Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | q22018ex991.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | amagq220188-k.htm |

Q2-2018 Financial Results August 2, 2018 © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 1

Forward-Looking Statements This presentation contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, the expected regulatory time line for all product candidates; beliefs about the expected U.S. market opportunity for preeclampsia treatment; expectations for insurance coverage for Intrarosa; AMAG’s expected approach to optimizing the Makena franchise; beliefs that higher utilization, growing monthly number of accounts and early converted accounts are early indicators of Feraheme’s launch success; expectations regarding the Feraheme market strategy, including expansion to infusion and OB/GYN settings; beliefs about the market opportunity for Intrarosa, including expected prescriptions; the key growth drivers for Intrarosa; beliefs about the Intrarosa marketing campaign, including potential consumer reach; AMAG’s beliefs regarding the target product profile for bremelanotide, including the presumed mode of administration, indication, safety profile and presumed mechanism of action; the breadth and make up of the hypoactive sexual desire disorder market and the expected market potential opportunity for bremelanotide; expectations that the majority of cash proceeds from the expected CBR divestiture will be used to pay off AMAG’s bond debt; beliefs that the expected debt pay off will align AMAG’s balance sheet with its long‐term growth strategy; beliefs that AMAG will continue to expand through growth of its current portfolio and additional business development; AMAG’s 2018 financial guidance, including total revenue, operating loss and adjusted EBITDA; and AMAG’s 2018 key priorities are based on management’s current expectations and beliefs and are forward‐looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward‐looking statements. Such risks and uncertainties include, among others, the risk that the pending CBR sale will not close on the anticipated timeline, or at all, or that AMAG will not realize the expected benefits of, or face challenges to its business with, the CBR sale, once consummated, and the risk that generic sales of Makena will have a greater impact on AMAG’s revenues and supply chain than anticipated, as well as those risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10‐K for the year ended December 31, 2017 and subsequent filings with the SEC, which are available at the SEC’s website at www.sec.gov. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. AMAG cautions you not to place undue reliance on any forward‐looking statements, which speak only as of the date they are made AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward‐looking statements. AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. MuGard® is a registered trademark of Abeona Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Cord Blood Registry® and CBR® are registered trademarks of Cbr Systems, Inc. Intrarosa® is a registered trademark of Endoceutics, Inc. © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 2

Agenda 1 Q2-2018 Highlights 2 Product Portfolio Update 3 Q2-2018 Financial Overview 4 Key Priorities and Closing Remarks 5 Q&A © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 3

Strong Execution Total Revenue ($M) Q2-2018 Highlights $176.3 Announced sale of CBR $158.4 CBR Underscores focus on Strengthens CBR development and balance $146.3 12% commercialization of sheet $130.4 pharmaceutical products FDA accepts NDA for bremelanotide with PDUFA date of 3/23/19 Strong Q2-2018 income generation; increased cash and investments by more than $40M to $410M1 Q2-2017 Q2-2018 Continuing Operations Discontinued Operations 1 Includes $60 million of cash and investments held in a CBR account, which is currently recorded as an asset held for sale. These cash and investments will be returned to AMAG upon closing of the transaction. © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 4

Growing Innovative Pipeline Approved/ PHASE 1 PHASE 2 PHASE 3 Regulatory Review Marketed Treatment of iron deficiency anemia Treatment to reduce recurrent preterm birth in certain at-risk women Treatment for moderate to severe dyspareunia (pain during sex) in postmenopausal women 1 Treatment of low desire or libido with HSDD study associated distress in postmenopausal women Treatment of low desire or libido with PDUFA Bremelanotide associated distress in premenopausal AdComm Q1-2019 03/23/19 women Severe preeclampsia Treatment of severe preeclampsia (Velo option) 1 HSDD: Hypoactive Sexual Desire Disorder © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 5

