Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Zoned Properties, Inc. | f8k0818_zonedproper.htm |

Exhibit 99.1

OTCQX: ZDPY I July 2018 Investor Presentation July 2018 | OTCQX: ZDPY A brand new EMERGING INDUSTRY “We are building for an industry that does not yet exist. It’s our responsibility to make sure it gets done right.” - Chairman & CEO; Bryan McLaren

1

FORWARD - LOOKING STATEMENTS This presentation release contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Readers are cautioned not to place undue reliance on these forward - looking statements . Actual results may differ materially from those indicated by these forward - looking statements as a result of risks and uncertainties impacting the Company's business including, increased competition ; the ability of the Company to expand its operations through either acquisitions or internal growth, to attract and retain qualified professionals, and to expand commercial relationships ; general economic conditions ; and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission . OTCQX: ZDPY I July 2018

2

ZONED PROPERTIES BUSINESS MODEL Our MISSION Our VISION Our VALUES To identify, develop and lease sophisticated, safe and sustainable properties in emerging industries. To be recognized for setting the standard in property development while increasing shareholder value and community prosperity. Integrity, Work Ethic, Transparency OTCQX: ZDPY I July 2018

3

ZONED PROPERTIES INDUSTRY LEADER OTCQX: ZDPY I July 2018

4

BUILDING VALUE & MITIGATING RISK • Strategic real estate development firm with property ownership and leasing focused on premium rental rates and triple - net (NNN), investment - grade leases. Lease terms of 10 - 20 years including personal guarantee. • Strategic development advisory services for clients with development projects in emerging industries, including the licensed medical marijuana industry. Targeting advisory fees equal to 10% of client’s gross revenues. • Positioned to benefit from growth in the licensed medical marijuana sector. • Solid balance sheet with $10.3M in assets and $2.2M in liabilities at March 31, 2018. • Delivering positive cash flow and quarterly net income. • Tight capital structure with 17.4 million shares outstanding, no warrants and 1.29 million options issued and outstanding. OTCQX: ZDPY I July 2018

