Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Railcar Industries, Inc. | form8kseaportpresentation.htm |

Exhibit 99.1 August 2018 1

Safe Harbor Statement This presentation contains statements relating to our expected financial performance, objectives, long-term strategies and/or future business prospects, events and plans that are forward-looking statements. Forward-looking statements represent our estimates and assumptions only as of the date of this presentation. Such statements include, without limitation, statements regarding: various estimates we have made in preparing our Forward Looking financial statements, expected future trends relating to our industry, products and markets, anticipated customer demand for our products and services, trends relating to our shipments, leasing business, railcar services, revenues, profit margin, capacity, financial condition, and results of operations, trends related to shipments for direct sale versus lease, anticipated benefits from our new supply agreement with GATX, expectations Disclaimer regarding our future production and delivery rates as a result of the new agreement, anticipated benefits from a longer term production plan, our backlog, estimated backlog value, and any implication that our backlog may be indicative of our future revenues, our vision, strategic objectives and long-term strategies, our results of operations, financial condition and the sufficiency of our capital resources, our capital expenditure plans and their anticipated benefits, short- and long-term liquidity needs, ability to service our current debt obligations and future financing plans, our stock repurchase program, anticipated benefits regarding the growth of our leasing business, the mix of railcars, customers and commodities in our lease fleet and our lease fleet financings, anticipated production schedules for our products and the anticipated production schedules of our joint ventures, the impact of the Tax Cuts and Jobs Act of 2017 on our business and financial statements, and the anticipated performance and capital requirements of our joint ventures. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those anticipated. Investors should not place undue reliance on forward-looking statements, which speak only as of the date they are made and are not guarantees of future performance. Potential risks and uncertainties that could adversely affect our business and prospects include, among other things: our ability to meet our vision, strategic objectives and long-term strategies; our prospects in light of the cyclical nature of our business; the health of and prospects for the overall railcar industry; the risk of being unable to market or remarket Forward Looking railcars for sale or lease at favorable prices or on favorable terms or at all; the highly competitive nature of the manufacturing, railcar leasing and railcar services industries; the risks associated with our ongoing compliance with transportation, environmental, health, safety, and regulatory laws and regulations, which may be subject to change; the impact, costs and expenses of any warranty claims or impairment losses to which we may be Disclaimer subject now or in the future; our ability to recruit, retain and train qualified personnel; risks relating to our compliance with the Federal Railroad Administration (FRA) directive released September 30, 2016 and subsequently revised and superseded on November 18, 2016 (Directive) and the settlement agreement related thereto, any developments related to the Directive and the settlement agreement related thereto or other regulatory actions and any costs or loss of revenue related thereto; the impact of policies and priorities of certain governments or other issues that may cause trade and market conditions that result in fluctuations in the supply and costs of raw materials, including steel and railcar components, and delays in the delivery of such raw materials and components and their impact on demand and margin; the variable purchase patterns of our railcar customers and the timing of completion, customer acceptance and shipment of orders, as well as the mix of railcars for lease versus direct sale; our ability to manage overhead and variations in production rates; our reliance upon a small number of customers that represent a large percentage of our revenues and backlog; fluctuations in commodity prices, including oil and gas; the risks associated with our current joint ventures and anticipated capital needs of and production capabilities at our joint ventures; uncertainties regarding the Tax Cuts and Jobs Act of 2017 or other changes in our tax provisions or positions; the ongoing risks related to our relationship with Mr. Carl Icahn, our principal beneficial stockholder through Icahn Enterprises L.P. (IELP), and certain of his affiliates; the impact, costs and expenses of any litigation to which we may be subject now or in the future; risks relating to the ongoing transition of the management of our railcar leasing business from ARL to in-house management following completion of the ARL Sale; risks related to the loss of executive officers; the sufficiency of our liquidity and capital resources, including long-term capital needs to further support the growth of our lease fleet; risks related to our and our subsidiaries’ indebtedness and compliance with covenants contained in our and our subsidiaries’ financing arrangements; the impact of repurchases pursuant to our stock repurchase program on our current liquidity and the ownership percentage of our principal beneficial stockholder through IELP, Mr. Carl Icahn; the conversion of our railcar backlog into revenues equal to our reported estimated backlog value; the risks and impact associated with any potential joint ventures, acquisitions, strategic opportunities, dispositions or new business endeavors; the integration with other systems and ongoing management of our new enterprise resource planning system; and the additional risk factors described in our filings with the Securities and Exchange Commission. We expressly disclaim any duty to provide updates to any forward-looking statements made in this presentation, whether as a result of new information, future events or otherwise.

