Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Western Asset Mortgage Capital Corp | wmcq2fy188-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Western Asset Mortgage Capital Corp | wmcq2fy18ex991.htm |

Second Quarter 2018 Investor Presentation August 6, 2018

Safe Harbor Statement We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward- looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate-related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and market trends in our industry, interest rates, real estate values, the debt securities markets or the general economy. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. 1

Second Quarter 2018 WMC Earnings Call Presenters Jennifer W. Murphy Lisa Meyer Anup Agarwal Chief Executive Officer & Chief Financial Officer & Chief Investment Officer President Treasurer 2

Overview of Western Asset Mortgage Capital Corporation Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company LLC One of the largest U.S. fixed income asset managers with AUM of $420 billion(1) • Structured Product AUM of $74.4 billion, of which $36.7 billion is invested in Agency RMBS and $37.7 billion in Non-Agency RMBS, CMBS, and ABS(1) Senior investment team members have worked together for approximately 12 years Extensive mortgage investing track record Publicly traded diversified mortgage REIT positioned to capture attractive current and long-term investment opportunities in the mortgage market Completed Initial Public Offering in May 2012 3 Please refer to page 15 for footnote disclosures.

Corporate Overview ▪ WMC is a diversified mortgage finance REIT supported by the deep investment experience of the mortgage and asset-backed investment and risk management teams of Western Asset Management Company LLC ("Western Asset"), a leading global fixed income manager. ▪ Western Asset's depth and breadth of fixed income expertise, comprehensive platform, and global institutional relationships provide WMC key advantages: * Best-in-class portfolio and risk management capabilities; * Access to investment opportunities and financing relationships and terms reflective of Western Asset's global platform with over $400 billion AUM; * Operational excellence and efficiencies; and * Highest standards of financial reporting, disclosure and transparency. ▪ WMC has built a diversified portfolio of residential and commercial assets including MBS and whole loans with the objective of generating strong total returns while preserving book value. ▪ WMC has paid a consistent dividend for 9 quarters, reflecting a philosophy of delivering a sustainable dividend that is supported by the core earnings of our portfolio. 4

Second Quarter Financial Highlights ▪ June 30, 2018 book value per share of $11.10, net of second quarter common dividend of $0.31 declared on June 21, 2018. ▪ GAAP net income of $1.5 million, or $0.03 per basic and diluted common share. ▪ Core earnings plus drop income of $15.2 million(4), or $0.36 per basic and diluted common share. ▪ Economic return on book value was 0.4%(3) for the quarter. ▪ 2.05%(6) annualized net interest margin on our investment portfolio. ▪ 7.3x leverage excluding securitized debt as of June 30, 2018 (10.0x leverage with securitized debt). ▪ Acquired $327.6 million in target assets, including 275.1 million of credit sensitive assets. * $52.5 million in Agency CMBS * $5.0 million in Non-Agency CMBS * $55.6 million in Residential Whole-Loans * $184.7 million in Residential Bridge Loans * $29.8 million Commercial Loan ▪ Repurchased 63,300 shares of common stock at an average price of $9.88 per share. 5 Please refer to page 17 for footnote disclosures.

Recent Performance (3) Book Value Economic Return 12.0 6.0 10.0 8.0 4.0 6.0 $10.88 $11.15 $11.37 $11.10 5.3% 5.2% 4.8% 4.0 2.0 2.0 0.4% 0.0 0.0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 (4) Dividend Per Share Core Earnings Plus Drop Income Per Share $0.35 $0.40 $0.30 $0.35 $0.30 $0.25 $0.25 $0.20 $0.20 $0.36 $0.15 $0.31 $0.31 $0.31 $0.31 $0.34 $0.15 $0.32 $0.31 $0.10 $0.10 $0.05 $0.05 $0.00 $0.00 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 6 Please refer to page 17 for footnote disclosures.