5

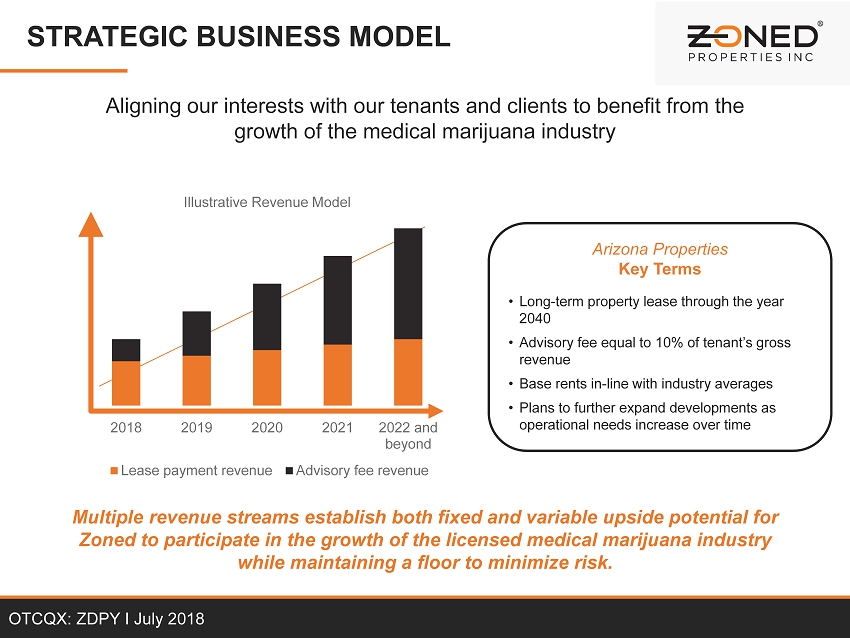

2018 2019 2020 2021 2022 and beyond Illustrative Revenue Model Lease payment revenue Advisory fee revenue STRATEGIC BUSINESS MODEL OTCQX: ZDPY I July 2018 Aligning our interests with our tenants and clients to benefit from the growth of the medical marijuana industry Arizona Properties Key Terms • Long - term property lease through the year 2040 • Advisory fee equal to 10% of tenant’s gross revenue • Base rents in - line with industry averages • Plans to further expand developments as operational needs increase over time Multiple revenue streams establish both fixed and variable upside potential for Zoned to participate in the growth of the licensed medical marijuana industry while maintaining a floor to minimize risk.