3

Manufacturing ARI Successful and Diversified Railcars Components Business Model Railcar Repair Railcar Services Leasing Complete life cycle solutions for the railcar industry 4

ARI Locations 5

Managing our lease fleet in-house gives us the opportunity to Integration of strong streamline processes sales force and lease and realize synergies fleet management and cost savings group through integrating with the rest of our Strategic organization Developments ARI has become a Our sales and one-stop shop with marketing strategy product offerings begins with listening to including our customers and manufacturing, leasing finding solutions to and railcar services meet their needs 6

ARI Key Railcar Markets - Two Largest Product Segments in the Railcar Industry* HOPPER RAILCARS • Product offerings include general service and specialty carbon steel or stainless steel railcars that are capable of transporting: • Plastic Pellets • Food Products • Grain • Sand • Specialty Chemical Products • Cement TANK RAILCARS • Product offerings include general service, pressurized, coiled, lined and insulated carbon steel or stainless steel railcars that are capable of transporting: • Chemicals • Ethanol • Food Products • Natural Gas Liquids • Crude Oil * Based upon backlog as of 6/30/18 per the Railway Supply Institute, Inc ARCI 2018 – 2nd Quarter Reporting Statistics (issued July 2018) 7

North American Fleet by Railcar Type 59% of the North American fleet is Covered Hopper and Tank Railcars North American Fleet by Railcar Type 106,133 , 17,098 , Tank Cars 7% 1% 409,593 , 203,125 , 25% 12% 214,321 , 13% Covered Hoppers 563,320 , 136,783 , 34% 8% Tank Cars Covered Hoppers Open-top Hoppers Gondolas Flat Cars Other Box Cars Our core products are covered hopper and tank railcars but we continue to explore other strategic car types for our manufacturing facilities to produce. The total North American railcar fleet was approximately 1.65 million railcars as of 6/30/2018 8 Source: Association of American Railroads’ Rail Time Indicators, issued 8/3/2018

Cyclical Industry Trends New Freight Car Delivery Trends 90 (Amounts in the 000s) 80 70 60 50 40 30 20 10 - Long-term average (1981 - 2022E) Sources: Q2 2018 FTR Rail Equipment Outlook – www.ftrintel.com (issued June 2018) and Railway Supply Institute, Inc. ARCI 2018 – 2nd Quarter Reporting Statistics (issued July 2018) 9

Industry Trends Covered Hopper Delivery Trends Tank Railcar Delivery Trends (Amounts in the 000s) (Amounts in the 000s) 35 40 35 36 30 30 35 26 25 29 30 25 23 23 20 21 20 21 25 19 20 19 20 19 21 22 17 19 20 18 18 18 18 15 17 15 14 11 15 12 12 10 10 8 9 9 9 9 6 6 5 6 5 5 4 2 5 - - Long-term average (1981 - 2022E) Long-term average (1981 - 2022E) After a peak in terms of overall volume, demand has With a major shift in the energy market, the industry expects decreased and shifted towards more specialty hopper more traditional and lower levels of replacement demand railcar types, including large cube hoppers for plastic pellets. for tank railcars as well as more specialty tank railcars 10 Sources: Q2 2018 FTR Rail Equipment Outlook – www.ftrintel.com (issued June 2018) and Railway Supply Institute, Inc. ARCI 2018 – 2nd Quarter Reporting Statistics (issued July 2018)

Freight Railcar Market Overview Industry Railcar Backlog as of 6/30/18 Industry Railcar Deliveries TTM 6/30/18 Tank Cars 17% 5% 6% 5% 9% Tank Cars 37% 3% Covered Hoppers 8% 3% Tank Cars 1% Open-top Hoppers 3% Gondolas Flat Cars 2% Intermodal 45% 56% Covered Hoppers Box Cars Covered Hoppers 82% of the industry railcar backlog as of 73% of railcars delivered by the industry as a whole for June 30, 2018 was for covered hopper and tank railcars the TTM ended June 30, 2018 were covered hopper and tank railcars The industry’s backlog of 65,161 railcars as of 6/30/2018 includes orders for deliveries that extend beyond 2019. 11 Source: Railway Supply Institute, Inc. ARCI 2018 – 2nd Quarter Reporting Statistics (issued July 2018)

