Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Service Properties Trust | hptq220188k.htm |

| EX-99.1 - EXHIBIT 99.1 - Service Properties Trust | ex991hptq22018earningsrele.htm |

Hospitality Properties Trust Exhibit 99.2 Second Quarter 2018 Supplemental Operating and Financial Data Kimpton Alexis Hotel Seattle Seattle, WA Operator: InterContinental Hotels Group Guest Rooms: 121 All amounts in this report are unaudited.

TABLE OF CONTENTS PAGE CORPORATE INFORMATION 6 Company Profile 7,8 Investor Information 9 Research Coverage 10 FINANCIALS Key Financial Data 12 Condensed Consolidated Balance Sheets 13 Condensed Consolidated Statements of Income 14 TABLE OF CONTENTS TABLE Notes to Condensed Consolidated Statements of Income 15 Condensed Consolidated Statements of Cash Flows 16 Debt Summary 17 Debt Maturity Schedule 18 Leverage Ratios, Coverage Ratios and Public Debt Covenants 19 FF&E Reserve Escrows 20 Property Acquisition and Disposition Information Since January 1, 2018 21 Calculation of EBITDA and Adjusted EBITDA 22 Calculation of Funds from Operations (FFO) and Normalized FFO Available for Common Shareholders 23 Non-GAAP Financial Measures Definitions 24 OPERATING AGREEMENTS AND PORTFOLIO INFORMATION Portfolio by Operating Agreement and Manager 26 Portfolio by Brand 27 Operating Agreement Information 28-30 Operating Statistics by Hotel Operating Agreement and Manager 31 Coverage by Operating Agreement and Manager 32 Hospitality Properties Trust 2 Supplemental Operating and Financial Data, June 30, 2018

WARNING CONCERNING FORWARD LOOKING STATEMENTS THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”, “INTEND”, “PLAN”, “ESTIMATE”, "WILL", “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING: • OUR HOTEL MANAGERS’ OR TENANTS’ ABILITIES TO PAY THE CONTRACTUAL AMOUNTS OF RETURNS OR RENTS DUE TO US, • OUR ABILITY TO COMPETE FOR ACQUISITIONS EFFECTIVELY, • OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS, • OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO SUSTAIN THE AMOUNT OF SUCH DISTRIBUTIONS, • OUR ABILITY TO RAISE DEBT OR EQUITY CAPITAL, • OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL, • OUR INTENT TO MAKE IMPROVEMENTS TO CERTAIN OF OUR PROPERTIES AND THE SUCCESS OF OUR HOTEL RENOVATIONS, • OUR ABILITY TO ENGAGE AND RETAIN QUALIFIED MANAGERS AND TENANTS FOR OUR HOTELS AND TRAVEL CENTERS ON SATISFACTORY TERMS, • THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY, • OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT, • OUR CREDIT RATINGS, • THE ABILITY OF TRAVELCENTERS OF AMERICA LLC, OR TA, TO PAY CURRENT AND DEFERRED RENT AMOUNTS AND OTHER OBLIGATIONS DUE TO US, • OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP INTEREST IN AND OTHER RELATIONSHIPS WITH THE RMR GROUP INC., OR RMR INC., • OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP INTEREST IN AND OTHER RELATIONSHIPS WITH AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS ARRANGED BY AIC, • OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, • CHANGES IN FEDERAL OR STATE TAX LAWS, AND • OTHER MATTERS. OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, FUNDS FROM OPERATIONS, OR FFO, AVAILABLE FOR COMMON SHAREHOLDERS, NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE, BUT ARE NOT LIMITED TO: • THE IMPACT OF CONDITIONS AND CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR MANAGERS AND TENANTS, • COMPETITION WITHIN THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL CENTER INDUSTRIES, PARTICULARLY IN THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED, • COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS AFFECTING THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL CENTER INDUSTRIES, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS, • LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME TAX PURPOSES, WARNING CONCERNING FORWARD LOOKING STATEMENTS CONCERNING FORWARD WARNING • ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL, AND • ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, TA, SONESTA INTERNATIONAL HOTELS CORPORATION, OR SONESTA, RMR INC., THE RMR GROUP LLC, OR RMR LLC, AIC AND OTHERS AFFILIATED WITH THEM. Hospitality Properties Trust 3 Supplemental Operating and Financial Data, June 30, 2018

FOR EXAMPLE: • OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A NUMBER OF FACTORS, INCLUDING OUR FUTURE EARNINGS, THE CAPITAL COSTS WE INCUR TO MAINTAIN OUR PROPERTIES AND OUR WORKING CAPITAL REQUIREMENTS. WE MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED, • THE SECURITY DEPOSITS WHICH WE HOLD ARE NOT IN SEGREGATED CASH ACCOUNTS OR OTHERWISE SEPARATE FROM OUR OTHER ASSETS AND LIABILITIES. ACCORDINGLY, WHEN WE RECORD INCOME BY REDUCING OUR SECURITY DEPOSIT LIABILITIES, WE DO NOT RECEIVE ANY ADDITIONAL CASH PAYMENT. BECAUSE WE DO NOT RECEIVE ANY ADDITIONAL CASH PAYMENT AS WE APPLY SECURITY DEPOSITS TO COVER PAYMENT SHORTFALLS, THE FAILURE OF OUR MANAGERS OR TENANTS TO PAY MINIMUM RETURNS OR RENTS DUE TO US MAY REDUCE OUR CASH FLOWS AND OUR ABILITY TO PAY DISTRIBUTIONS TO SHAREHOLDERS, • AS OF JUNE 30, 2018, APPROXIMATELY 74% OF OUR AGGREGATE ANNUAL MINIMUM RETURNS AND RENTS WERE SECURED BY GUARANTEES OR SECURITY DEPOSITS FROM OUR MANAGERS AND TENANTS. THIS MAY IMPLY THAT THESE MINIMUM RETURNS AND RENTS WILL BE PAID. IN FACT, CERTAIN OF THESE GUARANTEES AND SECURITY DEPOSITS ARE LIMITED IN AMOUNT AND DURATION AND ALL THE GUARANTEES ARE SUBJECT TO THE GUARANTORS’ ABILITIES AND WILLINGNESS TO PAY. WE CANNOT BE SURE OF THE FUTURE FINANCIAL PERFORMANCE OF OUR PROPERTIES AND WHETHER SUCH PERFORMANCE WILL COVER OUR MINIMUM RETURNS AND RENTS, WHETHER THE GUARANTEES OR SECURITY DEPOSITS WILL BE ADEQUATE TO COVER FUTURE SHORTFALLS IN THE MINIMUM RETURNS OR RENTS DUE TO US WHICH THEY GUARANTY OR SECURE, OR REGARDING OUR MANAGERS’, TENANTS’ OR GUARANTORS’ FUTURE ACTIONS IF AND WHEN THE GUARANTEES AND SECURITY DEPOSITS EXPIRE OR ARE DEPLETED OR THEIR ABILITIES OR WILLINGNESS TO PAY MINIMUM RETURNS AND RENTS OWED TO US. MOREOVER, THE SECURITY DEPOSITS WE HOLD ARE NOT SEGREGATED FROM OUR OTHER ASSETS AND THE APPLICATION OF SECURITY DEPOSITS TO COVER PAYMENT SHORTFALLS WILL RESULT IN US RECORDING INCOME, BUT WILL NOT RESULT IN US RECEIVING ADDITIONAL CASH. THE BALANCE OF OUR ANNUAL MINIMUM RETURNS AND RENTS AS OF JUNE 30, 2018 WAS NOT SECURED BY GUARANTEES OR SECURITY DEPOSITS, • THE $35.7 MILLION LIMITED GUARANTY FROM WYNDHAM HOTELS & RESORTS, INC., OR WYNDHAM, WAS DEPLETED DURING THE YEAR ENDED DECEMBER 31, 2017. WE DO NOT HOLD A SECURITY DEPOSIT WITH RESPECT TO AMOUNTS DUE UNDER THE WYNDHAM AGREEMENT. WYNDHAM HAS PAID 85% OF THE MINIMUM RETURNS DUE TO US FOR EACH OF THE THREE AND SIX MONTHS ENDED JUNE 30, 2018. WE CAN PROVIDE NO ASSURANCE AS TO WHETHER WYNDHAM WILL CONTINUE TO PAY AT LEAST THE GREATER OF AVAILABLE HOTEL CASH FLOWS AFTER PAYMENT OF HOTEL OPERATING EXPENSES AND 85% OF THE MINIMUM RETURNS DUE TO US OR IF WYNDHAM WILL DEFAULT ON ITS PAYMENTS, • WE HAVE NO GUARANTEES OR SECURITY DEPOSITS FOR THE MINIMUM RETURNS DUE TO US FROM OUR MARRIOTT NO. 1 OR OUR SONESTA HOTEL AGREEMENTS. ACCORDINGLY, WE MAY RECEIVE AMOUNTS THAT ARE LESS THAN THE CONTRACTUAL MINIMUM RETURNS STATED IN THESE AGREEMENTS, • WE HAVE RECENTLY RENOVATED CERTAIN HOTELS AND ARE CURRENTLY RENOVATING ADDITIONAL HOTELS. WE CURRENTLY EXPECT TO FUND APPROXIMATELY $145.4 MILLION DURING THE LAST SIX MONTHS OF 2018 AND $143.6 MILLION IN 2019 FOR RENOVATIONS AND OTHER CAPITAL IMPROVEMENT COSTS AT CERTAIN OF OUR HOTELS. THE COST OF CAPITAL PROJECTS ASSOCIATED WITH SUCH RENOVATIONS MAY BE GREATER THAN WE NOW ANTICIPATE. OPERATING RESULTS AT OUR HOTELS MAY DECLINE AS A RESULT OF HAVING ROOMS OUT OF SERVICE OR OTHER DISRUPTIONS DURING RENOVATIONS. ALSO, WHILE OUR FUNDING OF THESE CAPITAL PROJECTS WILL CAUSE OUR CONTRACTUAL MINIMUM RETURNS TO INCREASE, THE HOTELS’ OPERATING RESULTS MAY NOT INCREASE OR MAY NOT INCREASE TO THE EXTENT THAT THE MINIMUM RETURNS INCREASE. ACCORDINGLY, COVERAGE OF OUR MINIMUM RETURNS AT THESE HOTELS MAY REMAIN DEPRESSED FOR AN EXTENDED PERIOD, • WE CURRENTLY EXPECT TO PURCHASE FROM TA DURING THE LAST SIX MONTHS OF 2018 APPROXIMATELY $22.8 MILLION OF CAPITAL IMPROVEMENTS TA EXPECTS TO MAKE TO THE TRAVEL CENTERS WE LEASE TO TA. PURSUANT TO THE TERMS OF THE APPLICABLE LEASES, THE ANNUAL RENT PAYABLE TO US BY TA WILL INCREASE AS A RESULT OF ANY SUCH PURCHASES. WE MAY ULTIMATELY PURCHASE MORE OR LESS THAN THIS BUDGETED AMOUNT. TA MAY NOT REALIZE RESULTS FROM ANY OF THESE CAPITAL IMPROVEMENTS WHICH EQUAL OR EXCEED THE INCREASED ANNUAL RENTS IT WILL BE OBLIGATED TO PAY TO US, WHICH COULD INCREASE THE RISK OF TA BEING UNABLE TO PAY AMOUNTS DUE TO US, • HOTEL ROOM DEMAND AND TRUCKING ACTIVITY ARE OFTEN REFLECTIONS OF THE GENERAL ECONOMIC ACTIVITY IN THE COUNTRY AND IN THE GEOGRAPHIC AREAS WHERE OUR PROPERTIES ARE LOCATED. IF ECONOMIC ACTIVITY DECLINES, HOTEL ROOM DEMAND AND TRUCKING ACTIVITY MAY DECLINE AND THE OPERATING RESULTS OF OUR HOTELS AND TRAVEL CENTERS MAY DECLINE, THE FINANCIAL RESULTS OF OUR HOTEL MANAGERS AND OUR TENANTS, INCLUDING TA, MAY SUFFER AND THESE MANAGERS AND TENANTS MAY BE UNABLE TO PAY OUR RETURNS OR RENTS. ALSO, DEPRESSED OPERATING RESULTS FROM OUR PROPERTIES FOR EXTENDED PERIODS MAY RESULT IN THE OPERATORS OF SOME OR ALL OF OUR HOTELS AND OUR TRAVEL CENTERS BECOMING UNABLE OR UNWILLING TO MEET THEIR OBLIGATIONS OR THEIR GUARANTEES AND SECURITY DEPOSITS WE HOLD MAY BE EXHAUSTED, FORWARD LOOKING STATEMENTS (continued) LOOKING STATEMENTS FORWARD • HOTEL AND OTHER COMPETITIVE FORMS OF TEMPORARY LODGING SUPPLY (FOR EXAMPLE, AIRBNB) HAVE BEEN INCREASING AND MAY AFFECT OUR HOTEL OPERATORS' ABILITY TO GROW AVERAGE DAILY RATE, OR ADR, AND OCCUPANCY, AND ADR AND OCCUPANCY COULD DECLINE DUE TO INCREASED COMPETITION WHICH MAY CAUSE OUR HOTEL OPERATORS TO BECOME UNABLE TO PAY OUR RETURNS OR RENTS, • IF THE CURRENT LEVEL OF COMMERCIAL ACTIVITY IN THE COUNTRY DECLINES, IF THE PRICE OF DIESEL FUEL INCREASES SIGNIFICANTLY, IF FUEL CONSERVATION MEASURES ARE INCREASED, IF FREIGHT BUSINESS IS DIRECTED AWAY FROM TRUCKING, IF TA IS UNABLE TO EFFECTIVELY COMPETE OR OPERATE ITS BUSINESS, IF FUEL EFFICIENCIES, THE USE OF ALTERNATIVE FUELS OR TRANSPORTATION TECHNOLOGIES REDUCE THE DEMAND FOR PRODUCTS AND SERVICES TA SELLS OR FOR VARIOUS OTHER REASONS, TA MAY BECOME UNABLE TO PAY CURRENT AND DEFERRED RENTS DUE TO US, • OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES THAT GENERATE RETURNS OR CAN BE LEASED FOR RENTS WHICH EXCEED THEIR OPERATING AND CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE ACCEPTABLE PURCHASE PRICES, ACQUISITION FINANCING, MANAGEMENT CONTRACTS OR LEASE TERMS FOR NEW PROPERTIES, • CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND ANY EXPECTED ACQUISITIONS AND SALES AND ANY RELATED MANAGEMENT OR LEASE ARRANGEMENTS WE EXPECT TO ENTER MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS OR ARRANGEMENTS MAY CHANGE, Hospitality Properties Trust 4 Supplemental Operating and Financial Data, June 30, 2018