6

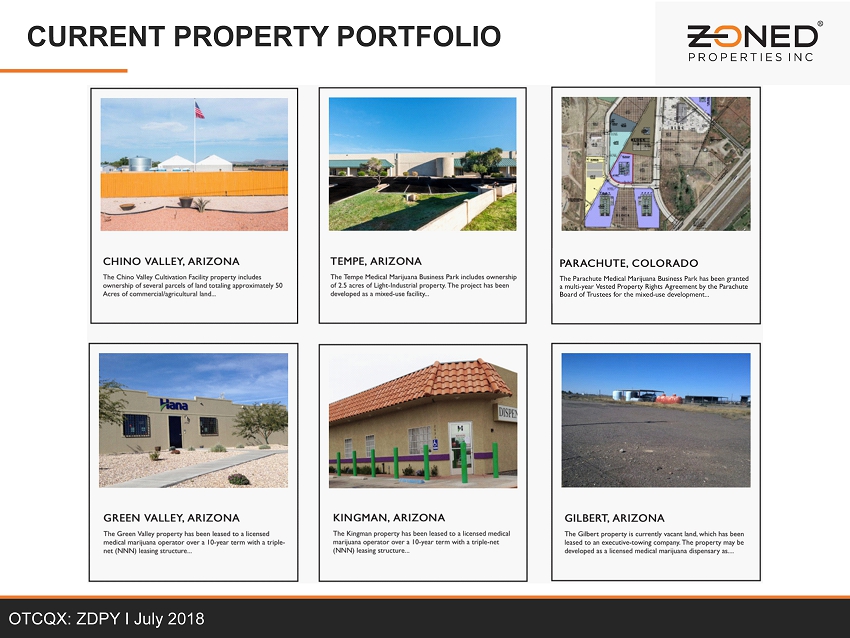

CURRENT PROPERTY PORTFOLIO OTCQX: ZDPY I July 2018

7

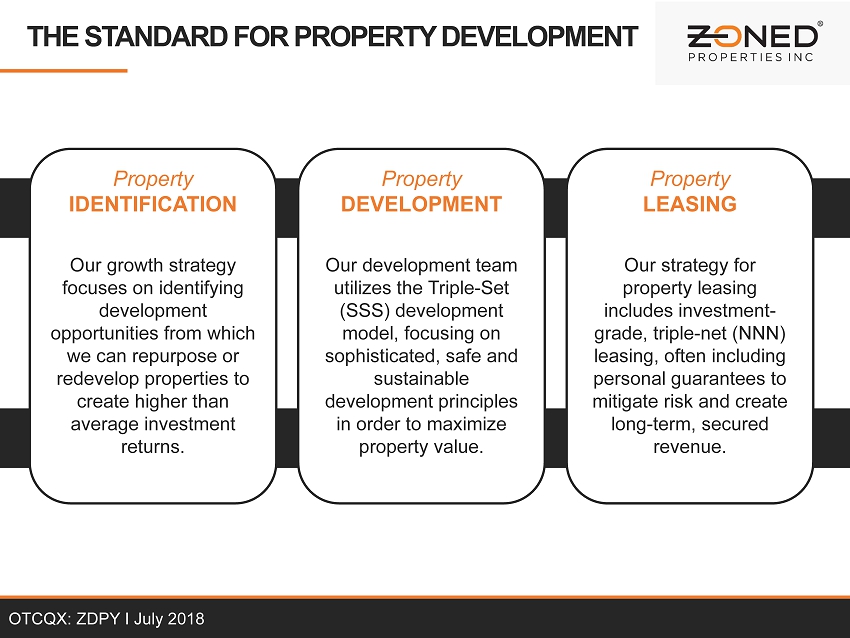

THE STANDARD FOR PROPERTY DEVELOPMENT Property IDENTIFICATION Our growth strategy focuses on identifying development opportunities from which we can repurpose or redevelop properties to create higher than average investment returns. Property DEVELOPMENT Our development team utilizes the Triple - Set (SSS) development model, focusing on sophisticated, safe and sustainable development principles in order to maximize property value. Property LEASING Our strategy for property leasing includes investment - grade, triple - net (NNN) leasing, often including personal guarantees to mitigate risk and create long - term, secured revenue. OTCQX: ZDPY I July 2018

8

PROPERTY IDENTIFICATION & DEVELOPMENT Large - scale development properties require implementation of sophisticated, safe and sustainable development principles for commercial construction and management. OTCQX: ZDPY I July 2018

9

PROPERTY IDENTIFICATION & DEVELOPMENT OTCQX: ZDPY I July 2018

10

STRATEGIC DEVELOPMENT ADVISORY SERVICES OTCQX: ZDPY I July 2018 Strategic Development Advisory Services provide clients with comprehensive due diligence, organizational assessment and master planning for each development property.

11

STRATEGIC DEVELOPMENT ADVISORY SERVICES OTCQX: ZDPY I July 2018

12

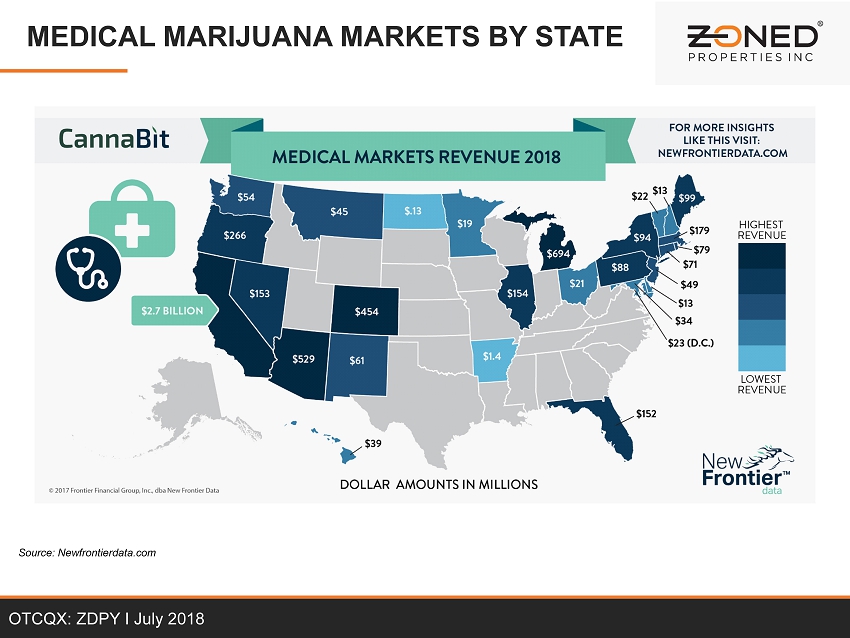

MEDICAL MARIJUANA MARKETS BY STATE OTCQX: ZDPY I July 2018 Source: Newfrontierdata.com

