Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EARTHSTONE ENERGY INC | form8-kxinvestorpresentati.htm |

Exhibit 99.1 Enercom – The Oil and Gas Conference August 21, 2018 1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: risks relating to any unforeseen liabilities; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit agreement; Earthstone’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the ability to successfully complete any potential asset acquisitions and the risks related thereto; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; Earthstone’s ability to replace oil and natural gas reserves; and any loss of senior management or key technical personnel. Earthstone’s 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, recent current reports on Form 8-K and any amendments of such filings, and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. Industry and Market Data This presentation has been prepared by Earthstone and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Earthstone believes these third-party sources are reliable as of their respective dates, Earthstone has not independently verified the accuracy or completeness of this information. Some data are also based on Earthstone’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. 2

Disclaimer Oil and Gas Reserves The SEC generally permits oil and gas companies, in filings made with the SEC, to disclose estimated proved reserves, which are estimates of reserve quantities that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. Earthstone discloses only estimated proved reserves in its filings with the SEC. Earthstone’s estimated proved reserves as of December 31, 2017 contained in this presentation were prepared by Cawley, Gillespie & Associates, Inc., an independent engineering firm (“CG&A”), and comply with definitions promulgated by the SEC. Additional information on Earthstone’s estimated proved reserves is contained in Earthstone’s filings with the SEC. This presentation also contains Earthstone’s internal estimates of its potential drilling locations, which may prove to be incorrect in a number of material ways. The actual number of locations that may be drilled may differ substantially. Certain estimates of proved reserves contained herein were independently prepared by CG&A utilizing NYMEX 5-year strip prices (future prices) for oil, natural gas and NGL’s as of December 31, 2017. Management believes that utilizing an alternate pricing case better represents the value of the reserves and are better aligned with fair value of reserves. Management also believes the alternate pricing case is useful to investors because it uses future prices and not historical prices in its planning and strategic decision making. In addition to using NYMEX 5-year strip prices, future plugging and abandonment costs net of salvage value have been excluded from the NYMEX 5-year strip price reserves case. 3

Investment Highlights Actively growing in the Midland Basin Growth through drill bit, acquisitions and significant business Midland Basin Focused Company combinations with Growing Inventory ~950 total gross drilling locations across core play in Midland Basin Upside from down-spacing and added benches Liquidity of $207 million(1), able to fund capital expenditures Prudently Managed Balance Sheet Conservative capital structure with low leverage Traditional reserve-based credit facility with standard covenants Midland Basin and Eagle Ford wells-in-progress provide ability to Visible Production Growth & Drilling ramp up production quickly Program with Substantial Optionality Majority of acreage in key areas is HBP Four prior successful public entities Operational excellence Proven Management Team Repeat institutional investors Market recognition from investors and sellside research analysts (1) Liquidity estimated as of June 30, 2018 based on $22.5mm drawn on revolving credit facility with a borrowing base of $225mm and $4.2mm of cash on hand. 4

Track Record • Management team has consistently created shareholder value - Repeated success with multiple entities over 25 years 2005 – 2007 Southern Bay Energy, LLC - Results have created long-term and recurring shareholders (Private) Gulf Coast, Permian Basin - Extensive industry and financial relationships Initial investors – 40% IRR - Technical and operational excellence . Multi-basin experience . Resource & conventional expertise 2001 – 2004 AROC, Inc. (Private) . Complex drilling & horizontal resource proficiency Gulf Coast, Permian Basin, Mid-Con. . Efficient and low-cost operator Preferred investors – 17% IRR Initial investors – 4x return . Proven acquisition and exploitation results 1997 – 2001 Texoil, Inc. (“TXLI”) Gulf Coast, Permian Basin 2007 – 2012 GeoResources, Inc. (“GEOI”) Preferred investors – 2.5x return Eagle Ford, Bakken / Three Forks, Gulf Coast Follow-on investors – 3x return Initial investors – 35% IRR Initial investors – 10x return Initial investors – 4.8x return 1992 – 1996 Hampton Resources Corp. (“HPTR”) Initial Southern Bay investors achieved a combined 7.4x ROI upon Gulf Coast the merger with GeoResources and subsequent sale in 2012 Preferred investors – 30% IRR Initial investors – 7x return Note: “Initial investors” refers to (i) in the case of private entities, investors that participated in the initial capitalization or recapitalization of the entity at the time a change in management occurred, or (ii) in the case of public entities, public shareholders existing at the date the transaction was announced to the public. Past performance is not necessarily indicative of future results. 5

Management . Strong management and technical team with demonstrated ability and prior success . Equity ownership - interests are clearly aligned with shareholders Years Years of Working Responsibility Experience Together Frank Lodzinski 46 30 CEO Robert Anderson 30 15 President Mark Lumpkin 20 1 CFO Steve Collins 28 22 Operations Tim Merrifield 37 19 Geology and Geophysics Francis Mury 42 30 Drilling and Development Tony Oviedo 37 1 Accounting and Administration Lane McKinney 20 5 Land Lenny Wood 16 1 Exploration and Development Scott Thelander 11 1 Finance 6

