UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C., 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported):

|

August 14, 2018

|

||||

|

CITIZENS FINANCIAL SERVICES, INC.

|

|||||

|

(Exact name of registrant as specified in its charter)

|

|||||

|

Pennsylvania

|

0-13222

|

23-2265045

|

|||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|||

|

15 South Main Street, Mansfield, PA

|

16933

|

||||

|

(Address of principal executive offices)

|

(Zip Code)

|

||||

|

Registrant's telephone number, including area code:

|

(570) 662-2121

|

||||

|

N/A

|

|||||

|

(Former name or former address, if changes since last report.)

|

|||||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

Citizens Financial Services, Inc. intends to use the materials furnished herewith in one or more meetings with investors and analysts. A copy of the investor presentation is attached hereto as Exhibit 99.1, and is being furnished herewith pursuant to Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

Description

|

|

99.1

|

Investor Presentation dated August 14, 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Citizens Financial Services, Inc. | |||

|

Date

|

By:

|

/s/ Randall E. Black | |

| Randall E. Black | |||

|

Chief Executive Officer and

President

|

|||

EXHIBIT INDEX

|

Exhibit Number

|

Description

|

|

99.1

|

Investor Presentation dated August 14, 2018

|

Rooted for the Future CZFSListed: OTC BB / OTC PinkRanked #1 PA Bank by ForbesInvestor PresentationAugust 14, 2018 CITIZENSFINANCIAL SERVICESINCORPORATED

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, results of operations, future performance and business of Citizens Financial Services, Inc. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. To the extent that statements in this presentation do not relate to historical or current facts, they constitute forward-looking statements. Although such statements are based on current estimates and expectations, and currently available competitive, financial, and economic data, forward-looking statements are inherently uncertain. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause actual results to differ materially from those presented. You will find more detailed information regarding these factors in our filings with the U.S. Securities and Exchange Commission, including in the “Risk Factors” section of our most recently filed Annual Report on Form 10-K and of our most recently filed Quarterly Report on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which speak only to the date such data was presented. Citizens Financial Services, Inc. undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise following this presentation, whether as a result of new information, future developments or otherwise, except as may be required by law. Citizens Financial Services, Inc. 2

Management Team Citizens Financial Services, Inc. 3 Strong, experienced management team with an average of 17 years of experience with the Company Name Title Year Started with CZFS Randall E. Black Director, CEO & President 1993 Mickey L. Jones Director (Bank), EVP, COO & CFO 2004 Terry B. Osborne Director (Bank), EVP & CCO 1975 David Z. Richards, Jr. Director, EVP 2017 Jeffrey L. Wilson EVP, Chief Lending Officer 1987 Gregory J. Anna SVP, Information Systems Manager 2002 Douglas L. Byers SVP, Southcentral Market Executive 2017 Kathleen M. Campbell SVP, Marketing Manager 2001 Jeffrey B. Carr SVP, Chief Retail Banking Officer 2001 Christopher S. Landis SVP, Senior Lending Officer 1996 Robert B. Mosso SVP, Wealth Management Division Manager 2002 Dwight D. Rohrer SVP, Senior Lender 2016 Amy C. Wood VP, Human Resource & Training Manager 2018

Corporate Profile Citizens Financial Services, Inc. 4 Exceptional management teamAttractive markets with diverse economic base#1 market position in legacy marketsStrong profitability Branches (28) Source: Company documents and SNL Financial.Market data as of July 26, 2018.(1) Excludes the impact of AOCI.

Investment Highlights Top Market Share Position in Legacy Northern PA MarketsGeographic Diversification and Expansion into New Growth MarketsProven Track Record of High ProfitabilityStrong Long-Term Record of GrowthSuccessful Acquisition of Lending TeamsStrong Asset QualityImpressive Shareholder Returns Citizens Financial Services, Inc. 5

