Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DYCOM INDUSTRIES INC | dyfy2019q2earningsreleaseg.htm |

| 8-K - 8-K - DYCOM INDUSTRIES INC | dyfy2019q28k-earningsrelea.htm |

Exhibit 99.2 2nd Quarter Fiscal 2019 August 13, 2018 Update Conference Call

Forward Looking Statements, Non-GAAP Financial Measures and Other Information The financial information contained in this presentation for the quarter ended July 28, 2018 is preliminary and represents estimates of financial results for the quarter then ended. When the Company files its Quarterly Report on Form 10-Q for the quarter ended July 28, 2018, such information may differ from this preliminary information as a result of the completion of our financial closing procedures, final adjustments or other developments that may arise between now and the time the Company files its Quarterly Report on Form 10-Q. Additionally, the revised guidance for fiscal 2019 and the guidance for the quarter ending October 27, 2018 included in this is presentation is preliminary and is subject to risks and uncertainties that could cause actual results for fiscal 2019 and the quarter ending October 27, 2018 to differ materially from this guidance. The guidance will be updated, as necessary, in our second quarter results release scheduled for Wednesday, August 29, 2018. This presentation contains “forward-looking statements”. Other than statements of historical facts, all statements contained in this presentation, including statements regarding the Company’s future financial position, future revenue, prospects, plans and objectives of management, are forward-looking statements. Words such as “outlook,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “should,” “could,” “project,” and similar expressions, as well as statements in future tense, identify forward-looking statements. You should not consider forward-looking statements as a guarantee of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief at that time with respect to future events. Such statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors, assumptions, uncertainties, and risks that could cause such differences are discussed in our Transition Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 2, 2018 and other filings with the SEC. The forward-looking statements in this presentation are expressly qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update these forward-looking statements to reflect new information, or events or circumstances arising after such date. This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slides included as slides 9 through 12 of this presentation. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. 2

Participants Steven E. Nielsen President & Chief Executive Officer H. Andrew DeFerrari Chief Financial Officer Richard B. Vilsoet General Counsel Agenda Introduction and Q2-19 Update Outlook Q&A 33

Q2-19 Summary The information for the quarter ended July 28, 2018 included in this presentation is preliminary. ™ Revenues and results for the quarter ended July 28, 2018 will be below previous guidance ¾ Contract revenues expected to be approximately $799.5 million (including $3.8 million of revenue from storm restoration services and $9.1 million from a previously acquired business) ¾ Non-GAAP Adjusted Diluted EPS expected to range from $1.05 - $1.08 (provision for income taxes includes approximately $0.9 million of incremental tax benefits primarily from fiscal year tax filings and the tax effect of the settlement of share-based awards) ¾ Large scale deployments were slower than expected during the quarter due to customer timing and tactical considerations, primarily permitting ¾ Margins pressured from under-absorption of labor and field costs at lower revenue level ™ Despite disappointing results for the quarter and near-term trends, pleased with substantial backlog growth and confident in industry opportunities ™ Liquidity solid at approximately $4Ϯϱ million as of July 28, 2018 with approximately $23.9 million expected in cash and $ϰϬϭ million of availability under our Credit Facility See “Regulation G Disclosure” slides 9-12 for a reconciliation of GAAP to Non-GAAP financial measures for the preliminary results. For a reconciliation of the previous guidance GAAP to Non-GAAP financial measures, see Exhibit 99.1 of the Company’s Current Report on Form 4 8-K filed with the Securities and Exchange Commission on May 22, 2018.

Q2-19 Revenue Update Organic % adjusted for revenues from an acquired business and storm restoration services The information for the quarter ended July 28, 2018 included in this presentation is preliminary. ™ Contract revenues expected to be $799.5 million for Q2-19, including $3.8 million of revenue from storm restoration services and $9.1 million from a previously acquired business ™ Excluding revenues from storm restoration services and a previously acquired business, contract revenues increased 0.8% organically: ¾ Top 5 customers increased 3.3% organically ¾ All other customers decreased 7.0% (a) organically (a) Contract revenue is preliminary for Q2-19 ™ Top 5 customers in quarters ended July 28, 2018 and July 29, 2017 represented 77.9% and 76.8%, respectively ™ Organic growth with Verizon at 88.1% and Comcast at 6.7% (a) (a) Customer revenue information is preliminary for Q2-19 See “Regulation G Disclosure” slides 9-12 for a reconciliation of GAAP to Non-GAAP financial measures. 5

