Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CRAWFORD & CO | exhibit991063018q2pressrel.htm |

| 8-K - 8-K - CRAWFORD & CO | a080620188-k.htm |

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// • Forward-Looking Statements —This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward- looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. —Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. • Revenues Before Reimbursements ("Revenues") —Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. • Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its three operating segments. Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to operate our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill impairment charges, restructuring and special charges, loss on disposition of business line, income taxes, and net income or loss attributable to noncontrolling interests and redeemable noncontrolling interests. • Earnings Per Share —The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. —In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. • Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. 2

SECOND QUARTER 2018 ////////////////////////////////////////////////////////////////////////// Financial Review

SECOND QUARTER FINANCIAL SUMMARY ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Quarter Ended June 30, June 30, ($ in millions, except per share amounts) 2018 2017 % Change Revenues $279.0 $269.2 4 % Net Income Attributable to Shareholders of Crawford & Company ($2.4) $10.2 (124)% Restructuring and Special Charges — $6.8 nm Loss on Disposition of Business Line $17.8 — nm Diluted (Loss) Earnings per Share CRD-A ($0.04) $0.19 (121)% CRD-B ($0.06) $0.17 (135)% Non-GAAP Diluted Earnings per Share (1) CRD-A $0.20 $0.27 (26)% CRD-B $0.19 $0.25 (24)% Operating Earnings (1) $21.6 $29.2 (26)% Operating Margin 7.7% 10.8% (310)bps Adjusted EBITDA (1) $31.3 $38.2 (18)% Adjusted EBITDA Margin 11.2% 14.2% (300)bps (1) See appendix for non-GAAP explanation and reconciliation of non-GAAP Earnings per Share. 9

CRAWFORD CLAIMS SOLUTIONS SEGMENT HIGHLIGHTS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Operating Results (2Q 2018 v. 2Q 2017) Three months ended • Revenues of $93.2 million versus $81.1 million (in thousands, except June 30, June 30, percentages) 2018 2017 Variance • Operating earnings of $3.8 million versus $3.3 million • Operating earnings margin of 4.0% versus 4.1% Revenues $93,188 $81,140 14.8% • Cases received of 130,574 versus 124,065 Direct compensation, benefits, and non-employee labor 60,104 51,982 15.6% Highlights Other expenses 29,332 25,831 13.6% • Higher revenue in the U.S. and Canadian regions as a result of increased weather related cases Operating earnings $3,752 $3,327 12.8% compensated for lower volumes in the UK and Operating margin 4.0% 4.1% (0.1%) Australia • Renewed 100% of our CAT agreements this storm Total cases received 130,574 124,065 5.2% season Full time equivalent employees 3,028 3,025 0.1% • Absent foreign exchange increases of $3.5 million, revenues would have been $89.6 million • Earnings reflect higher investments in IT, sales and planned international expansion costs in WeGoLook 10

CRAWFORD TPA SOLUTIONS: BROADSPIRE SEGMENT HIGHLIGHTS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Operating Results (2Q 2018 v. 2Q 2017) Three months ended • Revenues of $102.6 million versus $97.0 million (in thousands, except June 30, June 30, percentages) 2018 2017 Variance • Operating earnings of $8.1 million versus $9.7 million Revenues $102,644 $97,037 5.8% • Operating earnings margin of 7.9% versus 10.0% Direct compensation, benefits, and non-employee • Cases received of 205,945 versus 206,387 labor 59,842 54,554 9.7% Highlights Other expenses 34,667 32,773 5.8% Operating earnings $8,135 $9,710 (16.2%) • Increases in revenue due to new claims management clients augmenting growth in the U.S. and Canada Operating margin 7.9% 10.0% (2.1%) Absent foreign exchange increases of $0.9 million, • Total cases received 205,945 206,387 (0.2%) revenues would have been $101.7 million Full time equivalent employees 3,116 2,897 7.6% • 98% client retention rate with significant pipeline of future sales opportunities being pursued • Decreased operating earnings due to increased investment in technology and sales 11