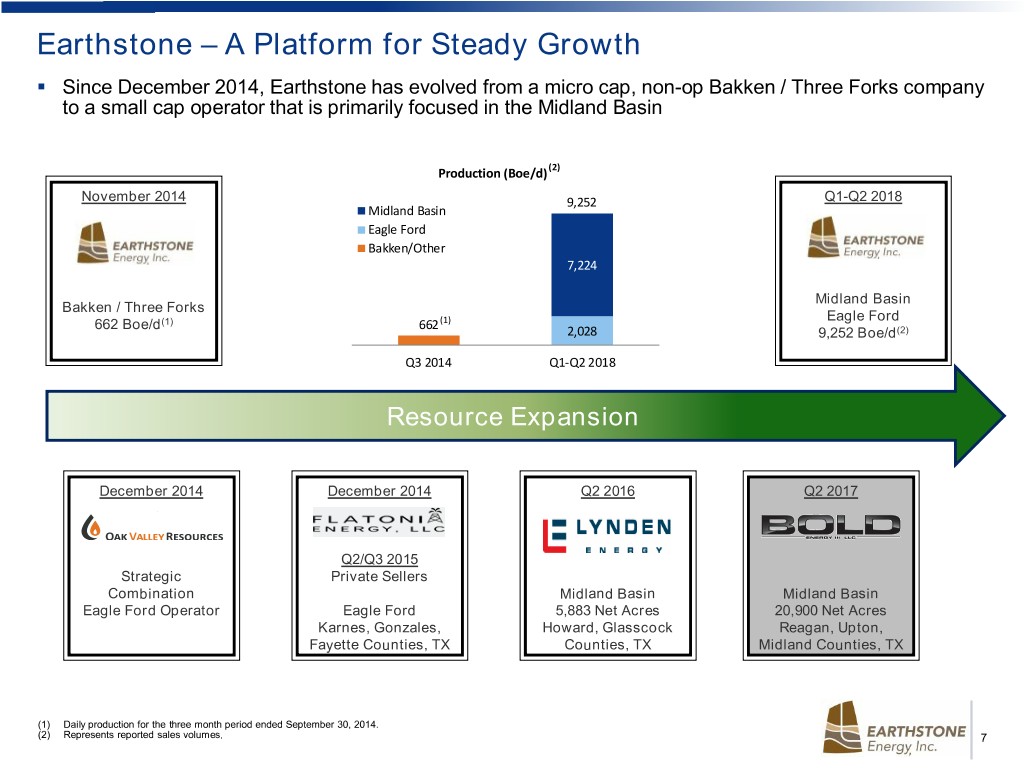

Earthstone – A Platform for Steady Growth . Since December 2014, Earthstone has evolved from a micro cap, non-op Bakken / Three Forks company to a small cap operator that is primarily focused in the Midland Basin Production (Boe/d) (2) November 2014 9,252 Q1-Q2 2018 Midland Basin Eagle Ford Bakken/Other 7,224 Midland Basin Bakken / Three Forks Eagle Ford 662 Boe/d(1) 662 (1) 2,028 9,252 Boe/d(2) Q3 2014 Q1-Q2 2018 Resource Expansion December 2014 December 2014 Q2 2016 Q2 2017 Q2/Q3 2015 Strategic Private Sellers Combination Midland Basin Midland Basin Eagle Ford Operator Eagle Ford 5,883 Net Acres 20,900 Net Acres Karnes, Gonzales, Howard, Glasscock Reagan, Upton, Fayette Counties, TX Counties, TX Midland Counties, TX (1) Daily production for the three month period ended September 30, 2014. (2) Represents reported sales volumes. 7

