Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - Novelis Inc. | novelisq1fy19results.htm |

| 8-K - 8-K EARNINGS - Novelis Inc. | nvl-form8xkq1fy19.htm |

Exhibit 99.2 NOVELIS Q1 FISCAL 2019 EARNINGS CONFERENCE CALL August 7, 2018 Steve Fisher President and Chief Executive Officer Devinder Ahuja Senior Vice President and Chief Financial Officer © 2018 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward-looking statements in this presentation including statements that end market demand remains strong. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our customers operate; changes in government regulations, particularly those affecting taxes, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; the effect of taxes and changes in tax rates; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended March 31, 2018. © 2018 Novelis 2

HIGHLIGHTS Adjusted EBITDA/ton ($) . Excellent operational 425 417 performance in favorable 400 market conditions 375 368 . Optimizing global rolling, 350 automotive and recycling 325 capacity . Executing on our strategy . Defend our core businesses . Strengthen our product portfolio . Invest in growth opportunities Strategy and operational focus delivering results © 2018 Novelis 3

MACRO/MARKET HEADLINES . Geo-political and trade uncertainty . One-time Q1FY19 events; expect little to no full year impact . National truckers strike in Brazil . North American auto customer unplanned downtime . End market demand outlook remains strong in near and long term © 2018 Novelis 4

FINANCIAL HIGHLIGHTS © 2018 Novelis

Q1 FISCAL 2019 FINANCIAL HIGHLIGHTS Q1FY19 vs Q1FY18 Shipments & Adjusted EBITDA . Net income of $137 million up from Adjusted $400 Shipments 800 $101 million in prior year EBITDA Shipments (kt) $375 790 . Favorable metal price lag $33 $350 $332 780 million $325 770 . Excluding tax-effected special $300 $289 $275 760 items*, net income up 10% from ($M) EBITDA Adjusted $250 750 $103 million to $113 million Q1FY18 Q1FY19 Net Leverage ratio . Adjusted EBITDA up 15% from $289 Net debt/TTM Adjusted EBITDA million to $332 million 6.0 . Sales up 16% to $3.1 billion 5.5 5.0 . Total FRP Shipments up 2% to 797 4.5 4.0 kilotonnes 3.5 2.9 3.0 . Strong liquidity position at $1.9 billion 2.5 . Net leverage ratio at 2.9x © 2018 Novelis 6 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business

Q1 ADJUSTED EBITDA BRIDGE $ Millions . Operating efficiencies and higher recycling benefits 6 . Strong demand worldwide including economic recovery 48 in Brazil 332 (17) 15 289 (9) . Lower-priced can contracts mitigated by product mix Q1FY18 Volume Price/Mix Operating Cost FX SG&A and Other Q1FY19 Realizing benefits from investments and efficiencies © 2018 Novelis 7

FREE CASH FLOW $ Millions Q1 Q1 . $73 million improvement in FY19 FY18 free cash flow YoY Adjusted EBITDA 332 289 . Maintain FY19 capex Capital expenditures (54) (39) guidance ~$450 million Interest paid (65) (81) Taxes paid (41) (27) . S&P Rating agency Working capital & other (176) (219) upgrade to BB- Free cash flow* (4) (77) * Free cash flow excludes the gain from Ulsan Aluminum JV transaction; see definition of Free Cash Flow in Appendix Maintaining financial discipline while investing in the future © 2018 Novelis 8

SUMMARY © 2018 Novelis

SUMMARY . Strong operating performance continues . Navigating through geo-political and trade uncertainty . Demand for aluminum flat rolled products remains high . Making disciplined strategic investments to diversify our product portfolio and strengthen our business © 2018 Novelis 10

THANK YOU AND QUESTIONS THANK YOU QUESTIONS? © 2018 Novelis

APPENDIX © 2018 Novelis

NET INCOME RECONCILIATION TO ADJUSTED EBITDA Q1 (in $ m) Q1 Q2 Q3 Q4 FY18 FY19 Net income attributable to our common shareholder 101 307 121 106 635 137 - Noncontrolling interests - - (16) 3 (13) - - Income tax provision 43 116 20 54 233 53 - Interest, net 62 62 62 60 246 63 - Depreciation and amortization 90 91 86 87 354 86 EBITDA 296 576 273 310 1,455 339 - Unrealized (gain) loss on derivatives (16) 18 (15) (7) (20) 4 - Realized (gain) loss on derivative instruments not included in segment income (1) - 1 - - - - Proportional consolidation 8 8 17 18 51 16 - Loss on sale of fixed assets 112373 - Restructuring and impairment, net 17251341 - Metal price lag 1 5 (1) (9) (4) (33) - Gain on sale of business - (318) - - (318) - - Other, net (1) 5 3 3 10 2 Adjusted EBITDA $289 $302 $305 $319 $1,215 $332 © 2018 Novelis 13

