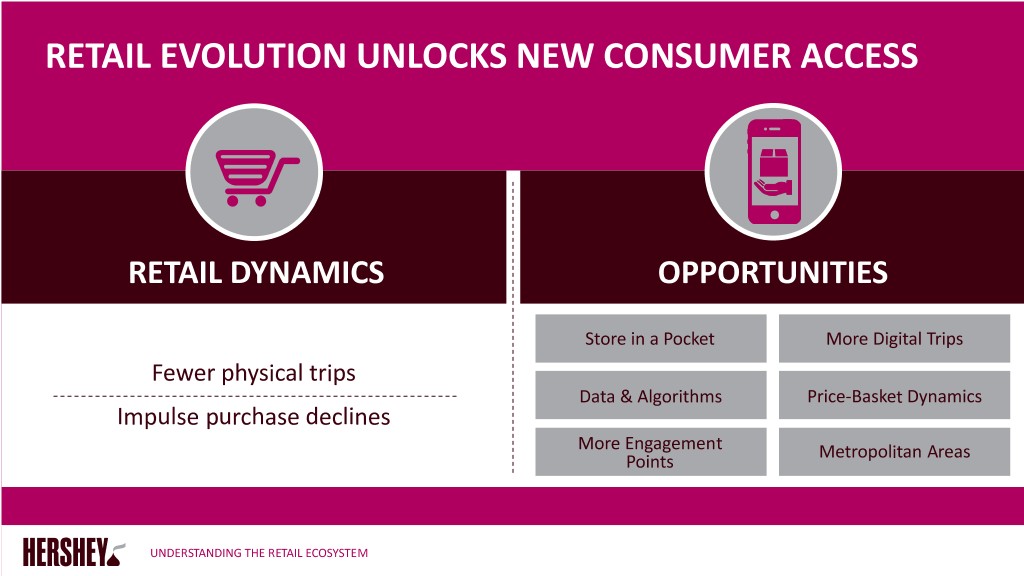

RETAIL EVOLUTION UNLOCKS NEW CONSUMER ACCESS RETAIL DYNAMICS OPPORTUNITIES Store in a Pocket More Digital Trips Fewer physical trips Data & Algorithms Price-Basket Dynamics Impulse purchase declines More Engagement Metropolitan Areas Points UNDERSTANDING THE RETAIL ECOSYSTEM

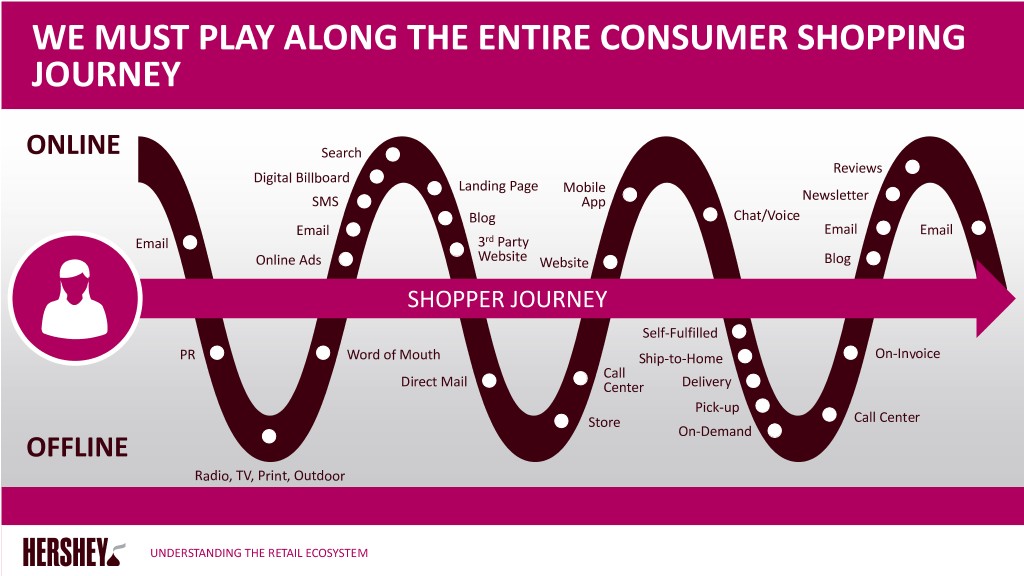

WE MUST PLAY ALONG THE ENTIRE CONSUMER SHOPPING JOURNEY ONLINE Search Reviews Digital Billboard Landing Page Mobile SMS App Newsletter Blog Chat/Voice Email Email Email Email 3rd Party Online Ads Website Website Blog SHOPPER JOURNEY Self-Fulfilled PR Word of Mouth Ship-to-Home On-Invoice Call Direct Mail Center Delivery Pick-up Store Call Center On-Demand OFFLINE Radio, TV, Print, Outdoor UNDERSTANDING THE RETAIL ECOSYSTEM

HERSHEY STRATEGY AND KEYS TO SUCCESS

HERSHEY HAS LEVERAGEABLE, TRANSLATABLE CAPABILITIES TO WIN IN DIGITAL… Beloved Deep Customer Recognized Strength in Paid Retailer Brands Relationships Category Expertise & Earned Media Profitability #1 most Ranked #5 by retailers Ranked #1 by 3B earned Amongst the highest loved brand in consumer goods retailers for category impressions at management product launch Source: Morning Consult, Advantage, Cision, Willard Bishop HERSHEY STRATEGY AND KEYS TO SUCCESS

…AND WE ARE WINNING Driving Higher Trips Building Bigger Maintaining Winning Share Average Selling Increasing Baskets Margin Profile Price +250bps Online Visits > 1.2x to 3.5x 1.0x to 3.5x Within year to date Offline Trips brick and mortar brick and mortar 100-150 bps of THC Avg Source: Retailer specific POS data, 2017-2018, Hershey financials HERSHEY STRATEGY AND KEYS TO SUCCESS

WE KNOW THE KEYS TO SUCCESS IN DIGITAL COMMERCE BE FOUND BE BRILLIANT Win At Search: The Shelf Digital Content: The Pack KNOW THEM Journey and Missions CONSUMER BE LOVED BE ON THE LIST CRM: The Relationship Algorithm and Missions and Models: The Cart HERSHEY STRATEGY AND KEYS TO SUCCESS CRM = Consumer Relationship Marketing