ARI’s Railcar Backlog 14,000 12,000 11,732 10,000 8,560 8,000 7,060 7,081 6,530 6,000 TotalRailcar Backlog 4,240 3,813 4,000 3,387 1,940 2,000 1,050 550 - Dec Dec Dec Jun Dec 2008 Dec 2010 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Dec 2015 2009 2016 2017 2018 Railcar backlog for lease - - - 2,200 1,810 2,330 2,844 1,452 1,637 389 1,041 Railcar backlog for direct sale 4,240 550 1,050 4,330 5,250 6,230 8,888 5,629 2,176 1,551 2,346 After 6/30/18, ARI entered into a supply agreement with GATX to produce 7,650 railcars including a mix of hoppers and tanks for delivery from 2019 through 2023. The agreement also includes an option for GATX to order up to an additional 4,400 railcars. 12

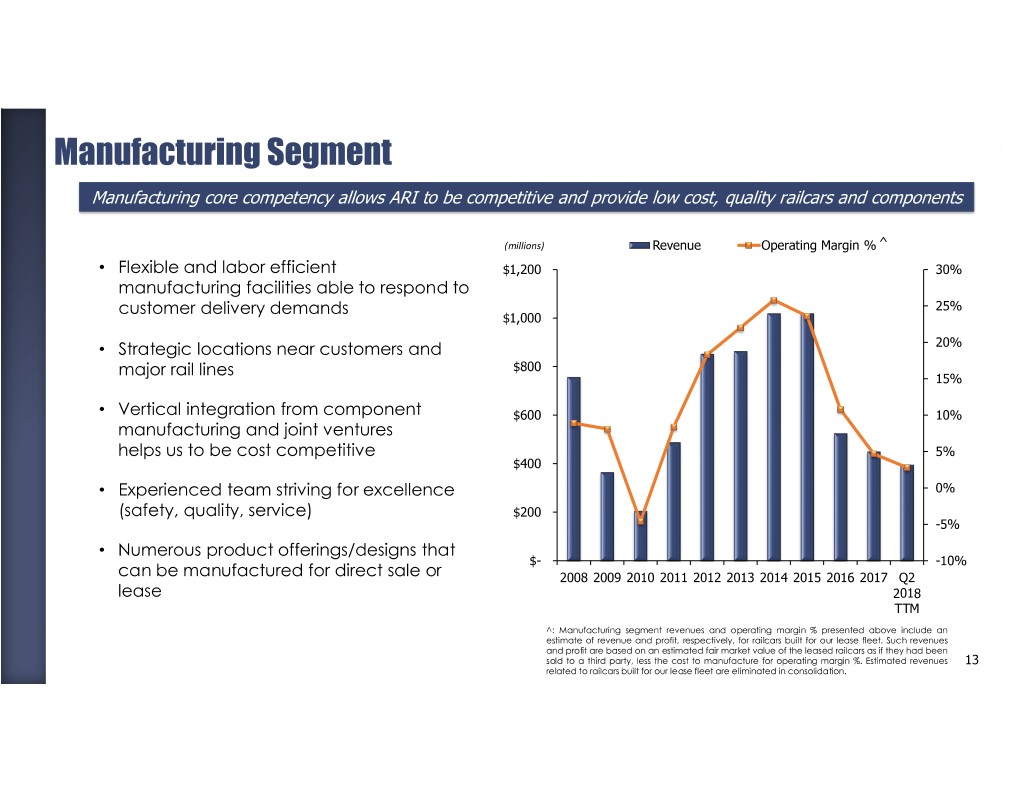

Manufacturing Segment Manufacturing core competency allows ARI to be competitive and provide low cost, quality railcars and components (millions) Revenue Operating Margin % ^ • Flexible and labor efficient $1,200 30% manufacturing facilities able to respond to customer delivery demands 25% $1,000 • Strategic locations near customers and 20% major rail lines $800 15% • Vertical integration from component $600 10% manufacturing and joint ventures helps us to be cost competitive 5% $400 • Experienced team striving for excellence 0% (safety, quality, service) $200 -5% • Numerous product offerings/designs that $- -10% can be manufactured for direct sale or 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 lease 2018 TTM ^: Manufacturing segment revenues and operating margin % presented above include an estimate of revenue and profit, respectively, for railcars built for our lease fleet. Such revenues and profit are based on an estimated fair market value of the leased railcars as if they had been sold to a third party, less the cost to manufacture for operating margin %. Estimated revenues 13 related to railcars built for our lease fleet are eliminated in consolidation.

