Attached files

Federal Signal Q2 2018 Earnings Call August 7, 2018 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer

Safe Harbor This presentation contains unaudited financial information and various forward-looking statements as of the date hereof and we undertake no obligation to update these forward- looking statements regardless of new developments or otherwise. Statements in this presentation that are not historical are forward-looking statements. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include but are not limited to: economic conditions in various regions, product and price competition, supplier and raw material prices, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described in filings with the Securities and Exchange Commission. This presentation also contains references to certain non-GAAP financial information. Such items are reconciled herein and in our earnings news release provided as of the date of this presentation. 2

Q2 Highlights * • Net sales of $291 M, up $67 M, or 30% • Organic sales growth of $27 M, or 13% • Operating income of $38.1 M, up $19.3 M, or 103% • Adjusted EBITDA of $47.8 M, up $18.8 M, or 65% • Adjusted EBITDA margin of 16.4%, exceeding target range, up from 12.9% • GAAP EPS of $0.44, up $0.25, or 132% • Adjusted EPS of $0.45, up $0.22, or 96% • Orders of $278 M, up $7 M, or 2% • Backlog of $322 M, up $100 M, or 45% * Comparisons versus Q2 of 2017, unless otherwise noted 3

Income from Continuing Operations $ millions, except % and per share Q2 2018 Q2 2017 $ Change % Change Net sales 291.0 224.4 66.6 30% Gross profit 79.2 54.7 24.5 45% SEG&A expenses 40.7 34.8 5.9 17% Acquisition and integration related expenses 0.4 1.0 (0.6) -60% Restructuring - 0.1 (0.1) -100% Operating income 38.1 18.8 19.3 103% Interest expense 2.5 1.3 1.2 92% Other (income) expense, net 0.4 (0.1) 0.5 NM Income tax expense 8.3 6.1 2.2 36% Income from continuing operations 26.9 11.5 15.4 134% Diluted earnings per share from continuing operations $ 0.44 $ 0.19 $0.25 132% Diluted adjusted earnings per share from continuing operations $ 0.45 $ 0.23 $0.22 96% Gross Margin 27.2% 24.4% SEG&A expenses as a % of net sales 14.0% 15.5% Effective tax rate 23.6% 34.7% 4

Adjusted Earnings per Share ($ in millions) Three Months Ended June 30, Six Months Ended June 30, 2018 2017 2018 2017 Income from continuing operations $ 26.9 $ 11.5 $ 39.8 $ 18.7 Add: Income tax expense 8.3 6.1 12.4 9.9 Income before income taxes 35.2 17.6 52.2 28.6 Add: Restructuring - 0.1 - 0.4 Executive severance costs - - - 0.7 Acquisition and integration-related expenses 0.4 1.0 0.9 1.5 Purchase accounting effects (1) 0.4 2.5 1.0 3.0 Hearing loss settlement charges - - 0.4 - Adjusted income before income taxes 36.0 21.2 54.5 34.2 Adjusted income tax expense (2) (8.5) (7.4) (12.9) (11.9) Adjusted net income from continuing operations $ 27.5 $ 13.8 $ 41.6 $ 22.3 Diluted EPS from continuing operations $ 0.44 $ 0.19 $ 0.65 $ 0.31 Adjusted diluted EPS from continuing operations $ 0.45 $ 0.23 $ 0.68 $ 0.37 (1) Purchase accounting effects relate to adjustments to exclude the step-up in the valuation of equipment acquired in connection with the TBEI and JJE acquisitions that was sold subsequent to the acquisition dates in the three and six months ended June 30, 2018 and 2017, as well as to exclude the depreciation of the step-up in the valuation of the rental fleet acquired in the JJE transaction. (2) Adjusted income tax expense for the three and six months ended June 30, 2018 and 2017 was recomputed after excluding the impact of restructuring activity, executive severance costs, acquisition and integration-related expenses, purchase accounting effects and hearing loss settlement charges, where applicable. 5