CRAWFORD SPECIALTY SOLUTIONS SEGMENT HIGHLIGHTS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Operating Results (2Q 2018 v. 2Q 2017) • Revenues of $83.2 million versus $91.1 million Three months ended • Operating earnings of $10.4 million versus $14.1 (in thousands, except June 30, June 30, percentages) 2018 2017 Variance million • Operating margin of 12.5% versus 15.5% Revenues $83,212 $91,070 (8.6%) Direct compensation, • Cases received of 93,812 versus 89,582 benefits, and non-employee labor 42,097 42,333 (0.6%) Highlights Other expenses 30,728 34,652 (11.3%) Operating earnings $10,387 $14,085 (26.3%) • Change in U.K. contractor repair business operating model reduced revenues by $2.8 million as compared Operating margin 12.5% 15.5% (3.0%) to 2017. This change had no impact on operating earnings Total cases received 93,812 89,582 4.7% Full time equivalent • Absent foreign exchange increases of $2.7 million, employees 1,710 1,825 (6.3%) revenues would have been $80.5 million • Lower revenues in Contractor Connection due to timing of repair project starts • Assignment counts for Contractor Connection are up in 2018 12

BALANCE SHEET HIGHLIGHTS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// December 31, Unaudited ($ in thousands) June 30, 2018 2017 Change Cash and cash equivalents $ 46,323 $ 54,011 $ (7,688) Accounts receivable, net 143,330 174,172 (30,842) Unbilled revenues, net 121,969 108,745 13,224 Total receivables 265,299 282,917 (17,618) Goodwill 97,503 96,916 587 Intangible assets arising from business acquisitions, net 92,767 97,147 (4,380) Goodwill and intangible assets arising from business acquisitions 190,270 194,063 (3,793) Deferred revenues 57,720 60,309 (2,589) Pension liabilities 76,543 87,035 (10,492) Short-term borrowings and current portion of capital leases 30,009 25,212 4,797 Long-term debt, less current portion 195,120 200,460 (5,340) Total debt 225,129 225,672 (543) Total stockholders' equity attributable to Crawford & Company 182,043 182,320 (277) Net debt (1) 178,806 171,661 7,145 Redeemable noncontrolling interests 6,140 6,775 (635) (1) See Appendix for non-GAAP explanation and reconciliation 13

OPERATING AND FREE CASH FLOW ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// For the six months ended June 30, Unaudited ($ in thousands) 2018 2017 Variance Net Income Attributable to Shareholders of Crawford & Company $ 6,144 $ 17,865 $ (11,721) Depreciation and Other Non-Cash Operating Items 25,328 23,794 1,534 Loss on Disposition of Business Line 17,795 — 17,795 Billed Receivables Change (539) (12,192) 11,653 Unbilled Receivables Change (28,346) (10,899) (17,447) Change in Accrued Compensation and 401K (17,165) (20,124) 2,959 Change in Accrued and Prepaid Income Taxes 775 4,078 (3,303) Working Capital Change (13,867) (10,223) (3,644) U.S. and U.K. Pension Contributions (8,824) (8,658) (166) Cash Flows from Operating Activities (18,699) (16,359) (2,340) Property & Equipment Purchases, net (9,538) (3,767) (5,771) Capitalized Software (internal and external costs) (8,270) (12,155) 3,885 Free Cash Flow $ (36,507) $ (32,281) $ (4,226) (1) See Appendix for non-GAAP explanation and reconciliation 14

2018 SHARE REPURCHASES ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// • During the 2018 second quarter, the Company did not repurchase any of its shares • During the six month period ended June 30, 2018, Crawford repurchased 1,011,958 shares of CRD-A for an average price of $8.28 per share, and 53,888 shares of CRD-B for an average price of $8.96 per share • As of June 30, 2018 the Company had remaining authorization to repurchase 600,825 shares under the 2017 Repurchase Authorization 15

