Attached files

| file | filename |

|---|---|

| 8-K - ENDONOVO THERAPEUTICS, INC. | form8-k.htm |

SALES AND MARKETING AGREEMENT

This Sales and Marketing Agreement (the “Agreement”) is entered into August 10, 2018 (“Effective Date”) by and between Endonovo Therapeutics, Inc. (OTCQB: ENDV), a Delaware corporation having its principal business address of 6320 Canoga Avenue, 15th Floor, Woodland Hills, CA 91367 (“ENDONOVO”) and MAGNIANT, LLC, a California limited liability company with offices at 7343 Bolero St Carlsbad CA 92009 (“MAGNIANT”). Each of MAGNIANT and ENDONOVO shall sometimes be referred to as a “Party” and collectively, as the “Parties”. This Agreement supersedes and replaces in their entirety, without prejudice, any and all other agreements or contracts between the parties, excluding the Non-Disclosure Agreement signed by the Parties.

WHEREAS

ENDONOVO is a commercial-stage developer of non-invasive medical devices and electrotherapies marketed in the United States under the trade names SofPulse, and Ivivi Roma.

ENDONOVO desires to retain MAGNIANT to provide sales and marketing services to ENDONOVO and grant MAGNIANT exclusive rights to market and sell the ENDONOVO products (“Products”) listed on EXHIBIT A within the territory defined in EXHIBIT B (“Territory” which may increase or decrease during the term of the Agreement based upon the terms of this Agreement or a future agreement between the Parties).

MAGNIANT is in the business of providing sales and marketing services in the healthcare industry.

MAGNIANT desires to obtain said exclusive rights to market and sell the Products in the healthcare industry, as further defined in this Agreement.

Accordingly, for good and valuable consideration, the Parties agree as follows:

| A. | DESCRIPTION OF SERVICES | |

| 1. | MAGNIANT will represent ENDONOVO and market and sell the Products in the given Territory and which exclusive territories are defined herein and excludes all rights under a separate agreement with Plagens Medical Supply Consultants, Inc. a copy of which has been shown to MAGNIANT) and will provide the following services: |

| a) | MAGNIANT will be responsible for marketing and promoting the Products. | |

| b) | Any publication and/or distribution of printed material in the promotion of the Products shall first be approved by ENDONOVO. The ENDONOVO name and logo, promotional materials, and information may be used with the approval of ENDONOVO during the term of this agreement. | |

| c) | MAGNIANT will collect and convey to ENDONOVO complete contact information on each prospective customer. | |

| d) | MAGNIANT will be financially responsible for all marketing, selling, administrative and other expenses relating to its marketing efforts. | |

| e) | MAGNIANT will be responsible for sales persons and any compensation it agrees to pay for their efforts in representing ENDONOVO Products. |

| 2. | ENDONOVO and MAGNIANT will set up a mutually agreed upon infrastructure for ENDONOVO to provide the following services: |

| a) | ENDONOVO will provide product training and ongoing support through an online resource to be developed by the parties. | |

| b) | ENDONOVO will provide clinical information and technical support as it is developed. | |

| c) | ENDONOVO will provide samples to help promote and market the Products as mutually agreed to. | |

| d) | ENDONOVO is responsible for manufacturing and shipping the Products. | |

| e) | ENDONOVO will provide to MAGNIANT written notice of all existing and new product registrations in both the United States and foreign countries regarding Products within ten (10) days of the execution of this Agreement or the receipt of new product registrations. | |

| f) | ENDONOVO will share with and distribute to MAGNIANT appropriate data regarding the Product including but not limited to research results, clinical and laboratory projects, published research articles or papers, and Subject Product licenses or registrations with government agencies. |

| B. | MARKET AND GEOGRAPHY | |

| 1. | MAGNIANT is granted exclusivity in Healthcare markets defined in EXHIBIT B and may be modified as mutually agreed upon during the term of the Agreement. | |

| 2. | ENDONOVO will identify and pursue prospective and existing customers and territories to which MAGNIANT will not have access and which will not generate commission due to MAGNIANT. In addition, MAGNIANT shall be non-exclusive in all activities inside or outside the United States not defined in Exhibit B, provided, however, that if ENDONOVO shall grant an exclusive license to any party for any territory or use not exclusive to MAGNIANT, MAGNIANT’s non-exclusive rights shall cease to the extent not allowed by such exclusive license. |

| C. | COMMISSIONS |

| 1. | ENDONOVO agrees to pay MAGNIANT a commission of 25% of Gross Revenue, as defined below, if: |

