Attached files

| file | filename |

|---|---|

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990106-30x2018.htm |

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k06-30x2018.htm |

Second Quarter 2018 Earnings Conference Call August 2, 2018

Safe Harbor Statement This presentation includes statements that are forward-looking statements made pursuant to the safe harbor provisions of the Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding 2018 earnings guidance, including statements regarding the impact of the Tax Cuts and Jobs Act of 2017 (the “TCJA”); statements regarding expected capital expenditures; statements regarding expected dividends; statements regarding the anticipated impact of ASU 2016-01; and statements regarding the adequacy of our liquidity to meet cash requirements. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Additional information concerning factors that could cause actual results to differ materially from those expressed in forward- looking statements is contained in El Paso Electric Company’s (“EE” or the “Company”) most recently filed periodic reports and in other filings made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and include, but is not limited to: The impact of the TCJA and other U.S. tax reform legislation Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies, including distributed generation Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant Unanticipated maintenance, repair, or replacement costs for generation, transmission, or distribution facilities and the recovery of proceeds from insurance policies providing coverage for such costs The size of our construction program and our ability to complete construction on budget and on time Potential delays in our construction schedule due to legal challenges or other reasons Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the Internal Revenue Service or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Actions by credit rating agencies Possible physical or cyber-attacks, intrusions or other catastrophic events Other factors of which we are currently unaware or deem immaterial EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date of this presentation, and EE does not undertake to update any forward-looking statement contained herein. 2