2018 GUIDANCE ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Crawford & Company is updating its guidance for 2018 to reflect the disposal of the Garden City Group business as follows: YEAR ENDING DECEMBER 31, 2018 Low End High End Consolidated revenues before reimbursements $1.07 $1.12 billion Net income attributable to shareholders of Crawford & Company $31.0 $36.0 million Diluted earnings per share--CRD-A $0.56 $0.66 per share Diluted earnings per share--CRD-B $0.49 $0.59 per share Non-GAAP net income attributable to shareholders of Crawford & Company before loss on disposition of business line $43.0 $48.0 million Diluted earnings per share--CRD-A $0.78 $0.88 per share Diluted earnings per share--CRD-B $0.71 $0.81 per share Consolidated operating earnings $85.0 $95.0 million Consolidated adjusted EBITDA $127.0 $137.0 million 16

CONCLUSION ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Looking forward Crawford has six primary objectives for 2018: ▪ Increasing the velocity of our revenue growth ▪ Launching new products and services to position Crawford as an innovator in the industry ▪ Maximizing our go to market strategy with carriers, corporations and intermediaries ▪ Prioritizing IT investments on improved capabilities across the globe to be at the forefront of innovation and disruption ▪ Focusing on our cash generation capabilities and driving free cash flow ▪ Advancing our employee training and leadership development programs to transform the Company into an engine for growth All of which, will position the Company to achieve our longer-term target of 5% revenue growth and 15% earnings growth, annually. 17

SECOND QUARTER 2018 ////////////////////////////////////////////////////////////////////////// Appendix

APPENDIX: NON-GAAP FINANCIAL INFORMATION ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 14. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer- relationship intangible assets, goodwill impairment charges, restructuring and special charges, loss on disposition of business line, income taxes, and net income or loss attributable to noncontrolling interests. 19

APPENDIX: NON-GAAP FINANCIAL INFORMATION (continued) ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Adjusted EBITDA Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income with adjustments for depreciation and amortization, interest expense-net, income tax provision, restructuring and special charges, loss on disposition of business line, goodwill impairment charges and non-cash stock-based compensation expense. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. Non-GAAP Adjusted Net Income and Diluted Earnings per Share Included in non-GAAP adjusted net income as an add back to GAAP net income and diluted earnings per share, are restructuring and special charges net of tax, and loss on disposition of business line, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations. 20

STATEMENT OF OPERATIONS HIGHLIGHTS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Unaudited ($ in thousands, except per share amounts) Three Months Ended June 30, 2018 2017 $ Change % Change Revenues Before Reimbursements $ 279,044 $ 269,247 $ 9,797 4 % Costs of Services Provided, Before Reimbursements 197,523 186,471 11,052 6 % Selling, General, and Administrative Expenses 64,000 57,327 6,673 12 % Corporate Interest Expense, Net 2,440 2,114 326 15 % Restructuring and Special Charges — 6,782 (6,782) nm Loss on Disposition of Business Line 17,795 — 17,795 nm Total Costs and Expenses Before Reimbursements 281,758 252,694 29,064 12 % Other Income 747 532 215 40 % (Loss) Income Before Income Taxes (1,967) 17,085 (19,052) (112)% Provision for Income Taxes 461 6,812 (6,351) (93)% Net (Loss) Income (2,428) 10,273 (12,701) (124)% Net Loss (Income) Attributable to Noncontrolling Interests and Redeemable Noncontrolling Interests 3 (72) 75 (104)% Net (Loss) Income Attributable to Shareholders of Crawford & Company $ (2,425) $ 10,201 $ (12,626) (124)% (Loss) Earnings Per Share - Diluted: Class A Common Stock $ (0.04) $ 0.19 $ (0.23) (121)% Class B Common Stock $ (0.06) $ 0.17 $ (0.23) (135)% Non-GAAP Adjusted Earnings Per Share - Diluted: (1) Class A Common Stock $ 0.20 $ 0.27 $ (0.07) (26)% Class B Common Stock $ 0.19 $ 0.25 $ (0.06) (24)% Cash Dividends per Share: Class A Common Stock $ 0.07 $ 0.07 $ — — % Class B Common Stock $ 0.05 $ 0.05 $ — — % (1) 21 See Appendix for non-GAAP explanation and reconciliation

