Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FARMERS & MERCHANTS BANCORP INC | d605332d8k.htm |

Exhibit 99.1

Additional information regarding the Merger, dated August 20, 2018

Farmers & Merchants Bancorp, Inc. Acquisition of Limberlost Bancshares, Inc.

Additional Information about the Transaction Farmers & Merchants Bancorp, Inc. (“FMAO”) intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (SEC), which will include a prospectus relating to the FMAO shares to be issued in the transaction, a proxy statement for a shareholder meeting of Limberlost Bancshares, Inc. (“Limberlost”) at which shareholders will be asked to approve the transaction, and certain other documents regarding the proposed transaction. Before making any voting or investment decision, investors are urged to carefully read the entire registration statement and related documents filed with the SEC, when they become available, because they will contain important information about the proposed transaction. Investors will be able to obtain these documents free of charge at the SEC’s website at www.sec.gov or by making a written request to Farmers & Merchants Bancorp, Inc., Attn: Barb Britenriker, CFO, 307 North Defiance Street, Archbold, OH 43502, or by calling (419) 445-2501.

Forward-Looking Statements Note This presentation may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, strategies, predictions, forecasts, objectives or assumptions of future events or performance are not historical facts and may be forward-looking. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of FMAO and Limberlost. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “expects,” “can,” “could,” “may,” “predicts,” “potential,” “opportunity,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “seeks,” “intends” and similar words or phrases. Accordingly, these statements involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual strategies, actions or results to differ materially from those expressed in them, and are not guarantees of timing, future results or other events or performance. Because forward-looking statements are necessarily only estimates of future strategies, actions or results, based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations, readers are cautioned not to place undue reliance on such statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite shareholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with FMAO’s and Limberlost’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which FMAO and Limberlost operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks; certain risks and important factors that could affect FMAO’s future results are identified in its Annual Report on Form10-K for the year ended December 31, 2017 and other reports filed with the SEC, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and FMAO undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise.

Transaction Overview Farmers & Merchants Bancorp, Inc. to acquire Limberlost Bancshares, Inc. Farmers & Merchants Bancorp (“FMAO”) will acquire Limberlost Bancshares, Inc. (“Limberlost”), the bank holding company for Bank of Geneva (“Bank”), a community bank based in Geneva, Indiana Each share of Limberlost will receive 1,830 shares of FMAO common stock and $8,465.00 in cash Limberlost has 1,000 common shares outstanding Based on FMAO closing price of $43.88 on August 17, 2018, the implied aggregate transaction value is $88.8 million Bank operates six full-service offices in the northeast Indiana communities of Geneva, Berne, Monroe, Portland, Decatur and Monroeville and reported $287 million in total assets, $257 million in loans and $212 million in deposits at June 30, 2018; provides an attractive deposit mix with ~ 16% in noninterest bearing, 23% in time deposits and cost of deposits at 0.60% for the 2Q-2018 Limberlost reported consolidated tangible equity of $30.6 million as of June 30, 2018 and YTD (S-Corp.) net income of $3.2 million for the 6 month period ending June 30, 2018 and $5.3 million for the 12 month period ending December 31, 2017 Natural extension of FMAO’s community bank footprint and complementary fit with FMAO’s recent offices in Indiana including four full-service offices (Angola, Auburn, Butler and Ft. Wayne). FMAO is planning a new office in southwest Ft. Wayne in late 2018 or early 2019

