Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UR-ENERGY INC | tv500350_8k.htm |

Exhibit 99.1

NYSE American: URG • TSX: URE Five Years at Lost Creek Ur - Energy Webcast August 7, 2018

NYSE American: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s maintaining controlled - level production operations, including whether MU 1 and MU 2 will continue to perform as currently anticipated ; the technical and economic viability of Lost Creek, including results of the planned capture of pounds not currently under pattern ; w hether current projections related to supply and demand will be recognized and sustained ; whether the ongoing changes in the sector resemble 2004 - 2007 and will have the same effects in the market ; the continuing ability to expand resources, at the Lost Creek Property ; the further exploration, development and permitting of Company projects, including at Shirley Basin ; the technical and economic viability of Shirley Basin (including the production and cost projections contained in the preliminary economic analysis of the Shirley Basin project) ; completion of (and timing for) regulatory approvals and other development at Shirley Basin and Lost Creek ; whether the expected increases in foreign state - subsidized imports of uranium occur in coming years ; the expected further negative impacts of such imports on U . S . uranium production and national security ; whether the Section 232 trade action with the Department of Commerce will proceed to a favorable recommendation and action taken by the President ; the Company’s positioning to ramp up in response to market changes ; and whether certain prospective catalysts will occur and/or affect the market . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed March 2 , 2018 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . James A Bonner, Ur - Energy Vice President, Geology, P . Geo . , and Qualified Person as defined by NI 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

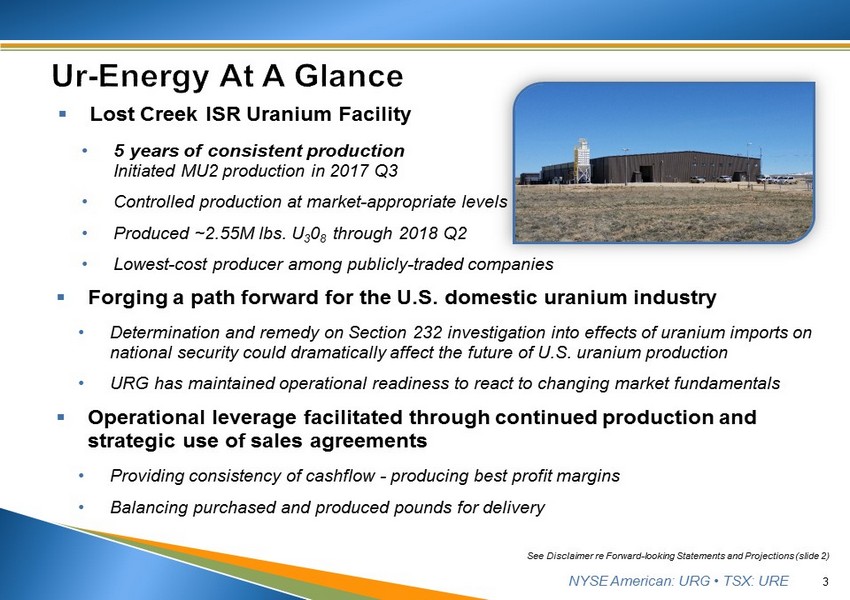

NYSE American: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2) ▪ Lost Creek ISR Uranium Facility • 5 years of consistent production Initiated MU2 production in 2017 Q3 • Controlled production at market - appropriate levels • Produced ~2.55M lbs. U 3 0 8 through 2018 Q2 • Lowest - cost producer among publicly - traded companies ▪ Forging a path forward for the U.S. domestic uranium industry • Determination and remedy on Section 232 investigation into effects of uranium imports on national security could dramatically affect the future of U.S. uranium production • URG has maintained operational readiness to react to changing market fundamentals ▪ Operational leverage facilitated through continued production and strategic use of sales agreements • Providing consistency of cashflow - producing best profit margins • Balancing purchased and produced pounds for delivery