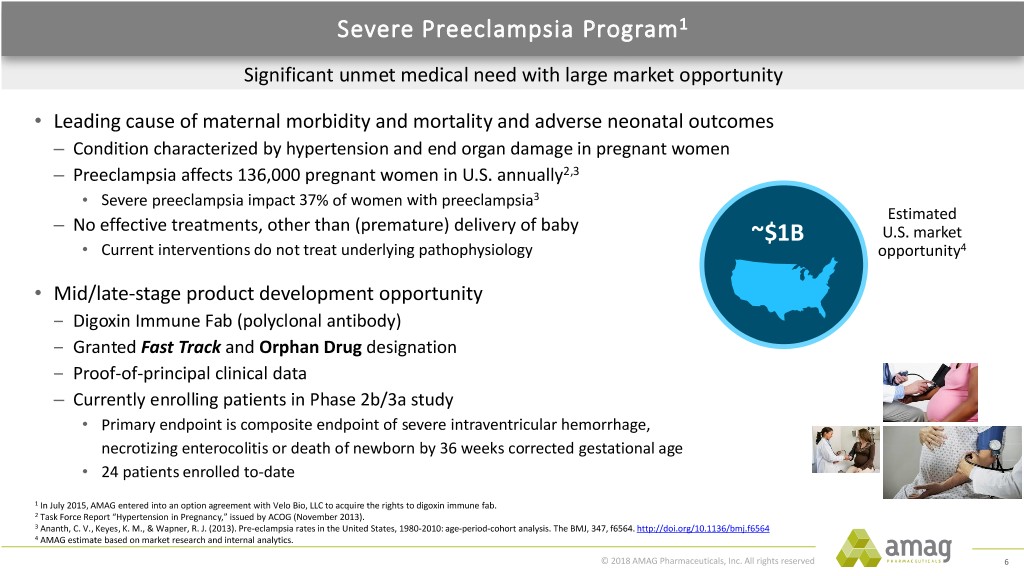

Severe Preeclampsia Program1 Significant unmet medical need with large market opportunity • Leading cause of maternal morbidity and mortality and adverse neonatal outcomes – Condition characterized by hypertension and end organ damage in pregnant women – Preeclampsia affects 136,000 pregnant women in U.S. annually2,3 • Severe preeclampsia impact 37% of women with preeclampsia3 Estimated – No effective treatments, other than (premature) delivery of baby ~$1B U.S. market • Current interventions do not treat underlying pathophysiology opportunity4 • Mid/late-stage product development opportunity ‒ Digoxin Immune Fab (polyclonal antibody) ‒ Granted Fast Track and Orphan Drug designation ‒ Proof-of-principal clinical data – Currently enrolling patients in Phase 2b/3a study • Primary endpoint is composite endpoint of severe intraventricular hemorrhage, necrotizing enterocolitis or death of newborn by 36 weeks corrected gestational age • 24 patients enrolled to-date 1 In July 2015, AMAG entered into an option agreement with Velo Bio, LLC to acquire the rights to digoxin immune fab. 2 Task Force Report “Hypertension in Pregnancy,” issued by ACOG (November 2013). 3 Ananth, C. V., Keyes, K. M., & Wapner, R. J. (2013). Pre-eclampsia rates in the United States, 1980-2010: age-period-cohort analysis. The BMJ, 347, f6564. http://doi.org/10.1136/bmj.f6564 4 AMAG estimate based on market research and internal analytics. © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 6

Makena® Feraheme® Intrarosa® Bremelanotide 7

Makena: Record Quarterly Revenue and Market Share Market Share1 Makena Revenue ($M) June 30, 2018 $105.2 $102.7 Off Guidance2 30% Makena 51% Compounded Hydroxy- progesterone Caproate 19% Q2-2017 Q2-2018 1 Company estimates Makena market share based on distributor dispensing data and all other market share based on physician market research data conducted by AMAG. 2 Off guidance represents patients treated outside guidance of Society for Maternal Fetal Medicine, including patients treated with unapproved therapies and untreated patients. MATERNAL HEALTH: MAKENA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 8

