Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - BARNES & NOBLE INC | form8k.htm |

Exhibit 10.1

GENERAL RELEASE AND WAIVER

1. Termination Date. Fred Argir (“Employee”) acknowledges and agrees that Employee’s employment with Barnes and Noble, Inc. (the “Company”) has ended effective at 11:59 pm on August 3, 2018 (the “Separation Date”). This General Release and Waiver (the “Release”) is made and entered into by and between Employee, on his/her behalf and on behalf of his/her heirs, executors, administrators, agents, representatives, successors and assigns (collectively, “Releasors”) and the Company, its parents, affiliates and subsidiaries, and each of their current and former officers, directors, shareholders, trustees, agents, representatives, attorneys and employees, and the heirs, executors, receivers, administrators, agents, representatives, successors and assigns of all of the foregoing individually and in their business capacities, and their employee benefit plans and programs and their administrators and fiduciaries (collectively, “Releasees”). This Release shall not be valid if signed before the Separation Date.

2. (a) Separation Payment. Employee agrees that, after Employee’s delivery to the Company of this fully executed and notarized Release as set forth below, and the expiration of the Revocation Period (defined below), Employee shall accept from the Company, and on behalf of the Company and each Releasee the gross amount of $500,000 payable over 52 weeks in accordance with the Company’s normal pay practices (“Separation Period”), less lawful deductions and withholdings. This amount plus the employer subsidized COBRA payment in section 2(c), below, if any, constitute the “Separation Payment.”

(b) Final Compensation. Employee acknowledges and agrees that (i) the Separation Payment is adequate consideration for all the terms of this Release and does not include any benefit, monetary or otherwise, which was earned or accrued or to which Employee was already entitled without signing this Release; and (ii) any monetary or other benefits which, prior to the execution of this Release, Employee may have earned or accrued or to which Employee may have been entitled, have been paid or will be paid in accordance with the Benefits Addendum attached hereto and incorporated herein by reference. Employee also acknowledges that, prior to or contemporaneous with Employee’s execution of this Release, Employee received all wages and other payments, including accrued vacation pay and bonuses if any, that were owed to Employee from the Company or any Releasee. Employee understands that he/she will receive any payment for wages owed to him/her upon termination regardless of whether he/she signs this Release.

(c) COBRA. Employee, on behalf of Employee and Employee’s spouse and dependents, as applicable, may elect to continue medical and dental benefits pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), (a “COBRA Election”) if enrolled in such benefits as of the Separation Date. If Employee makes a timely and proper COBRA Election, the Company will subsidize the premium rate for medical and dental coverage for the Separation Period in the same manner as if Employee were an active employee of the Company. At the end of such period, if Employee and/or Employee’s spouse and dependents, as applicable, remain on COBRA, Employee will be responsible for paying the full monthly COBRA premiums. If Employee elects COBRA, Employee may not be able to enroll in another health insurance plan (including Marketplace coverage) unless Employee has a qualifying life event (e.g., gaining new employment) or until there is an open enrollment period for the new plan. For avoidance of doubt, expiration of the period during which the Company contributes towards the applicable COBRA premium is not considered a qualifying life event. Similarly, losing COBRA coverage due to non-payment of premiums is not a qualifying life event.

(d) Medicare. Employee affirms and warrants that Employee has informed the Company Benefits Department in writing if Employee (i) is a Medicare beneficiary; (ii) is currently receiving, has received in the past, or is eligible for benefits from Medicare; or (iii) has applied for or sought benefits from Medicare. Employee agrees to indemnify and hold the Company harmless for any penalties or liability, including interest, that may be asserted against the Company pursuant to Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007, 42 U.S.C. § 1395y(b)(8), as a result of the payments and benefits described in section 2 of this Release.

THIS SECTION PROVIDES A COMPLETE RELEASE AND WAIVER OF ALL EXISTING AND POTENTIAL CLAIMS YOU MAY HAVE AGAINST EVERY RELEASEE AS SET FORTH BELOW. BEFORE YOU SIGN THIS RELEASE, YOU MUST READ THIS SECTION CAREFULLY, AND MAKE SURE THAT YOU UNDERSTAND IT FULLY.