RECONCILIATION OF NON-GAAP ITEMS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Revenues, Costs of Services Provided, and Operating Earnings Quarter Ended Quarter Ended Full Year June 30, June 30, Guidance Unaudited ($ in thousands) 2018 2017 2018 * Revenues Before Reimbursements Total Revenues $ 293,209 $ 283,972 $ 1,163,000 Reimbursements (14,165) (14,725) (68,000) Revenues Before Reimbursements $ 279,044 $ 269,247 $ 1,095,000 Costs of Services Provided, Before Reimbursements Total Costs of Services $ 211,688 $ 201,196 Reimbursements (14,165) (14,725) Costs of Services Provided, Before Reimbursements $ 197,523 $ 186,471 Quarter Ended Quarter Ended Full Year June 30, June 30, Guidance Unaudited ($ in thousands) 2018 2017 2018 * Operating Earnings: Crawford Claims Solutions $ 3,752 $ 3,327 Crawford TPA Solutions: Broadspire 8,135 9,710 Crawford Specialty Solutions 10,387 14,085 Unallocated corporate and shared costs and credits, net (703) 2,037 Consolidated Operating Earnings 21,571 29,159 $ 90,000 Deduct: Net corporate interest expense (2,440) (2,114) (10,000) Stock option expense (512) (457) (1,810) Amortization expense (2,791) (2,721) (11,000) Restructuring and special charges — (6,782) — Loss on disposition of business line (17,795) — (17,795) Income taxes (461) (6,812) (15,195) Net loss (income) attributable to non-controlling interests and redeemable noncontrolling interests 3 (72) (700) Net (Loss) Income Attributable to Shareholders of Crawford & Company $ (2,425) $ 10,201 $ 33,500 * Midpoints of Company's Guidance, updated August 6, 2018 22

RECONCILIATION OF NON-GAAP ITEMS (continued) ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Adjusted EBITDA Quarter Ended Full Year June 30, June 30, Guidance Unaudited ($ in thousands) 2018 2017 2018 * Net (loss) income attributable to shareholders of Crawford & Company $ (2,425) $ 10,201 $ 33,500 Add: Depreciation and amortization 11,200 10,178 48,300 Stock-based compensation 1,790 2,109 7,210 Net corporate interest expense 2,440 2,114 10,000 Restructuring and special charges — 6,782 — Loss on disposition of business line 17,795 — 17,795 Income taxes 461 6,812 15,195 Adjusted EBITDA $ 31,261 $ 38,196 $ 132,000 * Midpoints of Company's Guidance, updated August 6, 2018 23

RECONCILIATION OF NON-GAAP ITEMS (continued) ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Net Debt June 30, December 31, Unaudited ($ in thousands) 2018 2017 Net Debt Short-term borrowings $ 29,808 $ 24,641 Current installments of capital leases 201 571 Long-term debt and capital leases, less current installments 195,120 200,460 Total debt 225,129 225,672 Less: Cash and cash equivalents 46,323 54,011 Net debt $ 178,806 $ 171,661 24

RECONCILIATION OF NON-GAAP ITEMS (continued) ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Three Months Ended June 30, 2018 Net (Loss) Income Attributable to Diluted (Loss) Diluted (Loss) Unaudited ($ in (Loss) Income Net (Loss) Crawford & Earnings per Earnings per thousands) Before Taxes Income Taxes Income Company CRD-A Share CRD-B Share GAAP $ (1,967) $ (461) $ (2,428) $ (2,425) $ (0.04) $ (0.06) Add back: Loss on disposition of business line 17,795 (4,494) 13,301 13,301 0.24 0.25 Non-GAAP Adjusted $ 15,828 $ (4,955) $ 10,873 $ 10,876 $ 0.20 $ 0.19 Three Months Ended June 30, 2017 Net Income Attributable to Diluted Diluted Unaudited ($ in Income Before Crawford & Earnings per Earnings per thousands) Taxes Income Taxes Net Income Company CRD-A Share CRD-B Share GAAP $ 17,085 $ (6,812) $ 10,273 $ 10,201 $ 0.19 $ 0.17 Add back: Restructuring and special charges 6,782 (2,217) 4,565 4,565 0.08 0.08 Non-GAAP Adjusted $ 23,867 $ (9,029) $ 14,838 $ 14,766 $ 0.27 $ 0.25 25

