Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OptiNose, Inc. | q218earningsrelease.htm |

| 8-K - 8-K - OptiNose, Inc. | a8-kq218earningsrelease.htm |

Exhibit 99.2 Building a Leading ENT / Allergy Specialty Company Corporate Presentation A u g u s t 1 4 , 2 0 1 8

Forward Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: potential benefits of XHANCE®, the Xperience program and other patient support programs; market access objectives; potential effects of INS market seasonality and XHANCE sampling on XHANCE prescriptions, market opportunities; commercial strategies; the initiation and timing of clinical trials for chronic sinusitis; projected operating expenses and other statements regarding our future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: physician and patient acceptance of XHANCE; our ability to obtain adequate third-party reimbursement for XHANCE (market access); our ability to successfully commercialize XHANCE without the support provided by the Xperience program; uncertainties and delays relating to the initiation, completion and results of clinical trials; market opportunities for XHANCE may be smaller than we believe; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise. This presentation and our accompanying remarks also contain estimates, projections, market research and other data generated by independent third parties and by us concerning our industry, XHANCE, brand awareness, market access, the estimated size of markets, the prevalence of certain medical conditions and the perceptions and preferences of patients and physicians. Information that is based on estimates, projections, market research or similar methodologies is inherently subject to uncertainties and actual events and circumstances may differ materially from events and circumstances reflected in this information. You are cautioned not to give undue weight to such information. 2

Recent Key Accomplishments Executed contracts with two of the Publication of NAVIGATE II largest PBMs and EXHANCE-12 studies in in the US Peer-Reviewed Journals Physician Adoption Completed successful in ENT / Allergy $60M public offering Total Trialists in June 2018 CS trial design reviewed in meeting with FDA OPTINOSE® and XHANCE® are trademarks of OptiNose AS in the United States. All other trademarks appearing in this document are the property of their respective owners. OptiNose do not intend its use or display of other companies’ trademarks to 3 imply a relationship with, or endorsement or sponsorship of OptiNose by, any other companies.

High Awareness Generated Rapid Trials of XHANCE Pre-Launch (1Q 2018) Early Launch (2Q 2018) Jan Feb Mar Apr May Jun DIGITAL, SOCIAL AND NON-PERSONAL PROMOTION Corporate Campaign CLINICAL NURSE EDUCATORS 87% Awareness Device + Deposition OPTINOSE SALES FORCE XPERIENCE 4

Encouraging Feedback From Xperience Patient Survey Patient Responses Prior to Month 2 Refill Total Prior User of Prior User Respondents Flonase / Nasonex Budesonide Rinse (N=2,733) (n=820) (N=175) Patient Satisfaction 89% 90% 90% Experience Symptom Improvement 80% 79% 68% Prefer XHANCE 77% 82% 83% Recommend XHANCE to a Friend 92% 91% 87% Use without Difficulty 95% 95% 94% Note: in the same period that the 2,733 responses were received 402 patients declined 5 the opportunity to respond to the survey to receive a second prescription for a $0 co-pay.