• AT JUNE 30, 2018, WE HAD $16.5 MILLION OF CASH AND CASH EQUIVALENTS, $878.0 MILLION AVAILABLE UNDER OUR $1.0 BILLION REVOLVING CREDIT FACILITY AND SECURITY DEPOSITS AND GUARANTEES COVERING SOME OF OUR MINIMUM RETURNS AND RENTS. THESE STATEMENTS MAY IMPLY THAT WE HAVE ABUNDANT WORKING CAPITAL AND LIQUIDITY. HOWEVER, OUR MANAGERS AND TENANTS MAY NOT BE ABLE TO FUND MINIMUM RETURNS AND RENTS DUE TO US FROM OPERATING OUR PROPERTIES OR FROM OTHER RESOURCES; IN THE PAST AND CURRENTLY, CERTAIN OF OUR TENANTS AND HOTEL MANAGERS HAVE IN FACT NOT PAID THE MINIMUM AMOUNTS DUE TO US FROM THEIR OPERATIONS OF OUR LEASED OR MANAGED PROPERTIES. ALSO, CERTAIN OF THE SECURITY DEPOSITS AND GUARANTEES WE HAVE TO COVER ANY SUCH SHORTFALLS ARE LIMITED IN AMOUNT AND DURATION, AND ANY SECURITY DEPOSITS WE APPLY FOR SUCH SHORTFALLS DO NOT RESULT IN ADDITIONAL CASH FLOWS TO US. OUR PROPERTIES REQUIRE, AND WE HAVE AGREED TO PROVIDE, SIGNIFICANT FUNDING FOR CAPITAL IMPROVEMENTS, RENOVATIONS AND OTHER MATTERS. ACCORDINGLY, WE MAY NOT HAVE SUFFICIENT WORKING CAPITAL OR LIQUIDITY, • WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE, • WE INTEND TO CONDUCT OUR BUSINESS ACTIVITIES IN A MANNER THAT WILL AFFORD US REASONABLE ACCESS TO CAPITAL FOR INVESTMENT AND FINANCING ACTIVITIES. HOWEVER, WE MAY NOT SUCCEED IN THIS REGARD AND WE MAY NOT HAVE REASONABLE ACCESS TO CAPITAL, • CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CREDIT FACILITY CONDITIONS THAT WE MAY BE UNABLE TO SATISFY, • ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE DEBT WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND EXPENSES ASSOCIATED WITH SUCH DEBT, • THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN MAY BE INCREASED TO UP TO $2.3 BILLION ON A COMBINED BASIS IN CERTAIN CIRCUMSTANCES; HOWEVER, INCREASING THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN IS SUBJECT TO OUR OBTAINING ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR, • THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND TERM LOAN AND THE FACILITY FEE PAYABLE ON OUR REVOLVING CREDIT FACILITY ARE BASED ON OUR CREDIT RATINGS. FUTURE CHANGES IN OUR CREDIT RATINGS MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE, • WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS; HOWEVER, THE APPLICABLE CONDITIONS MAY NOT BE MET, • THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY TERMINATION IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS, • WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., TA, SONESTA, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND PROVIDE US WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE RELATIONSHIPS MAY NOT MATERIALIZE, • RMR INC. MAY REDUCE THE AMOUNT OF DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US, AND • MARRIOTT INTERNATIONAL, INC., OR MARRIOTT, HAS NOTIFIED US THAT IT DOES NOT INTEND TO EXTEND ITS LEASE FOR OUR RESORT HOTEL ON KAUAI, HAWAII WHEN THAT LEASE EXPIRES ON DECEMBER 31, 2019 AND WE INTEND TO HAVE DISCUSSIONS WITH MARRIOTT ABOUT THE FUTURE OF THIS HOTEL. THESE STATEMENTS MAY IMPLY THAT MARRIOTT WILL NOT OPERATE THIS HOTEL IN THE FUTURE OR THAT WE MAY RECEIVE LESS CASH FLOWS FROM THIS HOTEL IN THE FUTURE. OUR DISCUSSIONS WITH MARRIOTT HAVE BEGUN. AT THIS TIME WE CANNOT PREDICT HOW OUR DISCUSSIONS WITH MARRIOTT WILL IMPACT THE FUTURE OF THIS HOTEL. FOR EXAMPLE, THIS HOTEL MAY CONTINUE TO BE OPERATED BY MARRIOTT ON DIFFERENT CONTRACT TERMS THAN THE CURRENT LEASE, WE MAY IDENTIFY A DIFFERENT OPERATOR FOR THIS HOTEL OR THE CASH FLOWS WHICH WE RECEIVE FROM OUR OWNERSHIP OF THIS HOTEL MAY BE DIFFERENT THAN THE RENT WE NOW RECEIVE. ALSO, ALTHOUGH THE CURRENT LEASE EXPIRES ON DECEMBER 31, 2019, WE AND MARRIOTT MAY AGREE UPON A DIFFERENT TERMINATION DATE. CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM, NATURAL DISASTERS, CHANGES IN OUR MANAGERS’ OR TENANTS’ REVENUES OR EXPENSES, CHANGES IN OUR MANAGERS’ OR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND FOR HOTEL ROOMS OR FUEL OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY. FORWARD LOOKING STATEMENTS (continued) LOOKING STATEMENTS FORWARD THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR THE SEC, INCLUDING UNDER THE CAPTION “RISK FACTORS”, OR INCORPORATED HEREIN OR THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS. EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. Hospitality Properties Trust 5 Supplemental Operating and Financial Data, June 30, 2018

CORPORATE INFORMATION Staybridge Suites Fort Lauderdale, FL Operator: HospitalityInterContinental Properties Hotel Trust Group Guest Rooms:Supplemental 141 Operating and Financial Data, June 30, 2018

COMPANY PROFILE The Company: Corporate Headquarters: Hospitality Properties Trust, or HPT, we, our, or us, is a real estate investment trust, or REIT. As of June 30, 2018, Two Newton Place we owned 325 hotels and 199 travel centers located in 45 states, Puerto Rico and Canada. Our properties are 255 Washington Street, Suite 300 operated by other companies under long term management or lease agreements. We have been investment grade Newton, MA 02458-1634 rated since 1998 and we are currently included in a number of financial indices, including the S&P MidCap 400 Index, the Russell 1000 Index, the MSCI U.S. REIT Index, the FTSE EPRA/NAREIT United States Index and the S&P REIT (t) (617) 964-8389 Composite Index. (f) (617) 969-5730 COMPANY PROFILE COMPANY Management: Stock Exchange Listing: Nasdaq HPT is managed by The RMR Group LLC, or RMR, the majority owned operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an alternative asset management company that was founded in 1986 to manage Trading Symbol: real estate companies and related businesses. RMR primarily provides management services to five publicly Common Shares: HPT traded equity REITs, and three real estate related operating businesses. In addition to managing HPT, RMR Senior Unsecured Debt Ratings: manages Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical office buildings, Select Income REIT, a REIT that owns properties that are primarily net leased to single tenants, Standard & Poor's: BBB- Government Properties Income Trust, a REIT that primarily owns properties throughout the U.S. that are majority Moody's: Baa2 leased to the U.S. and state governments and office properties in the metropolitan Washington, D.C. market area Key Data (as of June 30, 2018): that are leased to government and private sector tenants, and Industrial Logistics Properties Trust, a REIT that owns and leases industrial and logistics properties. RMR also provides management services to TravelCenters of (dollars in 000s) America LLC, a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway Total properties: 524 System (including all the travel centers that HPT owns), convenience stores and restaurants, Five Star Senior Hotels 325 Living Inc., a publicly traded operator of senior living communities, and Sonesta International Hotels Corporation, Travel centers 199 a privately owned operator and franchisor of hotels (including some of the hotels that HPT owns) and cruise Number of hotel rooms/suites 50,379 ships. RMR also manages publicly traded securities of real estate companies, a publicly traded mortgage REIT Q2 2018 total revenues $ 611,951 and private commercial real estate debt funds through wholly owned SEC registered investment advisory Q2 2018 net income available for subsidiaries. As of June 30, 2018, RMR had $30.0 billion of real estate assets under management and the common shareholders $ 97,289 combined RMR managed companies had approximately $12.0 billion of annual revenues, over 1,700 properties Q2 2018 Normalized FFO and over 52,000 employees. We believe that being managed by RMR is a competitive advantage for HPT available for common because of RMR’s depth of management and experience in the real estate industry. We also believe RMR shareholders(1) $ 176,193 provides management services to us at costs that are lower than we would have to pay for similar quality (1) See pages 23-24 for the calculation of FFO services. available for common shareholders and Normalized FFO available for common shareholders and a reconciliation of net income available for common shareholders, determined in accordance with U.S. generally accepted accounting principles, or GAAP, to these amounts. Hospitality Properties Trust 7 Supplemental Operating and Financial Data, June 30, 2018

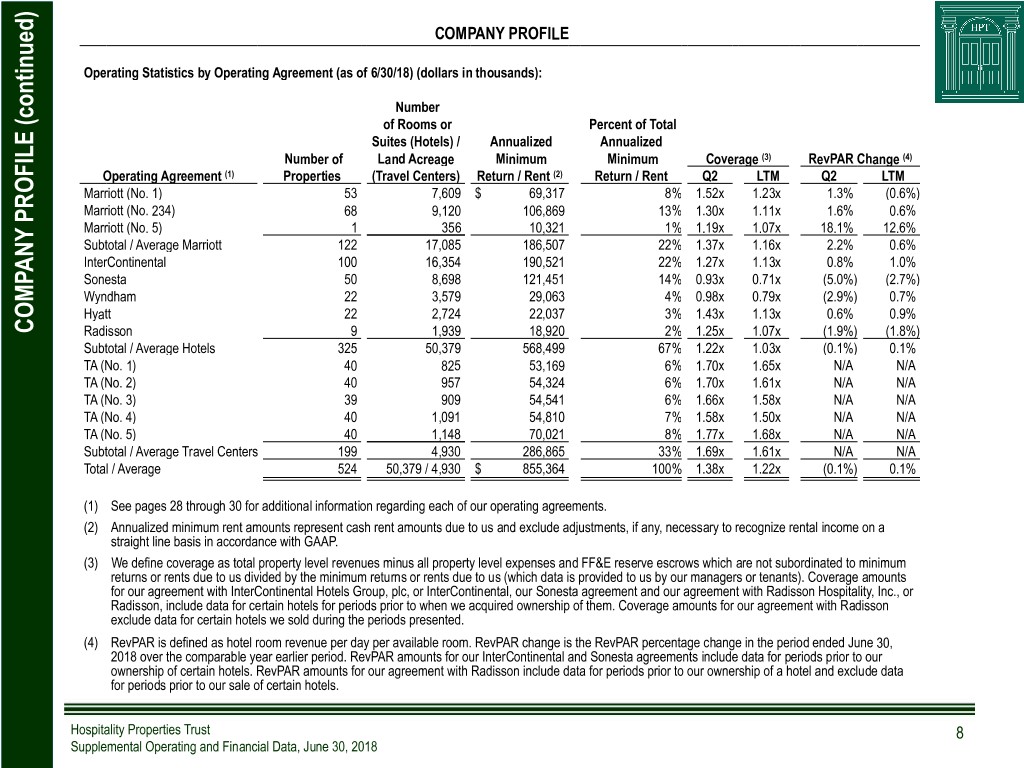

COMPANY PROFILE Operating Statistics by Operating Agreement (as of 6/30/18) (dollars in thousands): Number of Rooms or Percent of Total Suites (Hotels) / Annualized Annualized Number of Land Acreage Minimum Minimum Coverage (3) RevPAR Change (4) Operating Agreement (1) Properties (Travel Centers) Return / Rent (2) Return / Rent Q2 LTM Q2 LTM Marriott (No. 1) 53 7,609 $ 69,317 8% 1.52x 1.23x 1.3% (0.6%) Marriott (No. 234) 68 9,120 106,869 13% 1.30x 1.11x 1.6% 0.6% Marriott (No. 5) 1 356 10,321 1% 1.19x 1.07x 18.1% 12.6% Subtotal / Average Marriott 122 17,085 186,507 22% 1.37x 1.16x 2.2% 0.6% InterContinental 100 16,354 190,521 22% 1.27x 1.13x 0.8% 1.0% Sonesta 50 8,698 121,451 14% 0.93x 0.71x (5.0%) (2.7%) Wyndham 22 3,579 29,063 4% 0.98x 0.79x (2.9%) 0.7% Hyatt 22 2,724 22,037 3% 1.43x 1.13x 0.6% 0.9% COMPANY PROFILE (continued) COMPANY Radisson 9 1,939 18,920 2% 1.25x 1.07x (1.9%) (1.8%) Subtotal / Average Hotels 325 50,379 568,499 67% 1.22x 1.03x (0.1%) 0.1% TA (No. 1) 40 825 53,169 6% 1.70x 1.65x N/A N/A TA (No. 2) 40 957 54,324 6% 1.70x 1.61x N/A N/A TA (No. 3) 39 909 54,541 6% 1.66x 1.58x N/A N/A TA (No. 4) 40 1,091 54,810 7% 1.58x 1.50x N/A N/A TA (No. 5) 40 1,148 70,021 8% 1.77x 1.68x N/A N/A Subtotal / Average Travel Centers 199 4,930 286,865 33% 1.69x 1.61x N/A N/A Total / Average 524 50,379 / 4,930 $ 855,364 100% 1.38x 1.22x (0.1%) 0.1% (1) See pages 28 through 30 for additional information regarding each of our operating agreements. (2) Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a straight line basis in accordance with GAAP. (3) We define coverage as total property level revenues minus all property level expenses and FF&E reserve escrows which are not subordinated to minimum returns or rents due to us divided by the minimum returns or rents due to us (which data is provided to us by our managers or tenants). Coverage amounts for our agreement with InterContinental Hotels Group, plc, or InterContinental, our Sonesta agreement and our agreement with Radisson Hospitality, Inc., or Radisson, include data for certain hotels for periods prior to when we acquired ownership of them. Coverage amounts for our agreement with Radisson exclude data for certain hotels we sold during the periods presented. (4) RevPAR is defined as hotel room revenue per day per available room. RevPAR change is the RevPAR percentage change in the period ended June 30, 2018 over the comparable year earlier period. RevPAR amounts for our InterContinental and Sonesta agreements include data for periods prior to our ownership of certain hotels. RevPAR amounts for our agreement with Radisson include data for periods prior to our ownership of a hotel and exclude data for periods prior to our sale of certain hotels. Hospitality Properties Trust 8 Supplemental Operating and Financial Data, June 30, 2018