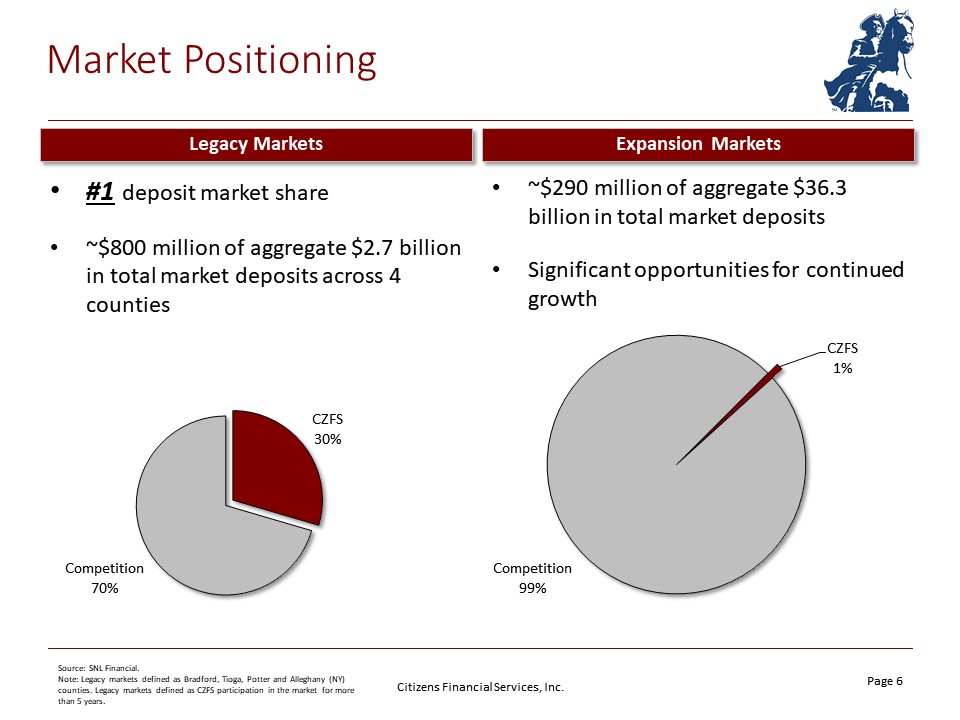

Market Positioning Citizens Financial Services, Inc. 6 Expansion Markets Legacy Markets Source: SNL Financial.Note: Legacy markets defined as Bradford, Tioga, Potter and Alleghany (NY) counties. Legacy markets defined as CZFS participation in the market for more than 5 years. #1 deposit market share~$800 million of aggregate $2.7 billion in total market deposits across 4 counties ~$290 million of aggregate $36.3 billion in total market deposits Significant opportunities for continued growth

Market Comparison Citizens Financial Services, Inc. 7 Source: SNL Financial. Data is weighted by deposits in market.Note: Legacy markets defined as Bradford, Tioga, Potter and Alleghany (NY) counties. Legacy markets defined as CZFS participation in the market for more than 5 years. Estimated Population Growth (‘18-’23) Median Household Income Number of Businesses Unemployment Rate (May 2018)

Deposit Portfolio Citizens Financial Services, Inc. 8 Source: SNL Financial and Company documents. Peers include exchange traded banks and thrifts in the Mid-Atlantic and Northeast with assets between $750 million and $2.5 billion.(1) Data as of 3/31/18. Deposit Growth Comparison ($mm) Current Deposit Composition (6/30/18) Deposit Beta Since Q4 2016(1) 76% non-time deposits20% growth in non-time deposits since 2015 compared to a 4% decline in non-time deposits40% lower(1) deposit beta compared to peer banks & thrifts since Q4 2016Cost of total deposits for the six months ended 6/30/18 of 53 bps $1.1B

