Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - PHOTRONICS INC | ex99_4.htm |

| EX-99.3 - EXHIBIT 99.3 - PHOTRONICS INC | ex99_3.htm |

| EX-99.2 - EXHIBIT 99.2 - PHOTRONICS INC | ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - PHOTRONICS INC | ex99_1.htm |

| 8-K - 8-K - PHOTRONICS INC | form8k.htm |

Exhibit 99.5

Photronics, Inc. Q3 2018 Financial Results Conference CallAugust 22, 2018

Safe Harbor Statement 2 This presentation and some of our comments may contain projections or other forward-looking statements regarding future events, our future financial performance, and/or the future performance of the industry. These statements are predictions, and contain risks and uncertainties. Actual events or results may differ materially from those presented. These statements include words like “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “may”, “should”, “plan”, “project” or the negative thereto. We cannot guarantee the accuracy of any forecasts or estimates, and we are not obligated to update any forward-looking statements if our expectations change. If you would like more information on the risks involved in forward-looking statements, please see the documents we file from time to time with the Securities and Exchange Commission, specifically our most recent Form 10K and Form 10Q.Non-GAAP Financial MeasuresThis presentation and some of our comments may reference non-GAAP financial measures. These non-GAAP financial measures exclude certain income or expense items, and are consistent with another way management internally analyzes our results of operations. Non-GAAP information should be considered to be a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. Please see the “Reconciliation of GAAP to Non-GAAP Financial Information” in this presentation.

Revenue grew 22% Y/Y and 4% Q/QHigh-end IC +94% Y/YChina revenue up 132% Y/Y & 44% Q/QRevenue to IC captives increased 161% Y/YGross and operating margins expanded on high operating leverage and cost containmentNet income attributable to Photronics, Inc. shareholders of $13.0M ($0.18/share)Cash balance grew to $333M on strong OCFLaunched share buyback program; repurchased 0.8M shares for $6.8M in Q318China investments on trackConstruction to be completed during Q418Tool move-in during Q119 Q3 2018 Summary 3 Successfully repositioned the business; China investments driving long-term, profitable growth