Railcar Leasing Segment Diversifying and supplementing our business with revenue streams generated over the life of the railcar (millions) Revenue Lease Fleet • Disciplined lease strategy balancing mix of $160 16,000 customers, commodities, acceptable market rates, and staggered lease terms $140 14,000 • Relatively young lease fleet with low maintenance expense $120 12,000 • Began in-house management of the railcar leasing business as a result of the ARL $100 10,000 sale on June 1, 2017 • Added to our existing sales force and $80 8,000 established lease fleet management group • Further integration of ARI’s business model $60 6,000 • Further fleet growth based on strategic opportunities and as demand dictates with $40 4,000 funding expected to come from existing liquidity and future railcar leveraged financing(s) $20 2,000 • Unencumbered leased railcars available to borrow against $- - 2012 2013 2014 2015 2016 2017 Q2 2018 TTM 14

Railcar Services Segment Supporting both ARI’s lease fleet and customers' railcar needs, while gaining valuable industry insight Revenue Operating Margin % TRADITIONAL REPAIR (millions) $90 25% • Railcar qualifications and inspections • Light/heavy railcar repairs $80 • Exterior and interior coatings 20% • Cleaning $70 • Valve replacement and testing $60 • Wheel and axle replacement 15% • Additional offerings for mini-shops and mobile $50 on-site customer repairs $40 TANK RAILCAR RETROFITTING 10% $30 • Tank railcar manufacturing facility offers $20 retrofit capabilities along with traditional 5% repair services $10 $- 0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2-18 TTM 15

• Tank Railcar Expansion • Wheel & Axle Assembly • Tank Head Press Major • Axle and Castings Joint Ventures • Repair Plant Expansions Historical • Brookhaven, MS Repair Plant • Lease Fleet Growth to Over 13,300 Railcars • Tank Railcar Manufacturing Facility Repair Projects Retrofit Expansion • Manufacturing Plant Flexibility Strategic • Continue to foster long-term relationships with Progress customers through our integrated sales team • Continue strategic growth in railcar lease fleet • Strategically target a balanced mix of railcar Continues… Future types for a broad variety of commodities • Continue to grow our field services network to provide further flexibility and insight into Growth customers’ needs • Further expand railcar repair capabilities at Objectives existing repair plants • Explore opportunities for product development of other railcar types • Partner with GATX on multi-year order 16

Strong Financial Profile • Positive financial returns resulting from ARI’s participation in the largest railcar markets: hopper and tank railcars • Strong balance sheet with increased financing capacity to support operations and future lease fleet growth • 24th consecutive quarterly dividend declared for the second quarter of 2018 (most recent - $0.40 per share) • Stock Repurchase Program of up to $250 million with purchases of $86.0 million through June 30, 2018 • Revolving credit capacity of up to $200 million 17

Our Financial History Consolidated Revenue ($ mil) ^ $1,000.0 $889.3 $808.8 $750.6 $800.0 $711.7 $733.0 $639.1 $519.4 $515.9 $600.0 $476.8 $423.4 $400.0 $273.6 $200.0 $0.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 2018 ^ Revenues related to railcars built for the Company's lease fleet are not recognized in consolidated revenues as railcar sales, but rather as lease revenues in accordance with the terms of the contract over the life of the lease. TTM Net Earnings & Adj. EBITDA ($ mil) $300.0 $278.9 Net Earnings Adj. EBITDA** $250.0 $200.0 $181.1 $188.0 $149.5 $142.8 $150.0 $133.5 $141.5 $107.8 $86.9 $99.5 $100.0 $78.8 $72.7 $50.5 $63.8 $40.0 $34.9 ** $35.6 ** $50.0 $31.4 $15.5 ($27.0) $4.5 $4.3 $0.0 ($50.0) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 2018 TTM * Please see reconciliation of net earnings (loss) to Adj. EBITDA on Exhibit A. ** 2017 and Q2 2018 TTM net earnings exclude a $107.3 million tax benefit related to a one-time adjustment driven by the Tax Cuts and Jobs Act of 2017. Please see reconciliation of the impact of the tax adjustments due to the Tax Cuts and Jobs Act of 2017 on net earnings and earnings per share on Exhibit B. 18