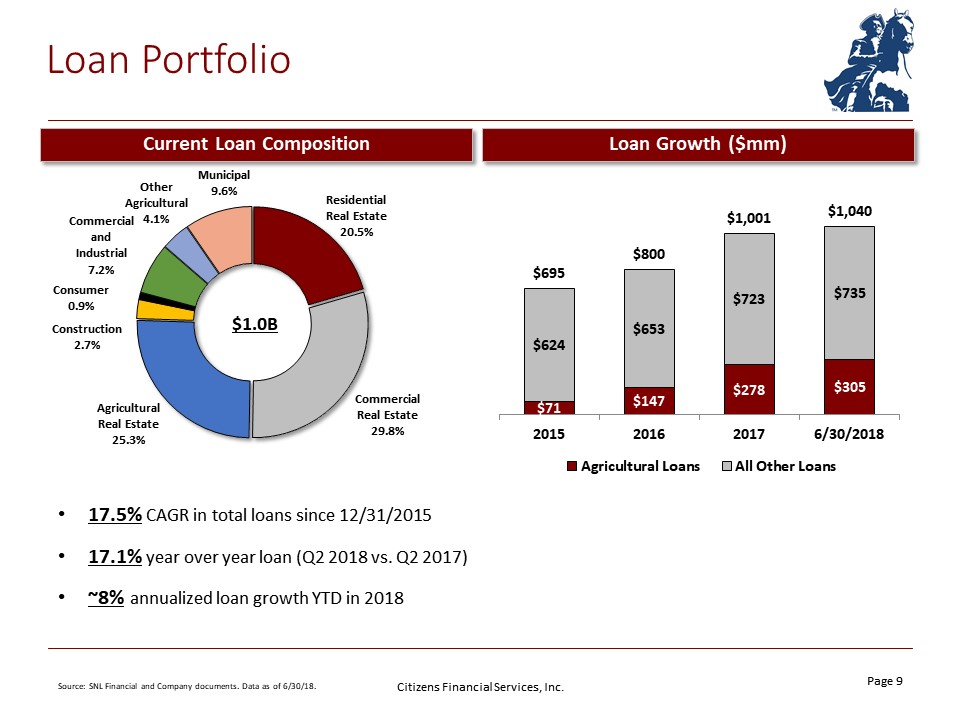

Loan Portfolio Citizens Financial Services, Inc. 9 Source: SNL Financial and Company documents. Data as of 6/30/18. Loan Growth ($mm) Current Loan Composition 17.5% CAGR in total loans since 12/31/201517.1% year over year loan (Q2 2018 vs. Q2 2017)~8% annualized loan growth YTD in 2018 $1.0B

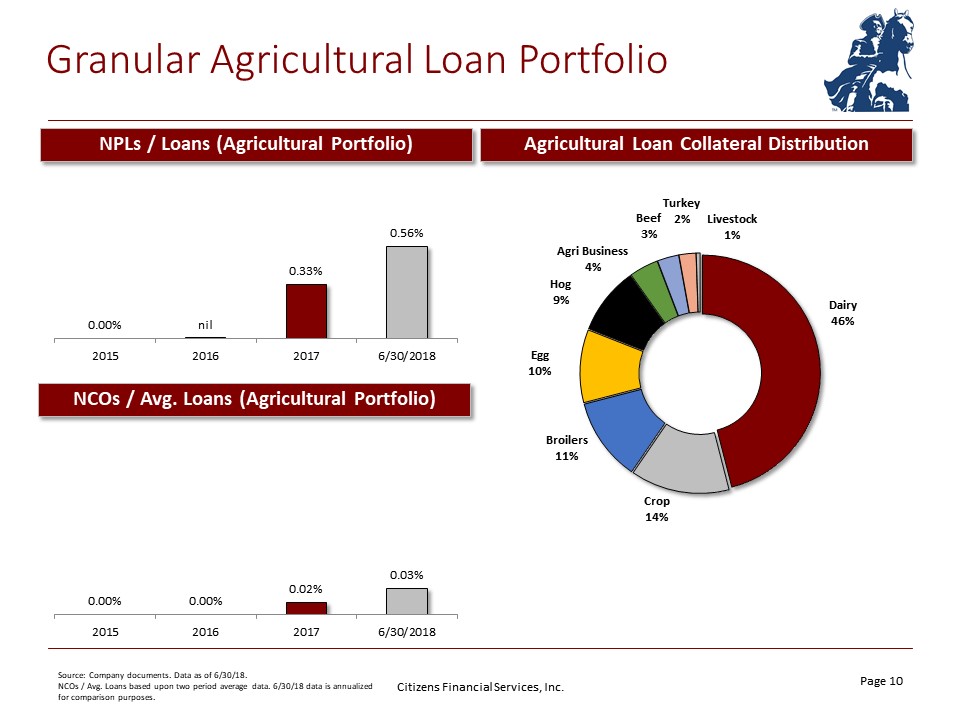

Granular Agricultural Loan Portfolio Citizens Financial Services, Inc. 10 Source: Company documents. Data as of 6/30/18.NCOs / Avg. Loans based upon two period average data. 6/30/18 data is annualized for comparison purposes. Agricultural Loan Collateral Distribution NPLs / Loans (Agricultural Portfolio) NCOs / Avg. Loans (Agricultural Portfolio)