INVESTOR INFORMATION Board of Trustees Donna D. Fraiche John L. Harrington William A. Lamkin Independent Trustee Lead Independent Trustee Independent Trustee John G. Murray Adam D. Portnoy Managing Trustee Managing Trustee INVESTOR INFORMATION INVESTOR Senior Management John G. Murray Mark L. Kleifges Ethan S. Bornstein President and Chief Executive Officer Chief Financial Officer and Treasurer Senior Vice President Contact Information Investor Relations Inquiries Hospitality Properties Trust Financial inquiries should be directed to Mark L. Kleifges, Two Newton Place Chief Financial Officer and Treasurer, at (617) 964-8389 255 Washington Street, Suite 300 or mkleifges@rmrgroup.com. Newton, MA 02458-1634 (t) (617) 964-8389 Investor and media inquiries should be directed to (f) (617) 969-5730 Katie Strohacker, Senior Director, Investor Relations at (email) info@hptreit.com (617) 796-8232, or kstrohacker@rmrgroup.com. (website) www.hptreit.com Hospitality Properties Trust 9 Supplemental Operating and Financial Data, June 30, 2018

RESEARCH COVERAGE Equity Research Coverage Baird D.A. Davidson & Co. B. Riley | FBR Michael Bellisario James O. Lykins Bryan Maher (414) 298-6130 (503) 603-3041 (646) 885-5423 mbellisario@rwbaird.com jlykins@dadco.com bmaher@fbr.com Janney Montgomery Scott Stifel Nicolaus Wells Fargo Securities Tyler Batory Simon Yarmak Jeffrey Donnelly RESEARCH COVERAGE (215) 665-4448 (443) 224-1345 (617) 603-4262 tbatory@janney.com yarmaks@stifel.com jeff.donnelly@wellsfargo.com Debt Research Coverage Wells Fargo Securities Thierry Perrein (704) 715-8455 thierry.perrein@wellsfargo.com Rating Agencies Moody’s Investors Service Standard & Poor’s Dilara Sukhov Michael Souers (212) 553-1438 (212) 438-2508 dilara.sukhov@moodys.com michael.souers@standardandpoors.com HPT is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding HPT's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of HPT or its management. HPT does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. Hospitality Properties Trust 10 Supplemental Operating and Financial Data, June 30, 2018

FINANCIALS Residence Inn Huntington Beach Fountain Valley Fountain Valley, CA Operator: HospitalityMarriott International,Properties Trust Inc. Guest Rooms:Supplemental 122 Operating and Financial Data, June 30, 2018

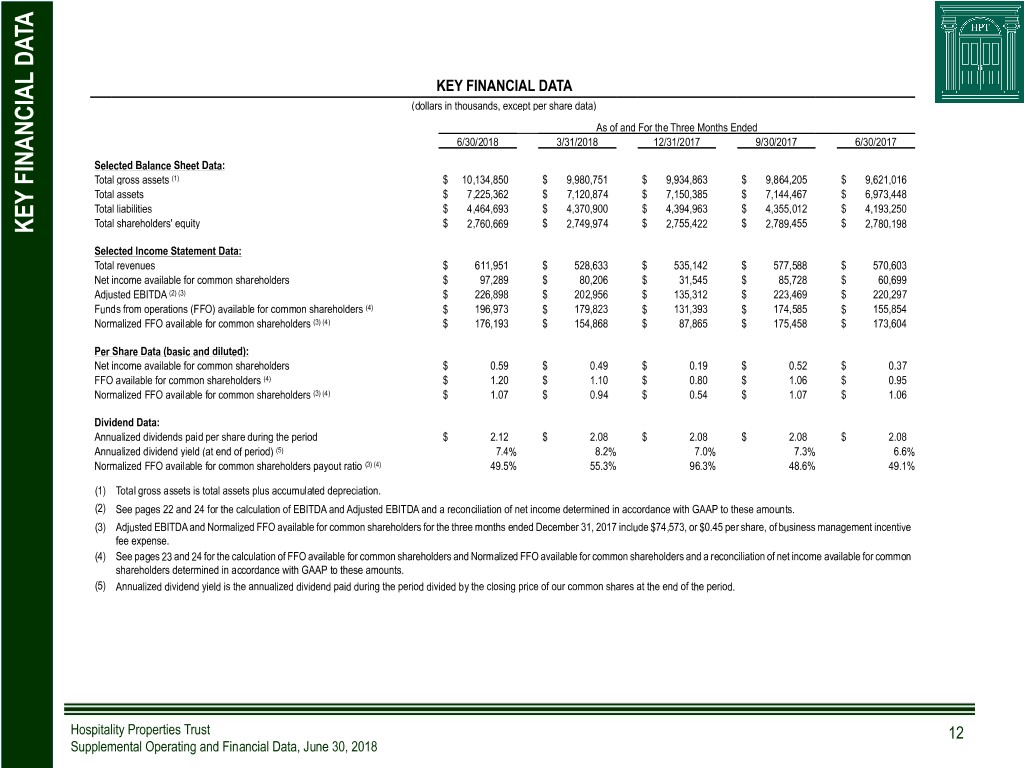

KEY FINANCIAL DATA (dollars in thousands, except per share data) As of and For the Three Months Ended 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 Selected Balance Sheet Data: Total gross assets (1) $ 10,134,850 $ 9,980,751 $ 9,934,863 $ 9,864,205 $ 9,621,016 Total assets $ 7,225,362 $ 7,120,874 $ 7,150,385 $ 7,144,467 $ 6,973,448 Total liabilities $ 4,464,693 $ 4,370,900 $ 4,394,963 $ 4,355,012 $ 4,193,250 Total shareholders' equity $ 2,760,669 $ 2,749,974 $ 2,755,422 $ 2,789,455 $ 2,780,198 KEY FINANCIAL DATA FINANCIAL KEY Selected Income Statement Data: Total revenues $ 611,951 $ 528,633 $ 535,142 $ 577,588 $ 570,603 Net income available for common shareholders $ 97,289 $ 80,206 $ 31,545 $ 85,728 $ 60,699 Adjusted EBITDA (2) (3) $ 226,898 $ 202,956 $ 135,312 $ 223,469 $ 220,297 Funds from operations (FFO) available for common shareholders (4) $ 196,973 $ 179,823 $ 131,393 $ 174,585 $ 155,854 Normalized FFO available for common shareholders (3) (4) $ 176,193 $ 154,868 $ 87,865 $ 175,458 $ 173,604 Per Share Data (basic and diluted): Net income available for common shareholders $ 0.59 $ 0.49 $ 0.19 $ 0.52 $ 0.37 FFO available for common shareholders (4) $ 1.20 $ 1.10 $ 0.80 $ 1.06 $ 0.95 Normalized FFO available for common shareholders (3) (4) $ 1.07 $ 0.94 $ 0.54 $ 1.07 $ 1.06 Dividend Data: Annualized dividends paid per share during the period $ 2.12 $ 2.08 $ 2.08 $ 2.08 $ 2.08 Annualized dividend yield (at end of period) (5) 7.4% 8.2% 7.0% 7.3% 6.6% Normalized FFO available for common shareholders payout ratio (3) (4) 49.5% 55.3% 96.3% 48.6% 49.1% (1) Total gross assets is total assets plus accumulated depreciation. (2) See pages 22 and 24 for the calculation of EBITDA and Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to these amounts. (3) Adjusted EBITDA and Normalized FFO available for common shareholders for the three months ended December 31, 2017 include $74,573, or $0.45 per share, of business management incentive fee expense. (4) See pages 23 and 24 for the calculation of FFO available for common shareholders and Normalized FFO available for common shareholders and a reconciliation of net income available for common shareholders determined in accordance with GAAP to these amounts. (5) Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period. Hospitality Properties Trust 12 Supplemental Operating and Financial Data, June 30, 2018

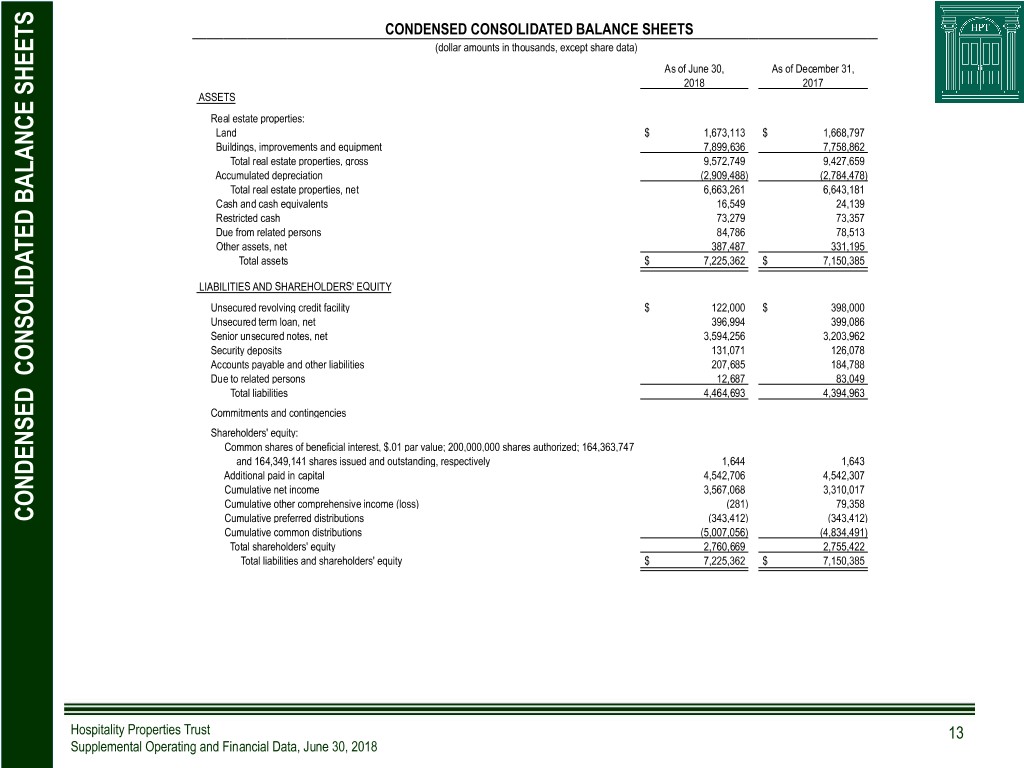

CONDENSED CONSOLIDATED BALANCE SHEETS (dollar amounts in thousands, except share data) As of June 30, As of December 31, 2018 2017 ASSETS Real estate properties: Land $ 1,673,113 $ 1,668,797 Buildings, improvements and equipment 7,899,636 7,758,862 Total real estate properties, gross 9,572,749 9,427,659 Accumulated depreciation (2,909,488) (2,784,478) Total real estate properties, net 6,663,261 6,643,181 Cash and cash equivalents 16,549 24,139 Restricted cash 73,279 73,357 Due from related persons 84,786 78,513 Other assets, net 387,487 331,195 Total assets $ 7,225,362 $ 7,150,385 LIABILITIES AND SHAREHOLDERS' EQUITY Unsecured revolving credit facility $ 122,000 $ 398,000 Unsecured term loan, net 396,994 399,086 Senior unsecured notes, net 3,594,256 3,203,962 Security deposits 131,071 126,078 Accounts payable and other liabilities 207,685 184,788 Due to related persons 12,687 83,049 Total liabilities 4,464,693 4,394,963 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 164,363,747 and 164,349,141 shares issued and outstanding, respectively 1,644 1,643 Additional paid in capital 4,542,706 4,542,307 Cumulative net income 3,567,068 3,310,017 Cumulative other comprehensive income (loss) (281) 79,358 CONDENSED CONSOLIDATED BALANCE SHEETS CONDENSED CONSOLIDATED Cumulative preferred distributions (343,412) (343,412) Cumulative common distributions (5,007,056) (4,834,491) Total shareholders' equity 2,760,669 2,755,422 Total liabilities and shareholders' equity $ 7,225,362 $ 7,150,385 Hospitality Properties Trust 13 Supplemental Operating and Financial Data, June 30, 2018

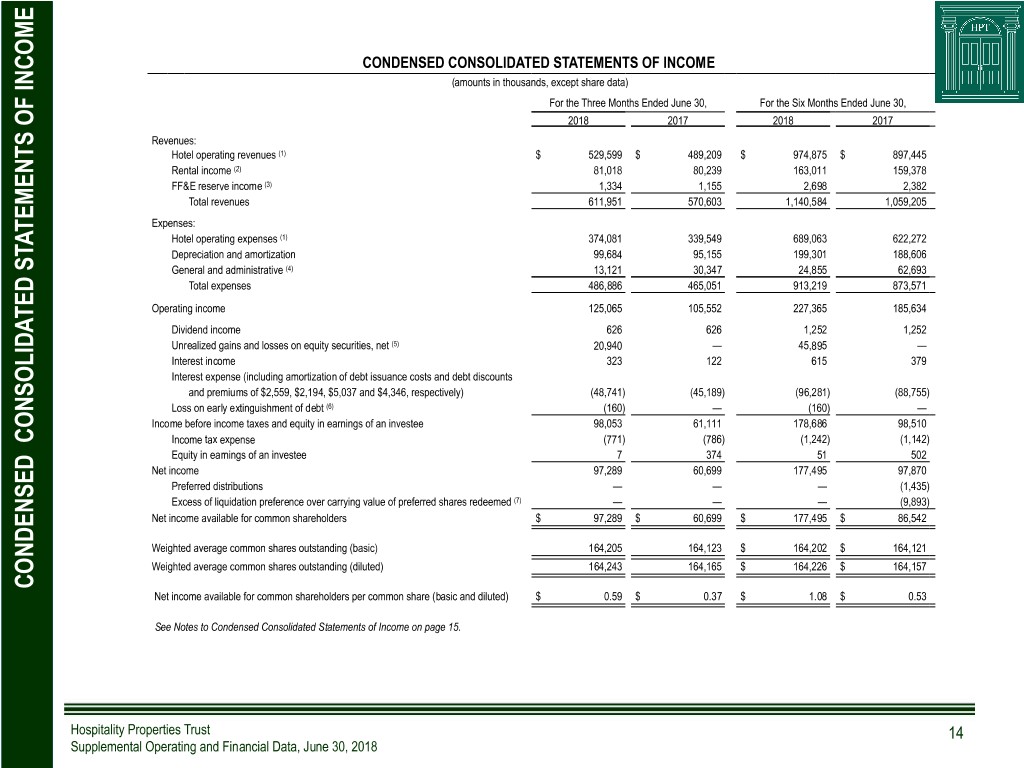

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (amounts in thousands, except share data) For the Three Months Ended June 30, For the Six Months Ended June 30, 2018 2017 2018 2017 Revenues: Hotel operating revenues (1) $ 529,599 $ 489,209 $ 974,875 $ 897,445 Rental income (2) 81,018 80,239 163,011 159,378 FF&E reserve income (3) 1,334 1,155 2,698 2,382 Total revenues 611,951 570,603 1,140,584 1,059,205 Expenses: Hotel operating expenses (1) 374,081 339,549 689,063 622,272 Depreciation and amortization 99,684 95,155 199,301 188,606 General and administrative (4) 13,121 30,347 24,855 62,693 Total expenses 486,886 465,051 913,219 873,571 Operating income 125,065 105,552 227,365 185,634 Dividend income 626 626 1,252 1,252 Unrealized gains and losses on equity securities, net (5) 20,940 — 45,895 — Interest income 323 122 615 379 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $2,559, $2,194, $5,037 and $4,346, respectively) (48,741) (45,189) (96,281) (88,755) Loss on early extinguishment of debt (6) (160) — (160) — Income before income taxes and equity in earnings of an investee 98,053 61,111 178,686 98,510 Income tax expense (771) (786) (1,242) (1,142) Equity in earnings of an investee 7 374 51 502 Net income 97,289 60,699 177,495 97,870 Preferred distributions — — — (1,435) Excess of liquidation preference over carrying value of preferred shares redeemed (7) — — — (9,893) Net income available for common shareholders $ 97,289 $ 60,699 $ 177,495 $ 86,542 Weighted average common shares outstanding (basic) 164,205 164,123 $ 164,202 $ 164,121 Weighted average common shares outstanding (diluted) 164,243 164,165 $ 164,226 $ 164,157 CONDENSED CONSOLIDATED STATEMENTS OF INCOME STATEMENTS CONDENSED CONSOLIDATED Net income available for common shareholders per common share (basic and diluted) $ 0.59 $ 0.37 $ 1.08 $ 0.53 See Notes to Condensed Consolidated Statements of Income on page 15. Hospitality Properties Trust 14 Supplemental Operating and Financial Data, June 30, 2018

