Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UGI CORP /PA/ | ugijun2018ex991.htm |

| 8-K - 8-K - UGI CORP /PA/ | ugijun2018er8k.htm |

Fiscal Third Quarter Results August 2, 2018 John L. Walsh President & CEO, UGI Corporation Ted J. Jastrzebski Chief Financial Officer, UGI Corporation Jerry E. Sheridan President & CEO, AmeriGas Partners 1

About This Presentation This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and future legal proceedings, continued analysis of recent tax legislation, liability for uninsured claims and for claims in excess of insurance coverage, domestic and international political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East, and foreign currency exchange rate fluctuations (particularly the euro), changes in Marcellus Shale gas production, the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our business, our ability to successfully integrate acquired businesses and achieve anticipated synergies, and the interruption, disruption, failure, malfunction, or breach of our information technology systems, including due to cyber-attack. UGI undertakes no obligation to release revisions to its forward- looking statements to reflect events or circumstances occurring after today. In addition, this presentation uses certain non-GAAP financial measures. Please see the appendix for reconciliations of these measures to the most comparable GAAP financial measure. UGI Corporation | Fiscal 2018 Third Quarter Results 2

Third Quarter Recap John L. Walsh President & CEO, UGI 3

Q3 Earnings Recap • Underlying performance of businesses Adjusted EPS remained strong • Q3 2018 includes a $0.09 reserve for tax savings at the Utility $0.09 $0.09 • Excluding reserve, Adjusted EPS nearly doubled results from Q3 2017 Expect full-year Adjusted EPS to be within current guidance range of $2.70 - $2.80 Q3 2017 Q3 2018 UGI Corporation | Fiscal 2018 Third Quarter Results Adjusted EPS is a non-GAAP measure. See Appendix for reconciliation. 4

Third Quarter Overview • Gas Utility has added over 11,000 new residential and commercial heating customers YTD and remains on pace with its infrastructure replacement program • Sunbury and Texas Creek projects contributed positively this quarter; continue to benefit from our diverse asset network in the Marcellus • AmeriGas benefited from cold weather as adjusted EBITDA increased 15% over Q3 2017; National Accounts delivered another strong quarter as volumes increased 11% over Q3 2017 • UGI International delivered another very strong quarter; DVEP and UniverGas have contributed positively to earnings YTD and are great examples of investments that “push the boundaries” UGI Corporation | Fiscal 2018 Third Quarter Results Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation. 5

Third Quarter Financial Review Ted J. Jastrzebski Chief Financial Officer, UGI 6

Q3 Adjusted Earnings Q3 2017 Q3 2018 ($ millions, except per share amounts) Net (loss) income attributable to UGI Corporation (GAAP) $(19.0) $52.4 Net loss (gains) on commodity derivative instruments1 19.8 (38.0) Unrealized losses (gains) on foreign currency derivative instruments1 10.5 (17.7) Integration expenses associated with Finagaz1 4.6 4.6 Impairment of Heritage tradenames and trademarks1 - 14.5 Loss on extinguishment of debt 1 0.7 - Impact from change in French tax rate - 0.1 Impact from Tax Cuts and Jobs Act - (0.8) Adjusted net income attributable to UGI Corporation $16.6 $15.1 Q3 2017 Q3 2018 UGI Corporation – Diluted (Loss) Earnings Per Share (GAAP) $(0.11) $0.30 Net loss (gains) on commodity derivative instruments2 0.10 (0.21) Unrealized losses (gains) on foreign currency derivative instruments2 0.06 (0.10) Integration expenses associated with Finagaz 0.03 0.02 Impairment of Heritage tradenames and trademarks - 0.08 Loss on extinguishment of debt 0.01 - Impact from change in French tax rate - - Impact from Tax Cuts and Jobs Act - - Adjusted diluted earnings per share3 $0.09 $0.09 1 Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates 7 UGI Corporation | Fiscal 2018 Third Quarter Results 2 Includes the effects of rounding 3 Adjusted diluted earnings per share for Q3 2017 is based upon fully diluted shares of 177.298 million

