Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH JERSEY INDUSTRIES INC | sjiq220188-kerpresentation.htm |

| EX-99 - EXHIBIT 99 - SOUTH JERSEY INDUSTRIES INC | q22018earningspresentation.pdf |

Second Quarter 2018 Earnings Conference Call August 9, 2018

Forward-Looking Statements and Use of Non-GAAP Measures Certain statements contained in this presentation may qualify as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact should be considered forward- looking statements made in good faith and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “expect”, “estimate”, “forecast”, “goal”, “intend”, “objective”, “plan”, “project”, “seek”, “strategy”, “target”, “will” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. These risks and uncertainties include, but are not limited to, the following: general economic conditions on an international, national, state and local level; weather conditions in our marketing areas; changes in commodity costs; changes in the availability of natural gas; “non-routine” or “extraordinary” disruptions in our distribution system; regulatory, legislative and court decisions; competition; the availability and cost of capital; costs and effects of legal proceedings and environmental liabilities; the failure of customers or suppliers to fulfill their contractual obligations; and changes in business strategies. These cautionary statements should not be construed by you to be exhaustive. While SJI believes these forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience. Further, SJI undertakes no obligation to update or revise any of its forward-looking statements, whether as a result of new information, future events or otherwise. This presentation includes certain non-GAAP financial measures, which the Company believes are useful in evaluating its performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The Company has provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the supplemental information portion of this presentation. Investor Contact: Investor Contact: Media Contact: Daniel Fidell Eric Jacobson Marissa Travaline 609-561-9000 x7027 609-561-9000 x4363 609-561-9000 x4227 dfidell@sjindustries.com ejacobson@sjindustries.com mtravaline@sjindustries.com 2

Participants on Today’s Call Michael J. Renna President and Chief Executive Officer Stephen H. Clark Executive Vice President and Chief Financial Officer 3

Executive Summary 4

Business Transformation On Track • In 2015, began planned shift in operating strategy toward a more regulated business mix • Plan driven by desire to increase the quality of earnings by increasing investment in utility and FERC-regulated assets that provide highly-visible cash flows and earnings • Plan also sought to reduce earnings volatility and optimizing the value of our non-core, non- regulated businesses • In 2016, announced cessation of new investment in solar projects, reduced our portfolio of on- site energy production businesses, and significantly strengthened our balance sheet through a successful equity offering • In 2017, announced plan to acquire ETG and Elkton, and received Certificate of Public Convenience and Necessity for PennEast from FERC • In 2018, completed acquisition of ETG and Elkton and announced sale of solar assets 5

Executing on Strategic Priorities 6

Delivering Shareholder Value $36.9 $60.2 $73.7 $60.7 $93.7 1. SJI uses the non-GAAP measure of Economic Earnings (EE.) EE eliminates all unrealized gains and losses on commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realized gains and losses attributed to hedges on inventory transactions and for the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period or was realized in a previous period. 2. Based on actual dividends paid in each respective year 7

Acquisitions of ETG and Elkton Completed Transaction • In October 2017, announced acquisitions of Elizabethtown Gas (ETG) in New Jersey and Elkton Gas (Elkton) in Maryland in a $1.7B transaction, with an effective purchase price of $1.5B. (1) • Transformative transaction that reinforces regulated business mix and builds scale, increasing rate base by 45%. • Accretive to 2020 economic earnings per share, building off ETG and Elkton 2016 standalone net income of $35 million. • Visibility for growth well beyond SJI standalone 5-year plan. Recent Developments • In December 2017, filed for regulatory approval in New Jersey (NJBPU). In January, filed for regulatory approval in Maryland (MPSC). • In February, received approval from Federal Communications Commission (FCC) and Hart-Scott-Rodino. • In April, completed an offering of equity units and common stock as part of our permanent financing plan. • In May/June, received MPSC and NJBPU regulatory approvals. • On July 1, announced closing of the transactions (1) Adjusted for approximately $200M tax basis step-up 8

Acquisition Rationale Improves SJI’s Business Risk Profile • In line with SJI’s strategic shift to focus on regulated investments • Meaningfully adds to regulated business mix • Expands gas utility rate base by ~45% and customer base by ~78% Leverages Strong, Existing Regulatory Relationships in NJ • Elizabethtown to benefit from SJI’s existing regional expertise and constructive relationship with New Jersey regulators • Customers will benefit from SJI’s commitment to the state and local communities it serves Growth and Earnings Accretion • Enhances the path to long-term, high-quality growth Enhanced Utility Investment Opportunity • Provides significant investment opportunity through the replacement of aging gas distribution infrastructure via accelerated recovery programs that focus on safety, reliability and storm hardening • Elizabethtown has ~$800 million of potential investment to replace aging infrastructure through 2026, plus additional investment opportunities totaling ~$450 million over the same period 9

