Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CorEnergy Infrastructure Trust, Inc. | a2018enercomslides_8k.htm |

EnerCom’s The Oil & Gas Conference Jeff Fulmer, Senior Vice President August 21, 2018 1

Disclaimer This presentation contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Other than as required by law, CorEnergy does not assume a duty to update any forward- looking statement. In particular, any distribution paid in the future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage covenants. 2

Infrastructure assets have desirable investment characteristics Infrastructure REIT Strategy Overview • Infrastructure assets are essential for our customers’ operations to produce revenue • CorEnergy’s triple-net leases and other contracts generate operating expense for our tenants • Total long-term return to stockholders of 8-10% on assets from base rents, plus acquisitions & participating rents • Growing CorEnergy through disciplined acquisitions that are accretive to AFFO and dividends per share Asset Fundamentals Investment Characteristics • Long-lived assets, critical to tenant operations • High cash flow component to total return • High barriers to entry with strategic locations • Attractive potential risk-adjusted returns • Contracts provide predictable revenue • Diversification vs. other asset classes • Limited sensitivity to price/volume changes • Potential inflation protection 3

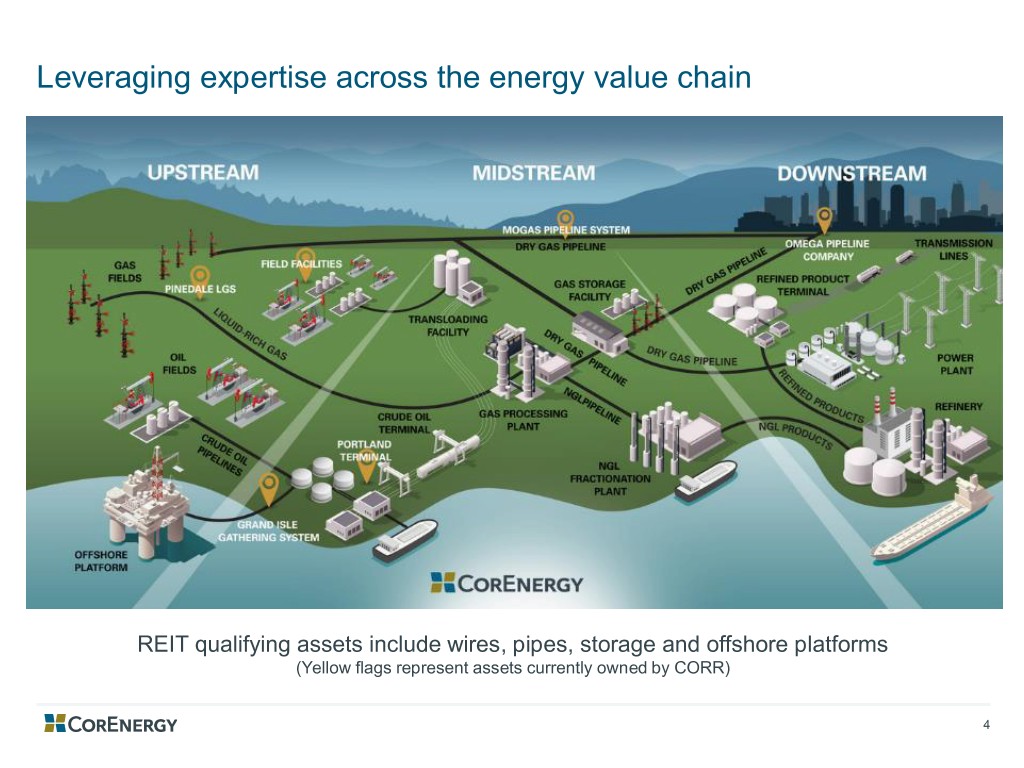

Leveraging expertise across the energy value chain REIT qualifying assets include wires, pipes, storage and offshore platforms (Yellow flags represent assets currently owned by CORR) 4

