Attached files

| file | filename |

|---|---|

| EX-99.6 - EX-99.6 - WELLCARE HEALTH PLANS, INC. | d564883dex996.htm |

| 8-K - FORM 8-K - WELLCARE HEALTH PLANS, INC. | d564883d8k.htm |

| EX-99.5 - EX-99.5 - WELLCARE HEALTH PLANS, INC. | d564883dex995.htm |

| EX-99.4 - EX-99.4 - WELLCARE HEALTH PLANS, INC. | d564883dex994.htm |

| EX-99.2 - EX-99.2 - WELLCARE HEALTH PLANS, INC. | d564883dex992.htm |

| EX-99.1 - EX-99.1 - WELLCARE HEALTH PLANS, INC. | d564883dex991.htm |

| EX-23.1 - EX-23.1 - WELLCARE HEALTH PLANS, INC. | d564883dex231.htm |

Exhibit 99.3 Investor Presentation WellCare Equity Offering for Meridian Transaction August 2018Exhibit 99.3 Investor Presentation WellCare Equity Offering for Meridian Transaction August 2018

Cautionary Statement This presentation contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as expects, anticipates, intends, plans, believes, estimates, will, and similar expressions are forward-looking statements. For example, statements regarding the company's financial outlook, and the timing, closing, manner of payment and financial impact of the pending transaction contain forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause WellCare Health Plans, Inc. (“WellCare”) actual future results to differ materially from those projected or contemplated in the forward-looking statements. These risks and uncertainties include, but are not limited to, the ability to complete the transaction in a timely manner or at all (which may adversely affect WellCare’s business and the price of the common stock of WellCare), the failure to satisfy the conditions to the consummation of the transaction (including the receipt of certain governmental and regulatory approvals), any requirements that may be imposed by governmental or regulatory authorities as a condition to approving the transaction, adjustments to the purchase price, the ability to achieve expected synergies within the expected time frames or at all, the ability to achieve accretion to WellCare’s earnings, revenues or other benefits expected, disruption to business relationships, operating results, and business generally of WellCare and/or Meridian and the ability to retain WellCare and Meridian employees, the availability of debt and equity financing, WellCare's progress on top priorities such as improving health care quality and access, ensuring a competitive cost position, and delivering prudent, profitable growth, WellCare's ability to effectively estimate and manage growth, WellCare's ability to effectively execute and integrate acquisitions, potential reductions in Medicaid and Medicare revenue, WellCare's ability to estimate and manage medical benefits expense effectively, including through its vendors, its ability to negotiate actuarially sound rates, especially in new programs with limited experience, the appropriation and payment by state governments of Medicaid premiums receivable, the outcome of any protests and litigation related to Medicaid awards, the approval of Medicaid contracts by CMS, any changes to the programs or contracts, WellCare's ability to address operational challenges related to new business, and WellCare's ability to meet the requirements of readiness reviews. Given the risks and uncertainties inherent in forward-looking statements, any of WellCare's forward-looking statements could be materially incorrect and investors are cautioned not to place undue reliance on any of our forward- looking statements. Additional information concerning these and other important risks and uncertainties can be found in the company's filings with the U.S. Securities and Exchange Commission, included under the captions Forward-Looking Statements and Risk Factors in the company's Annual Report on Form 10-K for the year ended December 31, 2017, and in the company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, which contain discussions of WellCare's business and the various factors that may affect it. Subsequent events and developments may cause actual results to differ, perhaps materially, from WellCare's forward- looking statements. WellCare's forward-looking statements speak only as of the date on which the statements are made. WellCare undertakes no duty, and expressly disclaims any obligation, to update these forward-looking statements to reflect any future events, developments or otherwise. Our 2018 estimated premium revenue metrics are as of July 31, 2018 and are not being updated in conjunction with this presentation. Please refer to the press release and presentation announcing the Meridian transaction dated May 29, 2018. The aforementioned press release is available on WellCare’s website via the following link: http://ir.wellcare.com/News/. 2Cautionary Statement This presentation contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as expects, anticipates, intends, plans, believes, estimates, will, and similar expressions are forward-looking statements. For example, statements regarding the company's financial outlook, and the timing, closing, manner of payment and financial impact of the pending transaction contain forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause WellCare Health Plans, Inc. (“WellCare”) actual future results to differ materially from those projected or contemplated in the forward-looking statements. These risks and uncertainties include, but are not limited to, the ability to complete the transaction in a timely manner or at all (which may adversely affect WellCare’s business and the price of the common stock of WellCare), the failure to satisfy the conditions to the consummation of the transaction (including the receipt of certain governmental and regulatory approvals), any requirements that may be imposed by governmental or regulatory authorities as a condition to approving the transaction, adjustments to the purchase price, the ability to achieve expected synergies within the expected time frames or at all, the ability to achieve accretion to WellCare’s earnings, revenues or other benefits expected, disruption to business relationships, operating results, and business generally of WellCare and/or Meridian and the ability to retain WellCare and Meridian employees, the availability of debt and equity financing, WellCare's progress on top priorities such as improving health care quality and access, ensuring a competitive cost position, and delivering prudent, profitable growth, WellCare's ability to effectively estimate and manage growth, WellCare's ability to effectively execute and integrate acquisitions, potential reductions in Medicaid and Medicare revenue, WellCare's ability to estimate and manage medical benefits expense effectively, including through its vendors, its ability to negotiate actuarially sound rates, especially in new programs with limited experience, the appropriation and payment by state governments of Medicaid premiums receivable, the outcome of any protests and litigation related to Medicaid awards, the approval of Medicaid contracts by CMS, any changes to the programs or contracts, WellCare's ability to address operational challenges related to new business, and WellCare's ability to meet the requirements of readiness reviews. Given the risks and uncertainties inherent in forward-looking statements, any of WellCare's forward-looking statements could be materially incorrect and investors are cautioned not to place undue reliance on any of our forward- looking statements. Additional information concerning these and other important risks and uncertainties can be found in the company's filings with the U.S. Securities and Exchange Commission, included under the captions Forward-Looking Statements and Risk Factors in the company's Annual Report on Form 10-K for the year ended December 31, 2017, and in the company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, which contain discussions of WellCare's business and the various factors that may affect it. Subsequent events and developments may cause actual results to differ, perhaps materially, from WellCare's forward- looking statements. WellCare's forward-looking statements speak only as of the date on which the statements are made. WellCare undertakes no duty, and expressly disclaims any obligation, to update these forward-looking statements to reflect any future events, developments or otherwise. Our 2018 estimated premium revenue metrics are as of July 31, 2018 and are not being updated in conjunction with this presentation. Please refer to the press release and presentation announcing the Meridian transaction dated May 29, 2018. The aforementioned press release is available on WellCare’s website via the following link: http://ir.wellcare.com/News/. 2