Portfolio Composition Agency RMBS Total Investment Portfolio ($ in millions) 2.0% Agency CMBS June 30, 2018 6.9% Non-Agency RMBS Agency RMBS $ 426 6.9% Agency CMBS 2,070 41.2% Non-Agency CMBS 2.0% Non-Agency RMBS 101 Residential Whole-Loans Non-Agency CMBS 331 4.9% GSE Credit Risk Transfer Securities 78 GSE Credit Risk Transfer Securities Residential Whole-Loans 335 Residential Bridge Loans(12) 259 Residential Bridge Loans (2) Securitized Commercial Loans 1,309 Securitized Commercial Commercial Loans 71 25.5% Loans 7.8% ABS 30 2.0% Commercial loans Total 5,010 1.0% Other Investments Select Sector Categories Agency RMBS Non-Agency RMBS, Whole-loans & Agency & Non-Agency CMBS, GSE CRT Securities Securitized Commercial Loans and Commercial Loans 39.9% 80.5% 16.6% 34.6% 54.7% 7.8% 15.2% 3.6% 4.9% 3.0% 28.3% 6.8% 2.1% 2.0% Agency CMBS Securitized Commercial Loans Non-Agency RMBS Residential Whole Loans Low-Loan Balance Modified (16) Lower Loan Balance(15) Legacy CMBS New-Issuance CMBS Residential Bridge Loans GSE CRT Securities MHA/HARP High LTV Other(14) CRE Mezz Commercial Loans Please refer to page 17 for footnote disclosures. 7

Portfolio Income Attribution(5) For the Three Months Ended June 30, 2018 (in thousands except per share data) Non- Non- Residential Residential Other Securitized Agency Agency Agency Agency Whole- Bride Investments Commercial Commercial CMBS RMBS CMBS RMBS Loans Loans(12) (10) Loans Loans(17) Total Interest Income $ 15,910 $ 4,265 7,679 $ 1,775 $ 3,703 $ 4,189 $ 2,234 $ 818 $ 2,237 $ 42,810 Interest expense(7) (10,561) (3,002) (2,519) (880) (2,949) (2,803) (805) (200) (73) (23,792) Net interest rate swap interest income(8) 767 198 46 30 — — 2 — 1,043 Net Interest Income 6,116 1,461 5,206 925 754 1,386 1,431 618 2,164 20,061 Realized gain/(loss) on investments (5,016) (4,531) (39) 2,221 — — 1,759 — — (5,606) Unrealized gain/ (loss) on investments (33,065) (577) 4,924 (1,205) (452) 92 (1,624) 375 (93) (31,625) Gain (loss) on derivative instruments, net(13) 20,032 5,168 1,202 793 — — 120 — — 27,315 OTTI(9) (74) (207) (2,753) (20) — — — — — (3,054) Portfolio Income (loss) $(12,007) $ 1,314 $ 8,540 $ 2,714 $ 302 $ 1,478 $ 1,686 $ 993 $ 2,071 $ 7,091 BV Per Share Increase (Decrease) $ (0.29) $ 0.03 $ 0.21 $ 0.07 $ 0.01 $ 0.04 $ 0.04 $ 0.02 $ 0.04 $ 0.17 per share Beginning book value $ 11.37 Portfolio Income(5) 0.17 Operating expenses and G&A (0.13) Dividends (0.31) Income tax benefit (provision) — Ending book value $ 11.10 8 Please refer to page 17 for footnote disclosures.