Portfolio of essential assets CorEnergy assets critically support our partners in conducting their businesses in the U.S. energy industry Purchase T ype Asset Description Price Location Pinedale Liquids Liquids gathering, processing & storage system for Upstream $228MM WY Gathering System condensate & water production Grand Isle Gathering Subsea to onshore pipeline & storage terminal for oil & Midstream $245MM GoM-LA System water production Midstream MoGas Pipeline Interstate natural gas pipeline supplying utilities $125MM MO-IL Natural gas utility supplying end-users at Fort Leonard Downstream Omega Pipeline $6MM MO Wood Midstream & Crude oil and petroleum products terminal with barge, rail Portland Terminal $50MM1 OR Downstream and truck supply 1) Includes $40MM purchase price, plus $10MM in construction costs 5

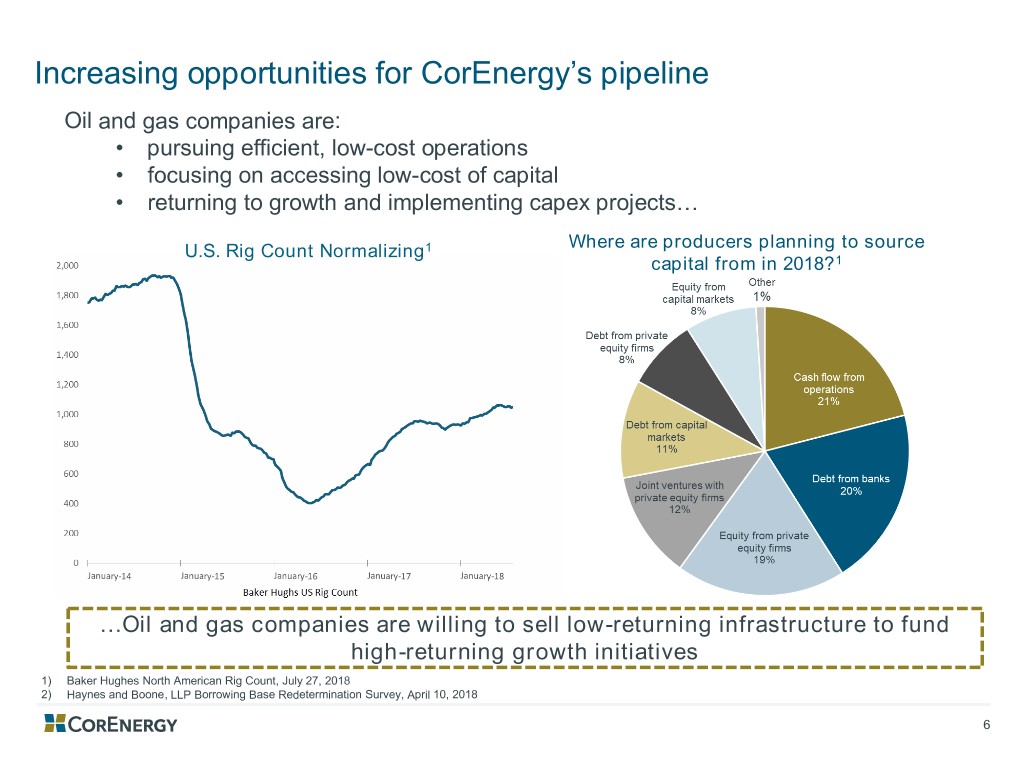

Increasing opportunities for CorEnergy’s pipeline Oil and gas companies are: • pursuing efficient, low-cost operations • focusing on accessing low-cost of capital • returning to growth and implementing capex projects… Where are producers planning to source U.S. Rig Count Normalizing1 capital from in 2018?1 …Oil and gas companies are willing to sell low-returning infrastructure to fund high-returning growth initiatives 1) Baker Hughes North American Rig Count, July 27, 2018 2) Haynes and Boone, LLP Borrowing Base Redetermination Survey, April 10, 2018 6