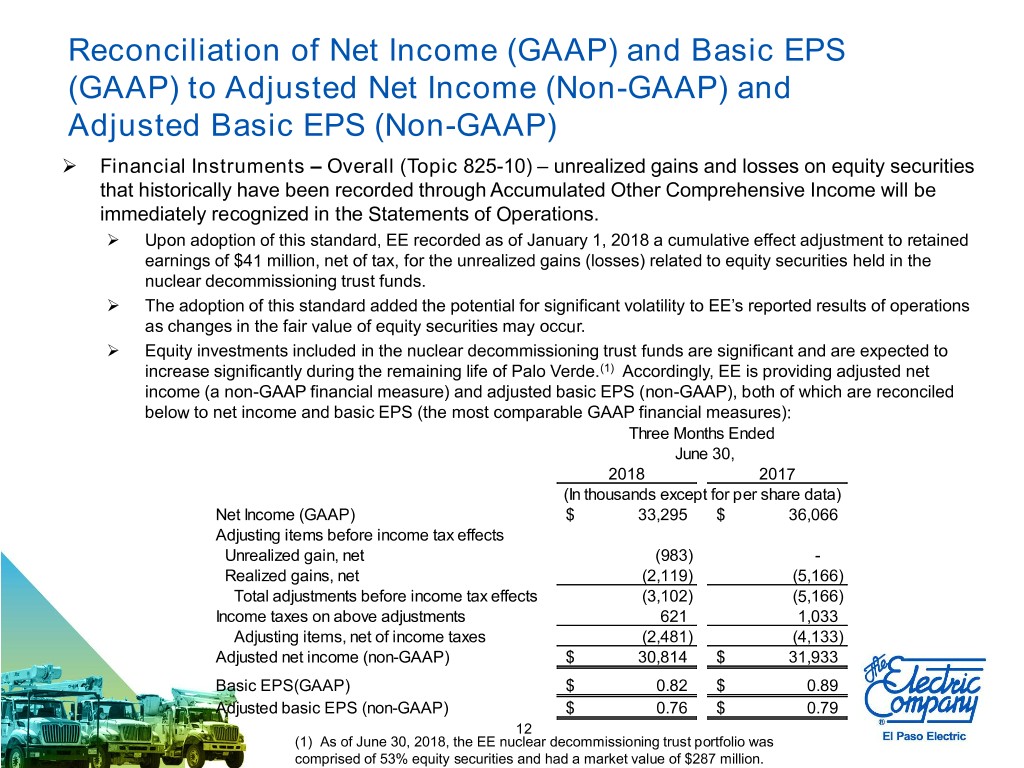

Use of Non-GAAP Financial Measures As required by a new accounting standard, changes in the fair value of equity securities are now recognized in EE’s Statements of Operations. The adoption of the new standard added the potential for significant volatility to the reported results of operations as changes in the fair value of equity securities may occur. Accordingly, in addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), EE has provided adjusted net income and adjusted basic earnings per share, both of which are non-GAAP financial measures. Management believes that providing this additional information is useful to investors in understanding EE’s core operating performance because each measure removes the effects of variances that are not indicative of fundamental changes in the earnings capacity of EE. Adjusted net income and adjusted basic earnings per share are calculated by excluding the impact of changes in fair value from EE’s equity securities and realized gains (losses) from the sale of both equity and fixed income securities. Adjusted net income and adjusted basic earnings per share are not measures of financial performance under GAAP and should not be considered as an alternative to net income and earnings per share, respectively. Further, EE’s presentation of any non- GAAP financial measure may not be comparable to similarly titled measures used by other companies. Please refer to slide 12 of this presentation for a reconciliation of adjusted net income and adjusted basic earnings per share to the most directly comparable financial measures, net income and earnings per share, respectively, prepared in accordance with GAAP. 3

2nd Quarter and YTD Financial Results GAAP – 2nd Quarter 2018 net income of $33.3 million (or $0.82 per basic share), compared to 2nd Quarter 2017 net income of $36.1 million (or $0.89 per basic share) Non-GAAP – 2nd Quarter 2018 adjusted net income of $30.8 million (or $0.76 per basic share), compared to 2nd Quarter 2017 adjusted net income of $31.9 million (or $0.79 per basic share)(1) GAAP – 2018 YTD net income of $26.3 million (or $0.65 per basic share), compared to 2017 YTD net income of $32.1 million (or $0.79 per basic share) Non-GAAP – 2018 YTD adjusted net income of $25.9 million (or $0.64 per basic share), compared to 2017 YTD adjusted net income of $26.2 million (or $0.65 per basic share)(1) (1) Adjusted net income and adjusted basic earnings per share are non-GAAP financial measures that reflect net income and basic earnings per share, respectively (the most comparable GAAP financial measures) adjusted to exclude the impact of changes in fair value of EE’s equity securities and realized gains (losses) from the sale of both equity and fixed income securities held in the nuclear decommissioning trust funds. Refer to slide 12 for a reconciliation of adjusted net income and adjusted basic earnings per share (non-GAAP) to net income and basic earnings per share, respectively (the comparable GAAP financial measure). 4

Generation Initiatives Recently implemented a comprehensive program to better evaluate and improve the generation fleet reliability, which resulted in higher outage costs in the second quarter The program is aimed at shoring up our existing generation resources Program is intended to reduce O&M costs over the long- term 5

Recent Highlights On May 24, 2018, increased the quarterly cash dividend to $0.36 per share from $0.335 per share On June 28, 2018, EE: Issued $125 million of 4.22% senior notes due August 15, 2028 Guaranteed the issuance by Rio Grande Resources Trust of $65 million of 4.07% senior notes due August 15, 2025 The net proceeds were used to repay borrowings under the revolving credit facility Achieved a new kWh sales record for Q2, which was 4.2% higher than the previous record for a second quarter Continuing to progress on large scale solar projects: The Holloman Air Force Base Solar Facility (5MW) is nearing completion and is expected to be commercially operational in Q3 2018 Seeking regulatory approvals for: New Mexico Community Solar Facility (2 MW) Expansion of the Texas Community Solar Program (2 MW) 6

Corporate Sustainability Report EE will release first Corporate Sustainability Report today Demonstrates commitment to transparency and improvement with regard to environmental, social, and governance sustainability performance Part of a collaborative effort designed to support the transition to a lower carbon and increasingly sustainable energy future 7

Economic Growth El Paso-based Hunt Companies and WestStar Bank held a groundbreaking in June to begin construction on an 18-story $85 million office tower in Downtown El Paso Number of downtown hotels and hotel rooms is expected to double by year-end 2018 over 2015 levels El Paso area school districts have started construction on approximately $500 million in planned capital improvements Texas Department of Transportation project review with the city of El Paso includes approximately $430 million of planned transportation improvement projects El Paso City Council voted in May to approve $94 million in capital improvements 8

Smart Community Initiatives Engaging regional stakeholders on smart community initiatives, including the possibility of investing in Advanced Metering Infrastructure Allows customers to better integrate current and future advanced technologies Allows EE to: Take advantage of technology to enhance grid resiliency and operations Expand customer services, such as smart pricing options, high usage alerts, online energy management, preventive maintenance, and potential low-income customer benefits In Texas, hope to seek legislative clarification in the first half of 2019 and then begin seeking required regulatory approvals in Texas and New Mexico in 2020 9