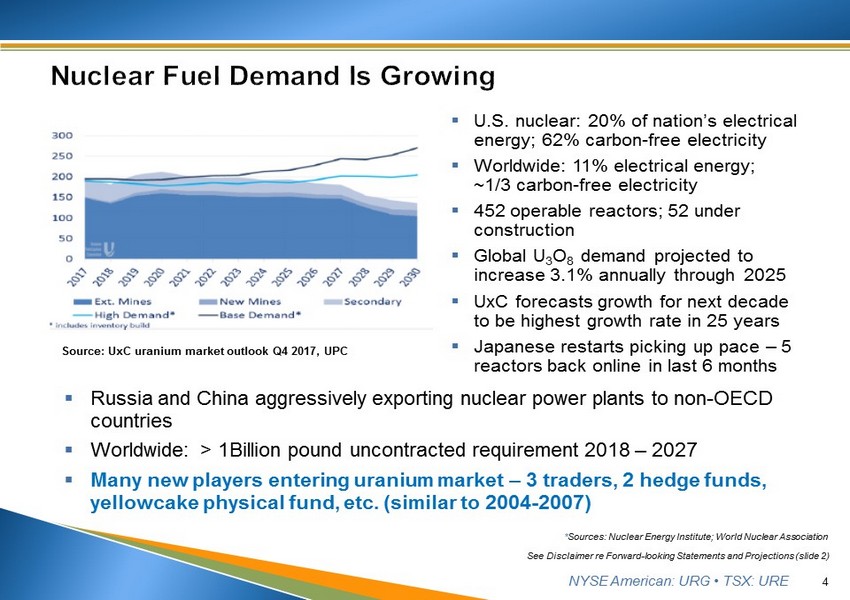

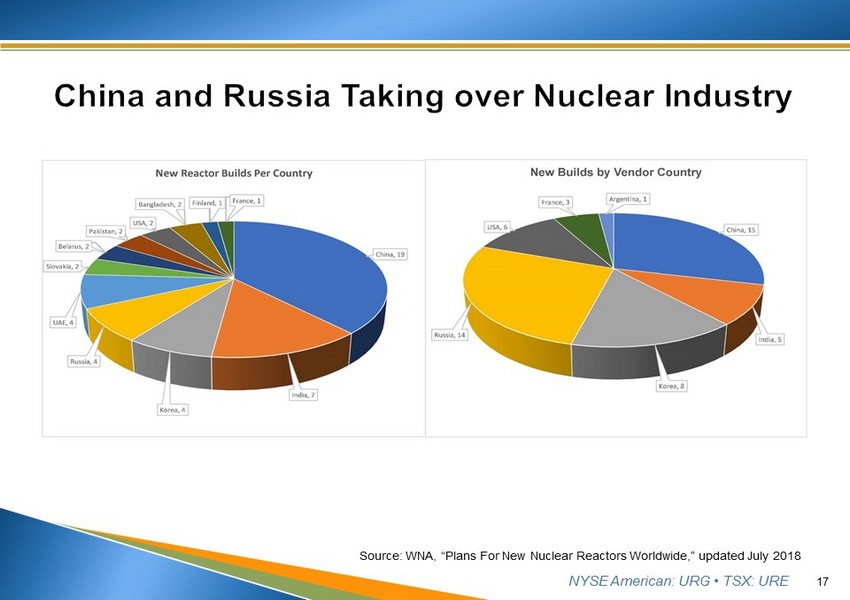

NYSE American: URG • TSX: URE ▪ U.S. nuclear: 20% of nation’s electrical energy; 62% carbon - free electricity ▪ Worldwide: 11% electrical energy; ~1/3 carbon - free electricity ▪ 452 operable reactors; 52 under construction ▪ Global U 3 O 8 demand projected to increase 3.1% annually through 2025 ▪ UxC forecasts growth for next decade to be highest growth rate in 25 years ▪ Japanese restarts picking up pace – 5 reactors back online in last 6 months 4 Source: UxC uranium market outlook Q4 2017, UPC See Disclaimer re Forward - looking Statements and Projections (slide 2) * Sources: Nuclear Energy Institute; World Nuclear Association ▪ Russia and China aggressively exporting nuclear power plants to non - OECD countries ▪ Worldwide: > 1Billion pound uncontracted requirement 2018 – 2027 ▪ Many new players entering uranium market – 3 traders, 2 hedge funds, yellowcake physical fund, etc. (similar to 2004 - 2007)