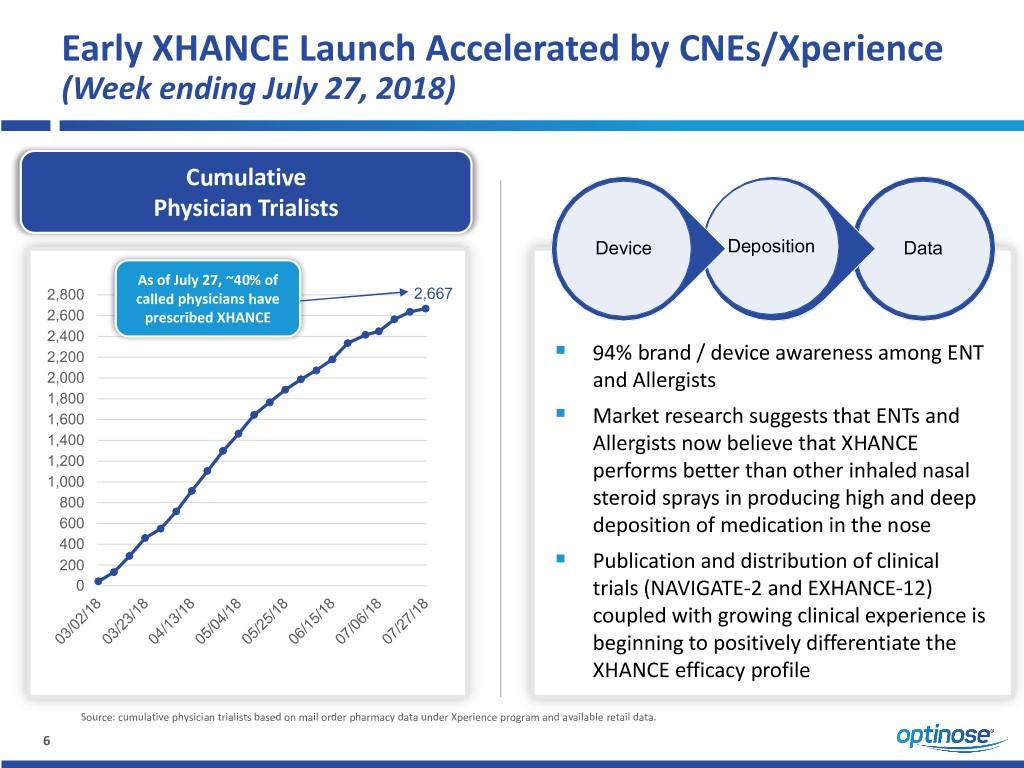

Early XHANCE Launch Accelerated by CNEs/Xperience (Week ending July 27, 2018) Cumulative Physician Trialists Device Deposition Data As of July 27, ~40% of 2,800 called physicians have 2,667 2,600 prescribed XHANCE 2,400 ▪ 2,200 94% brand / device awareness among ENT 2,000 and Allergists 1,800 ▪ 1,600 Market research suggests that ENTs and 1,400 Allergists now believe that XHANCE 1,200 1,000 performs better than other inhaled nasal 800 steroid sprays in producing high and deep 600 deposition of medication in the nose 400 ▪ 200 Publication and distribution of clinical 0 trials (NAVIGATE-2 and EXHANCE-12) coupled with growing clinical experience is beginning to positively differentiate the XHANCE efficacy profile Source: cumulative physician trialists based on mail order pharmacy data under Xperience program and available retail data. 6