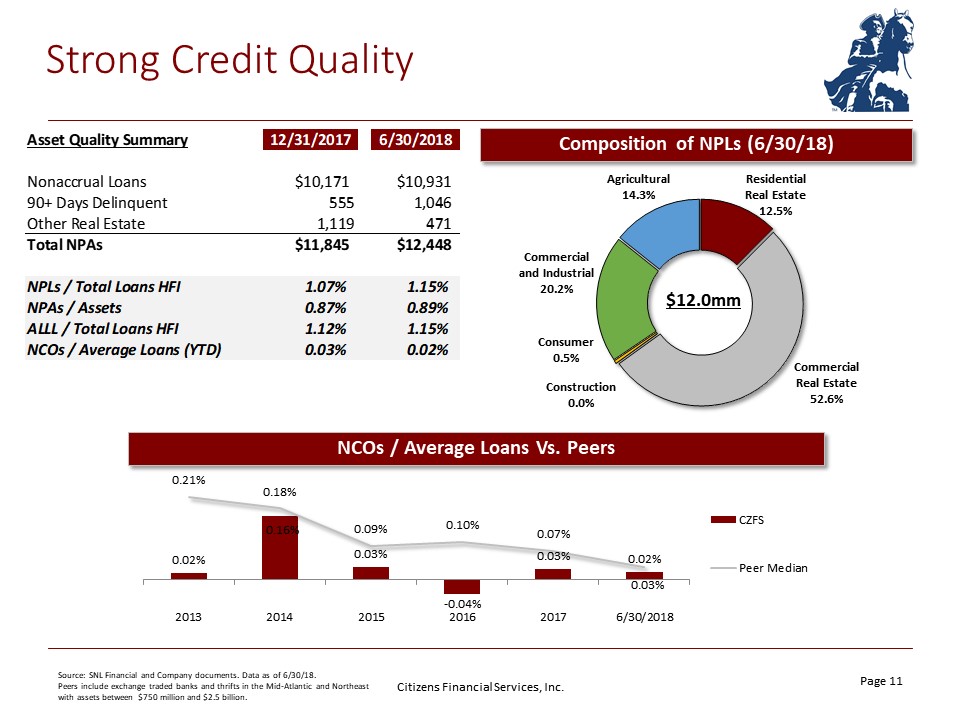

Strong Credit Quality Citizens Financial Services, Inc. 11 Source: SNL Financial and Company documents. Data as of 6/30/18.Peers include exchange traded banks and thrifts in the Mid-Atlantic and Northeast with assets between $750 million and $2.5 billion. Composition of NPLs (6/30/18) $12.0mm NCOs / Average Loans Vs. Peers

Successful Liftouts Driving Continued Growth Citizens Financial Services, Inc. 12 State College branch acquisition has provided an additional growth market for loans which has driven 23% aggregate loan growth in the market since the transaction closed in December 20172017 hire of South Central Pennsylvania Market head who was formerly the SVP and Commercial Team Leader for a large regional bank in South Central Pennsylvania, who has extensive experience with cash management services and building successful teamsIn the first half of 2016 hired three separate teams of lenders servicing central Pennsylvania, and Lebanon and Lancaster counties each with a strong emphasis in agricultural lendingIn January 2017 hired a team of commercial lenders primarily servicing the Lebanon county market