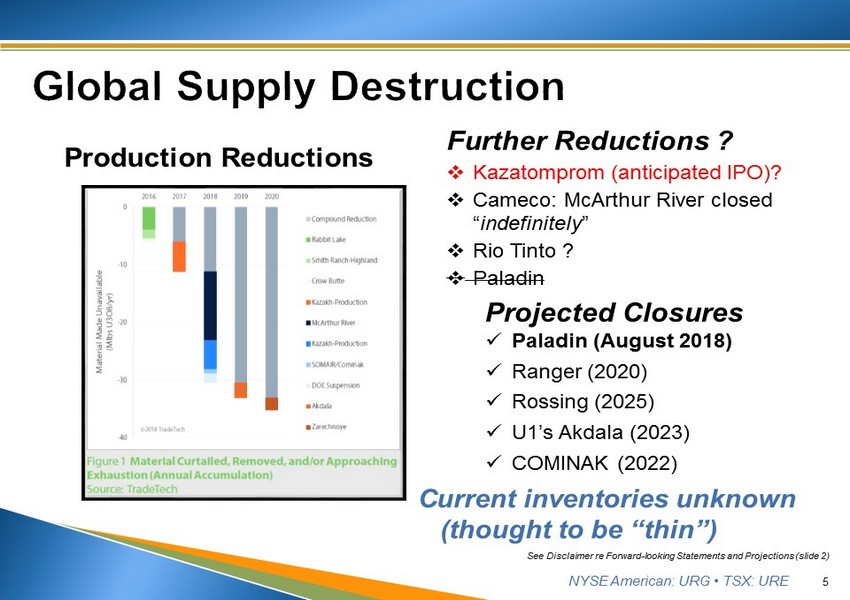

NYSE American: URG • TSX: URE 5 See Disclaimer re Forward - looking Statements and Projections (slide 2) Further Reductions ? □ Kazatomprom (anticipated IPO)? □ Cameco: McArthur River closed “ indefinitely ” □ Rio Tinto ? □ Paladin Projected Closures x Paladin (August 2018) x Ranger (2020) x Rossing (2025) x U1’s Akdala (2023) x COMINAK (2022) Production Reductions Current inventories unknown (thought to be “thin”)

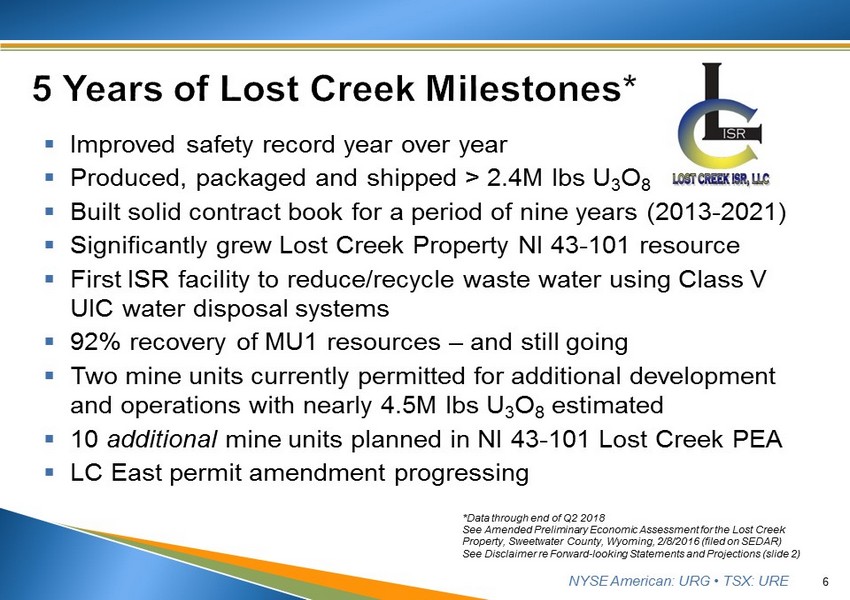

NYSE American: URG • TSX: URE 6 ▪ Improved safety record year over year ▪ Produced, packaged and shipped > 2.4M lbs U 3 O 8 ▪ Built solid contract book for a period of nine years (2013 - 2021) ▪ Significantly grew Lost Creek Property NI 43 - 101 resource ▪ First ISR facility to reduce/recycle waste water using Class V UIC water disposal systems ▪ 92% recovery of MU1 resources – and still going ▪ Two mine units currently permitted for additional development and operations with nearly 4.5M lbs U 3 O 8 estimated ▪ 10 additional mine units planned in NI 43 - 101 Lost Creek PEA ▪ LC East permit amendment progressing *Data through end of Q2 2018 See Amended Preliminary Economic Assessment for the Lost Creek Property, Sweetwater County, Wyoming, 2/8/2016 (filed on SEDAR) See Disclaimer re Forward - looking Statements and Projections (slide 2)

