Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Holdings USA, Inc. | june2018form8-k.htm |

SANTANDER HOLDINGS USA, INC. Fixed Income Investor Presentation Second Quarter 2018 August 17, 2018

Disclaimer 2 This presentation of Santander Holdings USA, Inc. (“SHUSA”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and future performance of SHUSA. Words such as “may,” “could,” “should,” “looking forward,” “will,” “would,” “believe,” “expect,” “hope,” “anticipate,” “estimate,” “intend,” “plan,” “assume” or similar expressions are intended to indicate forward-looking statements. Although SHUSA believes that the expectations reflected in these forward-looking statements are reasonable as of the date on which the statements are made, these statements are not guarantees of future performance and involve risks and uncertainties based on various factors and assumptions, many of which are beyond SHUSA’s control. Among the factors that could cause SHUSA’s financial performance to differ materially from that suggested by the forward-looking statements are: (1) the effects of regulation and/or policies of the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Federal Deposit Insurance Corporation (the "FDIC"), the Office of the Comptroller of the Currency (the “OCC”) and the Consumer Financial Protection Bureau (the “CFPB”), and other changes in monetary and fiscal policies and regulations, including interest rate policies of the Federal Reserve, as well as in the impact of changes in and interpretations of generally accepted accounting principles in the United States of America ("GAAP"), the failure to adhere to which could subject SHUSA to formal or informal regulatory compliance and enforcement actions; (2) the slowing or reversal of the current U.S. economic expansion and the strength of the U.S. economy in general and regional and local economies in which SHUSA conducts operations in particular, which may affect, among other things, the level of non-performing assets, charge-offs, and provisions for credit losses; (3) the ability of certain European member countries to continue to service their debt and the risk that a weakened European economy could negatively affect U.S.-based financial institutions, counterparties with which SHUSA does business, as well as the stability of global financial markets; (4) inflation, interest rate, market and monetary fluctuations, which may, among other things, reduce net interest margins, and impact funding sources and the ability to originate and distribute financial products in the primary and secondary markets; (5) regulatory uncertainties and changes faced by financial institutions in the U.S. and globally arising from the U.S. presidential administration and Congress and the potential impact those uncertainties and changes could have on SHUSA's business, results of operations, financial condition or strategy; (6) the pursuit of protectionist trade or other related policies by the U.S. and/or other countries; (7) adverse movements and volatility in debt and equity capital markets and adverse changes in the securities markets, including those related to the financial condition of significant issuers in SHUSA’s investment portfolio; (8) SHUSA's ability to grow revenue, manage expenses, attract and retain highly-skilled people and raise capital necessary to achieve its business goals and comply with regulatory requirements; (9) SHUSA’s ability to effectively manage its capital and liquidity, including approval of its capital plans by its regulators and its ability to continue to receive dividends from its subsidiaries or other investments; (10) changes in credit ratings assigned to SHUSA or its subsidiaries; (11) the ability to manage risks inherent in our businesses, including through effective use of systems and controls, insurance, derivatives and capital management; (12) SHUSA’s ability to manage credit risk that may increase to the extent our loans are concentrated by loan type, industry segment, borrower type or location of the borrower or collateral; (13) SHUSA’s ability to timely develop competitive new products and services in a changing environment that are responsive to the needs of SHUSA's customers and are profitable to SHUSA, the acceptance of such products and services by customers, and the potential for new products and services to impose additional unexpected costs, losses or other liabilities not anticipated at their initiation, and expose SHUSA to increased operational risk; (14) competitors of SHUSA that may have greater financial resources or lower costs, may innovate more effectively, or may develop products and technology that enable those competitors to compete more successfully than SHUSA; (15) Santander Consumer USA Inc.’s (“SC’s”) agreement with Fiat Chrysler Automobiles US LLC (“FCA”) may not result in currently anticipated levels of growth, is subject to performance conditions that could result in termination of the agreement, and is also subject to an option giving FCA the right to acquire an equity participation in the Chrysler Capital portion of SC’s business; (16) changes in customer spending or savings behavior, including changes due to recently enacted tax legislation; (17) the ability of SHUSA and its third-party vendors to convert and maintain SHUSA’s data processing and related systems on a timely and acceptable basis and within projected cost estimates; (18) SHUSA's ability to control operational risks, data security breach risks, outsourcing risks, and the possibility of errors in quantitative models SHUSA uses to manage its business, including

Disclaimer (cont.) 3 as a result of cyber attacks, technological failure, human error, fraud or malice, and the possibility that SHUSA's controls will prove insufficient, fail or be circumvented; (19) the outcome of ongoing tax audits by federal, state and local income tax authorities that may require SHUSA to pay additional taxes or recover fewer overpayments compared to what has been accrued or paid as of period-end; (20) changes to income tax laws and regulations; (21) acts of terrorism or domestic or foreign military conflicts; and acts of God, including natural disasters; (22) the costs and effects of regulatory or judicial proceedings, including possible business restrictions resulting from such proceedings; and (23) adverse publicity and negative public opinion, whether specific to SHUSA or regarding other industry participants or industry-wide factors, or other reputational harm. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest, and in making this presentation available, SHUSA gives no advice and makes no recommendation to buy, sell, or otherwise deal in shares or other securities of Banco Santander, S.A. (“Santander”), SHUSA, Santander Bank, N.A. (“Santander Bank” or “SBNA”), Santander Consumer Holdings USA, Inc. (“SC”) or any other securities or investments. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. In this presentation, we may sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, if utilized, may include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these items on our results for the periods presented due to the extent to which the items are indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. The enhanced prudential standards mandated by Section 165 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "DFA")(the “Final Rule") were enacted by the Federal Reserve System (the "Federal Reserve") to strengthen regulatory oversight of foreign banking organizations ("FBOs"). Under the Final Rule, FBOs with over $50 billion of U.S. non-branch assets, including Santander, were required to consolidate U.S. subsidiary activities under an IHC. Due to its U.S. non-branch total consolidated asset size, Santander is subject to the Final Rule. As a result of this rule, Santander transferred substantially all of its equity interests in U.S. bank and non-bank subsidiaries previously outside the Company to the Company, which became an IHC effective July 1, 2016. These subsidiaries included Santander BanCorp (“SBC”), Banco Santander International (“BSI”), Santander Investment Securities, Inc. (“SIS”), Santander Securities LLC (“SSLLC”), as well as several other subsidiaries. On July 1, 2017, an additional Santander subsidiary, SFS, a finance company located in Puerto Rico, was transferred to the Company. Additionally, effective July 2, 2018, Santander transferred Santander Asset Management, LLC ("SAM") to the IHC. The contribution of SAM to the Company transferred approximately $5.4 million of assets, $1.0 million of liabilities, and $4.4 million of equity to the Company.

Introduction 4 SHUSA is a bank holding company (“BHC”) wholly owned by Santander (NYSE: SAN) Santander • SHUSA consists of: Investment Santander Securities Bank • Well-established banking franchises in the Northeast U.S. and Puerto Rico • A nationwide auto finance business • A International private banking business • A wholesale broker-dealer in New York • Headquartered in Boston • Regulated by the Federal Reserve • SEC registered1 Santander Banco Consumer Santander • Bloomberg ticker: SOV USA International NYSE: SC • Website www.santanderus.com Santander Puerto Rico 1SHUSA’s SEC filings are accessible on the SEC website at www.sec.gov and are also accessible through SHUSA’s website at www.santanderus.com.

Corporate Structure1 5 SHUSA is the intermediate holding company (“IHC”) for Santander’s U.S. operations Santander 100% ownership SHUSA $130.1BN Assets SBNA SC BSI BSPR2 SIS $74.4BN Assets $41.2BN Assets $5.9BN Assets $5.2BN Assets $1.7BN Assets Retail Bank Auto Finance Private Banking Retail Bank Broker Dealer Approximately 68.0% ownership 1Balances as of June 30, 2018. 2Banco Santander Puerto Rico.