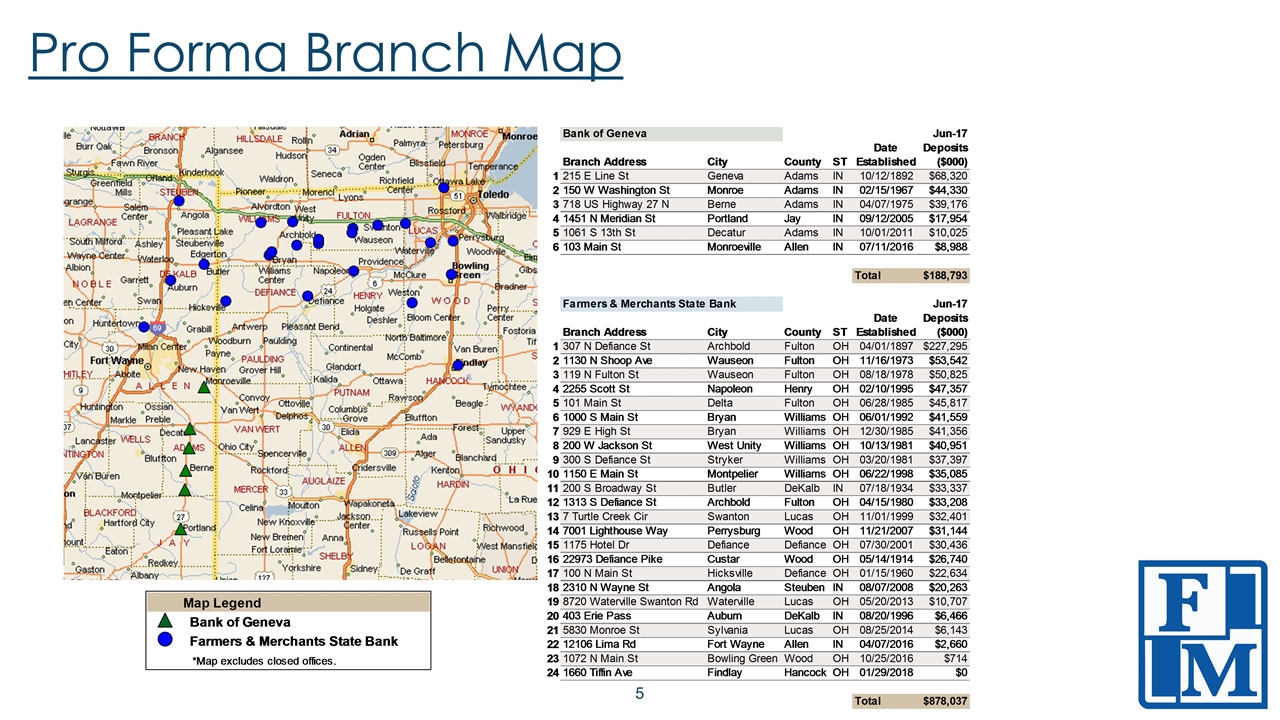

Pro Forma Branch Map

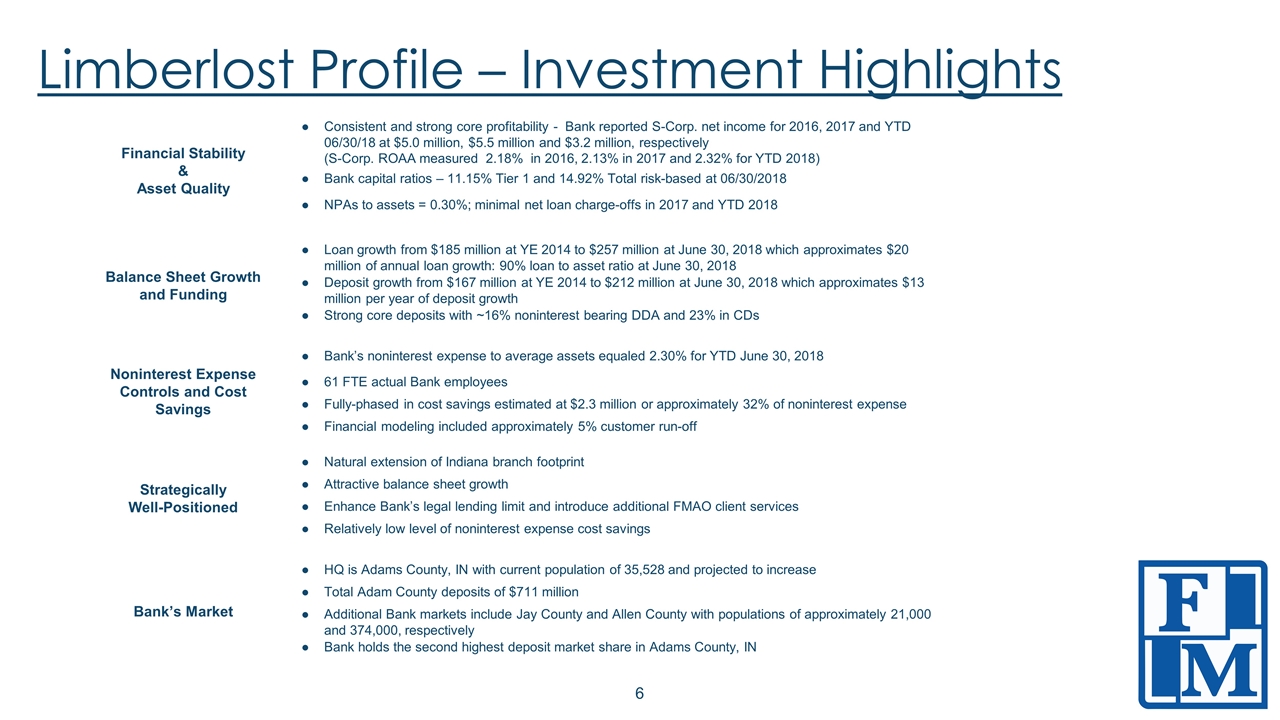

Limberlost Profile – Investment Highlights Financial Stability & Asset Quality ● Consistent and strong core profitability - Bank reported S-Corp. net income for 2016, 2017 and YTD 06/30/18 at $5.0 million, $5.5 million and $3.2 million, respectively (S-Corp. ROAA measured 2.18% in 2016, 2.13% in 2017 and 2.32% for YTD 2018) ● Bank capital ratios – 11.15% Tier 1 and 14.92% Total risk-based at 06/30/2018 ● NPAs to assets = 0.30%; minimal net loan charge-offs in 2017 and YTD 2018 Balance Sheet Growth and Funding ● Loan growth from $185 million at YE 2014 to $257 million at June 30, 2018 which approximates $20 million of annual loan growth: 90% loan to asset ratio at June 30, 2018 ● Deposit growth from $167 million at YE 2014 to $212 million at June 30, 2018 which approximates $13 million per year of deposit growth ● Strong core deposits with ~16% noninterest bearing DDA and 23% in CDs Noninterest Expense Controls and Cost Savings ● Bank’s noninterest expense to average assets equaled 2.30% for YTD June 30, 2018 ● 61 FTE actual Bank employees ● Fully-phased in cost savings estimated at $2.3 million or approximately 32% of noninterest expense ● Financial modeling included approximately 5% customer run-off Strategically Well-Positioned ● Natural extension of Indiana branch footprint ● Attractive balance sheet growth ● Enhance Bank’s legal lending limit and introduce additional FMAO client services ● Relatively low level of noninterest expense cost savings Bank’s Market ● HQ is Adams County, IN with current population of 35,528 and projected to increase ● Total Adam County deposits of $711 million ● Additional Bank markets include Jay County and Allen County with populations of approximately 21,000 and 374,000, respectively ● Bank holds the second highest deposit market share in Adams County, IN