| a. | the revenue can be verified as a direct or indirect referral from MAGNIANT. Total commission for MAGNIANT and referral fees paid by ENDONOVO cannot exceed 25% of the purchase price. | |

| b. | MAGNIANT has not already received a referral fee or commission in connection with the sale. ENDONOVO will not sell in the exclusive Territory or establish any referral source entitled to commission in exclusive Territory without MAGNIANT’s approval or in accordance with the provisions set forth herein. |

| 2. | Gross revenue is defined as total revenue collected by ENDONOVO from a customer for sale by ENDONOVO to the customer any Product less promotional discounts, rebates, other incentive discounts and credited returns. | |

| 3. | ENDONOVO shall pay commissions due to MAGNIANT on a monthly basis based on Gross Revenues within 20 days of the end of each calendar month for all billings generated by MAGNIANT. Chargebacks for uncollected billings will be reconciled and deducted from MAGNIANT’s commission once ENDONOVO determines the billing is unrecoverable and will need to be written off. | |

| 4. | ENDONOVO will pay MAGNIANT a consulting fee at mutually agreed upon rates for any pre-approved direct support of existing Endonovo business and any other business upon which MAGNIANT is not paid a commission. The agreed upon rate must be predetermined prior to commencing any services. | |

| 5. | Should ENDONOVO fail to make any payment whatsoever due and payable to the MAGNIANT hereunder at the time it is due, it shall be deemed an Event of Default as defined hereunder, provided however, that if ENDONOVO has reasonable grounds to dispute a payment, it shall not be grounds for default for the disputed portion to be withheld while the Parties seek to resolve the issue. |

| 6. | All payments due hereunder shall be paid by check or bank wire payable in United States of America currency to MAGNIANT, or to the account of MAGNIANT at such bank as MAGNIANT may designate by notice to ENDONOVO. Payments that are more than 10 calendar days late will begin to accrue interest at 1.5% per month and acceptance of such payment by MAGNIANT shall constitute an irrevocable waiver of any Event of Default related thereto. | |

| 7. | MAGNIANT shall be solely responsible for all payments due to any individual or organization which may perform work on behalf of MAGNIANT or with whom MAGNIANT arranges to share commissions. ENDONOVO shall have no direct or implied relationship with any individual or entity associated with MAGNIANT, or any responsibility to provide service to these independent entities. |

| D. | PRICING | |

| 1. | ENDONOVO will set the floor minimum sales price by market consistent with ENDONOVO’s overall pricing strategy internally and externally with third party partners. | |

| 2. | ENDONOVO will provide volume-based pricing consistent with ENDONOVO’s overall pricing strategy internally and externally with third party partners |

| E. | INITIAL TERM | |

| Unless earlier terminated as hereinafter provided, this Agreement shall continue in full force and effect for a period of three (3) years from the effective date subject to the extension of term as provided in paragraph F. | ||

| F. | EXTENSION OF TERM | |

| If MAGNIANT has met the terms of this Agreement and the threshold amounts as outlined in Exhibit B for the first three (3) years, MAGNIANT shall have the option to extend this Agreement for an additional three (3) years subject to the successful negotiation of the thresholds and commissions for the additional three (3) year term. | ||

| G. | TERMINATION | |

| 1. | Termination for any reason: |

| a. | This agreement may be terminated by either party for any reason with 30 days written notice. | |

| b. | If agreement is terminated for any reason other than Event of Default (as defined below) or non-performance (as specified below), commission will continue to be paid by ENDONOVO to MAGNIANT for a period of 3 years for accounts they have successfully consummated transactions as long as they continue to satisfactorily service said accounts. | |

| c. | Any and all accounts that are either the subject of a purchase order or a committed contract or where MAGNIANT can show documentation that leads to a reasonable likelihood of a purchase order or accepted contract and a written purchase order is received or a contract is signed within 90 days of the termination will be included in any survival compensation follow on rights. Upon any termination and as a condition to these rights, MAGNIANT shall, upon termination, provide ENDONOVO with a list of all potential customers covered by this provision. | |

| d. | As long as MAGNIANT is receiving commissions or other payments hereunder it shall, in addition to any other requirements specifically set forth herein, be fully subject to all of its obligations hereunder. |

| 2. | Termination in the Event of Default (as defined below): |

| a. | In the Event of Default, either Party may terminate this Agreement by providing 30 days’ notice to the defaulting Party that it has elected to terminate this Agreement. The notice shall specify the nature of the default and the other party shall have the right to cure during such 30-day period. | |

| b. | Each of the following circumstances shall constitute an “Event of Default” for purposes of this Agreement: |

| i. | a Party or its affiliate has taken an act that is intended to have, or is undertaken with willful disregard and has, the effect of injuring the reputation or business of the other Party in any material respect; | |