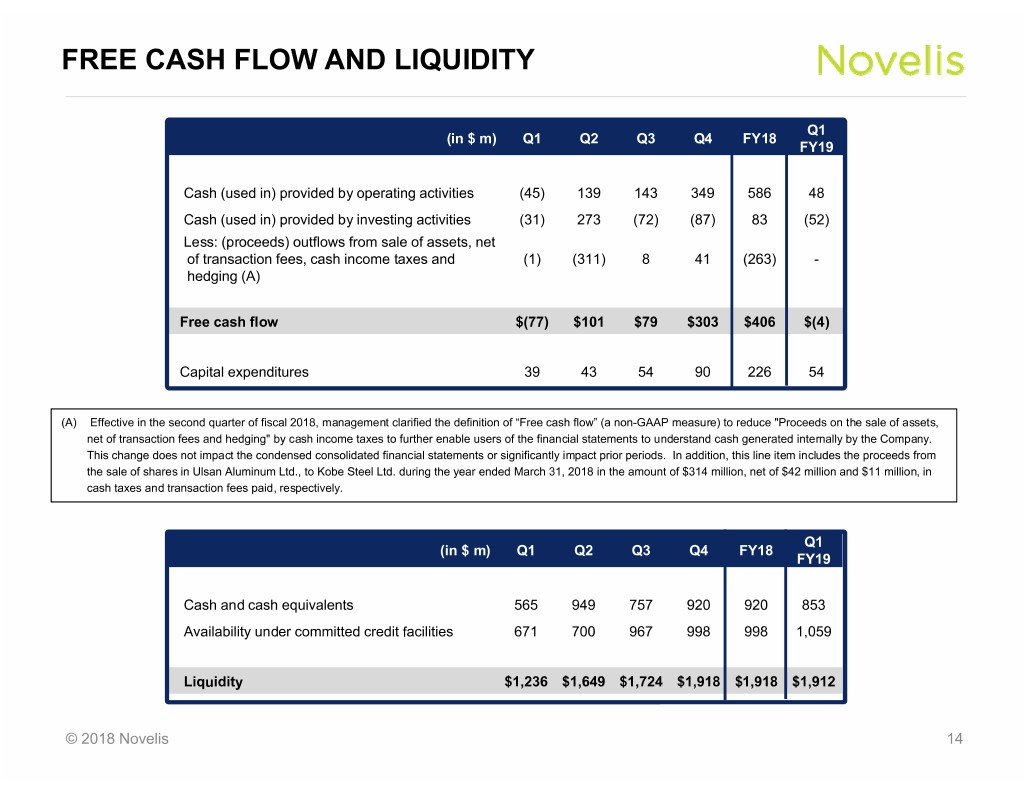

FREE CASH FLOW AND LIQUIDITY Q1 (in $ m) Q1 Q2 Q3 Q4 FY18 FY19 Cash (used in) provided by operating activities (45) 139 143 349 586 48 Cash (used in) provided by investing activities (31) 273 (72) (87) 83 (52) Less: (proceeds) outflows from sale of assets, net of transaction fees, cash income taxes and (1) (311) 8 41 (263) - hedging (A) Free cash flow $(77) $101 $79 $303 $406 $(4) Capital expenditures 39 43 54 90 226 54 (A) Effective in the second quarter of fiscal 2018, management clarified the definition of “Free cash flow” (a non-GAAP measure) to reduce "Proceeds on the sale of assets, net of transaction fees and hedging" by cash income taxes to further enable users of the financial statements to understand cash generated internally by the Company. This change does not impact the condensed consolidated financial statements or significantly impact prior periods. In addition, this line item includes the proceeds from the sale of shares in Ulsan Aluminum Ltd., to Kobe Steel Ltd. during the year ended March 31, 2018 in the amount of $314 million, net of $42 million and $11 million, in cash taxes and transaction fees paid, respectively. Q1 (in $ m) Q1 Q2 Q3 Q4 FY18 FY19 Cash and cash equivalents 565 949 757 920 920 853 Availability under committed credit facilities 671 700 967 998 998 1,059 Liquidity $1,236 $1,649 $1,724 $1,918 $1,918 $1,912 © 2018 Novelis 14