WHAT WINNING IN DIGITAL LOOKS LIKE

CONSUMER CONSUMER WHAT WINNING IN DIGITAL LOOKS LIKE

UNDERSTANDING MISSION AND MODELS UNLOCKS GROWTH AND PROFIT CONSUMER MISSION MODEL PORTFOLIO ECONOMICS WHAT WINNING IN DIGITAL LOOKS LIKE

SHOPPERS NOW HAVE OPTIONS BEYOND FILLING THEIR OWN BASKETS CONSUMER Deal Hunting/ Family Family Snacking Refill Family Snacking Refill Sudden Craving Special Purpose MISSION Snacking Refill Ship-to-home Delivery Pick-up On-demand DTC MODEL Items found in C-store; Large bags, multi-packs Unique Propositions/ Traditional items found in grocery/mass stores instant consumable of single serve bars Differentiated portfolio focused PORTFOLIO WHAT WINNING IN DIGITAL LOOKS LIKE

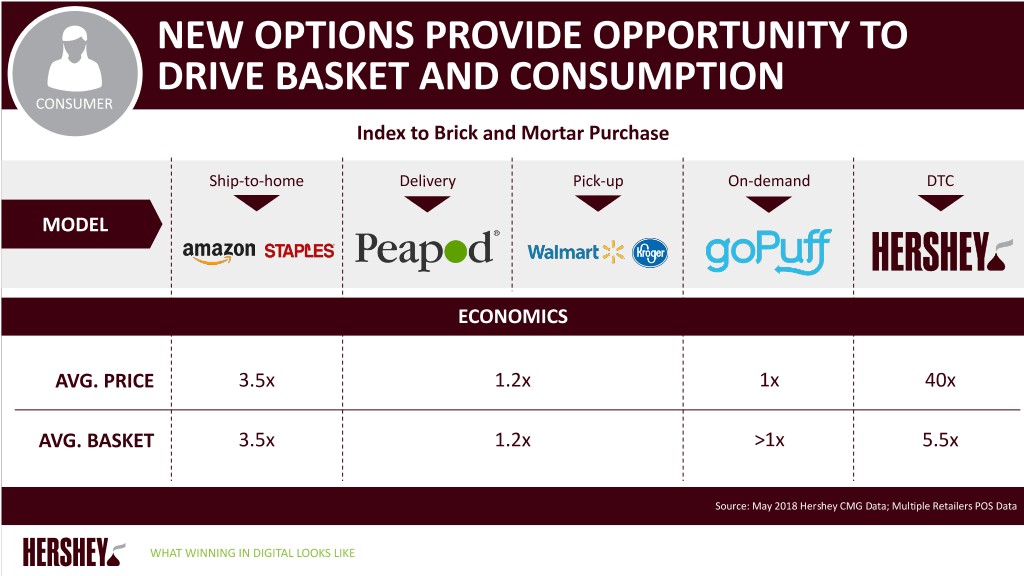

NEW OPTIONS PROVIDE OPPORTUNITY TO DRIVE BASKET AND CONSUMPTION CONSUMER Index to Brick and Mortar Purchase Ship-to-home Delivery Pick-up On-demand DTC MODEL ECONOMICS AVG. PRICE 3.5x 1.2x 1x 40x AVG. BASKET 3.5x 1.2x >1x 5.5x Source: May 2018 Hershey CMG Data; Multiple Retailers POS Data WHAT WINNING IN DIGITAL LOOKS LIKE

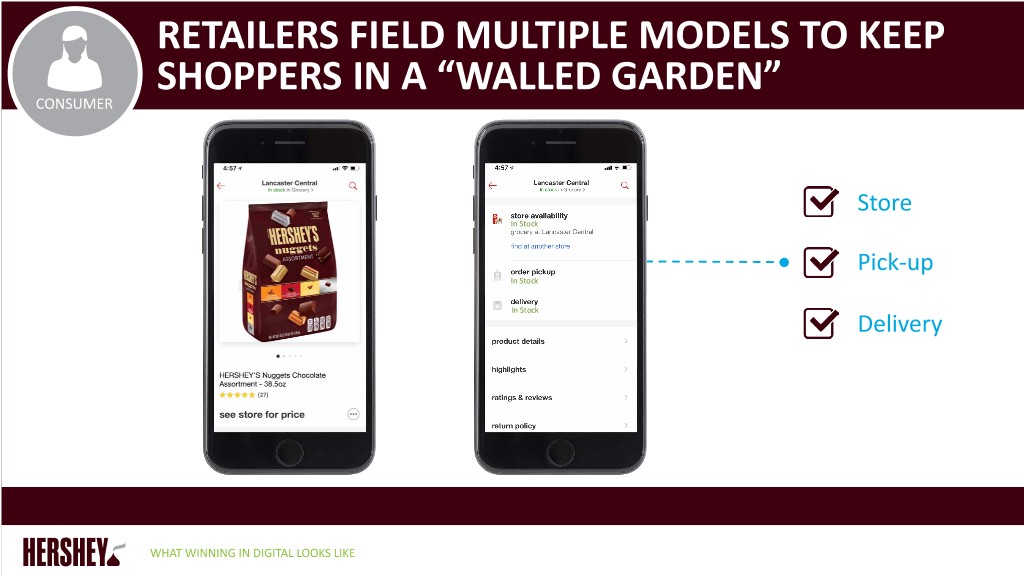

RETAILERS FIELD MULTIPLE MODELS TO KEEP SHOPPERS IN A “WALLED GARDEN” CONSUMER Store In Stock Pick-up In Stock In Stock Delivery (27) WHAT WINNING IN DIGITAL LOOKS LIKE

