Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - TD Holdings, Inc. | f10q0618ex32-2_chinacomm.htm |

| EX-32.1 - CERTIFICATION - TD Holdings, Inc. | f10q0618ex32-1_chinacomm.htm |

| EX-31.2 - CERTIFICATION - TD Holdings, Inc. | f10q0618ex31-2_chinacomm.htm |

| EX-31.1 - CERTIFICATION - TD Holdings, Inc. | f10q0618ex31-1_chinacomm.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2018

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 001-36055

China Commercial Credit, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-4077653 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

No.1 Zhongying Commercial Plaza,

Zhong Ying Road,

Wujiang, Suzhou,

Jiangsu Province, China

(Address of principal executive offices)

+86-512 6396-0022

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 13, 2018, 24,595,612 shares of the Company’s Common Stock, $0.001 par value per share, were issued and outstanding.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CHINA COMMERCIAL CREDIT, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, | December 31, | |||||||||

| Note | 2018 | 2017 | ||||||||

| (unaudited) | ||||||||||

| ASSETS | ||||||||||

| Cash | $ | 1,362,718 | $ | 1,359,630 | ||||||

| Other current assets | 7 | 909,242 | - | |||||||

| Assets of discontinued operations | 6 | - | 5,805,654 | |||||||

| Total current assets | 2,271,960 | 7,165,284 | ||||||||

| Operating lease assets, net | 8 | 1,870,983 | - | |||||||

| Property and equipment, net | 5,076 | - | ||||||||

| Total Assets | $ | 4,148,019 | $ | 7,165,284 | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT) | ||||||||||

| Liabilities | ||||||||||

| Other current liabilities | $ | 15,246 | $ | - | ||||||

| Liabilities of discontinued operations | 6 | - | 10,426,771 | |||||||

| Total current liabilities | 15,246 | 10,426,771 | ||||||||

| Other noncurrent liabilities | 9 | - | 1,311,000 | |||||||

| Total Liabilities | 15,246 | 11,737,771 | ||||||||

| Shareholders’ Equity (Deficit) | ||||||||||

| Series A Preferred Stock (par value $0.001 per share, 1,000,000 shares authorized at June 30, 2018 and December 31, 2017, respectively; nil and nil shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively) | $ | - | $ | - | ||||||

| Series B Preferred Stock (par value $0.001 per share, 5,000,000 shares authorized at June 30, 2018 and December 31, 2017, respectively; nil and nil shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively) | - | - | ||||||||

| Common stock (par value $0.001 per share, 100,000,000 shares authorized; 24,445,612 and 19,250,915 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively) | 11 | 24,446 | 19,251 | |||||||

| Subscription fee advanced from a shareholder | 524,974 | 699,974 | ||||||||

| Additional paid-in capital | 27,906,598 | 71,424,031 | ||||||||

| Accumulated deficit | (23,986,877 | ) | (81,534,396 | ) | ||||||

| Accumulated other comprehensive (loss) income | (336,368 | ) | 4,818,653 | |||||||

| Total Shareholders’ Equity (Deficit) | 4,132,773 | (4,572,487 | ) | |||||||

| Total Liabilities and Shareholders’ Equity (Deficit) | $ | 4,148,019 | $ | 7,165,284 | ||||||

See notes to the consolidated financial statements

1

CHINA COMMERCIAL CREDIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||||

| Note | 2018 | 2017 | 2018 | 2017 | ||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||

| Lease income and other interest income | ||||||||||||||||||

| Income from operating lease | $ | 96,721 | $ | - | $ | 96,721 | $ | - | ||||||||||

| Interests on deposits with banks | 315 | - | 315 | 35,000 | ||||||||||||||

| Total lease income and other interest income | 97,036 | - | 97,036 | 35,000 | ||||||||||||||

| Net depreciation expense on operating lease assets | (12,458 | ) | - | (12,458 | ) | - | ||||||||||||

| Net Revenue | 84,578 | - | 84,578 | 35,000 | ||||||||||||||

| Non-interest expense | ||||||||||||||||||

| Salaries and employee surcharge | (103,946 | ) | (125,093 | ) | (225,599 | ) | (428,204 | ) | ||||||||||

| Rental expenses | (14,250 | ) | (7,370 | ) | (26,389 | ) | (14,780 | ) | ||||||||||

| Business taxes and surcharge | (144 | ) | - | (144 | ) | - | ||||||||||||

| Class action settlement expenses – changes in fair value of stock portion | 9 | (19,000 | ) | (2,052,000 | ) | (166,540 | ) | (1,995,000 | ) | |||||||||

| Other operating expenses | 10 | (326,046 | ) | (857,257 | ) | (607,141 | ) | (1,070,166 | ) | |||||||||

| Total non-interest expense | (463,386 | ) | (3,041,720 | ) | (1,025,813 | ) | (3,508,150 | ) | ||||||||||

| Loss from acquisition of a variable interest entity | 1 | (14,004 | ) | - | (14,004 | ) | - | |||||||||||

| Net loss from continuing operations before income taxes | (392,812 | ) | (3,041,720 | ) | (955,239 | ) | (3,473,150 | ) | ||||||||||

| Income tax expense | 13 | (20 | ) | - | (20 | ) | - | |||||||||||

| Net loss from continuing operations | $ | (392,832 | ) | $ | (3,041,720 | ) | $ | (955,259 | ) | $ | (3,473,150 | ) | ||||||

| Net income (loss) from discontinued operations | 6 | 9,896,100 | (1,876,655 | ) | 10,072,629 | (2,673,302 | ) | |||||||||||

| Net income (loss) | $ | 9,503,268 | $ | (4,918,375 | ) | $ | 9,117,370 | $ | (6,146,452 | ) | ||||||||

| Income (loss) per share- basic and diluted | 12 | 0.428 | (0.284 | ) | 0.432 | (0.361 | ) | |||||||||||

| Net loss per share from continuing operations – basic and diluted | 12 | (0.018 | ) | (0.176 | ) | (0.045 | ) | (0.204 | ) | |||||||||

| Net income (loss) per share from discontinued operations – basic and diluted | 12 | 0.446 | (0.108 | ) | 0.478 | (0.157 | ) | |||||||||||

| Weighted Average Shares Outstanding-Basic and Diluted | 22,211,600 | 17,308,319 | 21,080,665 | 17,004,613 | ||||||||||||||

| Net income (loss) | $ | 9,503,268 | $ | (4,918,375 | ) | $ | 9,117,370 | $ | (6,146,452 | ) | ||||||||

| Other comprehensive (loss) income | ||||||||||||||||||

| Foreign currency translation adjustment | (117,085 | ) | 7,673 | (242,305 | ) | 29,288 | ||||||||||||

| Comprehensive income (loss) | $ | 9,386,183 | $ | (4,910,702 | ) | $ | 8,875,065 | $ | (6,117,164 | ) | ||||||||