Adjusted* Portfolio Composition Agency RMBS Total Investment Portfolio ($ in millions) 2.0% Agency CMBS 6.9% June 30, 2018 Non-Agency RMBS Agency RMBS $ 426 6.9% Non-Agency CMBS Agency CMBS 2,070 41.2% 2.0% Non-Agency RMBS 101 Residential Whole-Loans 4.9% Non-Agency CMBS 409 GSE Credit Risk Transfer GSE Credit Risk Transfer Securities 78 Securities Residential Whole-Loans 335 Residential Bridge Loans Residential Bridge Loans(12) 259 Commercial Loans 71 Securitized Commercial 25.5% Loans ABS 30 7.8% Total 3,779 2.0% Commercial loans 1.0% Other Investments *Excludes consolidation of VIE Trusts required under GAAP Select Sector Categories Agency RMBS Non-Agency RMBS, Whole-loans & Agency & Non-Agency CMBS, GSE CRT Securities and Commercial Loans 39.9% 80.5% 16.6% 81.0% 7.8% 15.2% 4.9% 5.4% 6.8% 28.3% 2.9% 7.6% Non-Agency RMBS Residential Whole Loans 3.1% Low-Loan Balance Modified (16) Lower Loan Balance(15) Agency CMBS Legacy CMBS Residential Bridge Loans GSE CRT Securities MHA/HARP High LTV Other(14) New-Issuance CMBS CRE Mezz Please refer to page 17 for footnote disclosures. 9 Commercial Loans

Adjusted* Portfolio Income Attribution(5) For the Three Months Ended June 30, 2018 (in thousands except per share data) Non- Non- Residential Residential Other Agency Agency Agency Agency Whole- Bride Investments Commercial CMBS RMBS CMBS RMBS Loans Loans(12) (10) Loans Total Interest Income $ 15,910 $ 4,265 9,916 $ 1,775 $ 3,703 $ 4,189 $ 2,234 $ 818 $ 42,810 Interest expense(7) (10,561) (3,002) (2,592) (880) (2,949) (2,803) (805) (200) (23,792) Net interest rate swap interest income(8) 767 198 46 30 — — 2 — 1,043 Net Interest Income 6,116 1,461 7,370 925 754 1,386 1,431 618 20,061 Realized gain/(loss) on investments (5,016) (4,531) (39) 2,221 — — 1,759 — (5,606) Unrealized gain/ (loss) on investments (33,065) (577) 4,831 (1,205) (452) 92 (1,624) 375 (31,625) Gain (loss) on derivative instruments, net(13) 20,032 5,168 1,202 793 — — 120 — 27,315 OTTI(9) (74) (207) (2,753) (20) — — — — (3,054) Portfolio Income (loss) $(12,007) $ 1,314 $ 10,611 $ 2,714 $ 302 $ 1,478 $ 1,686 $ 993 $ 7,091 BV Per Share Increase (Decrease) $ (0.29) $ 0.03 $ 0.25 $ 0.07 $ 0.01 $ 0.04 $ 0.04 $ 0.02 $ 0.17 Beginning book value $ 11.37 Portfolio Income(5) 0.17 Operating expenses and G&A (0.13) Dividends (0.31) Income tax benefit (provision) — Ending book value $ 11.10 *Excludes consolidation of VIE trusts required under GAAP. 10 Please refer to page 17 for footnote disclosures.

Financing Summary ▪ Master repurchase agreements with 28 counterparties. ▪ Outstanding borrowings with 17 counterparties. ▪ Capacity in excess of our current needs. Portfolio Financing June 30, 2018 ($ in thousands) Weighted Average Weighted Average Outstanding Interest Rate Interest Remaining Days to Repurchase Agreements Amounts Rate Maturity Agency RMBS $ 404,498 2.18% 56 Agency CMBS 1,923,906 2.21% 93 Non-Agency RMBS 73,152 3.71% 34 Non-Agency CMBS 249,055 3.77% 52 Residential Whole-Loans 268,100 3.86% 27 Residential Bridge Loans 256,488 4.32% 62 Securitized Commercial Loan 7,620 3.94% 20 Commercial Loans 12,321 4.83% 74 Other Securities (10) 72,229 3.97% 29 Total/Wtd Avg $ 3,267,369 2.71% 74 11 Please refer to page 17 for footnote disclosures.