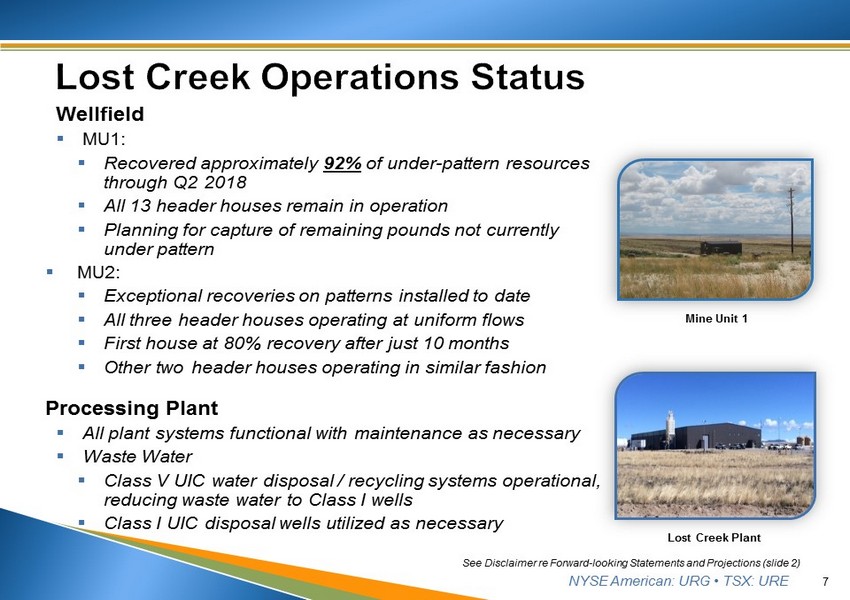

NYSE American: URG • TSX: URE 7 Wellfield ▪ MU1: ▪ Recovered approximately 92% of under - pattern resources through Q2 2018 ▪ All 13 header houses remain in operation ▪ Planning for capture of remaining pounds not currently under pattern ▪ MU2: ▪ Exceptional recoveries on patterns installed to date ▪ All three header houses operating at uniform flows ▪ First house at 80% recovery after just 10 months ▪ Other two header houses operating in similar fashion Processing Plant ▪ All plant systems functional with maintenance as necessary ▪ Waste Water ▪ Class V UIC water disposal / recycling systems operational, reducing waste water to Class I wells ▪ Class I UIC disposal wells utilized as necessary Lost Creek Plant Mine Unit 1 See Disclaimer re Forward - looking Statements and Projections (slide 2)