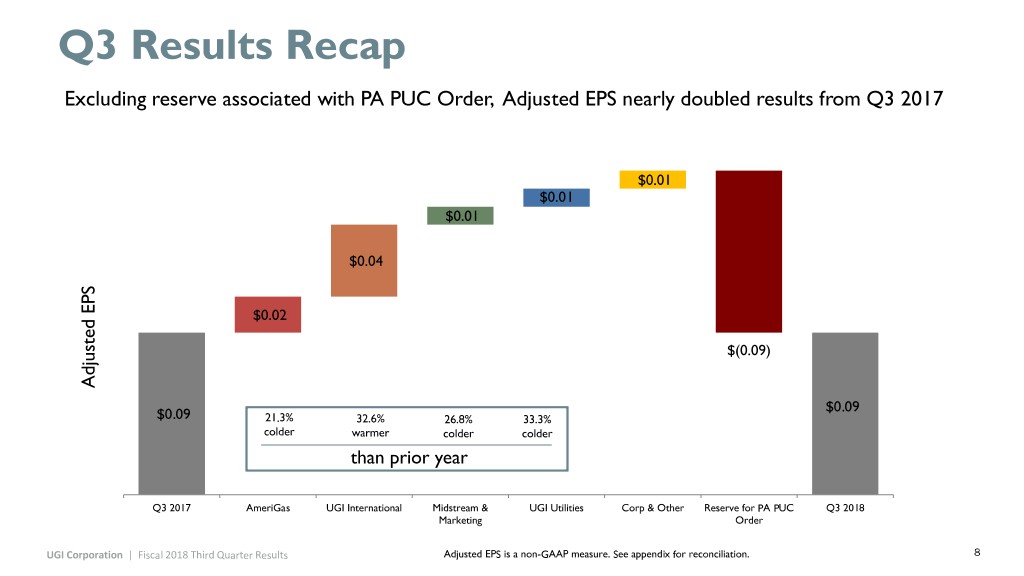

Q3 Results Recap Excluding reserve associated with PA PUC Order, Adjusted EPS nearly doubled results from Q3 2017 $0.01 $0.01 $0.01 $0.04 $0.02 $(0.09) Adjusted EPS Adjusted $0.09 $0.09 21.3% 32.6% 26.8% 33.3% colder warmer colder colder than prior year Q3 2017 AmeriGas UGI International Midstream & UGI Utilities Corp & Other Reserve for PA PUC Q3 2018 Marketing Order UGI Corporation | Fiscal 2018 Third Quarter Results Adjusted EPS is a non-GAAP measure. See appendix for reconciliation. 8

PA PUC Order • On May 17, 2018 the PA PUC required utilities to establish a Impact of PA PUC Order regulatory liability for tax benefits Period Relates to Revenue After-tax st th Recorded (period) Reduction earnings EPS Impact for the period Jan.1 – June 30 impact • Result of federal tax rate change Q2 Q2 $1.4mm $0.9mm < $(0.01) from 35% to 21% due to the Tax Q3 Q2 $20.9mm $14.9mm $(0.08) Cuts and Jobs Act Q3 Q3 $1.8mm $1.3mm $(0.01) • The rate treatment of the regulatory liability will be addressed in a future proceeding UGI Corporation | Fiscal 2018 Third Quarter Results 9

Financial Results – AmeriGas Weather versus normal ($ millions) Q3 2017 Q3 2018 colder Adjusted EBITDA $58.4 Retail Margin 13.0 Total Wholesale and Other Total Margin 0.9 margin Partnership Operating and Administrative Expenses (5.0) (9.6)% 9.6% Other Income, net (0.1) Adjusted EBITDA $67.2 (9.6)% Q3 2017 Q3 2018 Item Primary Drivers warmer Volume ↑ Cold weather in April Total Margin ↑ Higher retail volumes and slightly higher retail unit margins 21.3% colder than prior year Operating and Admin Expenses ↑ Excluding the effects of $7.5 million MGP accrual in 2017, expenses increased slightly; higher compensation and vehicle expenses; lower self-insured casualty and liability expense driven primarily by the absence of a settlement with an insurance carrier recorded in Q3 2017 UGI Corporation | Fiscal 2018 Third Quarter Results Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation. 10