Meridian: Advancing WellCare’s Strategy Strategically aligns with focus on government-sponsored health plans ü and related core capabilities Grows and diversifies Medicaid and Medicare Advantage businesses and adds substantial revenue ü + Adds integrated PBM capability and enhances dual-eligible and Individual Marketplace capabilities ü Financially attractive and accretive to adjusted earnings with opportunities for growth ü 3Meridian: Advancing WellCare’s Strategy Strategically aligns with focus on government-sponsored health plans ü and related core capabilities Grows and diversifies Medicaid and Medicare Advantage businesses and adds substantial revenue ü + Adds integrated PBM capability and enhances dual-eligible and Individual Marketplace capabilities ü Financially attractive and accretive to adjusted earnings with opportunities for growth ü 3

WellCare OverviewWellCare Overview

Solely Focused on Government-Sponsored Programs (1) $18.5B in total premium revenue in 2018 Medicaid Medicare Advantage Medicare Part D th th § 5 largest Medicaid plan§ 6th largest Medicare § 5 largest Individual Medicare in the U.S. Advantage (MA) plan in Part D Plan in the U.S. the U.S. ‒ 2.8 million members ‒ 1.1 million members (2) in 12 states ‒ 510,000 members in nationwide 18 states ‒ $11.4B in total premium ‒ $0.9B in total premium (1) revenue in 2018E (1) ‒ $6.2B in total premium revenue in 2018E (1) revenue in 2018E § #1 membership market share in Florida, Georgia, Kentucky and Missouri (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian (2) Includes states where WellCare receives Medicaid premium revenues associated with dually eligible special needs plans 5 Note: WellCare membership numbers as of June 30, 2018Solely Focused on Government-Sponsored Programs (1) $18.5B in total premium revenue in 2018 Medicaid Medicare Advantage Medicare Part D th th § 5 largest Medicaid plan§ 6th largest Medicare § 5 largest Individual Medicare in the U.S. Advantage (MA) plan in Part D Plan in the U.S. the U.S. ‒ 2.8 million members ‒ 1.1 million members (2) in 12 states ‒ 510,000 members in nationwide 18 states ‒ $11.4B in total premium ‒ $0.9B in total premium (1) revenue in 2018E (1) ‒ $6.2B in total premium revenue in 2018E (1) revenue in 2018E § #1 membership market share in Florida, Georgia, Kentucky and Missouri (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian (2) Includes states where WellCare receives Medicaid premium revenues associated with dually eligible special needs plans 5 Note: WellCare membership numbers as of June 30, 2018

Medicaid: An Attractive Growth Market Managed Medicaid spending growing at over 10% CAGR Medicaid Market Size Growth Opportunity Spending Enrollment § Managed Medicaid spending penetration expected to grow from 50% in 2017 to more than ~$600B ~74M 62% in 2022 ~$290B ~55M § Higher acuity populations moving to managed care § More states adopting managed care as a solution ~$800B ~80M ~$480B ~62M § Total Medicaid Numbers are approximations § Managed Medicaid Relative opportunity not to scale 6 Source: CMS: 2016 Actuarial Report on the Financial Outlook for Medicaid; HMA Managed Medicaid Enrollment Update 4Q17; Internal company projections 2022F 2017FMedicaid: An Attractive Growth Market Managed Medicaid spending growing at over 10% CAGR Medicaid Market Size Growth Opportunity Spending Enrollment § Managed Medicaid spending penetration expected to grow from 50% in 2017 to more than ~$600B ~74M 62% in 2022 ~$290B ~55M § Higher acuity populations moving to managed care § More states adopting managed care as a solution ~$800B ~80M ~$480B ~62M § Total Medicaid Numbers are approximations § Managed Medicaid Relative opportunity not to scale 6 Source: CMS: 2016 Actuarial Report on the Financial Outlook for Medicaid; HMA Managed Medicaid Enrollment Update 4Q17; Internal company projections 2022F 2017F