Sale of Solar Assets Transaction • As part of our business transformation plan, we are seeking to optimize the value of our non-core, non-regulated businesses. • In June 2018, we entered into an agreement to sell our portfolio of solar energy projects to an entity managed by Goldman Sachs Asset Management (GSAM) for approximately $350 million in cash. • The projects, located at 143 sites across New Jersey, Maryland, Massachusetts and Vermont, provide power to schools, hospitals, and commercial and industrial facilities. • We received $62.5 million of the purchase price in July, with the balance to be received over the next several months as individual projects in the portfolio satisfy closing conditions. • We expect nearly all projects in the portfolio will satisfy their closing conditions prior to December 31, 2018. • We are evaluating optimal deployment of the anticipated proceeds from the sale, including potential repayment of outstanding indebtedness and potential reduced share issuance under our existing forward equity agreement. 10

PennEast Pipeline Project • $200M investment with FERC level returns projected • 20% equity owner in $1.0B+, 1 BCF, 118-mile interstate pipeline from Marcellus region of PA into NJ • Fully subscribed; 80% of capacity under 15-year agreements • Contributed $1.2M to 1H 2018 earnings • In January 2018, PennEast received its Certificate of Public Convenience and Necessity from FERC • With this approval, we moved to the next phase to obtain survey access and submit completed applications for water permits in New Jersey and with the Delaware River Basin Commission (DRBC) • We continue to work with our PennEast partners as this critical infrastructure project moves through the state-level permitting processes. Project Status Timeline • At this point, we are working through the details of gaining access to remaining land parcels along the route in order to Application Submitted September, 2015 confirm field-level environmental data for our permits. FERC Draft EIS Issued July, 2016 • We will update the project timeline once we have clarity on completion dates for our state-level permitting; however, Final EIS Issued April, 2017 we do expect to commence construction on the project in FERC Approval January, 2018 late 2019. 11

Earnings Performance – Q2'18 Versus Q2'17 *SJI uses the non-GAAP measure of Economic Earnings when discussing results. A full explanation and reconciliation of this non-GAAP measure is provided under “Explanation and Reconciliation of Non-GAAP Financial Measures” in the Earnings Release. 12

Earnings Performance – YTD'18 Versus YTD'17 *SJI uses the non-GAAP measure of Economic Earnings when discussing results. A full explanation and reconciliation of this non-GAAP measure is provided under “Explanation and Reconciliation of Non-GAAP Financial Measures” in the Earnings Release. 13