1

3. (a) General Release. In consideration of Employee’s receipt and acceptance of the Separation Payment from the Company on behalf of the Company and each Releasee, Employee on Employee’s behalf and on behalf of each Releasor, hereby irrevocably and generally releases the Company and each Releasee, and hereby waives and/or settles, except as expressly provided in this Release, any and all claims, actions, causes of action, suits, debts, dues, sums of money, accounts, controversies, agreements, promises, damages, judgments, executions, contracts, losses, expenses, obligations, or any liability of any nature, kind and description, whether in law, equity or otherwise, whether or not now known or ascertained, which currently do or may exist prior to the execution of this Release (collectively “Claims”). Such Claims include, but are not limited to, the following: (i) claims arising from or relating to Employee’s employment with the Company, including, but not limited to, claims arising out of or relating to the Offer Letter between the Company and the Employee, dated as of June 12, 2015 (the “Offer Letter”), and claims for unpaid wages, front pay, back pay, bonuses, incentive pay, vacation pay, benefits, attorneys’ fees, breach or interference with contract (express or implied, written or oral), breach of the covenant of good faith and fair dealing, fraud, defamation, violation of public policy, infliction of emotional distress, misrepresentation, fraud, slander, libel, discrimination, retaliation, negligent retention/supervision, tortuous or harassing conduct, infliction of negligent or intentional emotional distress, assault/battery, wrongful dismissal, or termination of employment, damages including without limitation punitive or compensatory damages, attorneys’ fees, expenses, costs, injunctive or equitable relief; and (ii) claims arising under any applicable foreign, federal, state, local or other statutes, orders, laws, ordinances, regulations or the like, or case law, including, but not limited to, the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Civil Rights Acts of 1866 and 1871, the Age Discrimination in Employment Act of 1967, as amended (“ADEA”) (including, but not limited to, the Older Workers Benefit Protection Act (“OWBPA”)), the Americans with Disabilities Act of 1990, the Family Medical Leave Act of 1993, the Employee Retirement Income Security Act of 1974 (“ERISA”), the Immigration Reform and Control Act, the Fair Credit Reporting Act, the Genetic Information Nondiscrimination Act, the Worker Adjustment and Retraining Notification Act, the Vietnam Era Veterans' Readjustment Assistance Act, the Equal Pay Act, the New York Labor Law, the New York State Executive Law, the New York Administrative Code, the New Jersey Law Against Discrimination, the New Jersey Conscientious Employee Protection Act, the Massachusetts Wage Payment Statute, G.L. c. 149, §§ 148, 148A, 148B, 149, 150, 150A-150C, 151, 152, 152A, et seq., the Massachusetts Wage and Hour laws, G.L. c. 151§1A et seq., Minnesota Human Rights Act, West Virginia Human Rights Act, and all amendments of each of the foregoing laws.

(b) Exclusion from General Release. Employee and the Company acknowledge that nothing in this Release shall be deemed a release or waiver by Employee of Claims Employee may have against Releasees for or based on (i) any benefit vested as of the Separation Date, pursuant to the written terms of any applicable employee benefit plan governed by ERISA; (ii) workers' compensation (but claims for retaliation for exercising workers’ compensation rights are waived); (iii) unemployment insurance benefits; (iv) vested benefits under the Company’s 401(k) plan; (v) vested long-term incentive awards; and (vi) any claims that, under applicable law, are not waivable.

(c) Governmental Agencies. Nothing in or about this Release prohibits Employee from: (i) filing and, as provided for under Section 21F of the Securities Exchange Act of 1934, maintaining the confidentiality of a claim with a government agency that is responsible for enforcing a law; (ii) providing Confidential Information (as defined in section 8(a)) to the extent required by law or legal process or permitted by Section 21F of the Securities Exchange Act of 1934; (iii) cooperating, participating or assisting in any government or regulatory entity investigation or proceeding without notifying the Company; or (iv) receiving an award for information provided to any government agency that is responsible for enforcing the law, as set forth in Section 21F of the Securities Exchange Act of 1934.

(d) Collective/Class Action Waiver. If any claim is not subject to release, to the extent permitted by law, Employee waives any right or ability to be a class or collective action representative or to otherwise participate in any putative or certified class, collective or multi-party action or proceeding based on such a claim in which any Releasee is a party.

(e) Defend Trade Secrets Act of 2016. Notwithstanding anything herein to the contrary, under the federal Defend Trade Secrets Act of 2016, an individual may not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that (i) is made (A) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (B) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding if the individual files any document containing the trade secret under seal and does not disclose the trade secret except pursuant to court order. Nothing herein is intended, or should be construed, to affect the immunities created by the Defend Trade Secrets Act of 2016.