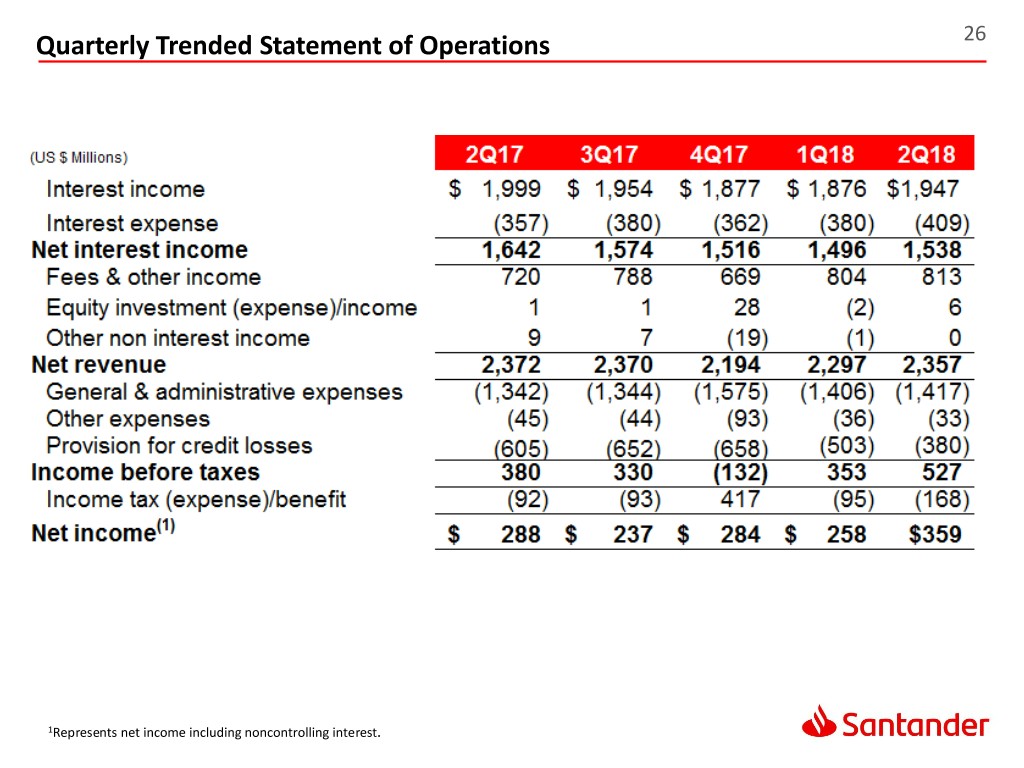

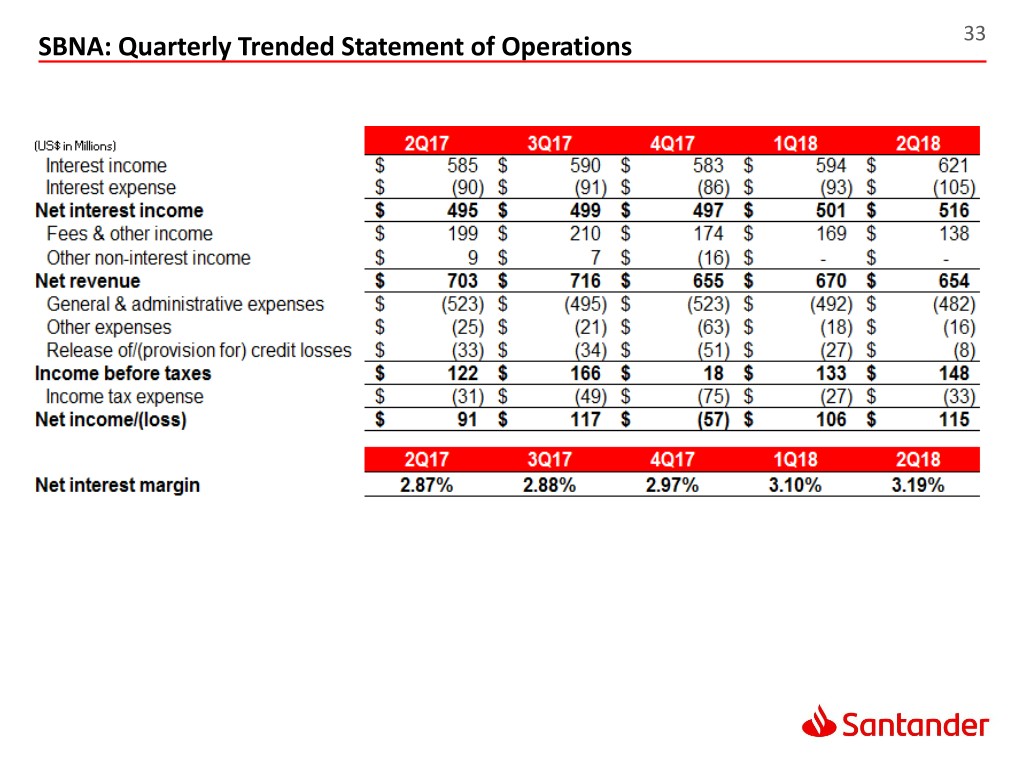

2Q 2018 Highlights and Subsequent Events 6 • Net income of $359MM1 for 2Q18; net income of $617MM1 for 1H18 • On June 28, 2018, SHUSA received a non-objection from the Federal Reserve on its 2018 Capital Plan. SHUSA and SC announced capital actions including dividend payments, SHUSA redemption of legacy capital instruments, and SC stock buybacks • On August 16, 2018, the Federal Reserve terminated the 2015 Written Agreement with SHUSA which addressed governance, risk management, and capital planning • Continued management of SHUSA’s debt structure through $0.5BN tender of non-total loss absorbing capacity (“TLAC”) eligible debt in July • SBNA’s Net Interest Margin (“NIM”) improved by 9bps QoQ to 3.19%, above FBO peers and close to regional peer median • Full roll-out in July of program for SC to facilitate the origination and provide servicing for auto loans to be held by SBNA • SC demonstrated strong access to the asset-backed securities (“ABS”) market through the issuance of 3 ABS transactions totaling $3.5BN in 2Q18 1Includes noncontrolling interest.

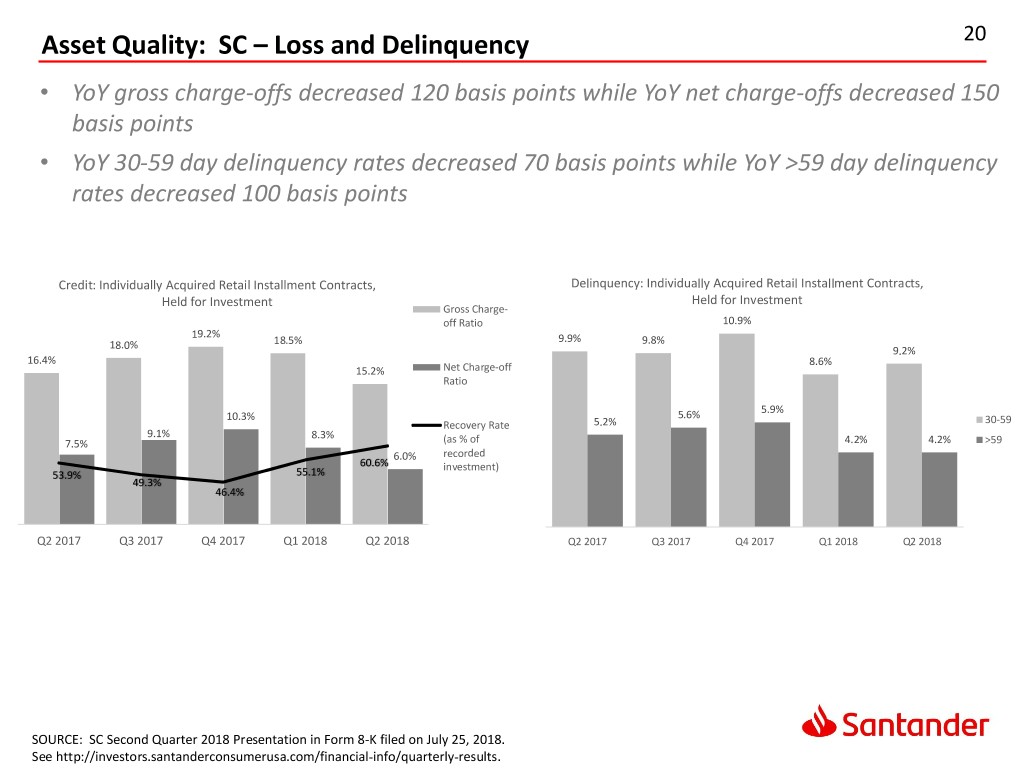

2Q 2018 Executive Summary1 7 • 2Q18 net income of $359MM2 vs. $288MM2 for 2Q17 Earnings • 1H18 net income of $617MM2 vs. $451MM2 for 1H17 • SBNA NIM of 3.19% for 2Q18 vs 2.87% for 2Q17 • SHUSA’s balance sheet increased QoQ from $129.2BN to $130.1BN primarily due to Balance Sheet growth in commercial and industrial (“C&I”) and residential mortgage loans at SBNA • In June 2018, SC completed the sale of $1.2BN of prime auto loans to Santander • Holding company (“HoldCo”) held $4.6BN in high-quality liquid assets (“HQLA”) Liquidity and • SHUSA maintains an LCR3 in excess of regulatory requirements Funding • SHUSA completed $0.5BN tender on its 2.70% debt due 2019 (settled 7/2/18) • SHUSA redeemed $0.2BN 3.45% debt on 7/27/18 (maturity 8/27/18) • CET14 ratio of 16.28% as of 2Q18 Capital • SHUSA continued dividend payments to Santander with $5MM paid in 2Q18 • SC completed its third dividend since 2014 with a dividend of $0.05 per share • On August 15, 2018, SHUSA completed the redemption of its preferred stock • SBNA’s credit metrics remain in line with large bank peers Credit Quality • SC’s gross and net charge-offs declined YoY by 120bps and 150bps, respectively • SC’s 30-59 day and >59 day delinquency rates declined YoY by 70bps and 100bps, respectively 1Data as of June 30, 2018 unless otherwise noted. 3Liquidity Coverage Ratio. 2Includes noncontrolling interest. 4Common equity Tier 1.