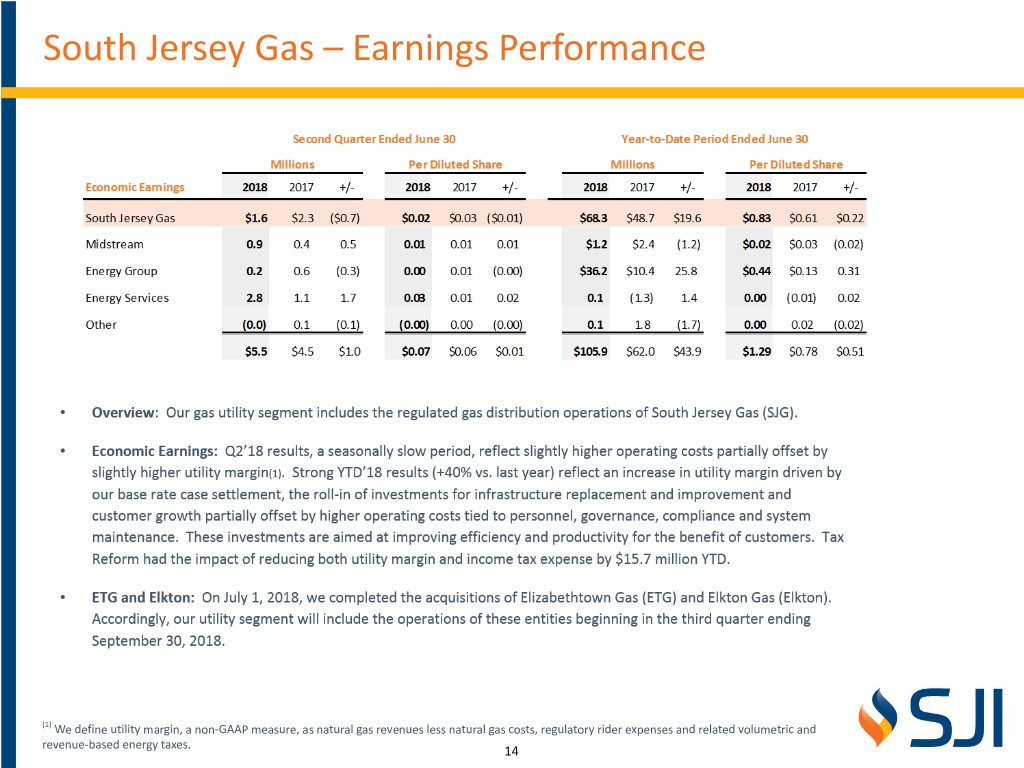

South Jersey Gas – Earnings Performance (1) We define utility margin, a non-GAAP measure, as natural gas revenues less natural gas costs, regulatory rider expenses and related volumetric and revenue-based energy taxes. 14

Midstream – Earnings Performance 15

Energy Group – Earnings Performance Note: sub-segment earnings and per share data may not add up due to rounding error. 16

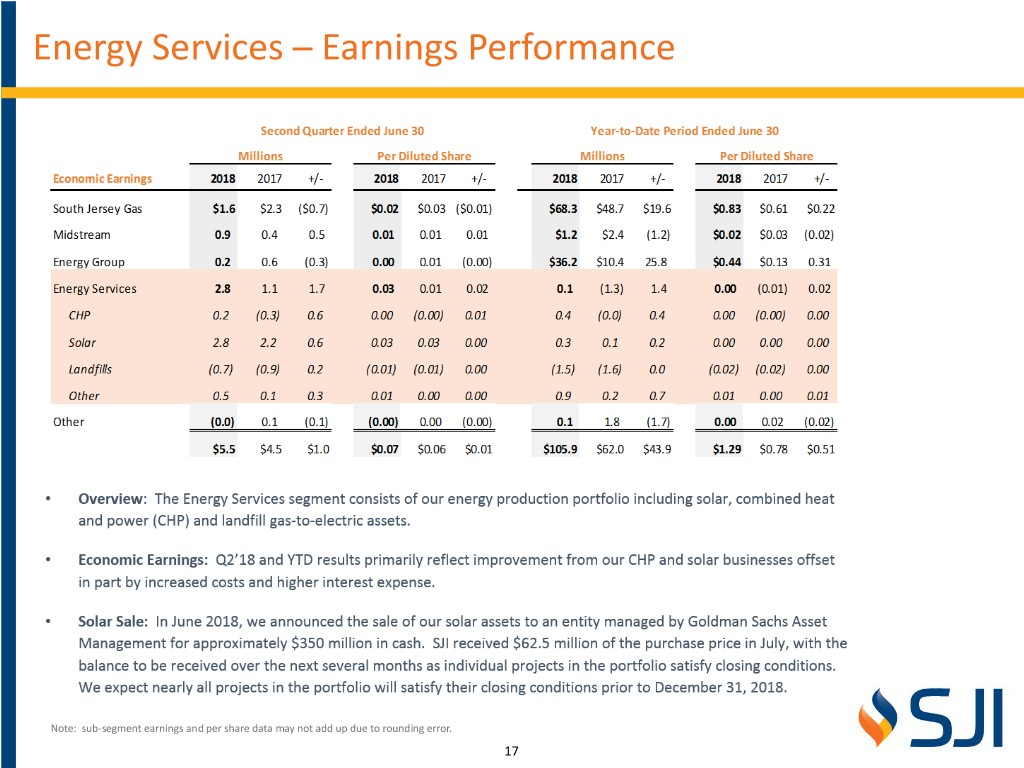

Energy Services – Earnings Performance Note: sub-segment earnings and per share data may not add up due to rounding error. 17

Guidance 2018 EXPECTED CONTRIBUTION TO 2018 • We are reaffirming our previous 2018 economic SEGMENT ECONOMIC EARNINGS earnings guidance of $1.57 to $1.65 per fully-diluted share for SJI, excluding impacts of acquisitions and REGULATED divestitures. Gas Utility 63% - 67% Midstream 2% - 5% • This range reflects our strong performance in the first half of 2018, including improved results from both our NON-REGULATED gas utility and non-regulated wholesale marketing and Energy Group 28% - 33% fuel management operations earlier this year, as well as Energy Services (1)% - 3% impacts from tax reform. • We continue to expect that our regulated businesses Tax Reform Impacts (SJG and Midstream) will provide 65 to 72 percent of 2018-2020 2018 economic earnings for SJI, excluding impacts of Income Statement acquisitions and divestitures. Annual benefit due to higher rate base. South Jersey Gas Amount dependent upon regulatory action and timing of base rate cases. Longer-Term Non-Utility and Annual benefit due to lower tax rate. Projected to be Corporate approximately $10M by 2020. • We previously provided 2020 economic earnings guidance of $160 million. Cash Flow • With the closing of our acquisitions of ETG and Elkton Annual cash flow decrease of $20-40M expected due to and the sale of our solar assets, we plan to provide a return to excess deferred taxes to customers and an SJI increase in cash taxes to be paid sooner than expected detailed review of our combined company growth resulting from the elimination of bonus depreciation. outlook at our upcoming Investor Conference. Actual amount is dependent upon regulatory action. 18