Optimize Makena Franchise Performance & Sustainability Protect the Brand Share in Generic Market • Convert usage to Makena SC auto-injector • First generic ANDA approved in June for – ~60% Makena Care Connection (MCC) enrollments are for single-dose intramuscular Makena SC auto-injector hydroxyprogesterone caproate (HPC) ‒ Priced at 15% discount to Makena WAC • Protect patient access to Makena SC auto-injector – Reinforce value of MCC • Partnered with Prasco, an experienced • Logistics support authorized generic company • Reimbursement support – Prasco launched single- and multi-dose • Patient assistance programs intramuscular HPC immediately following July availability of first generic HPC – Targeted payer strategy – Physician support: ~40% of prescriptions through MCC are “DISPENSE AS WRITTEN” MATERNAL HEALTH: MAKENA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 9

Positive Physician Feedback Regarding Makena Subcutaneous (SC) Auto-injector1 Perceptions of Makena SC Auto-injector Benefits of Makena SC Auto-injector Benefits Over Intramuscular (% Selecting) (% mentioned, unaided) 70% Ease of use / ease of administration 22% 1% (pre-loaded, single-dose) 34% Administration friendly (SC, accurate dosing, needle guard) 77% 31% Discreet Very beneficial Somewhat beneficial Not beneficial (administered in back of arm, thinner needle) 1 Auto-injector experience market research conducted by ThinkGen, May 2018. N=125, sample only includes HCPs who are aware of the auto-injector. MATERNAL HEALTH: MAKENA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 10

Makena® Feraheme® Intrarosa® Bremelanotide 11

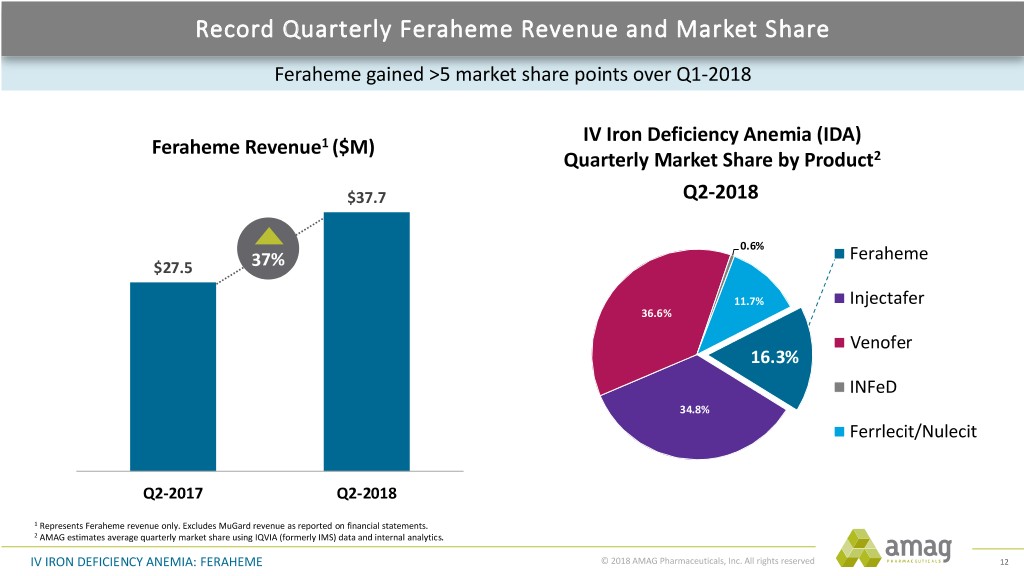

Record Quarterly Feraheme Revenue and Market Share Feraheme gained >5 market share points over Q1-2018 IV Iron Deficiency Anemia (IDA) Feraheme Revenue1 ($M) Quarterly Market Share by Product2 $37.7 Q2-2018 0.6% Feraheme $27.5 37% 11.7% Injectafer 36.6% Venofer 16.3% INFeD 34.8% Ferrlecit/Nulecit Q2-2017 Q2-2018 1 Represents Feraheme revenue only. Excludes MuGard revenue as reported on financial statements. 2 AMAG estimates average quarterly market share using IQVIA (formerly IMS) data and internal analytics. IV IRON DEFICIENCY ANEMIA: FERAHEME © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 12