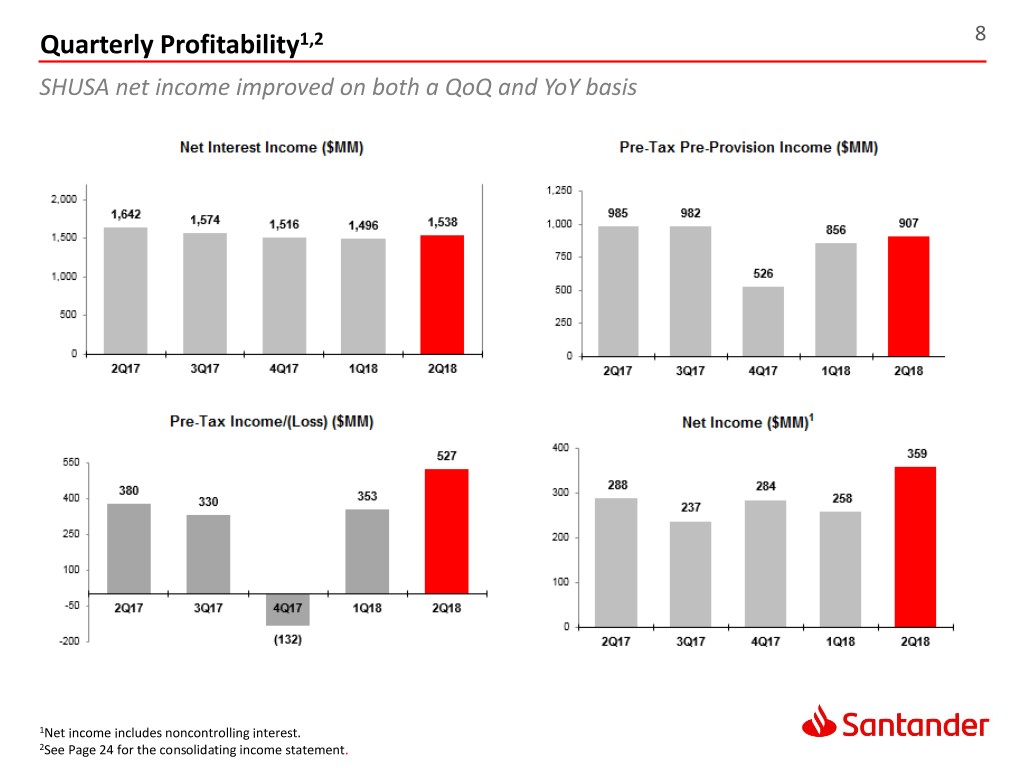

Quarterly Profitability1,2 8 SHUSA net income improved on both a QoQ and YoY basis 1Net income includes noncontrolling interest. 2See Page 24 for the consolidating income statement.

NIM and Interest Rate Risk (IRR) Sensitivity 9 • SBNA’s NIM has improved 32bps YoY due to balance sheet optimization actions • SHUSA remains asset sensitive and positioned to benefit from higher interest rates 2 NIM SHUSA IRR (Change in annual Net interest income for parallel rate movement)

Balance Sheet Overview1,2 10 SHUSA’s balance sheet reflects the combination of banks funded by core deposits and an auto finance company financed with diversified funding sources $105.9BN Liabilities $130.1BN Assets $24.2BN Equity Money Home 3 Market Equity CRE Residential Multi-Family Mortgage 4% 7% 20% Non Interest-Bearing 6% Demand Deposits 7% Goodwill (“NIB DDA”) 12% 4% Equity Other Assets C&I 18% 6% 17% Savings 5% Cash 5% 1% 6% Interest-Bearing Other 4% Demand Deposits Other Liabilities 1% Loans (“IB DDA”) 13% 9% 5% Investments FHLB4 7% 4% Certificates Auto Leases Other of Deposit 21% Borrowings 18% Revolving Credit Auto Loans Secured Facilities Structured Financings 1Balances as of June 30, 2018. 3Commercial Real Estate. 2See page 25 for the consolidating balance sheet. 4Federal Home Loan Bank.

Balance Sheet Trend 11 2018 balance sheet trend reflects loan and lease growth funded by deposit growth and reduced short-term (“ST”) funds and investments Assets ($BN) Liabilities and Equity ($BN) $135 $132 $130 $135 $8 $128 $129 $132 $128 $129 $130 $8 $7 $8 $6 $21 $20 $17 $17 $17 $47 $46 $45 $46 $47 $16 $16 $15 $16 $15 $85 $83 $83 $82 $85 $43 $41 $39 $38 $39 $5 $5 $5 $5 $5 $10 $10 $11 $11 $12 $23 $23 $24 $24 $24 $11 $11 $11 $11 $10 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 ST Funds Gross Loans Other Assets IB Deposits Borrowed Funds Equity Investments Leases NIB Deposits Other Liabilities

12 Balance Sheet Trend (cont.) • 2018 loan increase primarily due to SBNA C&I and residential mortgage loans1 • Deposit growth in core customers Loans and Leases ($BN) Deposits ($BN) $95 $96 $93 $94 $93 $63 $14 $16 $62 $61 $62 $62 $14 $15 $15 $16 $16 $16 $18 $17 $15 $15 $18 $18 $17 $9 $9 $9 $8 $9 $23 $22 $22 $21 $23 $6 $6 $6 $6 $6 $28 $26 $26 $27 $27 $25 $25 $25 $26 $25 $10 $10 $11 $11 $12 $7 $6 $5 $6 $6 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Res. Mtg C&I Leases NIB DDA Savings Time CRE Auto Other IB DDA MMDA Other 1See slides 37 and 38 for trend detail on SBNA loan portfolio

Borrowed Funds Profile1 13 Public issuances consist of SHUSA unsecured debt and SC ABS SHUSA Consolidated ($BN) SHUSA HOLDCO ($BN) $38.4 $38.8 SHUSA Debt $7.7 $8.1 SC ABS $16.0 $18.6 $8.1 SHUSA Debt $7.7 SC Private Amortizing $6.9 $5.7 rd SC 3 Party $5.2 All Other $4.6 $2.6 $1.8 1Q18 2Q18 1Q18 2Q18 SBNA ($BN) SC ($BN) $31.3 $31.9 $2.1 FHLB $1.6 0.8% ABS $16.0 $18.6 FHLB $1.5 $1.3 Private Amortizing $6.9 $5.7 3rd Party Revolving $4.6 $4.1 Bank Debt $0.6 Repurchase Agreement $0.6 $0.4 $0.3 Intragroup2 $3.2 $3.1 1Q18 2Q18 1Q18 2Q18 1As of June 30, 2018. 2Intragroup balance includes lending from SHUSA to SC, which is eliminated at the consolidated level.

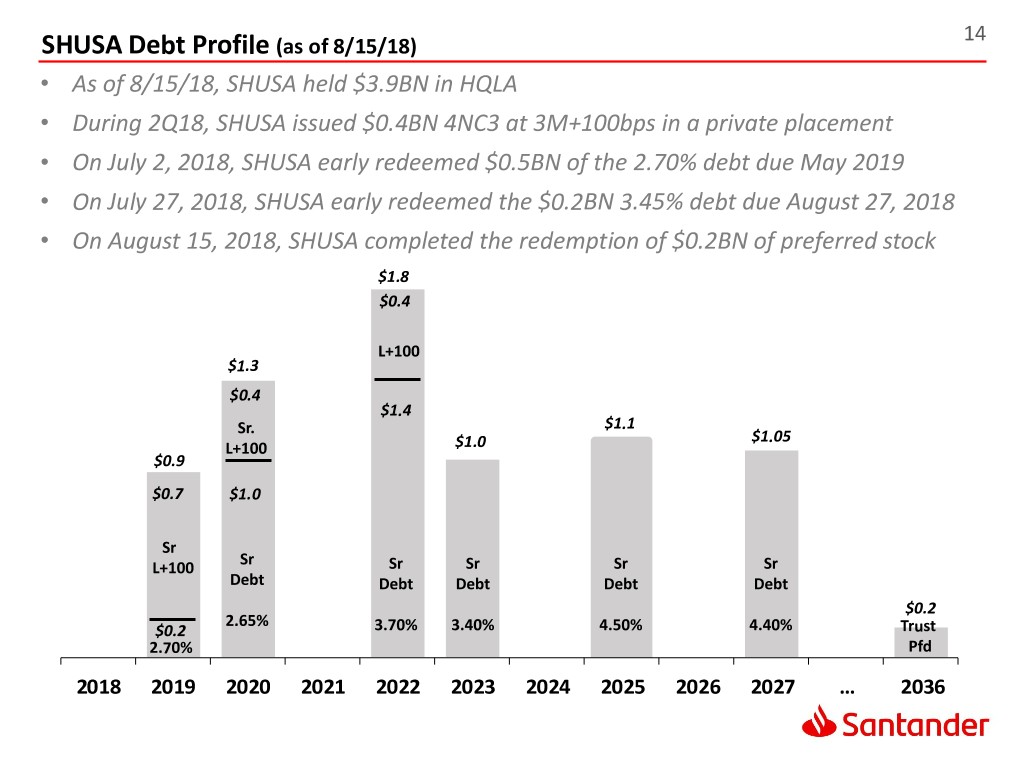

14 SHUSA Debt Profile (as of 8/15/18) • As of 8/15/18, SHUSA held $3.9BN in HQLA • During 2Q18, SHUSA issued $0.4BN 4NC3 at 3M+100bps in a private placement • On July 2, 2018, SHUSA early redeemed $0.5BN of the 2.70% debt due May 2019 • On July 27, 2018, SHUSA early redeemed the $0.2BN 3.45% debt due August 27, 2018 • On August 15, 2018, SHUSA completed the redemption of $0.2BN of preferred stock $1.8 $0.4 L+100 $1.3 $0.4 $1.4 $1.1 Sr. $1.05 L+100 $1.0 $0.9 $0.7 $1.0 Sr Sr L+100 Sr Sr Sr Sr Debt Debt Debt Debt Debt $0.2 2.65% $0.2 3.70% 3.40% 4.50% 4.40% Trust 2.70% Pfd 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 … 2036