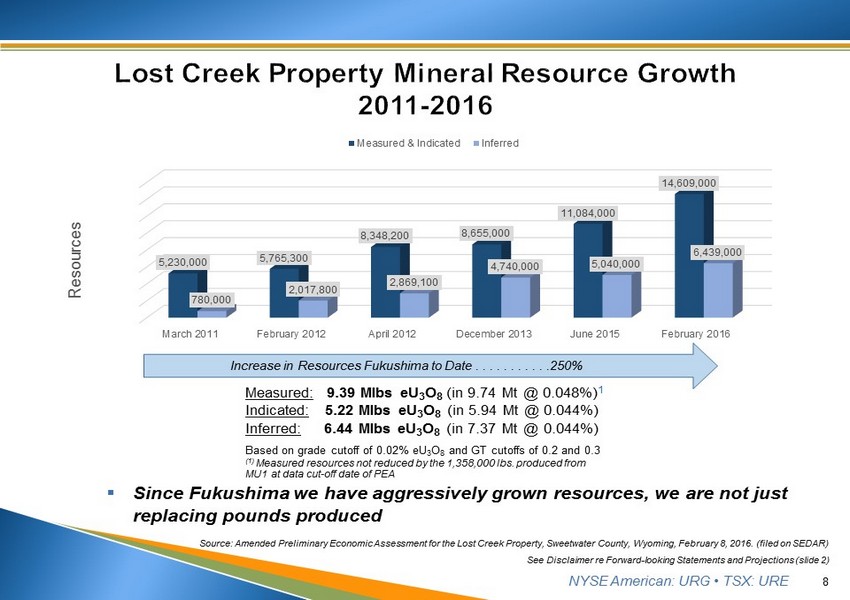

NYSE American: URG • TSX: URE 8 See Disclaimer re Forward - looking Statements and Projections (slide 2) Measured: 9.39 Mlbs eU 3 O 8 (in 9.74 Mt @ 0.048%) 1 Indicated: 5.22 Mlbs eU 3 O 8 (in 5.94 Mt @ 0.044%) Inferred: 6.44 Mlbs eU 3 O 8 (in 7.37 Mt @ 0.044%) Based on grade cutoff of 0.02% eU 3 O 8 and GT cutoffs of 0.2 and 0.3 (1) Measured resources not reduced by the 1,358,000 lbs. produced from MU1 at data cut - off date of PEA Source: Amended Preliminary Economic Assessment for the Lost Creek Property, Sweetwater County, Wyoming, February 8, 2016. (f ile d on SEDAR) Increase in Resources Fukushima to Date . . . . . . . . . . . 250 % March 2011 February 2012 April 2012 December 2013 June 2015 February 2016 5,230,000 5,765,300 8,348,200 8,655,000 11,084,000 14,609,000 780,000 2,017,800 2,869,100 4,740,000 5,040,000 6,439,000 Resources Measured & Indicated Inferred ▪ Since Fukushima we have aggressively grown resources, we are not just replacing pounds produced

NYSE American: URG • TSX: URE 9 2013 2014 2015 2016 2017 2018 thru Q2 Captured 190K lbs 596K lbs 784K lbs 538K lbs 265K lbs 173K lbs Drummed 131K lbs 548K lbs 727K lbs 561K lbs 254K lbs 154K lbs Cash Cost* $21.98/lb $19.73/lb $16.27/lb $17.15/lb $24.41/lb $25.37/lb Uranium Production and Cost 2013 2014 2015 2016 2017 2018 thru Q2 $5.7 million $26.5 million $41.8 million $22.2 million $38.3 million $23.5 million 90K lbs sold at $62.92/lb 518K lbs sold at $51.22/lb 925K lbs sold at $45.20/lb (LC: 725K Purchases: 200K) 562K lbs sold at $39.49/lb 780K lbs sold at $49.09/lb (LC: 261K Purchases: 519K) 480K lbs sold at $48.86/lb (LC: 10K Purchases: 470K) Uranium Revenues From Sales *Per Pound Sold, excludes severance and ad valorem taxes and non - cash costs See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE 10 ▪ Staffing Levels ▪ Reduced manpower to operating staff only ▪ Retained key staff to facilitate ramp up when time is right ▪ Efficiencies ▪ Optimized Class V waste water recycling ▪ Installing / testing disposal well mods ▪ Modified production systems to enhance and stabilize flowrates - optimized recovery curves Inside Lost Creek MU2 Header House Maintaining Available Resources: Operational Leverage Ready to Ramp Up! See Disclaimer re Forward - looking Statements and Projections (slide 2)