See notes to the consolidated financial statements

2

CHINA COMMERCIAL CREDIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT)

| Common Stock | Subscription advanced from a | Accumulated | Accumulated other comprehensive | |||||||||||||||||||||||||

| Shares | Amount | APIC | shareholder | deficit | (loss) income | Total | ||||||||||||||||||||||

| Balance as of December 31, 2017 | 19,250,915 | 19,251 | 71,424,031 | 699,974 | (81,534,396 | ) | 4,818,653 | (4,572,487 | ) | |||||||||||||||||||

| Issuance of common stocks and warrants to CFO | 50,000 | 50 | 174,950 | (175,000 | ) | - | - | - | ||||||||||||||||||||

| Issuance of common stocks in connection with class action settlement | 950,000 | 950 | 1,476,591 | - | - | - | 1,477,541 | |||||||||||||||||||||

| Issuance of common stocks in connection with private placements | 4,194,697 | 4,195 | 3,261,175 | - | - | - | 3,265,370 | |||||||||||||||||||||

| Net loss for the year | - | - | - | - | 9,117,370 | - | 9,117,370 | |||||||||||||||||||||

| Foreign currency translation gain/(loss) | - | - | - | - | - | (242,305 | ) | (242,305 | ) | |||||||||||||||||||

| Disposition of CCC BVI (note 6) | - | - | (48,430,149 | ) | - | 48,430,149 | (4,912,716 | ) | (4,912,716 | ) | ||||||||||||||||||

| Balance @ June 30, 2018 | 24,445,612 | 24,446 | 27,906,598 | 524,974 | (23,986,877 | ) | (336,368 | ) | 4,132,773 | |||||||||||||||||||

See notes to the consolidated financial statements

3

CHINA COMMERCIAL CREDIT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For The Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| (unaudited) | (unaudited) | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income (loss) | $ | 9,117,370 | $ | (6,146,452 | ) | |||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Depreciation of operating leased assets | 12,458 | - | ||||||

| Depreciation of property and equipment | 98 | - | ||||||

| Gain on disposal of discontinued operations | (9,794,873 | ) | - | |||||

| Loss on acquisition of a variable interest entity | 14,004 | - | ||||||

| Shares issued for settlement against legal proceedings | 943,860 | - | ||||||

| Shares issued to executive officers and professional services | - | 913,180 | ||||||

| Changes in fair value of noncurrent liabilities | 166,540 | 1,995,000 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Other current assets | (945,180 | ) | - | |||||

| Other current liabilities | (1,460 | ) | - | |||||

| Other noncurrent liabilities | (1,311,000 | ) | - | |||||

| Net cash provided by operating activities from discontinued operations | 992,334 | 1,417,164 | ||||||

| Net Cash Used in Operating Activities | (805,849 | ) | (1,821,108 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Proceeds from disposal of discontinued operations | 500,000 | - | ||||||

| Acquisition of subsidiary, net of cash acquired | 245 | - | ||||||

| Purchase of operating lease assets | (1,957,391 | ) | - | |||||

| Purchase of property and equipment | (5,376 | ) | - | |||||

| Net cash (used in) provided by investing activities from discontinued operations | (1,270,070 | ) | 1,238,159 | |||||

| Net Cash (Used in) Provided by Investing Activities | (2,732,592 | ) | 1,238,159 | |||||

| Cash Flows From Financing Activities: | ||||||||

| Cash raised in private placement | 3,265,371 | 560,000 | ||||||

| Net Cash Provided by Financing Activities | 3,265,371 | 560,000 | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 276,158 | 17,979 | ||||||

| Net Increase (Decrease) In Cash and Cash Equivalents | 3,088 | (4,970 | ) | |||||

| Cash and Cash Equivalents at Beginning of Period | 1,359,630 | 697,866 | ||||||

| Cash and Cash Equivalents at End of Period | $ | 1,362,718 | $ | 692,896 | ||||

See notes to the consolidated financial statements

4

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES |

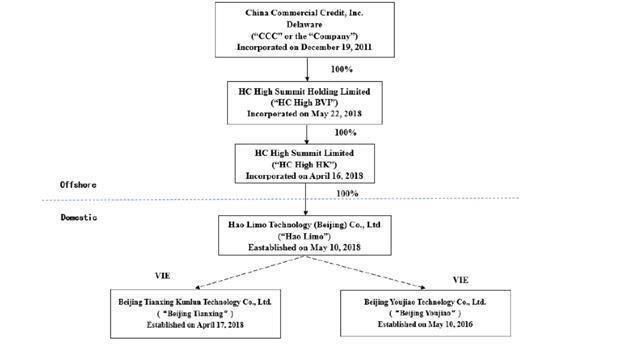

China Commercial Credit, Inc. (“CCC” or “the Company”) is a holding company that was incorporated under the laws of the State of Delaware on December 19, 2011.

On March 22, 2018, the Company formed HC High Summit Holding Limited (“HC High BVI”), a wholly owned subsidiary, in British Virgin Island (“BVI”). HC High BVI is authorized to issue a maximum of 50,000 shares of one class, at par value of $1.00 per share.

On April 16, 2018, HC High BVI formed a wholly owned subsidiary, HC High Summit Limited (“HC High HK”) in Hong Kong. On April 17, 2018, the Company, through HC High HK, established Hao Limo Technology (Beijing) Co. Ltd. (“Hao Limo”).

VIE AGREEMENTS WITH BEIJING YOUJIAO

On June 19, 2018, Hao Limo entered into a series of agreements (the “Youjiao VIE Agreements”) with Beijing Youjiao and Aizhen Li. The Youjiao VIE Agreements were designed to provide Hao Limo with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Beijing Youjiao, including absolute control rights and the rights to the management, operations, assets, property and revenue of Beijing Youjiao. The purpose of Youjiao VIE Agreements is solely to give Hao Limo the exclusive control over Beijing Youjiao’s management and operations. Beijing Youjiao has the requisite license to carry out used luxurious car leasing business in China. On June 19, 2018, the net liabilities of Beijing Youjiao are comprised of followings:

| June 19, 2018 | ||||

| (unaudited) | ||||

| Cash | $ | 245 | ||

| Accrued expenses | 13,759 | |||

| Net liabilities of Youjiao on acquisition date | $ | 14,004 | ||

| Cash consideration for the acquisition | - | |||

| Loss on acquisition | $ | 14,004 | ||

Material terms of each of the Youjiao VIE Agreements are described below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Beijing Youjiao and Hao Limo, Hao Limo provides Beijing Youjiao with technical support, consulting services and management services on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Beijing Youjiao granted an irrevocable and exclusive option to Hao Limo to purchase from Beijing Youjiao, any or all of Beijing Youjiao’s assets at the lowest purchase price permitted under the PRC laws. Should Hao Limo exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to Beijing Youjiao by Hao Limo under this agreement, Hao Limo is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, plus amount of the services fees or ratio decided by the board of directors of Hao Limo based on the value of services rendered by Hao Limo and the actual income of Beijing Youjiao from time to time, which is substantially equal to all of the net income of Beijing Youjiao.

The Exclusive Business Cooperation Agreement shall remain in effect for ten years unless it is terminated by Hao Limo with 30-day prior written notice. Beijing Youjiao does not have the right to terminate the agreement unilaterally. Hao Limo may unilaterally extend the term of this agreement with prior written notice.

5

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED) |

Share Pledge Agreement

Under the Share Pledge Agreement among Beijing Youjiao, Aizhen Li and Hao Limo, Aizhen Li pledged all of her equity interests in Beijing Youjiao to Hao Limo to guarantee the performance of Beijing Youjiao’s obligations under the Exclusive Business Cooperation Agreement. Under the terms of the agreement, in any event of default, as set forth in the Share Pledge Agreement, including that Beijing Youjiao or Aizhen Li breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, Hao Limo, as pledgee, will be entitled to certain rights, including, but not limited to, the right to dispose of the pledged equity interest in accordance with applicable PRC laws. Hao Limo shall have the right to collect any and all dividends declared or generated in connection with the equity interest during the term of pledge.