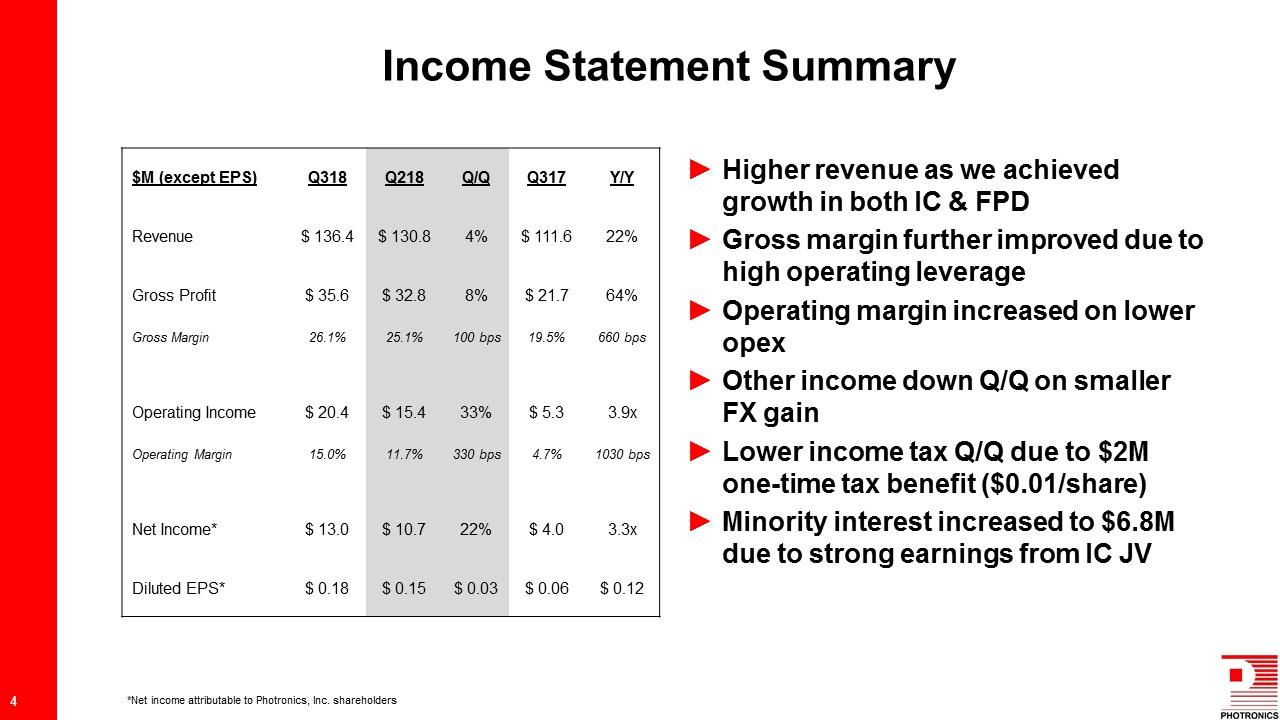

$M (except EPS) Q318 Q218 Q/Q Q317 Y/Y Revenue $ 136.4 $ 130.8 4% $ 111.6 22% Gross Profit $ 35.6 $ 32.8 8% $ 21.7 64% Gross Margin 26.1% 25.1% 100 bps 19.5% 660 bps Operating Income $ 20.4 $ 15.4 33% $ 5.3 3.9x Operating Margin 15.0% 11.7% 330 bps 4.7% 1030 bps Net Income* $ 13.0 $ 10.7 22% $ 4.0 3.3x Diluted EPS* $ 0.18 $ 0.15 $ 0.03 $ 0.06 $ 0.12 Higher revenue as we achieved growth in both IC & FPDGross margin further improved due to high operating leverageOperating margin increased on lower opexOther income down Q/Q on smaller FX gainLower income tax Q/Q due to $2M one-time tax benefit ($0.01/share)Minority interest increased to $6.8M due to strong earnings from IC JV Income Statement Summary 4 *Net income attributable to Photronics, Inc. shareholders