Medicare Advantage: An Attractive Growth Market Medicare spending and Medicare Advantage penetration continue to grow Medicare Market Size Growth Opportunity Spending Enrollment § Medicare Advantage enrollment growth in high-single digits over past five years ~$700B ~58M ~$240B ~20M § Continued growth driven by “baby boomer” age-ins and more familiarity with managed care § Medicare Advantage penetration rate is over 34% and expected ~$1T ~67M ~$460B to rise to more than 50% by 2025 ~30M § Total Medicare Numbers are approximations § Medicare Advantage Relative opportunity not to scale 7 Sources: CMS 2018 Medicare Board of Trustees Report; CMS Monthly Enrollment by State Report; Nephron research; Internal company projections 2022F 2017FMedicare Advantage: An Attractive Growth Market Medicare spending and Medicare Advantage penetration continue to grow Medicare Market Size Growth Opportunity Spending Enrollment § Medicare Advantage enrollment growth in high-single digits over past five years ~$700B ~58M ~$240B ~20M § Continued growth driven by “baby boomer” age-ins and more familiarity with managed care § Medicare Advantage penetration rate is over 34% and expected ~$1T ~67M ~$460B to rise to more than 50% by 2025 ~30M § Total Medicare Numbers are approximations § Medicare Advantage Relative opportunity not to scale 7 Sources: CMS 2018 Medicare Board of Trustees Report; CMS Monthly Enrollment by State Report; Nephron research; Internal company projections 2022F 2017F

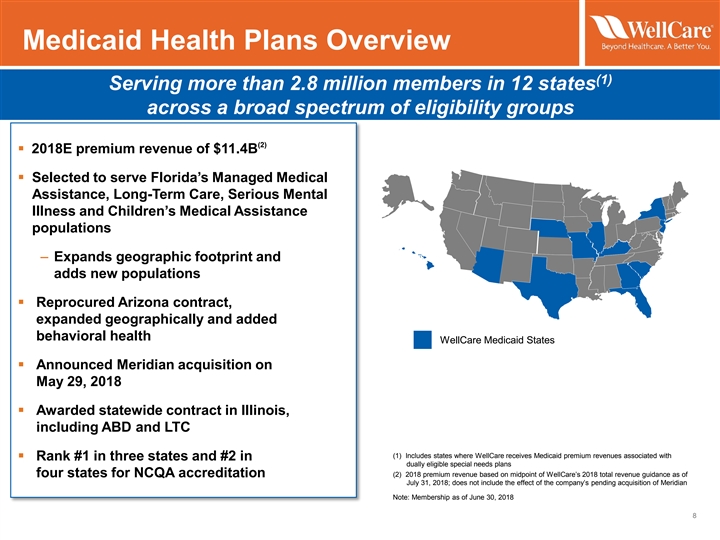

Medicaid Health Plans Overview (1) Serving more than 2.8 million members in 12 states across a broad spectrum of eligibility groups (2) § 2018E premium revenue of $11.4B § Selected to serve Florida’s Managed Medical Assistance, Long-Term Care, Serious Mental Illness and Children’s Medical Assistance populations ‒ Expands geographic footprint and adds new populations § Reprocured Arizona contract, expanded geographically and added behavioral health WellCare Medicaid States § Announced Meridian acquisition on May 29, 2018 § Awarded statewide contract in Illinois, including ABD and LTC (1) Includes states where WellCare receives Medicaid premium revenues associated with § Rank #1 in three states and #2 in dually eligible special needs plans four states for NCQA accreditation (2) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian Note: Membership as of June 30, 2018 8Medicaid Health Plans Overview (1) Serving more than 2.8 million members in 12 states across a broad spectrum of eligibility groups (2) § 2018E premium revenue of $11.4B § Selected to serve Florida’s Managed Medical Assistance, Long-Term Care, Serious Mental Illness and Children’s Medical Assistance populations ‒ Expands geographic footprint and adds new populations § Reprocured Arizona contract, expanded geographically and added behavioral health WellCare Medicaid States § Announced Meridian acquisition on May 29, 2018 § Awarded statewide contract in Illinois, including ABD and LTC (1) Includes states where WellCare receives Medicaid premium revenues associated with § Rank #1 in three states and #2 in dually eligible special needs plans four states for NCQA accreditation (2) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian Note: Membership as of June 30, 2018 8