SHUSA Issuance and TLAC Rule 15 • In 2H18, SHUSA expects to issue approximately $1.0BN in debt to meet the TLAC long-term debt (“LTD”) requirement by January 1, 2019 • Net increase of $0.2BN from 2Q18 as issuance mostly offset by redemptions of non-TLAC instruments 2 SHUSA Public Debt Outstanding1,2 1Chart includes preferred stock ($0.2BN) and trust preferred ($0.2BN). Chart does not include SHUSA private placements ($1.5BN). 22019 issuance assumes replacement of $0.7BN maturing private placements with public debt.

Capital Ratios1 16 SHUSA capital ratios remain at the top of peers2 CET1 Tier 1 Leverage Ratio 2 16.4% 16.6% 16.3% 15.7% 14.2% 14.4% 14.6% 14.6% 13.0% 13.4% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 19.5% 19.9% 19.5% 17.8% 18.3% 17.9% 19.1% 17.4% 18.1% 16.3% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 1Capital ratios calculated under the U.S. Basel III framework on a transitional basis.. 2See page 27 for comparison of SHUSA capital ratios to peers.

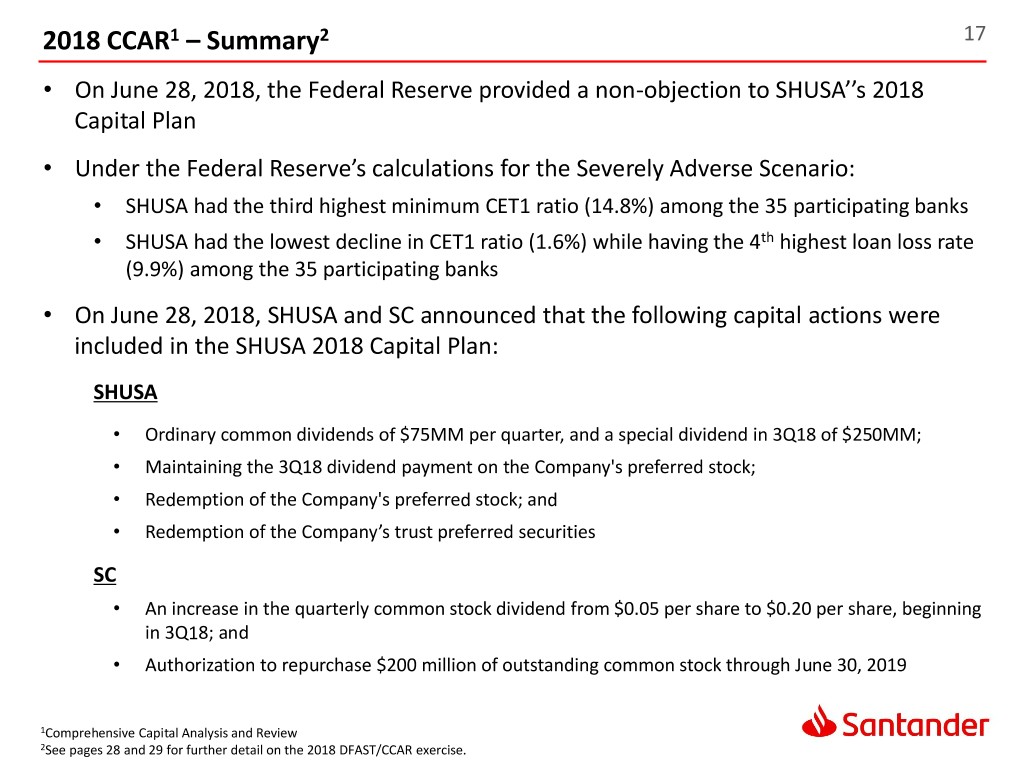

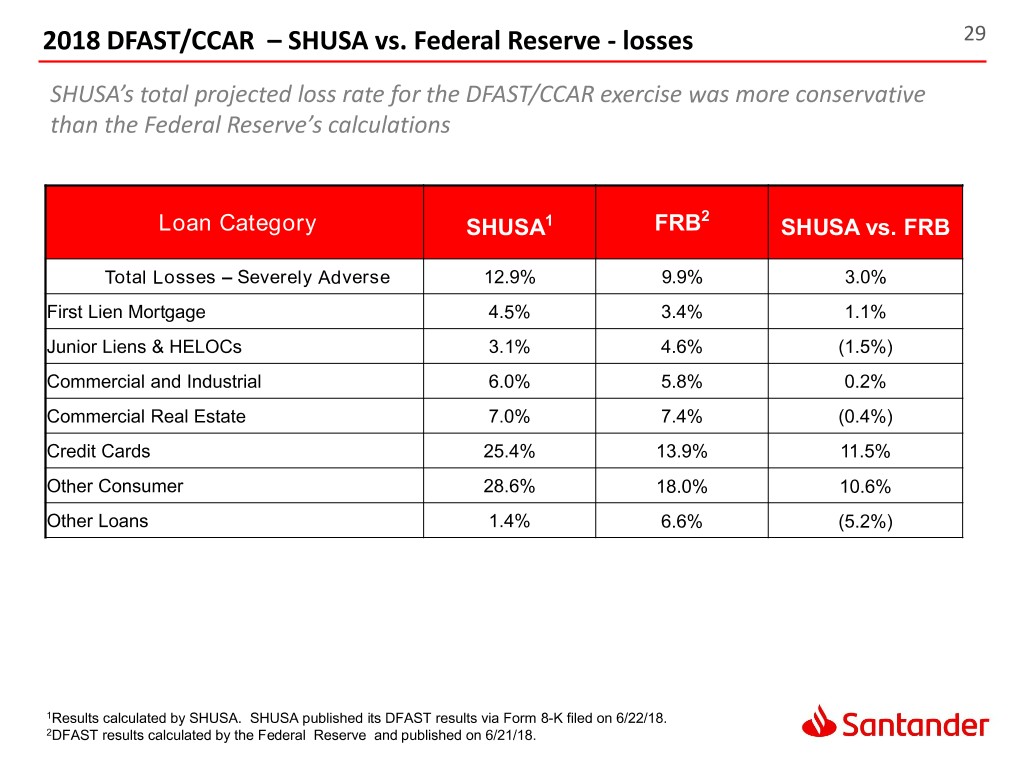

2018 CCAR1 – Summary2 17 • On June 28, 2018, the Federal Reserve provided a non-objection to SHUSA’’s 2018 Capital Plan • Under the Federal Reserve’s calculations for the Severely Adverse Scenario: • SHUSA had the third highest minimum CET1 ratio (14.8%) among the 35 participating banks • SHUSA had the lowest decline in CET1 ratio (1.6%) while having the 4th highest loan loss rate (9.9%) among the 35 participating banks • On June 28, 2018, SHUSA and SC announced that the following capital actions were included in the SHUSA 2018 Capital Plan: SHUSA • Ordinary common dividends of $75MM per quarter, and a special dividend in 3Q18 of $250MM; • Maintaining the 3Q18 dividend payment on the Company's preferred stock; • Redemption of the Company's preferred stock; and • Redemption of the Company’s trust preferred securities SC • An increase in the quarterly common stock dividend from $0.05 per share to $0.20 per share, beginning in 3Q18; and • Authorization to repurchase $200 million of outstanding common stock through June 30, 2019 1Comprehensive Capital Analysis and Review 2See pages 28 and 29 for further detail on the 2018 DFAST/CCAR exercise.