Group and Corporate Results $ millions, except % Q2 2018 Q2 2017 % Change ESG Orders 217.3 214.7 1% Sales 233.3 174.3 34% Operating income 37.2 21.0 77% Operating margin 15.9% 12.0% Adjusted EBITDA 45.8 29.3 56% Adjusted EBITDA margin 19.6% 16.8% SSG Orders 60.3 56.4 7% Sales 57.7 50.1 15% Operating income 8.2 5.6 46% Operating margin 14.2% 11.2% Adjusted EBITDA 9.2 6.7 37% Adjusted EBITDA margin 15.9% 13.4% Corporate expenses 7.3 7.8 -6% Consolidated Orders 277.6 271.1 2% Sales 291.0 224.4 30% Operating income 38.1 18.8 103% Operating margin 13.1% 8.4% Adjusted EBITDA 47.8 29.0 65% Adjusted EBITDA margin 16.4% 12.9% 6

Financial Strength and Flexibility * • Generated ~$28 M of cash from operations in Q2, compared to ~$32 M in prior year • YTD capital expenditures of $7.0 M, up from $2.7 M • Paid down ~$18 M of debt in Q2 • $248 M of debt outstanding; $36 M of cash . Net debt of $212 M ** • ~$140 M of availability under credit facility • Paid $4.8 M for dividends in Q2, reflecting increased dividend of $0.08 per share . Recently declared similar dividend for Q3 • $31 M remaining on share repurchase authorization (~ 2% of market capitalization) * Dollar amounts as of, or for the quarter ending 6/30/2018 ** Net debt is a non-GAAP measure and is computed as total debt of $248 M, less total cash and cash equivalents of $36 M 7

CEO Remarks • Exceptional Q2, with outstanding results in each of our groups . TTM revenues exceeded $1 billion, achieving our 2020 goal ~18 months early • SSG starting to see benefits of investments in sales and engineering resources made in prior quarters . New product introductions in the U.S. and Europe contributed to 11% organic growth in first half of 2018 • ESG continues to gain traction on its strategic initiatives . Gaining momentum penetrating new markets with our safe digging equipment . Solid aftermarket revenue growth, associated with our non-whole goods initiative . Rental fleet utilization exceeding expectations • ESG’s 19.6% adjusted EBITDA margin for Q2 exceeded target range . Exceptional margin performance driven by improved sales volumes, favorable mix, production efficiencies and operating leverage . Also includes price/cost benefits from actions taken in response to anticipated increases in commodity costs • Expecting year-over-year margin improvement in 2H 2018, despite headwinds associated with higher material costs 8

Market Conditions • Demand in most end markets continues to be strong • 3% organic order growth, despite pull forward of orders reported in prior two quarters • Taking actions in response to extended lead times for certain products . Adding labor, investing in machinery and equipment and shifting production of low volume units to other locations to free up capacity . ~$40 M of our current backlog not expected to ship until 2019 • While no significant delays identified to date, we continue to monitor chassis availability . Availability within the supply chain is tightening with extended lead times, but teams are planning ahead . In situations where we provide the chassis, believe we have adequate supply to meet our production needs in 2018 • Have also elected to pre-buy certain chassis for strategic reasons . With the TBEI business, we almost never own the chassis, and are more reliant upon customer-supplied chassis 9

Growth Initiatives • Internal initiative to use a portion of the savings from tax reform to accelerate longer-term growth kicked off in April • ~$61 M of debt paid down in a little over a year since the TBEI acquisition . Although we had expected to generate strong cash flow to allow us to de-lever quickly, the pace of de-levering is ahead of our expectations • Debt leverage ratio is down to a level that puts us in a solid position with significant flexibility to fund organic growth initiatives and M&A • M&A pipeline continues to be active 10