| ii. | a Party or its affiliate has made a willful intentional violation or after written notice, continued violation (even if inadvertent) of any material provision of this Agreement; | |

| iii. | the commission by a Party or its affiliate of an act of fraud or embezzlement; | |

| iv. | a Party’s commission of an intentional act or intentional failure to act (but excluding matters of business judgment) which harms or there is a reasonable probability will harm the other Party and/or its Affiliates; | |

| v. | a Party’s continual failure to perform substantially the material duties of a Party’s following 30 days written notice to the person of such failure, which notice shall identify the actions required to cure such failure, to the extent curable; | |

| vi. | a Party’s second failure to perform substantially the material duties of such person’s duties within twelve months following the cure of an earlier failure as provided in clause (v) |

| c. | If agreement is terminated for Event of Default, commission will continue to be paid by ENDONOVO to MAGNIANT for a period of 1 month following the notice of default. | |

| d. | In the event of a material breach by a Party, the other Party shall be entitled to pursue any and all remedies available at law or in equity |

| 3. | Termination for non-performance: |

| a. | The exclusivity outlined in this Agreement may be terminated by ENDONOVO if at any time during the term of this Agreement the Performance Thresholds, included herein in Exhibit B or mutually modified by the Parties are not met by MAGNIANT. |

| 1. | In the event that the Performance Threshold is not met, MAGNIANT may protect the exclusivity of the right granted hereunder by paying all additional amounts due for that year ending on the last day of that year, so that the threshold is met. | |

| 2. | Each Market or Channel is independent with respect to exclusivity and exclusivity may be terminated in one or more channels but will be in force in any market or channel where performance thresholds are met. | |

| 3. | If exclusivity in one or more markets or channels is terminated, Magniant will continue to have the rights to sell on a non-exclusive basis and all terms and conditions will remain in force and affect. |

| b. | If contract exclusivity is terminated for non-performance, commissions will continue to be paid on future purchases by customers with whom MAGNIANT had sales prior to the termination or has initiated a committed contract and continue to service satisfactorily. | |

| c. | After the initial 3-year performance goals are accomplished annually the Parties will establish mutually agreed revenue objectives for the purposes of maintaining specific exclusivity. |

| 4. | In the event that ENDONOVO terminates this agreement in connection with granting a distribution right or a licensing agreement on a nationwide basis for any of the markets in the Territory (“Third Party Transaction”), then for the three years following such termination, Magniant will be paid cash compensation as defined herein or equity-based compensation for all future revenues derived from MAGNIANT’s customers inclusive of customers under G. 1. (c.) in that Territory based on the terms of the Third Party Transaction. The compensation to MAGNIANT on sale shall be the last quarter’s compensation earned by MAGNIANT times twelve and shall be apportioned between cash and equity as the compensation in the transaction is apportioned in the payments to ENDONOVO. |

| H. | OWNERSHIP/INTELLECTUAL PROPERTY |

1. Confidentiality of Proprietary Information. MAGNIANT shall keep all “Confidential Information” (as defined below), and trade secret information of the Company confidential and shall not disseminate, disclose, publish, use for MAGNIANT’s benefit or for another’s benefit, directly or indirectly, or permit another to use or exploit in any way any Company trade secret or confidential information known by MAGNIANT, unless and until such information has been disseminated or made available to the general public by the Company through no action of MAGNIANT or unless otherwise required by court order to comply with applicable law

(a) Confidential Information. As used herein the term “Confidential Information” shall refer to all Intellectual Property, as defined below, and all data and other information (including, without limitation, proprietary information), whether or not patentable, of the Company that is disclosed to the MAGNIANT during the term of this Agreement, which may include specifications, know-how, trade secrets, technical and scientific information, models, business information, inventions, discoveries, practices, methods, planned future projects, pricing, procedures, formulae, protocols, techniques, programs, website design and architecture, schematics, software documentation, financial information, sales, business and marketing plans, contracts, and unpublished patent applications, whether disclosed in oral, written, graphic, or electronic form. As used herein, “Confidential Information” shall include the Confidential Information of the Company, each of its portfolio companies, and the potential portfolio companies with which the Company is, or has been, negotiating. However, intellectual property and Confidential Information derived by MAGNIANT’s efforts and resources shall not constitute Confidential Information for purposes of this Agreement.

(b) Intellectual Property. As used herein, the term “Intellectual Property” shall refer to any and all copyrights, patents, patent applications, patent registrations, provisional patents, business processes, data rights, moral rights, mask works, trademarks, trade names, service marks, service names, trade dress, software, source code, trade secrets, formulations, know-how, other proprietary rights, other Confidential Information, and any other similar rights arising out of, or enforceable under, the laws of the United States of America or elsewhere in the world.