Financial flexibility poises CORR for growth CorEnergy’s capital structure remains conservative, providing financial flexibility to acquire assets Total Debt/Total Capitalization of 25% is at low end of 25-50% target ratio Preferred/Total Equity of 29% is below 33% target ratio 7

Outlook Active Deal Pipeline One to Two Acquisitions per Year Size Range of $50-250 Million Financing Optionality • $160 million of • Preferred Equity 1 available liquidity • Common Equity • Bank Debt • Co-Investors • Convertible Debt Long-term Stable & Growing Dividend 1) As of June 30, 2018 8

APPENDIX 9

CorEnergy Senior Management Dave Schulte Rick Green Co-Founder, CEO & President Co-Founder, Executive Chairman Mr. Schulte has 27 years of investment experience, including Mr. Green has spent more than 30 years in the energy 18 years in the energy industry. Previously, Mr. Schulte was a industry, with 20 years as CEO of Aquila, Inc., an co-founder and Managing Director of Tortoise Capital Advisors, international electric and gas utility business and national an investment advisor with $16 billion under management. and energy marketing and trading business. During his tenure, a Managing Director at Kansas City Equity Partners (KCEP). Mr. Green led the strategy and successful business Before joining KCEP, he spent five years as an investment expansion of Aquila, Inc. to a Fortune 30 company. banker at the predecessor of Oppenheimer & Co. Jeff Fulmer Becky Sandring Senior Vice President Mr. Fulmer is a petroleum engineer and professional geologist Co-Founder, Senior Vice President, Secretary with more than 30 years of energy industry experience. Prior & Treasurer to joining CorEnergy, Mr. Fulmer spent six years as a Senior Ms. Sandring has over 20 years of experience in the energy Advisor with Tortoise Capital Advisors, led a post 9/11 critical industry. Prior to CorEnergy, Ms. Sandring was a Vice infrastructure team for the U.S. Department of Defense, and President with The Calvin Group. From 1993-2008, Ms. held leadership and technical positions with Statoil Energy, Sandring held various roles at Aquila Inc., formerly UtiliCorp ARCO Oil and Tenneco Oil Exploration and Production. United. Rick Kreul Sean DeGon President, MoGas, LLC & MoWood, LLC Vice President Mr. Kreul, a mechanical engineer with more than 35 years of Mr. DeGon is a chemical engineer with nearly 20 years of energy industry experience, serves as President of energy industry experience. Prior to joining CorEnergy in CorEnergy’s wholly-owned subsidiaries, MoWood, LLC and 2017, Mr. DeGon was a Director at IHS Markit where he led MoGas Pipeline, LLC. Previously, Mr. Kreul served as Vice and participated in well over 100 consulting projects focused President of Energy Delivery for Aquila, Inc., Vice President on liquid storage terminals, pipelines, refineries, processing for Inergy, L.P., and various engineering and management facilities and other energy assets, primarily in the U.S. and roles with Mobil Oil. the rest of the Americas. Jeff Teeven Vice President, Finance Mr. Teeven has more than 20 years of experience in private equity management and mergers and acquisitions in multiple sectors including energy. He served as a founding partner of Consumer Growth Partners, a private equity firm focused on the specialty retail and branded consumer products sectors, as well as 10 years with Kansas City Equity Partners (KCEP). 10

Grand Isle Gathering System • $245 million midstream infrastructure asset on the Gulf of Mexico Shelf, critical to Energy XXI Gulf Coast1 operations • Essential system to transport crude oil and produced water for large proven reserves • 153 miles of undersea pipeline and onshore terminal with separation, SWD and storage facilities • Triple-net operating lease; Average minimum rent of ~$40 million per year • Initial lease term: 11 years, with renewals at Fair Market Value (“FMV”) 1) Energy Gulf Coast has announced an acquisition by privately-held GoM operator, Cox Oil, expected to close in the third quarter of 2018 11