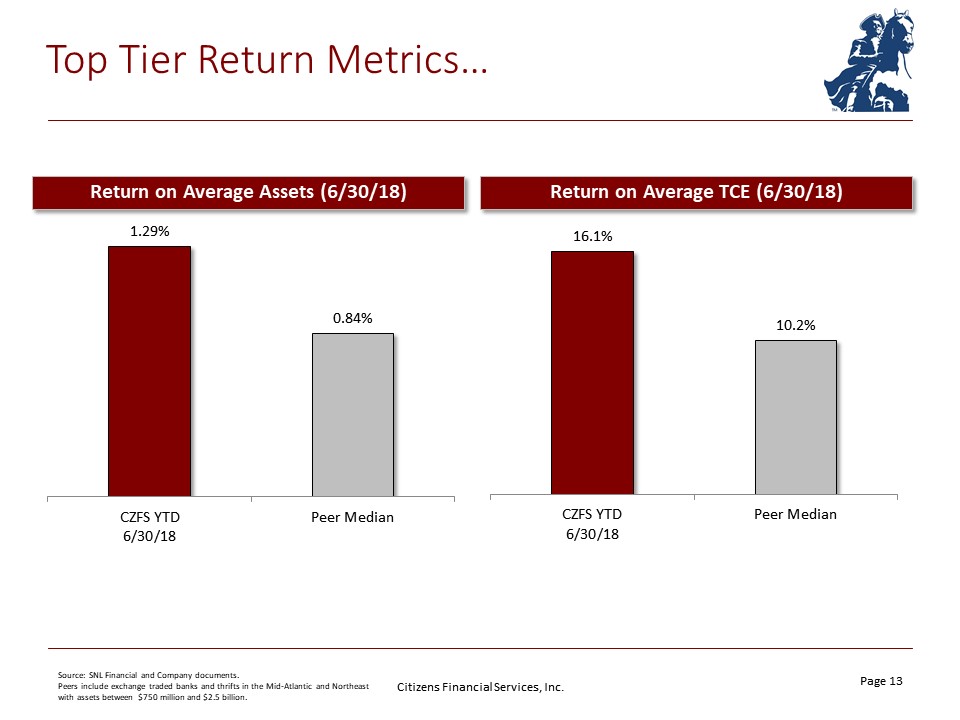

Top Tier Return Metrics… Citizens Financial Services, Inc. 13 Source: SNL Financial and Company documents. Peers include exchange traded banks and thrifts in the Mid-Atlantic and Northeast with assets between $750 million and $2.5 billion. Return on Average TCE (6/30/18) Return on Average Assets (6/30/18)

…Supported by Track Record of Outperformance Citizens Financial Services, Inc. 14 Source: SNL Financial and Company documents. Peers include exchange traded banks and thrifts in the Mid-Atlantic and Northeast with assets between $750 million and $2.5 billion. Peer 2017 data is as adjusted for the impact of tax reform for comparability purposes. Return on Average TCE Return on Average Assets Since the acquisition of First National Bank of Fredericksburg closed in December 2015, we have consistently outperformed our peer banks and our core profitability continues to improve with growth