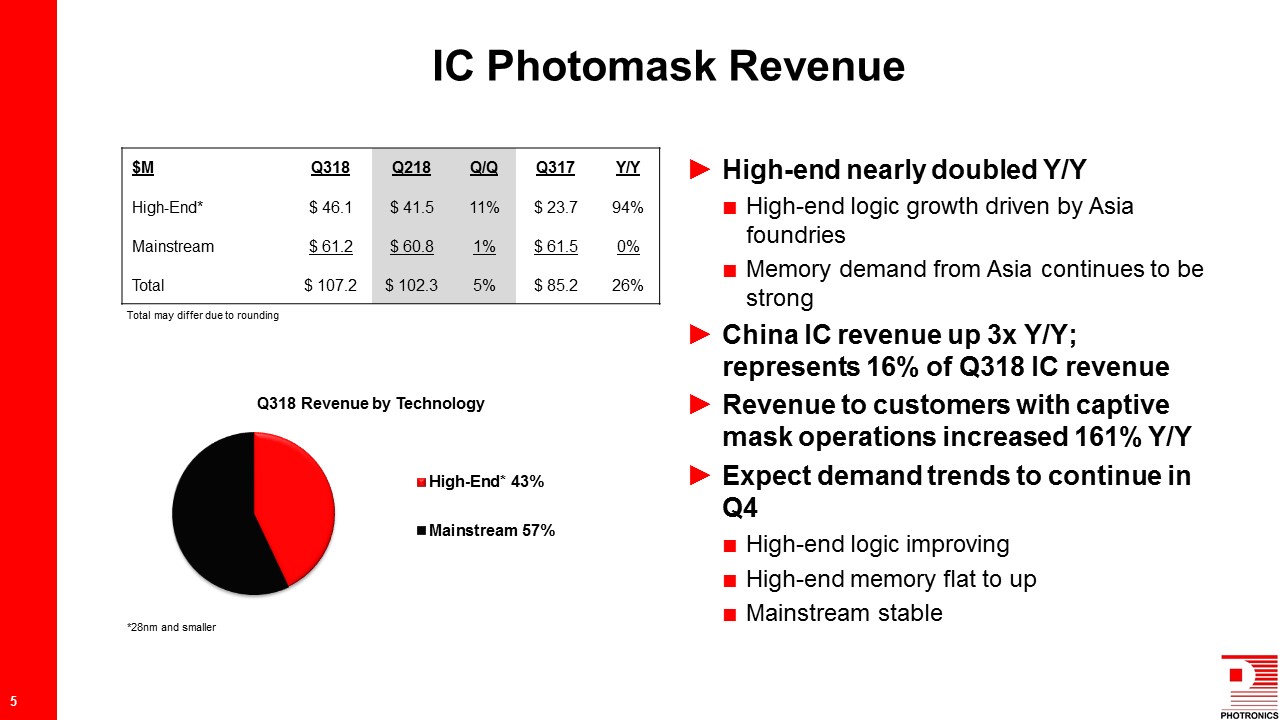

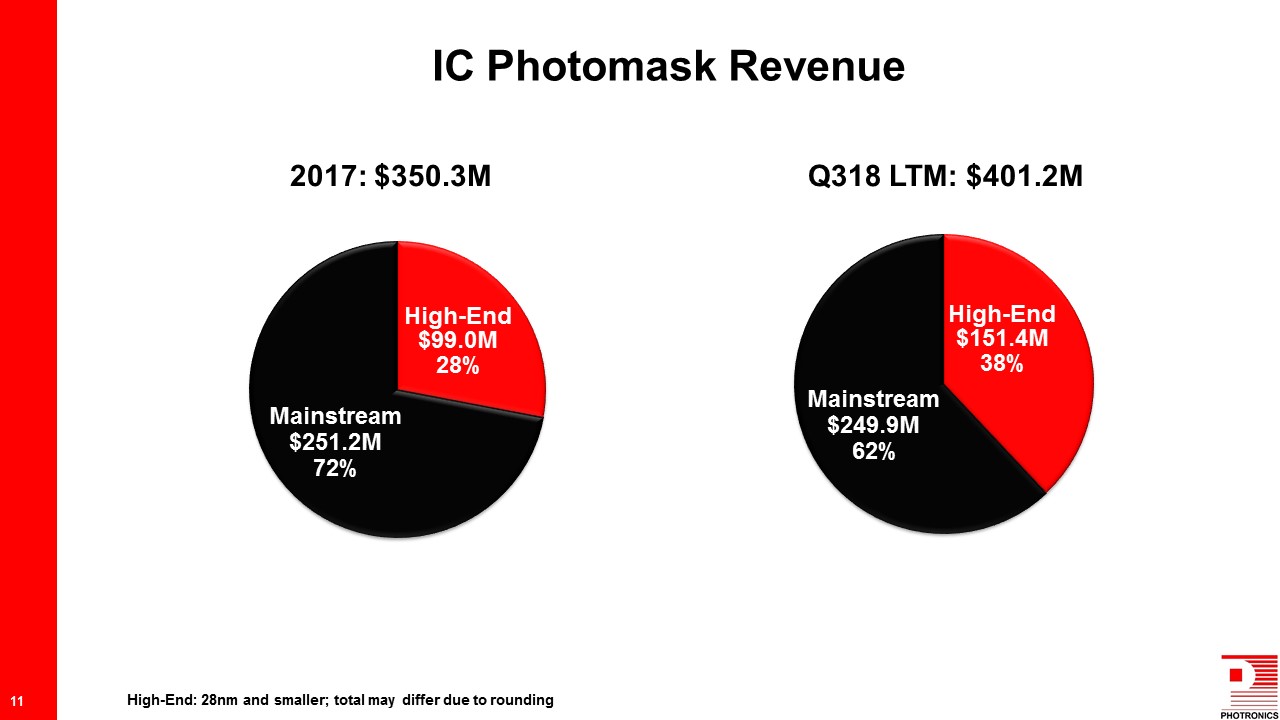

High-end nearly doubled Y/YHigh-end logic growth driven by Asia foundriesMemory demand from Asia continues to be strongChina IC revenue up 3x Y/Y; represents 16% of Q318 IC revenueRevenue to customers with captive mask operations increased 161% Y/YExpect demand trends to continue in Q4High-end logic improvingHigh-end memory flat to upMainstream stable $M Q318 Q218 Q/Q Q317 Y/Y High-End* $ 46.1 $ 41.5 11% $ 23.7 94% Mainstream $ 61.2 $ 60.8 1% $ 61.5 0% Total $ 107.2 $ 102.3 5% $ 85.2 26% IC Photomask Revenue 5 *28nm and smaller Total may differ due to rounding

