Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Evofem Biosciences, Inc. | d593468d8k.htm |

August

2018 SAUNDRA PELLETIER, CEO

NASDAQ: EVFM Exhibit 99.1 |

This presentation contains forward looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 and other federal securities laws. In some cases, you can identify forward looking statements by terms such as “may,” ”will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “strategy,” “designed,” “suggest,” “currently,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward looking statements of this presentation are only predictions and are subject to a number of risks, uncertainties and assumptions, including, without limitation risks and uncertainties relating to: the outcome or success of Evofem’s clinical trials; Evofem’s ability to obtain the necessary regulatory approvals for its product candidates, including approval from the U.S. Food and Drug Administration for the use of Amphora ® as a contraceptive, and the timing of such approvals; the rate and degree of market acceptance of Amphora ® ; Evofem’s ability to successfully commercialize Amphora ® and its ability to develop sales and marketing capabilities; Evofem’s ability to maintain and protect its intellectual property; Evofem’s ability to raise additional capital when needed and to rely on existing cash reserves to fund its current development plans and operations; Evofem’s reliance on third party providers, such as third party manufacturers and clinical research organizations; the absence of any adverse events or side effects relating to the use of Amphora ® ; Evofem’s ability to retain members of its management and other key personnel; and other risk factors detailed in Evofem’s filings from time to time with the U.S. Securities and Exchange Commission. The forward looking statements in this presentation represent Evofem’s views only as of the date of this presentation, August 8, 2018, and Evofem undertakes no obligation to update or review any forward looking statement, whether as a result of new information, future developments or otherwise, except as required by law. Disclaimer 2 |

• Clinical-stage biopharmaceutical company • Committed to discovery, development and commercialization of innovative women’s health pharmaceuticals • Lead product candidate Amphora ® is a non-hormonal, on-demand, woman- controlled vaginal gel • Phase 3 confirmatory study in contraception • Phase 2b study for the prevention of chlamydia • Accomplished executive leadership team with more than 80 years of combined experience in women’s healthcare • Located in San Diego, CA Company Overview 3 |

Leadership

Headlines “

Globally experienced pharmaceutical executive with 25+ years of management

experience in women’s health, raising capital,

and launching brands”

“25 years of experience in accounting and finance with over

$600M in equity and debt offerings in the biotech

and biopharma industries”

“Board-certified OB/GYN with ~20 years of medical oversight in

women’s health who served as the Medical Officer

with W.H.O. and the IPPF”

“26 years of global marketing & sales experience with experiencing launching

over 6 prescription and OTC brands worldwide that today bring in as much

$1.2B annually”

4 Saundra Pelletier Chief Executive Officer Jay File Chief Financial Officer Kelly Culwell, M.D. Chief Medical Officer Russell Barrans Chief Commercial Officer |

Amphora

- Normal Vaginal

pH Level 3.5 – 4.5 Water pH Level 7 Semen/Blood pH Level 7.1 – 8 pH Levels Soap pH Level 7 – 14 Acidic Basic Body pH Level 5 Lead Asset: Amphora Vaginal Contraceptive Gel 5 4 1 2 3 5 6 7 8 9 10 11 12 13 0 |

• L-lactic acid, citric acid, and potassium bitartrate • Buffering properties keep the vaginal environment in the pH acidic range • Maintains acidic vaginal environment, preventing the survival of spermatozoa • The introduction of semen into the vagina raises the pH above 6.0 • Amphora maintains the natural vaginal pH, inhibiting spermatozoa • Highly bioadhesive, forming a layer over vaginal and cervical surfaces Amphora: Attributes and Mechanism of Action 6 |