2

4. No Pending Claims. Employee represents and warrants that Employee has not filed, caused to be filed, is presently a party to or commenced any complaints, grievances, charges, claims, actions or proceedings of any kind against any Releasee with any federal, state or local court or any administrative, regulatory or arbitration agency or body. Notwithstanding the above, Employee agrees that he/she shall dismiss any of the foregoing that have been filed. Except for Employee’s right to bring a proceeding pursuant to the OWBPA to challenge the validity of the release of claims pursuant to the ADEA, and otherwise as provided herein or permitted by law, Employee agrees not to commence, maintain, prosecute or participate as a party in any action or proceeding in any court or arbitration forum against the Company or any other Releasee with respect to any act, omission, transaction or occurrence up to and including the date of the execution of this Release. Employee further agrees not to instigate, encourage, assist or participate in any court action or arbitration proceeding commenced by any other person (except a government agency) against the Company, or any other Releasee. In the event any government agency seeks to obtain any relief on behalf of Employee with regard to any claim released and waived by section 3(a) of this Release, Employee covenants not to accept, recover or receive any monetary relief or award that may arise out of or in connection with any such proceeding. Similarly, the Company represents and warrants that it has not filed, caused to be filed, is presently a party to or commenced any complaints, grievances, charges, claims, actions or proceedings of any kind against the Employee with any federal, state or local court or any administrative, regulatory or arbitration agency or body. The Company further represents and warrants that it is not currently aware of any claims or causes of action against the Employee that it could assert or file in any federal, state or local court or any administrative, regulatory or arbitration agency or body.

5. Affirmations. Employee affirms that Employee has been paid and/or has received all compensation, wages, bonuses, commissions, and/or benefits which are due and payable as of the date Employee signs this Release. Employee also affirms that Employee has been granted any leave to which Employee was entitled under the Family and Medical Leave Act or related state or local leave or disability accommodation laws. In addition, Employee affirms that Employee has no known workplace injuries or occupational diseases. Employee further affirms that Employee has not been retaliated against for reporting any allegations of wrongdoing by the Company or its officers, including any allegations of corporate fraud.

6. Nonadmission. This Release and any payments or benefits made hereunder are not intended to be, shall not be construed as, and are not an admission or concession by any Releasee of any liability, wrongdoing or illegal or actionable acts or omissions. Employee hereby affirms that no Releasee has made any written or oral statements, suggestions or representations, either directly or impliedly, of any liability, wrongdoing or illegal or actionable acts or omissions by any Releasee.

7. Employment Inquiries. Employee shall direct all requests and inquiries concerning Employee’s possible employment by prospective employers to the HR Service Center at 1-800-799-5335 which will comply with the Company’s neutral reference policy.

8. (a) Confidential Information and Materials. Employee hereby acknowledges that during Employee’s employment, Employee may have acquired proprietary, private and/or otherwise confidential information (“Confidential Information,” as defined and described in this section). Confidential Information shall mean all non-public information in any form or media that the Employee received, obtained or had access to during the course of or by virtue of his/her employment with the Company, including, but not limited to, information which constitutes, relates or refers to (i) the Company or any Releasee; (ii) any current or former employee of the Company or any Releasee; (iii) any person or entity with whom or which the Company or any Releasee transacted business during Employee's employment; (iv) any person or entity with respect to whom or which the Company or any Releasee acquired any non-public information; (v) any aspect of the operation of the business of the Company or any Releasee, including without limitation, all financial, operational and statistical information; (vi) any information or documents provided or produced in any litigation or other legal proceedings; (vii) any information protected or governed by any other confidentiality agreement or stipulation; and (viii) any information protected or governed by the attorney-client privilege, work-product doctrine or any similar privilege or immunity.

3

(b) Nondisclosure. Employee hereby represents and agrees that upon execution of this Release (i) Employee has returned to the Company, and has not retained any copies of, all documents, records or materials of any kind in any form or media, which contain, relate to or refer to any Confidential Information (“Confidential Materials”); and (ii) Employee has not disclosed any Confidential Information or Confidential Materials to any person or entity outside the scope of Employee’s job with the Company without the express authorization of an authorized officer of the Company. Employee further agrees that in consideration of the Company’s agreement to deliver the Separation Payment pursuant to the terms of this Release, Employee and/or any Releasor shall not disclose or use for any purpose any Confidential Information or Confidential Materials, in any manner directly or indirectly, except as may be required by law, permitted pursuant to written authorization by the Company, or otherwise provided herein.