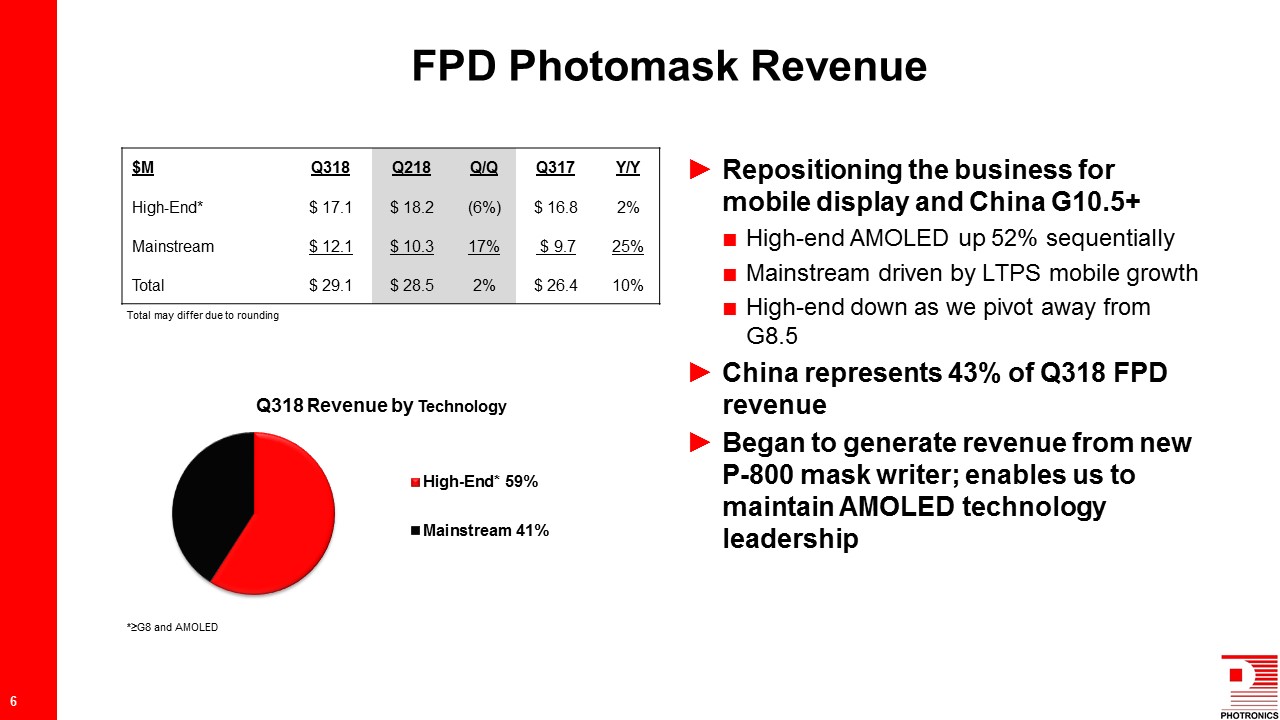

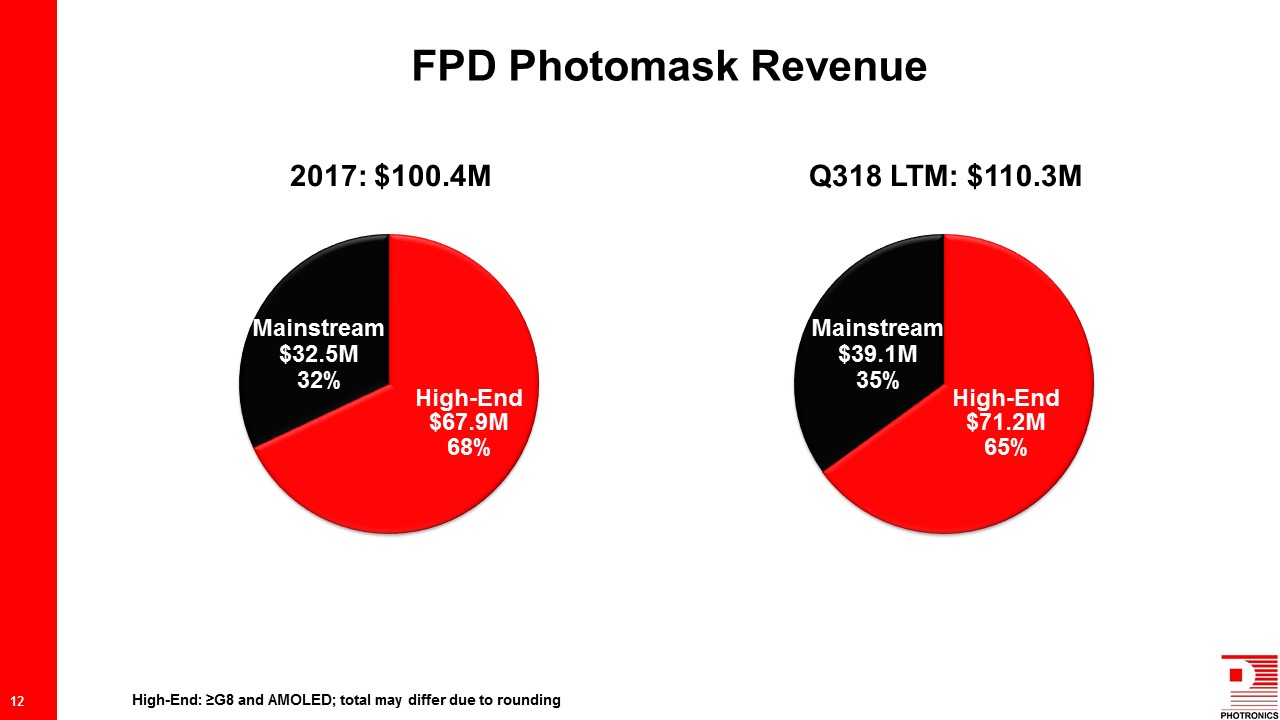

Repositioning the business for mobile display and China G10.5+High-end AMOLED up 52% sequentiallyMainstream driven by LTPS mobile growthHigh-end down as we pivot away from G8.5China represents 43% of Q318 FPD revenueBegan to generate revenue from new P-800 mask writer; enables us to maintain AMOLED technology leadership $M Q318 Q218 Q/Q Q317 Y/Y High-End* $ 17.1 $ 18.2 (6%) $ 16.8 2% Mainstream $ 12.1 $ 10.3 17% $ 9.7 25% Total $ 29.1 $ 28.5 2% $ 26.4 10% FPD Photomask Revenue 6 *≥G8 and AMOLED Total may differ due to rounding