(11) Hedging Summary Fixed Pay Interest Rate Swaps ($ in millions – as of June 30, 2018) Avg. Fixed Pay Avg. Floating Average Maturity Maturity Notional Amount Rate Receive Rate (Years) Forward Starting Less than 1 Year $ 400.0 1.5% 2.3% 1.0 —% 1 Year to 3 Years 200.0 1.8% 2.4% 1.9 —% 3 Years to 5 Years 738.0 2.0% 2.4% 3.8 —% >5 Years 1,816.6 2.5% 2.4% 10.3 10.9% Total Fixed Pay Rate $ 3,154.6 2.2% 2.4% 7.1 6.3% Our interest rate swaps are comprised of: ▪ $3.0 billion notional value of pay-fixed interest rate swaps, and ▪ Forward starting swap of $0.2 billion (approximately 1.9 month forward), which has a maturity of August 29, 2028. 12 Please refer to page 17 for footnote disclosures.

Duration as of June 30, 2018 Agency Holdings Key Rate Duration Contribution Total 6-months 2-Year 5-Year 10-Year 20-Year 30-Year Agency RMBS 1.00 0.02 0.09 0.22 0.34 0.26 0.07 Agency CMBS 3.73 — 0.03 0.84 2.79 0.07 — Swaps and Futures (4.92) 0.11 (0.91) (0.39) (3.44) (0.29) — Total (0.19) 0.13 (0.79) 0.67 (0.31) 0.04 0.07 ▪ Net Duration of the Agency RMBS and Agency CMBS portfolio: (0.19) years. 13 Please refer to page 17 for footnote disclosures.

2018 Macroeconomic Outlook Base case is for steady economic growth, where spread sectors are likely to outperform. ▪ U.S. housing and commercial real estate markets continue to exhibit positive fundamentals and favorable outlook. ▪ Central banks are cautiously signaling their path to normalization. ▪ Core inflation is expected to modestly increase. ▪ We expect elevated volatility in the near-term due to U.S. policy uncertainties, including trade wars and global political developments. ▪ Global economies are expected to continue to experience improving growth from subdued levels. ▪ Spread sectors should outperform, but margins are thin for some sectors. 14

Portfolio View Credit sensitive mortgage sectors have performed relatively well and are expected to continue to offer attractive returns. We expect to increase our credit sensitive investments. ▪ Residential Whole-loans continue to perform in-line with our expectations. * We expect to continue to increase our holdings of residential whole and bridge loans as opportunities arise. ▪ Commercial loans continue to offer attractive risk-reward opportunities. ▪ Securitized prime jumbo mortgages offer attractive value as convexity is priced in. ▪ We remain constructive on Agency CMBS spreads and look to further reduce our exposure to Agency RMBS. 15

Target Investment Opportunities ▪ Strategic partnerships with seasoned originators. ▪ Short-term non owner occupied single or multi-unit residences. ▪ Attractive unlevered net yield of 7-8%. Residential Bridge Loans ▪ Average loan sizes approximately $250,000. ▪ Target loan to value of 85% based on "as is" appraised value. • Single asset single borrower commercial loans. ▪ Invest in deals where our manager has an opportunity to negotiate deal Commercial Real Estate structure and covenants. ▪ Attractive yields of Libor plus 600-900 bps. Loans ▪ Target floating rate assets and short term deals. ▪ Multifamily residential loans guaranteed by Fannie Mae and Freddie Mac. ▪ Outstanding balance of more than $400 billion with annual issuance in excess Agency CMBS of $40 billion. ▪ Prepayment protection in the form of defeasance, yield maintenance or points. ▪ Interest only securities receive the prepayment penalties. ▪ Principal bearing bonds have soft bullets and tight windows for principal payment. 16