RECONCILIATION OF NON-GAAP ITEMS (continued) ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Six Months Ended June 30, 2018 Net Income Attributable to Diluted Diluted Unaudited ($ in Income Before Crawford & Earnings per Earnings per thousands) Taxes Income Taxes Net Income Company CRD-A Share CRD-B Share GAAP $ 10,429 $ (4,427) $ 6,002 $ 6,144 $ 0.13 $ 0.09 Add back: Loss on disposition of business line 17,795 (4,494) 13,301 13,301 0.23 0.24 Non-GAAP Adjusted $ 28,224 $ (8,921) $ 19,303 $ 19,445 $ 0.36 $ 0.33 Six Months Ended June 30, 2017 Net Income Attributable to Diluted Diluted Unaudited ($ in Income Before Crawford & Earnings per Earnings per thousands) Taxes Income Taxes Net Income Company CRD-A Share CRD-B Share GAAP $ 29,543 $ (11,647) $ 17,896 $ 17,865 $ 0.33 $ 0.29 Add back: Restructuring and special charges 7,387 (2,415) 4,972 4,972 0.09 0.09 Non-GAAP Adjusted $ 36,930 $ (14,062) $ 22,868 $ 22,837 $ 0.42 $ 0.38 26

PRO FORMA REVENUE BRIDGE EXCLUDING GARDEN CITY GROUP ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Quarter Ended Six Months June 30, Ended June 30, 2017 Revenue Excluding GCG $249,568 $496,887 Foreign exchange impact 7,169 12,736 Change in operating model for UK Contractor Connection and Canada Auto Appraisal (3,452) (9,862) Organic growth excluding GCG 11,837 22,512 2018 Revenue Excluding GCG $265,122 $522,273 Pro Forma Revenue Growth Rate Excluding GCG 6.2% 5.1% 27

PRO FORMA NON-GAAP RESULTS EXCLUDING GCG BUSINESS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Three Months Ended June 30, 2018 Net (Loss) Income Attributable to Diluted (Loss) Diluted (Loss) Operating Pretax (Loss) Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 279,044 $ 21,571 $ (1,967) $ (2,425) $ (0.04) $ (0.06) GCG business (1) (13,922) 1,410 1,407 957 0.02 0.02 Retained corporate overhead (2) — (1,278) (1,278) (868) (0.01) (0.02) Loss on disposition of business line (3) — — 17,795 13,301 0.24 0.25 Non-GAAP Adjusted $ 265,122 $ 21,703 $ 15,957 $ 10,965 $ 0.21 $ 0.19 Six Months Ended June 30, 2018 Net Income Attributable to Diluted Diluted Operating Pretax Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 552,148 $ 37,840 $ 10,429 $ 6,144 $ 0.13 $ 0.09 GCG business (1) (29,875) 3,935 3,932 2,670 0.05 0.05 Retained corporate overhead (2) — (2,925) (2,925) (1,986) (0.03) (0.04) Loss on disposition of business line (3) — — 17,795 13,301 0.23 0.24 Non-GAAP Adjusted $ 522,273 $ 38,850 $ 29,231 $ 20,129 $ 0.38 $ 0.34 (1) Removes the operating results for the 2018 periods of the GCG business disposed on June 15, 2018. (2) Overhead allocated to the GCG business that would have been retained at the parent level. (3) Loss on disposition of business line. 28