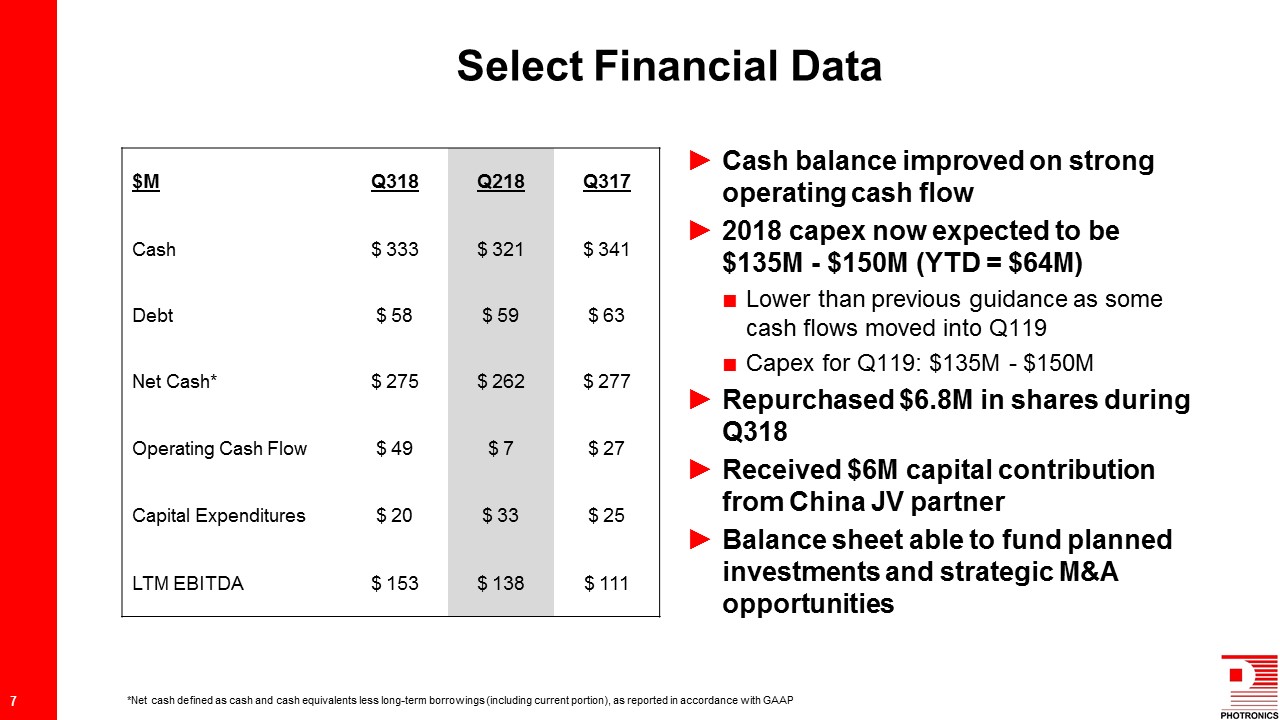

$M Q318 Q218 Q317 Cash $ 333 $ 321 $ 341 Debt $ 58 $ 59 $ 63 Net Cash* $ 275 $ 262 $ 277 Operating Cash Flow $ 49 $ 7 $ 27 Capital Expenditures $ 20 $ 33 $ 25 LTM EBITDA $ 153 $ 138 $ 111 Cash balance improved on strong operating cash flow2018 capex now expected to be $135M - $150M (YTD = $64M)Lower than previous guidance as some cash flows moved into Q119Capex for Q119: $135M - $150MRepurchased $6.8M in shares during Q318Received $6M capital contribution from China JV partnerBalance sheet able to fund planned investments and strategic M&A opportunities Select Financial Data 7 *Net cash defined as cash and cash equivalents less long-term borrowings (including current portion), as reported in accordance with GAAP