2. All content and improvements to ENDONOVO including its marketing materials, marketing plans and its intellectual property are the sole property of ENDONOVO. This shall apply with respect to ENDONOVO’s copyrightable works, ideas, discoveries, inventions, applications for patents, and patents, any improvements, further inventions or improvements, and any new items discovered or developed by ENDONOVO during the term of this Agreement. MAGNIANT shall sign all documents necessary to perfect the rights of ENDONOVO in such intellectual property, but will not be liable for any costs associated with perfecting the rights of ENDONOVO in said property.

| I. | STOCK OPTIONS | |

| 1. | It is the intent of both parties that MAGNIANT be recognized upon MAGNIANT’s contribution to the increased value of ENDONOVO business | |

| 2. | Parties agree to enter into a Stock Option Agreement with agreed upon strike pricing and vesting periods within 1 month of the signing of this agreement | |

| 3. | The principals and initial option grants as contemplated between the parties is outlined in Exhibit C. |

| J. | EXPENSE REIMBURSEMENT | |

| 1. | MAGNIANT shall pay all “out-of-pocket” expenses related to its marketing efforts (see paragraph A, “Description of Services” above), and shall not be entitled to reimbursement from ENDONOVO. | |

| 2. | MAGNIANT will hire, train and compensate its sales and marketing resources directly |

| K. | REGULAR REPORTING |

ENDONOVO will make available to MAGNIANT, on a regular and ad hoc basis detailed sales and manufacturing reports as mutually agreed upon.

| L. | INSURANCE |

The Parties shall each have product liability and other general insurance coverage for their respective business activities related to the Products in commercially reasonable amounts.

| M. | RELATIONSHIP OF PARTIES |

The Parties herby acknowledge and agree that each is an independent contractor and that neither Party shall be considered to be the agent, representative, master or servant of the other Party for any purpose whatsoever, and that neither Party has any authority to enter into a contract, to assume any obligation or to give warranties or representations on behalf of the other Party. Nothing in this relationship shall be construed to create a relationship of joint venture partnership, fiduciary, or other similar relationship between the Parties.

| N. | NON INTERFERENCE |

Notwithstanding the foregoing, each Party understands that it is entering this Agreement with pre-existing, historical business relationships unrelated to the business ventures of the other Parties, to that end, each Party is permitted to continue its normal business ventures with its pre-existing clientele and/or in its pre-existing market. However, MAGNIANT and its affiliates shall remain bound not to compete with ENDONOVO by marketing the same or similar Products or services during the term of this Agreement or for a period of five years after termination except in the case where MAGNIANT has terminated the agreement for ENDONOVO or its officer’s conviction of fraud. Because damages at law may not be adequate for the breach of this covenant, each Party shall be entitled to seek injunctive or other equitable relief in the event of a breach hereof. This clause shall only apply in the Territories defined herein.

| O. | GOVERNING POLICIES AND PROCEDURES |

All ENDONOVO rules, policies, and operating procedures, which will be modified from time to time by ENDONOVO concerning customer orders and returns, customer service, customer data, and product sales will apply to customers and prospects referred by MAGNIANT.

| P. | LEGAL REQUIREMENTS |

| 1. | MAGNIANT and ENDONOVO agree to obtain and maintain all permits, licenses and consents (governmental and otherwise) that are necessary or advisable for providing the services described in Section A above and further, in providing the services described in Section A above, to comply with all applicable legal requirements. | |

| 2. | ENDONOVO represents and warrants that it will comply with the requirements of all Federal, state, and local laws, statutes, and regulations, and all orders, writs, injunctions and decrees, applicable to it or to its business including complying with all FDA rulings and requirements and any and all regulatory requirements. MAGNIANT represents and warrants that it will and take all reasonable steps to ensure that its Representatives will comply with the requirements of all Federal, state, and local laws, statutes, and regulations, and all orders, writs, injunctions and decrees, applicable to it or to its business including complying with all FDA rulings and requirements and any and all regulatory requirements. |

| Q. | INDEMNIFICATION | |

| 1. | ENDONOVO agrees to indemnify MAGNIANT, together with the officers, directors and employees of MAGNIANT, and defend and hold them harmless from and against all claims, losses, causes of action, liabilities, damages and expenses (including, without limitation, reasonable attorneys’ fees) directly arising from, incurred as a consequence of or otherwise directly attributable to the gross negligence of ENDONOVO in connection with the Services being provided in this Agreement. | |