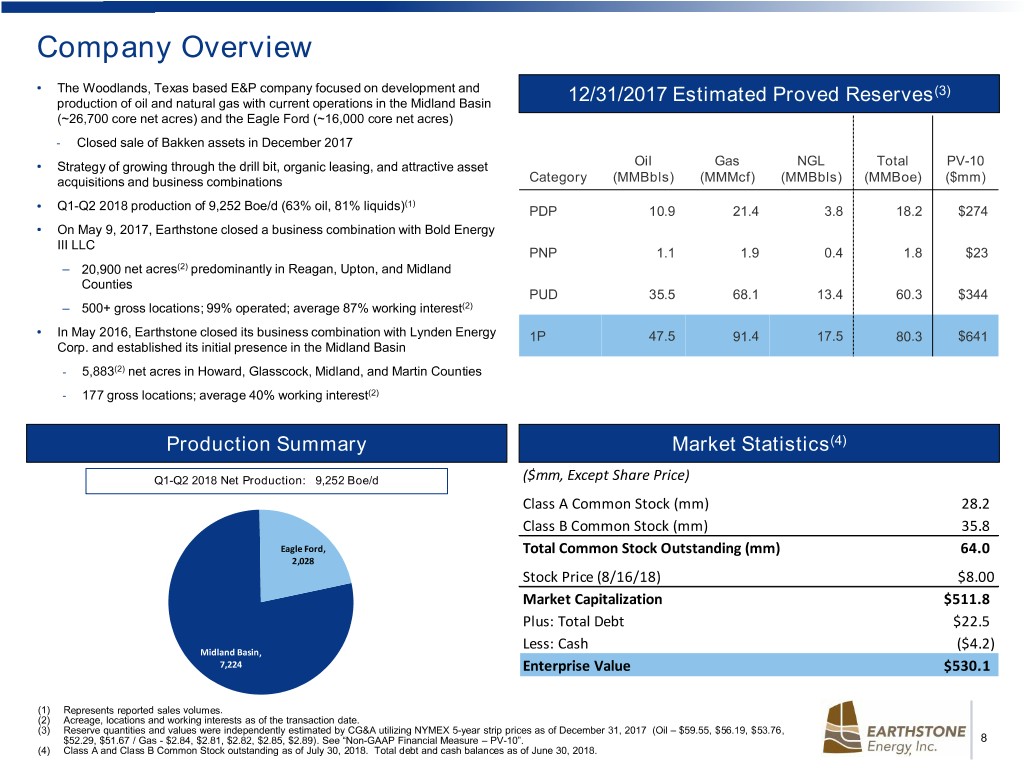

Company Overview • The Woodlands, Texas based E&P company focused on development and (3) production of oil and natural gas with current operations in the Midland Basin 12/31/2017 Estimated Proved Reserves (~26,700 core net acres) and the Eagle Ford (~16,000 core net acres) - Closed sale of Bakken assets in December 2017 • Strategy of growing through the drill bit, organic leasing, and attractive asset Oil Gas NGL Total PV-10 acquisitions and business combinations Category (MMBbls) (MMMcf) (MMBbls) (MMBoe) ($mm) (1) • Q1-Q2 2018 production of 9,252 Boe/d (63% oil, 81% liquids) PDP 10.9 21.4 3.8 18.2 $274 • On May 9, 2017, Earthstone closed a business combination with Bold Energy III LLC PNP 1.1 1.9 0.4 1.8 $23 – 20,900 net acres(2) predominantly in Reagan, Upton, and Midland Counties PUD 35.5 68.1 13.4 60.3 $344 – 500+ gross locations; 99% operated; average 87% working interest(2) • In May 2016, Earthstone closed its business combination with Lynden Energy 1P 47.5 91.4 17.5 80.3 $641 Corp. and established its initial presence in the Midland Basin - 5,883(2) net acres in Howard, Glasscock, Midland, and Martin Counties - 177 gross locations; average 40% working interest(2) Production Summary Market Statistics(4) Q1-Q2 2018 Net Production: 9,252 Boe/d ($mm, Except Share Price) Class A Common Stock (mm) 28.2 Class B Common Stock (mm) 35.8 Eagle Ford, Total Common Stock Outstanding (mm) 64.0 2,028 Stock Price (8/16/18) $8.00 Market Capitalization $511.8 Plus: Total Debt $22.5 Less: Cash ($4.2) Midland Basin, 7,224 Enterprise Value $530.1 (1) Represents reported sales volumes. (2) Acreage, locations and working interests as of the transaction date. (3) Reserve quantities and values were independently estimated by CG&A utilizing NYMEX 5-year strip prices as of December 31, 2017 (Oil – $59.55, $56.19, $53.76, $52.29, $51.67 / Gas - $2.84, $2.81, $2.82, $2.85, $2.89). See “Non-GAAP Financial Measure – PV-10”. 8 (4) Class A and Class B Common Stock outstanding as of July 30, 2018. Total debt and cash balances as of June 30, 2018.

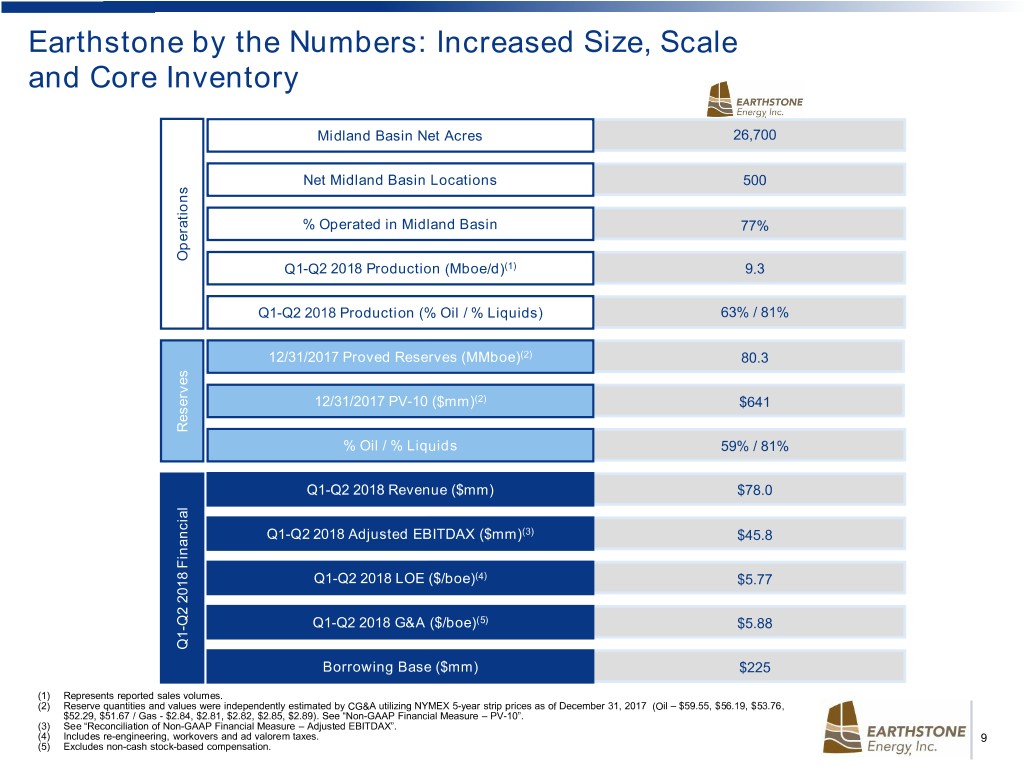

Earthstone by the Numbers: Increased Size, Scale and Core Inventory Midland Basin Net Acres 26,700 Net Midland Basin Locations 500 % Operated in Midland Basin 77% Operations Q1-Q2 2018 Production (Mboe/d)(1) 9.3 Q1-Q2 2018 Production (% Oil / % Liquids) 63% / 81% 12/31/2017 Proved Reserves (MMboe)(2) 80.3 12/31/2017 PV-10 ($mm)(2) $641 Reserves % Oil / % Liquids 59% / 81% Q1-Q2 2018 Revenue ($mm) $78.0 Q1-Q2 2018 Adjusted EBITDAX ($mm)(3) $45.8 Q1-Q2 2018 LOE ($/boe)(4) $5.77 Q2 2018 Financial (5) - Q1-Q2 2018 G&A ($/boe) $5.88 Q1 Borrowing Base ($mm) $225 (1) Represents reported sales volumes. (2) Reserve quantities and values were independently estimated by CG&A utilizing NYMEX 5-year strip prices as of December 31, 2017 (Oil – $59.55, $56.19, $53.76, $52.29, $51.67 / Gas - $2.84, $2.81, $2.82, $2.85, $2.89). See “Non-GAAP Financial Measure – PV-10”. (3) See “Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX”. (4) Includes re-engineering, workovers and ad valorem taxes. 9 (5) Excludes non-cash stock-based compensation.