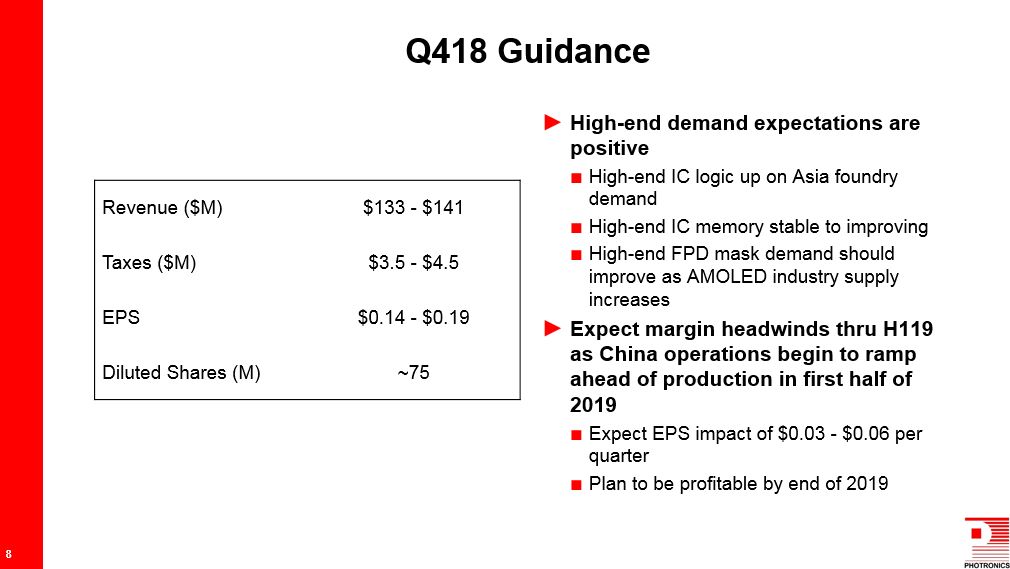

Revenue ($M) $133 - $141 Taxes ($M) $2 - $3 EPS $0.14 - $0.19 Diluted Shares (M) ~75 High-end demand expectations are positiveHigh-end IC logic up on Asia foundry demandHigh-end IC memory stable to improvingHigh-end FPD mask demand should improve as AMOLED industry supply increasesExpect margin headwinds thru H119 as China operations begin to ramp ahead of production in first half of 2019Expect EPS impact of $0.03 - $0.06 per quarterPlan to be profitable by end of 2019 Q418 Guidance 8

Thank you for your interest! For Additional Information:R. Troy Dewar, CFADirector, Investor Relations203.740.5610tdewar@photronics.com

Appendix

IC Photomask Revenue 11 Mainstream$249.9M62% High-End$151.4M38% High-End: 28nm and smaller; total may differ due to rounding

FPD Photomask Revenue 12 Mainstream$39.1M35% High-End$71.2M65% High-End: ≥G8 and AMOLED; total may differ due to rounding Mainstream$32.5M32% High-End$67.9M68%

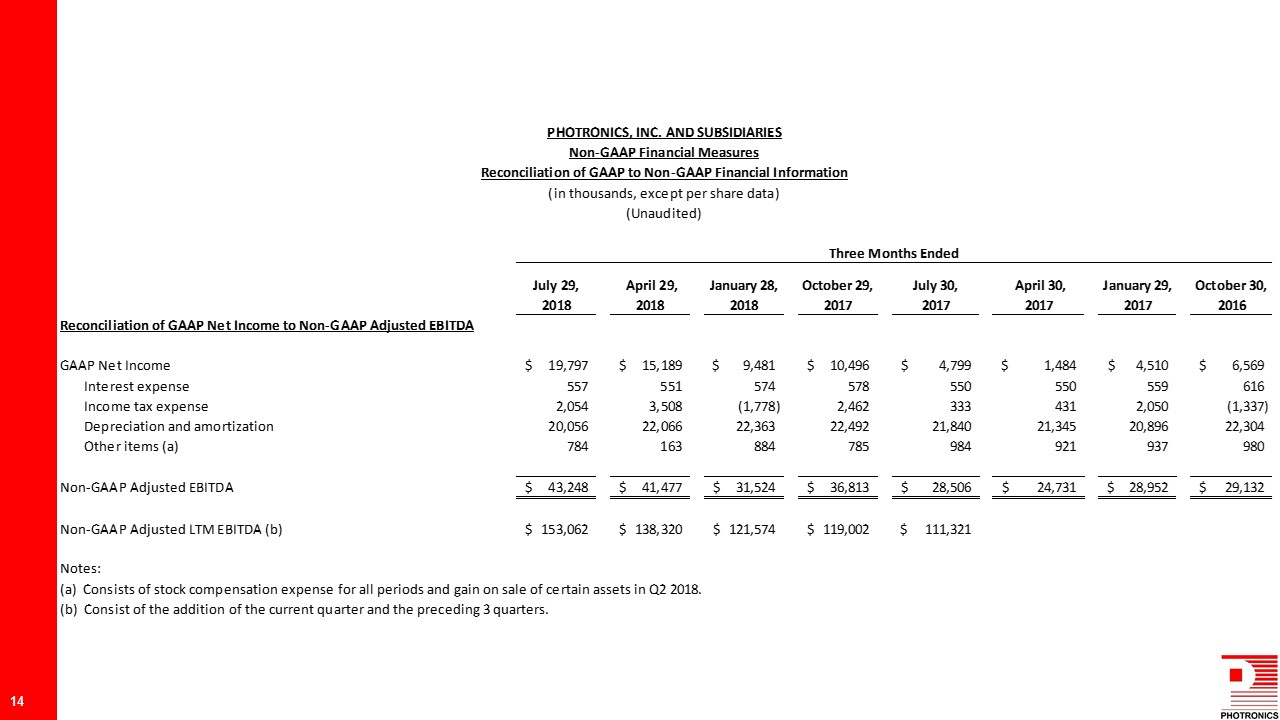

Non-GAAP Reconciliation

14