The Share Pledge Agreement shall be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Beijing Youjiao. Hao Limo shall cancel or terminate the Share Pledge Agreement upon Beijing Youjiao’s full payment of fees payable under the Exclusive Business Cooperation Agreement.

Exclusive Option Agreement

Under the Exclusive Option Agreement, Aizhen Li irrevocably granted Hao Limo (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Beijing Youjiao. The option price is equal to the capital paid in by Aizhen Li subject to any appraisal or restrictions required by applicable PRC laws and regulations.

The agreement remains effective for a term of ten years and may be renewed at Hao Limo’s election.

Power of Attorney

Under the Power of Attorney, Aizhen Li authorized Hao Limo to act on her behalf as her exclusive agent and attorney with respect to all rights as shareholder, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association of Beijing Youjiao, including but not limited to the sale or transfer or pledge or disposition of shares held by Aizhen Li in part or in whole; and (c) designating and appointing on behalf of Aizhen Li the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Beijing Youjiao.

Although it is not explicitly stipulated in the Power of Attorney, the term of the Power of Attorney shall be the same as the term of that of the Exclusive Option Agreement.

This Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid from the date of execution of this Power of Attorney, so long as Aizhen Li is a shareholder of Beijing Youjiao.

Timely Reporting Agreement

To ensure Beijing Youjiao promptly provides all of the information that Hao Limo and the Company need to file various reports with the SEC, a Timely Reporting Agreement was entered between Beijing Youjiao and the Company.

Under the Timely Reporting Agreement, Beijing Youjiao agreed that it is obligated to make its officers and directors available to the Company and promptly provide all information required by the Company so that the Company can file all necessary SEC and other regulatory reports as required.

Although it is not explicitly stipulated in the Timely Reporting Agreement, the parties agreed its term shall be the same as that of the Exclusive Business Cooperation Agreement. The Youjiao VIE Agreements became effective immediately upon their execution.

VIE AGREEMENTS WITH BEIJING TIANXING

On May 17, 2018, Hao Limo entered into a series of agreements (the “Tianxing VIE Agreements”) with Beijing Tianxing Kunlun Technology Co. Ltd . (“Beijing Tianxing”) and Shun Li and Jialin Cui, the shareholders of Beijing Tianxing. The Tianxing VIE Agreements are designed to provide Hao Limo with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Beijing Tianxing, including absolute control rights and the rights to the management, operations, assets, property and revenue of Beijing Tianxing. The purpose of the VIE Agreements is solely to give Hao Limo the exclusive control over Beijing Tianxing’s management and operations. Beijing Tianxing has the requisite license to carry out used luxurious car leasing business in China.

Material terms of each of the Tianxing VIE Agreements are similar to those of Youjiao VIE Agreements.

Beijing Youjiao has the requisite license to carry out used luxurious car leasing business in China.

6

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 1. | ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED) |

DISPOSITION OF CCC BVI

On June 19, 2018, the Company, HK Xu Ding Co, Limited, a private limited company duly organized under the laws of Hong Kong (the “Purchaser”) and CCCR International Investment Ltd., a business company incorporated in the British Virgin Islands with limited liability which was previously 100% owned by the Company (“CCC BVI”) entered into certain Share Purchase Agreement (the “Purchase Agreement”). Pursuant to the Purchase Agreement, the Purchaser agreed to purchase CCC BVI in exchange of cash purchase price of $500,000.

CCC BVI is the sole shareholder of CCC International Investment Ltd. (“CCC HK”), a company incorporated under the laws of the Hong Kong S.A.R. of the PRC, which is the sole shareholder of WFOE. WFOE, via a series of contractual arrangements, controls Wujiang Luxiang. CCC HK is the sole shareholder of PFL.

Upon closing of the disposition on June 21, 2018, the Purchaser became the sole shareholder of CCC BVI and as a result, assume all assets and obligations of all the subsidiaries and VIE entities owned or controlled by CCC BVI, including but not limited to Wujiang Luxiang and PFL.

Below is the Company’s structure chart after the completion of the Termination Agreement, Youjiao VIE Agreements and Purchase Agreement.

7

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Basis of presentation and principle of consolidation |

The unaudited condensed interim consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

The unaudited condensed interim financial information as of June 30, 2018 and for the six and three months ended June 30, 2018 and 2017 have been prepared without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and pursuant to Regulation S-X. Certain information and footnote disclosures, which are normally included in annual financial statements prepared in accordance with U.S. GAAP, have been omitted pursuant to those rules and regulations. The unaudited condensed interim financial information should be read in conjunction with the audited financial statements and the notes thereto, included in the Form 10-K for the fiscal year ended December 31, 2017 filed with the SEC on April 16, 2018.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s unaudited condensed financial position as of June 30, 2018, its unaudited condensed results of operations for the six and three months ended June 30, 2018 and 2017, and its unaudited condensed cash flows for the six months ended June 30, 2018 and 2017, as applicable, have been made. The unaudited interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

All significant inter-company accounts and transactions have been eliminated in consolidation.

| (b) | Recently adopted accounting standards |

In February 2018, the FASB issued ASU No. 2018-02, “Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income” (“ASU 2018-02”), which provides financial statement preparers with an option to reclassify stranded tax effects within accumulated other comprehensive income to retained earnings in each period in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act (or portion thereof) is recorded. The amendments in this ASU are effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption of ASU 2018-02 is permitted, including adoption in any interim period for the public business entities for reporting periods for which financial statements have not yet been issued. The amendments in this ASU should be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

In July 2017, the FASB issued ASU No. 2017-11, “Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Non-controlling Interests with a Scope Exception” (“ASU 2017-11”), which addresses the complexity of accounting for certain financial instruments with down round features. Down round features are features of certain equity-linked instruments (or embedded features) that result in the strike price being reduced on the basis of the pricing of future equity offerings. Current accounting guidance creates cost and complexity for entities that issue financial instruments (such as warrants and convertible instruments) with down round features that require fair value measurement of the entire instrument or conversion option. The amendments in Part I of this ASU are effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company is currently evaluating the impact of the adoption of ASU 2017-11 on its consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Amendments to the ASC 842 Leases. This update requires the lessee to recognize the assets and liability (the lease liability) arising from operating leases on the balance sheet for the lease term. When measuring assets and liabilities arising from a lease, a lessee (and a lessor) should include payments to be made in optional periods only if the lessee is reasonably certain to exercise an option to extend the lease or not to exercise an option to terminate the lease. Within twelve months or less lease term, a lessee is permitted to make an accounting policy election not to recognize lease assets and liabilities. If a lessee makes this election, it should recognize lease expense on a straight-line basis over the lease term. In transition, this update will be effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Management is evaluating the effect, if any, on the Company’s consolidated financial statements.