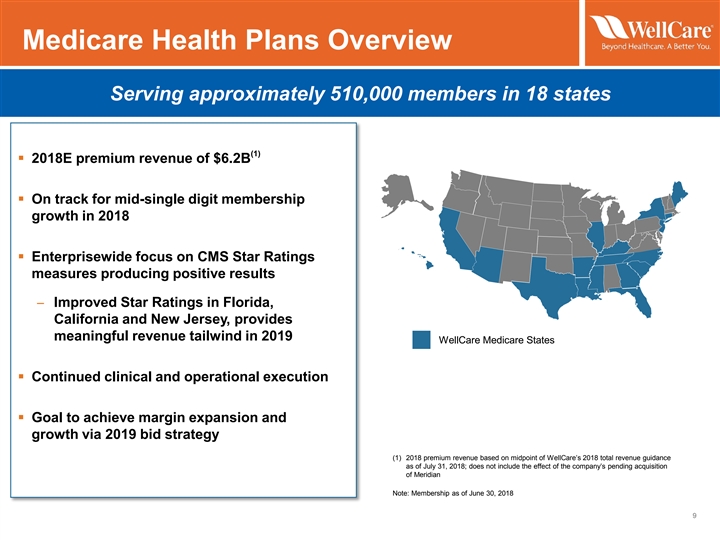

Medicare Health Plans Overview Serving approximately 510,000 members in 18 states (1) § 2018E premium revenue of $6.2B § On track for mid-single digit membership growth in 2018 § Enterprisewide focus on CMS Star Ratings measures producing positive results ̶ Improved Star Ratings in Florida, California and New Jersey, provides meaningful revenue tailwind in 2019 WellCare Medicare States § Continued clinical and operational execution § Goal to achieve margin expansion and growth via 2019 bid strategy (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian Note: Membership as of June 30, 2018 9Medicare Health Plans Overview Serving approximately 510,000 members in 18 states (1) § 2018E premium revenue of $6.2B § On track for mid-single digit membership growth in 2018 § Enterprisewide focus on CMS Star Ratings measures producing positive results ̶ Improved Star Ratings in Florida, California and New Jersey, provides meaningful revenue tailwind in 2019 WellCare Medicare States § Continued clinical and operational execution § Goal to achieve margin expansion and growth via 2019 bid strategy (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition of Meridian Note: Membership as of June 30, 2018 9

Medicare PDP Health Plans Overview Serving approximately 1.1 million members across all 50 states (1) § 2018E premium revenue of $0.9B § Fifth largest individual Medicare PDP health plan in U.S. § Strong margin business § Enterprise total pharmacy spend of ~$9B, including PDP, helps drive cost structure in Medicaid and Medicare Advantage WCG Medicare PDP States ̶ Improved cost structure benefits members and federal and state customers § Preliminary 2019 auto-assign footprint at 21 regions under the benchmark and 10 regions in the de minimus range as a (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition result of 2019 bid strategy of Meridian Note: Membership as of June 30, 2018 10Medicare PDP Health Plans Overview Serving approximately 1.1 million members across all 50 states (1) § 2018E premium revenue of $0.9B § Fifth largest individual Medicare PDP health plan in U.S. § Strong margin business § Enterprise total pharmacy spend of ~$9B, including PDP, helps drive cost structure in Medicaid and Medicare Advantage WCG Medicare PDP States ̶ Improved cost structure benefits members and federal and state customers § Preliminary 2019 auto-assign footprint at 21 regions under the benchmark and 10 regions in the de minimus range as a (1) 2018 premium revenue based on midpoint of WellCare’s 2018 total revenue guidance as of July 31, 2018; does not include the effect of the company’s pending acquisition result of 2019 bid strategy of Meridian Note: Membership as of June 30, 2018 10

Driving Earnings Growth and Margin Expansion Adjusted Earnings Per Share and Adjusted Net Income Margin Growth $8.52 $5.96 $3.59 $2.06 2014A 2015A 2016A 2017A 2.3% 1.9% 1.2% 0.7% 2014A 2015A 2016A 2017A (1) Refer to the Basis of Presentation and Supplemental Information in the Appendix for a discussion and reconciliation of these adjusted (non-GAAP) financial measures 11Driving Earnings Growth and Margin Expansion Adjusted Earnings Per Share and Adjusted Net Income Margin Growth $8.52 $5.96 $3.59 $2.06 2014A 2015A 2016A 2017A 2.3% 1.9% 1.2% 0.7% 2014A 2015A 2016A 2017A (1) Refer to the Basis of Presentation and Supplemental Information in the Appendix for a discussion and reconciliation of these adjusted (non-GAAP) financial measures 11

Executing on Our Growth Strategy Strong revenue CAGR of more than 10%...and growing ($ Billions) $18.5 $17.0 $14.2 $13.9 2015A 2016A 2017A 2018E Medicare Advantage Medicaid Organic M&A Organic M&A § Nebraska Medicaid § Advicare assets§ 9.3% organic § Universal American launch membership growth Corp. § Care1st Arizona in 2017 § Illinois and Missouri § Care1st Arizona D-SNP geographic expansion§ New state and county § PHP assets expansions and product § Meridian (pending) § Recent Florida, offerings in 2018 § Meridian (pending) Arizona and Hawaii contract wins 12 Note: 2018 premium revenue based on the midpoint of WellCare’s total revenue guidance as of July 31, 2018Executing on Our Growth Strategy Strong revenue CAGR of more than 10%...and growing ($ Billions) $18.5 $17.0 $14.2 $13.9 2015A 2016A 2017A 2018E Medicare Advantage Medicaid Organic M&A Organic M&A § Nebraska Medicaid § Advicare assets§ 9.3% organic § Universal American launch membership growth Corp. § Care1st Arizona in 2017 § Illinois and Missouri § Care1st Arizona D-SNP geographic expansion§ New state and county § PHP assets expansions and product § Meridian (pending) § Recent Florida, offerings in 2018 § Meridian (pending) Arizona and Hawaii contract wins 12 Note: 2018 premium revenue based on the midpoint of WellCare’s total revenue guidance as of July 31, 2018

Meridian Overview and Strategic RationaleMeridian Overview and Strategic Rationale