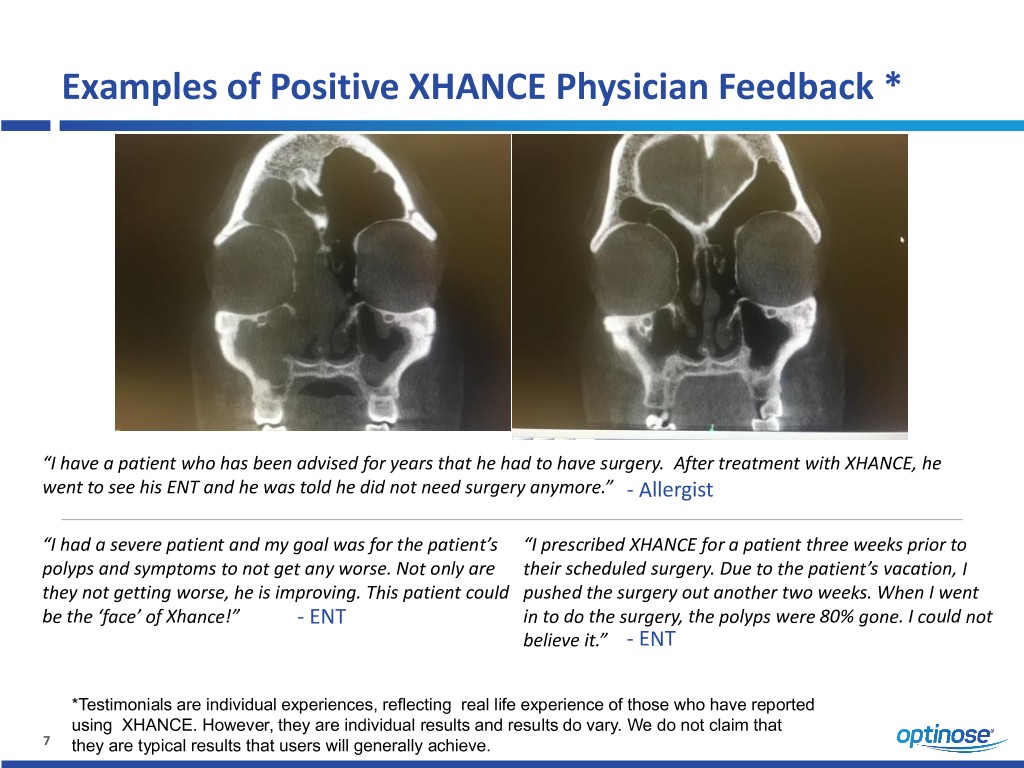

Examples of Positive XHANCE Physician Feedback * “I have a patient who has been advised for years that he had to have surgery. After treatment with XHANCE, he went to see his ENT and he was told he did not need surgery anymore.” - Allergist “I had a severe patient and my goal was for the patient’s “I prescribed XHANCE for a patient three weeks prior to polyps and symptoms to not get any worse. Not only are their scheduled surgery. Due to the patient’s vacation, I they not getting worse, he is improving. This patient could pushed the surgery out another two weeks. When I went be the ‘face’ of Xhance!” - ENT in to do the surgery, the polyps were 80% gone. I could not believe it.” - ENT *Testimonials are individual experiences, reflecting real life experience of those who have reported using XHANCE. However, they are individual results and results do vary. We do not claim that 7 they are typical results that users will generally achieve.

XHANCE Commercial Market Access XHANCE Overall Access: July 2018 • Nationally, we believe 76% of commercial lives are currently in a plan where XHANCE is covered. 24% • We continue to focus on access with minimized hassle for 76% prescribers and patients. • We are working towards achieving “limited hassle” access Access Key to XHANCE for 75% of NDC Blocked / Not Covered commercial lives by year end Covered (Single step edit, double step edit, PA or better) 2018. Source: Third party syndicated data and internal analyses as of July 2018. Coverage is subject to change. 8