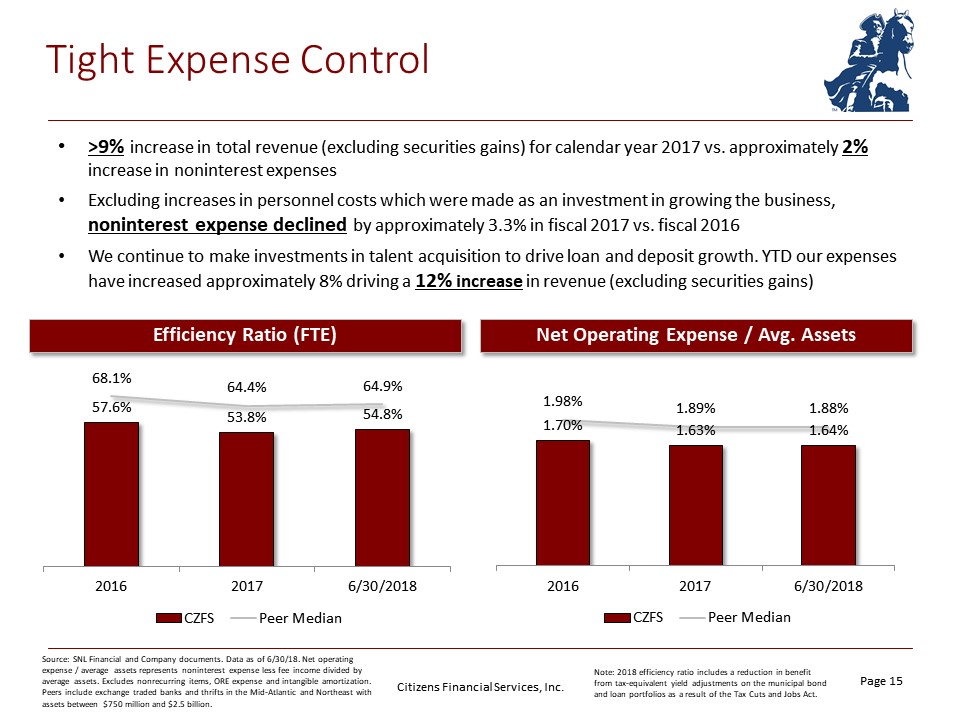

Tight Expense Control Citizens Financial Services, Inc. 15 Source: SNL Financial and Company documents. Data as of 6/30/18. Net operating expense / average assets represents noninterest expense less fee income divided by average assets. Excludes nonrecurring items, ORE expense and intangible amortization.Peers include exchange traded banks and thrifts in the Mid-Atlantic and Northeast with assets between $750 million and $2.5 billion. Net Operating Expense / Avg. Assets Efficiency Ratio (FTE) >9% increase in total revenue (excluding securities gains) for calendar year 2017 vs. approximately 2% increase in noninterest expensesExcluding increases in personnel costs which were made as an investment in growing the business, noninterest expense declined by approximately 3.3% in fiscal 2017 vs. fiscal 2016We continue to make investments in talent acquisition to drive loan and deposit growth. YTD our expenses have increased approximately 8% driving a 12% increase in revenue (excluding securities gains) Note: 2018 efficiency ratio includes a reduction in benefit from tax-equivalent yield adjustments on the municipal bond and loan portfolios as a result of the Tax Cuts and Jobs Act.

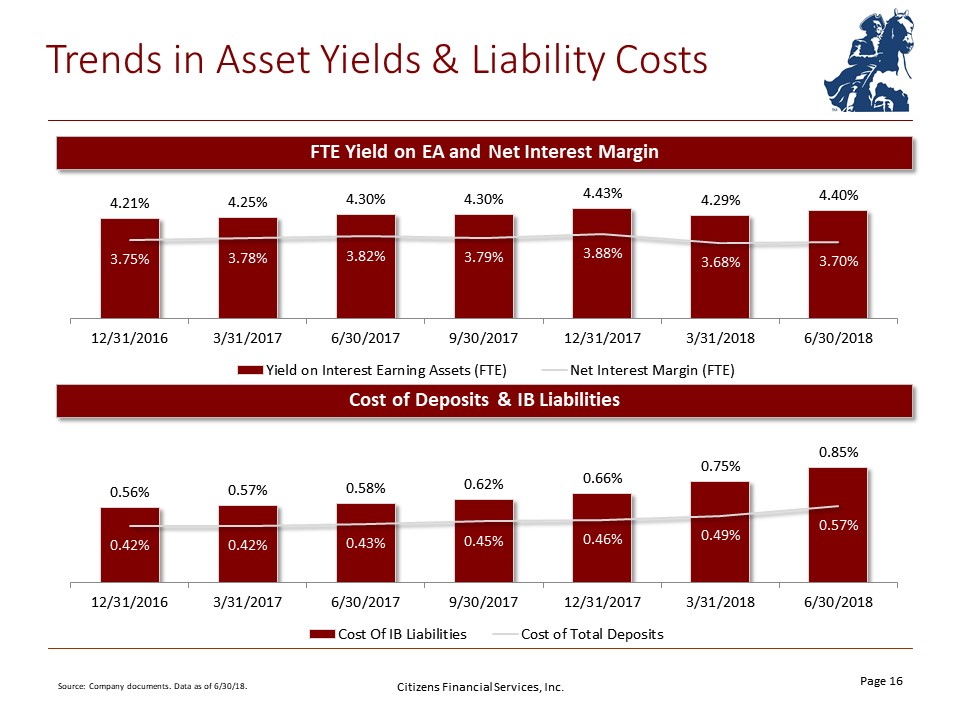

Citizens Financial Services, Inc. 16 Trends in Asset Yields & Liability Costs Source: Company documents. Data as of 6/30/18. Cost of Deposits & IB Liabilities FTE Yield on EA and Net Interest Margin