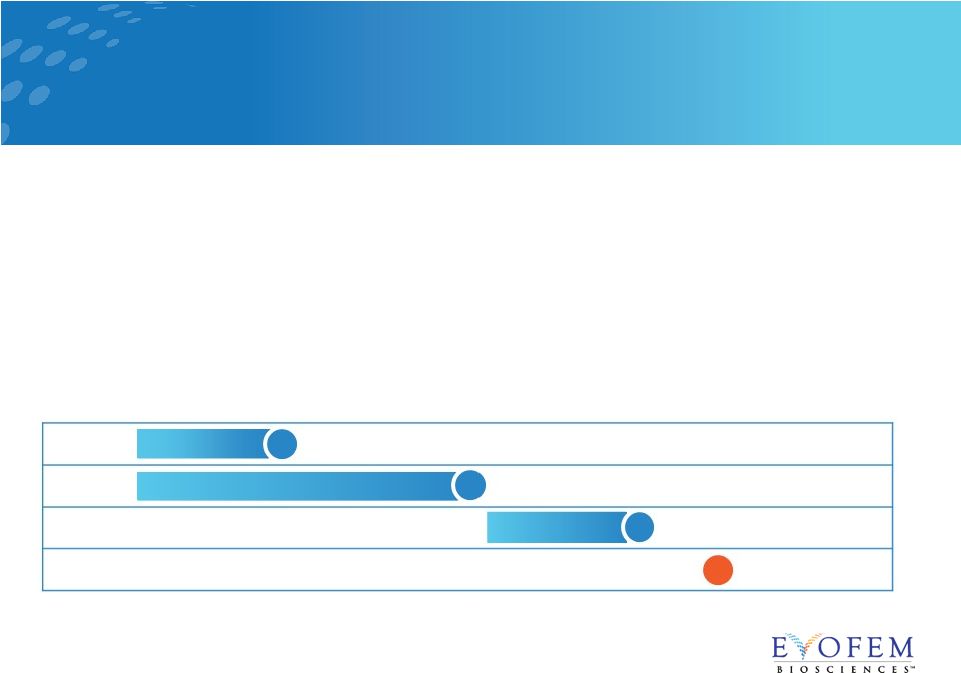

• Single-arm, open label trial in 1,400 women age 18-35 at 112 U.S. sites • Enrollment completed in February 2018 • 5 gram dose of Amphora administered up to one hour before intercourse • Primary endpoint: contraceptive efficacy over seven cycles • Exploratory endpoint: sexual satisfaction • Top-line results expected late 2018 AMP-002: Confirmatory Phase 3 Trial 7 Enrollment Confirmatory Phase 3 Trial Anticipated Top Line Results Anticipated Approval & Launch Anticipated NDA Resubmission 2017 2018 2019 2020 |

Hormone-free On-demand & woman-controlled Easy to self-administer Bioadhesive No weight restrictions / BMI agnostic Personal lubricant properties Patent protection through 2033* Amphora is Poised to Expand the Women’s Healthcare (WHC) Market 8 *Patent pending |

• Greater than 80% of women, and their partners, rated their Amphora experiences as

satisfying or extremely satisfying

• Note – more than half of respondents rated their experience as “extremely satisfied” • More than 4 out of 5 those who completed the study would recommend Amphora to a friend • 80% of respondents indicated that they felt confident the contraceptive gel, if

approved, would be effective in preventing pregnancy

User Experience Satisfaction Survey 1 9 Source: 1. Survey commissioned with Integrated Insights Consulting: Data on file – Healthcare Provider, AMP002 “Study participants just like how easy it is to use. They don't have to do a lot of pre-

planning. It's as easy to use as a tampon. It's portable. Their boyfriends, husbands,