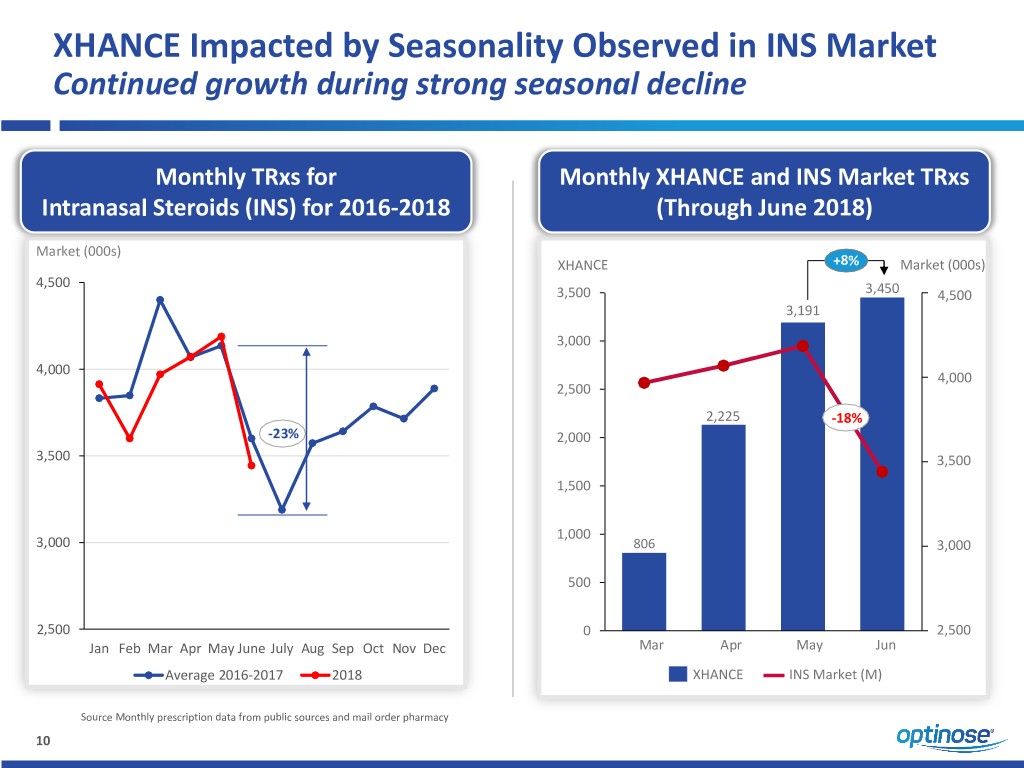

Key Observations From the Initial Months of Launch ▪ Our Clinical Nurse Educator initiative helped drive high awareness levels and created “pent up demand” prior to launch ▪ The Xperience program was effective at lowering barriers to pull- through of “pent up demand” and in helping drive initial trial of XHANCE ▪ After Xperience ended, traditional launch sampling greatly increased: physicians continue to want a vehicle for trial that is low/no cost to patient ▪ The XHANCE market, particularly during launch, appears to be subject to some seasonality, which may or may not be as much as the overall INS market ▪ Recent market research indicates that the target audience now perceives XHANCE as differentiated from inhaled nasal steroids on “Device” and “Deposition” – can now shift communication emphasis to appreciation for “Efficacy” ▪ Physicians may initially perceive market access as worse than it really is: negative prior perceptions of market access for the category must be overcome. 9

XHANCE Impacted by Seasonality Observed in INS Market Continued growth during strong seasonal decline Monthly TRxs for Monthly XHANCE and INS Market TRxs Intranasal Steroids (INS) for 2016-2018 (Through June 2018) Market (000s) XHANCE +8% Market (000s) 4,500 3,500 3,450 4,500 3,191 3,000 4,000 4,000 2,500 2,225 -18% -23% 2,000 3,500 3,500 1,500 1,000 3,000 806 3,000 500 2,500 0 2,500 Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec Mar Apr May Jun Average 2016-2017 2018 XHANCE INS Market (M) Source Monthly prescription data from public sources and mail order pharmacy 10

