Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - POPULAR, INC. | d603358dex991.htm |

| 8-K - 8-K - POPULAR, INC. | d603358d8k.htm |

Investor Presentation Acquisition of Wells Fargo’s Auto Finance Business in Puerto Rico August 1st, 2018 Exhibit 99.2

This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including without limitation those about the full phased-in costs savings resulting from Popular Inc.’s (the “Corporation”, “Popular”, “we” “us” or “our”) acquisition of certain assets and assumption of certain liabilities from Wells Fargo’s auto finance business in Puerto Rico described herein, as well as the pre-tax income, net income, earnings accretion and operating expenses of the acquired business during the first 12 months following the acquisition. These statements are not guarantees of future performance, are based on management’s current expectations and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Risks and uncertainties include without limitation the effect of competitive and economic factors, and our reaction to those factors, the adequacy of the allowance for loan losses, delinquency trends, market risk and the impact of interest rate changes, capital market conditions, capital adequacy and liquidity, the effect of legal proceedings and new accounting standards on the Corporation’s financial condition and results of operations, the impact of Hurricanes Irma and Maria on us, our ability to successfully integrate the auto finance business acquired from Wells Fargo, as well as the unexpected costs, including, without limitation, costs due to exposure to any unrecorded liabilities or issues not identified during the due diligence investigation of the business or that are not subject to indemnification or reimbursement, and risks that the business may suffer as a result of the transaction, including due to adverse effects on relationships with customers, employees and service providers. All statements contained herein that are not clearly historical in nature, are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions, and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, are generally intended to identify forward-looking statements. More information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Annual Report on Form 10-K for the year ended December 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018 to be filed with the SEC. Our filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements or information which speak as of their respective dates. Cautionary Note Regarding Forward-Looking Statements