whoever –

they like the lubricant aspect.” |

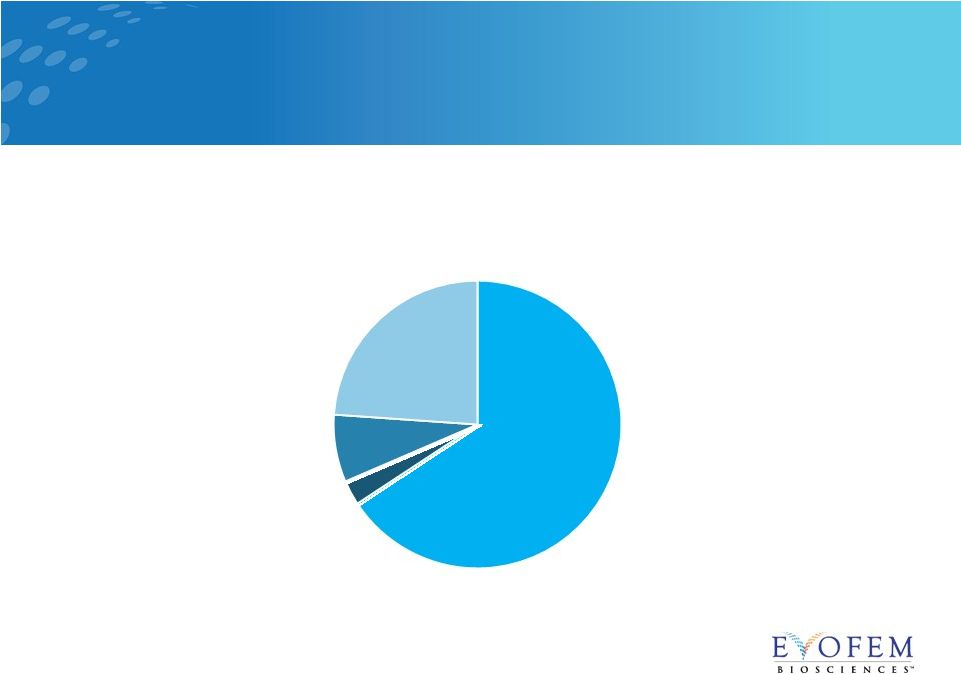

16.5M

Women in the U.S. Currently are Sexually Active but do Nothing to Prevent

Pregnancy 10

Source: 1. Derived from NCHS Data Brief No. 173_December 2014 and the 2016 US Census Bureau data.

Sexually active, not using contraception 16.5M Rhythm Method 0.7M Withdrawal Method 1.9M Condoms 6M Amphora Targets in U.S. Women 15-44 (in Millions) 1 |

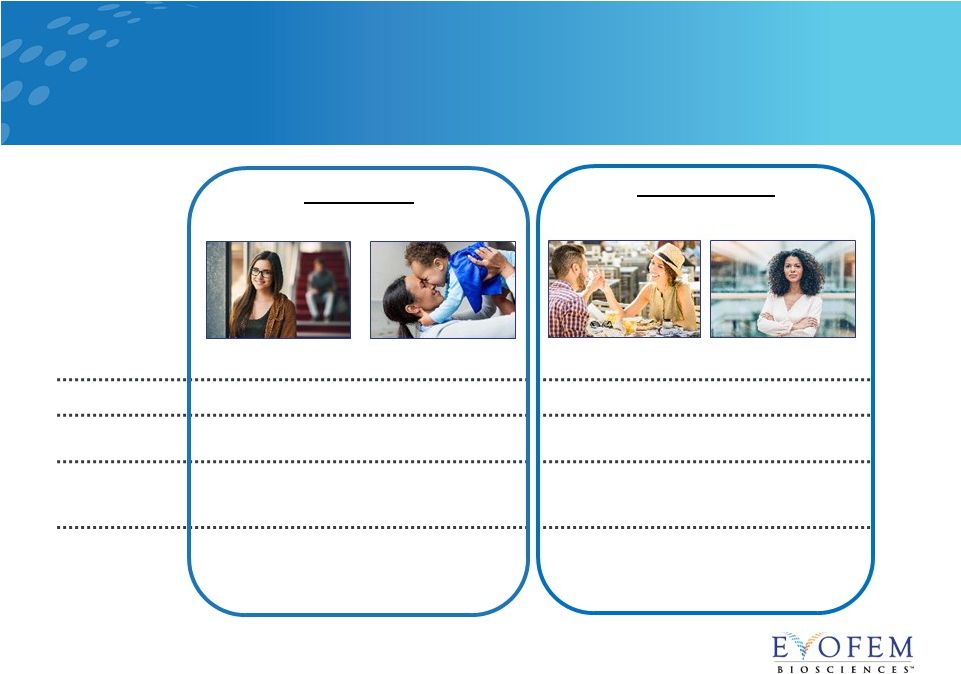

Amphora

Consumer Segmentation: Market research supports a shift in women’s

attitudes towards a non-hormonal option Life Stage

“Focused on School”

“Family Focused”

“Relationship Focused” “Focused on Career” Age 26 35 28 45 Occupation Law Student Homemaker Financial Analyst Director of Global Marketing Relationship Status Single, casual dater Married, 1 toddler Committed relationship, no children Single, casual dater, 2 teens Hormone Attitude Experienced hormonal side effects and inconsistent pill user Breast feeding and is concerned about hormones Concerned about hormones and prefers to add Amphora Currently using barrier method and likes lubricating properties Nicole* Jessica* Amanda* Laura* Alternatives Supplementers 11 Source: Commissioned Market Research – Data on File. *Not an actual study participant |

Amphora

Healthcare Providers Segmentation: A more effective

way to predict future prescribing patterns

12 We believe the healthcare provider community applicable to Amphora breaks down as follows:

Segment A (31%)