CONSUMER CONNECTIONS WHAT WINNING IN DIGITAL LOOKS LIKE

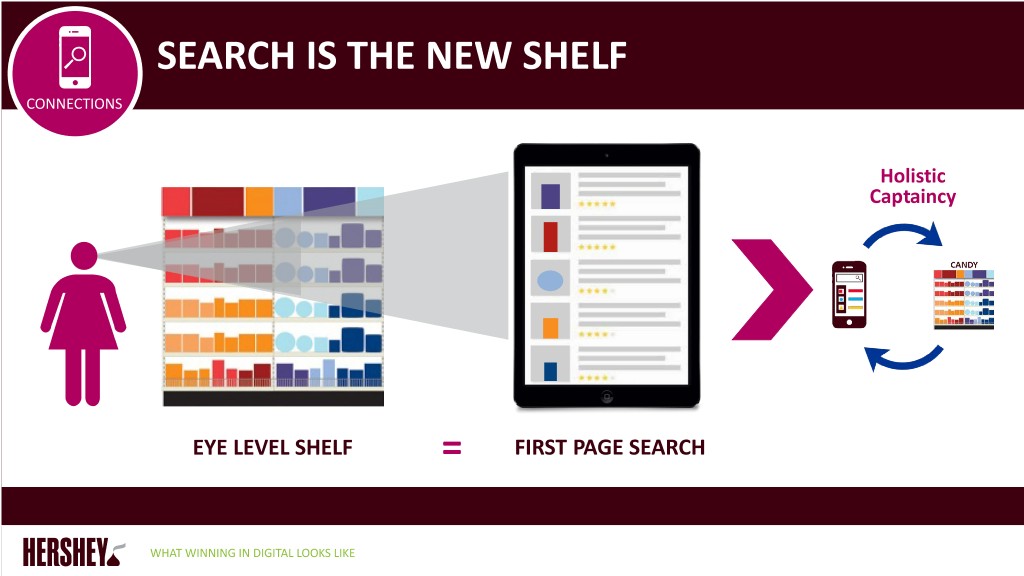

SEARCH IS THE NEW SHELF CONNECTIONS Holistic Captaincy EYE LEVEL SHELF = FIRST PAGE SEARCH WHAT WINNING IN DIGITAL LOOKS LIKE

FIRST PAGE OF SEARCH IS EYE LEVEL CONNECTIONS “Chocolate” Paid Display Paid Search Organic Search Results WHAT WINNING IN DIGITAL LOOKS LIKE

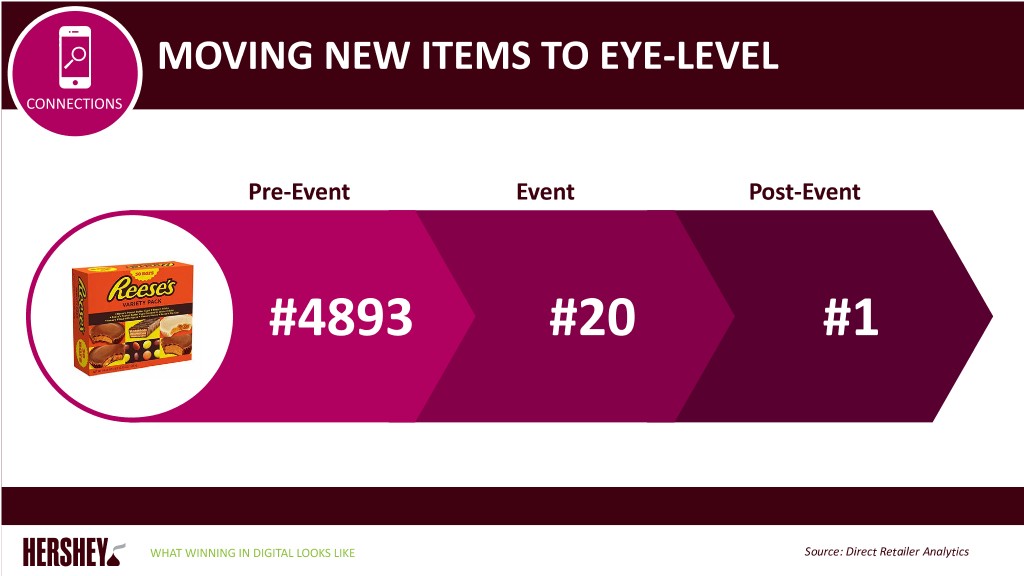

MOVING NEW ITEMS TO EYE-LEVEL CONNECTIONS Pre-Event Event Post-Event #4893 #20 #1 WHAT WINNING IN DIGITAL LOOKS LIKE Source: Direct Retailer Analytics

CONSUMER CONTENT WHAT WINNING IN DIGITAL LOOKS LIKE

DIGITAL VISITS PRECEDE AND EXCEED PHYSICAL TRIPS CONTENT DIGITAL SHELF PHYSICAL SHELF WHAT WINNING IN DIGITAL LOOKS LIKE

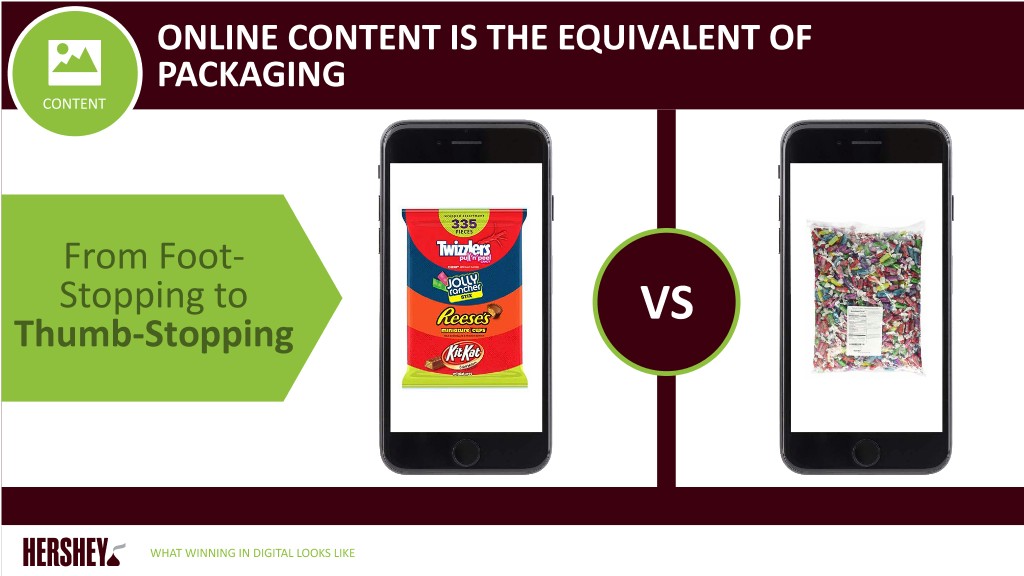

ONLINE CONTENT IS THE EQUIVALENT OF PACKAGING CONTENT From Foot- Stopping to VS Thumb-Stopping WHAT WINNING IN DIGITAL LOOKS LIKE