Pinedale Liquids Gathering System • $228 million asset, critical to operation of Ultra Petroleum’s Pinedale, Wyoming natural gas field • 150 miles of pipeline, 107 receipt points, 4 above-ground facilities • Triple-net operating lease; Minimum rent of ~$21 million per year • Initial lease term: 15 years, with renewals at FMV Pinedale Liquids Gathering System 12

MoGas and Omega Pipelines • MoGas Interstate Pipeline • $125 million interstate natural gas pipeline operated by CorEnergy taxable REIT subsidiary, subject to intercompany mortgages • 263-mile pipeline connecting natural gas supply to St. Louis area and over 15 smaller Missouri utilities, municipalities and industrial end-users • Only source of natural gas for many of the customers served • Vast majority of revenue derived from fixed, take-or-pay transport contracts • Omega Pipeline Company • In the initial years of its 3rd 10-year contract term with the Department of Defense in supplying Fort Leonard Wood’s natural gas and distribution services Scott Pike Christia Ralls Monroe Chariton Randolph PEPL Connect Missouri Illinois Greene Audrain Pike REX Connect Macoupin Montgomery Saline Howard Curryville Compressor Calhoun Jersey Lincoln Boone Montgomery MRT Connect Cooper Bond Callaway Warren Madison ettis Saint Charles Saint Moniteau Saint Louis Louis City Clinton Cole Osage Morgan Gasconade Franklin Saint Clair Washington nton Monroe Jefferson Miller Maries Perry Camden Randolph Washington kory Crawford Pulaski Sainte Genevieve Phelps Saint Francois Perry Jackson Dallas Laclede Iron Dent Madison Reynolds B lli C Gi d 13

Portland Terminal • $40 million purchase price, plus $10 million of CORR financed improvements • 39-acre terminal to receive, store and deliver light and heavy petroleum products on Willamette River • 84 tanks with 1.5 million barrels of storage capacity; loading for ships, rail and trucks • Triple-net operating lease with Zenith Energy; Minimum rent of ~$6MM rent per year • Initial lease term: 15 years, with purchase option, 5 year termination rights and / or FMV renewals 14

Comparison of technical characteristics of infrastructure vehicles REIT structure provides more attractive access to energy infrastructure than MLP & Fund structures Institutional, tax exempt and non-U.S. investors desire access to the infrastructure asset class 15

Differentiated and larger investor audience for REITs than MLPs Utility & REIT markets are larger and more institutional than MLP MLPs Utilities REITs CorEnergy (2)(3) Market Cap: ~$325bn(1)(2) Market Cap: ~$1.2Tn(1)(2) Market Cap: ~$1.2Tn(1)(2) Market Cap: ~$694mm 3% 1%<1%<1% <1% <1% 21% 17% 29% 41% 37% 31% 62% 35% 30% 78% 80% 30% Retail Institutional Insiders & Sponsors (1) Fidelity Sectors & Industry Overview, July 31, 2018 (2) Estimated using Bloomberg Shareholder Data (3) Includes perpetual preferred stock and “in the money” convertible bonds 16

CORR has pioneered broad access to deep capital markets $161,000,000 $41,000,000 Revolving Line of Project Level Debt for Credit Pinedale LGS Lead Banks: Prudential Financial BankDebt July 2017 December 2012 $56,300,000 $115,000,000 $73,750,000 Series A 7.375% 7% Convertible Bonds Series A 7.375% Cumulative Preferred Cumulative Preferred Stock Lead Underwriters: Stock Lead Underwriters: Lead Underwriters: JuniorCapital January 2015 June 2015 April 2017 $101,660,000 $77,625,000 $89,700,000 $48,587,500 Common Stock Common Stock Common Stock Common Stock Lead Underwriters: Lead Underwriters: Lead Underwriters: Lead Underwriter: CommonStock November 2014 June 2015 December 2012 January 2014 17