Segment B (27%)

Segment C (13%)

Segment D (11%)

Segment E (9%)

Segment F (9%)

Name Attentive Adrian Traditional Terry Surly Stanley Joan of LARC Mindful Marcia Rooted Rose Demographics Gender 50/50, physicians, more likely single- specialty Older, more likely male, lowest # mid- levels in practice Older, more likely male Younger, more likely female, more likely rural Mid-Levels, more likely female Older, more likely female Attitude Driver – Patient Satisfaction Least likely to believe patient knows the best option for herself Least patient oriented Influenced by colleagues Most reliant on KOLs and guidelines for treatment High concern about hormones and their safety Behavior Average speed of adoption More conservative about adoption Late adopters Highest contraception procedures (surgical & non surgical) Highest contraceptive usage Slow adopter and will like the idea of Amphora |

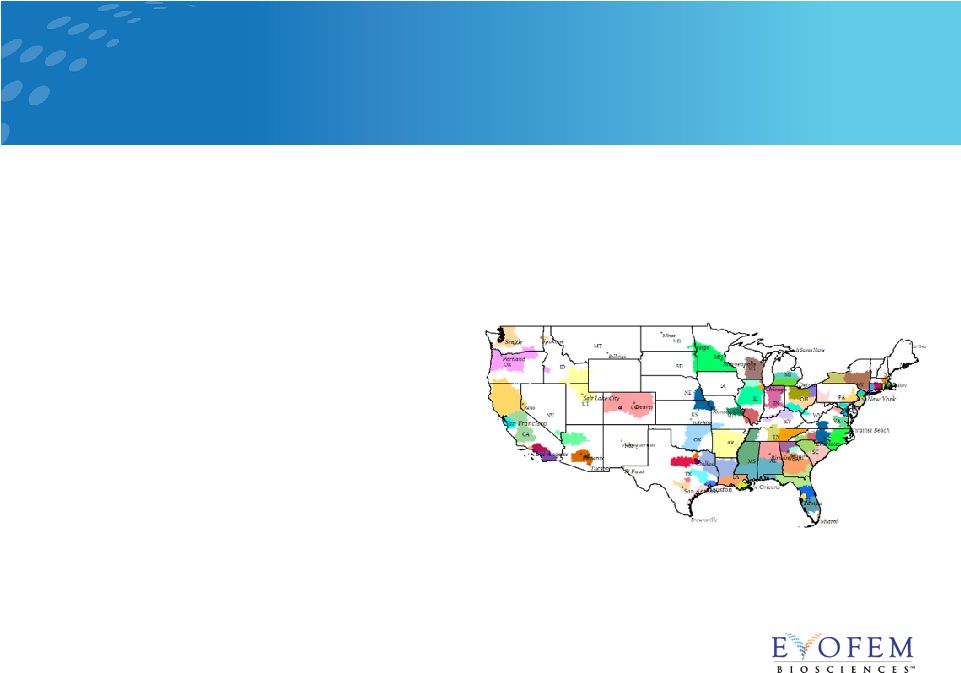

85 Sales Representatives cover ~96% of Deciles 6-10 oral contraceptive prescriptions 1 • Optimize deciles 6-10 OB/GYN coverage at the prescribed reach and frequency • 98% of total prescriptions of the top 10K writers in the oral contraceptive marketplace come from OB/GYNs 2 • Expected salesforce cost $15-20M annually • Affordable Care Act (ACA) • Under the federal mandate, Amphora is expected to be classified as a new class of prescription contraception allowing for it to be covered at $0 copay and $0 deductible for a majority of women Sources: 1. Quintiles – March 18, 2016: Evofem_Target_Universe_PCP+OBGYN_10USC_4Feb2016.xlsx