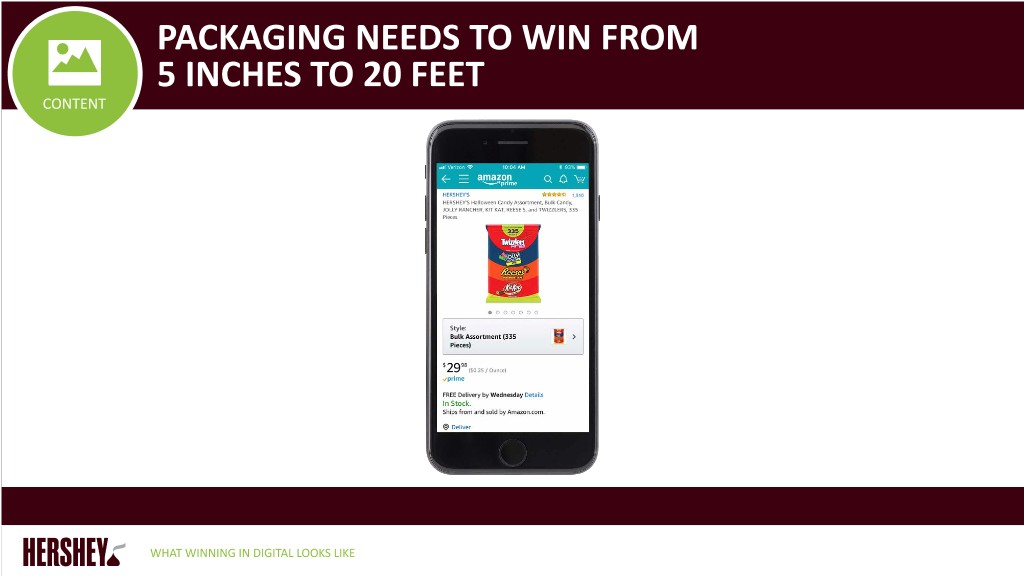

PACKAGING NEEDS TO WIN FROM 5 INCHES TO 20 FEET CONTENT WHAT WINNING IN DIGITAL LOOKS LIKE

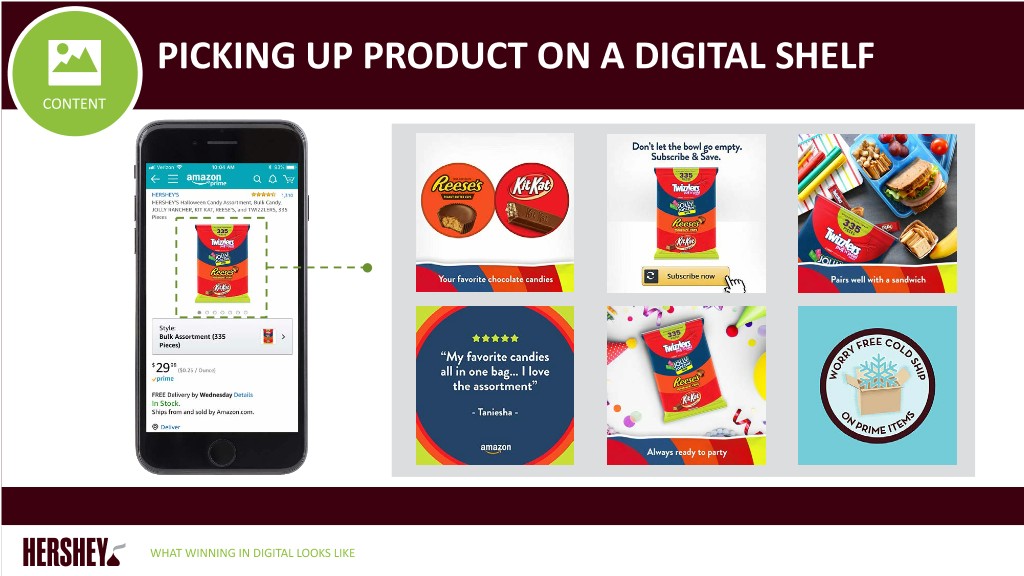

PICKING UP PRODUCT ON A DIGITAL SHELF CONTENT WHAT WINNING IN DIGITAL LOOKS LIKE

CONSUMER CONVERT WHAT WINNING IN DIGITAL LOOKS LIKE

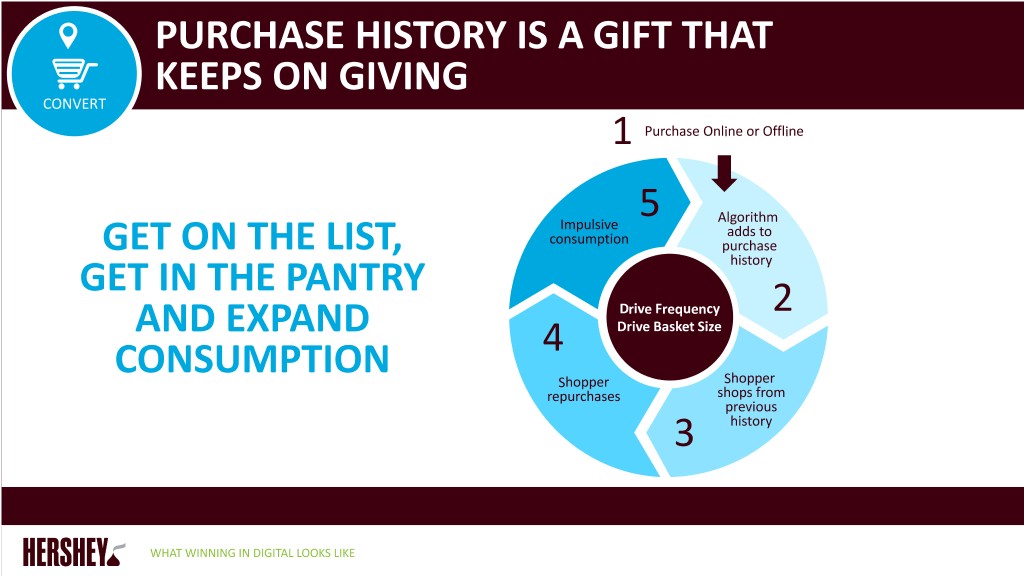

PURCHASE HISTORY IS A GIFT THAT KEEPS ON GIVING CONVERT 1 Purchase Online or Offline 5 Algorithm Impulsive adds to consumption purchase GET ON THE LIST, history GET IN THE PANTRY Drive Frequency 2 AND EXPAND 4 Drive Basket Size CONSUMPTION Shopper Shopper repurchases shops from previous 3 history WHAT WINNING IN DIGITAL LOOKS LIKE