Terminal value conviction Grand Isle Pinedale LGS Portland Terminal MoGas Pipeline Omega Pipeline Gathering System Long-lived assets, critical to tenant operations Criteria High barriers to entry with strategic locations Asset Ownership Asset Assets essential to operators’ cash flow support lease renewal expectations Underwriting of terminal value Life of Field Life of Field Market Market Market Contracts and similar services based on fair value of assets Asset value based on production estimates of reserve reports / market values for similar assets Contractual Protections Contractual Leases enable tenant to purchase asset or renew lease at FMV Tenant may not devalue CORR’s asset, i.e. construct a replacement asset Retain portion of rent payment for reinvestment & debt repayment Dividend Supports sustainable, long- Sustainment term dividend CORR targets an AFFO to dividend coverage ratio of 1.5x 18

Corporate structure alignment with investors Corporate Structure External Fee Structure Management Management Fee Agreement • Services provided: Assets Fees • Presents the Company with suitable acquisition opportunities, responsible for the day-to-day operations of the Company and Grand Isle Pinedale Base Fee performs such services and activities relating to the assets and Gathering LGS System operations of the Company as may be appropriate Incentive Fee • Base Fees paid: MoGas Portland Pipeline Terminal Administration Fee • Quarterly management fee equal to 0.25 percent (1.00 percent annualized) of the value of the Company’s Managed Assets3 as of Omega the end of each quarter Pipeline • Incentive Fees paid: CORR Expense Metrics vs. Peer Group1 • Quarterly incentive fee of 10 percent of the increase in distributions earned over a threshold distribution equal to $0.625 per share per quarter. The Management Agreement also requires at least half of any incentive fees to be reinvested in the Company’s common stock Administrative Fee • Services provided: CORR Avg. • Performs (or oversees or arranges for the performance of) the administrative services necessary for our operation, including without limitation providing us with equipment, clerical, bookkeeping and record keeping services • Fees paid: • 0.04 percent of our aggregate average daily Managed Assets, with a minimum annual fee of $30 thousand (1) Peer group consists of REITs included in the FTSE NAREIT All Equity index under $1BN market cap (excludes HMG, STAR, IIPR, IRET) (2) Gross Asset Value = Asset Value of Investment Properties + Accumulated Depreciation (3) “Managed Assets” is defined as Total Assets of CORR minus the initial invested value of non-controlling interests, the value of any hedged derivative assets, any prepaid expenses, all of the accrued liabilities other than deferred taxes and debt entered into for the purposed of leverage 19

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation NAREIT FFO, FFO Adjusted for Securities Investment and AFFO Reconciliation For the Three Months Ended For the Six Months Ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Net Income attributable to CorEnergy Stockholders $ 7,810,849 $ 9,000,172 $ 15,518,557 $ 16,669,650 Less: Preferred Dividend Requirements 2,396,875 2,123,129 4,793,750 3,160,238 Net Income attributable to Common Stockholders $ 5,413,974 $ 6,877,043 $ 10,724,807 $ 13,509,412 Add: Depreciation 6,139,171 5,822,383 12,277,590 11,644,679 Less: Non-Controlling Interest attributable to NAREIT FFO reconciling items (1) — 411,455 — 822,910 NAREIT funds from operations (NAREIT FFO) $ 11,553,145 $ 12,287,971 $ 23,002,397 $ 24,331,181 Add: Distributions received from investment securities 55,714 252,213 59,665 475,379 Less: Net distributions and dividend income 55,714 221,440 59,665 264,902 Net realized and unrealized gain (loss) on other equity securities (881,100) 614,634 (867,134) 70,426 Income tax (expense) benefit from investment securities 220,500 (310,622) 241,987 (114,862) Funds from operations adjusted for securities investments (FFO) $ 12,213,745 $ 12,014,732 $ 23,627,544 $ 24,586,094 20