Growing Share through Clinical Differentiation and New Broad Label Feraheme monthly market share1 SALINE SHORTAGE IMPACT 17.1% 16.2% 15.4% Indicators of Launch Success 12.3% 11.8% Early converted Higher utilization Growing monthly 10.7% accounts 10.2% of Feraheme in number of producing accounts ordering existing large incremental Feraheme accounts volume Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 1 AMAG estimates market share using IQVIA (formerly IMS) data and internal analytics. IV IRON DEFICIENCY ANEMIA: FERAHEME © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 13

IV Iron Market Represents Small Subset of Patients Who Suffer from IDA 4.5M total U.S. patients diagnosed with iron deficiency anemia1 Diagnosed IDA Patients • Under the care of other physician specialists, including in women’s health, where AMAG has a strong commercial presence 700,000 IV iron patients2 Market Expansion Strategy • Increasing share in infusion setting • Increase anemia patient referrals from OB/GYNs ‒ Pilot with Maternal Health sales force in 2H-2018 ‒ Potential to expand initiative in 2019 1 Global Intravenous (I.V.) Iron Drugs Market Report: 2015 Edition. 2 AMAG estimates number of non-dialysis IV patients using 1.3M grams and an estimated average dose per course of therapy. IV IRON DEFICIENCY ANEMIA: FERAHEME © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 14

Makena® Feraheme® Intrarosa® Bremelanotide 15

Intrarosa is Differentiated from Estrogen Therapies Non-estrogen treatment1 Differentiated MOA1 Unique safety profile (no boxed warning) 1 Intrarosa is converted by enzymes in the body into androgens and estrogens, though the mechanism of action is not fully established. WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 16

Significant Momentum with HCPs Continues At 3/31/18 At 6/30/18 TRx’s written since launch1 ~50,000 ~93,000 HCP prescribers since launch1 ~6,600 ~9,100 Total week ending market share1 2.8% 3.8% Commercial lives covered (unrestricted)2 74% 75% CMS clarified that drugs for the treatment of Medicare Part D coverage moderate to severe dyspareunia due to menopause are not excluded from coverage 1 Based on IQVIA (formerly IMS) data. 2 MMIT data adjusted for non-reporters and MMIT timing delays. WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 17

Intrarosa HCP Prescribing and Market Share Continue to Increase Rx Volume1 • High level of sales force HCP engagement 4,500 – Averaged 2,000 weekly prescribers in Q2, a 41% increase 4,000 over Q1 3,500 – ~200 speaker programs held in Q2 3,000 • Intrarosa NRx market share continues to grow: 2,500 – 5.6% NRx share (commercial only), 3.8% overall 2,000 • Second half 2018 growth drivers 1,500 Number Number of Scripts – Publications on androgenic benefit 1,000 – Medicare Part D clarification 500 – Branded DTC launch 0 – Co-pay card removes cost barrier TRx NRx 1 Based weekly data as reported in the last week of each month from IQVIA (formerly IMS). WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 18

Commercial Copay Savings Program Removing cost as a barrier and driving persistency • Comprehensive commercial copay savings program – $0 copay first month on therapy (regardless of formulary access) – Refill copays are no greater than $25 (regardless of formulary access) • Copay card driving high gross to net (GTN), but impact declining every month as insurance pull through occurs – Copay card facilitating starts and persistency – Rapid growth nationally of high deductible plans impacting copay card programs (and GTN) – Evaluating modification to copay program based on maturity of launch • 40% of Intrarosa patients are still on therapy at six months – Copay card patients are significantly more persistent than non-copay card patients • More than twice as many patients getting to a second fill • Almost four times as many getting to a sixth fill WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 19