2. IMS Nov’15 Prescription Data

Direct Sales Opportunity

13 |

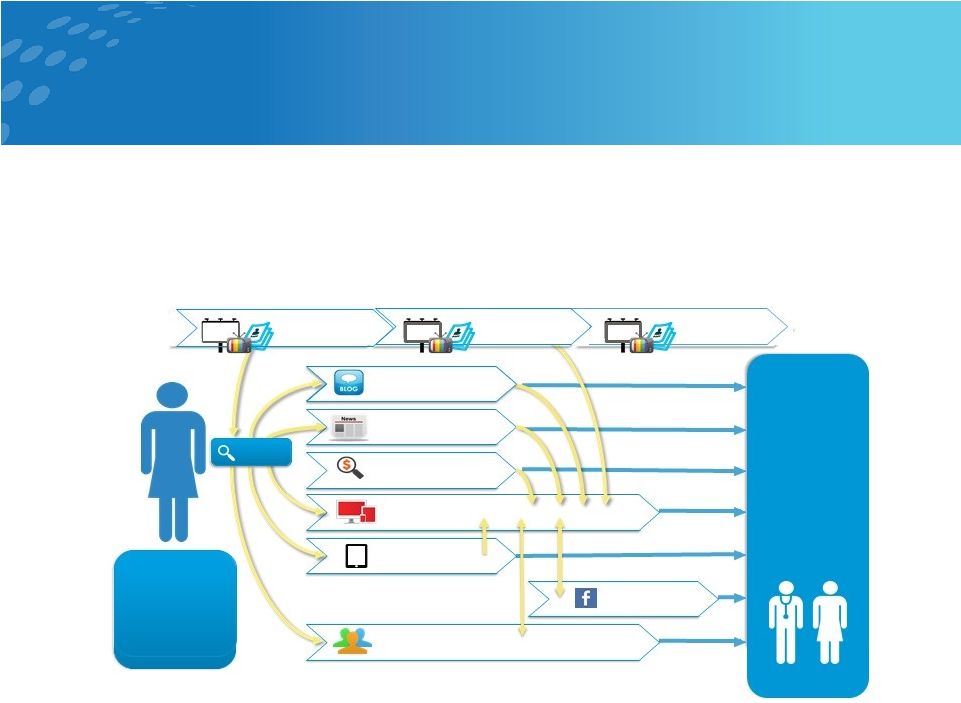

Precise

Targeting thru Direct-to-Consumer Digital Marketing

14 Strategy • Initiate direct-to-consumer (DTC) 6-9 months post launch • Shape the Amphora market by creating awareness and excitement among women who need and desire non-hormonal contraception • Annual DTC Budget ~$25-30M Paid Search Paid Ads Paid Digital Related Blogs Contextually Relevant Articles Search Engine Marketing amphora.com Consumer Website SEARCH Digital Booklet “I am unhappy, currently sexually active, and not using any forms of birth control. I have tried many different options.

What else is left?

“ Sponsored Events Facebook Page DOCTOR VISIT “My patient

came

in unhappy with the hormonal side effects she has been experiencing and cannot remember to take her pill daily. She is inquiring about non-hormonal options.” |

Pipeline:

Targeting Unmet Needs in Women’s Healthcare 15

Sources: 1. Guttmacher Institute. Contraceptive Use in the United States. Available at:

https://www.guttmacher.org/article/2017/10/contraceptive-method-use-united- states-trends-and-characteristics-between-2008-2012. Accessed 01 April 2018.

2. CDC 2016 Sexually Transmitted Disease Surveillance Report. 3. Multipurpose prevention technologies (MPTs) have a combination of contraceptive, microbicidal and/or anti-sexually transmitted infection (STI)

properties to prevent pregnancy, HIV and/or STIs.

4. The Prevalence of Bacterial Vaginosis in the United States, 2001–2004; Associations With Symptoms, Sexual Behaviors, and Reproductive

Health. 5.

While we have received a QIDP designation, we may be required to reapply should we alter

the formulation of this product candidate. |

Source:

1. CDC 2016 Sexually Transmitted Disease Surveillance Report

• 1.6M new cases of chlamydia in 2016 in U.S. 1 • Phase 2b trial – enrollment ongoing • Double-blinded, placebo-controlled efficacy trial at up to 50 U.S. sites • 844 women, 18-45 years old, with chlamydia infection in past four months • Four-month interventional period + one-month follow-up • Primary endpoint: prevention of chlamydia trachomatis in women

• Exploratory endpoint: sexual satisfaction • Fast Track designation for prevention of urogenital chlamydia in women • The additional protection from chlamydia will make Amphora an even more appealing addition to a woman’s current contraceptive method Amphora Label Expansion Opportunity: Prevention of Chlamydia 16 |

• BV is caused by an imbalance of a woman’s vaginal bacteria • Symptoms include unpleasant odor and abnormal vaginal discharge • BV has up to 58% recurrence rate 1 • Phase 1 dose-finding study completed • pH levels maintained to seven days • FDA designated QIDP for BV 2 • Eligible for FDA’s Fast Track • Adds five years market exclusivity for BV indication Pipeline Development: Prevention of Recurrent Bacterial Vaginosis (BV) 17 Sources: 1. Bradshaw CS et al., High Recurrence Rates of Bacterial Vaginosis over the Course of 12 Months after Oral Metronidazole Therapy and Factors

Associated with Recurrence. The Journal

of Infectious Diseases 193:1478-86 (2006). 2.