Robust Growth with a Focus on Operations and Balance Sheet Average Daily Production (Boe/d)(1) Adj. EBITDAX ($mm)(3) 16,000 $120.0 (4) $91.6 (2) 12,000 10,750 $90.0 9,252 7,869 $60.6 8,000 $60.0 4,002 3,936 ($mm) EBITDAX $26.5 4,000 $30.0 $18.7 Average Daily Production (Boe/d) 0 $0.0 Lease Operating Expense ($/Boe)(5) Net Debt / LTM EBITDAX $12.00 $10.95 2.0x $10.29 $9.00 1.5x $6.84 $5.77 (2) $6.00 $5.38 1.0x $3.00 0.5x LOE per Boe ($/Boe) Boe per LOE 0.2x 0.2x NetDebt / LTM EBITDAX (x) NM 0.0x $0.00 0.0x (1) Represents reported sales volumes. (2) Reflects midpoint of 2018 FY Guidance. (3) See “Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX”. 10 (4) Based Q1-Q2 2018 Adjusted EBITDAX of $45.8mm on an annualized basis. (5) Includes re-engineering, workovers and ad valorem taxes.

Areas of Operations Eagle Ford 1P Reserves (MMBoe) 6.5 % PD 73% % Oil 62% PV-10 ($mm) 82.1 Q2 2018 Net Production (Boe/d)(1) 1,960 Midland Basin Gross Producing Wells 178 1P Reserves (MMBoe) 73.7 Core Net Acres 16,000 % PD 21% Core Gross Drilling Locations 161 % Oil 59% PV-10 ($mm) 559.1 Q2 2018 Net Production (Boe/d)(1) 6,885 Total Gross Producing Wells 209 1P Reserves (MMBoe) 80.3 Core Net Acres 26,700 % PD 25% Core Gross Drilling Locations 943 % Oil 59% PV-10 ($mm) 641.2 Q2 2018 Net Production (Boe/d)(1) 8,845 Gross Producing Wells 387 Core Net Acres 42,700 Core Gross Drilling Locations 1,104 Notes: Reserve quantities and values were independently estimated by CG&A utilizing NYMEX 5-year strip prices as of December 31, 2017 (Oil – $59.55, $56.19, $53.76, $52.29, $51.67 / Gas - $2.84, $2.81, $2.82, $2.85, $2.89). PV-10 is a non-GAAP financial measure. See “Non-GAAP Financial Measure – PV-10”. (1) Represents reported sales volumes. 11

Asset Overview 12

Significant Position in the Midland Basin 26,700 Total Net Acres in Core of Midland Basin 943 gross locations identified in only 4 benches Significant Operated Position in Midland Basin(1) 20,500 net acres, 87% working interest, 526 gross locations identified in only 4 benches Q2 2018 Net Production of 6,885 Boe/d(2) (60% oil, 80% liquids) Wells in progress drive immediate production growth Attractive Rates of Returns (“ROR”)(3) Single well RORs of 80% - +100% Position Delineated In Multiple Benches Strong offset results in the Wolfcamp A and B, Lower Spraberry, Significant Wolfcamp C potential Completion Evolution Sets Stage for Further Well Acreage Legend Performance Improvement Operated Non-Operated (1) Does not include non-operated position. (2) Represents reported sales volumes for both operated and non-operated properties. (3) Single well rates of return based on flat price deck of Oil – $60.00/Bbl, Gas - $3.00/Mcf before deductions for transportation, gathering and quality differential. 13

Consistent Thickness in Place Across the Operated Position . Reagan County Wolfcamp Wolfcamp Formation Isopach (Midland Basin)(1) - Thickest Wolfcamp shale section in Midland Basin . Current Reagan inventory - 1 Wolfcamp A target - 2 Wolfcamp B targets - 1 Wolfcamp C target . 7 viable target benches tested or developed by industry - 2 Wolfcamp A targets - 3 Wolfcamp B targets - 1 Wolfcamp C target - 1 Wolfcamp D target . Offset operators have developed five benches in a stacked “wine rack” pattern - 2 Wolfcamp A targets - 3 Wolfcamp B targets . Thermal maturity places ESTE’s acreage in oil window with low gas/oil ratios (“GOR”) - Average 80% Liquids, 20% Gas . Shallower true vertical depth (“TVD”) than northern end of Midland Basin - D&C costs are lower Source: University of Texas Bureau of Economic Geology. 14 (1) Does not include Wolfcamp A in the Wolfcamp Isopach.

High Quality Pay Across Multiple Zones Reagan County Type Section Reagan Co. Resource Greater than Midland Co. North Midland Central Reagan Dean Dean Wolfcamp A Wolfcamp A Wolfcamp Upper B Wolfcamp B Wolfcamp A Thickness increases 50-100’ from Midland to Reagan County. Wolfcamp Lower B Wolfcamp B Wolfcamp C Thickness increases 250-300’ Wolfcamp from Midland to Reagan County. C Wolfcamp C Bench is much thicker in Reagan County. Wolfcamp D Wolfcamp D Primary Targets Prospective Targets(1) (1) Prospective targets tested in offset wells by other operators. 15

Significant Acreage Position in Midland Basin Core at an Attractive Price Selected Midland Basin Transactions RSPP/Adventure – 7/2014 Oxy/Vanguard – 3/2017 Purchase price: $259mm Purchase price: $105 mm Production, net: 1,100 boe/d Production, net: 203 boe/d Acreage: 6,652 Acreage: 3,048 Adj. $/acre: $30,667 Adj. $/acre: $32,118 Parsley/PCORE – 12/2015 Purchase price: $149mm Production, net: 1,000 boe/d Acreage: 5,274 Adj. $/acre: $21,521 Parsley/Riverbend – 4/2016 Purchase price: $215mm Production, net: 1,100 boe/d Acreage: 8,700 Adj. $/acre: $20,893 Parsley/Cimarex – 8/2014 Purchase price: $252mm Production, net: 1,800 boe/d Acreage: 5,472 Adj. $/acre: 29,605 AEP/Tall City– 10/2014 AEP/Enduring – 6/2014 Purchase price: $726mm Purchase price: $2,500mm Production, net: 1,400 boe/d Production, net: 16,000 boe/d Acreage: 27,000 Acreage: 63,000 Adj. $/acre: $24,296 Adj. $/acre: $26,984 ESTE Operated ESTE Non-Op Compelling Bold purchase price of ~$12,000(1) per undeveloped net acre compares favorably to recent Midland Basin acquisitions Source: Company filings and 1Derrick. Note: Includes transactions with purchase prices greater than or equal to $100mm at announcement in Reagan, Glasscock and Upton counties for which transaction price and PDP is publicly available. Transaction value excludes PDP value of: $50,000/boe/d for transactions in 2014, $35,000/boe/d for transactions in 2015, $30,000/boe/d in 1H 2016 and $35,000/boe/d thereafter. 16 (1) Based on announced transaction value of ~$324mm on 11/8/2016 and PDP value of $35,000/boe/d.