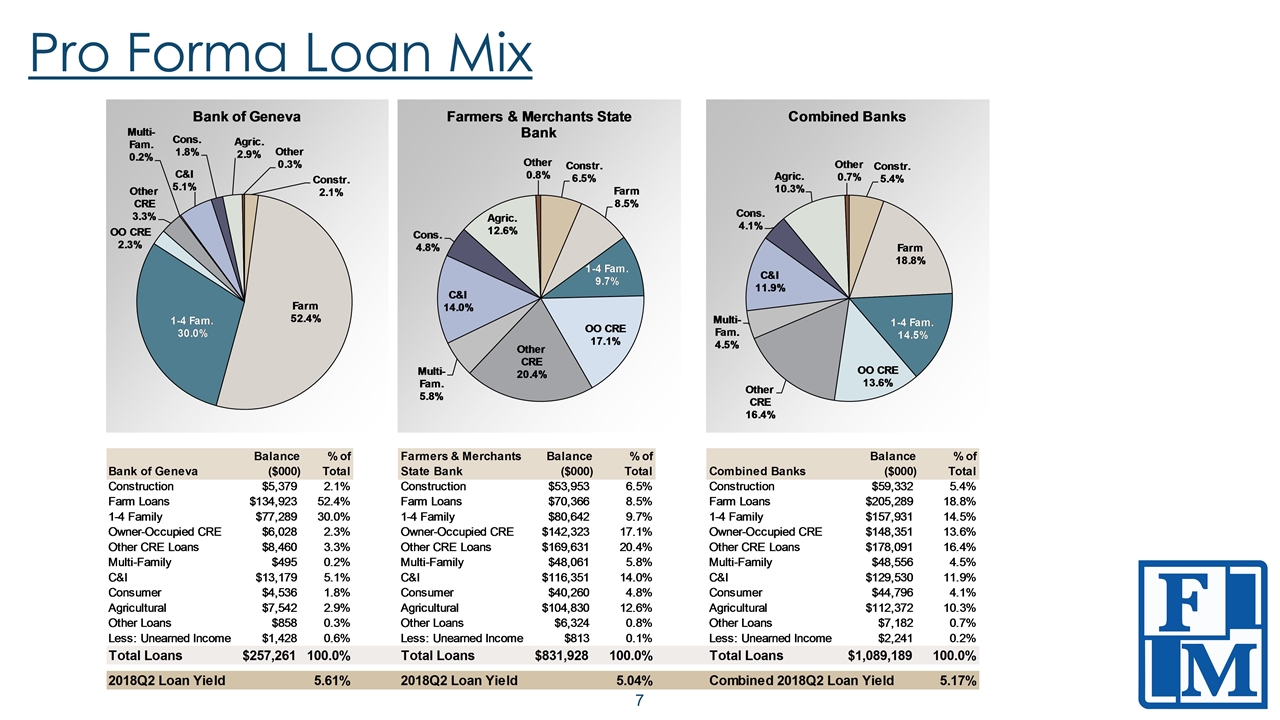

Pro Forma Loan Mix

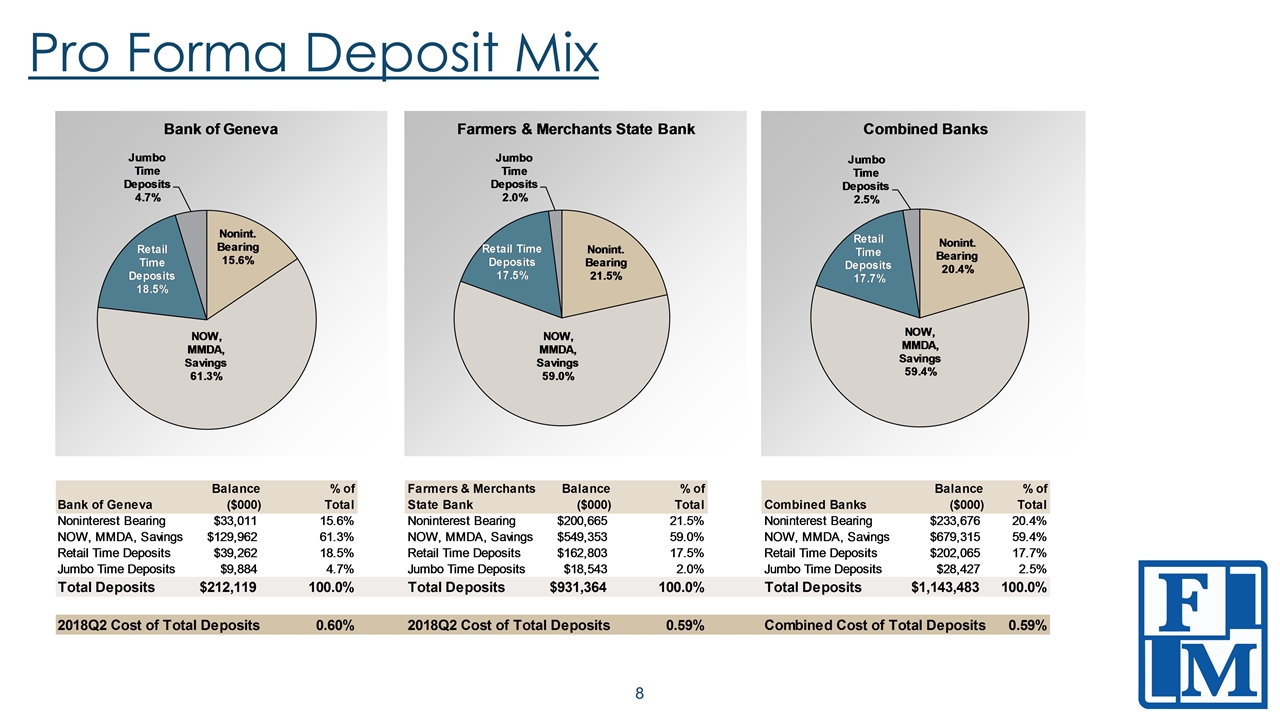

Pro Forma Deposit Mix

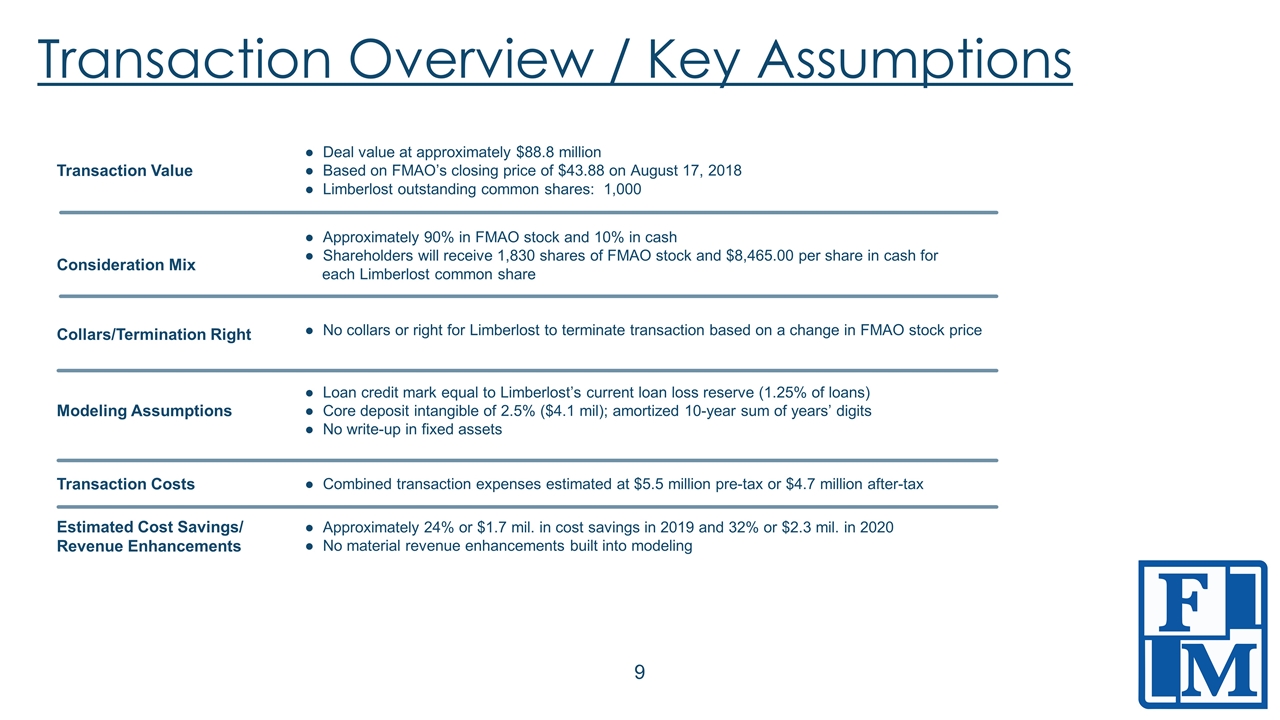

Transaction Overview / Key Assumptions Transaction Value ● Deal value at approximately $88.8 million ● Based on FMAO’s closing price of $43.88 on August 17, 2018 ● Limberlost outstanding common shares: 1,000 Consideration Mix ● Approximately 90% in FMAO stock and 10% in cash ● Shareholders will receive 1,830 shares of FMAO stock and $8,465.00 per share in cash for each Limberlost common share Collars/Termination Right ● No collars or right for Limberlost to terminate transaction based on a change in FMAO stock price Modeling Assumptions ● Loan credit mark equal to Limberlost’s current loan loss reserve (1.25% of loans) ● Core deposit intangible of 2.5% ($4.1 mil); amortized 10-year sum of years’ digits ● No write-up in fixed assets Transaction Costs ● Combined transaction expenses estimated at $5.5 million pre-tax or $4.7 million after-tax Estimated Cost Savings/ Revenue Enhancements ● Approximately 24% or $1.7 mil. in cost savings in 2019 and 32% or $2.3 mil. in 2020 ● No material revenue enhancements built into modeling