| 2. | MAGNIANT agrees to indemnify ENDONOVO, together with the officers, Directors, and employees of ENDONOVO, and defend and hold them harmless from and against all claims, losses, causes of action, liabilities, damages and expenses (including, without limitation, reasonable attorneys’ fees) directly arising from, incurred as a consequence of or otherwise directly attributable to the gross negligence of MAGNIANT in connection with the Services being provided in this Agreement. |

| R. | ASSlGNMENT |

Neither party’s obligation under this Agreement may be assigned or transferred to any other person, firm, or corporation without the prior written consent of the other party, provided that ENDONOVO’s approval of MAGNIANT’s transfer or assignment shall be based upon ENDONOVO’s reasonable determination, in its discretion, that MAGNIANT’s transferee or assignee has the requisite experience, resources, and financial stability to fulfill the obligations of MAGNIANT under this Agreement, and that the transfer will not create a conflict of interest with ENDONOVO’s corporate goals. ENDONOVO may, however, assign this Agreement without consent of MAGNIANT in connection with a merger, consolidation, acquisition or sale of substantially all of its assets or stock, or substantially all of the assets of its business. Regardless of assignment the terms of section C. , commissions will endure any material change in ownership or other transaction which provides the rights to Products, and will remain in force and effect with any and all successors. Furthermore, should ENDONOVO grant a license to an affiliated party for the sale of the Products in the Territory covered by this agreement, such license shall include an assignment of this agreement to such affiliated party. Upon such assignment to an affiliate party, MAGINANT would receive stock options set forth herein from both companies whereby the options granted MAGNIANT will be divided proportionately from both companies based on the retained percentage of revenue retained by each entity going forward.

| S. | CONFIDENTIALITY |

| 1. | Except as otherwise provided in this Agreement or with the consent of the other party hereto, each of the parties agrees that all information including, without limitation, the terms of this Agreement, business and financial information, customer and vendor lists and pricing and sales information, concerning either party, or any of their respective affiliates, provided by or on behalf of any of them shall remain strictly confidential and secret and shall not be utilized, directly or indirectly by the party receiving such information for its own business purposes or for any other purpose, except and solely to the extent that any such information is generally known or available to the public through a source or sources other than such party hereto or its affiliates. Notwithstanding the foregoing, each party is hereby authorized to deliver a copy of any such information (a) to any person pursuant to a subpoena issued by any court or administrative agency, (b) to its accountants, attorneys or other agents (including employees and investors on a need to know basis) on a confidential basis and (c) otherwise as required by applicable law, rule, regulation or legal process including, without limitation, the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, and the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. | |

| 2. | The term “Confidential Information” shall mean all of the other Party’s information which is not generally available to the public, and which is related to the business of the Party, including without limitation all technical, financial (including tax returns, balance sheets, general ledgers, income statements, accounts payable ledgers, accounts receivables ledgers, audited financial statements and trial balances), manufacturing, customer, employee or market information, trade secrets, scientific or statistical data or other proprietary information relating thereto. | |

| 3. | “Confidential Information” also means all information or material not generally known to the public or the industry in which any Party is or may become engaged which: (a) gives the Party some competitive business advantage or the opportunity of obtaining such advantage or the disclosure of which could be detrimental to the interest of the Party; (b) is owned by the Party or in which the Party has an interest; and/or (c) is either marked “confidential” or “proprietary.” | |

| 4. | “Confidential Information” includes, without limitation, the following types of information (whether or not reduced to writing): trade secrets, information that constitutes a trade secret under the Uniform Trade Secrets Act, inventions, proposals, tapes, file data, documentation, diagrams, specifications, know-how, processes, formulas, models, flowcharts, software in various stages of development, source codes, research and development procedures and test results, marketing techniques and materials and plans, price and discount lists, pricing policies, business plans, customer and vendor identities and agreements, customer lists, leads and employee files. |

| T. | SURVIVAL |

The confidentiality provisions of this Agreement shall remain in full force and effect after the termination of this Agreement for a period of five years.

| U. | GOVERNING LAW |

This Agreement shall be construed in accordance with California law, excluding its principles of conflicts of laws. The Parties hereto agree that in any action related to this Agreement, venue shall lie solely and exclusively in State Court located in Orange County, California, and the Parties hereby irrevocably submit to the jurisdiction of the courts in Orange County. Each Party hereby waives any right to a jury trial in any action concerning this Agreement. The Parties agree that this Agreement shall not be construed against any party by reason of that Party allegedly being the drafter of this Agreement.