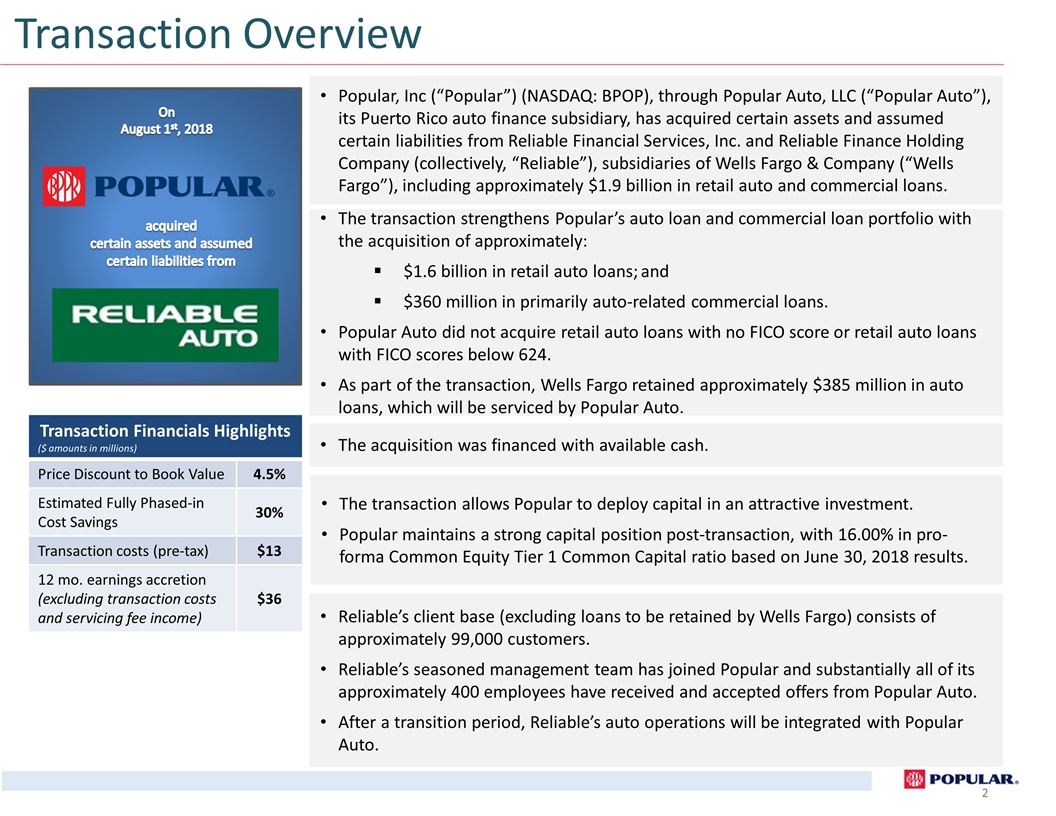

Transaction Overview On August 1st, 2018 acquired certain assets and assumed certain liabilities from Transaction Financials Highlights ($ amounts in millions) Price Discount to Book Value 4.5% Estimated Fully Phased-in Cost Savings 30% Transaction costs (pre-tax) $13 12 mo. earnings accretion (excluding transaction costs and servicing fee income) $36 Popular, Inc (“Popular”) (NASDAQ: BPOP), through Popular Auto, LLC (“Popular Auto”), its Puerto Rico auto finance subsidiary, has acquired certain assets and assumed certain liabilities from Reliable Financial Services, Inc. and Reliable Finance Holding Company (collectively, “Reliable”), subsidiaries of Wells Fargo & Company (“Wells Fargo”), including approximately $1.9 billion in retail auto and commercial loans. The transaction strengthens Popular’s auto loan and commercial loan portfolio with the acquisition of approximately: $1.6 billion in retail auto loans; and $360 million in primarily auto-related commercial loans. Popular Auto did not acquire retail auto loans with no FICO score or retail auto loans with FICO scores below 624. As part of the transaction, Wells Fargo retained approximately $385 million in auto loans, which will be serviced by Popular Auto. The acquisition was financed with available cash. The transaction allows Popular to deploy capital in an attractive investment. Popular maintains a strong capital position post-transaction, with 16.00% in pro-forma Common Equity Tier 1 Common Capital ratio based on June 30, 2018 results. Reliable’s client base (excluding loans to be retained by Wells Fargo) consists of approximately 99,000 customers. Reliable’s seasoned management team has joined Popular and substantially all of its approximately 400 employees have received and accepted offers from Popular Auto. After a transition period, Reliable’s auto operations will be integrated with Popular Auto.

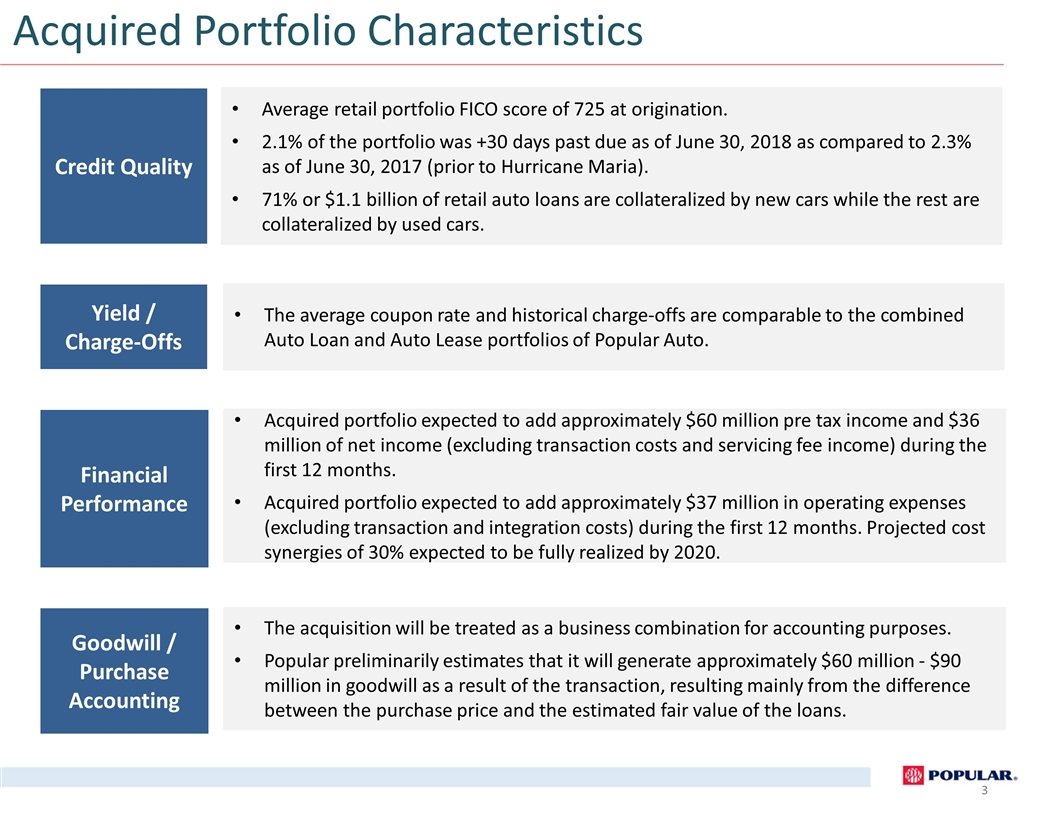

The average coupon rate and historical charge-offs are comparable to the combined Auto Loan and Auto Lease portfolios of Popular Auto. Yield / Charge-Offs Average retail portfolio FICO score of 725 at origination. 2.1% of the portfolio was +30 days past due as of June 30, 2018 as compared to 2.3% as of June 30, 2017 (prior to Hurricane Maria). 71% or $1.1 billion of retail auto loans are collateralized by new cars while the rest are collateralized by used cars. Credit Quality Acquired Portfolio Characteristics The acquisition will be treated as a business combination for accounting purposes. Popular preliminarily estimates that it will generate approximately $60 million - $90 million in goodwill as a result of the transaction, resulting mainly from the difference between the purchase price and the estimated fair value of the loans. Goodwill / Purchase Accounting Acquired portfolio expected to add approximately $60 million pre tax income and $36 million of net income (excluding transaction costs and servicing fee income) during the first 12 months. Acquired portfolio expected to add approximately $37 million in operating expenses (excluding transaction and integration costs) during the first 12 months. Projected cost synergies of 30% expected to be fully realized by 2020. Financial Performance

Investor Presentation Acquisition of Wells Fargo’s Auto Finance Business in Puerto Rico August 1st, 2018