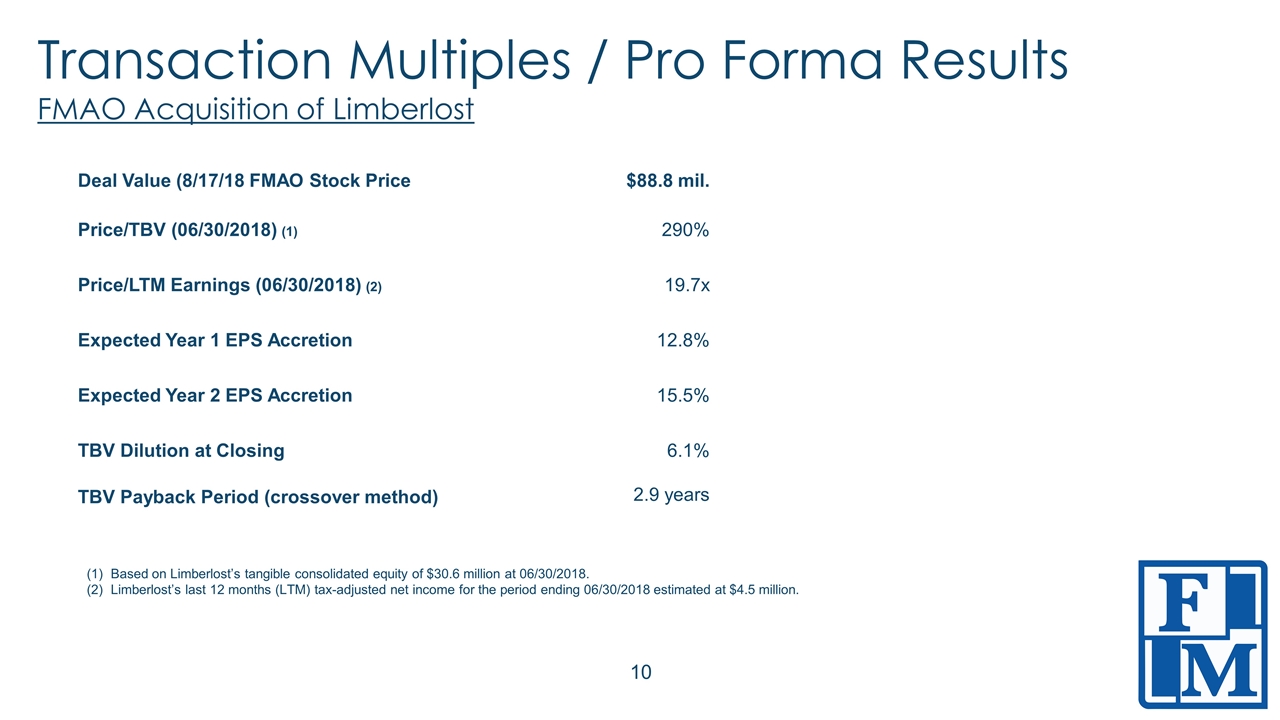

Transaction Multiples / Pro Forma Results FMAO Acquisition of Limberlost Deal Value (8/17/18 FMAO Stock Price $88.8 mil. Price/TBV (06/30/2018) (1) 290% Price/LTM Earnings (06/30/2018) (2) 19.7x Expected Year 1 EPS Accretion 12.8% Expected Year 2 EPS Accretion 15.5% TBV Dilution at Closing 6.1% TBV Payback Period (crossover method) 2.9 years Based on Limberlost’s tangible consolidated equity of $30.6 million at 06/30/2018. Limberlost’s last 12 months (LTM) tax-adjusted net income for the period ending 06/30/2018 estimated at $4.5 million.