Significant Multi-zone Results in Southern Midland Basin 1 Concho 9 Parsley Karen P1 Unit #5101BH Char Hughes 28-2 #4803H Wolfcamp B Upper Wolfcamp C IPW2: 1388 Boe/d (88% oil) IPW2: 1304 Boe/d (82% oil) 2 Henry 10 Apache Fantasy #717WB SRH North #1527HA Wolfcamp B Upper Wolfcamp A IPW2: 1075 Boe/d (89% oil) IPW2: 1266 Boe/d (75% oil) 3 Pioneer 11 Apache 10 11 Univ. 3-310 PU #9H SRH North #1526HU Wolfcamp A Wolfcamp A IPW2: 1242 Boe/d (84% oil) IPW2: 1403 Boe/d (85% oil) 1 16 12 4 12 13 Pioneer Earthstone (Bold) 15 Univ. 2-20 #76H Hartgrove 22 A #4HL 14 9 Cline/Wolfcamp D Wolfcamp B Lower 2 IPW2: 2998 Boe/d (82% oil) IP24: 1030 Boe/d (93% oil) (1) 4 3 5 13 Sequitur Callon 8 Univ. 9 #2707 WC Ham A1 #101LH 5 Wolfcamp B Lower Wolfcamp B Lower IPW2: 900 Boe/d (92% oil) IPW2: 2034 Boe/d (86% oil) 6 Sable 14 Earthstone (Bold) 6 7 Chico East #236HS West Hartgrove 1 #1BU Wolfcamp A Wolfcamp B Upper IPW2: 1114 Boe/d (86% oil) IP24: 1267 Boe/d (86% oil) (1) 7 Earthstone (Bold) 15 Earthstone (Bold) WTG 4-232 A #2BL West Hargrove 1 #2C Earthstone Acreage Wolfcamp B Lower Wolfcamp C IP24: 2000 Boe/d (93% oil) (1) IP24: 995 Boe/d (77% oil) (1) 8 Pioneer 16 Callon Industry Well ESTE Well ESTE Planned Q3/Q4 ESTE DUC Rocker B #133H Eaglehead A-A3 #3LH 2018 Wolfcamp B Upper Wolfcamp B Lower IPW2: 1397 Boe/d (82% oil) IPW2: 1437 Boe/d (85% oil) Source: Company filings and investor presentations. Note: Well completions filed since Jan. 2018. IP tests are 24 hour tests. 17 (1) Wells are flowing back and may not have reached peak rates.

Recent Wolfcamp C Activity 4 1 Parsley Taylor 45-33 #4601 3 IPW2: 3214 Boe/d (77% oil) 1 TLL: 10,379’ 2 Endeavor 3 Parsley 5 2 Jalonick 40-45 #242 Oliver 39-34 #4807H IPW2: 734 Boe/d (76% oil) IPW2: 2522 Boe/d (77% oil) TLL: 7,211’ TLL: 10,408’ 4 Parsley 5 Parsley Paige 13A & 12A #4801H Bast 34 & 39 #4809H 6 IPW2: 1827 Boe/d (74% oil) IPW2: 1054 Boe/d (75% oil) TLL: 10,438’ TLL: 10,189’ 8 6 Callon 7 Parsley 10 Eaglehead C A3 #26CH Victor 1223 #4804H 7 IPW2: 1197 Boe/d (90% oil) IPW2: 541 Boe/d (82% oil) TLL: 7,269’ TLL: 5,090’ 8 Parsley 9 PT Petroleum Char Hughes 28-2 #4803H University Orange #6091C IPW2: 1304 Boe/d (82% oil) IPW2: 1101 Boe/d (93% oil) TLL: 11,265’ TLL: 9,597’ 10 Earthstone (Bold) West Hartgrove 1 #2C IP24: 995 Boe/d (77% oil) (1) TLL: 5,860’ 9 ESTE Leasehold Wolfcamp C Producer Source: Company filings and investor presentations. Note: Well completions filed since Jan. 2017. IP tests are 24 hour tests. 18 (1) Wells are flowing back and may not have reached peak rates.

Differentiated, Balanced Inventory in Midland Basin Midland Basin Overview Gross Locations by Lateral Length and Target . Contiguous acreage positions provide significant Gross Locations by Lateral Length development advantage Target 5,000' - 6,250' 6,250' - 8,750' 8,750' - 10,000' Total % Total Lower Spraberry 1 46 40 87 9% . Long lateral development increases capital efficiency Wolfcamp A 9 112 160 281 30% . Over 95% of Midland horizontal locations have laterals of ~6,250 feet or greater Upper Wolfcamp B 9 98 159 266 28% – Over 50% of horizontal locations 8,750 feet or greater Lower Wolfcamp B 7 81 119 207 22% . Additional upside from: Wolfcamp C 6 55 41 102 11% – Middle Spraberry Total Gross Locations 32 392 519 943 100% – Jo Mill Total Net Locations 500 – Additional Lower Spraberry % Total (Gross) 3% 42% 55% 100% – Additional benches in Wolfcamp B – Wolfcamp D . Actively pursuing acreage and acquisition bolt-on opportunities to increase lateral lengths and ownership . Near-term drilling focused in the Wolfcamp A and the Wolfcamp B based on positive offset results, but are optimistic about the upside potential in other zones 19