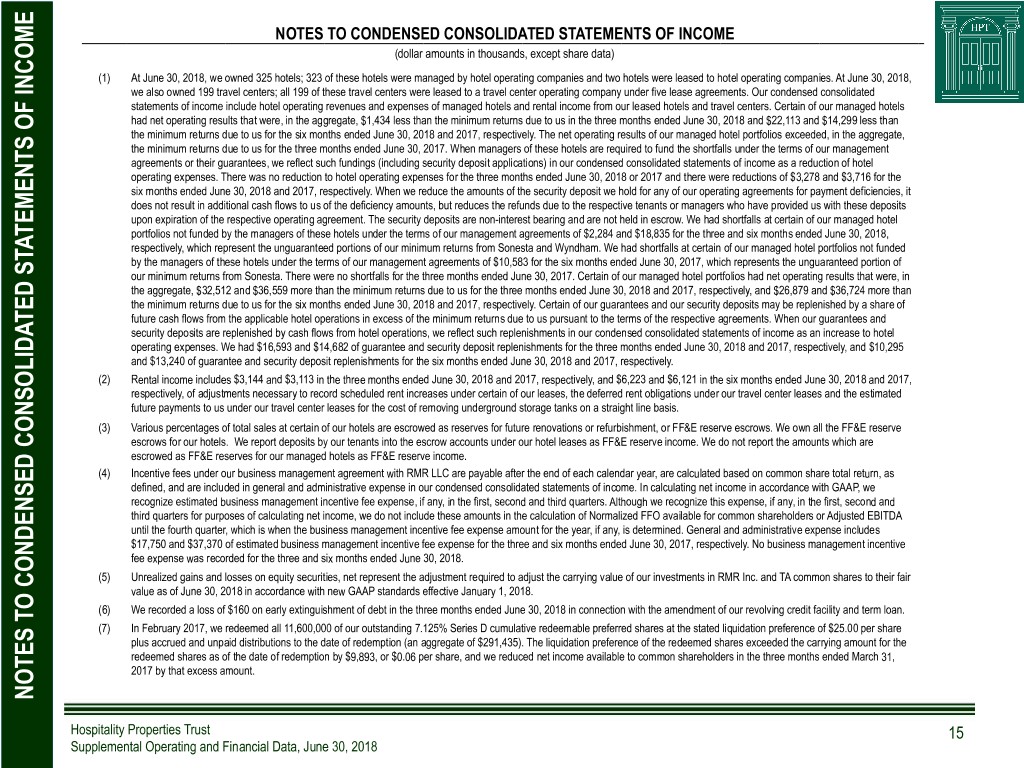

NOTES TO CONDENSED CONSOLIDATED STATEMENTS OF INCOME (dollar amounts in thousands, except share data) (1) At June 30, 2018, we owned 325 hotels; 323 of these hotels were managed by hotel operating companies and two hotels were leased to hotel operating companies. At June 30, 2018, we also owned 199 travel centers; all 199 of these travel centers were leased to a travel center operating company under five lease agreements. Our condensed consolidated statements of income include hotel operating revenues and expenses of managed hotels and rental income from our leased hotels and travel centers. Certain of our managed hotels had net operating results that were, in the aggregate, $1,434 less than the minimum returns due to us in the three months ended June 30, 2018 and $22,113 and $14,299 less than the minimum returns due to us for the six months ended June 30, 2018 and 2017, respectively. The net operating results of our managed hotel portfolios exceeded, in the aggregate, the minimum returns due to us for the three months ended June 30, 2017. When managers of these hotels are required to fund the shortfalls under the terms of our management agreements or their guarantees, we reflect such fundings (including security deposit applications) in our condensed consolidated statements of income as a reduction of hotel operating expenses. There was no reduction to hotel operating expenses for the three months ended June 30, 2018 or 2017 and there were reductions of $3,278 and $3,716 for the six months ended June 30, 2018 and 2017, respectively. When we reduce the amounts of the security deposit we hold for any of our operating agreements for payment deficiencies, it does not result in additional cash flows to us of the deficiency amounts, but reduces the refunds due to the respective tenants or managers who have provided us with these deposits upon expiration of the respective operating agreement. The security deposits are non-interest bearing and are not held in escrow. We had shortfalls at certain of our managed hotel portfolios not funded by the managers of these hotels under the terms of our management agreements of $2,284 and $18,835 for the three and six months ended June 30, 2018, respectively, which represent the unguaranteed portions of our minimum returns from Sonesta and Wyndham. We had shortfalls at certain of our managed hotel portfolios not funded by the managers of these hotels under the terms of our management agreements of $10,583 for the six months ended June 30, 2017, which represents the unguaranteed portion of our minimum returns from Sonesta. There were no shortfalls for the three months ended June 30, 2017. Certain of our managed hotel portfolios had net operating results that were, in the aggregate, $32,512 and $36,559 more than the minimum returns due to us for the three months ended June 30, 2018 and 2017, respectively, and $26,879 and $36,724 more than the minimum returns due to us for the six months ended June 30, 2018 and 2017, respectively. Certain of our guarantees and our security deposits may be replenished by a share of future cash flows from the applicable hotel operations in excess of the minimum returns due to us pursuant to the terms of the respective agreements. When our guarantees and security deposits are replenished by cash flows from hotel operations, we reflect such replenishments in our condensed consolidated statements of income as an increase to hotel operating expenses. We had $16,593 and $14,682 of guarantee and security deposit replenishments for the three months ended June 30, 2018 and 2017, respectively, and $10,295 and $13,240 of guarantee and security deposit replenishments for the six months ended June 30, 2018 and 2017, respectively. (2) Rental income includes $3,144 and $3,113 in the three months ended June 30, 2018 and 2017, respectively, and $6,223 and $6,121 in the six months ended June 30, 2018 and 2017, respectively, of adjustments necessary to record scheduled rent increases under certain of our leases, the deferred rent obligations under our travel center leases and the estimated future payments to us under our travel center leases for the cost of removing underground storage tanks on a straight line basis. (3) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishment, or FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. We report deposits by our tenants into the escrow accounts under our hotel leases as FF&E reserve income. We do not report the amounts which are escrowed as FF&E reserves for our managed hotels as FF&E reserve income. (4) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include these amounts in the calculation of Normalized FFO available for common shareholders or Adjusted EBITDA until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. General and administrative expense includes $17,750 and $37,370 of estimated business management incentive fee expense for the three and six months ended June 30, 2017, respectively. No business management incentive fee expense was recorded for the three and six months ended June 30, 2018. (5) Unrealized gains and losses on equity securities, net represent the adjustment required to adjust the carrying value of our investments in RMR Inc. and TA common shares to their fair value as of June 30, 2018 in accordance with new GAAP standards effective January 1, 2018. (6) We recorded a loss of $160 on early extinguishment of debt in the three months ended June 30, 2018 in connection with the amendment of our revolving credit facility and term loan. (7) In February 2017, we redeemed all 11,600,000 of our outstanding 7.125% Series D cumulative redeemable preferred shares at the stated liquidation preference of $25.00 per share plus accrued and unpaid distributions to the date of redemption (an aggregate of $291,435). The liquidation preference of the redeemed shares exceeded the carrying amount for the redeemed shares as of the date of redemption by $9,893, or $0.06 per share, and we reduced net income available to common shareholders in the three months ended March 31, 2017 by that excess amount. NOTES TO CONDENSED CONSOLIDATED STATEMENTS OF INCOME STATEMENTS CONDENSED CONSOLIDATED NOTES TO Hospitality Properties Trust 15 Supplemental Operating and Financial Data, June 30, 2018

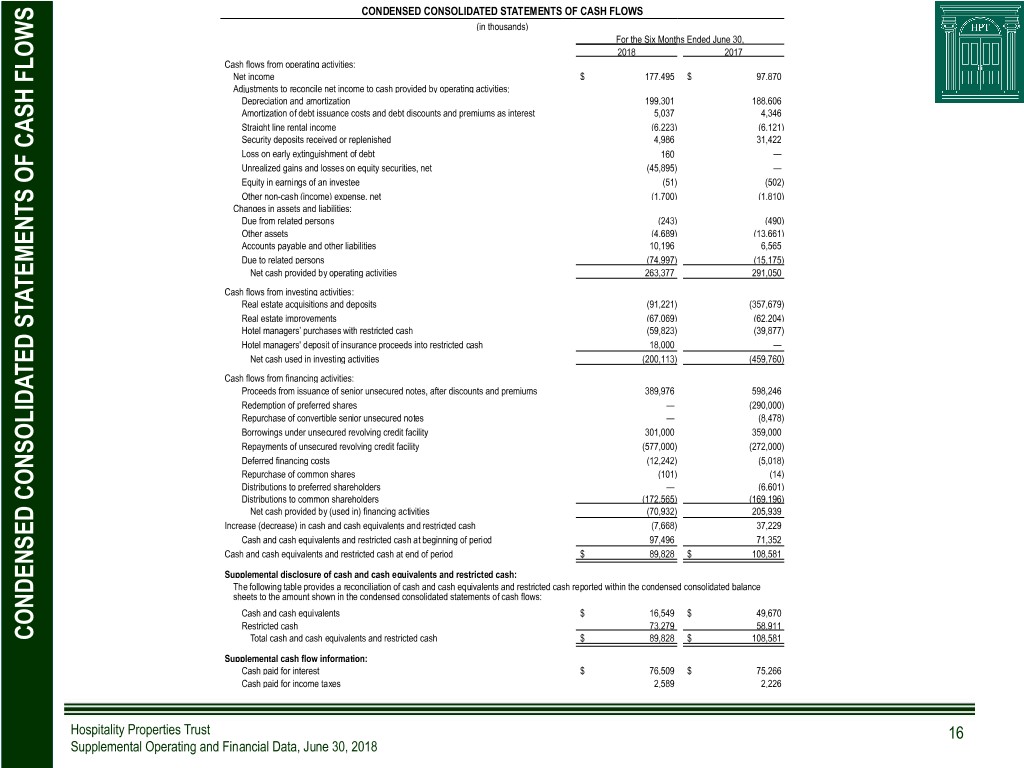

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) For the Six Months Ended June 30, 2018 2017 Cash flows from operating activities: Net income $ 177,495 $ 97,870 Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization 199,301 188,606 Amortization of debt issuance costs and debt discounts and premiums as interest 5,037 4,346 Straight line rental income (6,223) (6,121) Security deposits received or replenished 4,986 31,422 Loss on early extinguishment of debt 160 — Unrealized gains and losses on equity securities, net (45,895) — Equity in earnings of an investee (51) (502) Other non-cash (income) expense, net (1,700) (1,810) Changes in assets and liabilities: Due from related persons (243) (490) Other assets (4,689) (13,661) Accounts payable and other liabilities 10,196 6,565 Due to related persons (74,997) (15,175) Net cash provided by operating activities 263,377 291,050 Cash flows from investing activities: Real estate acquisitions and deposits (91,221) (357,679) Real estate improvements (67,069) (62,204) Hotel managers’ purchases with restricted cash (59,823) (39,877) Hotel managers' deposit of insurance proceeds into restricted cash 18,000 — Net cash used in investing activities (200,113) (459,760) Cash flows from financing activities: Proceeds from issuance of senior unsecured notes, after discounts and premiums 389,976 598,246 Redemption of preferred shares — (290,000) Repurchase of convertible senior unsecured notes — (8,478) Borrowings under unsecured revolving credit facility 301,000 359,000 Repayments of unsecured revolving credit facility (577,000) (272,000) Deferred financing costs (12,242) (5,018) Repurchase of common shares (101) (14) Distributions to preferred shareholders — (6,601) Distributions to common shareholders (172,565) (169,196) Net cash provided by (used in) financing activities (70,932) 205,939 Increase (decrease) in cash and cash equivalents and restricted cash (7,668) 37,229 Cash and cash equivalents and restricted cash at beginning of period 97,496 71,352 Cash and cash equivalents and restricted cash at end of period $ 89,828 $ 108,581 Supplemental disclosure of cash and cash equivalents and restricted cash: The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets to the amount shown in the condensed consolidated statements of cash flows: Cash and cash equivalents $ 16,549 $ 49,670 Restricted cash 73,279 58,911 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS STATEMENTS CONDENSED CONSOLIDATED Total cash and cash equivalents and restricted cash $ 89,828 $ 108,581 Supplemental cash flow information: Cash paid for interest $ 76,509 $ 75,266 Cash paid for income taxes 2,589 2,226 Hospitality Properties Trust 16 Supplemental Operating and Financial Data, June 30, 2018