All-Source Request for Proposals (RFP) Issued an all-source RFP on June 30, 2017 for 50 MW of capacity by 2022 and an additional 320 MW of capacity by 2023 Continue to evaluate the proposals received in response to the RFP and anticipate reaching a final decision in late 2018 Conducting additional analysis due to the complexities of options and technological advances Additional analysis to assist with regulatory approvals and to ensure we select the best resources to complement our current generation fleet and benefit customers Deployment of resources should not be impacted by the change in the timeline Seek regulatory approval as necessary with the Public Utility Commission of Texas (PUCT) and the New Mexico Public Regulation Commission (NMPRC) Capital expenditures are subject to change until a final decision is made and regulatory approvals are obtained 10

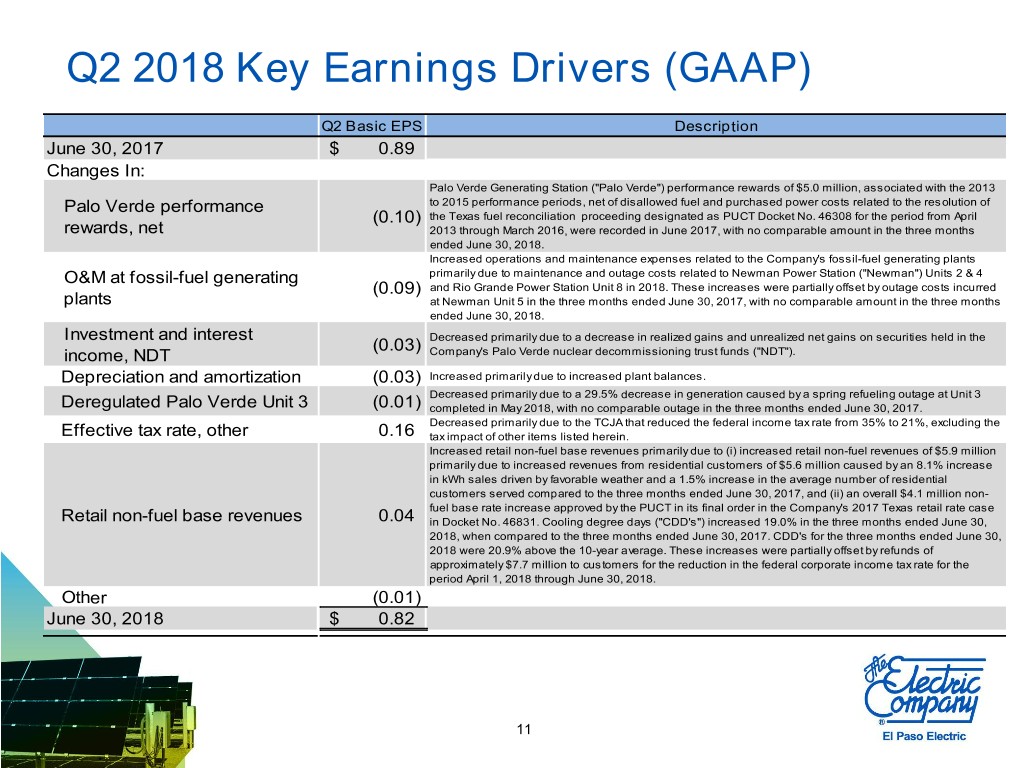

Q2 2018 Key Earnings Drivers (GAAP) Q2 Basic EPS Description June 30, 2017 $ 0.89 Changes In: Palo Verde Generating Station ("Palo Verde") performance rewards of $5.0 million, associated with the 2013 Palo Verde performance to 2015 performance periods, net of disallowed fuel and purchased power costs related to the resolution of (0.10) the Texas fuel reconciliation proceeding designated as PUCT Docket No. 46308 for the period from April rewards, net 2013 through March 2016, were recorded in June 2017, with no comparable amount in the three months ended June 30, 2018. Increased operations and maintenance expenses related to the Company's fossil-fuel generating plants O&M at fossil-fuel generating primarily due to maintenance and outage costs related to Newman Power Station ("Newman") Units 2 & 4 (0.09) and Rio Grande Power Station Unit 8 in 2018. These increases were partially offset by outage costs incurred plants at Newman Unit 5 in the three months ended June 30, 2017, with no comparable amount in the three months ended June 30, 2018. Investment and interest Decreased primarily due to a decrease in realized gains and unrealized net gains on securities held in the (0.03) income, NDT Company's Palo Verde nuclear decommissioning trust funds ("NDT"). Depreciation and amortization (0.03) Increased primarily due to increased plant balances. Decreased primarily due to a 29.5% decrease in generation caused by a spring refueling outage at Unit 3 Deregulated Palo Verde Unit 3 (0.01) completed in May 2018, with no comparable outage in the three months ended June 30, 2017. Decreased primarily due to the TCJA that reduced the federal income tax rate from 35% to 21%, excluding the Effective tax rate, other 0.16 tax impact of other items listed herein. Increased retail non-fuel base revenues primarily due to (i) increased retail non-fuel revenues of $5.9 million primarily due to increased revenues from residential customers of $5.6 million caused by an 8.1% increase in kWh sales driven by favorable weather and a 1.5% increase in the average number of residential customers served compared to the three months ended June 30, 2017, and (ii) an overall $4.1 million non- fuel base rate increase approved by the PUCT in its final order in the Company's 2017 Texas retail rate case Retail non-fuel base revenues 0.04 in Docket No. 46831. Cooling degree days ("CDD's") increased 19.0% in the three months ended June 30, 2018, when compared to the three months ended June 30, 2017. CDD's for the three months ended June 30, 2018 were 20.9% above the 10-year average. These increases were partially offset by refunds of approximately $7.7 million to customers for the reduction in the federal corporate income tax rate for the period April 1, 2018 through June 30, 2018. Other (0.01) June 30, 2018 $ 0.82 11