| V. | NOTICES |

All notices required and permitted under this Agreement shall be in writing and shall be delivered in person or deposited in the mail, postage prepaid to the mailing address on page 1 of this Agreement. Such address may be changed from time to time by either party by providing written notice to the other in the manner set forth above.

| W. | ENTIRE AGREEMENT |

This Agreement contains the entire understanding of the Parties as to its subject matter. Any and all prior or contemporaneous statements, representations, promises, or agreements between the Parties are supplanted by and merged within this Agreement, and if they are not written or expressly incorporated by reference herein, they are considered by the Parties not to have been made, and they are not binding on the Parties. Each Party hereby represents to the other that it is not relying upon any statement, representation, or promise of the other that is not contained within the four corners of this Agreement. This Agreement shall not be amended or altered orally, but rather, only by an agreement in writing signed by an authorized representative of each of the Parties.

| X. | AMENDMENT |

This Agreement may be modified or amended if the amendment is made in writing and is signed by both parties.

| Y. | SEVERABILITY |

If any provision of this Agreement shall be held to be invalid or unenforceable for any reason, the remaining provisions shall continue to be valid and enforceable. If a Court finds that any provision of this Agreement is invalid or unenforceable, but that by limiting such provision it would become valid and enforceable then such provision shall be deemed to be written construed and enforced as so limited.

| Z. | WAIVER OF CONTRACTUAL RIGHT |

The failure of either party to enforce any provision of the Agreement shall not be construed as a waiver or limitation of that party’s right to subsequently enforce and compel strict compliance with every provision of this Agreement. No waiver by a Party shall be valid unless in writing and signed by a representative authorized to bind the Party.

| AA. | APPLICABLE LAW |

This Agreement shall be governed by the laws of the State of California, United States of America as they are applied to contracts executed, delivered and to be performed entirely within such state.

| BB. | LEGAL FEES AND COSTS |

If a legal action is initiated by any party to this Agreement against another, arising out of or relating to the alleged performance or non-performance of any right or obligation established hereunder, or any dispute concerning the same, any and all fees, costs and expenses reasonably incurred by the prevailing Party or his, her or its legal counsel in investigating, preparing for, prosecuting, defending against, or providing evidence, producing documents or taking any other action in respect of, such action shall be the joint and several obligation of and shall be paid or reimbursed by the non-prevailing Party.

| CC. | COUNTERPARTS |

This Agreement may be executed in any number of counterparts each of which, once executed and delivered, shall be deemed an original and it shall not be necessary in making proof of the agreement to produce or account for any counterpart other than the one signed by the Party against whom enforcement is sought. Facsimile or .pdf signatures shall be acceptable and deemed as if they were original signatures.

| DD. | NOTICES |

All notices in connection with this Agreement shall be in writing and shall be given by certified, registered, or first class mail or personally delivered to the Parties at the addresses set forth below. For purposes of this Agreement, a notice shall be deemed effective upon personal delivery to the Party or if by mail five days after transmission.

| ENDONOVO: | Endonovo Therapeutics, Inc. | |

| ℅ Don Calabria | ||

| Chief Operating Officer | ||

| 6320 Canoga Avenue, 15th Floor | ||

| Woodland Hills, CA 91367 | ||

| MAGNIANT: | Magniant LLC. | |

| ℅ Rob Crousore | ||

| Principal | ||

| 7343 Bolero Street | ||

| Carlsbad, CA 92009 |

(The Remainder of this Page is Intentionally Blank)

IN WITNESS THEREOF, the parties hereto have executed this Agreement as of the date first above written.

| Endonovo Therapeutics, Inc. | ||

| By: | Alan Collier | |

| Its: | CEO | |

| Dated: | August 10, 2018 | |

| Magniant, LLC | ||

| By: | Robert Crousore | |

| Its: | Managing Director | |

| Dated: | August 10, 2018 | |

EXHIBIT A

PRODUCTS

SofPulse® Torino II Electroceutical™ System

ENDONOVO will make 50 units of available to MAGNIANT at no cost for marketing purposes.

Right of first offer to sell updated, next generation SofPulse product or additional products developed or acquired by ENDONOVO that would directly compete with SofPulse or where marketing additional products in the MAGNIANT Territory and channels would be synergistic.

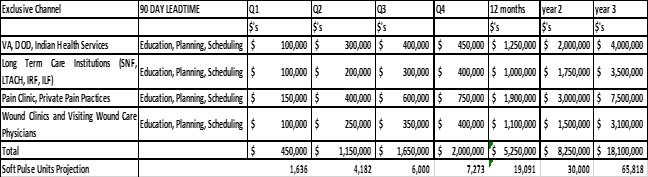

EXHIBIT B

EXCLUSIVE TERRITORY FOR US DISTRIBUTION

Performance Thresholds (“Gross Revenues”):

The Parties acknowledge that these Performance Thresholds will be increased by mutual agreement as additional indications for the Products are approved or reimbursements by third parties are approved or increased.