Q2-19 Update - Backlog and Awards Financial charts - $ in millions The information for the quarter ended July 28, 2018 included in this presentation is preliminary. (a) (a) (a) (a) (a) Due to the change in the Company’s fiscal year end, the Company’s fiscal 2018 six month transition period consisted of Q1-18 and Q2-18. Selected Current Awards and Extensions Approximate Customers Description Area Term (in years) Comcast Framework Agreement Multi-year Verizon Construction & Engineering Services Various 4 AT&T Construction Services Michigan, Indiana, Ohio 3 Windstream Construction Services Pennsylvania 3 Various Rural and Other Services Oregon, South Dakota, Indiana, Virginia, South Carolina 1-2 Notes: Our backlog estimates represent amounts under master service agreements and other contractual agreements for services projected to be performed over the terms of contracts. These estimates are generally based on contract terms and assessments regarding the timing of the services to be provided. In the case of master service agreements, backlog is calculated based on the work performed in the preceding twelve month period, when available. When estimating backlog for newly initiated master service agreements and other long and short term contracts, we also consider the anticipated scope of the contract and information received from the customer in the procurement process. A significant majority of our backlog estimates comprise services under master service agreements and other long term contracts. Backlog is not a measure defined by United States generally accepted accounting principles; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by others. 6

Q2-19 Update The information for the quarter ended July 28, 2018 included in this presentation is preliminary. ™ Revenues and results for the quarter ended July 28, 2018 will be below previous guidance Previous Guidance Preliminary Results Q2-19 Q2-19(a)(b) Contract revenues $830-$860 million $799.5 million Diluted EPS – GAAP $1.02 -$1.17 $0.94 - $0.97 Non-GAAP Adjusted Diluted EPS $1.13 - $1.28 $1.05 - $1.08 Non-GAAP Adjusted EBITDA % of contract revenues 12.4% - 12.8% 12.0% - 12.2% (a) Preliminary results Q2-19 for contract revenues include approximately $3.8 million of storm restoration services and approximately $9.1 million of revenues from a previously acquired business. (b) Preliminary results Q2-19 for Diluted EPS and Non-GAAP Adjusted Diluted EPS include approximately $0.9 million of incremental tax benefits primarily from fiscal year tax filings and the tax effect of the settlement of share-based awards. ™ Liquidity solid at approximately $4Ϯϱ million as of July 28, 2018 with approximately $23.9 million expected in cash and $ϰϬϭ million of availability under our Credit Facility ¾ Term loan facilities outstanding of $346.0 million as of July 28, 2018 ¾ No outstanding revolver borrowings under Credit Facility as of July 28, 2018 See “Regulation G Disclosure” slides 9-12 for a reconciliation of GAAP to Non-GAAP financial measures for the preliminary results. For a reconciliation of the previous guidance GAAP to Non-GAAP financial measures, see Exhibit 99.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 22, 2018. 7

Outlook The revised guidance for fiscal 2019 and the guidance for the quarter ending October 27, 2018 included in this presentation are preliminary and will be updated, as necessary, in our second quarter results release scheduled for Wednesday, August 29, 2018. ™ Revised financial guidance for Fiscal 2019 Previous Guidance Revised Guidance Fiscal 2019 Fiscal 2019(a) Contract revenues $3.23 - $3.43 billion $3.01- $3.11 billion Diluted EPS – GAAP $3.81 - $4.70 $2.17 - $2.62 Non-GAAP Adjusted Diluted EPS $4.26 - $5.15 $2.62 - $3.07 Non-GAAP Adjusted EBITDA % of contract revenues 12.4% - 12.9% 10.7% - 11.1% (a) Revised Guidance for Diluted EPS and Non-GAAP Adjusted Diluted EPS for fiscal 2019 includes approximately $0.9 million of incremental tax benefits primarily from fiscal year tax filings and the tax effect of the settlement of share-based awards recognized during the quarter ended July 28, 2018. ™ Guidance for the Quarter Ending October 27, 2018 (Q3-19) Guidance Quarter Ending October 27, 2018 (Q3-19) Contract revenues $785 - $835 million Diluted EPS –GAAP $0.69 - $0.93 Non-GAAP Adjusted Diluted EPS $0.80 - $1.04 Non-GAAP Adjusted EBITDA % of contract revenues 11.6% - 12.2% See “Regulation G Disclosure” slides 9-12 for a reconciliation of GAAP to Non-GAAP financial measures for the revised guidance. For a reconciliation of the previous guidance GAAP to Non-GAAP financial measures, see Exhibit 99.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission 8 on May 22, 2018.