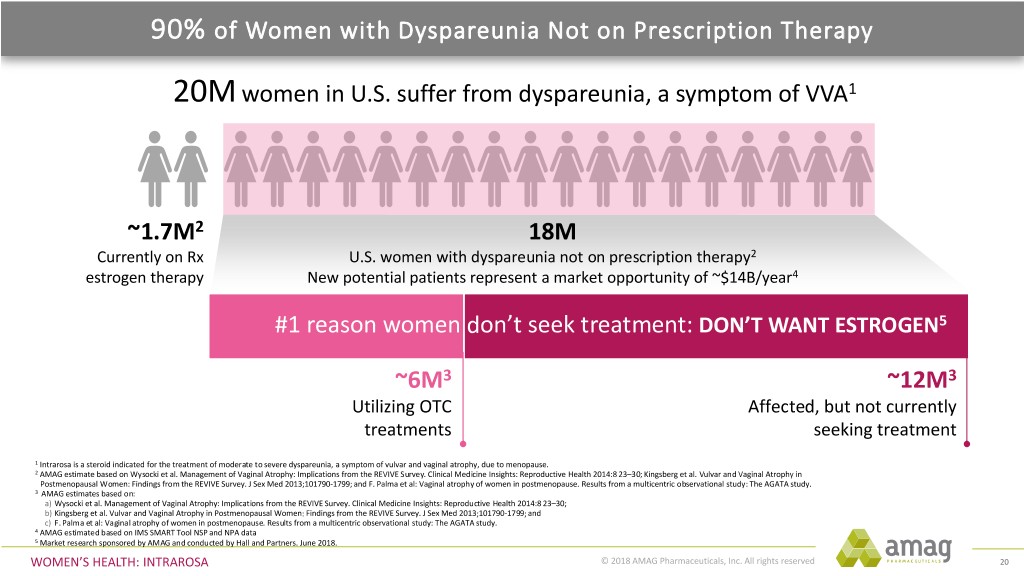

90% of Women with Dyspareunia Not on Prescription Therapy 20M women in U.S. suffer from dyspareunia, a symptom of VVA1 ~1.7M2 18M Currently on Rx U.S. women with dyspareunia not on prescription therapy2 estrogen therapy New potential patients represent a market opportunity of ~$14B/year4 #1 reason women don’t seek treatment: DON’T WANT ESTROGEN5 ~6M3 ~12M3 Utilizing OTC Affected, but not currently treatments seeking treatment 1 Intrarosa is a steroid indicated for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy, due to menopause. 2 AMAG estimate based on Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30; Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799; and F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study. 3 AMAG estimates based on: a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30; b) Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799; and c) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study. 4 AMAG estimated based on IMS SMART Tool NSP and NPA data 5 Market research sponsored by AMAG and conducted by Hall and Partners. June 2018. WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 20

Key Intrarosa Growth Drivers Accessing the 90% of women who are not being treated with Rx Branded consumer campaign resulting 5 in patients asking for Intrarosa Increase HCP prescribing and make Intrarosa the 1st choice treatment 4 3 Educate with unbranded condition awareness campaign Create affordable access for all patients 2 Intrarosa 1 Increase market awareness GROWTH STRATEGY LAUNCH PRIORITIES WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 21

Coming Soon: Unbranded and Branded Consumer Campaigns PHASE 1: I N MARKET NOW PHASE 2: COMING SOON Copay Registration on Intrarosa.com Paid Search Campaign 1,400+ copay registrations Updated Intrarosa.com and media campaign 35,000+ visits to Intrarosa.com to date (730 redeemed) to date Robust media plan reaches 20M women 45-64 avg 30 times through year end April 2 April 19 August Apr May Jun Jul Aug Sep Oct 2019 May 2 June 2 August September Facebook page Condition Awareness Website Patient Support Program Condition Awareness PR Campaign 2.6M engagements to date PauseSexPain.com & Media Campaign Integrated email, direct • 316,000 visitors since June 6th mail, text program to • Media plan to reach 16M women drive INTRAROSA 45-64 avg 20 times through year end adherence WOMEN’S HEALTH: INTRAROSA © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 22

Makena® Feraheme® Intrarosa® Bremelanotide 23

Significant Market Opportunity in Area of High Unmet Need 1 Bremelanotide Overview Self-administered auto-injector PEN NOVEL mechanism of action: used in ANTICIPATION melanocortin receptor agonist (MCR4) of sexual activity TWO Phase 3 studies met co-primary, pre-specified endpoints on desire and distress Favorable SAFETY profile Investigational product for premenopausal WOMEN used to treat Large market OPPORTUNITY Low desire/libido with associated distress affects 1 in 10 premenopausal women2,3 (Hypoactive Sexual Desire Disorder or HSDD) 1 If regulatory approval is received. 2 Shifren JL, Monz BU, Russo PA, Segreti A, Johannes CB. Sexual problems and distress in United States women: prevalence and correlates. Obstet Gynecol. 2008;112(5):970–978. [PubMed] 3 Goldstein I, Kim NN, Clayton AH, et al. Hypoactive sexual desire disorder: International Society for the Study of Women’s Sexual Health (ISSWSH) expert consensus panel review. Mayo Clin Proc. 2017;92(1):114‐128. WOMEN’S HEALTH: BREMELANOTIDE © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 24