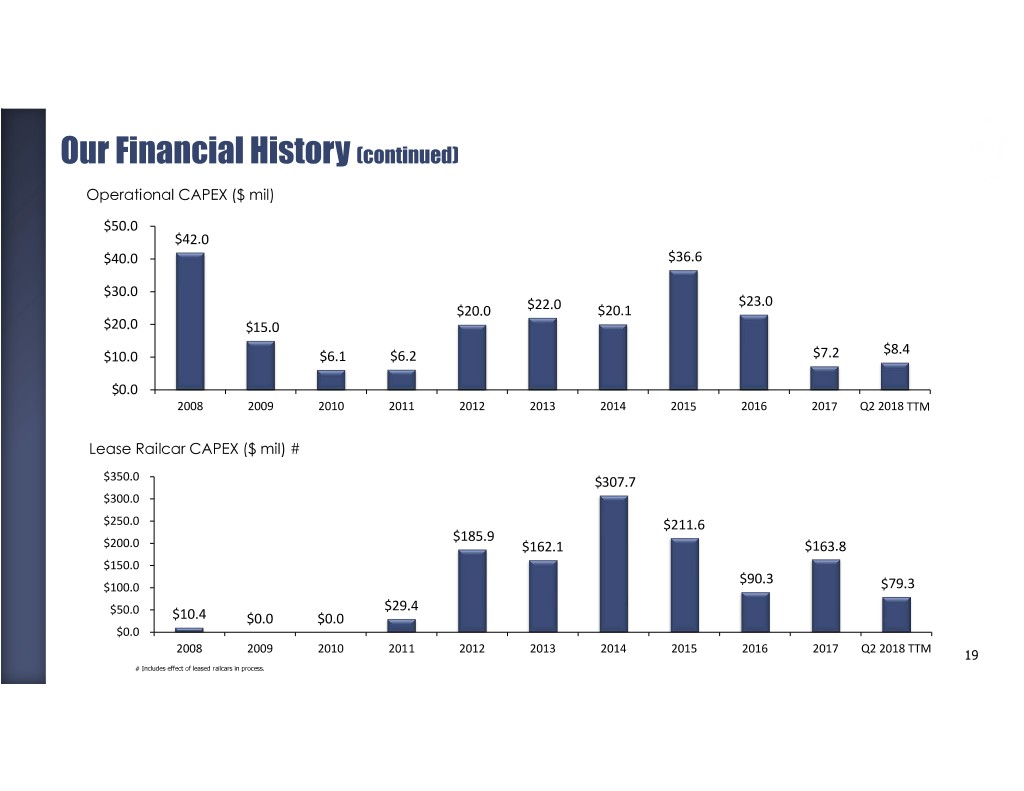

Our Financial History (continued) Operational CAPEX ($ mil) $50.0 $42.0 $40.0 $36.6 $30.0 $23.0 $20.0 $22.0 $20.1 $20.0 $15.0 $8.4 $10.0 $6.1 $6.2 $7.2 $0.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 2018 TTM Lease Railcar CAPEX ($ mil) # $350.0 $307.7 $300.0 $250.0 $211.6 $185.9 $200.0 $162.1 $163.8 $150.0 $90.3 $100.0 $79.3 $50.0 $29.4 $10.4 $0.0 $0.0 $0.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q2 2018 TTM 19 # Includes effect of leased railcars in process.