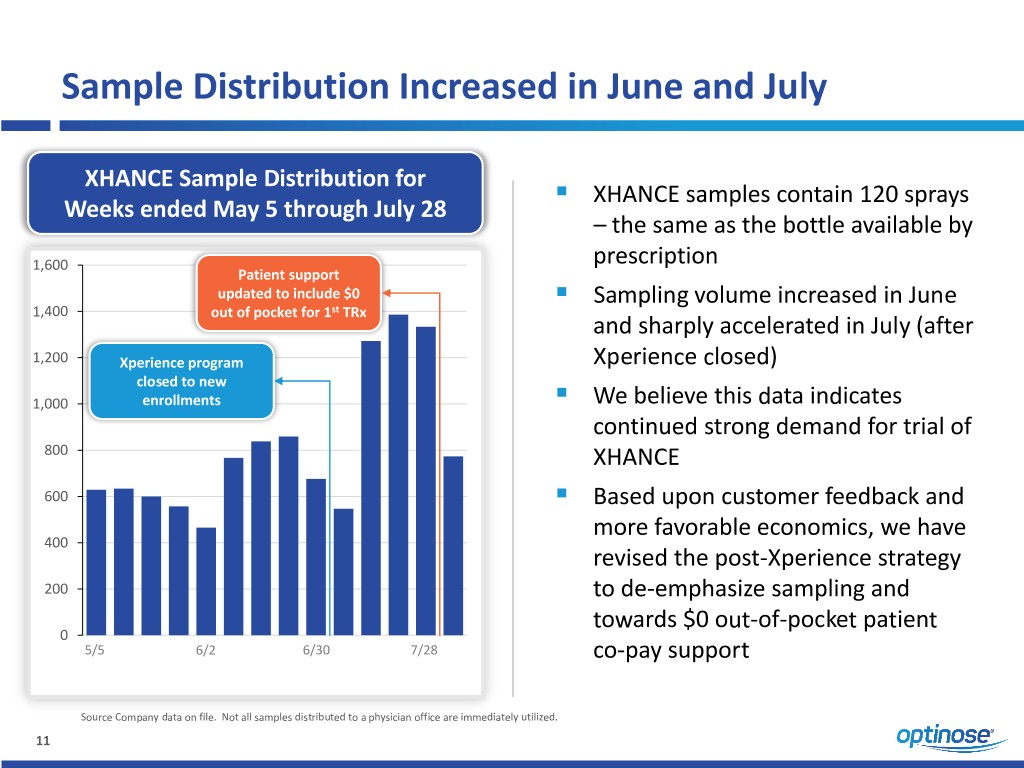

Sample Distribution Increased in June and July XHANCE Sample Distribution for ▪ XHANCE samples contain 120 sprays Weeks ended May 5 through July 28 – the same as the bottle available by 1,600 prescription Patient support ▪ updated to include $0 Sampling volume increased in June 1,400 out of pocket for 1st TRx and sharply accelerated in July (after 1,200 Xperience program Xperience closed) closed to new ▪ 1,000 enrollments We believe this data indicates continued strong demand for trial of 800 XHANCE ▪ 600 Based upon customer feedback and more favorable economics, we have 400 revised the post-Xperience strategy 200 to de-emphasize sampling and towards $0 out-of-pocket patient 0 5/5 6/2 6/30 7/28 co-pay support Source Company data on file. Not all samples distributed to a physician office are immediately utilized. 11

XHANCE and INS Market Weekly TRx Demand in July Includes Xperience Program and Retail Data XHANCE July Weekly TRX Demand ▪ (Through July 27, 2018) Total samples distributed in the last 3 weeks of July increased by XHANCE Market (M) ~2,000 relative to an average 3 1,000 800 weeks from May and June 900 700 ▪ 800 Average weekly XHANCE TRx 749 712 600 reported in July decreased slightly 700 664 639 500 600 more than the average weekly INS 500 400 market TRx. - XHANCE samples do not appear 400 300 as TRx 300 200 ▪ st 200 Following the 1 week of July 100 100 XHANCE resumed week over 0 0 week growth 7/6/2018 7/13/2018 7/20/2018 7/27/2018 XHANCE Market (M) Source Monthly prescription data from public sources and mail order pharmacy 12

Second Half 2018 Business Priorities ▪ Continue to leverage rich data sets to maintain balance of discipline and flexibility in commercial execution ▪ Shift communication emphasis toward Xhance efficacy during calls with physicians and their staff - Promote additional registration data (eg, SNOT-22, PGIC) - Distribute NAVIGATE-2 and XHANCE-12 publications ▪ To accelerate clinical experience that creates differentiation and preference, we will reduce and communicate to physicians the low barriers to trial and ongoing usage - $0 patient co-pay for first prescription; low co-pays for refills - Expanded specialty pharmacy network ▪ Continue to work to increase coverage and to reduce hassles that create barriers to adoption in physician offices ▪ Prepare for start of the Chronic Sinusitis clinical program 13

Financial Review – Second Quarter 2018 Q2 2018 Revenues and Average Selling Price (ASP) ▪ ($ 000’s) As planned, most units of XHANCE were $1,274 sold through the Xperience program in Q2 - As a reminder, Q1 revenues were primarily the result of building wholesale inventory $865 for the April 2018 retail launch of XHANCE ▪ We estimate higher gross to net deductions for sales of XHANCE through Xperience than through retail ▪ We believe the Xperience program has helped to accelerate demand in the early phase of launch ▪ As a result of this program, ASP in Q2 was Q1 2018 Q2 2018 significantly less than in Q1 14