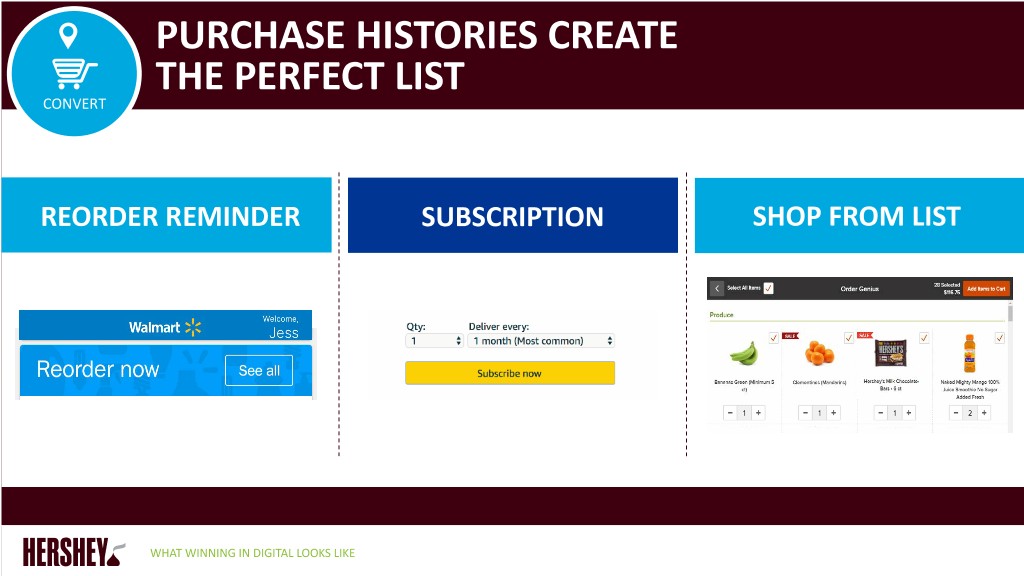

PURCHASE HISTORIES CREATE THE PERFECT LIST CONVERT REORDER REMINDER SUBSCRIPTION SHOP FROM LIST $1.99 $4.99 $3.49 $3.09 WHAT WINNING IN DIGITAL LOOKS LIKE

IMPULSE CONSUMPTION IS AN OPPORTUNITY CONVERT WHAT WINNING IN DIGITAL LOOKS LIKE

IMPULSE PURCHASE IS STILL IMPORTANT BUT IT TAKES NEW FORMS CONVERT CHECKOUT LANE POST ORDER MAKE THE MINIMUM AUTO-ADD RECIPE ADD-ON You’re 2 ingredients away from Chocolate Cookie Cake! Here’s all you need for the perfect dessert WHAT WINNING IN DIGITAL LOOKS LIKE