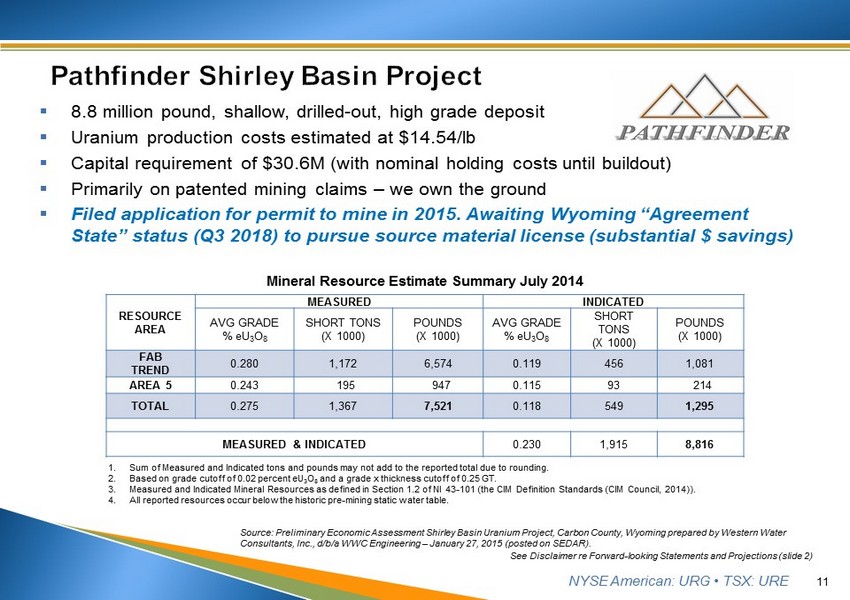

NYSE American: URG • TSX: URE ▪ 8.8 million pound, shallow, drilled - out, high grade deposit ▪ Uranium production costs estimated at $14.54/lb ▪ Capital requirement of $30.6M (with nominal holding costs until buildout) ▪ Primarily on patented mining claims – we own the ground ▪ Filed application for permit to mine in 2015. Awaiting Wyoming “Agreement State” status (Q3 2018) to pursue source material license (substantial $ savings) 11 See Disclaimer re Forward - looking Statements and Projections (slide 2) 1. Sum of Measured and Indicated tons and pounds may not add to the reported total due to rounding. 2. Based on grade cutoff of 0.02 percent eU 3 O 8 and a grade x thickness cutoff of 0.25 GT. 3. Measured and Indicated Mineral Resources as defined in Section 1.2 of NI 43 - 101 (the CIM Definition Standards (CIM Council, 2014 )). 4. All reported resources occur below the historic pre - mining static water table. RESOURCE AREA MEASURED INDICATED AVG GRADE % eU 3 O 8 SHORT TONS (X 1000) POUNDS (X 1000) AVG GRADE % eU 3 O 8 SHORT TONS (X 1000) POUNDS (X 1000) FAB TREND 0.280 1,172 6,574 0.119 456 1,081 AREA 5 0.243 195 947 0.115 93 214 TOTAL 0.275 1,367 7,521 0.118 549 1,295 MEASURED & INDICATED 0.230 1,915 8,816 Mineral Resource Estimate Summary July 2014 Source: Preliminary Economic Assessment Shirley Basin Uranium Project, Carbon County, Wyoming prepared by Western Water Consultants, Inc., d/b/a WWC Engineering – January 27, 2015 (posted on SEDAR).

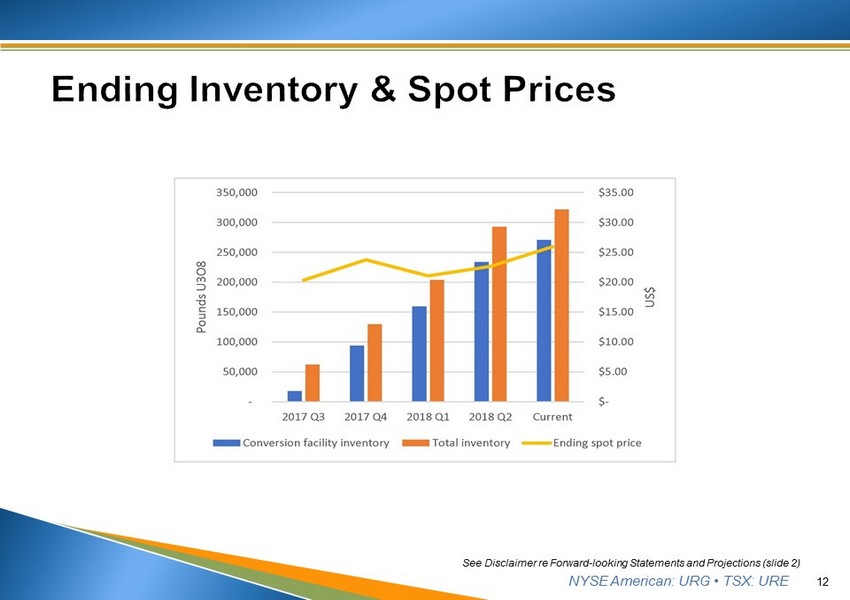

NYSE American: URG • TSX: URE 12 See Disclaimer re Forward - looking Statements and Projections (slide 2)