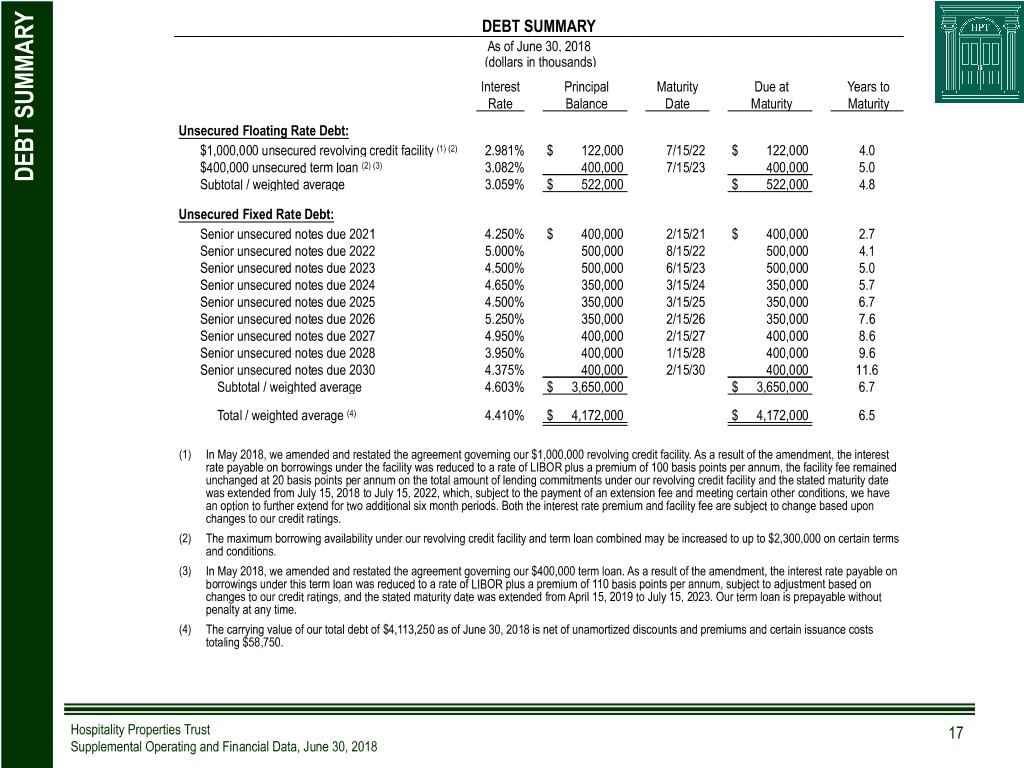

DEBT SUMMARY As of June 30, 2018 (dollars in thousands) Interest Principal Maturity Due at Years to Rate Balance Date Maturity Maturity Unsecured Floating Rate Debt: $1,000,000 unsecured revolving credit facility (1) (2) 2.981% $ 122,000 7/15/22 $ 122,000 4.0 $400,000 unsecured term loan (2) (3) 3.082% 400,000 7/15/23 400,000 5.0 DEBT SUMMARY Subtotal / weighted average 3.059% $ 522,000 $ 522,000 4.8 Unsecured Fixed Rate Debt: Senior unsecured notes due 2021 4.250% $ 400,000 2/15/21 $ 400,000 2.7 Senior unsecured notes due 2022 5.000% 500,000 8/15/22 500,000 4.1 Senior unsecured notes due 2023 4.500% 500,000 6/15/23 500,000 5.0 Senior unsecured notes due 2024 4.650% 350,000 3/15/24 350,000 5.7 Senior unsecured notes due 2025 4.500% 350,000 3/15/25 350,000 6.7 Senior unsecured notes due 2026 5.250% 350,000 2/15/26 350,000 7.6 Senior unsecured notes due 2027 4.950% 400,000 2/15/27 400,000 8.6 Senior unsecured notes due 2028 3.950% 400,000 1/15/28 400,000 9.6 Senior unsecured notes due 2030 4.375% 400,000 2/15/30 400,000 11.6 Subtotal / weighted average 4.603% $ 3,650,000 $ 3,650,000 6.7 Total / weighted average (4) 4.410% $ 4,172,000 $ 4,172,000 6.5 (1) In May 2018, we amended and restated the agreement governing our $1,000,000 revolving credit facility. As a result of the amendment, the interest rate payable on borrowings under the facility was reduced to a rate of LIBOR plus a premium of 100 basis points per annum, the facility fee remained unchanged at 20 basis points per annum on the total amount of lending commitments under our revolving credit facility and the stated maturity date was extended from July 15, 2018 to July 15, 2022, which, subject to the payment of an extension fee and meeting certain other conditions, we have an option to further extend for two additional six month periods. Both the interest rate premium and facility fee are subject to change based upon changes to our credit ratings. (2) The maximum borrowing availability under our revolving credit facility and term loan combined may be increased to up to $2,300,000 on certain terms and conditions. (3) In May 2018, we amended and restated the agreement governing our $400,000 term loan. As a result of the amendment, the interest rate payable on borrowings under this term loan was reduced to a rate of LIBOR plus a premium of 110 basis points per annum, subject to adjustment based on changes to our credit ratings, and the stated maturity date was extended from April 15, 2019 to July 15, 2023. Our term loan is prepayable without penalty at any time. (4) The carrying value of our total debt of $4,113,250 as of June 30, 2018 is net of unamortized discounts and premiums and certain issuance costs totaling $58,750. Hospitality Properties Trust 17 Supplemental Operating and Financial Data, June 30, 2018

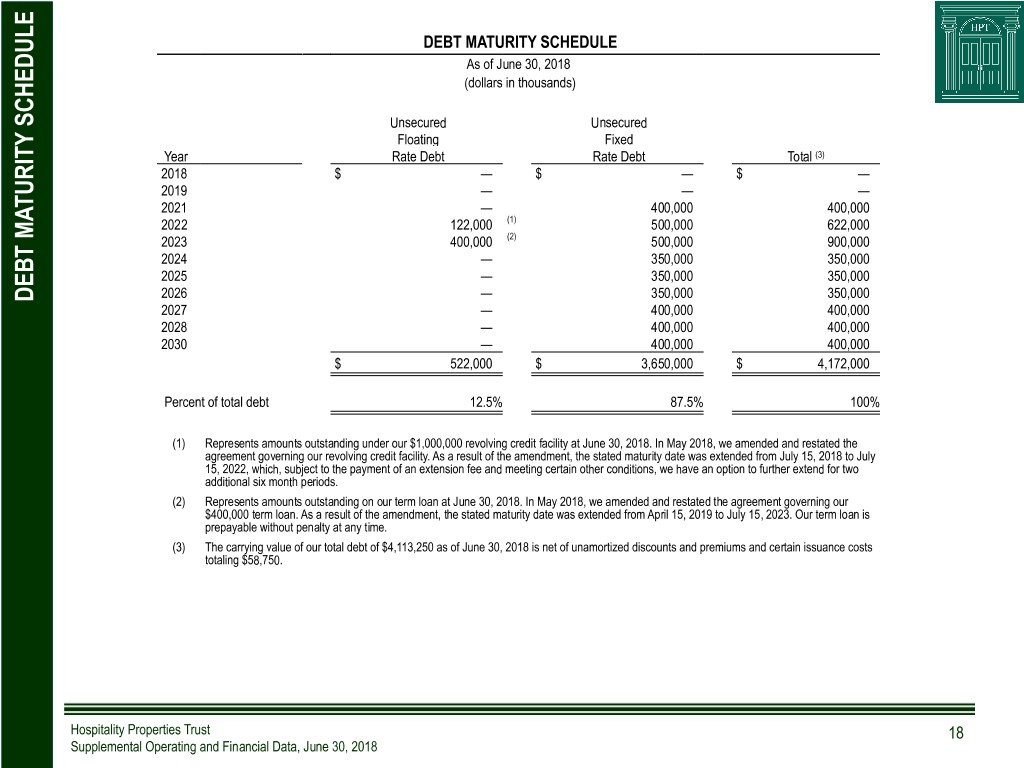

DEBT MATURITY SCHEDULE As of June 30, 2018 (dollars in thousands) Unsecured Unsecured Floating Fixed Year Rate Debt Rate Debt Total (3) 2018 $ — $ — $ — 2019 — — — 2021 — 400,000 400,000 2022 122,000 (1) 500,000 622,000 2023 400,000 (2) 500,000 900,000 2024 — 350,000 350,000 2025 — 350,000 350,000 2026 — 350,000 350,000 DEBT MATURITY SCHEDULE DEBT MATURITY 2027 — 400,000 400,000 2028 — 400,000 400,000 2030 — 400,000 400,000 $ 522,000 $ 3,650,000 $ 4,172,000 Percent of total debt 12.5% 87.5% 100% (1) Represents amounts outstanding under our $1,000,000 revolving credit facility at June 30, 2018. In May 2018, we amended and restated the agreement governing our revolving credit facility. As a result of the amendment, the stated maturity date was extended from July 15, 2018 to July 15, 2022, which, subject to the payment of an extension fee and meeting certain other conditions, we have an option to further extend for two additional six month periods. (2) Represents amounts outstanding on our term loan at June 30, 2018. In May 2018, we amended and restated the agreement governing our $400,000 term loan. As a result of the amendment, the stated maturity date was extended from April 15, 2019 to July 15, 2023. Our term loan is prepayable without penalty at any time. (3) The carrying value of our total debt of $4,113,250 as of June 30, 2018 is net of unamortized discounts and premiums and certain issuance costs totaling $58,750. Hospitality Properties Trust 18 Supplemental Operating and Financial Data, June 30, 2018

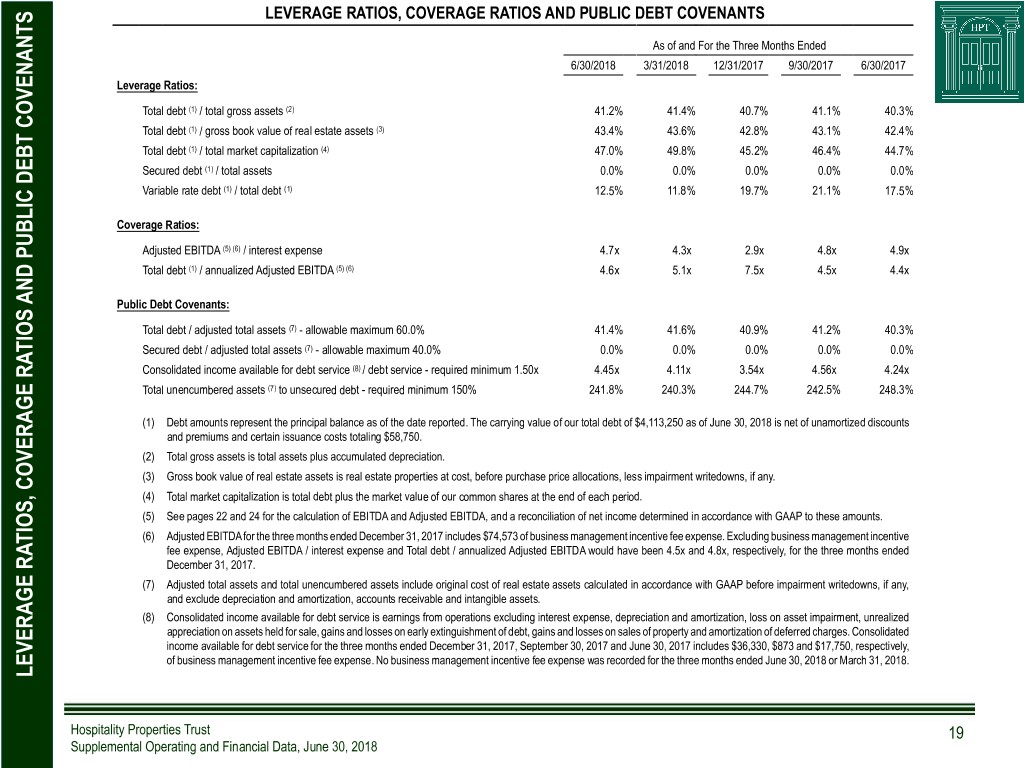

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS As of and For the Three Months Ended 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 Leverage Ratios: Total debt (1) / total gross assets (2) 41.2% 41.4% 40.7% 41.1% 40.3% Total debt (1) / gross book value of real estate assets (3) 43.4% 43.6% 42.8% 43.1% 42.4% Total debt (1) / total market capitalization (4) 47.0% 49.8% 45.2% 46.4% 44.7% Secured debt (1) / total assets 0.0% 0.0% 0.0% 0.0% 0.0% Variable rate debt (1) / total debt (1) 12.5% 11.8% 19.7% 21.1% 17.5% Coverage Ratios: Adjusted EBITDA (5) (6) / interest expense 4.7x 4.3x 2.9x 4.8x 4.9x Total debt (1) / annualized Adjusted EBITDA (5) (6) 4.6x 5.1x 7.5x 4.5x 4.4x Public Debt Covenants: Total debt / adjusted total assets (7) - allowable maximum 60.0% 41.4% 41.6% 40.9% 41.2% 40.3% Secured debt / adjusted total assets (7) - allowable maximum 40.0% 0.0% 0.0% 0.0% 0.0% 0.0% Consolidated income available for debt service (8) / debt service - required minimum 1.50x 4.45x 4.11x 3.54x 4.56x 4.24x Total unencumbered assets (7) to unsecured debt - required minimum 150% 241.8% 240.3% 244.7% 242.5% 248.3% (1) Debt amounts represent the principal balance as of the date reported. The carrying value of our total debt of $4,113,250 as of June 30, 2018 is net of unamortized discounts and premiums and certain issuance costs totaling $58,750. (2) Total gross assets is total assets plus accumulated depreciation. (3) Gross book value of real estate assets is real estate properties at cost, before purchase price allocations, less impairment writedowns, if any. (4) Total market capitalization is total debt plus the market value of our common shares at the end of each period. (5) See pages 22 and 24 for the calculation of EBITDA and Adjusted EBITDA, and a reconciliation of net income determined in accordance with GAAP to these amounts. (6) Adjusted EBITDA for the three months ended December 31, 2017 includes $74,573 of business management incentive fee expense. Excluding business management incentive fee expense, Adjusted EBITDA / interest expense and Total debt / annualized Adjusted EBITDA would have been 4.5x and 4.8x, respectively, for the three months ended December 31, 2017. (7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. (8) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Consolidated income available for debt service for the three months ended December 31, 2017, September 30, 2017 and June 30, 2017 includes $36,330, $873 and $17,750, respectively, of business management incentive fee expense. No business management incentive fee expense was recorded for the three months ended June 30, 2018 or March 31, 2018. LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS COVERAGE RATIOS LEVERAGE RATIOS, Hospitality Properties Trust 19 Supplemental Operating and Financial Data, June 30, 2018