Employee further represents that Employee has not, and agrees that Employee shall not, disclose orally or in writing, directly or indirectly, to any person (other than to the members of Employee’s immediate family, Employee’s attorney, financial advisor, and accountant, each of whom shall be directed by Employee not to disclose such information), except as required by law: (i) the underlying facts leading up to or the existence or terms of this Release; and (ii) the amount of any payments or benefits made hereunder.

(c) Subpoenas/Request for Information. In the event that Employee and/or any Releasor receives a subpoena or any other written or oral request for any Confidential Information, Confidential Materials or any other information concerning the Company or any Releasee, Employee shall, within two (2) business days of the service or receipt of such subpoena or other request (i) notify the Company c/o Michelle Smith, Vice President, Human Resources, or his successor in writing, by email at MSmith@bn.com and (ii) provide a copy of such subpoena or other request if in writing, and/or disclose the nature of the request for information if oral.

(d) Return of Company Property. Employee also represents and agrees that upon the execution of this Release, Employee has returned to the Company all property of the Company, including without limitation, any keys to the offices or properties of the Company, and Company identification cards, computers, cellular telephones or other equipment. Employee affirms that Employee is in possession of all of Employee’s property that Employee had at the Company’s premises and that the Company is not in possession of any of Employee’s property.

(e) Enforceability. Employee acknowledges that the scope of the promises and covenants in this Release is reasonable in light of its narrow focus and the legitimate interests of the Company to be protected. Employee agrees that if any part of Employee’s covenants or the duration thereof is deemed too restrictive by a court of competent jurisdiction, the court may alter the covenants and/or duration to make the same reasonable under the circumstances, and Employee acknowledges that Employee shall be bound thereby. If any promises or covenants contained in this Release are determined to be illegal, invalid or unenforceable, then, in the Company’s sole discretion and to the extent permitted by law, it can decide whether to invalidate the remainder of the Release, including whether to continue to pay Employee any remaining portion of the Separation Payment or other benefits, and/or require Employee to repay any or all of the Separation Payment received.

9. Nondisparagement. Employee represents and agrees that he/she shall not make any oral, written or electronic defamatory or maliciously disparaging statements or representations of or concerning the Company or any Releasee. Employee further represents and agrees that Employee has not and will not engage in any conduct or take any actions whatsoever to cause or influence any person or entity, including, but not limited to, any past, present or prospective employee of the Company, to initiate oral, written or electronic defamatory or maliciously disparaging statements or representations of or concerning the Company or any Releasee.

10. Restrictive Covenants. In further consideration of the Company’s agreement to pay the Separation Payment pursuant to the terms of this Release, Employee agrees that Employee will not, without the prior written consent of the Company:

(a) For a period of one year following the Separation Date, solicit, recruit, employ or retain, or induce or cause any other person or entity to solicit, recruit, employ or retain, any person who is employed or retained by the Company or any of its subsidiaries or affiliates, or who was employed or retained by the Company or any of its subsidiaries or affiliates with whom you worked in the course of your employment at any time within one year prior to the Separation Date.

4

(b) During the Separation Period, or for a period of six (6) months following the Separation Date, whichever is longer, become employed or retained, by any of the following entities or any of their parents, subsidiaries or affiliates: Books-A-Million, Amazon.com and Apple Inc.

11. No Future Employment. Employee hereby waives any right to, and agrees not to seek reinstatement or employment of any kind with the Company, its parents, subsidiaries, or any entity that controls or is under common control with any of the foregoing entities. “Control”, for this purpose means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such entity, whether through the ownership of voting securities, by contract or otherwise. The existence of this Release shall be a valid, non-discriminatory basis for any Releasee to reject any such application or, in the event Employee obtains such employment or other relationship with any Releasee, for that Releasee to terminate such employment or other relationship.

12. Breach of Release. The covenants, representations and acknowledgments made by Employee in this Release shall survive the execution of the Release and the delivery of any installment of the Separation Payment. The Company or any Releasee shall be excused and released from any obligation to make any part of the Separation Payment or provide any other benefits contained in the Release to the extent permitted by law in the event that (i) Employee has made a material misstatement in or commits any material breach of the terms, conditions or covenants in this Release (in which case Employee or Releasor shall also be liable for any damages suffered by the Company or any Releasee by reason of such breach or misstatement, including, but not limited to, attorneys’ fees); (ii) any part of this Release is determined to be illegal, invalid or unenforceable; or (iii) Employee or Releasor claims in any forum that the Release is illegal, invalid or unenforceable. Employee understands and acknowledges that if he/she breaches this Release, Employee’s release and waiver of claims contained in this Release remain in full force and effect.