2018 CCAR Results – SHUSA vs. Peers 18 SHUSA maintains one of the highest post-stress CET1 minimums and had the lowest CET1 shock among peers 16.4% 16.0% 16.3% 1.6% 5.4% 5.9% 12.4% 12.1% 11.8% 11.6% 11.2% 11.1% 11.0% 10.6% 10.3% 10.2% 10.0% 10.2% 3.8% 4.5% 9.5% 9.7% 4.6% 5.8% 5.8% 5.9% 4.2% 4.2% 5.1% 6.1% 4.1% 5.4% 5.7% 14.8% 5.0% 10.6% 10.4% 8.3% 7.9% 7.2% 6.0% 5.8% 5.8% 5.5% 5.4% 5.4% 5.2% 4.9% 4.7% 4.8% 4.6% SHUSA Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10Peer 11Peer 12Peer 13Peer 14Peer 15Peer 16 CET1 Post-Stress Minimum CCAR CET1 Shock Peers: ALLY, BBT, BBVA, BMO, BNP, COF, CFG, DFS, FITB, HBAN, KEY, MTB, MUFG, RF, STI, TD Source: CCAR results published by Federal Reserve on 6/28/2018.

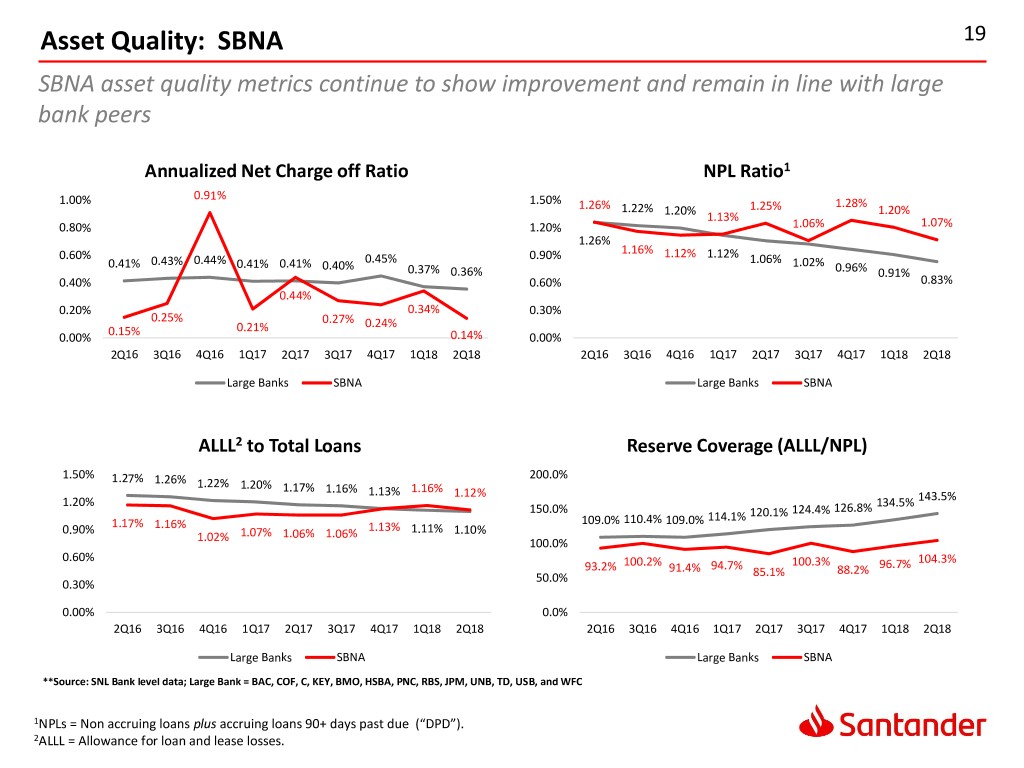

Asset Quality: SBNA 19 SBNA asset quality metrics continue to show improvement and remain in line with large bank peers Annualized Net Charge off Ratio NPL Ratio1 0.91% 1.00% 1.50% 1.28% 1.26% 1.22% 1.25% 1.20% 1.20% 1.13% 0.80% 1.20% 1.06% 1.07% 1.26% 1.16% 0.60% 0.45% 0.90% 1.12% 1.12% 1.06% 0.41% 0.43% 0.44% 0.41% 0.41% 0.40% 1.02% 0.37% 0.36% 0.96% 0.91% 0.40% 0.60% 0.83% 0.44% 0.20% 0.34% 0.30% 0.25% 0.27% 0.24% 0.15% 0.21% 0.00% 0.14% 0.00% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Large Banks SBNA Large Banks SBNA ALLL2 to Total Loans Reserve Coverage (ALLL/NPL) 1.50% 1.27% 200.0% 1.26% 1.22% 1.20% 1.17% 1.16% 1.13% 1.16% 1.12% 1.20% 134.5% 143.5% 150.0% 120.1% 124.4% 126.8% 109.0% 110.4% 109.0% 114.1% 1.17% 1.16% 1.13% 0.90% 1.07% 1.06% 1.06% 1.11% 1.10% 1.02% 100.0% 0.60% 100.2% 100.3% 104.3% 93.2% 91.4% 94.7% 88.2% 96.7% 50.0% 85.1% 0.30% 0.00% 0.0% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Large Banks SBNA Large Banks SBNA **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC 1NPLs = Non accruing loans plus accruing loans 90+ days past due (“DPD”). 2ALLL = Allowance for loan and lease losses.

Asset Quality: SC – Loss and Delinquency 20 • YoY gross charge-offs decreased 120 basis points while YoY net charge-offs decreased 150 basis points • YoY 30-59 day delinquency rates decreased 70 basis points while YoY >59 day delinquency rates decreased 100 basis points Credit: Individually Acquired Retail Installment Contracts, Delinquency: Individually Acquired Retail Installment Contracts, 25.0% 120.0% Held for Investment Held for Investment Gross Charge-12.0% 110.0%off Ratio 10.9% 19.2% 9.9% 20.0% 18.0% 18.5% 100.0% 9.8% 10.0% 9.2% 16.4% 8.6% 15.2% 90.0%Net Charge-off 15.0% Ratio 8.0% 80.0% 5.9% 10.3% 5.6% 70.0%Recovery Rate 6.0% 5.2% 30-59 10.0% 9.1% 8.3% (as % of 4.2% 4.2% >59 7.5% 60.0% 6.0% recorded 4.0% 60.6% investment) 53.9% 55.1% 50.0% 5.0% 49.3% 46.4% 2.0% 40.0% 0.0% 30.0% 0.0% Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.

Asset Quality: SC – Vintage Loss Performance 21 2016 vintage continues to outperform the 2015 vintage on a gross and net loss basis Total Annual Vintage Cumulative Gross Loss Rate Total Annual Vintage Cumulative Net Loss Rate 25% 18% 16% Rate 20% 14% 12% 15% 10% Net Loss Net Loss 8% 10% 6% 5% 4% Cumulative Cumulative 2% Cumulative Cumulative Gross Loss Rate 0% 0% 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Months on Book Months on Book 2014 2015 2016 2017 2014 2015 2016 2017 *Retained originations only SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.

Rating Agencies 22 On August 9, 2018, S&P affirmed SHUSA’s ratings at BBB+/A-2 and SBNA’s 2 ratings at A-/A-2. The outlook for both remains Stable On December 14, 2017, Moody’s upgraded SBNA’s long-term rating by 1 notch from Baa2 to Baa1. SHUSA’s ratings were not impacted On July 19, 2018, Fitch affirmed the ratings for SHUSA and SBNA at BBB+/F-2 and the outlook at Stable SBNA SHUSA Santander July 2018 Te S&P Moody’s Fitch S&P Moody’s Fitch S&P1 Moody’s2 Fitch3 Short Term A-2 P-1 F-2 A-2 N/A F-2 A-1 P-1 F-1 Deposits Senior Debt A- Baa1 BBB+ BBB+ Baa3 BBB+ A A2 A Outlook Stable Stable Stable Stable Stable Stable Stable Stable Stable 1On April 6, 2018, S&P upgraded Santander from A-/A-2/Stable to A/A-1/Stable. 2On April 17, 2018, Moody’s upgraded Santander from A3/P-2/Stable to A2/P-1/Stable. 3On July 17, 2018, Fitch upgraded Santander from A-/F-2 to A/F-1.

Appendix

Consolidating Income Statement 24 1Includes holding company activities, IHC eliminations, eliminations and purchase accounting marks related to SC consolidation. 2The entities acquired in the formation of the IHC are presented within "other" in SHUSA’s financial statement segment presentation due to immateriality. 3SHUSA net income includes non-controlling interest.

Consolidating Balance Sheet 25 1Includes holding company eliminations, IHC eliminations and purchase accounting marks related to SC consolidation. 2The entities acquired in the formation of the IHC are presented within "other" in SHUSA’s financial statement segment presentation due to immateriality. 3Other investment securities include trading securities.

Quarterly Trended Statement of Operations 26 1Represents net income including noncontrolling interest.