Appendix: Regulation G Disclosure Explanation of Non-GAAP Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures used in this presentation as follows: • Non-GAAP Organic Contract Revenues - contract revenues from businesses that are included for the entire period in both the current and prior year periods, excluding contract revenues from storm restoration services. Non-GAAP Organic Contract Revenue growth (decline) is calculated as the percentage change in Non-GAAP Organic Contract Revenues over those of the comparable prior year period. Management believes organic growth (decline) is a helpful measure for comparing the Company’s revenue performance with prior periods. • Non-GAAP Adjusted EBITDA - net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates. • Non-GAAP Adjusted Net Income - GAAP net income before non-cash amortization of the debt discount and the related tax impact, certain tax impacts resulting from vesting and exercise of share-based awards and certain non-recurring items. • Non-GAAP Adjusted Diluted Earnings per Common Share and Non-GAAP Adjusted Diluted Shares - Non-GAAP Adjusted Net Income divided by Non-GAAP Adjusted Diluted Shares outstanding. The Company has a note hedge in effect to offset the economic dilution of additional shares from the Company’s 0.75% convertible senior notes due September 2021 (the “Notes”) up to an average quarterly share price of $130.43. The measure of Non-GAAP Adjusted Diluted shares used in computing Non- GAAP Adjusted Diluted Earnings per Common Share excludes dilution from the Notes. Management believes that the calculation of Non-GAAP Adjusted Diluted shares to reflect the note hedge will be useful to investors because it provides insight into the offsetting economic effect of the hedge against potential conversion of the Notes. Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share: • Non-cash amortization of the debt discount - The Notes were allocated between debt and equity components. The difference between the principal amount and the carrying amount of the liability component of the Notes represents a debt discount. The debt discount is being amortized over the term of the Notes but does not result in periodic cash interest payments. The Company has excluded the non-cash amortization of the debt discount from its Non-GAAP financial measures because it believes it is useful to analyze the component of interest expense for the Notes that will be paid in cash. The exclusion of the non-cash amortization from the Company’s Non- GAAP financial measures provides management with a consistent measure for assessing financial results. • Tax impact of adjusted results - The tax impact of adjusted results reflects the Company’s effective tax rate used for financial planning for the applicable period. 9

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Organic Contract Revenue – certain customers Unaudited ($ in millions) The information for the quarter ended July 28, 2018 included in this presentation is preliminary. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of Non-GAAP Measures on slide 9. 10