Well Performance Update . All areas outperforming initial expectations . All areas and target horizons generating attractive returns at strip prices with cost inflation . Increased early time production profile while maintaining EUR – Improved rate of return (“ROR”) due to initial production outperforming previous type curves Reagan County Results(1) Midland and Upton County Results(2) 150 150 2017 Reagan Co Avg. (16 wells) Midland & Upton Co Avg. (6 wells) Texaco-Parish 1 #1HU 1,000 MBOE Hamman 45 #6HM Texaco-Parish 2 #1HM Hamman 45 #7HL 120 Hartgrove 22A 3HU 120 Hartgrove 22A 4HL West Hartgrove 1 1BU 850 MBOE West Hartgrove 1 2C 90 WTG 4-232 A 2BL 90 WTG 4-232 A 3A 60 60 30 30 7,500' Norm CUMULATIVE PRODUCTION, MBOE STREAM)(2 7,500' Norm CUMULATIVE PRODUCTION, MBOE STREAM)(2 0 0 0 1 2 3 4 5 6 0 1 2 3 4 5 6 TIME, MONTHS TIME, MONTHS Type Curve Summary (100% WI, 75% NRI 7,500' Laterals) DC & E(3) EUR Oil NGL ROR (%) (4) County ($m) (M Boe ) (%) (%) $50/$3 $60/$3 Midland / Upton $7,000 1,000 67% 20% >100% >100% Reagan $6,800 850 59% 22% 47% 88% (1) Reflects average cumulative production of wells completed in 2016 and 2017 in Reagan County. Excludes shut in time for offset frac activity/operational downtime. (2) Reflects average cumulative production of wells completed in 2016 and 2017 in Upton and Midland Counties. (3) Reflects estimated 2018 drilling, completions and equipment costs, including production facilities. 20 (4) Single well rates of return assumes 3-stream economics on flat price deck of Oil – $50.00 and $60.00/Bbl, Gas - $3.00/Mcf before deductions for transportation, gathering and quality differential.

Blocking Up Acreage – East Central Upton County Pre Acreage Trade Acreage Trade Highlights Completed trade with offset operator to block up acreage for longer laterals Earthstone now has 2,650 net acres in the Benedum prospect with average 95% WI (80% NRI) Trade gives Earthstone 75 gross potential drilling locations in the Wolfcamp A, Upper B, and Lower B Average lateral length ~ 6,650’ 2 wells planned for 2018 Post Acreage Trade 21

Blocking Up Acreage – Southeast Reagan County Pre Acreage Trade Acreage Trade Highlights Completed trade with offset operator and became operator of the RCR RE 180 well and unit 480 net acres in the RCR Unit with 100% WI (76% NRI) Ability to drill future wells with 7,500 ft laterals Retained 2.5% ORRI in offsetting 640 acre standup unit RCR RE 180 well online in December 2017 Continuing to pursue other adjacent acreage acquisitions/trades to increase lateral lengths Post Acreage Trade 2.5% ORRI 22

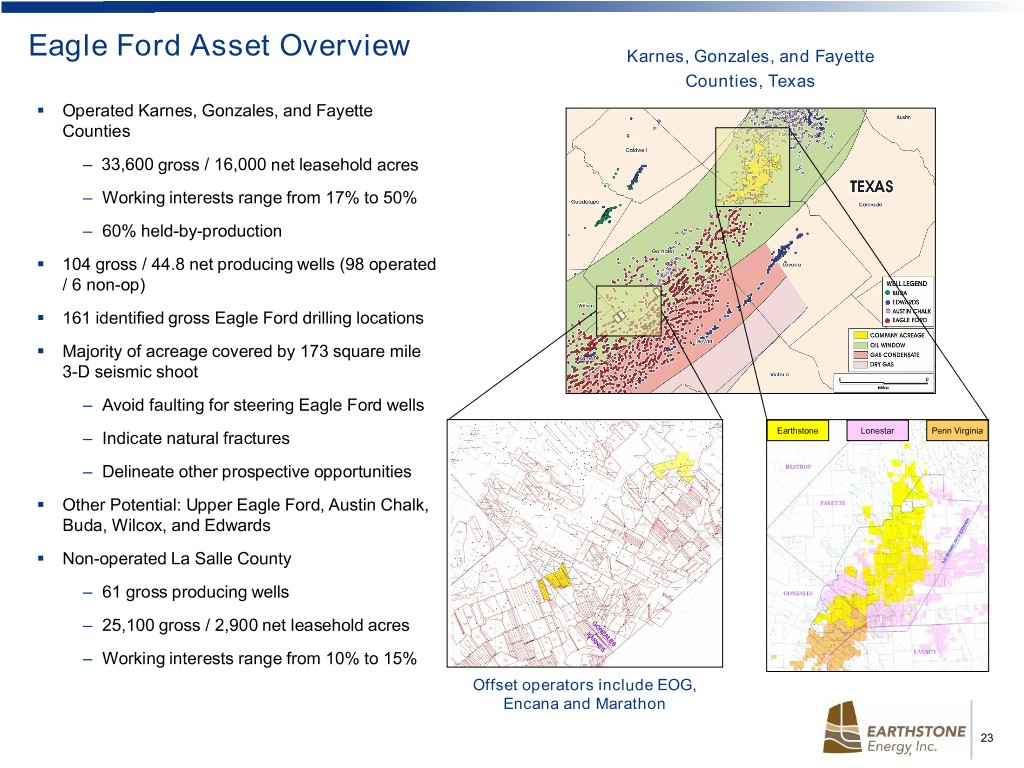

Eagle Ford Asset Overview Karnes, Gonzales, and Fayette Counties, Texas . Operated Karnes, Gonzales, and Fayette Counties – 33,600 gross / 16,000 net leasehold acres – Working interests range from 17% to 50% – 60% held-by-production . 104 gross / 44.8 net producing wells (98 operated / 6 non-op) . 161 identified gross Eagle Ford drilling locations . Majority of acreage covered by 173 square mile 3-D seismic shoot – Avoid faulting for steering Eagle Ford wells Earthstone Lonestar Penn Virginia – Indicate natural fractures – Delineate other prospective opportunities . Other Potential: Upper Eagle Ford, Austin Chalk, Buda, Wilcox, and Edwards . Non-operated La Salle County – 61 gross producing wells – 25,100 gross / 2,900 net leasehold acres – Working interests range from 10% to 15% Offset operators include EOG, Encana and Marathon 23