Exclusive Territory shall mean all of the United States and its territories in the markets and channels as listed here and above and commonly known as healthcare channels: VA, DOD, Indian Health Services, Long Term Care Institutions (SNF, LTACH, IRF, ILF), Pain Clinics and Private Pain Practices, Wound Clinics, Visiting Wound Care Physicians and Home Care Nurses.

Nonexclusive Territory shall mean inside and outside the United States for all healthcare channels for which MAGNIANT will be able to sell Product and indications not covered in the exclusive territories herein above.

EXHIBIT C

STOCK AND INCENTIVE STOCK OPTIONS

| 1. | STOCK AND INCENTIVE STOCK OPTIONS |

(a) ENDONOVO will grant MAGNIANT 1,000,000 options to purchase shares of restricted stock at a per share price equal to the 3-day look back of the VWAP of ENDV stock on the day of entering into the Sales and Marketing Agreement between the parties (the “Initial Option Grant” or “IOG”). The IOG will vest monthly over a twelve-month vesting period at the rate of 83,333 per month.

(b) ENDONOVO and MAGNIANT also will enter into a milestone-based Stock Option Purchase Agreement (the “SOPA”) based on a 3-day look back of the VWAP of ENDV stock at the date such milestone is achieved (the “Option Price”). Milestones will be based on gross revenues generated by MAGNIANT as defined in the Sales and Marketing Agreement. The parties will agree to a revenue milestone schedule, the first of which will be granted after $1,000,000 of gross product revenues attributed to MAGNIANT under the Sales and Marketing Agreement.

| i. | The number of options awarded under the SOPA will equal 5% of gross revenues ($1,000,000 X 5% = $50,000 ÷ 3-day VWAP= number of Options), be fully-vested with an exercise period of two years. |

| 2. | NUMBER OF OPTIONS AVAILABLE |

(a) It is the intent of both parties that MAGNIANT be recognized for MAGNIANT’s contribution to the increased value of ENDONOVO business by way of the SOPA.

(b) The total number of options available will be calculated as follows:

| i. | The Parties Agree to enter into a milestone-based option grant schedule related to sales volume generated by MAGNIANT as well as other direct or indirect MAGNIANT contributions agreed to between the parties. A key component of the schedule will be the calculation in 1 (b) i above. | |

| ii. | The maximum percentage of ownership upon exercising of the aggregate of the IOG and subsequent SOPA options granted to MAGNIANT will not to exceed 4.99% of the existing current issued and outstanding shares of ENDONOVO’s common stock. To the extent ENDONOVO issues additional shares, the limit of 4.99% will include the then current issued and outstanding shares. |

| 3. | VESTING SCHEDULE. |

(a) The IOG will not be exercisable for one year and should the Sales and Marketing Agreement be terminated in the first year only the vested shares under the IOG will be exercisable. Milestones under the SOPA will be fully vested and exercisable at the time such milestone is achieved. For purposes of this Agreement, “Vesting Commencement Date” shall mean the commencement date of this agreement. Notwithstanding anything to the contrary, MAGNIANT further agrees any sales of the common stock purchased through the above options is pursuant to Rule 144 or otherwise shall be limited in volume to 2% of the volume reported for the day of the sale and no sales after 3:30pm EST. MAGNIANT’s broker shall acknowledge these limitations in writing and MAGNIANT shall upon request provide reasonable documentation of its compliance.

(b) The right of exercise shall be cumulative so that to the extent the option is not exercised in any period to the maximum extent permissible it shall continue to be exercisable, in whole or in part, with respect to all Shares for which it is vested until the earlier of the Final Exercise Date or the termination of this option.

| 4. | EXCERCISE OF OPTION. |

(a) Form of Exercise. Each election to exercise this option shall be accompanied by a completed Notice of Stock Option Exercise in the form attached hereto as Exhibit A, signed by MAGNIANT, and received by ENDONOVO at its principal office, accompanied by this agreement, and payment in full in the manner provided above. MAGNIANT may purchase less than the number of shares covered hereby, provided that no partial exercise of this option may be for any fractional share or for fewer than ten whole shares.

(b) Continuous Relationship with the Company Required. Except as otherwise provided in this Section 3, the options under the SOPA may not be exercised if the Sales and Marketing Agreement between ENDONOVO and MAGNIANT dated August 10, 2018, has been terminated due to the default of MAGNIANT.