13

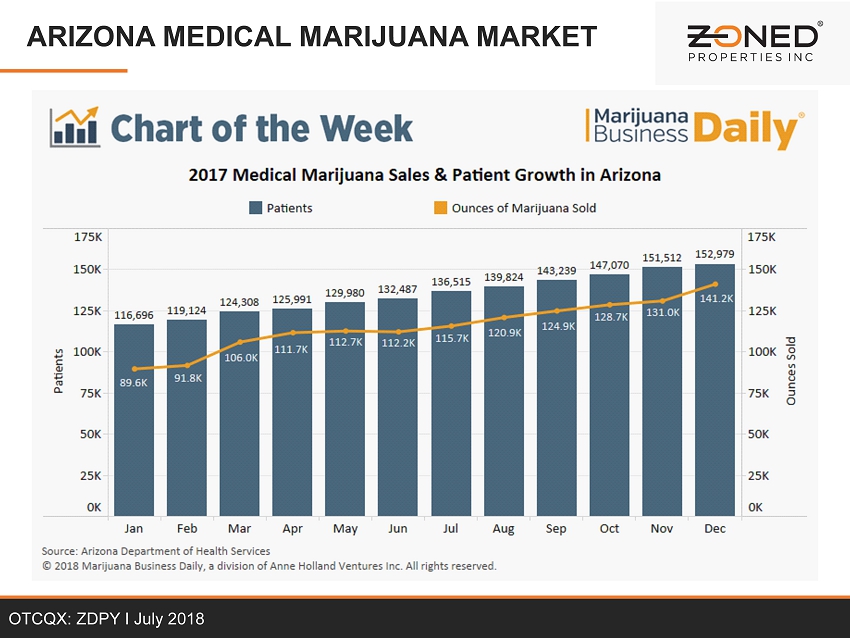

ARIZONA MEDICAL MARIJUANA MARKET OTCQX: ZDPY I July 2018

14

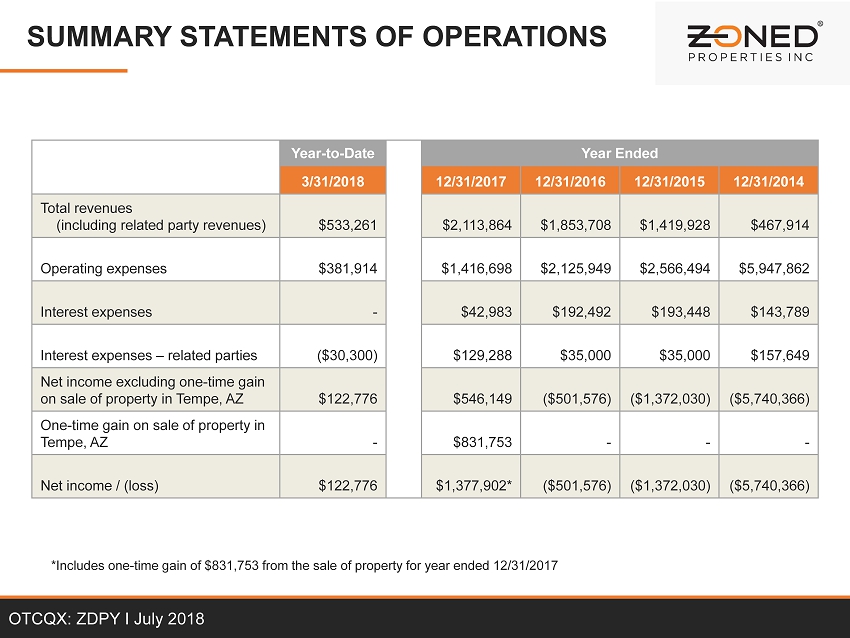

SUMMARY STATEMENTS OF OPERATIONS Year - to - Date Year Ended 3/31/2018 12/31/2017 12/31/2016 12/31/2015 12/31/2014 Total revenues (including related party revenues) $533,261 $2,113,864 $1,853,708 $1,419,928 $467,914 Operating expenses $381,914 $1,416,698 $2,125,949 $2,566,494 $5,947,862 Interest expenses - $42,983 $192,492 $193,448 $143,789 Interest expenses – related parties ($30,300) $129,288 $35,000 $35,000 $157,649 Net income excluding one - time gain on sale of property in Tempe, AZ $122,776 $546,149 ($501,576) ($1,372,030) ($5,740,366) One - time gain on sale of property in Tempe, AZ - $831,753 - - - Net income / (loss) $122,776 $1,377,902* ($501,576) ($1,372,030) ($5,740,366) *Includes one - time gain of $831,753 from the sale of property for year ended 12/31/2017 OTCQX: ZDPY I July 2018