Meridian at a Glance Executive Summary: For-profit, multi-state managed care organization Meridian At A Glance focused on government-sponsored health programs § For-profit, privately held managed care organization § Headquartered in Detroit, Michigan with ~2,000 associates Organization § Founded in 1997 (1) § Largest Medicaid health plan in Michigan and Illinois (2) § 1.1 million members Medicaid § 4.0 NCQA rating in both states (3) § 27,000 Medicare Advantage members in Michigan, Illinois, Indiana and Ohio Medicare § Experience with integrated-dual demonstrations § Fully integrated, proprietary PBM platform PBM (2) § Serves 1.1 million members as well as third-party customers § 5,000 Health Insurance Exchange members in Michigan Individual (1) Michigan Medicaid contract effective through December 31, 2020, with three 1-year renewal options (through 2023); Illinois Medicaid contract effective through December 31, 2021 and can be renewed up to four years (through 2025) 14 (2) Based on Meridian’s membership as of June 30, 2018 (3) Includes approximately 13,000 integrated dual-eligible membersMeridian at a Glance Executive Summary: For-profit, multi-state managed care organization Meridian At A Glance focused on government-sponsored health programs § For-profit, privately held managed care organization § Headquartered in Detroit, Michigan with ~2,000 associates Organization § Founded in 1997 (1) § Largest Medicaid health plan in Michigan and Illinois (2) § 1.1 million members Medicaid § 4.0 NCQA rating in both states (3) § 27,000 Medicare Advantage members in Michigan, Illinois, Indiana and Ohio Medicare § Experience with integrated-dual demonstrations § Fully integrated, proprietary PBM platform PBM (2) § Serves 1.1 million members as well as third-party customers § 5,000 Health Insurance Exchange members in Michigan Individual (1) Michigan Medicaid contract effective through December 31, 2020, with three 1-year renewal options (through 2023); Illinois Medicaid contract effective through December 31, 2021 and can be renewed up to four years (through 2025) 14 (2) Based on Meridian’s membership as of June 30, 2018 (3) Includes approximately 13,000 integrated dual-eligible members

Strategic Rationale Strengthens existing business and positions WellCare for future growth § Adds substantial revenue (1) § Adds 1.1 million Medicaid members Well-positioned for additional growth § Grows and diversifies WellCare’s opportunities in ü Medicaid portfolio Meridian’s footprint § Increases #1 Medicaid membership (1) market position from four to six states Adds new and § Grows Medicare Advantage business enhances existing (2) by 27,000 members and adds three capabilities ü new states to business portfolio § Adds fully integrated, proprietary Accretive to PBM platform adjusted earnings ü § Enhances integrated dual-eligible and Marketplace capabilities (1) Based on Meridian’s membership as of June 30, 2018 (2) Includes approximately 13,000 integrated dual-eligible members 15Strategic Rationale Strengthens existing business and positions WellCare for future growth § Adds substantial revenue (1) § Adds 1.1 million Medicaid members Well-positioned for additional growth § Grows and diversifies WellCare’s opportunities in ü Medicaid portfolio Meridian’s footprint § Increases #1 Medicaid membership (1) market position from four to six states Adds new and § Grows Medicare Advantage business enhances existing (2) by 27,000 members and adds three capabilities ü new states to business portfolio § Adds fully integrated, proprietary Accretive to PBM platform adjusted earnings ü § Enhances integrated dual-eligible and Marketplace capabilities (1) Based on Meridian’s membership as of June 30, 2018 (2) Includes approximately 13,000 integrated dual-eligible members 15

Transaction Details § $2.5 billion purchase price § Expected funding through: Consideration ̶ Available cash on hand and $1.3 billion revolving credit facility (1) ̶ New debt issuance of approximately $700 million and Financing (1) ̶ New equity issuance of $1.1 billion § Pro forma debt-to-capital ratio post-transaction expected to be at or below ~40% § Expected to close within the next few months Closing § Subject to customary closing conditions, including regulatory approvals § One-time transaction-related expenses of $75 million to $85 million Transaction and § Cumulative integration-related expenses of $50 million to $60 million Integration Costs § Includes $30 million to $40 million of Accretive to Adjusted EPS synergies, ramping up over next few years Accretion Adjusted EPS § Excludes transaction and integration costs (1) Final amounts are subject to market conditions 16Transaction Details § $2.5 billion purchase price § Expected funding through: Consideration ̶ Available cash on hand and $1.3 billion revolving credit facility (1) ̶ New debt issuance of approximately $700 million and Financing (1) ̶ New equity issuance of $1.1 billion § Pro forma debt-to-capital ratio post-transaction expected to be at or below ~40% § Expected to close within the next few months Closing § Subject to customary closing conditions, including regulatory approvals § One-time transaction-related expenses of $75 million to $85 million Transaction and § Cumulative integration-related expenses of $50 million to $60 million Integration Costs § Includes $30 million to $40 million of Accretive to Adjusted EPS synergies, ramping up over next few years Accretion Adjusted EPS § Excludes transaction and integration costs (1) Final amounts are subject to market conditions 16

Our Value Proposition Solely focused on growth “sweet spot” ü of managed care Strong momentum from both organic and acquired growth as well as margin strength ü Well-positioned through capabilities and experience for additional attractive, long-term ü growth opportunities Disciplined focus on operational and financial execution to drive further revenue and EPS growth ü 17Our Value Proposition Solely focused on growth “sweet spot” ü of managed care Strong momentum from both organic and acquired growth as well as margin strength ü Well-positioned through capabilities and experience for additional attractive, long-term ü growth opportunities Disciplined focus on operational and financial execution to drive further revenue and EPS growth ü 17