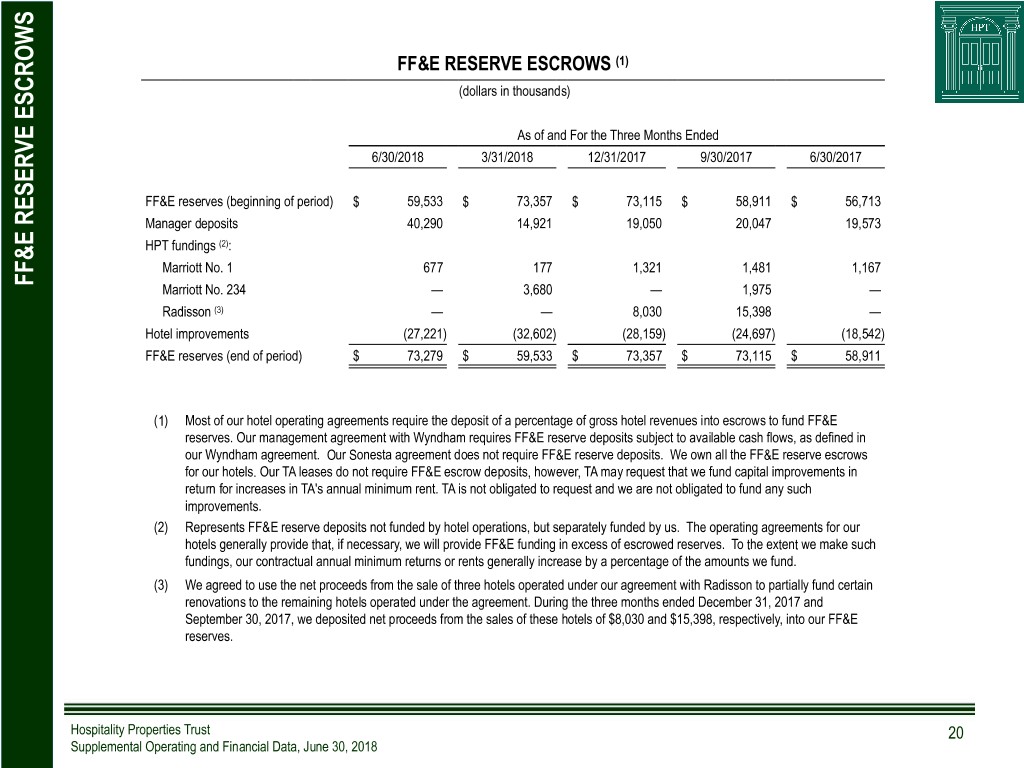

FF&E RESERVE ESCROWS (1) (dollars in thousands) As of and For the Three Months Ended 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 FF&E reserves (beginning of period) $ 59,533 $ 73,357 $ 73,115 $ 58,911 $ 56,713 Manager deposits 40,290 14,921 19,050 20,047 19,573 HPT fundings (2): Marriott No. 1 677 177 1,321 1,481 1,167 FF&E RESERVE ESCROWS FF&E RESERVE Marriott No. 234 — 3,680 — 1,975 — Radisson (3) — — 8,030 15,398 — Hotel improvements (27,221) (32,602) (28,159) (24,697) (18,542) FF&E reserves (end of period) $ 73,279 $ 59,533 $ 73,357 $ 73,115 $ 58,911 (1) Most of our hotel operating agreements require the deposit of a percentage of gross hotel revenues into escrows to fund FF&E reserves. Our management agreement with Wyndham requires FF&E reserve deposits subject to available cash flows, as defined in our Wyndham agreement. Our Sonesta agreement does not require FF&E reserve deposits. We own all the FF&E reserve escrows for our hotels. Our TA leases do not require FF&E escrow deposits, however, TA may request that we fund capital improvements in return for increases in TA's annual minimum rent. TA is not obligated to request and we are not obligated to fund any such improvements. (2) Represents FF&E reserve deposits not funded by hotel operations, but separately funded by us. The operating agreements for our hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such fundings, our contractual annual minimum returns or rents generally increase by a percentage of the amounts we fund. (3) We agreed to use the net proceeds from the sale of three hotels operated under our agreement with Radisson to partially fund certain renovations to the remaining hotels operated under the agreement. During the three months ended December 31, 2017 and September 30, 2017, we deposited net proceeds from the sales of these hotels of $8,030 and $15,398, respectively, into our FF&E reserves. Hospitality Properties Trust 20 Supplemental Operating and Financial Data, June 30, 2018

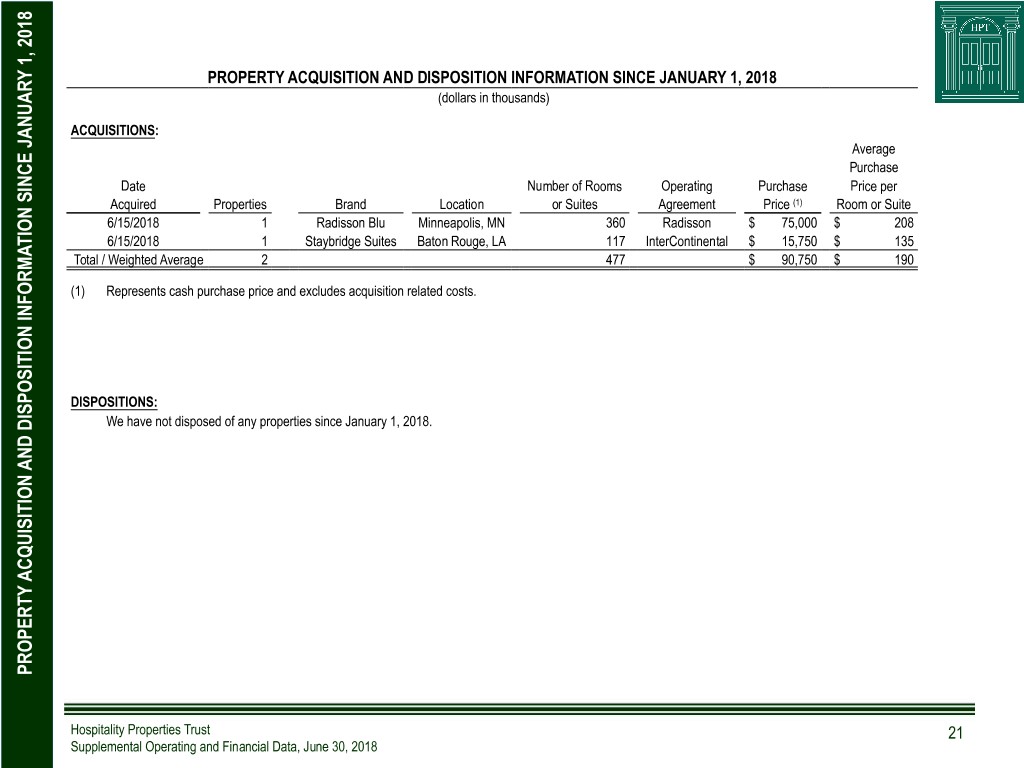

PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2018 (dollars in thousands) ACQUISITIONS: Average Purchase Date Number of Rooms Operating Purchase Price per Acquired Properties Brand Location or Suites Agreement Price (1) Room or Suite 6/15/2018 1 Radisson Blu Minneapolis, MN 360 Radisson $ 75,000 $ 208 6/15/2018 1 Staybridge Suites Baton Rouge, LA 117 InterContinental $ 15,750 $ 135 Total / Weighted Average 2 477 $ 90,750 $ 190 (1) Represents cash purchase price and excludes acquisition related costs. DISPOSITIONS: We have not disposed of any properties since January 1, 2018. PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2018 SINCE JANUARY AND DISPOSITION INFORMATION ACQUISITION PROPERTY Hospitality Properties Trust 21 Supplemental Operating and Financial Data, June 30, 2018

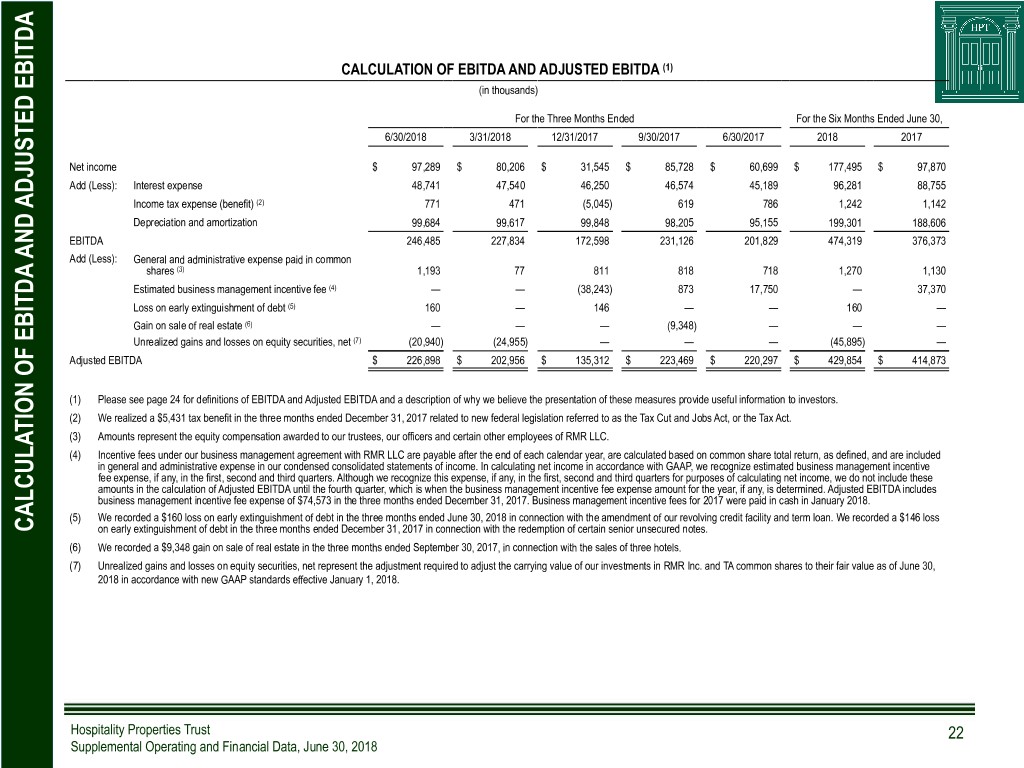

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1) (in thousands) For the Three Months Ended For the Six Months Ended June 30, 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 2018 2017 Net income $ 97,289 $ 80,206 $ 31,545 $ 85,728 $ 60,699 $ 177,495 $ 97,870 Add (Less): Interest expense 48,741 47,540 46,250 46,574 45,189 96,281 88,755 Income tax expense (benefit) (2) 771 471 (5,045) 619 786 1,242 1,142 Depreciation and amortization 99,684 99,617 99,848 98,205 95,155 199,301 188,606 EBITDA 246,485 227,834 172,598 231,126 201,829 474,319 376,373 Add (Less): General and administrative expense paid in common shares (3) 1,193 77 811 818 718 1,270 1,130 Estimated business management incentive fee (4) — — (38,243) 873 17,750 — 37,370 Loss on early extinguishment of debt (5) 160 — 146 — — 160 — Gain on sale of real estate (6) — — — (9,348) — — — Unrealized gains and losses on equity securities, net (7) (20,940) (24,955) — — — (45,895) — Adjusted EBITDA $ 226,898 $ 202,956 $ 135,312 $ 223,469 $ 220,297 $ 429,854 $ 414,873 (1) Please see page 24 for definitions of EBITDA and Adjusted EBITDA and a description of why we believe the presentation of these measures provide useful information to investors. (2) We realized a $5,431 tax benefit in the three months ended December 31, 2017 related to new federal legislation referred to as the Tax Cut and Jobs Act, or the Tax Act. (3) Amounts represent the equity compensation awarded to our trustees, our officers and certain other employees of RMR LLC. (4) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include these amounts in the calculation of Adjusted EBITDA until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. Adjusted EBITDA includes business management incentive fee expense of $74,573 in the three months ended December 31, 2017. Business management incentive fees for 2017 were paid in cash in January 2018. (5) We recorded a $160 loss on early extinguishment of debt in the three months ended June 30, 2018 in connection with the amendment of our revolving credit facility and term loan. We recorded a $146 loss CALCULATION OF EBITDA AND ADJUSTED EBITDA AND OF EBITDA CALCULATION on early extinguishment of debt in the three months ended December 31, 2017 in connection with the redemption of certain senior unsecured notes. (6) We recorded a $9,348 gain on sale of real estate in the three months ended September 30, 2017, in connection with the sales of three hotels. (7) Unrealized gains and losses on equity securities, net represent the adjustment required to adjust the carrying value of our investments in RMR Inc. and TA common shares to their fair value as of June 30, 2018 in accordance with new GAAP standards effective January 1, 2018. Hospitality Properties Trust 22 Supplemental Operating and Financial Data, June 30, 2018