Financial Overview 25

Divestiture of Cord Blood Registry • $530M all-cash sale – Announced June 15, 2018; expected to close mid-August 2018 – Majority of net proceeds expected to be used to retire $475M Senior Notes • Debt repayment will align balance sheet with long-term growth strategy – Focus on investing and growing pharmaceutical product portfolio – Continue to expand through additional business development FINANCIAL OVERVIEW © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 26

Strong Financial Results While Investing in the Future GAAP product revenue and operating income from continuing operations ($M)1 $146.3 $3.2 $130.4 12% $37.8 $27.7 5% Intrarosa Revenue $102.7 $105.2 Feraheme/MuGard Revenue Makena Revenue $41.9 GAAP Operating Income $3.3 Q2-2017 Q2-2018 1 Excludes revenue and operating income from CBR. FINANCIAL OVERVIEW © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 27

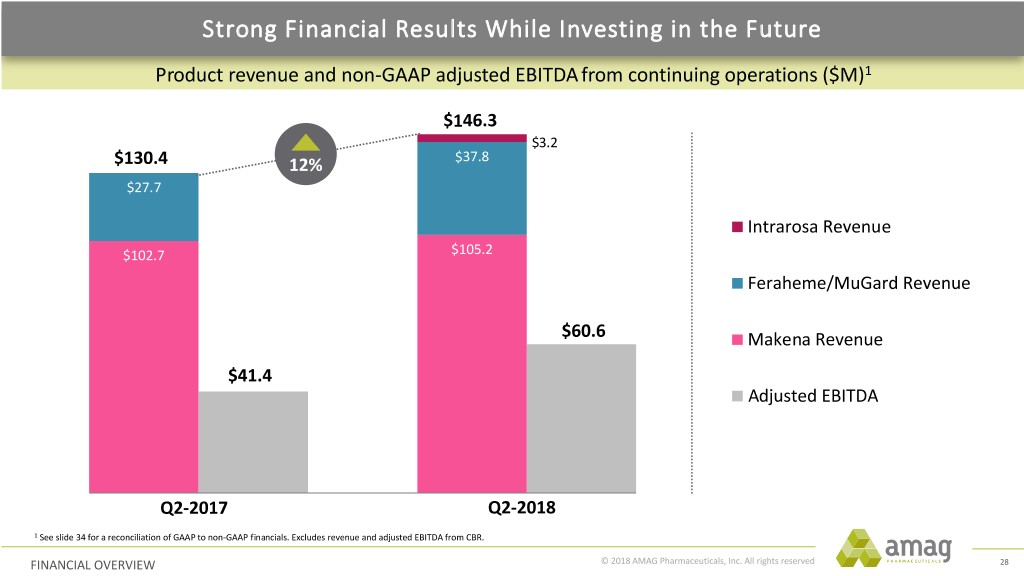

Strong Financial Results While Investing in the Future Product revenue and non-GAAP adjusted EBITDA from continuing operations ($M)1 $146.3 $3.2 $130.4 12% $37.8 $27.7 Intrarosa Revenue $102.7 $105.2 Feraheme/MuGard Revenue $60.6 Makena Revenue $41.4 Adjusted EBITDA Q2-2017 Q2-2018 1 See slide 34 for a reconciliation of GAAP to non-GAAP financials. Excludes revenue and adjusted EBITDA from CBR. FINANCIAL OVERVIEW © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 28