AppendixAppendix

Basis of Presentation Non-GAAP Financial Measures In addition to results determined under GAAP, we provide certain non-GAAP financial measures that management believes are useful in assessing our performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, or superior to, financial measures prepared in accordance with GAAP. We have provided a reconciliation of the historical non-GAAP financial measures with the most directly comparable financial measure calculated in accordance with GAAP. Earnings per share, net income and, as noted below, other specific operating and financial measures have been adjusted for the effect of certain expenses and, as appropriate, the related tax effect for: • previously disclosed government investigations and related litigation and resolution costs (“investigation costs”) (2014-2018); • amortization expense associated with acquisitions (“acquisition-related amortization expenses”) (2015-2018); • certain one-time transaction and integration costs associated with the acquisition of Universal American and the pending acquisition of Meridian (“transaction and integration costs”) (2017-2018); • transitory costs related to the company’s decision to change its pharmacy benefit manager (“PBM”) as of January 1, 2016 (“PBM transitory costs”) (2015-2016); • certain nonrecurring Iowa-related SG&A expenses relating to readiness costs, certain wind-down costs of WellCare's Iowa operations and certain legal costs (“Iowa SG&A costs”) (2015-2016); • costs related to the divestiture of Sterling (“Sterling divestiture costs”) (2015-2016); • the effect of a gain on the divestiture of Sterling and changes to the gain (“Sterling gain”) (2015); • the costs associated with the redemption of the company’s 2020 notes, including the early redemption premium, write-off of associated deferred financing costs and write-off of associated premiums paid on the 2020 notes (“loss on extinguishment of debt”) (2017); and • the tax effect of the deferred tax revaluation after the Tax Cuts and Jobs Act of 2017 was enacted in December 2017 (“deferred tax revaluation”) (2017). Although the excluded items may recur, we believe that by providing non-GAAP measures exclusive of these items, it facilitates period-over-period comparisons and provides additional clarity about events and trends affecting our core operating performance, as well as providing comparability to competitor results. The investigation costs are related to a discrete incident which management does not expect to reoccur. We have adjusted for acquisition-related amortization expenses as these transactions do not directly relate to the servicing of products for our customers and are not directly related to the core performance of our business operations. The other costs mentioned above are related to specific events, which do not reflect the underlying ongoing performance of the business. In addition, because reimbursements for Medicaid premium tax and the ACA industry fee are both included in the premium rates or reimbursement established in certain Medicaid contracts and also recognized separately as a component of expense, we exclude these reimbursements from premium revenue when calculating key ratios as we believe that these components are not indicative of operating performance. Following is a description of the adjustments made to GAAP measures used to calculate the non-GAAP measures used in this presentation. Adjusted premium revenue (non-GAAP) = Total premium revenue (GAAP) less Medicaid premium taxes revenue and Medicaid reimbursements of the ACA industry fee. The company’s adjusted Medicaid Health Plans segment premium revenue uses this non-GAAP definition of adjusted premium revenue. MBR (GAAP) = medical benefits expense divided by total premium revenue (GAAP). Adjusted MBR (non-GAAP) = medical benefits expense divided by adjusted premium revenue. The company’s adjusted Medicaid Health Plans segment MBR uses this non-GAAP definition of adjusted MBR. SG&A expense ratio (GAAP) = SG&A expense (GAAP) divided by total premium revenue (GAAP). Adjusted SG&A expense (non-GAAP) = SG&A expense (GAAP) less investigation costs, transaction and integration costs, PBM transitory costs, Iowa SG&A costs, and Sterling divestiture costs. Adjusted SG&A ratio (non-GAAP) = adjusted SG&A expense divided by adjusted premium revenue. Adjusted depreciation & amortization (non-GAAP) = depreciation & amortization expense (GAAP) less acquisition-related amortization expenses. Adjusted income before taxes (non-GAAP) = income before income taxes (GAAP) less investigation costs, acquisition-related amortization expenses, transaction and integration costs, PBM transitory costs, Iowa SG&A costs, Sterling divestiture costs, Sterling gain, and loss on extinguishment of debt. Adjusted income tax expense (non-GAAP) = income tax associated with the applicable adjusted income before taxes, based on the applicable effective income tax rate, and the deferred tax revaluation. Adjusted effective income tax rate (non-GAAP) = adjusted income tax expense divided by adjusted income before taxes. Adjusted net income (non-GAAP) = adjusted income before taxes less adjusted income tax expense. Net income margin (GAAP) = net income (GAAP) divided by total premium revenue (GAAP). Adjusted net income margin (non-GAAP) = adjusted net income divided by adjusted premium revenue. Adjusted earnings per diluted share (non-GAAP) = Adjusted net income divided by weighted average common shares outstanding on a fully diluted basis. 