Recent Eagle Ford Activity . 11 gross wells drilled in southwestern Gonzales County and completed in late 2017 and early 2018 – 2 wells in Davis Unit (~5,300 foot lateral); 17% working interest – 3 wells in Pilgrim Unit (~7,300 foot lateral); 19% working interest – 6 wells in Crosby Unit (~4,900 foot lateral); 25% working interest . Joint Development Agreements (“JDA”) with IOG Capital to fund a majority of Earthstone’s capital expenditures for a 50% interest in 13 wells in the Eagle Ford (11 drilled in 2017 and completed in 2017 and beginning of 2018) – JDAs in the Pilgrim, Davis and Crosby Units – Operated interests previously included 33% in Davis Unit, 38% in Pilgrim Unit and 50% in Crosby Unit – Reduced estimated 2017 budget by $17 million . Offsetting successful Earthstone Boggs Unit – 4 wells completed in October 2016 – Cumulative production of 596 MBoe (93% oil) through January 2018 – Average lateral length of ~6,260 feet – Average proppant of ~2,260 lbs/ft . 2018 drilling and completion plans to offset the Davis and Crosby Units – Completed 5 well Sayre Pad offsetting Davis unit in July 2018 24

Financial Overview 25

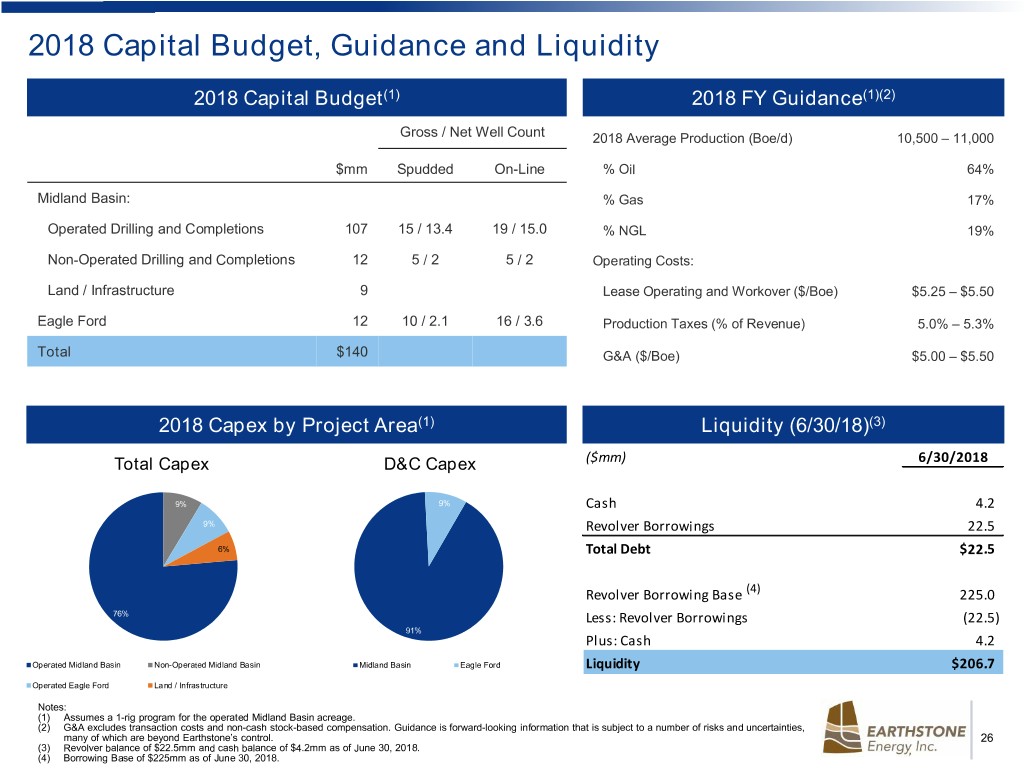

2018 Capital Budget, Guidance and Liquidity 2018 Capital Budget(1) 2018 FY Guidance(1)(2) Gross / Net Well Count 2018 Average Production (Boe/d) 10,500 – 11,000 $mm Spudded On-Line % Oil 64% Midland Basin: % Gas 17% Operated Drilling and Completions 107 15 / 13.4 19 / 15.0 % NGL 19% Non-Operated Drilling and Completions 12 5 / 2 5 / 2 Operating Costs: Land / Infrastructure 9 Lease Operating and Workover ($/Boe) $5.25 – $5.50 Eagle Ford 12 10 / 2.1 16 / 3.6 Production Taxes (% of Revenue) 5.0% – 5.3% Total $140 G&A ($/Boe) $5.00 – $5.50 2018 Capex by Project Area(1) Liquidity (6/30/18)(3) ($mm) 6/30/2018 Total Capex D&C Capex 9% 9% Cash 4.2 9% Revolver Borrowings 22.5 6% Total Debt $22.5 Revolver Borrowing Base (4) 225.0 76% Less: Revolver Borrowings (22.5) 91% Plus: Cash 4.2 Operated Midland Basin Non-Operated Midland Basin Midland Basin Eagle Ford Liquidity $206.7 Operated Eagle Ford Land / Infrastructure Notes: (1) Assumes a 1-rig program for the operated Midland Basin acreage. (2) G&A excludes transaction costs and non-cash stock-based compensation. Guidance is forward-looking information that is subject to a number of risks and uncertainties, many of which are beyond Earthstone’s control. 26 (3) Revolver balance of $22.5mm and cash balance of $4.2mm as of June 30, 2018. (4) Borrowing Base of $225mm as of June 30, 2018.