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation (cont.) For the Three Months Ended For the Six Months Ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Add: Provision for loan losses, net of tax — — 500,000 — Transaction costs 24,615 211,269 56,896 470,051 Amortization of debt issuance costs 353,637 468,871 707,181 937,742 Amortization of deferred lease costs 22,983 22,983 45,966 45,966 Accretion of asset retirement obligation 127,928 160,629 255,856 321,258 Less: Non-cash settlement of accounts payable — 171,609 — 171,609 Non-cash gain (loss) associated with derivative instruments — (10,619) — 16,453 Income tax benefit 394,349 214,887 817,688 351,733 Non-Controlling Interest attributable to AFFO reconciling items (1) — 3,358 — 6,709 Adjusted funds from operations (AFFO) $ 12,348,559 $ 12,499,249 $ 24,375,755 $ 25,814,607 21

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation (cont.) For the Three Months Ended For the Six Months Ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Weighted Average Shares of Common Stock Outstanding: Basic 11,928,297 11,896,616 11,923,627 11,892,670 Diluted 15,382,843 15,351,161 15,378,172 15,347,215 NAREIT FFO attributable to Common Stockholders Basic $ 0.97 $ 1.03 $ 1.93 $ 2.05 Diluted (2) $ 0.89 $ 0.94 $ 1.78 $ 1.87 FFO attributable to Common Stockholders Basic $ 1.02 $ 1.01 $ 1.98 $ 2.07 Diluted (2) $ 0.94 $ 0.93 $ 1.82 $ 1.89 AFFO attributable to Common Stockholders Basic $ 1.04 $ 1.05 $ 2.04 $ 2.17 Diluted (3) $ 0.93 $ 0.94 $ 1.84 $ 1.94 1) There is no non-controlling interest for the three and six months ended June 30, 2018 2) Diluted per share calculations include dilutive adjustments for convertible note interest expense, discount amortization and deferred debt issuance amortization. 3) Diluted per share calculations include a dilutive adjustment for convertible note interest expense. 22

Non-GAAP Financial Metrics: Fixed-Charges Ratio Ratio of Earnings to Combine Fixed Charges and Preferred Stock Dividends For the Six Months Ended June 30, For the Years Ended December 31, 2018 2017 2016 2015 2014 Earnings: Pre-tax income from continuing operations before adjustment for income or loss from equity investees $ 15,266,351 $ 34,470,016 $ 28,561,682 $ 11,782,422 $ 6,973,693 Fixed charges(1) 6,406,838 12,378,514 14,417,839 9,781,184 3,675,122 Amortization of capitalized interest — — — — — Distributed income of equity investees 59,665 680,091 1,140,824 1,270,754 1,836,783 Pre-tax losses of equity investees for which charges arising from guarantees are included in fixed charges — — — — — Subtract: Interest capitalized — — — — — Preference security dividend requirements of consolidated subsidiaries — — — — — Noncontrolling interest in pre-tax income of subsidiaries that have not incurred fixed charges — — — — — Earnings $ 21,732,854 $ 47,528,621 $ 44,120,345 $ 22,834,360 $ 12,485,598 Combined Fixed Charges and Preference Dividends: Fixed charges(1) $ 6,406,838 $ 12,378,514 $ 14,417,839 $ 9,781,184 $ 3,675,122 Preferred security dividend(2) 4,793,750 7,953,988 4,148,437 3,848,828 — Combined fixed charges and preference dividends $ 11,200,588 $ 20,332,502 $ 18,566,276 $ 13,630,012 $ 3,675,122 Ratio of earnings to fixed charges 3.39 3.84 3.06 2.33 3.40 Ratio of earnings to combined fixed charges and preference dividends 1.94 2.34 2.38 1.68 3.40 1) Fixed charges consist of interest expense, as defined under U.S. generally accepted accounting principles, on all indebtedness 2) This line represents the amount of preferred stock dividends accumulated as of June 30, 2018 23

24