Application of “ETI” to Acquisitions • Targeting companies that are operating within our stated EBITDA ranges, or those which have the ability to operate within the ranges, after the application of our ETI principles • Since we completed the JJE acquisition a little over 2 years ago, we have focused on multiple projects to improve the profitability of their business model • The focus of these projects has ranged from: . Optimizing pricing for product lines that are not manufactured by us; . Discontinuing low-margin product lines; . Modifying the terms of transactions; and . Targeting growth of higher margin offerings, including sales into industrial markets, rentals and parts • As a result of these actions, in Q2 JJE was able to deliver its highest quarterly EBITDA margin since we completed the acquisition 11

Raising 2018 Outlook Raising adjusted EPS* outlook range to a new range of $1.26 to $1.32, from a range of $1.15 to $1.22 Represents increase of 48% - 55% over 2017 Key Assumptions . Adjustments to include items related to . Interest expense of ~4% acquisitions . Additional operating expenses to . Depreciation and amortization expense accelerate longer-term growth to increase by ~$8 M to $10 M initiatives are expected to reduce EPS by • Reflects full year of TBEI and additional up to $0.03 investment in rental fleet . Effective income tax rate of ~25% . Increase in capital expenditures of • Based on preliminary assessment of impact between $7 M - $12 M vs. 2017 levels of tax reform * Adjusted EPS is a non-GAAP measure, which includes certain adjustments to reported GAAP net income and diluted EPS. Our outlook assumes certain adjustments to exclude the impact of acquisition and integration-related expenses, purchase accounting effects and hearing loss settlement charges, where applicable. In 2017, we also made adjustments to exclude the impact of restructuring activity, executive severance costs, pension settlement charges, and special tax items, where applicable. Should any similar items occur during 2018, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B). 12

Federal Signal Q2 2018 Earnings Call Q&A August 7, 2018 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer 13

Investor Information Stock Ticker - NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 INVESTOR RELATIONS CONTACTS 630-954-2000 Ian Hudson Svetlana Vinokur SVP, Chief Financial Officer VP, Treasurer and Corporate Development IHudson@federalsignal.com SVinokur@federalsignal.com 14