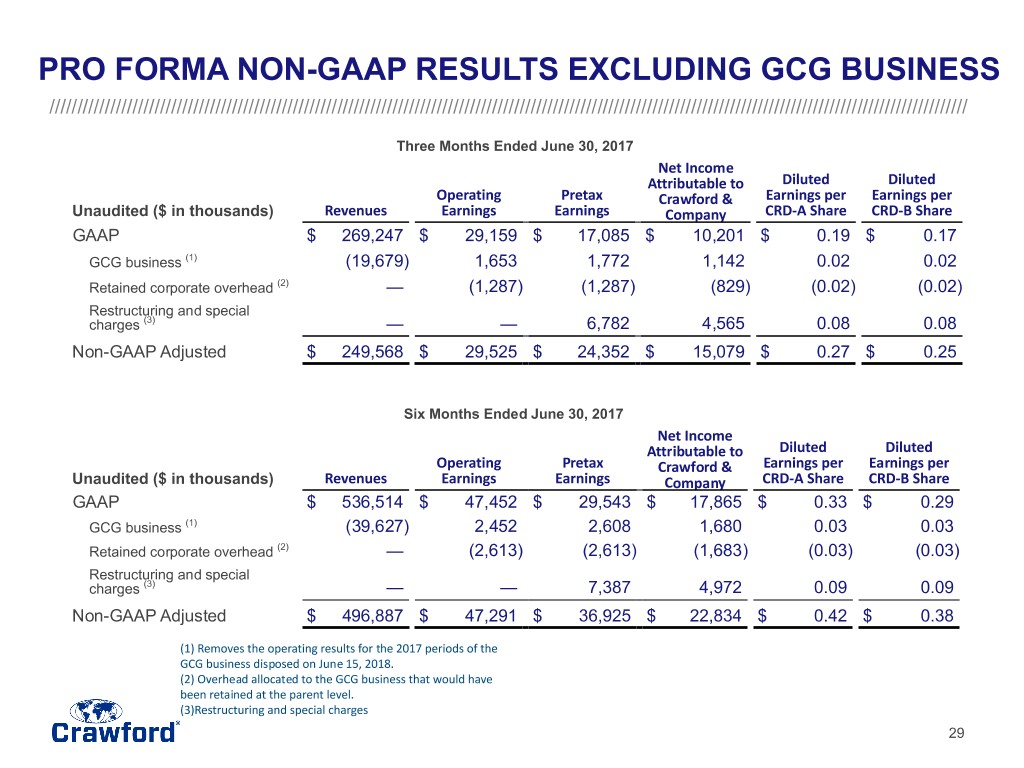

PRO FORMA NON-GAAP RESULTS EXCLUDING GCG BUSINESS ////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// Three Months Ended June 30, 2017 Net Income Attributable to Diluted Diluted Operating Pretax Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 269,247 $ 29,159 $ 17,085 $ 10,201 $ 0.19 $ 0.17 GCG business (1) (19,679) 1,653 1,772 1,142 0.02 0.02 Retained corporate overhead (2) — (1,287) (1,287) (829) (0.02) (0.02) Restructuring and special charges (3) — — 6,782 4,565 0.08 0.08 Non-GAAP Adjusted $ 249,568 $ 29,525 $ 24,352 $ 15,079 $ 0.27 $ 0.25 Six Months Ended June 30, 2017 Net Income Attributable to Diluted Diluted Operating Pretax Crawford & Earnings per Earnings per Unaudited ($ in thousands) Revenues Earnings Earnings Company CRD-A Share CRD-B Share GAAP $ 536,514 $ 47,452 $ 29,543 $ 17,865 $ 0.33 $ 0.29 GCG business (1) (39,627) 2,452 2,608 1,680 0.03 0.03 Retained corporate overhead (2) — (2,613) (2,613) (1,683) (0.03) (0.03) Restructuring and special charges (3) — — 7,387 4,972 0.09 0.09 Non-GAAP Adjusted $ 496,887 $ 47,291 $ 36,925 $ 22,834 $ 0.42 $ 0.38 (1) Removes the operating results for the 2017 periods of the GCG business disposed on June 15, 2018. (2) Overhead allocated to the GCG business that would have been retained at the parent level. (3)Restructuring and special charges 29