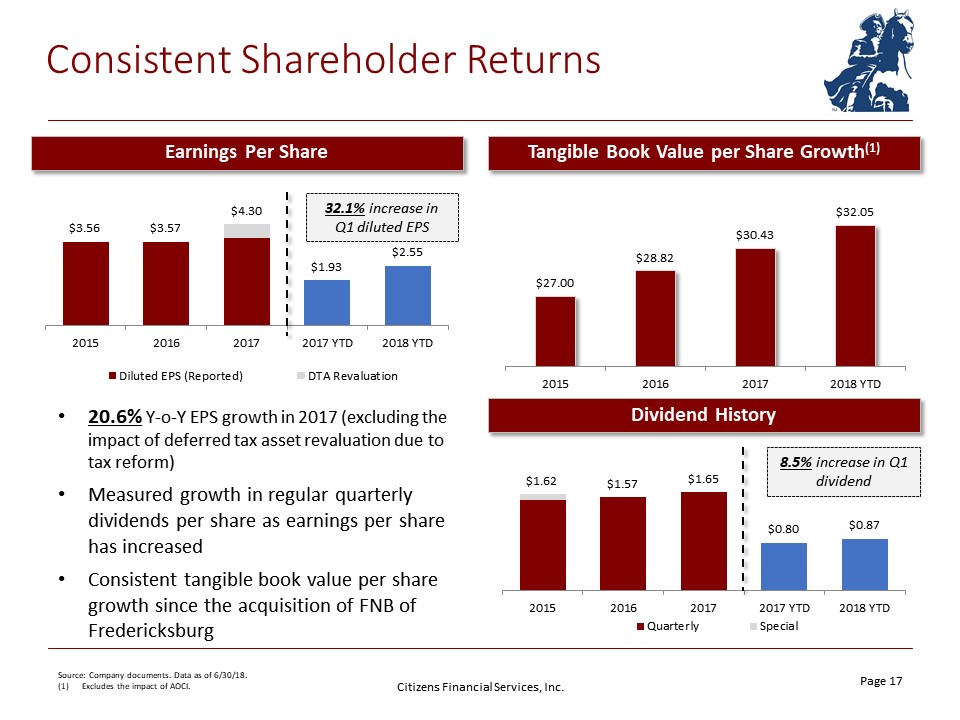

Consistent Shareholder Returns Citizens Financial Services, Inc. 17 Source: Company documents. Data as of 6/30/18.(1) Excludes the impact of AOCI. Dividend History Tangible Book Value per Share Growth(1) Earnings Per Share 8.5% increase in Q1 dividend 32.1% increase in Q1 diluted EPS 20.6% Y-o-Y EPS growth in 2017 (excluding the impact of deferred tax asset revaluation due to tax reform)Measured growth in regular quarterly dividends per share as earnings per share has increasedConsistent tangible book value per share growth since the acquisition of FNB of Fredericksburg

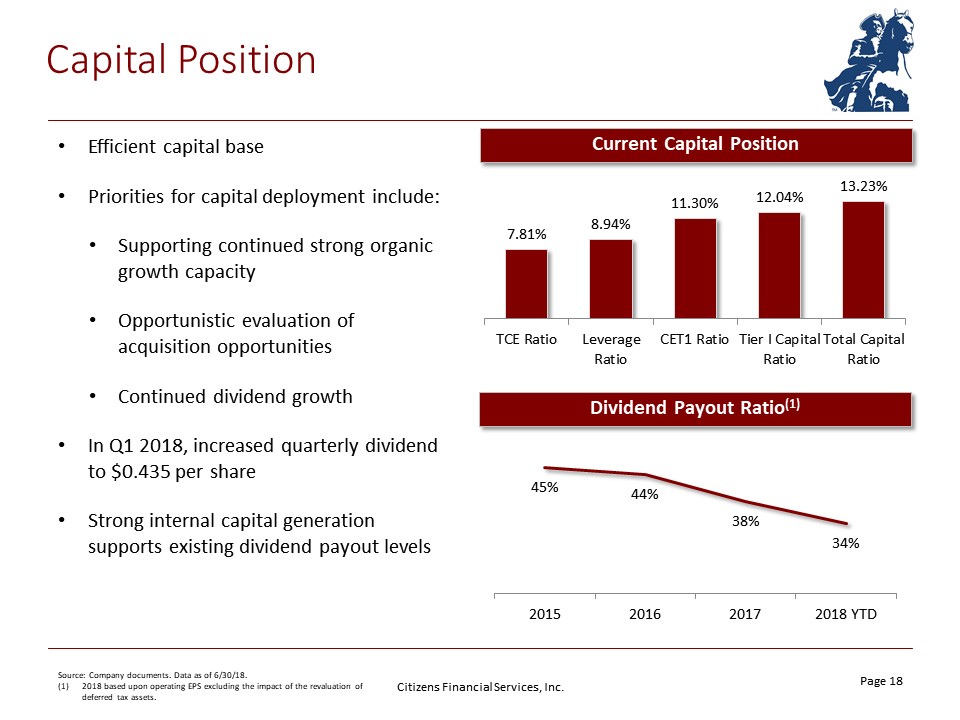

Capital Position Citizens Financial Services, Inc. 18 Source: Company documents. Data as of 6/30/18.(1) 2018 based upon operating EPS excluding the impact of the revaluation of deferred tax assets. Current Capital Position Efficient capital basePriorities for capital deployment include:Supporting continued strong organic growth capacityOpportunistic evaluation of acquisition opportunitiesContinued dividend growthIn Q1 2018, increased quarterly dividend to $0.435 per shareStrong internal capital generation supports existing dividend payout levels Dividend Payout Ratio(1)