Reconciliation of Net Income (GAAP) and Basic EPS (GAAP) to Adjusted Net Income (Non-GAAP) and Adjusted Basic EPS (Non-GAAP) Financial Instruments – Overall (Topic 825-10) – unrealized gains and losses on equity securities that historically have been recorded through Accumulated Other Comprehensive Income will be immediately recognized in the Statements of Operations. Upon adoption of this standard, EE recorded as of January 1, 2018 a cumulative effect adjustment to retained earnings of $41 million, net of tax, for the unrealized gains (losses) related to equity securities held in the nuclear decommissioning trust funds. The adoption of this standard added the potential for significant volatility to EE’s reported results of operations as changes in the fair value of equity securities may occur. Equity investments included in the nuclear decommissioning trust funds are significant and are expected to increase significantly during the remaining life of Palo Verde.(1) Accordingly, EE is providing adjusted net income (a non-GAAP financial measure) and adjusted basic EPS (non-GAAP), both of which are reconciled below to net income and basic EPS (the most comparable GAAP financial measures): Three Months Ended June 30, 2018 2017 (In thousands except for per share data) Net Income (GAAP) $ 33,295 $ 36,066 Adjusting items before income tax effects Unrealized gain, net (983) - Realized gains, net (2,119) (5,166) Total adjustments before income tax effects (3,102) (5,166) Income taxes on above adjustments 621 1,033 Adjusting items, net of income taxes (2,481) (4,133) Adjusted net income (non-GAAP) $ 30,814 $ 31,933 Basic EPS(GAAP) $ 0.82 $ 0.89 Adjusted basic EPS (non-GAAP) $ 0.76 $ 0.79 12 (1) As of June 30, 2018, the EE nuclear decommissioning trust portfolio was comprised of 53% equity securities and had a market value of $287 million.

Q2 Customers and Retail Sales Average No. Percent Percent of Retail MWH Change (1) Change (1) Customers Residential 373,372 1.5% 783,644 8.1% C&I Small 42,452 1.4% 658,463 1.7% C&I Large 48 - 282,508 2.2% Public Authorities 5,581 (0.7%) 434,352 2.6% Total Retail 421,453 1.5% 2,158,967 4.2% Cooling Degree Days 1,319 19.0% (1) Percent change expressed as change in Q2 2018 from Q2 2017 13