Federal Signal Q2 2018 Earnings Call Appendix 15

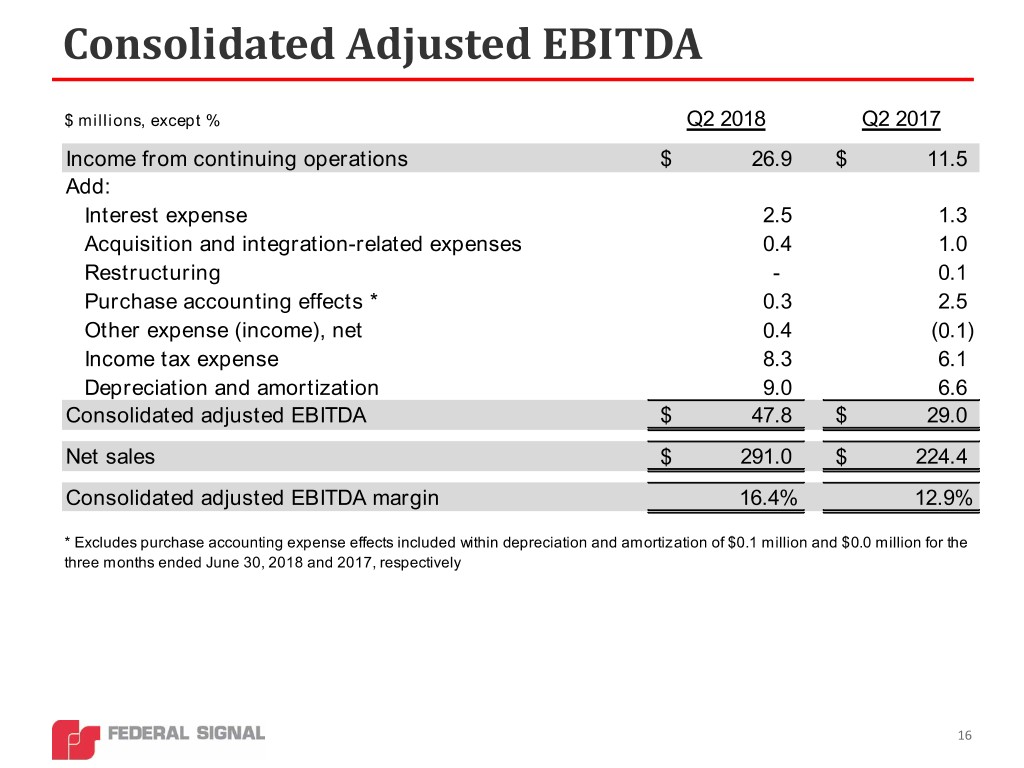

Consolidated Adjusted EBITDA $ millions, except % Q2 2018 Q2 2017 Income from continuing operations $ 26.9 $ 11.5 Add: Interest expense 2.5 1.3 Acquisition and integration-related expenses 0.4 1.0 Restructuring - 0.1 Purchase accounting effects * 0.3 2.5 Other expense (income), net 0.4 (0.1) Income tax expense 8.3 6.1 Depreciation and amortization 9.0 6.6 Consolidated adjusted EBITDA $ 47.8 $ 29.0 Net sales $ 291.0 $ 224.4 Consolidated adjusted EBITDA margin 16.4% 12.9% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.1 million and $0.0 million for the three months ended June 30, 2018 and 2017, respectively 16

Segment Adjusted EBITDA ESG $ millions, except % Q2 2018 Q2 2017 Operating Income $ 37.2 $ 21.0 Add: Acquisition and integration-related expenses 0.3 0.2 Purchase accounting effects * 0.3 2.5 Depreciation and amortization 8.0 5.6 Adjusted EBITDA $ 45.8 $ 29.3 Net sales $ 233.3 $ 174.3 Adjusted EBITDA margin 19.6% 16.8% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.1 million and $0.0 million for the three months ended June 30, 2018 and 2017, respectively SSG $ millions, except % Q2 2018 Q2 2017 Operating Income $ 8.2 $ 5.6 Add: Restructuring - 0.1 Depreciation and amortization 1.0 1.0 Adjusted EBITDA $ 9.2 $ 6.7 Net sales $ 57.7 $ 50.1 Adjusted EBITDA margin 15.9% 13.4% 17

Non-GAAP Measures • Adjusted net income and earnings per share (“EPS”) - The Company believes that modifying its 2018 and 2017 net income and diluted EPS provides additional measures which are representative of the Company’s underlying performance and improves the comparability of results across reporting periods. During the three and six months ended June 30, 2018 and 2017 adjustments were made to reported GAAP net income and diluted EPS to exclude the impact of restructuring activity, executive severance costs, acquisition and integration-related expenses, purchase accounting effects and hearing loss settlement charges, where applicable. • Adjusted EBITDA and adjusted EBITDA margin - The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales (“adjusted EBITDA margin”), at both the consolidated and segment level, as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin, at both the consolidated and segment level, are meaningful metrics to investors in evaluating the Company’s underlying financial performance. • Consolidated adjusted EBITDA is a non-GAAP measure that represents the total of income from continuing operations, interest expense, hearing loss settlement charges, acquisition and integration-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of income from continuing operations, interest expense, hearing loss settlement charges, acquisition and integration-related expenses, restructuring activity, executive severance costs, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense divided by net sales for the applicable period(s). • Segment adjusted EBITDA is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, restructuring activity, purchase accounting effects and depreciation and amortization expense, as applicable. Segment adjusted EBITDA margin is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, restructuring activity, purchase accounting effects and depreciation and amortization expense, as applicable, divided by net sales for the applicable period(s). Segment operating income includes all revenues, costs and expenses directly related to the segment involved. In determining segment income, neither corporate nor interest expenses are included. Segment depreciation and amortization expense relates to those assets, both tangible and intangible, that are utilized by the respective segment. 18