In August 2016, the FASB has issued Accounting Standards Update (ASU) No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, to address diversity in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The amendments provide guidance on the following eight specific cash flow issues: (1) Debt Prepayment or Debt Extinguishment Costs; (2) Settlement of Zero-Coupon Debt Instruments or Other Debt Instruments with Coupon Interest Rates That Are Insignificant in Relation to the Effective Interest Rate of the Borrowing; (3) Contingent Consideration Payments Made after a Business Combination; (4) Proceeds from the Settlement of Insurance Claims; (5) Proceeds from the Settlement of Corporate-Owned Life Insurance Policies, including Bank-Owned; (6) Life Insurance Policies; (7) Distributions Received from Equity Method Investees; (8) Beneficial Interests in Securitization Transactions; and Separately Identifiable Cash Flows and Application of the Predominance Principle. The amendments are effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. The amendments should be applied using a retrospective transition method to each period presented. If it is impracticable to apply the amendments retrospectively for some of the issues, the amendments for those issues would be applied prospectively as of the earliest date practicable. Management is evaluating the effect, if any, on the Company’s consolidated financial statements. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

8

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

On November 22, 2017, the FASB ASU No. 2017-14, “Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition Topic 605), and Revenue from Contracts with Customers (Topic 606): Amendments to SEC Paragraphs Pursuant to Staff Accounting Bulletin No. 116 and SEC Release 33-10403.” The ASU amends various paragraphs in ASC 220, Income Statement — Reporting Comprehensive Income; ASC 605, Revenue Recognition; and ASC 606, Revenue From Contracts With Customers, that contain SEC guidance. The amendments include superseding ASC 605-10-S25-1 (SAB Topic 13) as a result of SEC Staff Accounting Bulletin No. 116 and adding ASC 606-10-S25-1 as a result of SEC Release No. 33-10403. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect would have a material effect on the consolidated financial position, statements of operations and cash flows.

| (c) | Business Combination |

The Company accounts for its business combination using the acquisition method of accounting in accordance with ASC 805 “Business Combinations”. The cost of an acquisition is measured as the aggregate of the acquisition date fair values of the assets transferred and liabilities incurred by the Company to the sellers and equity instruments issued. Transaction costs directly attributable to the acquisition are expensed as incurred. Identifiable assets and liabilities acquired or assumed are measured separately at their fair values as of the acquisition date, irrespective of the extent of any non-controlling interests. The excess of (i) the total costs of acquisition, fair value of the non-controlling interests and acquisition date fair value of any previously held equity interest in the acquiree over (ii) the fair value of the identifiable net assets of the acquiree is recorded as goodwill.

| (d) | Reclassifications |

Certain items in the financial statements of comparative period have been reclassified to conform to the financial statements for the current period. (See Note 6)

| (e) | Use of estimates |

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. Significant accounting estimates reflected in the financial statements include: (i) the allowance for other current assets; (ii) useful lives of long-lived assets; (iii) the impairment of long-lived assets; (iv) the valuation allowance of deferred tax assets; and (v) contingencies and litigation.

9

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

| (f) | Foreign currency translation |

The reporting currency of the Company is United States Dollars (“US$”), which is also the Company’s functional currency. The PRC subsidiaries and VIEs maintain their books and records in its local currency, the Renminbi Yuan (“RMB”), which is their functional currencies as being the primary currency of the economic environment in which these entities operate.

For financial reporting purposes, the financial statements of the PRC subsidiaries and VIEs prepared using RMB, are translated into the Company’s reporting currency, US$, at the exchange rates quoted by www.oanda.com. Assets and liabilities are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders’ equity is translated at historical exchange rates, except for the change in accumulated deficit during the year which is the result of the income statement translation process. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive income in shareholders’ deficit.

| June 30, 2018 | December 31, 2017 | |||||||

| Balance sheet items, except for equity accounts | 6.6198 | 6.5064 | ||||||

| For the six months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Items in the statements of operations and comprehensive loss, and statements of cash flows | 6.3681 | 6.8752 | ||||||

Transactions denominated in currencies other than the functional currency are translated into prevailing functional currency at the exchange rates prevailing at the dates of the transactions. The resulting exchange differences are included in the consolidated statements of comprehensive income (loss).

Pursuant to ASC 830-30-40-1, Upon sale or upon complete or substantially complete liquidation of an investment in a foreign entity, the amount attributable to that entity and accumulated in the translation adjustment component of equity shall be both:

| a. | Removed from the separate component of equity |

| b. | Reported as part of the gain or loss on sale or liquidation of the investment for the period during which the sale or liquidation occurs. |

| (g) | Fair value measurement |

The Company has adopted ASC Topic 820, Fair Value Measurement and Disclosure, which defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. It does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. It establishes a three-level valuation hierarchy of valuation techniques based on observable and unobservable inputs, which may be used to measure fair value and include the following:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Classification within the hierarchy is determined based on the lowest level of input that is significant to the fair value measurement.

10

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

The carrying value of financial items of the Company including cash and cash equivalents approximate their fair values due to their short-term nature and are classified within Level 1 of the fair value hierarchy.

As of June 30, 2018 and December 31, 2017, the Company’s other noncurrent liabilities represented the share settlement in class actions were measured at fair value within Level 1 by reference to the quoted market price per share as the Company is a public entity.

| (h) | Operating lease asset, net |

Operating lease asset, net, represents the automobiles that are underlying our automotive lease contracts and is reported at cost, less accumulated depreciation and net of impairment charges and origination fees or costs. Depreciation of vehicles is recorded on a straight-line basis to an estimated residual value over the useful life of nine years. We periodically evaluate our depreciation rate for leased vehicles based on expected residual values and adjust depreciation expense over the remaining life of the lease if deemed necessary.

We have significant investments in the residual values of the assets in our operating lease portfolio. The residual values represent an estimate of the values of the assets at the end of the lease contracts. At contract inception, we determine pricing based on the projected residual value of the lease vehicle. This evaluation is primarily based on a proprietary model, which includes variables such as age, expected mileage, seasonality, segment factors, vehicle type, economic indicators, production cycle, automotive manufacturer incentives, and shifts in used vehicle supply. This internally-generated data is compared against third-party, independent data for reasonableness. Realization of the residual values is dependent on our future ability to market the vehicles under the prevailing market conditions. Over the life of the lease, we evaluate the adequacy of our estimate of the residual value and make adjustments to the depreciation rates to the extent the expected value of the vehicle at lease termination changes. In addition to estimating the residual value at lease termination, we also evaluate the current value of the operating lease asset and test for impairment to the extent necessary when there is an indication of impairment based on market considerations and portfolio characteristics. Impairment is determined to exist if fair value of the leased asset is less than carrying value and it is determined that the net carrying value is not recoverable. The net carrying value of a leased asset is not recoverable if it exceeds the sum of the undiscounted expected future cash flows expected to result from the lease payments and the estimated residual value upon eventual disposition. If our operating lease assets are considered to be impaired, the impairment is measured as the amount by which the carrying amount of the assets exceeds the fair value as estimated by discounted cash flows. No impairment was recognized in the six months ended June 30, 2018. We accrue rental income on our operating leases when collection is reasonably assured.