Footnotes (1) As of June 30, 2018 (2) In March 2018, the Company acquired a $67.8 million Non-Agency CMBS security which resulted in the consolidation of a variable interest entity and the recording of a $1.4 billion securitized commercial loan and $1.3 billion of securitized debt. (3) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and dividing by the beginning book value. (4) Core earnings is a non-GAAP measures which includes the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives. Drop income is income derived from the use of ‘to-be-announced’ forward contract (“TBA”) dollar roll transactions which is a component of our gain (loss) on derivative instruments on our consolidated statement of operations, but is not included in core earnings. Drop income was approximately $281 thousand for the three months ended June 30, 2018. (5) Non-GAAP measure which includes net interest margin (as defined in footnote 6), realized and unrealized gains or losses in the portfolio and other than temporary impairment. (6) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for the quarter ended June 30, 2018. Also excludes the net income from the consolidation of VIE Trusts required under GAAP. (7) Convertible senior notes interest expense has been allocated based on deployment of proceeds from October 2017 through May 2018. (8) Net interest rate swaps interest income have been allocated based on average duration contribution. (9) Includes other than temporary impairment on IO's and IIO's accounted for as derivatives. (10) Other investments include ABS and GSE Credit Risk Transfer securities. (11) While we use hedging strategies as part of our overall portfolio management, these strategies are not designed to eliminate all risks in the portfolio. There can be no assurance as to the level or effectiveness of these strategies. (12) The bridge loans acquired prior to October 25, 2017 are carried at amortized costs, since we did not elect the fair value option for these loans. For the bridge loans acquired subsequent to October, 25, 2017, we elected the fair value option to be consistent with the accounting of other investments. Accordingly, the carrying amount of the bridge loans as of June 30, 2018 includes $236.4 million of residential bridge loans carried at fair value and $23.0 million of residential bridge loans carried at amortized costs. (13) Gain (loss) on derivative instruments, net (excluding cost of hedging) has been allocated based average duration contribution. (14) Other includes investor loans and low-FICO loans. (15) Lower loan balance pools generally consist of loans below $150,000. (16) Represents loans that have been modified to have 40-year maturities, with balance below $175,000. (17) The portfolio income attribution for securitized commercial loan is presented on an unconsolidated basis. 17