15

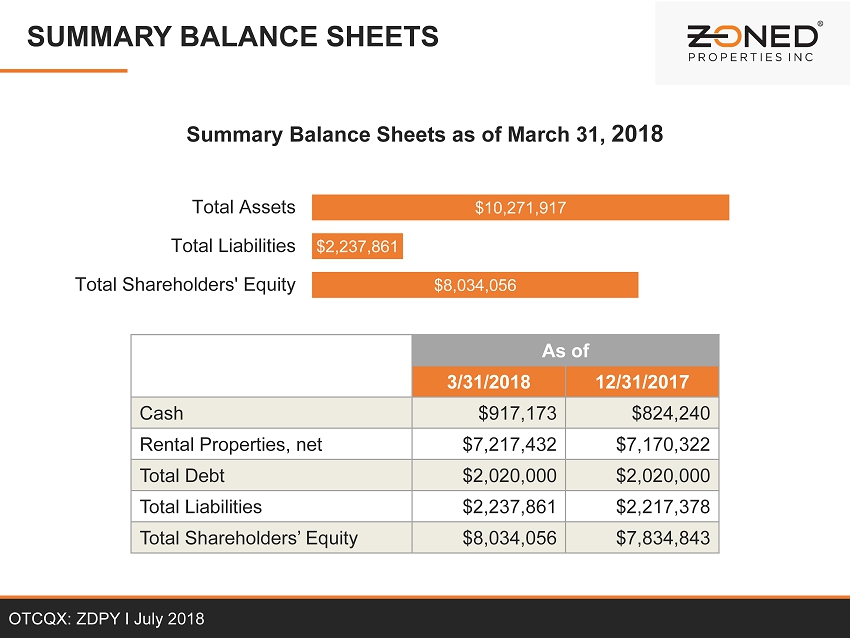

SUMMARY BALANCE SHEETS As of 3/31/2018 12/31/2017 Cash $917,173 $824,240 Rental Properties, net $7,217,432 $7,170,322 Total Debt $2,020,000 $2,020,000 Total Liabilities $2,237,861 $2,217,378 Total Shareholders’ Equity $8,034,056 $7,834,843 $8,034,056 $2,237,861 $10,271,917 Total Shareholders' Equity Total Liabilities Total Assets Summary Balance Sheets as of March 31, 2018 OTCQX: ZDPY I July 2018