27 Capital Ratios Peer Comparison (as of 6/30/18) CET1 Tier 1 Risk-Based Capital 2 Total Risk-Based Capital Tier 1 Leverage - - - - Peer Median Peer data from SNL Peers: ALLY, BBT, BBVA, BMO, BNP, COF, CIT, CFG, CMA, DFS, FITB, HBAN, KEY, MTB, MUFG, RF, STI, TD

2018 DFAST1 – SHUSA vs. Federal Reserve – capital ratios 28 • SHUSA’s minimum capital ratios under stress remain well above the regulatory minimums and at the top of CCAR banks • SHUSA’s projected minimum capital ratios are lower than the ratios projected by the Federal Reserve, reflecting that SHUSA’s stress testing was more severe 4Q17 Federal Regulatory Starting SHUSA2 Capital Reserve3 Minimum Ratio Stressed Capital Ratios Severely Adverse Scenario Minimum CET1 ratio (%) 16.4% 12.4% 15.2% 4.5% Tier 1 RBC ratio (%) 17.8% 13.8% 16.5% 6.0% Total RBC ratio (%) 19.5% 15.5% 18.2% 8.0% Tier 1 leverage ratio (%) 14.2% 10.5% 13.0% 4.0% 1Dodd Frank Act Stress Test 2Results calculated by SHUSA. SHUSA published its DFAST results via Form 8-K filed on 6/22/18. 3DFAST results calculated by the Federal Reserve and published on 6/21/18

2018 DFAST/CCAR – SHUSA vs. Federal Reserve - losses 29 SHUSA’s total projected loss rate for the DFAST/CCAR exercise was more conservative than the Federal Reserve’s calculations 2 Loan Category SHUSA1 FRB SHUSA vs. FRB Total Losses – Severely Adverse 12.9% 9.9% 3.0% First Lien Mortgage 4.5% 3.4% 1.1% Junior Liens & HELOCs 3.1% 4.6% (1.5%) Commercial and Industrial 6.0% 5.8% 0.2% Commercial Real Estate 7.0% 7.4% (0.4%) Credit Cards 25.4% 13.9% 11.5% Other Consumer 28.6% 18.0% 10.6% Other Loans 1.4% 6.6% (5.2%) 1Results calculated by SHUSA. SHUSA published its DFAST results via Form 8-K filed on 6/22/18. 2DFAST results calculated by the Federal Reserve and published on 6/21/18.

Non-GAAP to GAAP Reconciliations 30 $ Millions 2Q17 3Q17 4Q17 1Q18 2Q18 SHUSA Pre-Tax Pre-Provision Income Pre-tax income, as reported $ 380 $ 330 $ (132) $ 353 $ 527 Add back: Provision for credit losses 605 652 658 503 380 Pre-tax pre-provision Income $ 985 $ 982 $ 526 $ 856 $ 907

31 Non-GAAP to GAAP Reconciliations (cont.)

SBNA: Quarterly Profitability 32 Net Interest Income ($MM) Pre-Tax Pre-Provision Income ($MM) NII Net Interest Margin 2 600 200 2 495 499 497 501 516 200 500 155 160 156 3.19% 150 400 3.10% 2.97% 2.87% 2.88% 300 100 69 200 50 100 0 0 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Pre-Tax Income ($MM) Net Income/(Loss) ($MM) 125 117 115 175 166 106 148 100 91 150 133 122 75 125 50 100 25 75 0 50 -25 2Q17 3Q17 4Q17 1Q18 2Q18 25 18 -50 0 (57) 2Q17 3Q17 4Q17 1Q18 2Q18 -75 US $ millions 1See non-GAAP to GAAP reconciliation of pre-tax pre-provision income.

SBNA: Quarterly Trended Statement of Operations 33 2

SBNA: Quarterly Average Balance Sheet 34 Quarterly Averages 2 2

SBNA: Funding – Deposits* 35 Average Non-Maturity Deposit Balances1 ($Bn) Average Total Deposit Balances1 ($Bn) 2 0.75% $49.2 0.63% $48.1 $48.4 $48.0 $48.0 $55.1 $52.9 $53.2 $52.8 $53.0 0.70% 0.55% 0.58% 0.63% 0.65% 0.53% 0.60% 0.48% 0.44% 0.52% 0.55% 0.43% 0.50% 0.35% 0.38% 0.43% 0.45% 0.31% 0.38% 0.29% 0.33% 0.37% 0.40% 0.28% 0.35% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Non Maturity Deposit Balances Avg. Interest Cost Total Deposits Avg. Interest Cost *SBNA total deposits less the SHUSA cash deposit held at SBNA. 1Represents average quarterly balances.

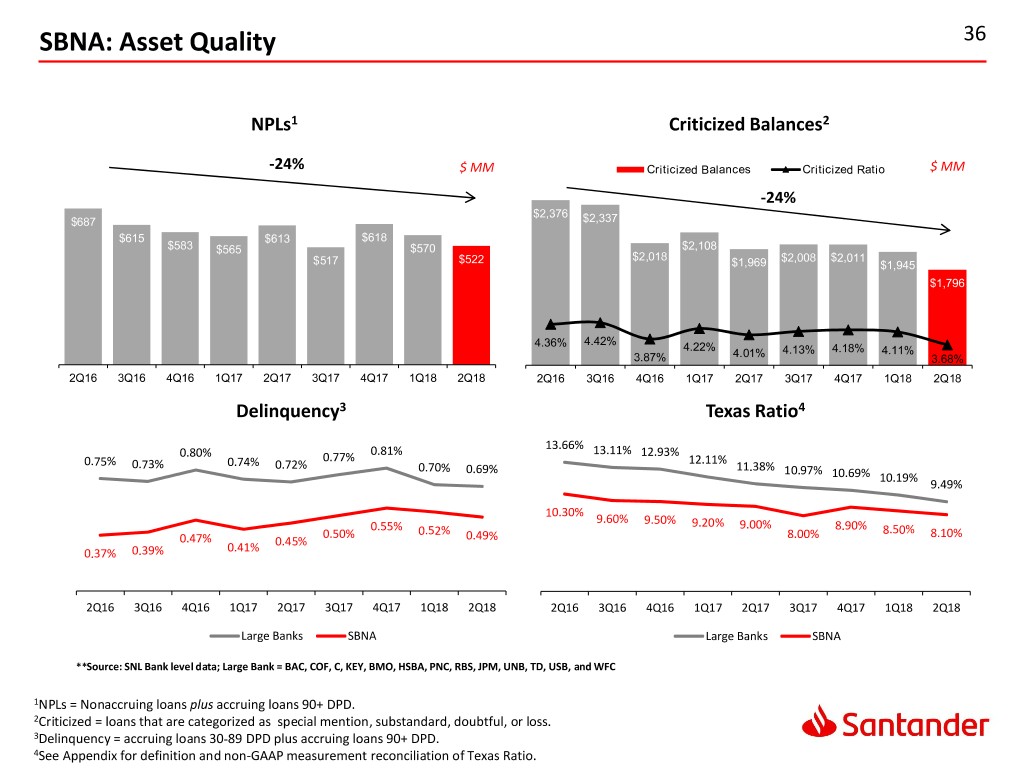

SBNA: Asset Quality 36 NPLs1 Criticized Balances2 -24% $ MM Criticized Balances Criticized Ratio $ MM -24% $2,376 $687 $2,337 $615 $613 $618 $583 $565 $570 $2,108 $522 $2,018 $2,008 $2,011 $517 $1,969 $1,945 $1,796 4.42% 4.36% 4.22% 4.01% 4.13% 4.18% 4.11% 3.87% 3.68% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Delinquency3 Texas Ratio4 3 Texas Ratio4 Deliquency 13.66% 0.80% 0.81% 13.11% 12.93% 0.75% 0.74% 0.77% 12.11% 0.73% 0.72% 0.70% 0.69% 11.38% 10.97% 10.69% 10.19% 9.49% 10.30% 9.60% 9.50% 0.55% 9.20% 9.00% 8.90% 0.50% 0.52% 8.00% 8.50% 8.10% 0.47% 0.45% 0.49% 0.37% 0.39% 0.41% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Large Banks SBNA Large Banks SBNA **Source: SNL Bank level data; Large Bank = BAC, COF, C, KEY, BMO, HSBA, PNC, RBS, JPM, UNB, TD, USB, and WFC 1NPLs = Nonaccruing loans plus accruing loans 90+ DPD. 2Criticized = loans that are categorized as special mention, substandard, doubtful, or loss. 3Delinquency = accruing loans 30-89 DPD plus accruing loans 90+ DPD. 4See Appendix for definition and non-GAAP measurement reconciliation of Texas Ratio.

SBNA: Asset Quality (cont.) 37 Mortgages Home Equity $8.6 $7.9 $8.2 $7.4 $5.9 $5.9 $5.9 $7.0 $7.2 $5.8 $5.8 $5.7 $5.7 $5.6 $6.6 $6.7 $6.8 $5.5 2.37% 2.30% 2.27% 2.17% 1.93% 1.76% 1.85% 1.82% 1.60% 1.43% 1.25% 1.69% 1.70% 1.72% 1.68% 1.78% 1.76% 1.81% 0.17% 0.14% 0.14% 0.13% 0.08% 0.05% 0.01% 0.01% 0.00% 0.29% 0.27% 0.23% 0.22% 0.21% 0.22% 0.22% 0.21% 0.20% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Commercial Real Estate1 Santander Real Estate Capital (SREC) $10.1 $9.8 $9.3 $9.1 $8.8 $8.7 $5.5 $5.4 $5.5 $5.4 $5.5 $8.7 $8.4 $8.5 $5.4 $5.2 $5.1 $5.3 1.36% 1.10% 0.98% 0.82% 0.45% 0.51% 0.51% 0.48% 0.38% 0.09% 0.09% 0.10% 0.03% 0.01% 0.08% 0.09% 0.10% 0.32% 0.08% 0.09% 0.00% 0.00% -0.01% -0.01% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00% -0.01% -0.18% -0.12% -0.15% -0.05% 0.06% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Outstandings NPLs* to Total Loans Net Charge-Offs** *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters US $ Billions 1Commercial real estate (“CRE”) is comprised of the commercial real estate and continuing care retirement communities business segments (SREC segment included in separate graph).