19Basis of Presentation Non-GAAP Financial Measures In addition to results determined under GAAP, we provide certain non-GAAP financial measures that management believes are useful in assessing our performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, or superior to, financial measures prepared in accordance with GAAP. We have provided a reconciliation of the historical non-GAAP financial measures with the most directly comparable financial measure calculated in accordance with GAAP. Earnings per share, net income and, as noted below, other specific operating and financial measures have been adjusted for the effect of certain expenses and, as appropriate, the related tax effect for: • previously disclosed government investigations and related litigation and resolution costs (“investigation costs”) (2014-2018); • amortization expense associated with acquisitions (“acquisition-related amortization expenses”) (2015-2018); • certain one-time transaction and integration costs associated with the acquisition of Universal American and the pending acquisition of Meridian (“transaction and integration costs”) (2017-2018); • transitory costs related to the company’s decision to change its pharmacy benefit manager (“PBM”) as of January 1, 2016 (“PBM transitory costs”) (2015-2016); • certain nonrecurring Iowa-related SG&A expenses relating to readiness costs, certain wind-down costs of WellCare's Iowa operations and certain legal costs (“Iowa SG&A costs”) (2015-2016); • costs related to the divestiture of Sterling (“Sterling divestiture costs”) (2015-2016); • the effect of a gain on the divestiture of Sterling and changes to the gain (“Sterling gain”) (2015); • the costs associated with the redemption of the company’s 2020 notes, including the early redemption premium, write-off of associated deferred financing costs and write-off of associated premiums paid on the 2020 notes (“loss on extinguishment of debt”) (2017); and • the tax effect of the deferred tax revaluation after the Tax Cuts and Jobs Act of 2017 was enacted in December 2017 (“deferred tax revaluation”) (2017). Although the excluded items may recur, we believe that by providing non-GAAP measures exclusive of these items, it facilitates period-over-period comparisons and provides additional clarity about events and trends affecting our core operating performance, as well as providing comparability to competitor results. The investigation costs are related to a discrete incident which management does not expect to reoccur. We have adjusted for acquisition-related amortization expenses as these transactions do not directly relate to the servicing of products for our customers and are not directly related to the core performance of our business operations. The other costs mentioned above are related to specific events, which do not reflect the underlying ongoing performance of the business. In addition, because reimbursements for Medicaid premium tax and the ACA industry fee are both included in the premium rates or reimbursement established in certain Medicaid contracts and also recognized separately as a component of expense, we exclude these reimbursements from premium revenue when calculating key ratios as we believe that these components are not indicative of operating performance. Following is a description of the adjustments made to GAAP measures used to calculate the non-GAAP measures used in this presentation. Adjusted premium revenue (non-GAAP) = Total premium revenue (GAAP) less Medicaid premium taxes revenue and Medicaid reimbursements of the ACA industry fee. The company’s adjusted Medicaid Health Plans segment premium revenue uses this non-GAAP definition of adjusted premium revenue. MBR (GAAP) = medical benefits expense divided by total premium revenue (GAAP). Adjusted MBR (non-GAAP) = medical benefits expense divided by adjusted premium revenue. The company’s adjusted Medicaid Health Plans segment MBR uses this non-GAAP definition of adjusted MBR. SG&A expense ratio (GAAP) = SG&A expense (GAAP) divided by total premium revenue (GAAP). Adjusted SG&A expense (non-GAAP) = SG&A expense (GAAP) less investigation costs, transaction and integration costs, PBM transitory costs, Iowa SG&A costs, and Sterling divestiture costs. Adjusted SG&A ratio (non-GAAP) = adjusted SG&A expense divided by adjusted premium revenue. Adjusted depreciation & amortization (non-GAAP) = depreciation & amortization expense (GAAP) less acquisition-related amortization expenses. Adjusted income before taxes (non-GAAP) = income before income taxes (GAAP) less investigation costs, acquisition-related amortization expenses, transaction and integration costs, PBM transitory costs, Iowa SG&A costs, Sterling divestiture costs, Sterling gain, and loss on extinguishment of debt. Adjusted income tax expense (non-GAAP) = income tax associated with the applicable adjusted income before taxes, based on the applicable effective income tax rate, and the deferred tax revaluation. Adjusted effective income tax rate (non-GAAP) = adjusted income tax expense divided by adjusted income before taxes. Adjusted net income (non-GAAP) = adjusted income before taxes less adjusted income tax expense. Net income margin (GAAP) = net income (GAAP) divided by total premium revenue (GAAP). Adjusted net income margin (non-GAAP) = adjusted net income divided by adjusted premium revenue. Adjusted earnings per diluted share (non-GAAP) = Adjusted net income divided by weighted average common shares outstanding on a fully diluted basis. 19