Financial Results – UGI International ($ millions) Q3 2017 Q3 2018 Weather versus Loss Before Taxes $(5.2) normal Total Margin 46.2 colder Operating and Administrative Expenses (32.2) Depreciation and Amortization (8.7) Interest Expense 0.1 Other Income, net 2.8 Q3 2017 Q3 2018 Income Before Taxes $3.0 -7.4% -6.2% (2.7)% (34.6)% Integration Expenses 7.0 7.6 Adjusted Income Before Taxes $1.8 $10.6 Item Primary Drivers LPG Volume ↑ Acquisition of UniverGas in Italy and carry-over effects of cold late-March warmer weather in France 32.6% warmer Total Margin ↑ Higher LPG unit margins, stronger Fx rates, and incremental margin from than prior year acquisitions Operating and Admin Expenses ↑ Stronger Fx rates, incremental expenses from acquisitions, slightly higher distribution costs and higher compliance costs Other Income, net ↑ Gain on sales of assets and interest income 11 UGI Corporation | Fiscal 2018 Third Quarter Results Adjusted Income Before Taxes is a non-GAAP measure.

Financial Results – Midstream & Marketing Weather versus ($ millions) Q3 2017 Q3 2018 normal Income Before Taxes $3.3 colder Total Margin 15.4 Operating and Administrative Expenses (7.3) Depreciation and Amortization (2.3) Interest Expense (0.2) (17.1)% 5.1% Other Income, net (0.7) Income Before Taxes $8.2 Item Primary Drivers Total Margin ↑ Higher capacity management, peaking, gathering and generation total margins Q3 2017 Q3 2018 warmer Operating and Admin Expenses ↑ Higher compensation and benefit expenses and greater peaking and gathering activities related to new investments and expanded activities 26.8% colder than Other Income, net ↓ Absence of AFUDC income associated with Sunbury prior year UGI Corporation | Fiscal 2018 Third Quarter Results 12

Financial Results – Utilities ($ millions) Q3 2017 Q3 2018 Gas Utility weather versus Income Before Taxes $17.5 normal 1 Total Margin 15.4 colder Impact of PA PUC Order (22.7) Operating and Administrative Expenses (6.9) Depreciation and Amortization (3.5) Interest Expense 0.1 (21.2)% 5.1% Other Income, net (6.0) (21.2)% Loss Before Taxes $(6.1) Item Primary Drivers Volume ↑ Core market throughput higher due to colder weather and customer growth Q3 2017 Q3 2018 warmer Total Margin ↑ PA PUC Order; higher core market throughput, increase in PNG base rates and higher large firm delivery service total margin 33.3% colder than Operating and Admin Expenses ↑ Higher IT maintenance and consulting expense, higher uncollectible accounts prior year expense, and higher distribution systems expenses Depreciation and Amortization ↑ Increased capital expenditure activity Other Income, net ↓ Q3 2017 includes income from environmental insurance settlement of $5.8 million UGI Corporation | Fiscal 2018 Third Quarter Results 1Total Margin excludes $22.7mm revenue reduction required by the PA PUC for tax savings resulting from 13 federal tax change from 35% to 21%. Including the revenue reduction, Total Margin for Q3 2018 is $(7.3)

AmeriGas Third Quarter Recap Jerry E. Sheridan President & CEO, AmeriGas AmeriGas 14

AmeriGas Q3 2018 Earnings Recap Adjusted EBITDA1 • Adjusted EBITDA increased 15% compared to Q3 2017 75 $185.1 ($ in millions) $67.2 • Volume up 4% due to cold and wet April weather 65 $551.2 $58.4 • Unit margins up slightly despite average costs at Mt. 55 Belvieu that were ~40% higher than prior year 45 • Propane costs stable throughout the quarter • 35 Operating expenses up 1% due to increased volume & higher delivery activity after adjusting for MGP accrual 25 Q3 2017 Q3 2018 Expected Q4 Adjusted EBITDA FY18 Guidance Range (August 2, 2018) $40 – 50 million $610 - $620 million Adjusted EBITDA1 Adjusted EBITDA1 UGI Corporation | Fiscal 2018 Third Quarter Results 1Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation. 15