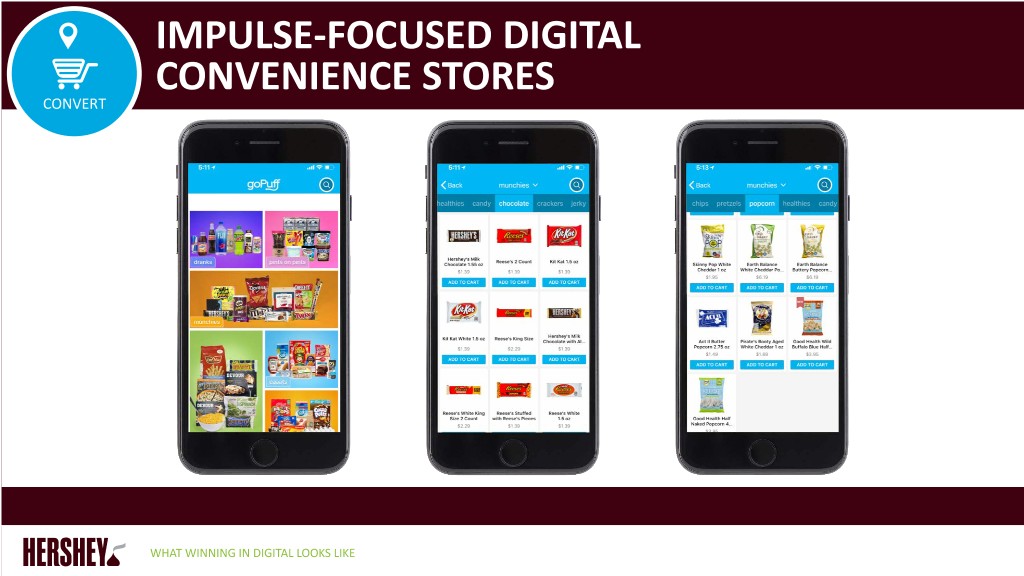

IMPULSE-FOCUSED DIGITAL CONVENIENCE STORES CONVERT WHAT WINNING IN DIGITAL LOOKS LIKE

MAGNIFYING THE SEASONAL OPPORTUNITY CONVERT Mobile Desktop Store WHAT WINNING IN DIGITAL LOOKS LIKE

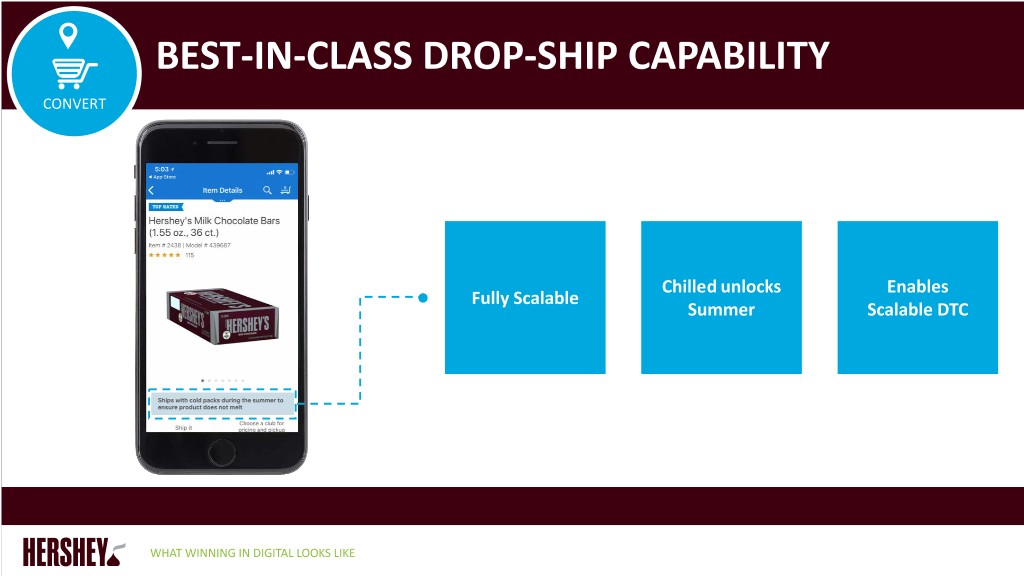

BEST-IN-CLASS DROP-SHIP CAPABILITY CONVERT Chilled unlocks Enables Fully Scalable Summer Scalable DTC WHAT WINNING IN DIGITAL LOOKS LIKE

CONSUMER COMMUNITY WHAT WINNING IN DIGITAL LOOKS LIKE

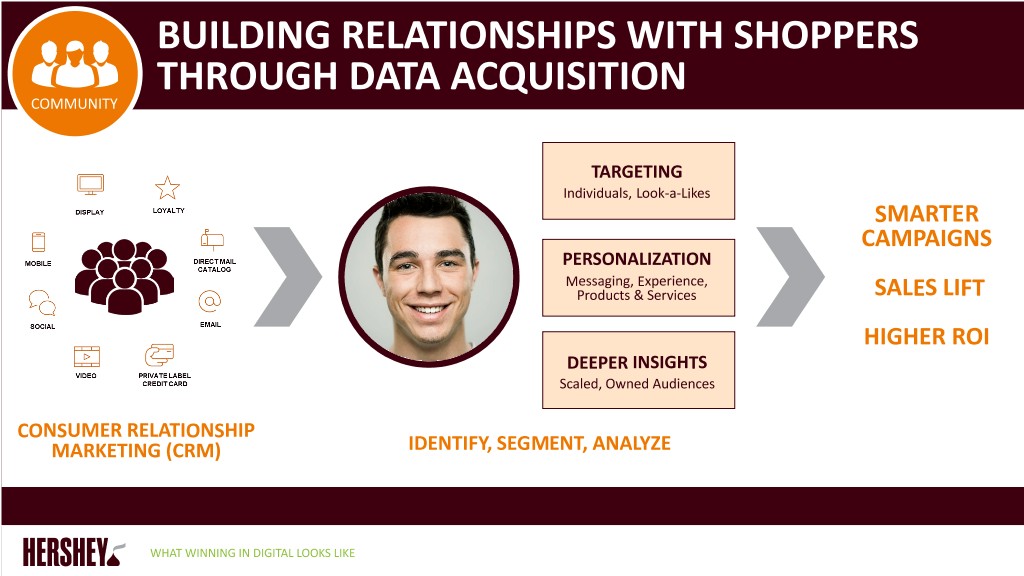

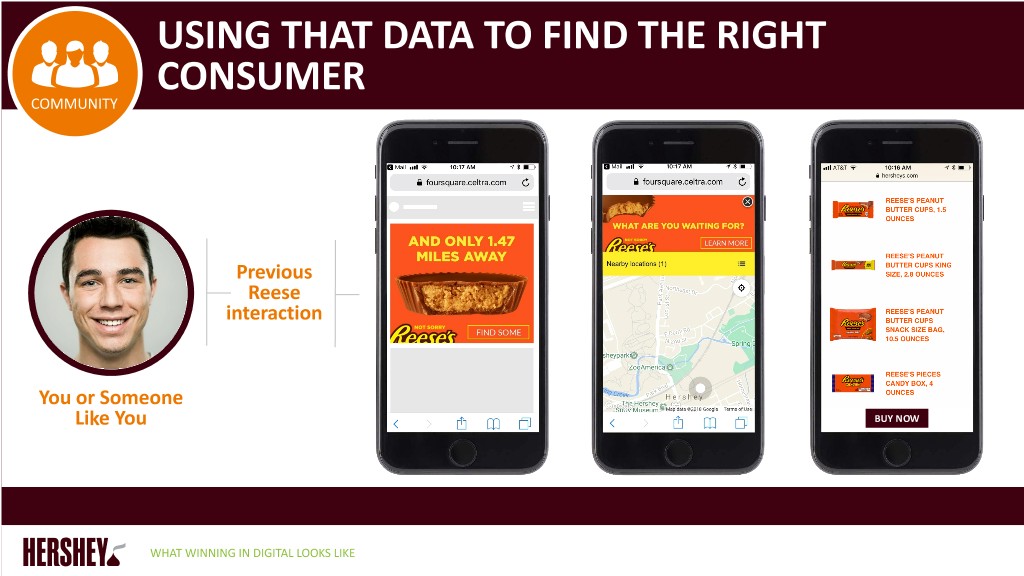

BUILDING RELATIONSHIPS WITH SHOPPERS THROUGH DATA ACQUISITION COMMUNITY TARGETING Individuals, Look-a-Likes SMARTER CAMPAIGNS PERSONALIZATION Messaging, Experience, Products & Services SALES LIFT HIGHER ROI DEEPER INSIGHTS Scaled, Owned Audiences CONSUMER RELATIONSHIP MARKETING (CRM) IDENTIFY, SEGMENT, ANALYZE WHAT WINNING IN DIGITAL LOOKS LIKE