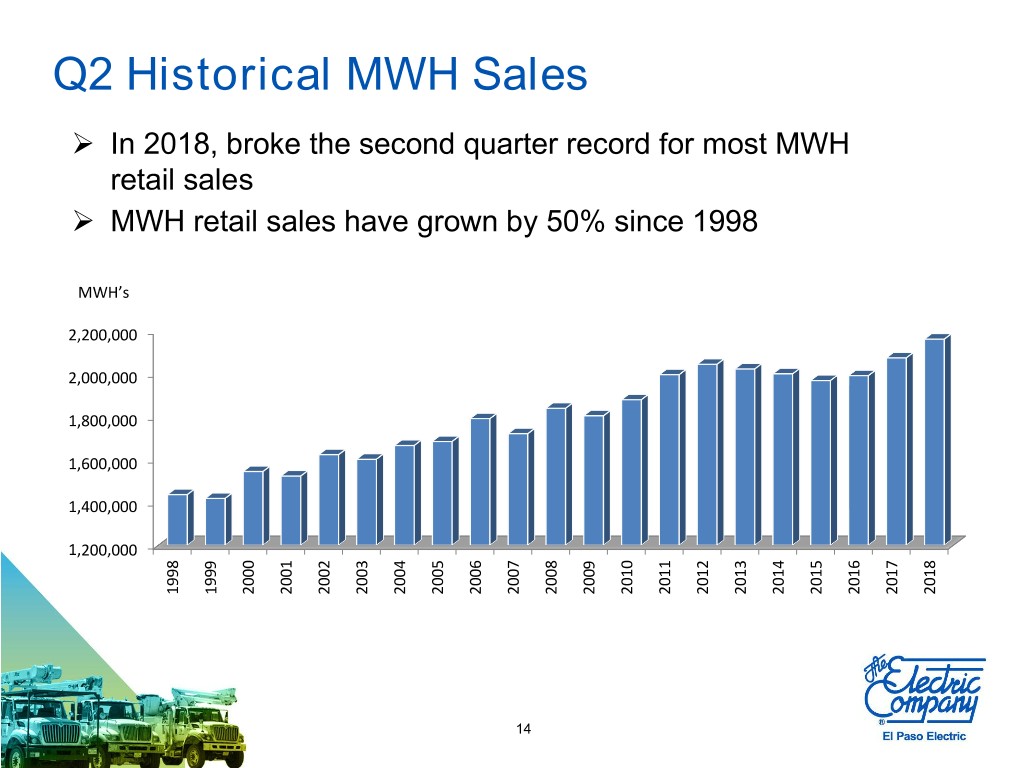

Q2 Historical MWH Sales In 2018, broke the second quarter record for most MWH retail sales MWH retail sales have grown by 50% since 1998 MWH’s 2,200,000 2,000,000 1,800,000 1,600,000 1,400,000 1,200,000 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 14

Q2 2018 Weather Summary Q2 2018 CDD’s vs 10-YR Average 1400 1,319 10-YR CDD 1,178 1,169 1,138 1,108 Average – 1,091 1200 1,013 995 1,095 965 1000 929 800 600 400 200 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 June CDD's 10-Year Average Q2 2018 CDD’s • 20.9% Above 10-YR Average • 19.0% Above Q2 2017 15

Capital Requirements and Liquidity On June 30, 2018, EE had liquidity of $281.4 million, including cash and cash equivalents of $11.9 million and unused capacity under the revolving credit facility Expended $117.3 million for additions to utility plant for the six months ended June 30, 2018 Capital expenditures for utility plant in 2018 are expected to be approximately $236 million For the six months ended June 30, 2018, credited $11.8 million to customers for the reduction in the federal corporate income tax rate Paid $28.3 million in cash dividends for the first six months of the year On July 19, 2018, the Board approved a quarterly cash dividend of $0.36 per share of common stock payable on September 28, 2018 to shareholders of record as of the close of business as of September 14, 2018 16

2018 Earnings Guidance EE is updating the following guidance: GAAP earnings guidance range to $2.25 - $2.55 per basic share from $2.30 - $2.65 per basic share Non-GAAP earnings guidance range to $2.05 - $2.30 per basic share from $2.10 - $2.40 per basic share GAAP Non - GAAP $2.42 $2.55 $2.21 $2.30 $2.25 $2.05 2017 Basic EPS Actual 2018 Basic EPS 2017 Adjusted Basic 2018 Adjusted Basic Guidance EPS Actual EPS Guidance Guidance assumes normal operations and considers significant variables that may impact earnings, such as weather, expenses, capital expenditures, nuclear decommissioning trust gains/losses, and the impact of the TCJA. The mid-point of the guidance range assumes ten-year average weather (cooling and heating degree days). The GAAP guidance range includes $8.0 million or $0.20 per share to $10.0 million or $0.25 per share, after-tax, of unrealized gains (losses) on equity securities and realized gains (losses) from the sale of both equity and fixed income securities from the Palo Verde decommissioning trust funds. 17

APPENDIX 18

Tax Reform The impact of the lower federal income tax rate is based on pre-tax earnings The reduction to customers’ rates is based on a per kWh sales credit The table below displays EE’s typical seasonal pre-tax earnings and kWh sales patterns (1): Q1 Q2 Q3 Q4 Pre-Tax Earnings 1% 31% 65% 3% Kilowatt Hour Sales 21% 26% 31% 22% (1) Based on historical five-year average 19