When a lease vehicle is returned to us, either at the end of the lease term or through repossession, the asset is reclassified from operating lease assets to property and equipment, net and recorded at the lower-of-cost or estimated fair value, less costs to sell. Any losses recognized at this time are recorded as depreciation expense. Subsequent decline in value and any gain or loss recognized at the time of sale is recognized as a remarketing gain or loss and presented as a component of depreciation expense.

| (i) | Income from operating lease |

Income from operating lease represents lease origination fees and rental fee, netting of lease origination costs. The income is recognized as operating lease revenue on a straight-line basis over the scheduled lease term.

| (j) | Income taxes |

The Company accounts for income taxes under the asset and liability method. Under this method, deferred tax assets and liabilities are determined based on differences between the financial statement carrying amounts of existing assets and liabilities and their tax bases. Deferred tax assets and liabilities are measured using enacted tax rates applicable for the differences that are expected to affect taxable income.

| (k) | Income (loss) per share |

Basic income (loss) per share is computed by dividing the net loss by the weighted average number of common shares outstanding during the period. Diluted income (loss) per share is the same as basic income (loss) per share due to the lack of dilutive items in the Company for the three and six months ended June 30, 2018 and 2017. The number of warrants is omitted excluded from the computation as the anti-dilutive effect.

11

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) |

| (l) | Comprehensive income (loss) |

Comprehensive income (loss) includes net income (loss) and other comprehensive foreign currency adjustments income. Comprehensive income (loss) is reported in the statements of operations and comprehensive income (loss).

Accumulated other comprehensive income, as presented on the balance sheets are the cumulative foreign currency translation adjustments.

| (m) | Commitments and contingencies |

In the normal course of business, the Company is subject to loss contingencies, such as legal proceedings and claims arising out of its business, that cover a wide range of matters, including, among others, government investigations and tax matters. In accordance with ASC No. 450 Sub topic 20, “Loss Contingencies”, the Company records accruals for such loss contingencies when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated.

| (n) | Share-based awards |

Share-based awards granted to the Company’s employees are measured at fair value on grant date and share-based compensation expense is recognized (i) immediately at the grant date if no vesting conditions are required, or (ii) using the accelerated attribution method, net of estimated forfeitures, over the requisite service period. The fair value of restricted shares is determined with reference to the fair value of the underlying shares.

At each date of measurement, the Company reviews internal and external sources of information to assist in the estimation of various attributes to determine the fair value of the share-based awards granted by the Company, including but not limited to the fair value of the underlying shares, expected life, expected volatility and expected forfeiture rates. The Company is required to consider many factors and make certain assumptions during this assessment. If any of the assumptions used to determine the fair value of the share-based awards changes significantly, share-based compensation expense may differ materially in the future from that recorded in the current reporting period.

| (o) | Warrants |

The Company had warrants to four individuals in private placements, through which the Company issued both common shares and warrants as separable units, and neither instrument is registered when issued. Warrants requiring share settlement are classified as equity.

The capital raised from the private placement is allocated between the fair value of the common stocks and warrants. The Company determined the fair value of warrants by application of the Black-Scholes-Merton formula.

| (p) | Discontinued operation |

In accordance with ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, a disposal of a component of an entity or a group of components of an entity is required to be reported as discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results when the components of an entity meets the criteria in paragraph 205-20-45-1E to be classified as held for sale. When all of the criteria to be classified as held for sale are met, including management, having the authority to approve the action, commits to a plan to sell the entity, the major current assets, other assets, current liabilities, and noncurrent liabilities shall be reported as components of total assets and liabilities separate from those balances of the continuing operations. At the same time, the results of all discontinued operations, less applicable income taxes (benefit), shall be reported as components of net income (loss) separate from the net income (loss) of continuing operations in accordance with ASC 205-20-45.

As of June 30, 2018, the Company’s microcredit service segment met all the conditions required in order to be classified as a discontinued operation (Note 1). Accordingly, the operating results of microcredit service segment are reported as a gain from discontinued operations in the accompanying consolidated financial statements for all periods presented. In addition, the assets and liabilities related to our microcredit service segment are reported as assets and liabilities of discontinued operations in the accompanying consolidated balance sheets at June 30, 2017. For additional information, see Note 6, “Disposition of CCC BVI”.

| (q) | Segment reporting |

Our business had been organized into two reportable operating segments: (i) our microcredit service segment, and (ii) our luxury car leasing segment. However, due to changes in our organizational structure associated with the microcredit service segment as a discontinued operation (Note 2(m)), management has determined that the Company now operates in one operating segment with one reporting segment. The accounting policies of our one reportable segment are the same as those described in this Note 2.

12

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 3. | LIQUIDITY |

In assessing the Company’s liquidity and its ability to continue as a going concern, the Company monitors and analyzes its cash and cash equivalent and its ability to generate sufficient cash flow in the future to support its operating and capital expenditure commitments. The Company’s liquidity needs are to meet its working capital requirements and operating expenses obligations.

Since the Company disposed its microcredit business and launched luxurious car leasing business in May 2018. As of June 30, 2018, the Company had cash balance of $1,362,718 and a positive working capital of $2,256,714. The management estimated the operating expenses obligation for the next twelve months after issuance of the financial statements to be $500,000. Therefore, the management believes that the Company will continue as a going concern in the following 12 months. In addition, the Company’s shareholders will continuously provide financial support to the Company when there is any business expansion plan.

| 4. | VARIABLE INTEREST ENTITIES AND OTHER CONSOLIDATION MATTERS |

As of June 30, 2018, the Company had two VIEs.

The following financial statement amounts and balances of the VIEs were included in the unaudited condensed consolidated financial statements as of June 30, 2018 and December 31, 2017 and for the six and three months ended June 30, 2018 and 2017:

| June 30, 2018 | December 31, | |||||||

| (unaudited) | ||||||||

| Total assets | $ | 3,438,252 | $ | - | ||||

| Total liabilities | $ | 3,280,617 | $ | - | ||||

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Revenue | $ | 97,036 | $ | - | $ | 97,036 | $ | - | ||||||||

| Net income | $ | 8,007 | $ | - | $ | 8,007 | $ | - | ||||||||

13

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 5. | RISKS |

| (a) | Credit risk |

Assets that potentially subject the Company to significant concentration of credit risk primarily consist of cash and cash equivalents. The maximum exposure of such assets to credit risk is their carrying amount as at the balance sheet dates. As June 30, 2018, approximately $709,767 was deposited with a bank in the United States which was insured by the government up to $250,000. At June 30, 2018 and December 31, 2017, approximately $652,951 and $nil, respectively, were primarily deposited in financial institutions located in Mainland China, which were uninsured by the government authority. To limit exposure to credit risk relating to deposits, the Company primarily place cash deposits with large financial institutions in China which management believes are of high credit quality.