While we have received a QIDP designation, we may be required to reapply should we alter

the formulation of this product candidate. |

Ticker NASDAQ: EVFM Shares outstanding (as of 07/30/2018) 25.8M Common stock warrants outstanding: Merger-related May 2018 offering 2.0M @ $8.35 1.7M @ $7.50 Unrestricted Cash (as of 6/30/2018) $22.8M Key Stock Data 18 |

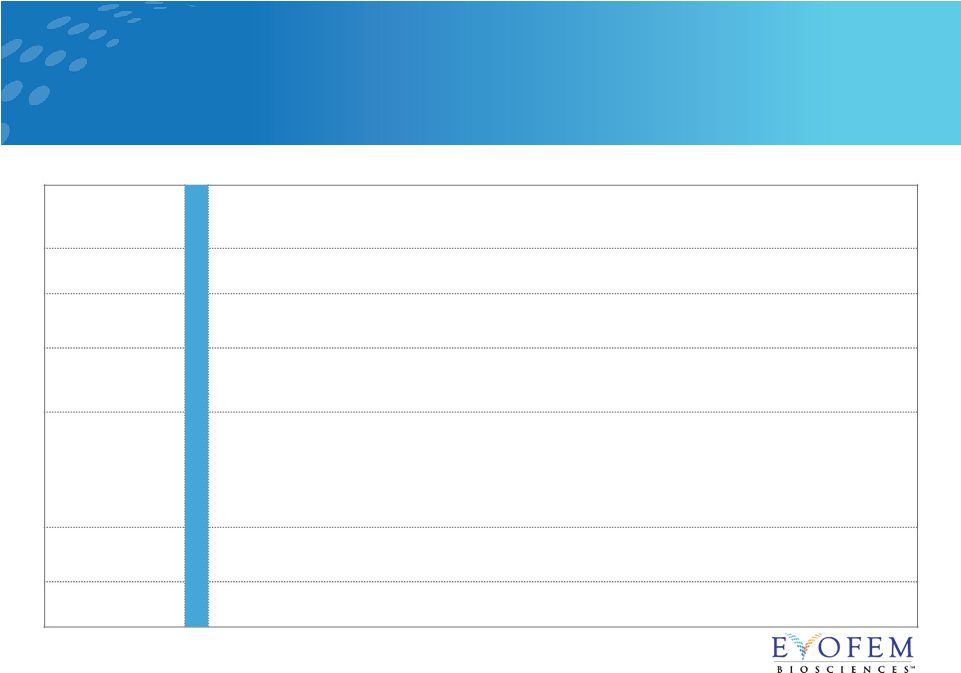

Initiate Phase 2b Amphora STI trial (first patient in)

Dec 2017

FDA grants Fast Track designation to Amphora for the

prevention of urogenital chlamydia in women

Feb 2018 Complete enrollment in Phase 3 Amphora contraceptive trial Feb 2018 Last patient last visit in Phase 3 Amphora contraceptive trial Fall 2018 Expected top-line results from Phase 3 Amphora contraceptive trial Late 2018 Resubmit Amphora NDA for contraception 1H 2019 Anticipated FDA action on Amphora NDA for contraception Q4 2019 Launch Amphora for contraception Q1 2020 Multiple Near-Term Catalysts 19 |

Evofem

Biosciences Highlights 20

*Patent pending Innovation Expertise Unmet Need Measurement Analytics Pipeline Exclusivity Amphora is first in class, non-hormonal, on-demand • Commercial launch anticipated January 2020 World class executive leadership team 16.5M women feel the trade-off avoiding hormones is worth the increased risk of

pregnancy Segmentation allows for precision in marketing messaging and sales force target

customers Near term catalysts: • Phase 3 confirmatory study, last patient out expected in the Fall 2018 • Topline results expected late 2018 • Expected NDA submission 1H 2019 Lifecycle management: prevention of chlamydia Additional product candidate: prevention of recurrent bacterial vaginosis IP through 2033* |

|