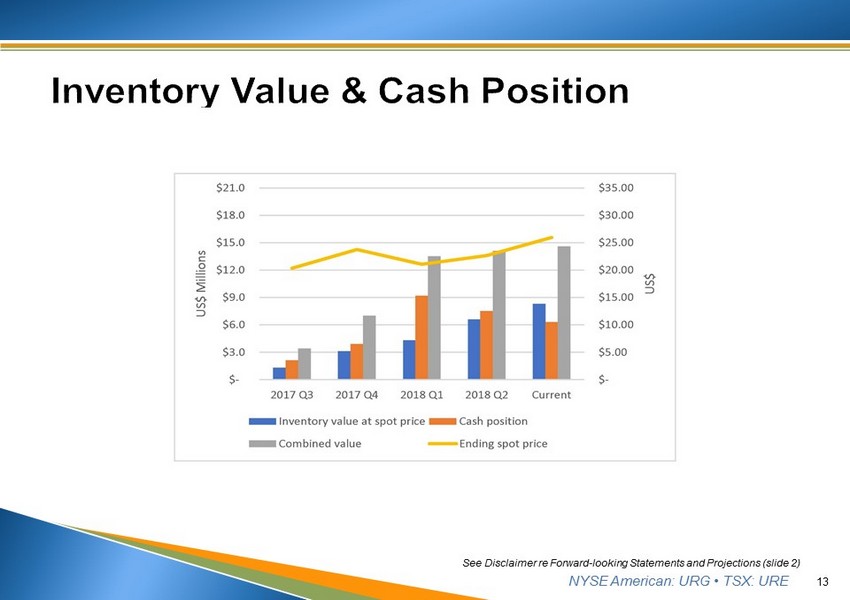

NYSE American: URG • TSX: URE 13 See Disclaimer re Forward - looking Statements and Projections (slide 2)

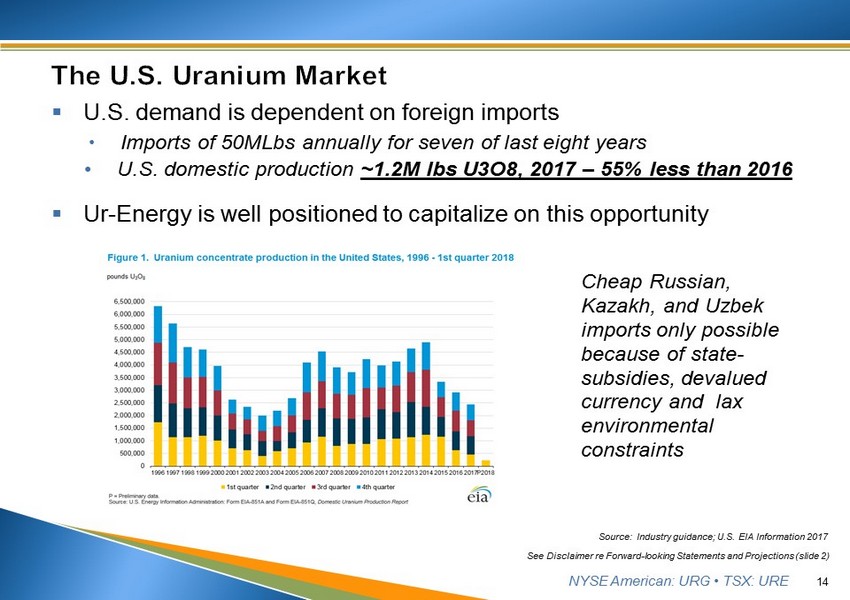

NYSE American: URG • TSX: URE ▪ U.S. demand is dependent on foreign imports Imports of 50MLbs annually for seven of last eight years • U.S. domestic production ~1.2M lbs U3O8, 2017 – 55% less than 2016 ▪ Ur - Energy is well positioned to capitalize on this opportunity 14 See Disclaimer re Forward - looking Statements and Projections (slide 2) Source: Industry guidance; U.S. EIA Information 2017 Cheap Russian, Kazakh, and Uzbek imports only possible because of state - subsidies, devalued currency and lax environmental constraints