Supplemental Information Reconciliation of GAAP to Adjusted (non-GAAP) Financials (Unaudited; dollars in millions, except per share data) The Company reports adjusted operating results on a non-GAAP basis to exclude certain expenses and other items that management believes are not indicative of longer-term business trends and operations. The following table presents applicable financial information presented herein, as determined under GAAP, reconciled to the adjusted financial information for the same periods. Refer to the basis of presentation for a discussion of non-GAAP financial measures. For the Year Ended December 31, 2014 2015 2016 2017 Premium Revenue: As determined under GAAP $ 12,915.5 $ 13,874.8 $ 14,220.9 $ 16,960.3 Medicaid premium taxes (76.5) (94.7) (110.0) (119.8) ACA industry fee reimbursement (124.6) (219.2) (244.9) — Adjusted premium revenue (non-GAAP) $ 12,714.4 $ 13,560.9 $ 13,866.0 $ 16,840.5 For the Year Ended December 31, 2014 2015 2016 2017 $$ Per Diluted Share $$ Per Diluted Share $$ Per Diluted Share $$ Per Diluted Share Net Income and Diluted Earnings Per Share: As determined under GAAP $ 63.7 $ 1.44 $ 118.6 $ 2.67 $ 242.1 $ 5.43 $ 373.7 $ 8.31 Adjustments: Investigation costs 37.6 0.86 30.4 0.68 16.0 0.36 7.9 0.18 Transaction and integration costs — — — — — — 37.5 0.83 Sterling divestiture costs — — 2.0 0.05 1.7 0.04 — — PBM transitory costs — — 18.1 0.41 4.9 0.11 — — Iowa SG&A costs — — 11.9 0.27 5.2 0.12 — — Acquisition-related amortization — — 10.6 0.24 10.4 0.22 32.7 0.73 Gain on divestiture of business — — (6.1) (0.14) — — — — Loss on extinguishment of debt — — — — — — 26.1 0.58 Tax benefit due to TCJA (a) — — — — — — (56.1) (1.25) Tax effect of adjustments (b) (10.4) (0.24) (26.2) (0.59) (14.3) (0.32) (38.6) (0.86) Adjusted net income (non-GAAP) $ 90.9 $ 2.06 $ 159.3 $ 3.59 $ 266.0 $ 5.96 $ 383.2 $ 8.52 2014 2015 2016 2017 Net Income Margin: As determined under GAAP 0.5% 0.9% 1.7% 2.2% Adjustments 0.2% 0.3% 0.2% 0.1% Adjusted net income margin (non-GAAP) 0.7% 1.2% 1.9% 2.3% (a) Income tax expense and the effective tax rate for the year ended December 31, 2017 was adjusted by $56.1 million, or $1.25 per diluted share, due to the one-time revaluation of the Company’s net deferred tax liability associated with the enactment of the Tax Cuts and Jobs Act of 2017 ( TCJA ). (b) Based on the effective income tax rates applicable to adjusted (non-GAAP) results, the company estimated the effect on income tax expense and the effective tax rate associated with the non-GAAP adjustments. Refer to the basis of presentation for a discussion of non-GAAP financial measures. * WellCare is not able to estimate amounts associated with investigation costs, transaction and integration costs, or the associated tax effect of such adjustments expected to be incurred in 2018; therefore, the company cannot reconcile these metrics to total projected GAAP metrics. 20Supplemental Information Reconciliation of GAAP to Adjusted (non-GAAP) Financials (Unaudited; dollars in millions, except per share data) The Company reports adjusted operating results on a non-GAAP basis to exclude certain expenses and other items that management believes are not indicative of longer-term business trends and operations. The following table presents applicable financial information presented herein, as determined under GAAP, reconciled to the adjusted financial information for the same periods. Refer to the basis of presentation for a discussion of non-GAAP financial measures. For the Year Ended December 31, 2014 2015 2016 2017 Premium Revenue: As determined under GAAP $ 12,915.5 $ 13,874.8 $ 14,220.9 $ 16,960.3 Medicaid premium taxes (76.5) (94.7) (110.0) (119.8) ACA industry fee reimbursement (124.6) (219.2) (244.9) — Adjusted premium revenue (non-GAAP) $ 12,714.4 $ 13,560.9 $ 13,866.0 $ 16,840.5 For the Year Ended December 31, 2014 2015 2016 2017 $$ Per Diluted Share $$ Per Diluted Share $$ Per Diluted Share $$ Per Diluted Share Net Income and Diluted Earnings Per Share: As determined under GAAP $ 63.7 $ 1.44 $ 118.6 $ 2.67 $ 242.1 $ 5.43 $ 373.7 $ 8.31 Adjustments: Investigation costs 37.6 0.86 30.4 0.68 16.0 0.36 7.9 0.18 Transaction and integration costs — — — — — — 37.5 0.83 Sterling divestiture costs — — 2.0 0.05 1.7 0.04 — — PBM transitory costs — — 18.1 0.41 4.9 0.11 — — Iowa SG&A costs — — 11.9 0.27 5.2 0.12 — — Acquisition-related amortization — — 10.6 0.24 10.4 0.22 32.7 0.73 Gain on divestiture of business — — (6.1) (0.14) — — — — Loss on extinguishment of debt — — — — — — 26.1 0.58 Tax benefit due to TCJA (a) — — — — — — (56.1) (1.25) Tax effect of adjustments (b) (10.4) (0.24) (26.2) (0.59) (14.3) (0.32) (38.6) (0.86) Adjusted net income (non-GAAP) $ 90.9 $ 2.06 $ 159.3 $ 3.59 $ 266.0 $ 5.96 $ 383.2 $ 8.52 2014 2015 2016 2017 Net Income Margin: As determined under GAAP 0.5% 0.9% 1.7% 2.2% Adjustments 0.2% 0.3% 0.2% 0.1% Adjusted net income margin (non-GAAP) 0.7% 1.2% 1.9% 2.3% (a) Income tax expense and the effective tax rate for the year ended December 31, 2017 was adjusted by $56.1 million, or $1.25 per diluted share, due to the one-time revaluation of the Company’s net deferred tax liability associated with the enactment of the Tax Cuts and Jobs Act of 2017 ( TCJA ). (b) Based on the effective income tax rates applicable to adjusted (non-GAAP) results, the company estimated the effect on income tax expense and the effective tax rate associated with the non-GAAP adjustments. Refer to the basis of presentation for a discussion of non-GAAP financial measures. * WellCare is not able to estimate amounts associated with investigation costs, transaction and integration costs, or the associated tax effect of such adjustments expected to be incurred in 2018; therefore, the company cannot reconcile these metrics to total projected GAAP metrics. 20