USING THAT DATA TO FIND THE RIGHT CONSUMER COMMUNITY Previous Reese interaction You or Someone Like You BUY NOW WHAT WINNING IN DIGITAL LOOKS LIKE

WHERE WE ARE AND WHERE WE ARE HEADED

WHERE ARE WE ON OUR JOURNEY FUNDAMENTALS IN PLACE MAGNIFYING OUR STRENGTHS Digital & Digital Commerce Strategy Snacking Focus Enterprise Approach Customer Relationships & Captaincy Technology Stack Media Strength Fit to Compete Structure & Talent Data & Data Science WHERE WE ARE AND WHERE WE ARE HEADED

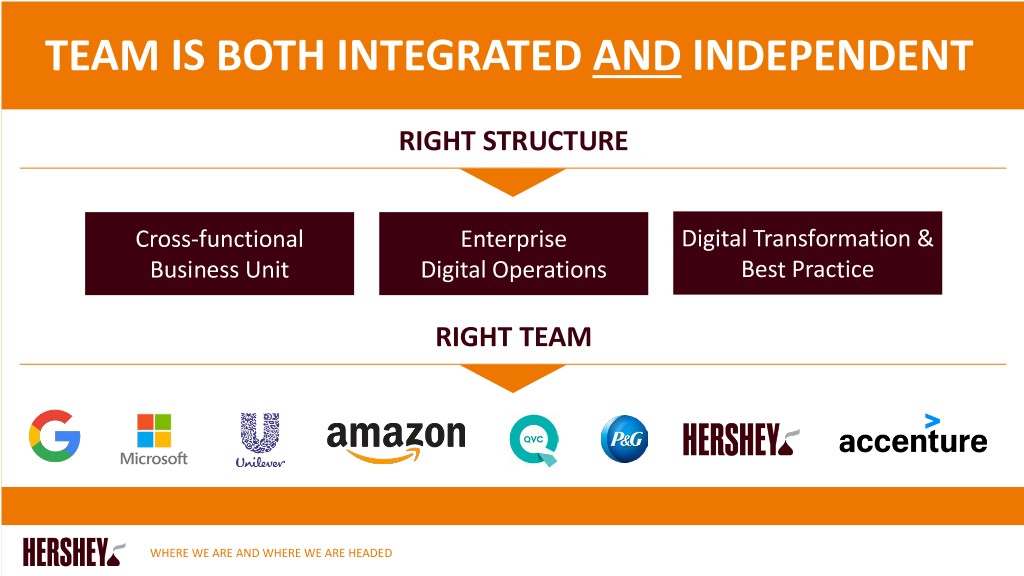

TEAM IS BOTH INTEGRATED AND INDEPENDENT RIGHT STRUCTURE Cross-functional Enterprise Digital Transformation & Business Unit Digital Operations Best Practice RIGHT TEAM WHERE WE ARE AND WHERE WE ARE HEADED

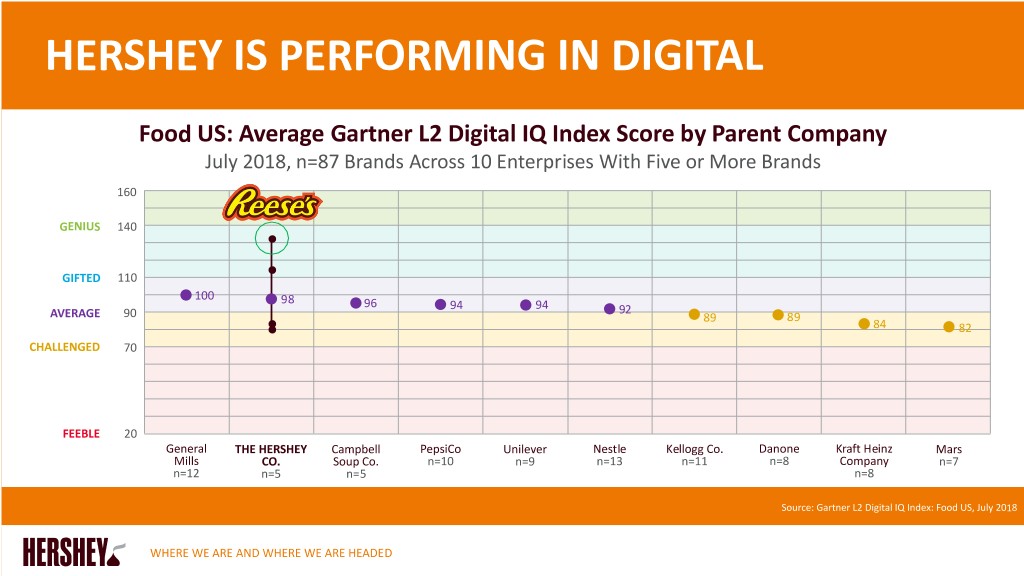

HERSHEY IS PERFORMING IN DIGITAL Food US: Average Gartner L2 Digital IQ Index Score by Parent Company July 2018, n=87 Brands Across 10 Enterprises With Five or More Brands 160 GENIUS 140 GIFTED 110 100 98 96 94 94 92 AVERAGE 90 89 89 84 82 CHALLENGED 70 FEEBLE 20 General THE HERSHEY Campbell PepsiCo Unilever Nestle Kellogg Co. Danone Kraft Heinz Mars Mills CO. Soup Co. n=10 n=9 n=13 n=11 n=8 Company n=7 n=12 n=5 n=5 n=8 Source: Gartner L2 Digital IQ Index: Food US, July 2018 WHERE WE ARE AND WHERE WE ARE HEADED