The Company’s operations are carried out in Mainland China. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC as well as by the general state of the PRC’s economy. In addition, the Company’s business may be influenced by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, rates and methods of taxation, and the extraction of mining resources, among other factors.

| (b) | Liquidity risk |

The Company is also exposed to liquidity risk which is risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, the Company will turn to other financial institutions and the owners to obtain short-term funding to meet the liquidity shortage.

| (c) | Foreign currency risk |

Substantially all of the Company’s operating activities and the Company’s major assets and liabilities are denominated in RMB, except for the cash deposit of approximately $709,767 which was in U.S. dollars at June 30, 2018, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the Peoples’ Bank of China (“PBOC”) or other authorized financial institutions at exchange rates quoted by PBOC. Approval of foreign currency payments by the PBOC or other regulatory institutions requires submitting a payment application form together with suppliers’ invoices and signed contracts. The value of RMB is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market. Where there is a significant change in value of RMB, the gains and losses resulting from translation of financial statements of a foreign subsidiary will be significant affected.

| (d) | VIE risk |

It is possible that the VIE Agreements among Beijing Youjiao, Hao Limo, and the Beijing Youjiao Shareholder would not be enforceable in China if PRC government authorities or courts were to find that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event that the Company were unable to enforce these contractual arrangements, the Company would not be able to exert effective control over the VIE. Consequently, the VIE’s results of operations, assets and liabilities would not be included in the Company’s consolidated financial statements. If such were the case, the Company’s cash flows, financial position, and operating performance would be materially adversely affected. The Company’s contractual arrangements with Beijing Youjiao, Hao Limo, and the Beijing Youjiao Shareholder are approved and in place. Management believes that such contracts are enforceable, and considers the possibility remote that PRC regulatory authorities with jurisdiction over the Company’s operations and contractual relationships would find the contracts to be unenforceable.

This is the same case for the VIE Agreements among Beijing Tianxing, Hao Limo and the Beijing Tianxing Shareholders.

The Company’s operations and businesses rely on the operations and businesses of its two VIEs, which holds certain recognized revenue-producing assets including the luxury used cars. The VIE also has an assembled workforce, focused primarily on promotion and marketing, whose costs are expensed as incurred. The Company’s operations and businesses may be adversely impacted if the Company loses the ability to use and enjoy assets held by its VIEs.

14

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 6. | DISPOSITION OF CCC BVI |

On June 19, 2018, the Company, HK Xu Ding Co., Limited, a private limited company duly organized under the laws of Hong Kong (the “Purchaser”) and CCCR International Investment Ltd., a business company incorporated in the British Virgin Islands with limited liability (“CCC BVI”) entered into certain Share Purchase Agreement (the “Purchase Agreement”). Pursuant to the Purchase Agreement, the Purchaser agreed to purchase CCC BVI in exchange of cash purchase price of $500,000. The consideration was paid as of June 30, 2018.

CCC BVI is the sole shareholder of CCC International Investment Ltd. (“CCC HK”), a company incorporated under the laws of the Hong Kong S.A.R. of the PRC, which is the sole shareholder of WFOE. WFOE, via a series of contractual arrangements, controls Wujiang Luxiang. CCC HK is the sole shareholder of PFL. Upon the Disposition, the Purchaser will become the sole shareholder of CCC BVI and as a result, assume all assets and obligations of all the subsidiaries and VIE entities owned or controlled by CCC BVI.

On June 17, 2018, management was authorized to approve and commit to a plan to sell CCC BVI, therefore the major assets and liabilities relevant to the disposal are reported as components of total assets and liabilities separate from those balances of the continuing operations. At the same time, the results of all discontinued operations, less applicable income taxes, are reported as components of net income (loss) separate from the net loss of continuing operations in accordance with ASC 205-20-45. The assets relevant to the sale of CCC BVI with a carrying value of $6.2 million were classified as assets held for sale as of June 19, 2018. The liabilities relevant to the sale of CCC BVI with a carrying value of $10.5 million were classified as liabilities held for sale as of June 19, 2018. A net gain of $9.8 million was recognized as the net gain from disposal of discontinued operation in 2018.

In accordance with ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, a disposal of a component of an entity or a group of components of an entity is required to be reported as discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results when the components of an entity meets the criteria in paragraph 205-20-45-1E to be classified as held for sale. When all of the criteria to be classified as held for sale are met, including management, having the authority to approve the action, commits to a plan to sell the entity, the major current assets, other assets, current liabilities, and noncurrent liabilities shall be reported as components of total assets and liabilities separate from those balances of the continuing operations. At the same time, the results of all discontinued operations, less applicable income taxes (benefit), shall be reported as components of net income (loss) separate from the net income (loss) of continuing operations in accordance with ASC 205-20-45.

Reconciliation of the carrying amounts of assets and liabilities of discontinued operations in the unaudited condensed consolidated balance sheet.

| June 30, 2018 | December 31, 2017 | |||||||

| (unaudited) | ||||||||

| Carrying amounts of assets of discontinued operations : | ||||||||

| Cash | $ | - | $ | 1,138,564 | ||||

| Loan receivable, net | - | 4,064,921 | ||||||

| Interest receivable | - | 35,440 | ||||||

| Other assets | - | 566,729 | ||||||

| Total assets of discontinued operations | $ | - | $ | 5,805,654 | ||||

| Carrying amounts of liabilities of discontinued operations: | ||||||||

| Deposit payable | $ | - | $ | 261,281 | ||||

| Accrual for financial guarantee services | - | 9,270,882 | ||||||

| Other current liabilities | - | 166,440 | ||||||

| Due to related parties | - | 398,073 | ||||||

| Income tax payable | - | 330,095 | ||||||

| Liabilities of discontinued operations | $ | - | 10,426,771 | |||||

Reconciliation of the amounts of major classes of income from discontinued operations in the consolidated statements of operations and comprehensive income (loss).

| For the six months ended June 30 | ||||||||

| 2018 | 2017 | |||||||

| (unaudited) | (unaudited) | |||||||

| Operations discontinued | ||||||||

| Total interest and fees income | $ | 106,985 | $ | 130,641 | ||||

| Reversal of provision (Provision) for loan losses | 417,600 | (2,920,981 | ) | |||||

| (Provision) Reversal of provision for financial guarantee services | (104,229 | ) | 312,667 | |||||

| Non-interest expenses | (142,600 | ) | (195,629 | ) | ||||

| Net gain from discontinued operations | 9,794,873 | - | ||||||

| Net income from discontinued operations | $ | 10,072,629 | $ | 2,673,302 | ||||

15

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 7. | OTHER CURRENT ASSETS |

| June 30, 2018 | December 31, 2017 | |||||||

| (unaudited) | ||||||||

| Petty cash advanced for purchase of operating lease assets | $ | 909,242 | $ | - | ||||

As of June 30, 2018, the balance of other receivables represents the amount advanced to the Company’s management and staff for purchase of used luxurious cars.

| 8. | OPERATING LEASE ASSETS, NET |

The Company started its used luxurious car leasing business in China since May 2018.

As of the June 30, 2018, the Company had investments in six used luxurious cars. Among the six used luxurious cars, three of them have not completed registration as of June 30, 2018. The balance of the used luxurious cars is comprised of the following:

| Useful life | June 30, 2018 | December 31, 2017 | ||||||||

| (years) | (unaudited) | |||||||||

| Used luxurious cars | 9 | $ | 1,882,967 | $ | - | |||||

| Less: accumulated depreciation | (11,984 | ) | - | |||||||

| Operating lease asset, net | $ | 1,870,983 | $ | - | ||||||

During the three and six months ended June 30, 2018, the Company incurred depreciation expenses on these cars of $12,458. No impairment was recognized in the six months ended June 30, 2018.