Growth Initiatives Cylinder Exchange • Volume flat vs. Q3 2017; up 7% YTD • Total locations up 6% vs. Q3 2017 National Accounts • Volume was up 11% vs. Q3 2017 due to April weather • YTD volume up 12% vs. Q3 2017 Q3 Acquisitions • Acquired a business that is expected to add 3 million gallons annually UGI Corporation | Fiscal 2018 Third Quarter Results 16

ConclusionInvestor Relations: and Q&A WillJohn Ruthrauff L. Walsh Brendan Heck 610President-456-6571 & CEO, UGI 610-456-6608 ruthrauffw@ugicorp.com heckb@ugicorp.com 17

Key Growth Drivers Natural Gas Infrastructure LPG and International • Continue to identify and develop broad range of • Focus on National Accounts continues to fuel new investments as demand for natural gas volume growth continues to grow • PennEast – Working through permit • Innovative strategies to improve the experience process for ACE customers • Bethlehem LNG –2mm gallons of LNG • European LPG distribution business continues to storage and new vaporization capacity grow • Gas Utility capital spend to exceed $350mm for • Growth through acquisitions FY 2018 • Pipeline replacement and betterment • Continue to develop and expand natural gas and • Tools to enhance safety and customer power marketing position service • DVEP acquisition UGI Corporation | Fiscal 2018 Third Quarter Results 18

Q&A 19

APPENDIX 20

UGI Supplemental Footnotes • Management uses "adjusted net income attributable to UGI" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. For the periods presented, adjusted net income attributable to UGI is net income attributable to UGI Corporation after excluding net after-tax gains and losses on commodity and certain foreign currency derivative instruments not associated with current period transactions (principally comprising changes in unrealized gains and losses on derivative instruments), Finagaz integration expenses, losses associated with extinguishments of debt and the impact on net deferred tax liabilities from a change in French corporate income tax rate and U.S. tax reform legislation, and impairment of Partnership tradenames and trademarks. Volatility in net income at UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP"). • Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impact of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current- period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. • The following tables on the following slides reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above. UGI Corporation | Fiscal 2018 Third Quarter Results 21

UGI Adjusted Net Income and EPS Quarter Ended June 30, 2018 AmeriGas UGI Midstream & Corporate & Total UGI Utilities (Millions of dollars, except per share) Propane International Marketing Other Adjusted net income attributable to UGI Corporation: Net income (loss) attributable to UGI Corporation $ 52.4 $ (11.2) $ 6.5 $ 5.8 $ (3.0) $ 54.3 Net gains on commodity derivative instruments not associated with current-period transactions (net of tax of (38.0) — — — — (38.0) $16.5) (a) Unrealized gains on foreign currency derivative instruments (17.7) — — — — (17.7) (net of tax of $8.4) (a) Integration expenses associated with Finagaz (net of tax of 4.6 — 4.6 — — — $(3.0)) (a) Impairment of Heritage tradenames and trademarks (net of 14.5 14.5 — — — — tax $(5.8)) (a) Impact of French Finance Bill 0.1 — 0.1 — — — Impact from Tax Cuts and Jobs Act (0.8) (0.2) (0.5) 0.5 (1.1) 0.5 Adjusted net income (loss) attributable to UGI Corporation $ 15.1 $ 3.1 $ 10.7 $ 6.3 $ (4.1) $ (0.9) Adjusted diluted earnings per share: UGI Corporation earnings (loss) per share - diluted $ 0.30 $ (0.06) $ 0.04 $ 0.03 $ (0.02) $ 0.31 Net gains on commodity derivative instruments not (0.21) — — — — (0.21) associated with current-period transactions (b) Unrealized gains on foreign currency derivative instruments (0.10) — — — — (0.10) Integration expenses associated with Finagaz (b) 0.02 — 0.02 — — — Impairments of Heritage tradenames and trademarks 0.08 0.08 — — — — Impact of French Finance Bill — — — — — — Impact from Tax Cuts and Jobs Act — — — — — — Adjusted diluted earnings (loss) per share $ 0.09 $ 0.02 $ 0.06 $ 0.03 $ (0.02) $ - (a) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates. (b) Includes the effects of rounding associated with per share amounts. UGI Corporation | Fiscal 2018 Third Quarter Results 22