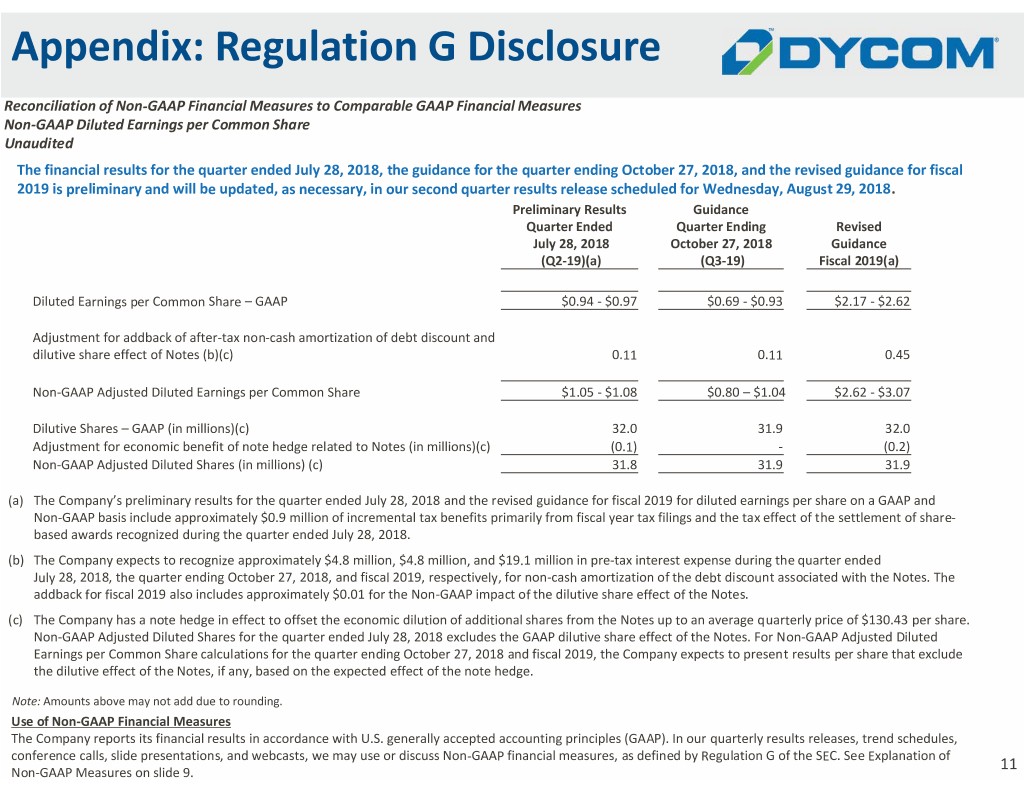

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Non-GAAP Diluted Earnings per Common Share Unaudited The financial results for the quarter ended July 28, 2018, the guidance for the quarter ending October 27, 2018, and the revised guidance for fiscal 2019 is preliminary and will be updated, as necessary, in our second quarter results release scheduled for Wednesday, August 29, 2018. Preliminary Results Guidance Quarter Ended Quarter Ending Revised July 28, 2018 October 27, 2018 Guidance (Q2-19)(a) (Q3-19) Fiscal 2019(a) Diluted Earnings per Common Share – GAAP $0.94 - $0.97 $0.69 - $0.93 $2.17 - $2.62 Adjustment for addback of after-tax non-cash amortization of debt discount and dilutive share effect of Notes (b)(c) 0.11 0.11 0.45 Non-GAAP Adjusted Diluted Earnings per Common Share $1.05 - $1.08 $0.80 –Ψ1.04 $2.62 - $3.07 Dilutive Shares – GAAP (in millions)(c) 32.0 31.9 32.0 Adjustment for economic benefit of note hedge related to Notes (in millions)(c) (0.1) - (0.2) Non-GAAP Adjusted Diluted Shares (in millions) (c) 31.8 31.9 31.9 (a) The Company’s preliminary results for the quarter ended July 28, 2018 and the revised guidance for fiscal 2019 for diluted earnings per share on a GAAP and Non-GAAP basis include approximately $0.9 million of incremental tax benefits primarily from fiscal year tax filings and the tax effect of the settlement of share- based awards recognized during the quarter ended July 28, 2018. (b) The Company expects to recognize approximately $4.8 million, $4.8 million, and $19.1 million in pre-tax interest expense during the quarter ended July 28, 2018, the quarter ending October 27, 2018, and fiscal 2019, respectively, for non-cash amortization of the debt discount associated with the Notes. The addback for fiscal 2019 also includes approximately $0.01 for the Non-GAAP impact of the dilutive share effect of the Notes. (c) The Company has a note hedge in effect to offset the economic dilution of additional shares from the Notes up to an average quarterly price of $130.43 per share. Non-GAAP Adjusted Diluted Shares for the quarter ended July 28, 2018 excludes the GAAP dilutive share effect of the Notes. For Non-GAAP Adjusted Diluted Earnings per Common Share calculations for the quarter ending October 27, 2018 and fiscal 2019, the Company expects to present results per share that exclude the dilutive effect of the Notes, if any, based on the expected effect of the note hedge. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of 11 Non-GAAP Measures on slide 9.

Appendix: Regulation G Disclosure Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures Reconciliation of Net Income to Non-GAAP Adjusted EBITDA based on the Midpoint of Earnings per Common Share ("EPS") range Unaudited The financial results for the quarter ended July 28, 2018, the guidance for the quarter ending October 27, 2018, and the revised guidance for fiscal 2019 is preliminary and will be updated, as necessary, in our second quarter results release scheduled for Wednesday, August 29, 2018. Note: Amounts above may not add due to rounding. Use of Non-GAAP Financial Measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In our quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, we may use or discuss Non-GAAP financial measures, as defined by Regulation G of the SEC. See Explanation of 12 Non-GAAP Measures on slide 9.

2nd Quarter Fiscal 2019 August 13, 2018 Update Conference Call