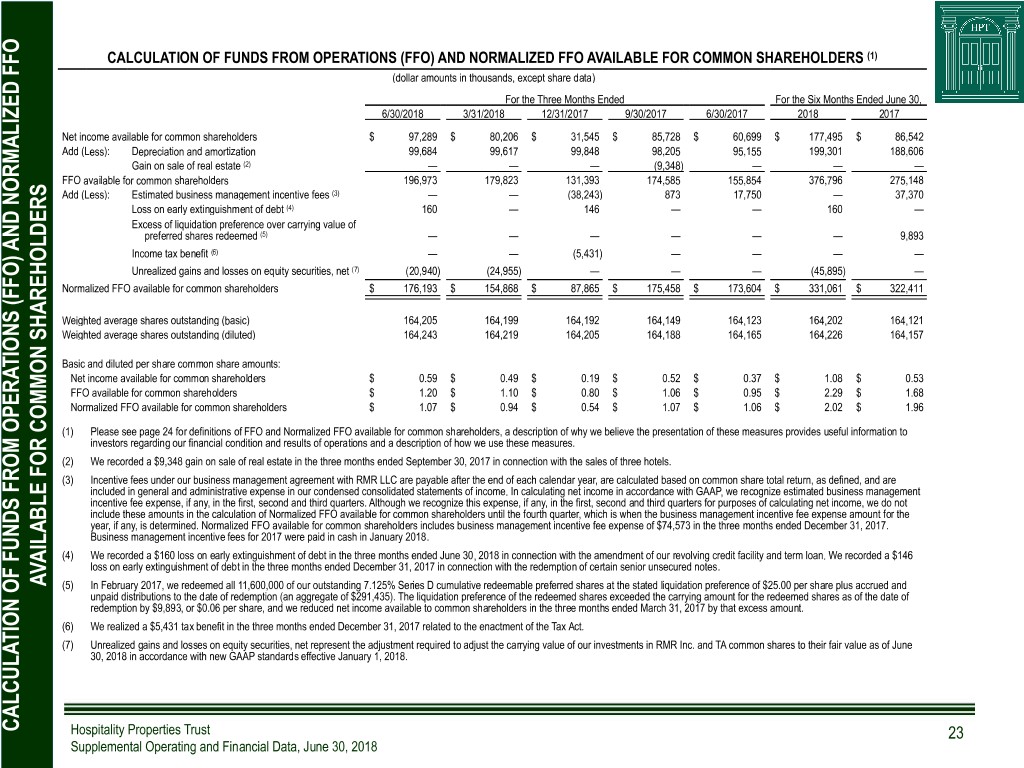

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS (1) (dollar amounts in thousands, except share data) For the Three Months Ended For the Six Months Ended June 30, 6/30/2018 3/31/2018 12/31/2017 9/30/2017 6/30/2017 2018 2017 Net income available for common shareholders $ 97,289 $ 80,206 $ 31,545 $ 85,728 $ 60,699 $ 177,495 $ 86,542 Add (Less): Depreciation and amortization 99,684 99,617 99,848 98,205 95,155 199,301 188,606 Gain on sale of real estate (2) — — — (9,348) — — — FFO available for common shareholders 196,973 179,823 131,393 174,585 155,854 376,796 275,148 Add (Less): Estimated business management incentive fees (3) — — (38,243) 873 17,750 — 37,370 Loss on early extinguishment of debt (4) 160 — 146 — — 160 — Excess of liquidation preference over carrying value of preferred shares redeemed (5) — — — — — — 9,893 Income tax benefit (6) — — (5,431) — — — — Unrealized gains and losses on equity securities, net (7) (20,940) (24,955) — — — (45,895) — Normalized FFO available for common shareholders $ 176,193 $ 154,868 $ 87,865 $ 175,458 $ 173,604 $ 331,061 $ 322,411 Weighted average shares outstanding (basic) 164,205 164,199 164,192 164,149 164,123 164,202 164,121 Weighted average shares outstanding (diluted) 164,243 164,219 164,205 164,188 164,165 164,226 164,157 Basic and diluted per share common share amounts: Net income available for common shareholders $ 0.59 $ 0.49 $ 0.19 $ 0.52 $ 0.37 $ 1.08 $ 0.53 FFO available for common shareholders $ 1.20 $ 1.10 $ 0.80 $ 1.06 $ 0.95 $ 2.29 $ 1.68 Normalized FFO available for common shareholders $ 1.07 $ 0.94 $ 0.54 $ 1.07 $ 1.06 $ 2.02 $ 1.96 (1) Please see page 24 for definitions of FFO and Normalized FFO available for common shareholders, a description of why we believe the presentation of these measures provides useful information to investors regarding our financial condition and results of operations and a description of how we use these measures. (2) We recorded a $9,348 gain on sale of real estate in the three months ended September 30, 2017 in connection with the sales of three hotels. (3) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include these amounts in the calculation of Normalized FFO available for common shareholders until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. Normalized FFO available for common shareholders includes business management incentive fee expense of $74,573 in the three months ended December 31, 2017. Business management incentive fees for 2017 were paid in cash in January 2018. (4) We recorded a $160 loss on early extinguishment of debt in the three months ended June 30, 2018 in connection with the amendment of our revolving credit facility and term loan. We recorded a $146 loss on early extinguishment of debt in the three months ended December 31, 2017 in connection with the redemption of certain senior unsecured notes. AVAILABLE FOR COMMON SHAREHOLDERS AVAILABLE (5) In February 2017, we redeemed all 11,600,000 of our outstanding 7.125% Series D cumulative redeemable preferred shares at the stated liquidation preference of $25.00 per share plus accrued and unpaid distributions to the date of redemption (an aggregate of $291,435). The liquidation preference of the redeemed shares exceeded the carrying amount for the redeemed shares as of the date of redemption by $9,893, or $0.06 per share, and we reduced net income available to common shareholders in the three months ended March 31, 2017 by that excess amount. (6) We realized a $5,431 tax benefit in the three months ended December 31, 2017 related to the enactment of the Tax Act. (7) Unrealized gains and losses on equity securities, net represent the adjustment required to adjust the carrying value of our investments in RMR Inc. and TA common shares to their fair value as of June 30, 2018 in accordance with new GAAP standards effective January 1, 2018. CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO (FFO) OF FUNDS FROM OPERATIONS CALCULATION Hospitality Properties Trust 23 Supplemental Operating and Financial Data, June 30, 2018

Non-GAAP Financial Measures Definitions Definition of EBITDA and Adjusted EBITDA We calculate EBITDA and Adjusted EBITDA as shown on page 22. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance, along with net income, net income available for common shareholders and operating income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain historical amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating performance. In calculating Adjusted EBITDA, we include business management incentive fees only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income, net income available for common shareholders or operating income as indicators of operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income available for common shareholders and operating income as presented in our condensed consolidated statements of income. Other real estate companies and REITs may calculate EBITDA and Adjusted EBITDA differently than we do. Definition of FFO and Normalized FFO We calculate FFO available for common shareholders and Normalized FFO available for common shareholders as shown on page 23. FFO available for common shareholders is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income available for common shareholders calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO available for common shareholders differs from Nareit's definition of FFO available for common shareholders because we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year, and we exclude the excess of liquidation preference over carrying value of preferred shares redeemed, certain deferred tax benefits, loss on early extinguishment of debt and unrealized gains and losses on equity securities. We consider FFO available for common shareholders and Normalized FFO available for common shareholders to be appropriate supplemental measures of operating performance for a REIT, along with net income, net income available for common shareholders and operating income. We believe that FFO available for common shareholders and Normalized FFO available for common shareholders provide NON-GAAP FINANCIAL MEASURES DEFINITIONS FINANCIAL NON-GAAP useful information to investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO available for common shareholders and Normalized FFO available for common shareholders may facilitate a comparison of our operating performance between periods and with other REITs. FFO available for common shareholders and Normalized FFO available for common shareholders are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. FFO available for common shareholders and Normalized FFO available for common shareholders do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income, net income available for common shareholders or operating income as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income available for common shareholders and operating income as presented in our condensed consolidated statements of income. Other real estate companies and REITs may calculate FFO available for common shareholders and Normalized FFO available for common shareholders differently than we do. Hospitality Properties Trust 24 Supplemental Operating and Financial Data, June 30, 2018

OPERATING AGREEMENTS AND PORTFOLIO INFORMATION TA Travel Center, 10679 Lancaster Road SE I-70 at OH 37, Exit 12 Hebron, OH Operator: TravelCenters of America Hospitality Properties Trust Supplemental Operating and Financial Data, June 30, 2018

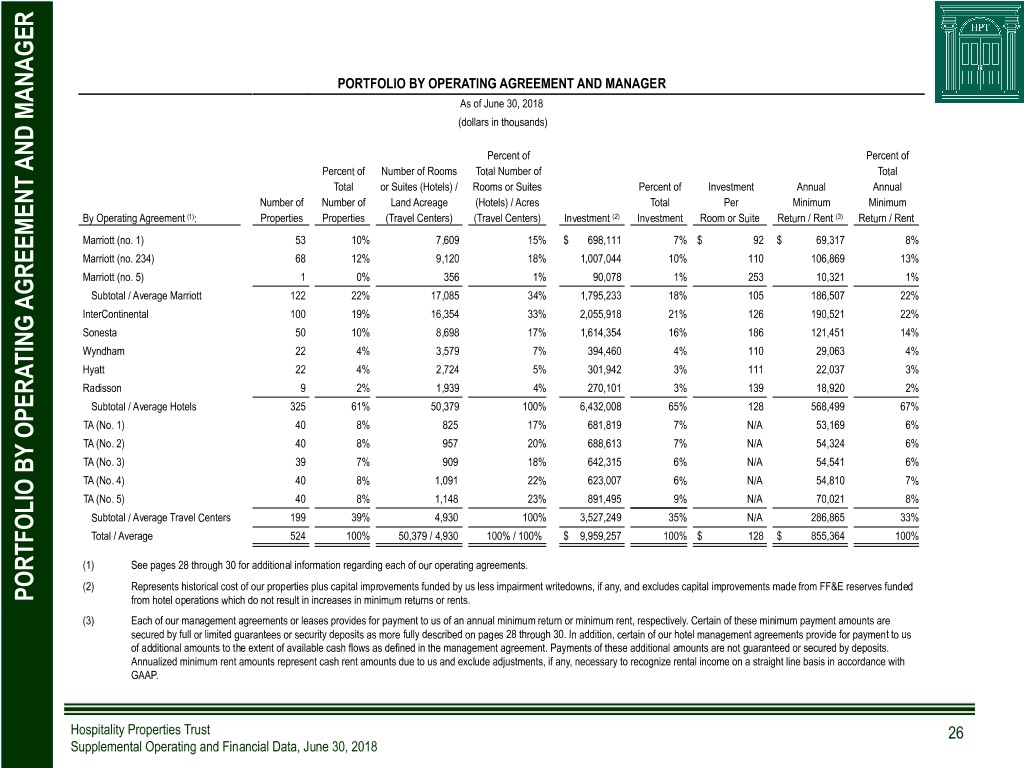

PORTFOLIO BY OPERATING AGREEMENT AND MANAGER As of June 30, 2018 (dollars in thousands) Percent of Percent of Percent of Number of Rooms Total Number of Total Total or Suites (Hotels) / Rooms or Suites Percent of Investment Annual Annual Number of Number of Land Acreage (Hotels) / Acres Total Per Minimum Minimum By Operating Agreement (1): Properties Properties (Travel Centers) (Travel Centers) Investment (2) Investment Room or Suite Return / Rent (3) Return / Rent Marriott (no. 1) 53 10% 7,609 15% $ 698,111 7% $ 92 $ 69,317 8% Marriott (no. 234) 68 12% 9,120 18% 1,007,044 10% 110 106,869 13% Marriott (no. 5) 1 0% 356 1% 90,078 1% 253 10,321 1% Subtotal / Average Marriott 122 22% 17,085 34% 1,795,233 18% 105 186,507 22% InterContinental 100 19% 16,354 33% 2,055,918 21% 126 190,521 22% Sonesta 50 10% 8,698 17% 1,614,354 16% 186 121,451 14% Wyndham 22 4% 3,579 7% 394,460 4% 110 29,063 4% Hyatt 22 4% 2,724 5% 301,942 3% 111 22,037 3% Radisson 9 2% 1,939 4% 270,101 3% 139 18,920 2% Subtotal / Average Hotels 325 61% 50,379 100% 6,432,008 65% 128 568,499 67% TA (No. 1) 40 8% 825 17% 681,819 7% N/A 53,169 6% TA (No. 2) 40 8% 957 20% 688,613 7% N/A 54,324 6% TA (No. 3) 39 7% 909 18% 642,315 6% N/A 54,541 6% TA (No. 4) 40 8% 1,091 22% 623,007 6% N/A 54,810 7% TA (No. 5) 40 8% 1,148 23% 891,495 9% N/A 70,021 8% Subtotal / Average Travel Centers 199 39% 4,930 100% 3,527,249 35% N/A 286,865 33% Total / Average 524 100% 50,379 / 4,930 100% / 100% $ 9,959,257 100% $ 128 $ 855,364 100% (1) See pages 28 through 30 for additional information regarding each of our operating agreements. (2) Represents historical cost of our properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from FF&E reserves funded PORTFOLIO BY OPERATING AGREEMENT AND MANAGER AGREEMENT OPERATING PORTFOLIO BY from hotel operations which do not result in increases in minimum returns or rents. (3) Each of our management agreements or leases provides for payment to us of an annual minimum return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees or security deposits as more fully described on pages 28 through 30. In addition, certain of our hotel management agreements provide for payment to us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed or secured by deposits. Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a straight line basis in accordance with GAAP. Hospitality Properties Trust 26 Supplemental Operating and Financial Data, June 30, 2018

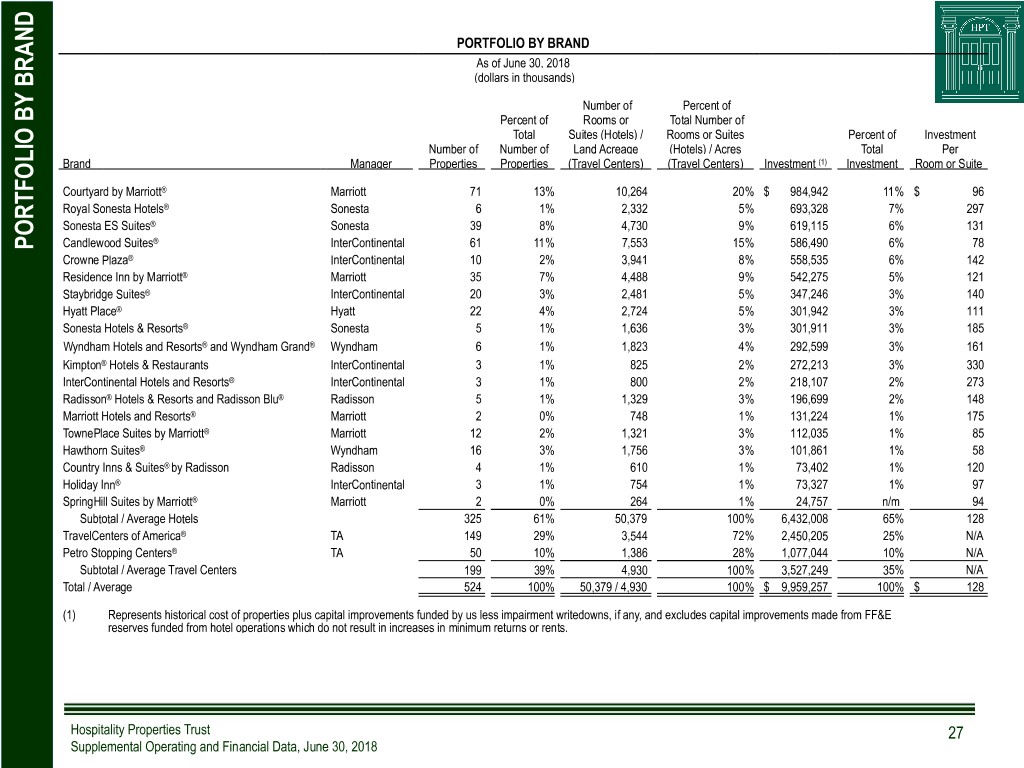

PORTFOLIO BY BRAND As of June 30, 2018 (dollars in thousands) Number of Percent of Percent of Rooms or Total Number of Total Suites (Hotels) / Rooms or Suites Percent of Investment Number of Number of Land Acreage (Hotels) / Acres Total Per Brand Manager Properties Properties (Travel Centers) (Travel Centers) Investment (1) Investment Room or Suite Courtyard by Marriott® Marriott 71 13% 10,264 20% $ 984,942 11% $ 96 Royal Sonesta Hotels® Sonesta 6 1% 2,332 5% 693,328 7% 297 Sonesta ES Suites® Sonesta 39 8% 4,730 9% 619,115 6% 131 ® PORTFOLIO BY BRAND PORTFOLIO BY Candlewood Suites InterContinental 61 11% 7,553 15% 586,490 6% 78 Crowne Plaza® InterContinental 10 2% 3,941 8% 558,535 6% 142 Residence Inn by Marriott® Marriott 35 7% 4,488 9% 542,275 5% 121 Staybridge Suites® InterContinental 20 3% 2,481 5% 347,246 3% 140 Hyatt Place® Hyatt 22 4% 2,724 5% 301,942 3% 111 Sonesta Hotels & Resorts® Sonesta 5 1% 1,636 3% 301,911 3% 185 Wyndham Hotels and Resorts® and Wyndham Grand® Wyndham 6 1% 1,823 4% 292,599 3% 161 Kimpton® Hotels & Restaurants InterContinental 3 1% 825 2% 272,213 3% 330 InterContinental Hotels and Resorts® InterContinental 3 1% 800 2% 218,107 2% 273 Radisson® Hotels & Resorts and Radisson Blu® Radisson 5 1% 1,329 3% 196,699 2% 148 Marriott Hotels and Resorts® Marriott 2 0% 748 1% 131,224 1% 175 TownePlace Suites by Marriott® Marriott 12 2% 1,321 3% 112,035 1% 85 Hawthorn Suites® Wyndham 16 3% 1,756 3% 101,861 1% 58 Country Inns & Suites® by Radisson Radisson 4 1% 610 1% 73,402 1% 120 Holiday Inn® InterContinental 3 1% 754 1% 73,327 1% 97 SpringHill Suites by Marriott® Marriott 2 0% 264 1% 24,757 n/m 94 Subtotal / Average Hotels 325 61% 50,379 100% 6,432,008 65% 128 TravelCenters of America® TA 149 29% 3,544 72% 2,450,205 25% N/A Petro Stopping Centers® TA 50 10% 1,386 28% 1,077,044 10% N/A Subtotal / Average Travel Centers 199 39% 4,930 100% 3,527,249 35% N/A Total / Average 524 100% 50,379 / 4,930 100% $ 9,959,257 100% $ 128 (1) Represents historical cost of properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations which do not result in increases in minimum returns or rents. Hospitality Properties Trust 27 Supplemental Operating and Financial Data, June 30, 2018