13. Liquidated Damages. Employee and the Company agree that it would be impossible or extremely difficult to ascertain the amount of actual damages caused by Employee’s breach of the confidentiality and nondisparagement provisions in this Release. Therefore, Employee agrees to pay the Company liquidated damages equal to 15% of the Separation Payment for a breach of those sections. Employee and the Company further acknowledge that these liquidated damages are not intended to be a penalty, but are instead the parties’ estimate of damages to be incurred by the Company in the event of Employee’s breach and that the damages are reasonable in light of and proportionate to the anticipated harm caused by the related breach. The Company’s election to seek an award of these liquidated damages shall not in any way limit its right to seek injunctive relief in addition to liquidated damages or to seek other remedies for breach of other provisions of this Release.

14. Entire Agreement. This Release constitutes the sole and complete understanding and agreement between the Releasee and Releasors with respect to the matters set forth herein and supersedes all prior agreements between the Employee and Company, including the Offer Letter, and there are no other agreements or understandings, whether written or oral and whether made contemporaneously or otherwise (other than any confidentiality agreement that previously may have been entered into, the terms of which will survive execution of this Release). No term, condition, covenant, representation or acknowledgment contained in this Release may be amended unless made in writing and signed by the Employee and the Company or its successors or assigns.

15. Governing Law. The validity, performance and enforceability of this Release shall be determined and governed by the laws of the State of New York, without regard to its conflict of law principles. The exclusive forum for any action concerning this Release or the transactions contemplated hereby shall be in a court of competent jurisdiction in New York County with respect to a state court, or the United States District Court for the Southern District of New York, with respect to a federal court. EMPLOYEE HEREBY CONSENTS TO THE EXERCISE OF JURISDICTION OF THE COURT IN THE EXCLUSIVE FORUM SET FORTH IN THIS RELEASE AND WAIVES ANY RIGHT EMPLOYEE MAY HAVE TO CHALLENGE OR CONTEST THE REMOVAL AT ANY TIME BY THE COMPANY TO FEDERAL COURT OF ANY ACTION EMPLOYEE MAY BRING AGAINST IT IN STATE COURT. EMPLOYEE AND THE COMPANY MUTUALLY WAIVE THEIR RIGHT TO TRIAL BY JURY IN ANY ACTION CONCERNING THIS RELEASE OR EMPLOYEE’S EMPLOYMENT IN GENERAL.

5

16. Interpretation of Terms. The rule of construction to the effect that ambiguities are to be resolved against the drafting party shall not be employed in interpreting this Release. The language of all parts of this Release shall in all cases be construed as a whole, according to its plain meaning, and not strictly for or against any of the parties. The parties intend for this Release to be construed or limited in conformity with all applicable laws.

17. Severability. Should any provision of this Release be declared illegal or unenforceable by any court of competent jurisdiction and cannot be modified to be enforceable, excluding the general release language, such provision shall immediately become null and void, leaving the remainder of this Release in full force and effect.

18. Revocation. By executing this Release, Employee acknowledges and agrees that (i) Employee is hereby advised by the Company to consult with an attorney regarding the terms of and before executing this Release; (ii) the offer set forth in this Release remains open for twenty-one (21) calendar days, during which time the Employee may review, consult with Employee’s counsel and consider whether to sign the Release; (iii) the Release is written in a manner understandable by Employee; and (iv) Employee has been advised that Employee has seven (7) calendar days following execution of this Release to revoke it (“Revocation Period”). Should Employee return the executed Release in less than twenty-one (21) calendar days, Employee agrees that he/she does so knowingly and voluntarily. This Release will not be effective or enforceable, and the Separation Payment shall not be paid or delivered by the Company, until Employee signs the Release and the Revocation Period has expired. If Employee elects to revoke the Release, revocation shall be made by delivering a written notice of revocation to:

|

Barnes & Noble, Inc.

|

||

|

c/o HR Service Center

|

||

|

1400 Old Country Road, 2nd Floor

|

||

|

Westbury, NY 11590

|

19. Voluntary Agreement. Employee agrees and acknowledges that (i) Employee has had an adequate opportunity to review this Release and all of its terms, and to be represented by counsel; (ii) Employee understands all of the terms of this Release, which are fair, reasonable and are not the result of any fraud, duress, coercion, pressure or undue influence exercised by or on behalf of any Releasee; and (iii) Employee has agreed to and/or entered into this Release and all of the terms hereof, knowingly, freely and voluntarily.