Financial Review – Third Quarter and Full Year 2018 Q3 and Full Year 2018 Perspectives ▪ Operating Expenses now expected in the range from $117M to $121M for the full year of 2018 - Prior range was $119M to $125M ▪ We expect Q3 ASP to be similar to Q2 ASP due to the following factors: - A substantial number of patients remain eligible for a second prescription through the Xperience program - We expect our revised patient assistance program, in which eligible patients can receive a first prescription with $0 out-of-pocket and low subsequent co-pays, to apply to a large number of new XHANCE patients ▪ Retail volumes have been sufficient to drive consistent reordering by all of our Wholesale customers ▪ We have observed an average refill cycle of approaching 6 weeks for patients in the Xperience program 15

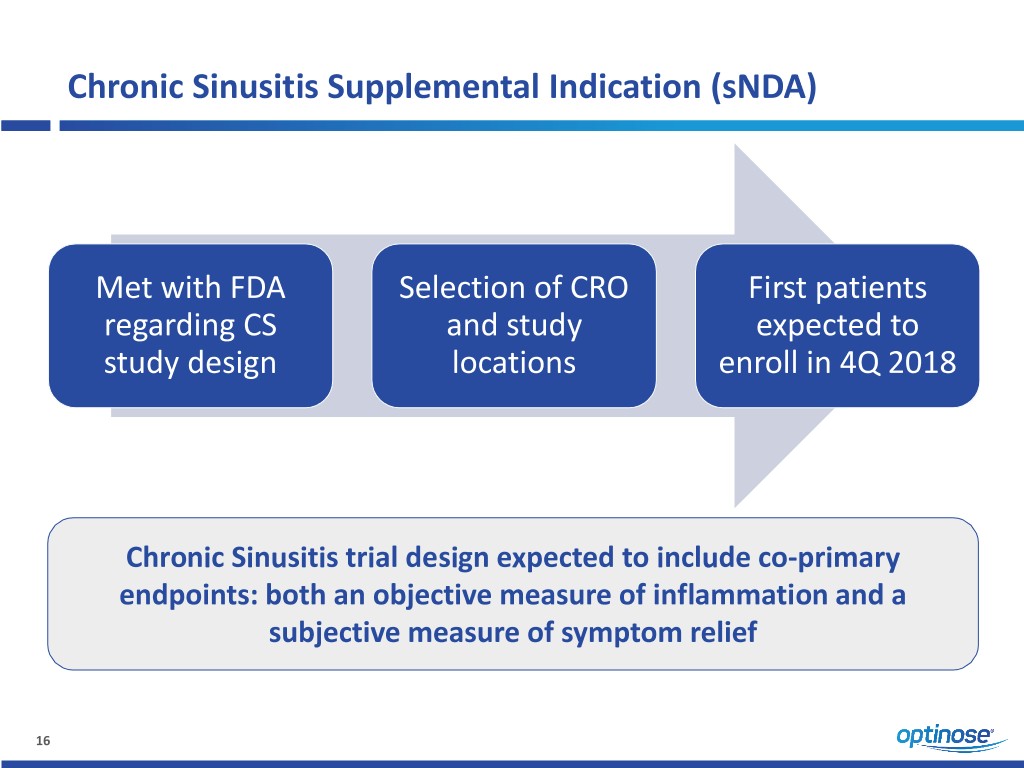

Chronic Sinusitis Supplemental Indication (sNDA) Met with FDA Selection of CRO First patients regarding CS and study expected to study design locations enroll in 4Q 2018 Chronic Sinusitis trial design expected to include co-primary endpoints: both an objective measure of inflammation and a subjective measure of symptom relief 16

17

Investor Relations – NASDAQ: OPTN At 30 June 2018: Analyst Coverage1 – $245 million in cash – Long-term debt: $75 million BMO: Gary Nachman – 41.1 million common shares o/s Jefferies: David Steinberg – 8.0 million options & warrants o/s Cantor Fitzgerald: William Tanner Optinose Investor Contact Jonathan Neely, VP, Investor Piper Jaffray: David Amsellem Relations and Business Operations 267-521-0531 RBC: Randall Stanicky investors@optinose.com www.optinose.com @optinose 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. 18