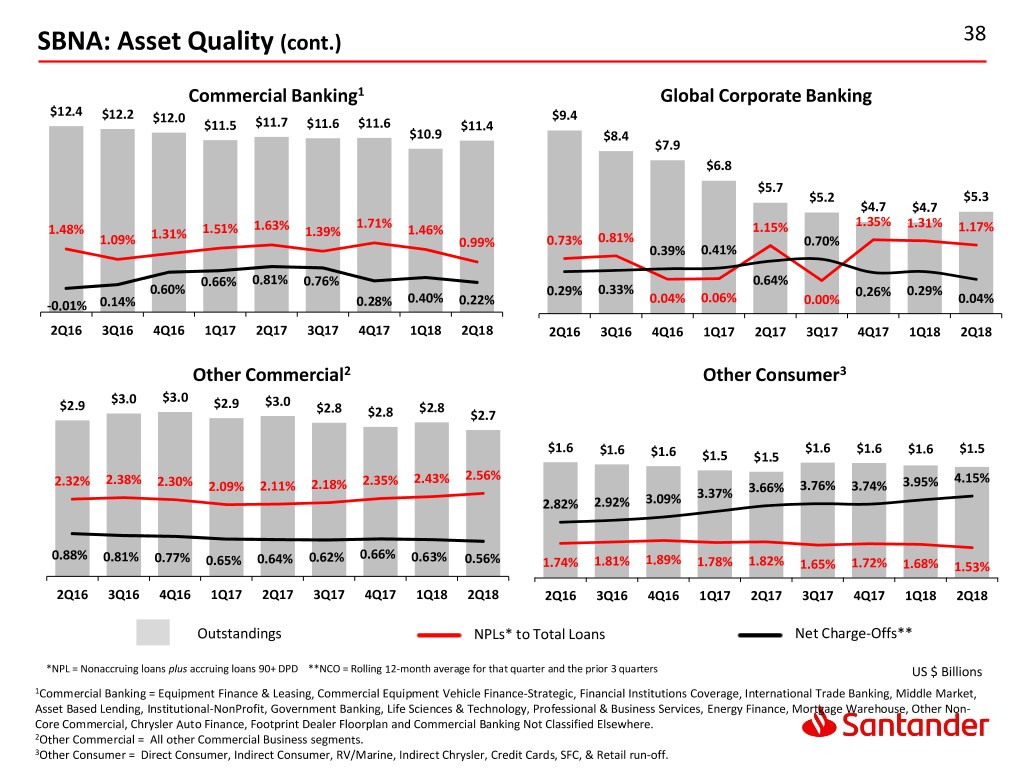

SBNA: Asset Quality (cont.) 38 Commercial Banking1 Global Corporate Banking $12.4 $12.2 $12.0 $9.4 $11.5 $11.7 $11.6 $11.6 $11.4 $10.9 $8.4 $7.9 $6.8 $5.7 $5.2 $5.3 $4.7 $4.7 1.63% 1.71% 1.35% 1.31% 1.17% 1.48% 1.31% 1.51% 1.39% 1.46% 1.15% 1.09% 0.99% 0.73% 0.81% 0.70% 0.39% 0.41% 0.66% 0.81% 0.76% 0.64% 0.60% 0.29% 0.33% 0.29% 0.40% 0.04% 0.06% 0.26% 0.04% -0.01% 0.14% 0.28% 0.22% 0.00% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Other Commercial2 Other Consumer3 $3.0 $3.0 $2.9 $2.9 $3.0 $2.8 $2.8 $2.8 $2.7 $1.6 $1.6 $1.6 $1.6 $1.6 $1.5 $1.6 $1.5 $1.5 2.43% 2.56% 4.15% 2.32% 2.38% 2.30% 2.11% 2.18% 2.35% 3.76% 3.74% 3.95% 2.09% 3.37% 3.66% 2.82% 2.92% 3.09% 0.88% 0.81% 0.77% 0.64% 0.62% 0.66% 0.63% 0.56% 0.65% 1.74% 1.81% 1.89% 1.78% 1.82% 1.65% 1.72% 1.68% 1.53% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 Outstandings NPLs* to Total Loans Net Charge-Offs** *NPL = Nonaccruing loans plus accruing loans 90+ DPD **NCO = Rolling 12-month average for that quarter and the prior 3 quarters US $ Billions 1Commercial Banking = Equipment Finance & Leasing, Commercial Equipment Vehicle Finance-Strategic, Financial Institutions Coverage, International Trade Banking, Middle Market, Asset Based Lending, Institutional-NonProfit, Government Banking, Life Sciences & Technology, Professional & Business Services, Energy Finance, Mortgage Warehouse, Other Non- Core Commercial, Chrysler Auto Finance, Footprint Dealer Floorplan and Commercial Banking Not Classified Elsewhere. 2Other Commercial = All other Commercial Business segments. 3Other Consumer = Direct Consumer, Indirect Consumer, RV/Marine, Indirect Chrysler, Credit Cards, SFC, & Retail run-off.

SBNA: Capital Ratios1 39 CET1 Tier 1 Leverage Ratio 18.7% 14.2% 14.4% 17.6% 18.1% 18.2% 18.2% 13.4% 13.7% 13.9% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 19.9% 18.2% 18.7% 18.2% 19.4% 19.3% 17.6% 18.1% 18.7% 19.2% 2Q17 3Q17 4Q17 1Q18 2Q18 2Q17 3Q17 4Q17 1Q18 2Q18 1Capital ratios calculated under the U.S. Basel III framework on a transitional basis.