Supplemental Information

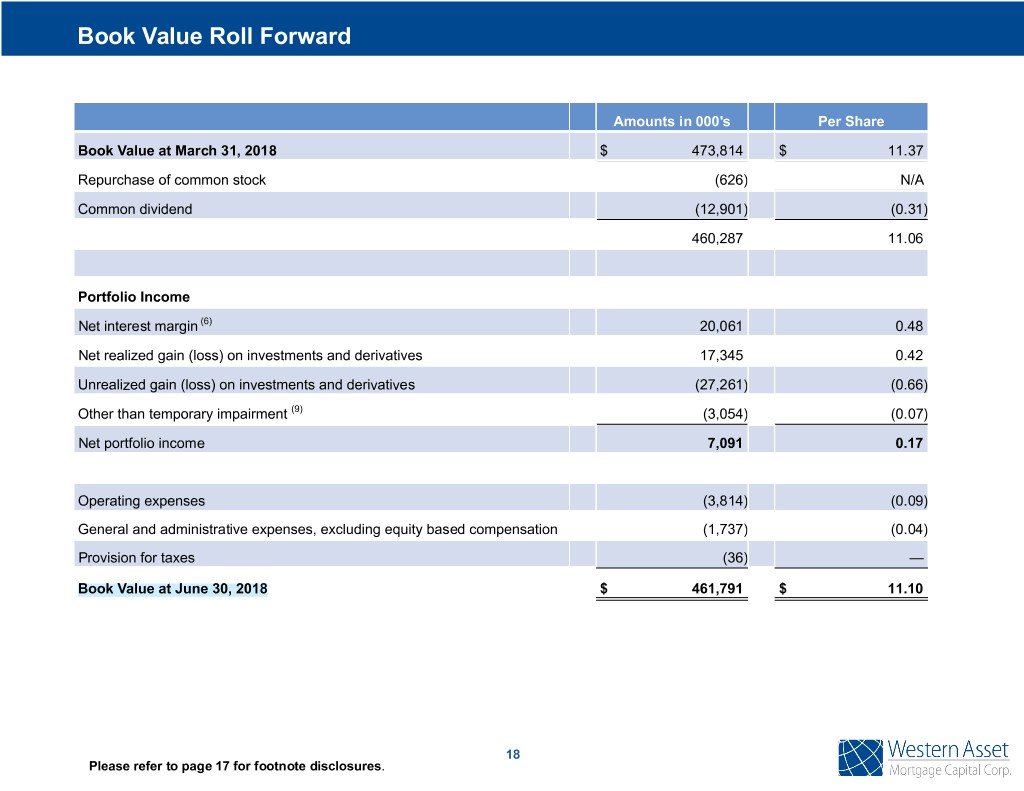

Book Value Roll Forward Amounts in 000's Per Share Book Value at March 31, 2018 $ 473,814 $ 11.37 Repurchase of common stock (626) N/A Common dividend (12,901) (0.31) 460,287 11.06 Portfolio Income Net interest margin (6) 20,061 0.48 Net realized gain (loss) on investments and derivatives 17,345 0.42 Unrealized gain (loss) on investments and derivatives (27,261) (0.66) Other than temporary impairment (9) (3,054) (0.07) Net portfolio income 7,091 0.17 Operating expenses (3,814) (0.09) General and administrative expenses, excluding equity based compensation (1,737) (0.04) Provision for taxes (36) — Book Value at June 30, 2018 $ 461,791 $ 11.10 18 Please refer to page 17 for footnote disclosures.

Portfolio Composition as of June 30, 2018 Agency Portfolio ($ in millions) Principal Amortized Costs Fair Value Net Weighted Net Weighted Balance Average Coupon Average Yield Agency CMBS $ 2,141.2 $ 2,144.5 $ 2,064.6 3.0% 3.0% Agency CMBS IOs and IIOs(1) N/A — 4.9 0.5% 4.2% Agency RMBS 20-Year, 30-Year and 40-Year 403.2 416.6 402.9 3.6% 3.1% Agency RMBS IOs and IIOs(1) N/A 13.5 22.8 2.5% 7.3% Total $ 2,544.3 $ 2,574.6 $ 2,495.2 2.9% 3.0% (1) Excludes amortized cost basis of $7.6MM and $5.1MM of Agency RMBS IOs and IIOs and Agency CMBS IOs and IIOs, respectively, that are accounted for as derivatives. Agency CMBS 82.8% Agency RMBS 30-Year mortgage 2.4% Agency RMBS 20-Year mortgage 13.7% Agency RMBS IO & IIO 0.9% Agency CMBS IO & IIO 0.2% 19

Portfolio Composition as of June 30, 2018 (Continued) Credit Sensitive Portfolio ($ in millions) Principal Balance Amortized Costs Fair Value Net Weighted Net Weighted Average Coupon Average Yield Non-Agency RMBS $ 115.8 $ 97.6 $ 101.2 1.0% 6.5% Non-Agency CMBS 421.6 337.9 331.4 5.2% 8.7% Residential Whole Loans 329.2 332.1 335.1 4.9% 5.1% Residential Bridge Loans 257.8 259.0 259.2 9.0% 8.4% Securitized Commercial Loans 1,295.9 1,298.3 1,309.2 5.0% 4.9% Commercial Loans 70.6 70.3 70.7 8.0% 7.4% Other Securities(1) 83.7 96.3 108.0 8.6% 9.5% $ 2,574.6 $ 2,491.5 $ 2,514.8 4.3% 6.1% (1) Other Securities includes GSE Credit Risk Transfer securities and ABS. Commercial Loan: 2.8% Other Securities: 4.3% Non-Agency RMBS: 4.0% Securitized Commercial Loans: Non-Agency CMBS: 13.2% 52.1% Residential Whole Loans: 13.3% Residential Bridge Loans: 10.3% 20