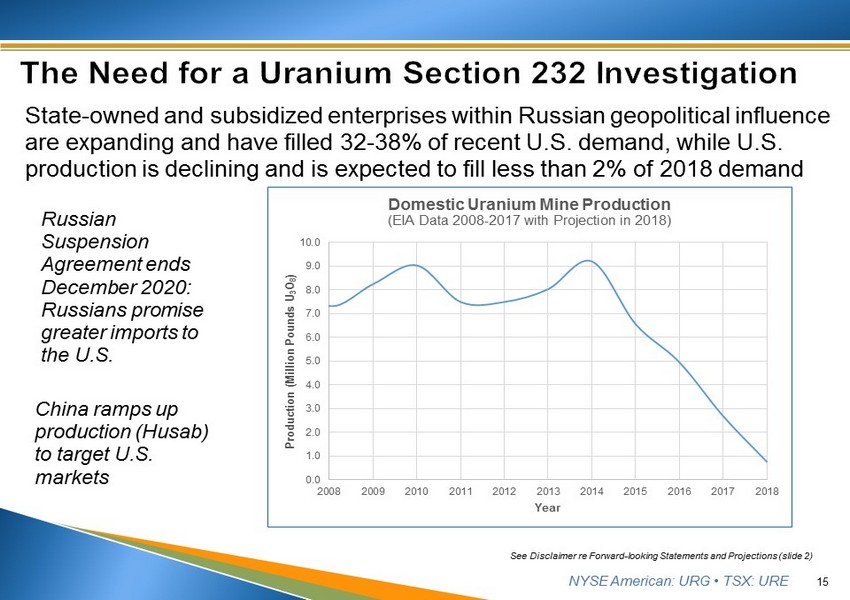

NYSE American: URG • TSX: URE State - owned and subsidized enterprises within Russian geopolitical influence are expanding and have filled 32 - 38% of recent U.S. demand, while U.S. production is declining and is expected to fill less than 2% of 2018 demand 15 Russian Suspension Agreement ends December 2020: Russians promise greater imports to the U.S. China ramps up production (Husab) to target U.S. markets 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Production (Million Pounds U 3 O 8 ) Year Domestic Uranium Mine Production (EIA Data 2008 - 2017 with Projection in 2018) See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Military needs, by treaty, must be filled with domestic supply yet our inventory is, in the words of DOE, “finite and diminishing . ” x Tritium x Naval Propulsion x Weapons x Priority Missions ▪ National economic security is also an integral part of the statute . U . S . nuclear utilities produce 20 % of our nation’s electricity and get upwards of 40 % of their fuel from Russia and its allies . We expect that percentage to increase as Canadian inventories fall . ▪ We are losing our seat at the non - proliferation table. 16 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE 17 Source: WNA, “Plans For New Nuclear Reactors Worldwide,” updated July 2018

NYSE American: URG • TSX: URE ▪ The Petition was filed by Ur - Energy USA Inc. and Energy Fuels Resources (USA) Inc. and covers uranium mining only ▪ The 700+ page exhaustive Petition discusses x the decline of the domestic uranium mining industry, x the cause of the decline, x the nexus to national security, and x remedies and economic impact of the remedies ▪ Two proposed remedies: x Buy American x Quota reserving 25% of U.S. market to domestic producers ▪ Petition does not seek tariffs, as that could be counter - productive 18 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Petition filed January 16, 2018 ▪ Commerce initiated the investigation on July 18, 2018 ▪ Public comment period ends September 10, 2018 ▪ Comments can be submitted to uranium232@bis.doc.gov ▪ Commerce must complete its investigation within 270 days and make recommendations to the President ▪ The President then has up to 90 days to accept Commerce’s recommendations or substitute his own judgment ▪ The process will be complete no later than July 15, 2019 ▪ Remedies would likely take effect immediately, per statute 19 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Very few remaining uranium companies (~40 worldwide / down from 585 in 2007) ▪ Even fewer who are producers or reasonably can be expected to be near - term producers ▪ Renewed emphasis on production and operational leverage ▪ Market conditions beginning to resemble 2004 - 2007 era market surge 20 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Supply / Demand: Growth Rate is Real • > 1Billion pound uncontracted requirement in next decade • New players entering uranium market • Real production cuts needed from Kazakhstan - plus Cameco’s announcements ▪ Current Market Forces • Kazatomprom’s planned IPO – 2018 H2 • Section 232 trade action creates potential for increased market for U.S. producers ▪ Geopolitical Risks • U.S. facing conflicts and uncertainty in multiple regions around the globe • Heavy dependence upon low - cost imports from Russia, Kazakhstan, and Uzbekistan increases potential for significant supply disruption 21 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE Q&A Session Your questions, please 22

NYSE American: URG • TSX: URE For more information, please contact: Jeff Klenda , Chairman, President & CEO By Mail: Ur - Energy Inc. 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com 23