Hedging Summary Oil Production Hedged Gas Production Hedged Period Volume (Bbls) $/Bbl Period Volume (MMBtu) $/MMBtu Q3 2018 459,700 $54.55 Q3 2018 610,000 $2.947 Q4 2018 413,700 $54.05 Q4 2018 610,000 $2.947 Q1 2019 315,000 $57.17 Q2 2019 318,500 $57.17 Q3 2019 322,000 $57.17 Q4 2019 303,600 $57.07 WTI Midland Argus Crude Basis Swaps LLS Argus Crude Oil Basis Swaps Period Volume (Bbls) $/Bbl (Differential) Period Volume (MMBtu) $/Bbl (Differential) Q3 2018 181,800 ($0.92) Q3 2018 92,000 $6.35 Q4 2018 243,800 ($1.90) Q4 2018 92,000 $6.35 Q1 2019 315,000 ($6.39) Q1 2019 90,000 $4.50 Q2 2019 318,500 ($6.39) Q2 2019 91,000 $4.50 Q3 2019 322,000 ($6.39) Q3 2019 92,000 $4.50 Q4 2019 322,000 ($6.39) Q4 2019 92,000 $4.50 Q1 2020 182,000 ($5.38) Q2 2020 182,000 ($5.38) Q3 2020 184,000 ($5.38) Q4 2020 184,000 ($5.38) 27

Analyst Coverage Firm Analyst Contact Info Baird Joseph Allman / 646-557-3209 / jdallman@rwbaird.com Coker Palmer David Beard / 631-725-8810 / beard@cokerpalmer.com Euro Pacific Joel Musante / 800-727-7922 ext: 144 / jmusante@europac.net Imperial Capital Jason Wangler / 713-892-5603 / jwangler@imperialcapital.com Johnson Rice Ron Mills / 504-584-1217 / rmills@jrco.com Northland Jeff Grampp / 949-600-4150 / jgrampp@northlandcapitalmarkets.com RBC Brad Heffern / 512-708-6311 / brad.heffern@rbccom.com Roth John White / 949-720-7115 / jwhite@roth.com Seaport Global John Aschenbeck / 713-658-6343 / jaschenbeck@seaportglobal.com Stephens Will Green / 817-900-5712 / will.green@stephens.com SunTrust Neal Dingmann / 713-247-9000 / neal.dingmann@suntrust.com Wells Fargo Gordon Douthat / 303-863-6880 / gordon.douthat@wellsfargo.com 28

Contact Information Mark Lumpkin, Jr. EVP, Chief Financial Officer Scott Thelander Director of Finance Corporate Offices Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Midland 600 N. Marienfeld | Suite 1000 | Midland, TX 79701 | (432) 686-1100 Website www.earthstoneenergy.com 29

Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX Adjusted EBITDAX (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator. We define “Adjusted EBITDAX” as net income plus accretion of asset retirement obligations; depletion, depreciation and amortization; interest expense, net; (gain) on sale of oil and gas properties; unrealized loss on hedges; non-cash stock-based compensation; and income tax (benefit). Our Adjusted EBITDAX measure provides additional information that may be used to better understand our operations. Adjusted EBITDAX is one of several metrics that we use as a supplemental financial measurement in the evaluation of our business and should not be considered as an alternative to, or more meaningful than, the GAAP measure of net income as an indicator of operating performance. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic cost of depreciable and depletable assets. Adjusted EBITDAX, as used by us, may not be comparable to similarly titled measures reported by other companies. We believe that Adjusted EBITDAX is a widely followed measure of operating performance and is one of many metrics used by our management team and by other users of our consolidated financial statements. For example, Adjusted EBITDAX can be used to assess our operating performance and return on capital in comparison to other independent exploration and production companies without regard to financial or capital structure and to assess the financial performance of our assets and our Company without regard to capital structure or historical cost basis. The following table provides a reconciliation of Net income to Adjusted EBITDAX for the six months ended June 30, 2018: ($000's) Q1-Q2 2018 Net income $13,663 (Gain) on sale of oil and gas properties (512) Accretion 84 Depletion, depreciation and amortization 20,520 Interest expense, net 1,223 Unrealized loss on MTM of hedges 6,858 Non-cash stock based compensation 4,013 Income tax (benefit) (53) Adjusted EBITDAX $45,796 30

Non-GAAP Financial Measure – PV-10 PV-10 is derived from the Standardized Measure of discounted future net cash flows, which is the most directly comparable GAAP financial measure. PV-10 is a computation of the Standardized Measure on a pre-tax basis. PV-10 is equal to the Standardized Measure at the applicable date, before deducting future income taxes, discounted at 10%. We believe that the presentation of PV-10 is relevant and useful to investors because it presents the discounted future net cash flows attributable to our estimated net proved reserves prior to taking into account future corporate income taxes, and it is a useful measure for evaluating the relative monetary significance of our oil and natural gas properties. Further, investors may utilize the measure as a basis for comparison of the relative size and value of our reserves to other companies. We use this measure when assessing the potential return on investment related to our oil and natural gas properties. PV-10, however, is not a substitute for the Standardized Measure. Our PV-10 measure and the Standardized Measure do not purport to present the fair value of our oil and natural gas reserves. Earthstone’s proved reserves as of December 31, 2017 were independently estimated by CG&A utilizing NYMEX 5-year strip prices as of December 31, 2017 (Oil – $59.55, $56.19, $53.76, $52.29, $51.67 / Gas - $2.84, $2.81, $2.82, $2.85, $2.89). 31