(c) Continuous Satisfactory Performance. Except as otherwise provided in this Section 3, this option may not be exercised unless the Performance Thresholds as mutually agreed upon from time to time between ENDONOVO and MAGNIANT in terms of the Sales and Marketing Agreement between ENDONOVO and MAGNIANT dated August 10, 2018, are achieved, and have been at all times since the Grant Date.

(d) Termination of Relationship with the Company. If the Sales and Marketing Agreement between ENDONOVO and MAGNIANT dated August, 10, 2018 terminates for any reason, then, except as provided in paragraphs (e) below, the right to exercise this option shall terminate coterminously with the end of the commission tail defined herein. Provided that this option shall be exercisable only to the extent that MAGNIANT was entitled to exercise this option on the date of such cessation. Notwithstanding the foregoing, if MAGNIANT, prior to the Final Exercise Date, violates the non-competition or confidentiality provisions of any Sales and Marketing Agreement between ENDONOVO and MAGNIANT, confidentiality and nondisclosure agreement or other agreement between ENDONOVO and MAGNIANT, the right to exercise this option shall terminate immediately upon such violation.

(e) Termination for Cause. If, prior to the Final Exercise Date, the Sales and Marketing Agreement between ENDONOVO and MAGNIANT is terminated by the ENDONOVO for Cause (as defined in the Sales and Marketing Agreement), the right to exercise this option shall terminate immediately upon the effective date of such termination of the Sales and Marketing Agreement.

| 5. | COMPANY RIGHT OF FIRST REFUSAL. |

(a) Notice of Proposed Transfer. If MAGNIANT proposes to sell, assign, transfer, pledge, hypothecate or otherwise dispose of, by operation of law or otherwise (collectively, “transfer”) any Shares acquired upon exercise of this option, then MAGNIANT shall first give written notice of the proposed transfer (the “Transfer Notice”) to ENDONOVO The Transfer Notice shall name the proposed transferee and state the number of such Shares the MAGNIANT proposes to transfer (the “Offered Shares”), the price per share and all other material terms and conditions of the transfer.

(b) Company Right to Purchase. For 15 business days following its receipt of such Transfer Notice, ENDONOVO shall have the option to purchase all or part of the Offered Shares at the price and upon the terms set forth in the Transfer Notice. In the event the ENDONOVO elects to purchase all or part of the Offered Shares, it shall give written notice of such election to MAGNIANT within such 5-day period. Within 10 days after his or her receipt of such notice, MAGNIANT shall tender to ENDONOVO at its principal offices the certificate or certificates representing the Offered Shares to be purchased by ENDONOVO, duly endorsed in blank by MAGNIANT or with duly endorsed stock powers attached thereto, all in a form suitable for transfer of the Offered Shares to ENDONOVO. Promptly following receipt of such certificate or certificates, ENDONOVO shall deliver or mail to MAGNIANT a check in payment of the purchase price for such Offered Shares; provided that if the terms of payment set forth in the Transfer Notice were other than cash against delivery, ENDONOVO may pay for the Offered Shares on the same terms and conditions as were set forth in the Transfer Notice; and provided further that any delay in making such payment shall not invalidate ENDONOVO’s exercise of its option to purchase the Offered Shares.

(c) Shares Not Purchased By ENDONOVO. If the ENDONOVO does not elect to acquire all of the Offered Shares, MAGNIANT may, within the 30-day period following the expiration of the option granted to ENDONOVO under subsection (b) above, transfer the Offered Shares which ENDONOVO has not elected to acquire to the proposed transferee, provided that such transfer shall not be on terms and conditions more favorable to the transferee than those contained in the Transfer Notice.

(d) Consequences of Non-Delivery. After the time at which the Offered Shares are required to be delivered to ENDONOVO for transfer to ENDONOVO pursuant to subsection (b) above, ENDONOVO shall not pay any dividend to MAGNIANT on account of such Offered Shares or permit MAGNIANT to exercise any of the privileges or rights of a stockholder with respect to such Offered Shares, but shall, insofar as permitted by law, treat ENDONOVO as the owner of such Offered Shares

| 6. | STOCK GRANT UNDER SECTION G (4) |

In the event that this Agreement is terminated under Section G(4), MAGNIANT shall for three years thereafter, be granted stock on a quarterly basis with a market value on date of grant based on a 3 day VWAP, equal to the compensation MAGNIANT would have been entitled to on the gross sales to customers to whom MAGNIANT had previously effected sales. These stock grants shall continue for three years after the termination under G(4) and shall be paid no later than 15 days after ENDONOVO files the 10-Q or 10—K report for such quarter with the Securities and Exchange Commission.