Quarterly Financial Comparison Consolidated Revenue ($ mil) ^ $200.0 $176.2 $167.5 $150.5 $145.0 $146.5 $150.0 $132.4 $120.7 $114.7 $109.0 $116.2 $100.0 $50.0 $0.0 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 ^ Revenues related to railcars built for the Company's lease fleet are not recognized in consolidated revenues as railcar sales, but rather as lease revenues in accordance with the terms of the contract over the life of the lease. Net Earnings & Adj. EBITDA ($ mil) Net Earnings Adjusted EBITDA * $60.0 $54.5 $50.4 $51.8 $50.0 $36.1 $37.0 $34.6 $36.9 $37.5 $40.0 $31.3 $33.8 $30.0 $22.8 $19.9 $22.3 $20.0 $13.0 $10.6 $10.9 $9.2 $10.0 $7.7 $8.9 $4.6 $0.0 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 * Please see reconciliation of net earnings (loss) to Adj. EBITDA on Exhibit A. 20

Quarterly Financial Comparison (continued) Operational CAPEX ($ mil) $8.0 $6.7 $7.1 $6.0 $4.4 $4.8 $3.7 $4.0 $2.3 $1.8 $2.0 $1.6 $1.4 $0.8 $0.0 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Lease Railcar CAPEX ($ mil) # $60.0 $55.9 $47.9 $40.0 $36.0 $28.6 $31.4 $20.9 $20.6 $18.1 $20.0 $12.8 $1.2 $0.0 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 # Includes effect of leased railcars in process. 21

Exhibit A – Adj. EBITDA Reconciliation In Thousands, unaudited 22

Exhibit A – Adj. EBITDA Reconciliation EBITDA represents net earnings before income tax expense, interest expense (income) and depreciation of property, plant and equipment. The Company believes EBITDA is useful to investors in evaluating ARI’s operating performance compared to that of other companies in the same industry. In addition, ARI’s management uses EBITDA to evaluate operating performance. The calculation of EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital spending. These items may vary for different companies for reasons unrelated to the overall operating performance of a company’s business. EBITDA is not a financial measure presented in accordance with U.S. generally accepted accounting principles (U.S. GAAP). Accordingly, when analyzing the Company’s operating performance, investors should not consider EBITDA in isolation or as a substitute for net earnings (loss), cash flows provided by operating activities or other statement of operations or cash flow data prepared in accordance with U.S. GAAP. The calculation of EBITDA is not necessarily comparable to that of other similarly titled measures reported by other companies. Adjusted EBITDA represents EBITDA before share-based compensation expense (income) related to stock appreciation rights (SARs), other income related to our short-term investments, and losses from the impairment of long-lived assets. Management believes that Adjusted EBITDA is useful to investors in evaluating the Company’s operating performance, and therefore uses Adjusted EBITDA for that purpose. The Company’s SARs, which settle in cash, are revalued each period based primarily upon changes in ARI’s stock price. Management believes that eliminating the expense (income) associated with share-based compensation and income associated with short-term investments allows management and ARI’s investors to understand better the operating results independent of financial changes caused by the fluctuating price and value of the Company’s common stock and short-term investments. Adjusted EBITDA is not a financial measure presented in accordance with U.S. GAAP. Accordingly, when analyzing operating performance, investors should not consider Adjusted EBITDA in isolation or as a substitute for net earnings, cash flows provided by operating activities or other statements of operations or cash flow data prepared in accordance with U.S. GAAP. The Company’s calculation of Adjusted EBITDA is not necessarily comparable to that of other similarly titled measures reported by other companies. 23

Exhibit B – Impact of 2017 Tax Act Reconciliation In Thousands, except per share amounts, unaudited 24

Exhibit B – Impact of 2017 Tax Act Reconciliation Net earnings excluding tax adjustments represents net earnings before a one-time adjustment related to the impact of the new Tax Cuts and Jobs Act of 2017 (the "2017 Tax Act"). The Company believes that net earnings excluding tax adjustments is a useful measure to investors in evaluating ARI’s operating performance compared to prior quarters as the impact of the 2017 Tax Act is not expected to be repeated. The calculation of net earnings excluding tax adjustments excludes the income tax benefit recognized by the Company related to its revaluation of deferred tax assets and liabilities to account for the future impact of lower corporate tax rates and other provisions of the 2017 Tax Act. Net earnings excluding tax adjustments is not a financial measure presented in accordance with U.S. generally accepted accounting principles (U.S. GAAP). Accordingly, when analyzing the Company’s operating performance, investors should not consider net earnings excluding tax adjustments in isolation or as a substitute for net earnings, cash flows provided by operating activities or other statement of operations or cash flow data prepared in accordance with U.S. GAAP. The calculation of net earnings excluding tax adjustments is not necessarily comparable to that of other similarly titled measures reported by other companies. 25

A Tradition of Industry Leadership