Since July 16, 2018, one of the luxurious cars was pledged for a three-month period.

| 9. | OTHER NONCURRENT LIABILITIES |

| June 30, 2018 | December 31, 2017 | |||||||

| (unaudited) | ||||||||

| Accrued provision for share settlement against legal proceedings | $ | - | $ | 1,311,000 | ||||

| $ | - | $ | 1,311,000 | |||||

On November 22, 2016, the Company entered into a Stipulation and Agreement of Settlement (the “Stipulation”) to settle the Securities Class Action. The Stipulation resolves the claims asserted against the Company and certain of its current and former officers and directors in the Securities Class Action without any admission or concession of wrongdoing or liability by the Company or the other defendants. The Stipulation also provides, among other things, a settlement payment by the Company of $245,000 in cash and the issuance of 950,000 shares of its common stock (the “Settlement Shares”) to the plaintiff’s counsel and class members. The terms of the Stipulation were subject to approval by the Court following notice to all class members. The issuance of the Settlement Shares are exempt from registration pursuant to Section 3(a)(10) of the Securities Act of 1933, as amended. A fairness hearing was held on May 30, 2017, and the Court approved the settlement.

On June 1, 2017, following a final fairness hearing on May 30, 2017 regarding the proposed settlement, the Court entered a final judgment and order that: (i) dismisses with prejudice the claims asserted in the Securities Class Action against all named defendants in connection with the Securities Class Action, including the Company, and releases any claims that were or could have been asserted that arise from or relate to the facts alleged in the Securities Class Action, such that every member of the settlement class will be barred from asserting such claims in the future; and (ii) approves the payment of $245,000 in cash and the issuance of 950,000 shares of its common stock to members of the settlement class.

On July 28, 2017, the Court amended the order that 1) Attorney’s Fees, Litigation Expenses, and Incentive Awards be paid out of the Settlement Fund; and 2) Levi& Korsinsky be awarded attorney’s fees in the amount of $55,000 in cash and 237,500 shares (Plaintiff Attorney Fee Shares). Thus, cash to be paid to the class shall be $190,000 (“Class Settlement Cash”) and shares to be issued to the class shall be 712,500 (“Class Settlement Shares”).

16

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 9. | OTHER NONCURRENT LIABILITIES (CONTINUED) |

The $245,000 cash portion was settled in December 2017.

On December 22, 2017, the Court entered a distribution order approving the distribution of the Settlement Shares to the class plaintiffs. The settlement has been finalized, and that thereafter there are no remaining claims outstanding as against the Company with respect to this litigation. On January 19, 2018 and April 10, 2018, the Company issued 712,500 and 237,500 class settlement shares, at the market share price of $1.68 and $1.18 per share, respectively.

The Company recorded expenses of $166,540 and $19,000 for the six and three months ended June 30, 2018 under the account of “Changes in fair value of noncurrent liabilities”. As the Company is a public entity with quoted market price, the fair value of other noncurrent liabilities were classified as level 1. The expenses were accrued by reference to the quoted market share price per share on each reporting date. The movement of the other noncurrent liabilities during the three and six months ended June 30, 2018 was as follows:

For the three months ended June 30, 2018:

| Number of Shares unsettled | Share price | Other noncurrent liabilities | ||||||||||

| (unaudited) | ||||||||||||

| As of March 31, 2018 | 237,500 | $ | 1.10 | $ | 261,540 | |||||||

| Class action settlement expenses – changes in fair value of stock portion | 19,000 | |||||||||||

| Share settlement | (237,500 | ) | $ | 1.18 | (280,540 | ) | ||||||

| As of June 30, 2018 | - | $ | - | |||||||||

For the six months ended June 30, 2018:

| Number of Shares unsettled | Share price | Other noncurrent liabilities | ||||||||||

| (unaudited) | ||||||||||||

| As of December 31, 2017 | 950,000 | $ | 1.38 | $ | 1,311,000 | |||||||

| Class action settlement expenses – changes in fair value of stock portion | 166,540 | |||||||||||

| Share settlement of 712,500 shares | (712,500 | ) | $ | 1.68 | (1,197,000 | ) | ||||||

| Share settlement of 237,500 shares | (237,500 | ) | $ | 1.18 | (280,540 | ) | ||||||

| As of June 30, 2018 | - | $ | - | |||||||||

| 10. | OTHER OPERATING EXPENSE |

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Depreciation and amortization | $ | 98 | $ | - | $ | 98 | $ | - | ||||||||

| Travel expenses | 30,108 | 13,544 | 61,484 | 13,544 | ||||||||||||

| Entertainment expenses | 582 | - | 582 | - | ||||||||||||

| Promotion expenses | 15,943 | - | 15,943 | - | ||||||||||||

| Legal and consulting expenses | 158,874 | 777,107 | 362,434 | 868,000 | ||||||||||||

| Car expenses | 18,766 | - | 18,766 | - | ||||||||||||

| Bank charges | 510 | 370 | 945 | 690 | ||||||||||||

| Audit-related expense | 18,390 | 25,705 | 38,990 | 97,486 | ||||||||||||

| Other tax expenses | 44,369 | - | 44,369 | - | ||||||||||||

| Other expenses | 38,406 | 40,531 | 63,531 | 90,446 | ||||||||||||

| Total | $ | 326,046 | $ | 857,257 | $ | 607,141 | $ | 1,070,166 | ||||||||

17

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 11. | CAPITAL TRANSACTION |

Common Stock

The Company is authorized to issue up to 100,000,000 shares of Common Stock.

On December 1, 2017, the Company has entered into a securities purchase agreement with Mr. Yang Jie, a significant shareholder and Vice President of Finance of the Company and Mr. Long Yi, the Chief Financial Officer of the Company to sell 150,000 and 50,000 common shares, respectively, at a per share price of US$3.5, in the total amount of US$525,000 and US$175,000, respectively. On February 20, 2018, the Company issued 50,000 shares of common stocks and warrants to purchase 20,000 shares of common stocks at $4.20 to Mr. Long Yi. As of June 30, 2018, the 150,000 shares of common stocks and related warrants unissued to Mr. Yang Jie.

On January 19, 2018 and April 10, 2018, the Company issued 712,500 and 237,500 shares common stocks as the share settlement of 950,000 shares, respectively, as disclosed in Note 9.

During the three months ended June 30, 2018, the Company raised an aggregation of $3,265,370 from several private placements by issuing 4,194,697 shares of common stock, par value $0.001 per share, at the per share purchase price of $0.77 or $0.78. The shares of common stocks were issued to certain “non-U.S. Persons” as defined in Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to the securities purchase agreement (“SPA”) dated April 28, 2018, May 29, 2018 and June 19, 2018, respectively. The details of the issuance of shares of common stock in the private placements are as follows:

| Number of shares issued | Per share purchase price | Capital raised | ||||||||||

| April 11, 2018 | 649,350 | 0.77 | 500,000 | |||||||||

| May 10, 2018 | 1,336,314 | 0.78 | 1,042,324 | |||||||||

| May 29, 2018 | 658,000 | 0.78 | 513,240 | |||||||||

| May 29, 2018 | 982,996 | 0.78 | 766,737 | |||||||||

| June 19, 2018 | 568,037 | 0.78 | 443,069 | |||||||||

| 4,194,697 | 3,265,370 | |||||||||||

As of June 30, 2018, there were 24,445,612 shares of Common Stock issued and outstanding.

Warrants

As of December 31, 2017, the Company had outstanding warrants to purchase 193,370 shares with aggregation of fair value of $186,268.