ACKNOWLEDGED AND AGREED TO BY:

|

|

|

/s/ Fred Argir | |

| Fred Argir |

|

STATE OF MINNESOTA

|

)

|

|

|

: ss.:

|

||

|

COUNTY OF RAMSEY

|

)

|

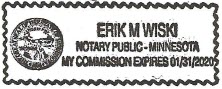

On the 6th day of August, 2018, personally came Fred Argir and being known to me to be the individual described in, and who executed the foregoing General Release and Waiver, and duly acknowledged to me their signature above.

|

|

|

/s/ Erik M. Wiski | |

|

Notary Public

|

|||

6

Benefits Addendum

Medical and Dental Benefits

If you have medical and/or dental benefits, your coverage will end August 3, 2018. You can elect to continue coverage for eighteen (18) months through COBRA by paying the full monthly premium, plus a 2% administration fee described below.

|

2018 Monthly COBRA Premium

Effective 1/1/18 – 12/31/18

|

|||

|

Single

|

Two Member

|

Family

|

|

|

Medical - EPO

|

(***)†

|

(***)†

|

(***)†

|

|

Medical - PPO

|

(***)†

|

(***)†

|

(***)†

|

|

Dental

|

(***)†

|

(***)†

|

(***)†

|

However, the Company will subsidize the premium rate for medical and dental coverage during the severance period in the same manner as if you were an active employee of the Company, provided we receive a fully executed, notarized and enforceable Release. Below is the subsidize premium.

|

2018 Monthly Subsidized Premium

Effective 1/1/18 – 12/31/18

|

|||

|

Single

|

Two Member

|

Family

|

|

|

Medical - EPO

|

(***)†

|

(***)†

|

(***)†

|

|

Medical - PPO

|

(***)†

|

(***)†

|

(***)†

|

|

Dental

|

(***)†

|

(***)†

|

(***)†

|

To take advantage of the subsidized rates, you must return your signed Release along with your COBRA election. The COBRA notice with detailed information regarding your continuation coverage will be mailed to your home address shortly after your termination date. To limit interruption of your benefit continuation, you may email your election form directly to the Benefits Department at BenefitsDepartment@bn.com.

If you choose to continue your coverage after the severance period ends, you will be responsible for payment of the full monthly premium payments, plus a 2% administration fee.

If you become covered by other similar group medical and/or dental coverage including Medicare, your eligibility to continue coverage will cease. Please notify the Benefits Department when you become covered in another group plan.

Flexible Spending Account (FSA)

If you have a balance in your FSA account, you may be able to continue coverage under FSA COBRA. You will be notified by the Benefits Department if you are eligible. Should you choose to elect FSA COBRA continuation, you will be billed for your regular contribution plus a 2% administration fee through the end of the current enrollment period (December 2018). Healthcare expenses incurred while your participation remains in effect are eligible for reimbursement from your FSA.

Life Insurance

Your group life insurance coverage will be discontinued on August 3, 2018. You may convert this coverage to an individual policy within thirty-one (31) days of the expiration. If you are interested in converting your Group Term Life Insurance coverage and you would like rate information, please contact Liberty Mutual Insurance at 1-888-786-2688.

Long-Term Disability

If you are enrolled in long-term disability, coverage will be discontinued on the August 3, 2018.

401(k) Plan

If you participate in the 401(k) Plan, your contributions will cease August 3, 2018. Fidelity will mail materials to your home address that will outline the choices available to you. For further information, please call Fidelity at (800) 421-3844.

Vacation and Personal Days

You will be paid for all unused and accrued vacation time as well as any unused personal time.

Relocation

You will be eligible for assistance to relocate back to Minnesota (including complete cost of moving household belongings) within six (6) months from August 3, 2018 and reimbursement for four (4) months’ rent for your New York apartment at a rate of $5,500 per month. If you breach any provision of the Release, you will be required to repay 100% of the relocation costs.

If you have questions on any of the above benefits, you can reach the Benefits Department through the HR Service Center at (800) 799-5335 or directly via email at BenefitsDepartment@bn.com.

______________________

(***)† This information has been omitted based on a request for confidential treatment. The omitted portions have been separately filed with the Securities and Exchange Commission.