SBNA: Non-GAAP to GAAP Reconciliations 40 2 2

41 SBNA: Non-GAAP to GAAP Reconciliations (cont.) 1Mortgage servicing rights. 2Troubled debt restructurings.

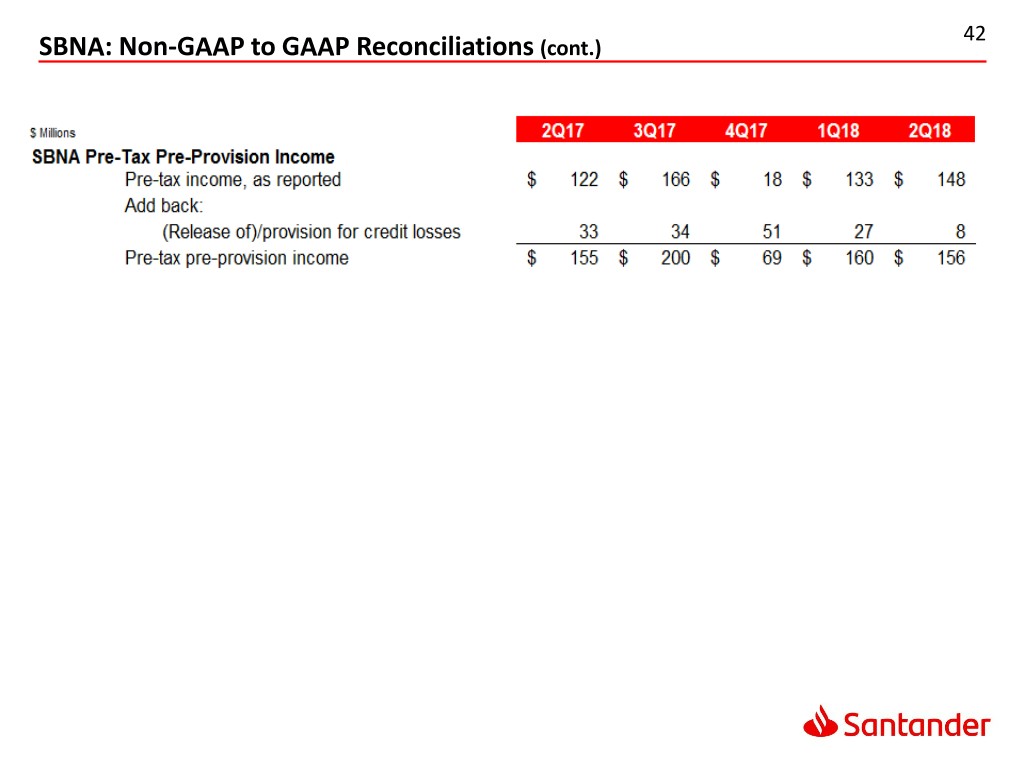

42 SBNA: Non-GAAP to GAAP Reconciliations (cont.) 2

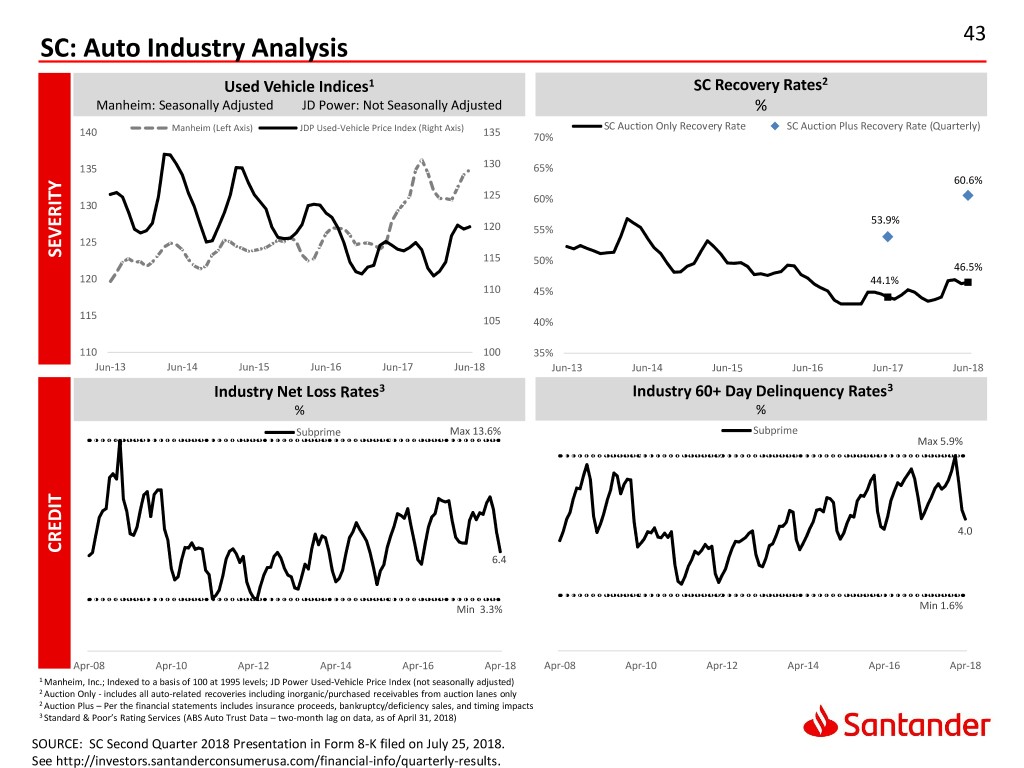

43 SC: Auto Industry Analysis Used Vehicle Indices1 SC Recovery Rates2 Manheim: Seasonally Adjusted JD Power: Not Seasonally Adjusted % Manheim (Left Axis) JDP Used-Vehicle Price Index (Right Axis) SC Auction Only Recovery Rate SC Auction Plus Recovery Rate (Quarterly) 140 135 70% 135 130 65% 60.6% 125 60% 130 53.9% 120 55% 125 SEVERITY 115 50% 46.5% 120 44.1% 110 45% 115 105 40% 110 100 35% Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Industry Net Loss Rates3 Industry 60+ Day Delinquency Rates3 % % Subprime Max 13.6% Subprime Max 5.9% 4.0 CREDIT 6.4 Min 3.3% Min 1.6% Apr-08 Apr-10 Apr-12 Apr-14 Apr-16 Apr-18 Apr-08 Apr-10 Apr-12 Apr-14 Apr-16 Apr-18 1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; JD Power Used-Vehicle Price Index (not seasonally adjusted) 2 Auction Only - includes all auto-related recoveries including inorganic/purchased receivables from auction lanes only 2 Auction Plus – Per the financial statements includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts 3 Standard & Poor’s Rating Services (ABS Auto Trust Data – two-month lag on data, as of April 31, 2018) SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.

SC: Originations diversified across credit spectrum 44 Originations by Credit (RIC only)1 ($ in millions) $4,055 $3,328 $3,014 $4,278 $5,344 31% 29% 33% 38% 36% >640 600-640 13% 15% 16% 13% 13% 540-599 24% 27% <540 23% 24% 26% $2,737 $3,815 No FICO Commercial 2 17% 14% 14% 14% 14% 12% 10% 10% 12% 12% 2% 2% 2% 2% 1% 2Q17 3Q17 4Q17 1Q18 2Q18 New/Used Originations ($ in millions) $4,055 $3,328 $3,014 $4,278 $5,344 40% 52% 45% 47% 50% Used New 60% 48% 55% 53% 50% 2Q17 3Q17 4Q17 1Q18 2Q18 Average loan balance in dollars $20,816 $21,825 $22,013 $21,699 $22,926 1 RIC; Retail Installment Contract 2 Loans to commercial borrowers; no FICO score obtained SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.

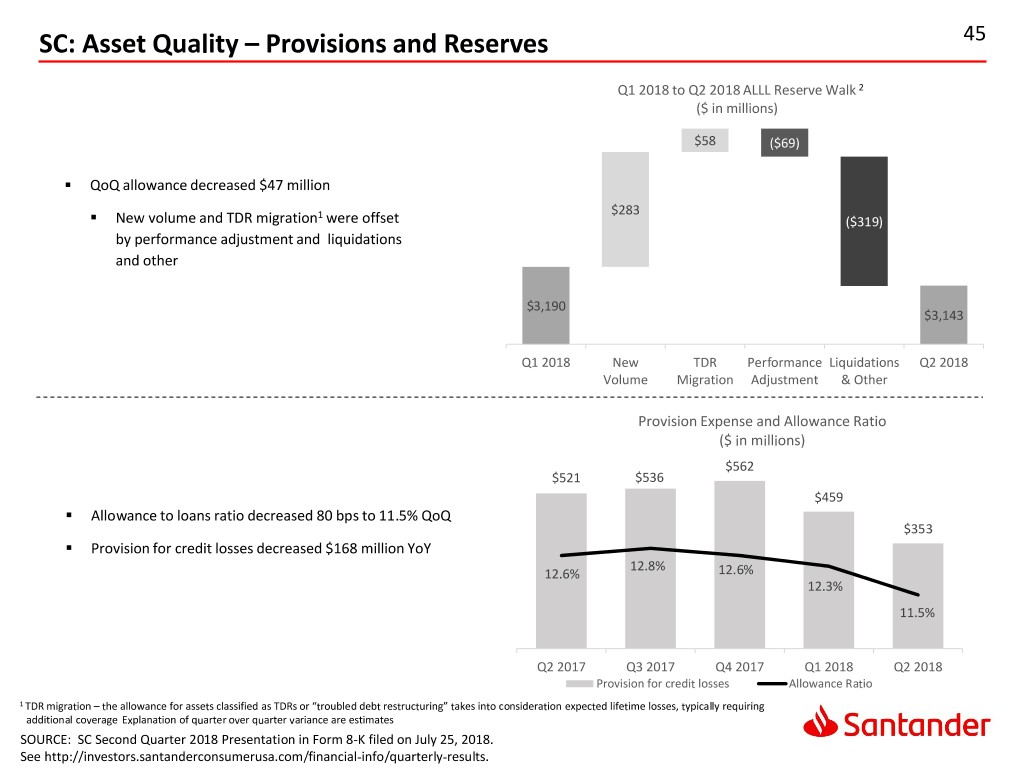

SC: Asset Quality – Provisions and Reserves 45 Q1 2018 to Q2 2018 ALLL Reserve Walk 2 ($ in millions) $3,550 $3,500 $58 ($69) $3,450 . QoQ allowance decreased $47 million $3,400 $3,350 . 1 $283 New volume and TDR migration were offset $3,300 ($319) by performance adjustment and liquidations $3,250 $3,473 $3,461 and other $3,200 $3,150 $3,100 $3,190 $3,190 $3,143 $3,143 $3,050 $3,000 Q1 2018 New TDR Performance Liquidations Q2 2018 Volume Migration Adjustment & Other Provision Expense and Allowance Ratio ($ in millions) $562 $600 $521 $536 14.5% $500 $459 . Allowance to loans ratio decreased 80 bps to 11.5% QoQ $400 $353 . Provision for credit losses decreased $168 million YoY 13.0% $300 12.8% 12.6% 12.6% $200 12.3% 11.5% $100 11.5% $0 10.0% Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Provision for credit losses Allowance Ratio 1 TDR migration – the allowance for assets classified as TDRs or “troubled debt restructuring” takes into consideration expected lifetime losses, typically requiring additional coverage Explanation of quarter over quarter variance are estimates SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.

SC: TDR Balance Composition by Vintage 46 TDR balances gradually down three consecutive quarters TDR Balance by Origination Vintage ($ billions) $6.28 $6.26 $5.88 $6.00 $5.79 1% $5.96 16% $5.60 4% 9% $5.33 20% $5.03 24% 22% 30% 26% 13% 35% 37% 37% 37% 36% 35% 34% 32% 33% 29% 27% 24% 22% 20% 18% 51% 44% 37% 32% 28% 23% 21% 19% 16% 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 2013 & Prior 2014 2015 2016 2017 SOURCE: SC Second Quarter 2018 Presentation in Form 8-K filed on July 25, 2018. See http://investors.santanderconsumerusa.com/financial-info/quarterly-results.