Portfolio Composition as of June 30, 2018 (Continued) Adjusted Credit Sensitive Portfolio * ($ in millions) Principal Balance Amortized Costs Fair Value Net Weighted Net Weighted Average Coupon Average Yield Non-Agency RMBS $ 115.8 $ 97.6 $ 101.2 1.0% 6.5% Non-Agency CMBS 499.3 415.6 409.3 6.1% 9.3% Residential Whole Loans 329.2 332.1 335.1 4.9% 5.1% Residential Bridge Loans 257.8 259.0 259.2 9.0% 8.4% Commercial Loans 70.6 70.3 70.7 8.0% 7.4% Other Securities(1) 83.7 96.3 108.0 8.6% 9.5% $ 1,356.4 $ 1,270.9 $ 1,283.5 4.2% 7.7% (1) Other Securities includes GSE Credit Risk Transfer securities and ABS. Commercial Loans: 5.5% Other Securities: 8.4% Residential Bridge Loans: 20.2% Non-Agency RMBS: 7.9% Residential Whole Loans: Non-Agency CMBS: 31.9% 26.1% *Excludes consolidation of VIE Trusts required under GAAP 21

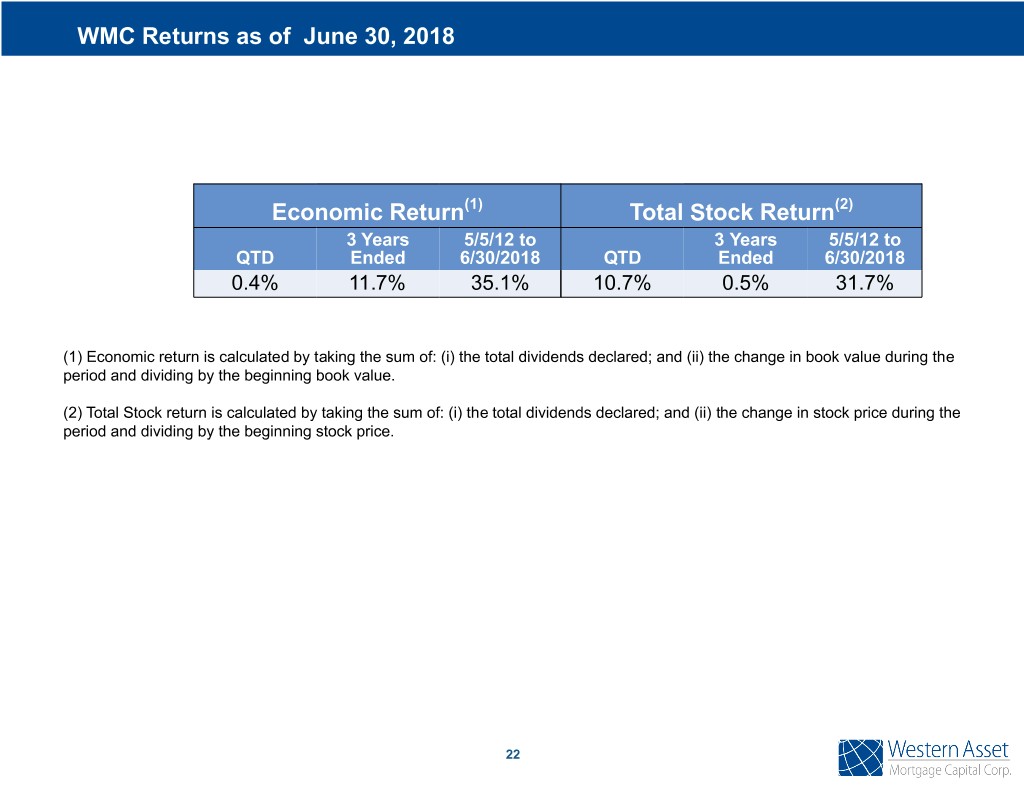

WMC Returns as of June 30, 2018 Economic Return(1) Total Stock Return(2) 3 Years 5/5/12 to 3 Years 5/5/12 to QTD Ended 6/30/2018 QTD Ended 6/30/2018 0.4% 11.7% 35.1% 10.7% 0.5% 31.7% (1) Economic return is calculated by taking the sum of: (i) the total dividends declared; and (ii) the change in book value during the period and dividing by the beginning book value. (2) Total Stock return is calculated by taking the sum of: (i) the total dividends declared; and (ii) the change in stock price during the period and dividing by the beginning stock price. 22

Contact Information Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com