On February 20, 2018, the Company issued warrants to purchase 20,000 shares to Mr. Long Yi, as part of the private placements mentioned above. The warrant has an exercise price of $4.2 per share and is exercisable on the date of issuance and expire five years from the date of issuance. The fair value of the warrants aggregated $24,662, estimated by using the Black-Scholes valuation model. As of June 30, 2018, the Company had outstanding warrants to purchase 213,370 shares with fair value of $210,930.

The balance of warrants as of June 30, 2018 and December 31, 2017 is comprised of the followings:

| June 30, 2018 | December 31, 2017 | |||||||||||||||

| Number of warrants | Fair value of warrants | Number of warrants | Fair value of warrants | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Yang Jie | 158,370 | $ | 152,553 | 158,370 | $ | 152,553 | ||||||||||

| Long Yi | 55,000 | 58,377 | 35,000 | 33,715 | ||||||||||||

| 213,370 | $ | 210,930 | 193,370 | $ | 186,268 | |||||||||||

18

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 11. | CAPITAL TRANSACTION (CONTINUED) |

As of June 30, 2018 and December 31, 2017, the Company had authorized but unissued stocks and warrants as followings:

| June 30, 2018 | December 31, 2017 | |||||||||||||||||||||||

| Number of stocks | Number of warrants | Subscription fee advanced from a shareholder | Number of stocks | Number of warrants | Subscription fee advanced from shareholders | |||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||

| Yang Jie | 150,000 | * | 60,000 | $ | 524,974 | 150,000 | 60,000 | $ | 524,974 | |||||||||||||||

| Long Yi | - | - | - | 50,000 | 20,000 | 175,000 | ||||||||||||||||||

| 150,000 | 60,000 | $ | 524,974 | 200,000 | 80,000 | $ | 699,974 | |||||||||||||||||

*The 150,000 shares of common stock were issued to Yang Jie in July 2018.

| 12. | INCOME (LOSS) PER COMMON SHARE |

The following table sets forth the computation of basic and diluted earnings per common share for the three and six months ended June 30, 2018 and 2017, respectively:

| For the three months ended June 30, | For the six months ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Net income (loss) | $ | 9,503,268 | $ | (4,918,375 | ) | $ | 9,117,370 | $ | (6,146,452 | ) | ||||||

| Weighted Average Shares Outstanding-Basic and Diluted | 22,211,600 | 17,308,319 | 21,080,665 | 17,004,613 | ||||||||||||

| Income (loss) per share- basic and diluted | $ | 0.428 | $ | (0.284 | ) | $ | 0.432 | $ | (0.361 | ) | ||||||

| Net loss per share from continuing operations – basic and diluted | $ | (0.018 | ) | $ | (0.176 | ) | $ | (0.045 | ) | $ | (0.204 | ) | ||||

| Net income (loss) per share from discontinued operations – basic and diluted | $ | 0.446 | $ | (0.108 | ) | $ | 0.478 | $ | (0.157 | ) | ||||||

Basic income (loss) per share is computed by dividing the net loss by the weighted average number of common shares outstanding during the period. Diluted income (loss) per share is the same as basic income (loss) per share due to the lack of dilutive items in the Company for the three and six months ended June 30, 2018 and 2017. The number of warrants is excluded from the computation as the anti-dilutive effect.

| 13. | INCOME TAXES |

Effective January 1, 2008, the New Taxation Law of PRC stipulates that domestic enterprises and foreign invested enterprises (the “FIEs”) are subject to a uniform tax rate of 25%. Under the PRC tax law, companies are required to make quarterly estimate payments based on 25% tax rate; companies that received preferential tax rates are also required to use a 25% tax rate for their installment tax payments. The overpayment, however, will not be refunded and can only be used to offset future tax liabilities.

The Company evaluates the level of authority for each uncertain tax position (including the potential application of interest and penalties) based on the technical merits, and measures the unrecognized benefits associated with the tax positions. For the three and six months ended June 30, 2018 and 2017, the Company had no unrecognized tax benefits. Due to uncertainties surrounding future utilization, the Company estimates there will not be sufficient future income to realize the deferred tax assets. The Company maintains a full valuation allowance on its net deferred tax assets as of June 30, 2018.

The Company does not anticipate any significant increase to its liability for unrecognized tax benefit within the next 12 months. The Company will classify interest and penalties related to income tax matters, if any, in income tax expense.

The Company does not have any current and deferred tax expenses for the three and six months ended June 30, 2018 and 2017.

The Company accounts for uncertainty in income taxes using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more than 50% likely of being realized upon settlement. Interest and penalties related to uncertain tax positions are recognized and recorded as necessary in the provision for income taxes. The Company is subject to income taxes in the PRC. According to the PRC Tax Administration and Collection Law, the statute of limitations is three years if the underpayment of taxes is due to computational errors made by the taxpayer or the withholding agent. The statute of limitations is extended to five years under special circumstances, where the underpayment of taxes is more than RMB 100,000. In the case of transfer pricing issues, the statute of limitation is ten years. There is no statute of limitation in the case of tax evasion. There were no uncertain tax positions as of June 30, 2018 and December 31, 2017 and the Company does not believe that its unrecognized tax benefits will change over the next twelve months.

19

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 AND 2017

| 14. | RELATED PARTY TRANSACTIONS AND BALANCES |

During the three months ended June 30, 2018 and 2017, the Company did not identify significant related party transactions.

| 15. | COMMITMENTS AND CONTINGENCIES |

| 1) | Lease Commitments |

We leased certain office space in New York, NY where we paid a monthly rent of US$3,600 during 2018. In addition, during the three months ended June 30, 2018, we entered into a rental free office lease agreement with a third party. The following table sets forth the Company’s contractual obligations as of June 30, 2018 in future periods:

| Rental payments | ||||

| Year ending June 30, 2019 | $ | 14,400 | ||

| Year ending June 30, 2020 | - | |||

| Total | $ | 14,400 | ||

| 2) | Contingencies |

| a) | 2014 Class Action litigation |

On August 6, 2014, a purported shareholder Andrew Dennison filed a putative class action complaint in the United States District Court District of New Jersey (the “N.J. district court”) relating to a July 25, 2014 press release about the Company’s progress in recovering a significant portion of the $5.4 million the Company paid in the first quarter of 2014 on behalf of loan guarantee customers. The action, Andrew Dennison v. China Commercial Credit, Inc., et al., Case No. 2:2014-cv-04956, alleges that the Company and its current and former officers and directors Huichun Qin, Long Yi, Jianming Yin, Jinggen Ling, Xiangdong Xiao, and John F. Levy violated the federal securities laws by misrepresenting in prior public filings certain material facts about the risks associated with its loan guarantee business. On October 2, 2014, purported shareholders Zhang Yun and Sanjiv Mehrotra (the “Yun Group”) asserted substantially similar claims against the same defendants in a putative class action captioned Zhang Yun v. China Commercial Credit, Inc., et al., Case No. 2:14-cv-06136 (D. N.J.). Neither complaint states the amount of damages sought.

On or about October 6, 2014, Dennison, the Yun Group and another purported shareholder, Jason Stark, filed motions to consolidate the cases, be appointed as lead plaintiff and to have their respective counsel appointed as lead counsel. On October 31, 2014, the N.J. district court entered an order consolidating the cases under the caption “In re China Commercial Credit Inc. Securities Litigation” and appointing the Yun Group as lead plaintiff (“Class Plaintiff”) and the Yun Group’s counsel as lead counsel.