16

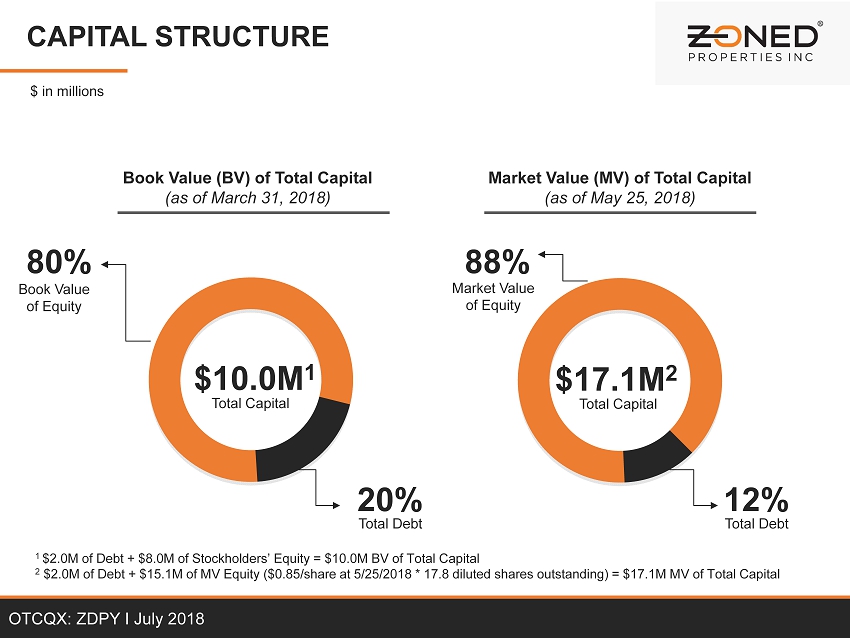

CAPITAL STRUCTURE OTCQX: ZDPY I July 2018 Book Value (BV) of Total Capital (as of March 31, 2018) Market Value (MV) of Total Capital (as of May 25, 2018) 1 $2.0M of Debt + $8.0M of Stockholders’ Equity = $10.0M BV of Total Capital 2 $2.0M of Debt + $15.1M of MV Equity ($ 0.85/share at 5/25/2018 * 17.8 diluted shares outstanding) = $17.1M MV of Total Capital Total Capital Total Capital Book Value of Equity Total Debt Market Value of Equity Total Debt 88% 12% 80% 20% $10.0M 1 $ 17.1M 2 $ in millions

17

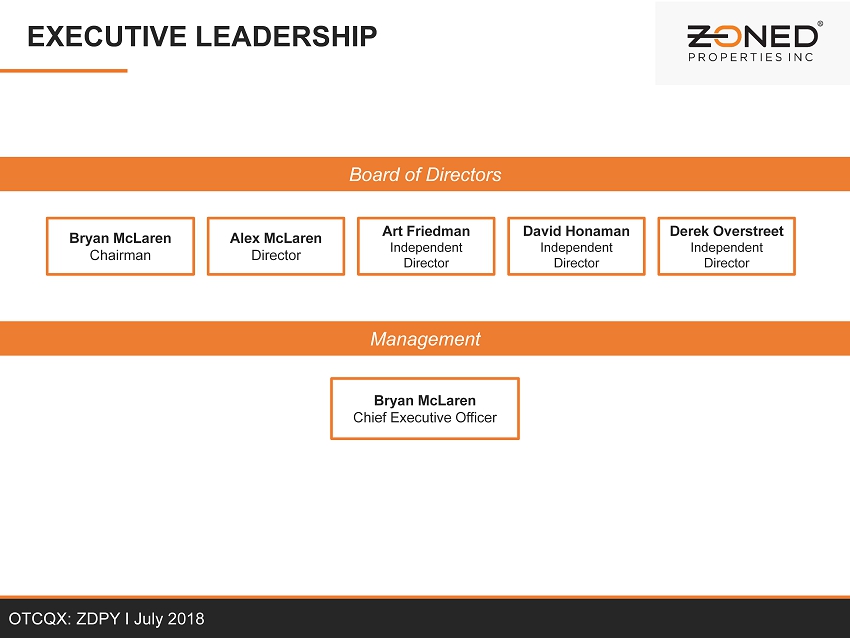

David Honaman Independent Director EXECUTIVE LEADERSHIP OTCQX: ZDPY I July 2018 Bryan McLaren Chief Executive Officer Management Board of Directors Bryan McLaren Chairman Alex McLaren Director Art Friedman Independent Director Derek Overstreet Independent Director

18

FOR MORE INFORMATION OTCQX: ZDPY I July 2018 COMPANY CONTACT Bryan McLaren , Chairman & CEO Zoned Properties, Inc. Scottsdale, AZ Tel 877.360.8839 l www.zonedproperties.com INVESTOR RELATIONS Brett Maas , Managing Partner Hayden IR Tel 646.536.7331 l www.haydenir.com

19