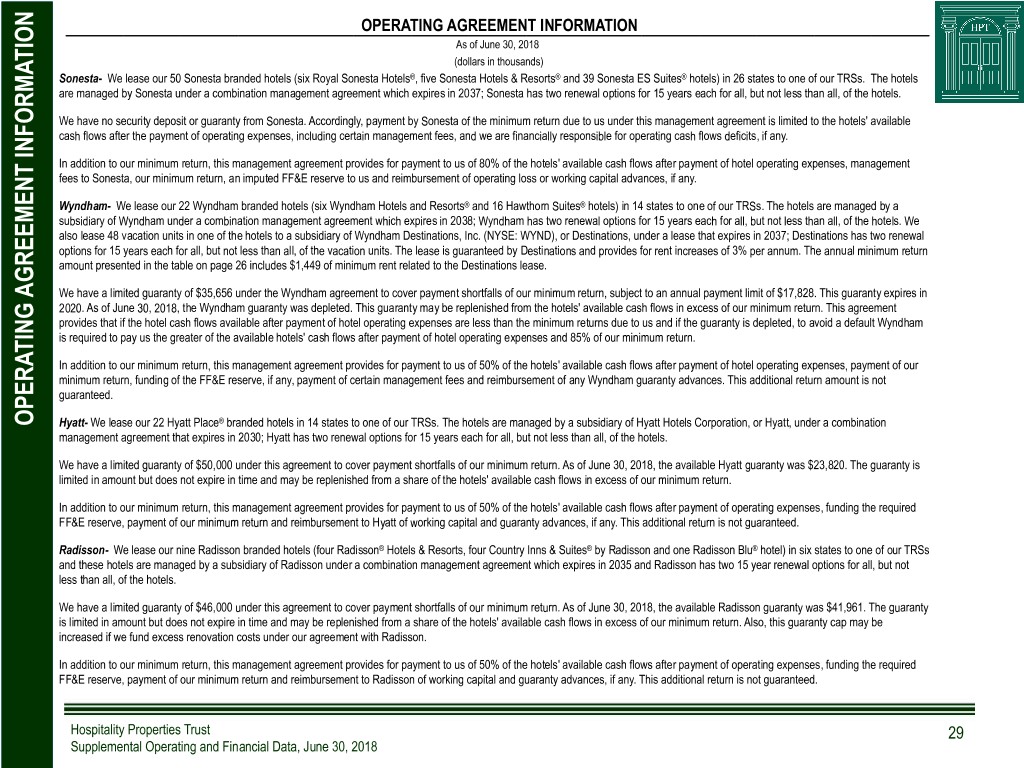

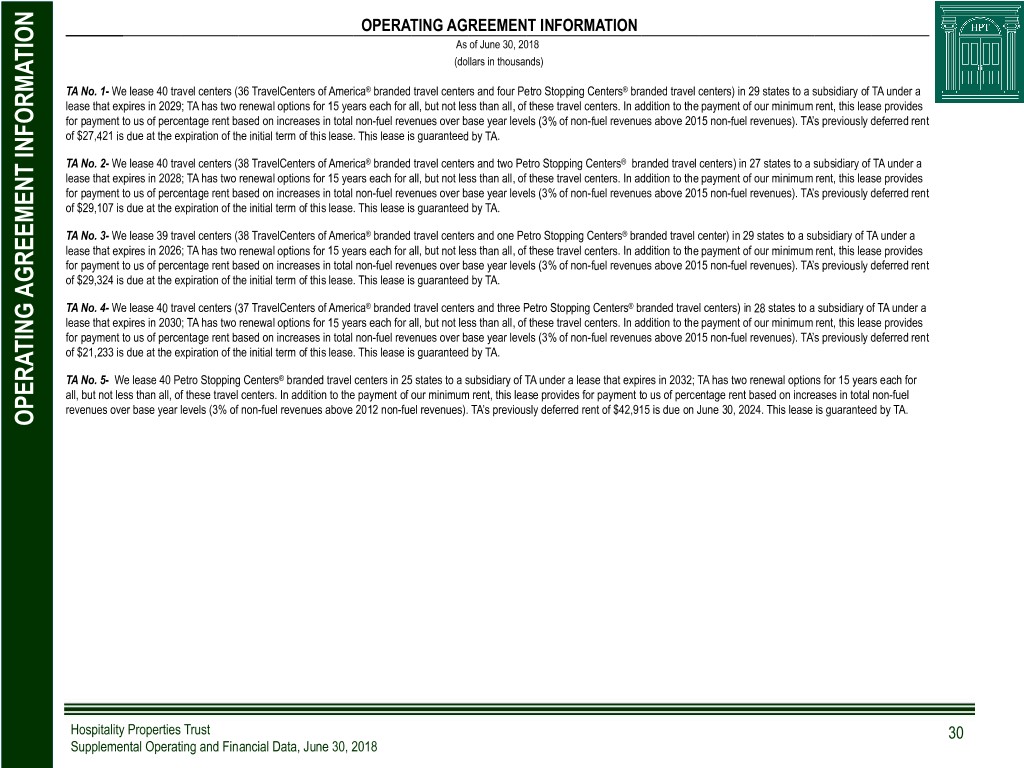

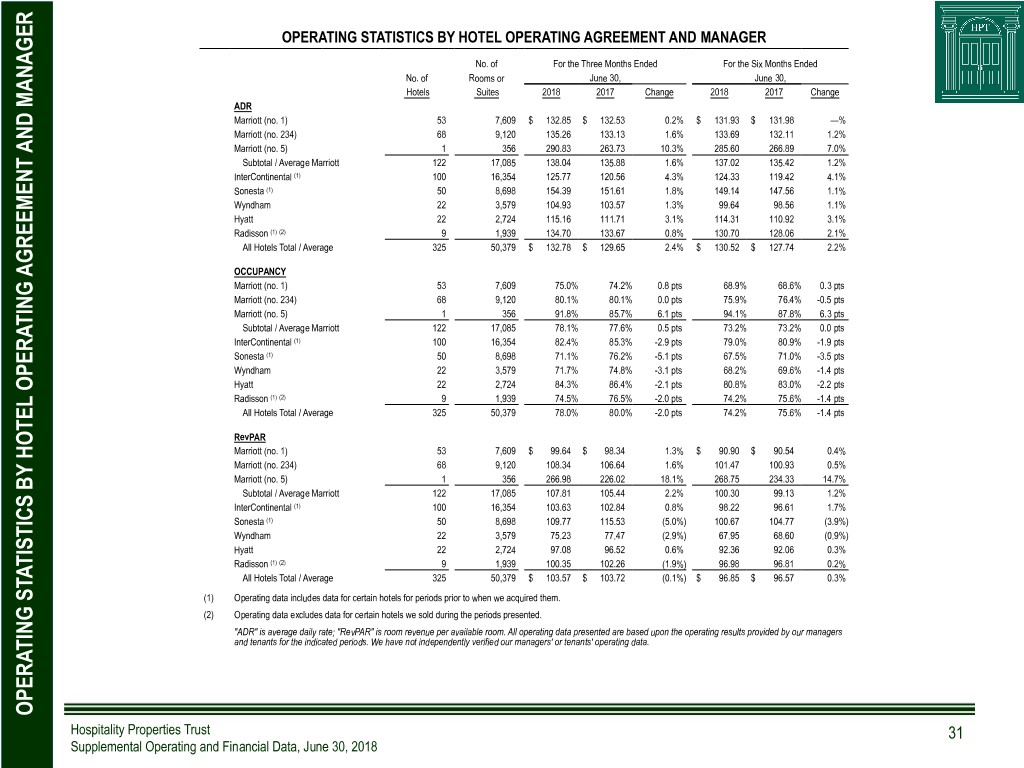

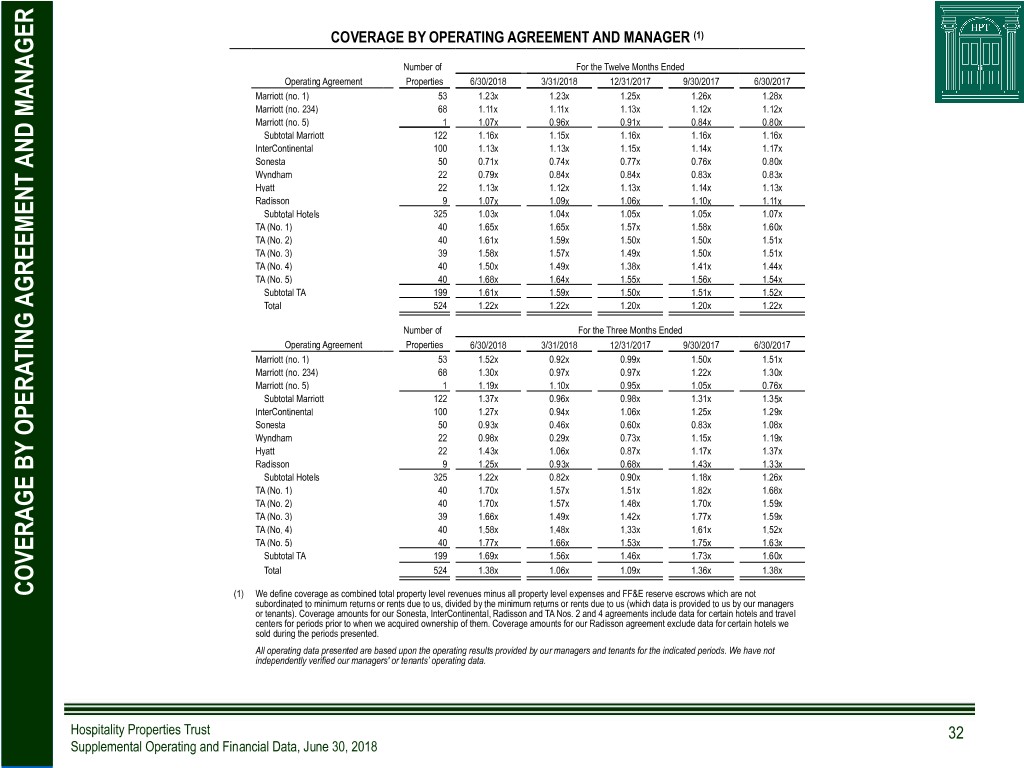

OPERATING AGREEMENT INFORMATION As of June 30, 2018 (dollars in thousands) Marriott No. 1- We lease 53 Courtyard by Marriott® branded hotels in 24 states to one of our taxable REIT subsidiaries, or TRSs. The hotels are managed by a subsidiary of Marriott under a combination management agreement which expires in 2024; Marriott has two renewal options for 12 years each for all, but not less than all, of the hotels. We have no security deposit or guaranty from Marriott for these 53 hotels. Accordingly, payment by Marriott of the minimum return due to us under this management agreement is limited to the hotels' available cash flows after payment of operating expenses and funding of the FF&E reserve. In addition to our minimum return, this agreement provides for payment to us of 50% of the hotels' available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve, payment of our minimum return and payment of certain management fees. Marriott No. 234- We lease 68 of our Marriott® branded hotels (one full service Marriott®, 35 Residence Inn by Marriott®, 18 Courtyard by Marriott®, 12 TownePlace Suites by Marriott® and two SpringHill Suites by Marriott® hotels) in 22 states to one of our TRSs. The hotels are managed by subsidiaries of Marriott under a combination management agreement which expires in 2025; Marriott has two renewal options for 10 years each for all, but not less than all, of the hotels. We originally held a security deposit of $64,700 under this agreement to cover payment shortfalls of our minimum return. As of June 30, 2018, the available balance of this security deposit was $30,956. This security deposit may be replenished from a share of the hotels' available cash flows in excess of our minimum return and certain management fees. Marriott has also provided us with a $40,000 limited guaranty to cover payment shortfalls up to 90% of our minimum return after the available security deposit balance has been depleted, which expires in 2019. As of June 30, 2018, the available Marriott guaranty was $30,672. In addition to our minimum return, this agreement provides for payment to us of 62.5% of the hotels' available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve, payment of our minimum return, payment of certain management fees and replenishment of the security deposit. This additional return amount is not guaranteed or secured by the security deposit. Marriott No. 5- We lease one Marriott® branded hotel in Kauai, HI to a subsidiary of Marriott under a lease that expires in 2019. Marriott has four renewal options for 15 years each. On August 31, 2016, Marriott notified us that it will not exercise its renewal option at the expiration of the current lease term ending on December 31, 2019. This lease is guaranteed by Marriott and OPERATING AGREEMENT INFORMATION OPERATING provides for increases in the annual minimum rent payable to us based on changes in the consumer price index. InterContinental- We lease 99 InterContinental branded hotels (20 Staybridge Suites®, 61 Candlewood Suites®, two InterContinental®, 10 Crowne Plaza®, three Holiday Inn® and three Kimpton® Hotels & Restaurants) in 29 states in the U.S. and Ontario, Canada to one of our TRSs. These 99 hotels are managed by subsidiaries of InterContinental under a combination management agreement. We lease one additional InterContinental® branded hotel in Puerto Rico to a subsidiary of InterContinental. The annual minimum return amount presented in the table on page 26 includes $7,912 of minimum rent related to the leased Puerto Rico hotel. The management agreement and the lease expire in 2036; InterContinental has two renewal options for 15 years each for all, but not less than all, of the hotels. As of June 30, 2018, we held a security deposit of $100,000 under this agreement to cover payment shortfalls of our minimum return. This security deposit, if utilized, may be replenished and increased up to $100,000 from the hotels' available cash flows in excess of our minimum return and certain management fees. Under this agreement, InterContinental is required to maintain a minimum security deposit of $37,000. In addition to our minimum return, this management agreement provides for an annual additional return payment to us of $12,067 from the hotels' available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve, if any, payment of our minimum return, payment of certain management fees and replenishment and expansion of the security deposit. In addition, the agreement provides for payment to us of 50% of the hotels' available cash flows after payment to us of the annual additional return amount. These additional return amounts are not guaranteed or secured by the security deposit we hold. Hospitality Properties Trust 28 Supplemental Operating and Financial Data, June 30, 2018