UGI Adjusted Net Income and EPS Midstream Quarter Ended June 30, 2017 AmeriGas UGI Corporate Total & UGI Utilities (Millions of dollars except per share) Propane International & Other Marketing Adjusted net income attributable to UGI Corporation: Net income (loss) attributable to UGI Corporation $ (19.0) $ (1.4) $ (2.0) $ 3.0 $ 10.7 $ (29.3) Net losses on commodity derivative instruments not associated with current-period transactions (net of tax of 19.8 — — — — 19.8 $(12.6)) (a) Unrealized losses on foreign currency derivative 10.5 — — — — 10.5 instruments (net of tax of $(5.5)) (a) Loss on extinguishments of debt (net of tax of $(0.4)) (a) 0.7 0.7 — — — — Integration expenses associated with Finagaz (net of tax 4.6 — 4.6 — — — of $(2.4)) (a) Adjusted net income (loss) attributable to UGI $ 16.6 $ (0.7) $ 2.6 $ 3.0 $ 10.7 $ 1.0 Corporation Adjusted diluted earnings per share: UGI Corporation earnings (loss) per share - diluted $ (0.11) $ (0.01) $ (0.01) $ 0.02 $ 0.06 $ (0.17) Net losses on commodity derivative instruments not 0.10 — — — — 0.10 associated with current-period transactions Unrealized losses on foreign currency derivative 0.06 — — — — 0.06 instruments (b) Loss on extinguishments of debt 0.01 0.01 — — — — Integration expenses associated with Finagaz 0.03 — 0.03 — — — Adjusted diluted earnings (loss) per share (c) $ 0.09 $ — $ 0.02 $ 0.02 $ 0.06 $ (0.01) (a) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates. (b) Includes the effects of rounding. (c) Adjusted diluted earnings per share for the three months ended June 30, 2017 are based upon fully diluted shares of 177.298 million UGI Corporation | Fiscal 2018 Third Quarter Results 23

AmeriGas Supplemental Footnotes • The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income. • EBITDA and Adjusted EBITDA are not measures of performance or financial condition under GAAP. Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies. • EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year- over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and amortization, gains and losses on commodity derivative instruments not associated with current-period transactions, and other gains and losses that competitors do not necessarily have from Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant periods. Management also uses Adjusted EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's Adjusted EBITDA to assess the profitability of the Partnership, which is one of UGI Corporation’s business segments. UGI Corporation discloses the Partnership's Adjusted EBITDA as the profitability measure for its domestic propane segment. UGI Corporation | Fiscal 2018 Third Quarter Results 24

AmeriGas EBITDA and Adjusted EBITDA (Millions of dollars) Quarter Ended June 30, 2018 2017 EBITDA and Adjusted EBITDA Net loss attributable to AmeriGas Partners $ (74.4) $ (46.8) Income tax expense (a) 0.7 0.6 Interest expense 40.4 40.6 Depreciation 36.0 35.5 Amortization 10.4 10.7 EBITDA 13.1 40.6 (Subtract net gains) add net losses on commodity derivative instruments not associated with current-period transactions (20.3) 6.0 Loss on extinguishments of debt - 4.4 MGP environmental accrual - 7.5 Impairment of Heritage tradenames and trademarks 75.0 - Noncontrolling interest in net losses on commodity derivative instruments, impairment of tradenames and trademarks and MGP accrual (a) (0.6) (0.1) Adjusted EBITDA $ 67.2 $ 58.4 (a) Includes the impact of rounding. UGI Corporation | Fiscal 2018 Third Quarter Results 25

Investor Relations: Brendan Heck 610-456-6608 heckb@ugicorp.com 26