Appendix 19

SJI Organizational Structure (1) The Company is currently exploring the potential divestiture of certain of these assets. Sale of solar assets was announced in June, 2018. 20

GAAP Reconciliation to Economic Earnings – 2Q'18 $140,000 3,680 1,345 9,277 $120,000 111,306 100,418 $100,000 (25,190) $80,000 $60,000 $40,000 $20,000 $0 P ts m s s E AA os or ute ive E G C ef sp at on x R Di riv iti Ta al De uis eg n cq L s o A ain d G lize rea Un 21

South Jersey Gas – Performance Drivers ¹ Slide depicts changes to period over period net income, it is not intended to be a substitute for financial statements ² Excludes expenses where there is a corresponding credit in operating revenues (i.e., no impact on our financial results) ³ Expenses associated with accelerated infrastructure investments are reflected within that line item 22

South Jersey Gas - Customer Growth Trends (1) Reflects year-over-year net growth (2) Based on EIA expected winter 17/18 expenditures 23

Utility Customer Growth 12 Months Ended June 30, 2018 Margin Growth from Customer Additions $2.3M Conversions 6,581 New Construction 2,138 Total Gross Customer Additions 8,719 Net Customer Additions 5,913 Year Over Year Net Growth Rate 1.6% 24

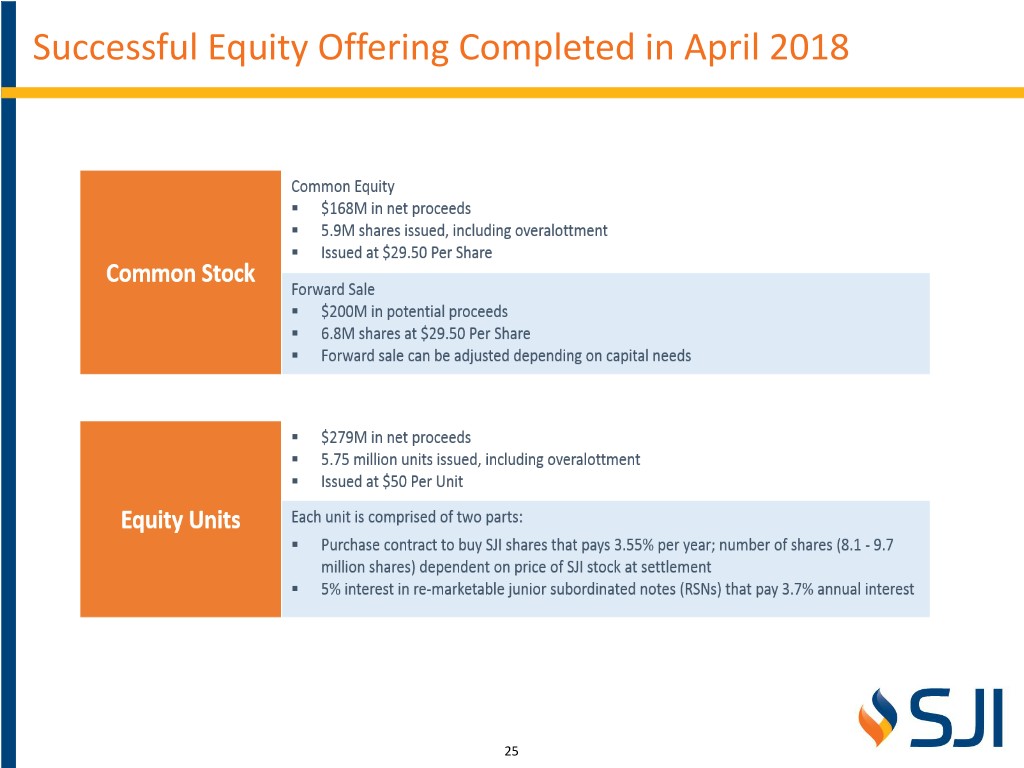

Successful Equity Offering Completed in April 2018 25