WHAT’S NEXT 2019-2023 Opportunity STRUCTURE BEND THE FUNDAMENTALS AND TEAM GROWTH CURVE WHERE WE ARE AND WHERE WE ARE HEADED

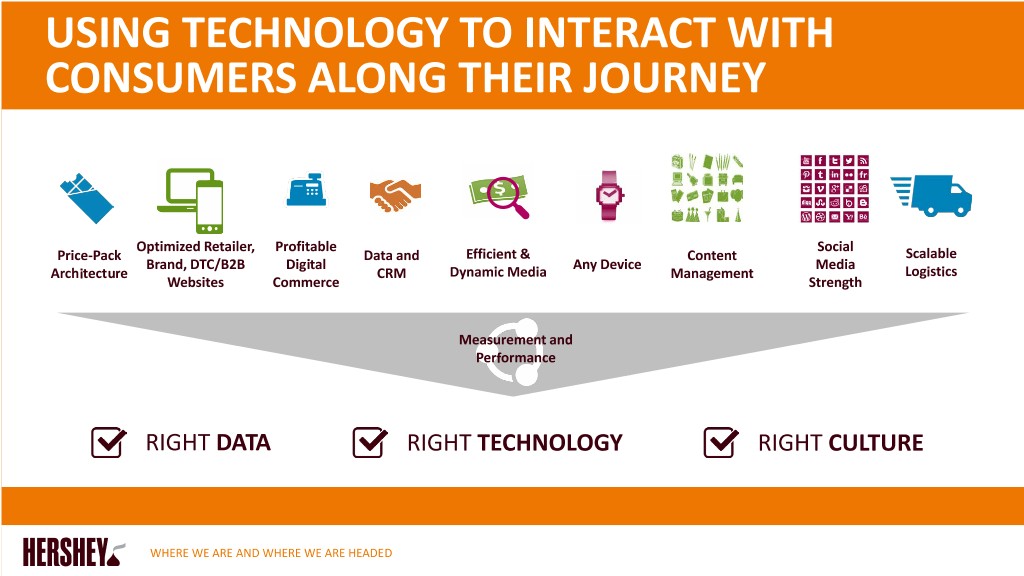

USING TECHNOLOGY TO INTERACT WITH CONSUMERS ALONG THEIR JOURNEY Optimized Retailer, Profitable Social Price-Pack Data and Efficient & Content Scalable Brand, DTC/B2B Digital Any Device Media Architecture CRM Dynamic Media Management Logistics Websites Commerce Strength Measurement and Performance RIGHT DATA RIGHT TECHNOLOGY RIGHT CULTURE WHERE WE ARE AND WHERE WE ARE HEADED

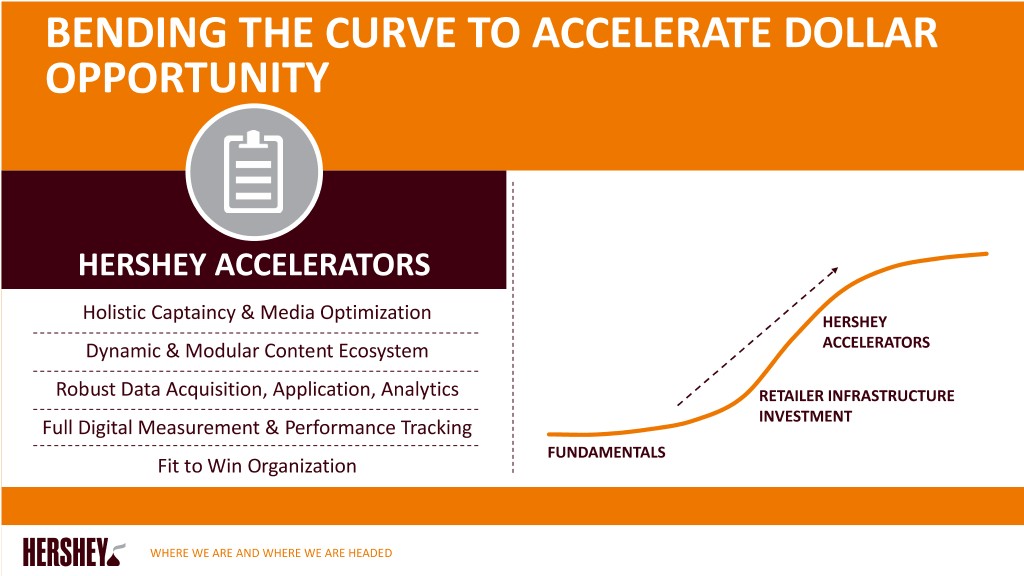

BENDING THE CURVE TO ACCELERATE DOLLAR OPPORTUNITY GROWTHHERSHEY ACCELERATORSACCELERATORS Holistic Captaincy & Media Optimization HERSHEY Dynamic & Modular Content Ecosystem ACCELERATORS Robust Data Acquisition, Application, Analytics RETAILER INFRASTRUCTURE INVESTMENT Full Digital Measurement & Performance Tracking FUNDAMENTALS Fit to Win Organization WHERE WE ARE AND WHERE WE ARE HEADED

HERSHEY HAS LEVERAGEABLE, TRANSLATABLE CAPABILITIES TO WIN IN DIGITAL… Beloved Deep Customer Recognized Strength in Paid Retailer Brands Relationships Category Expertise & Earned Media Profitability #1 most Ranked #5 by retailers Ranked #1 by 3B earned Amongst the highest loved brand in consumer goods retailers for category impressions at management product launch Source: Morning Consult, Advantage, Cision, Willard Bishop WHERE WE ARE AND WHERE WE ARE HEADED

…AND WE ARE WINNING Driving Higher Trips Building Bigger Maintaining Winning Share Average Selling Increasing Baskets Margin Profile Price WHERE WE ARE AND WHERE WE ARE HEADED