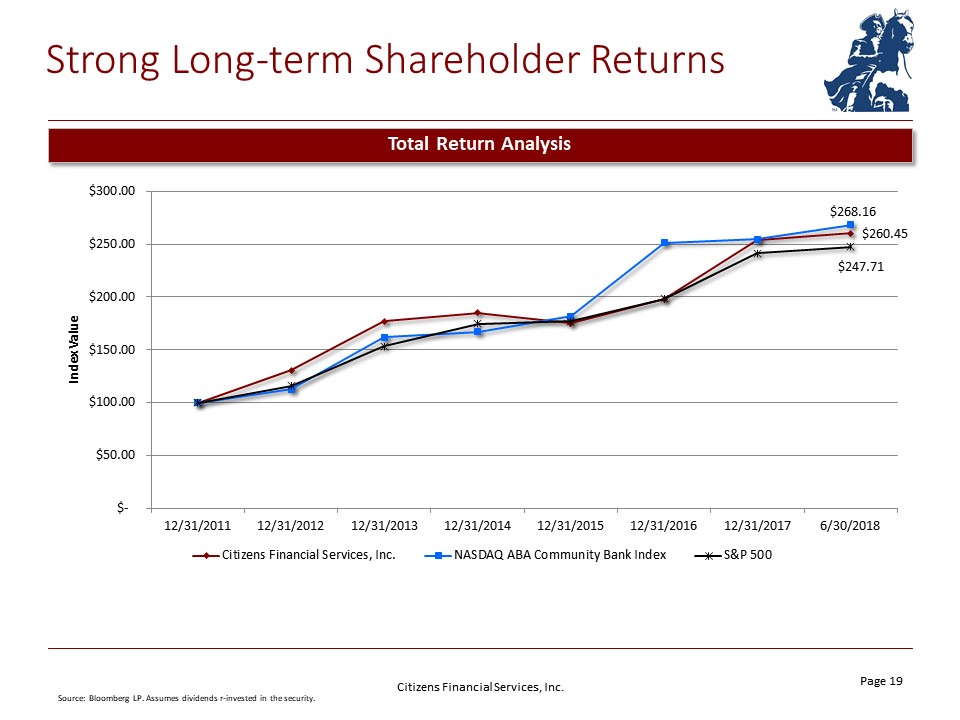

Strong Long-term Shareholder Returns Citizens Financial Services, Inc. 19 Source: Bloomberg LP. Assumes dividends r-invested in the security. Total Return Analysis

Conclusions Profitable franchise in diverse, attractive marketsNine consecutive years as one of the top 200 community banks in the country by US Banker Magazine based upon our three-year average return on equity#1 once in this nine year spanOur profitability metrics are very strong relative to peer institutionsRanked #1 in-state bank for the Commonwealth of PA by Forbes, overall customer satisfaction, trust, branch services and financial advice(2)Ranked #47 among community banks with assets between $1 billion and $10 billion using six categories for analysis(3)Strong agricultural lending practice with excellent risk managementRanked as one of the top 100 farm lenders by dollar volume in the nation and #2 headquartered in the state of Pennsylvania(1) Ranked #1 by the FFIEC in both small business and agricultural lending in Tioga, Bradford and Potter CountiesWe are positioned for disciplined continued organic growth and accretive opportunities through acquisition Citizens Financial Services, Inc. 20 Per American Banker Magazine. As of 9/30/17.https://www.forbes.com/best-in-state-banks/list/#industryRanks:PennsylvaniaPer S&P Global Market Intelligence. Our focus is to provide outstanding customer service and above market shareholder returns

Citizens Financial Services, Inc.15 South Main StreetMansfield, PA 16933570-662-2121800-326-9486www.firstcitizensbank.com First Citizens Community Bank locations: Mansfield – Mansfield WalMart – Blossburg – Wellsboro – Millerton – Troy – Gillett – Canton – Towanda – Sayre Lockhart – Sayre Elmira Street – LeRaysville – Rome – Ulysses – Genesee – Mill Hall – Winfield – Fredericksburg – Lebanon Sunset – Lebanon Isabel Drive – Lebanon Valley Mall – Mt Aetna – Mount Joy – Schuylkill Haven – Friedensburg – Narvon – State College – Wellsville, NY