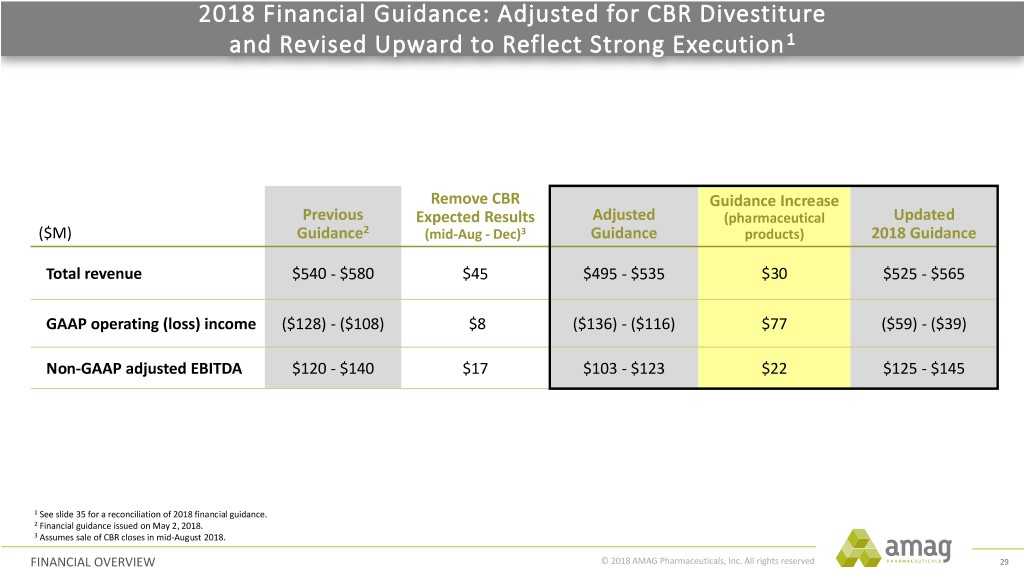

2018 Financial Guidance: Adjusted for CBR Divestiture and Revised Upward to Reflect Strong Execution 1 Remove CBR Guidance Increase Previous Expected Results Adjusted (pharmaceutical Updated ($M) Guidance2 (mid-Aug - Dec)3 Guidance products) 2018 Guidance Total revenue $540 - $580 $45 $495 - $535 $30 $525 - $565 GAAP operating (loss) income ($128) - ($108) $8 ($136) - ($116) $77 ($59) - ($39) Non-GAAP adjusted EBITDA $120 - $140 $17 $103 - $123 $22 $125 - $145 1 See slide 35 for a reconciliation of 2018 financial guidance. 2 Financial guidance issued on May 2, 2018. 3 Assumes sale of CBR closes in mid-August 2018. FINANCIAL OVERVIEW © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 29

Strengthening Balance Sheet ($M) 3/31/18 6/30/18 Cash, cash equivalents and investments $371 $4101 Principal debt outstanding: Convertible senior notes (2.5%) due 2019 $ 21 $ 21 Convertible senior notes (3.25%) due 2022 320 320 Senior notes (7.875%) due 20232 475 475 Total debt outstanding (current) $816 $816 1 Includes $60 million of cash and investments held in a CBR account, which is currently recorded as an asset held for sale. These cash and investments will be returned to AMAG upon closing of the transaction. 2 Expected to be paid in full with proceeds from sale of CBR. FINANCIAL OVERVIEW © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 30

2018 Key Priorities Progress to-date Bremelanotide Submit NDA in Q1-2018 Continue to drive HCP prescribing and initiate Intrarosa consumer campaign Launch subcutaneous auto-injector and drive Makena conversion Feraheme Launch broad IDA label and grow market share Cord Blood Registry Complete divestiture and eliminate high yield bonds Business Development Build shareholder value through portfolio expansion Financial Meet or beat financial guidance © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 31

Q&A © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 32

Appendix 33

Reconciliation of GAAP to Non-GAAP Financial Results1 ($M) Q2-2017 Q2-2018 GAAP operating income $3.3 $41.9 Depreciation and intangible asset amortization 25.4 62.1 Non-cash inventory step-up adjustments 0.2 1.0 Stock-based compensation 5.0 5.4 Adjustments to contingent consideration 1.7 (49.8) Acquired IPR&D 5.8 ― Non-GAAP adjusted EBITDA $41.4 $60.6 1 Excludes financial results from CBR. APPENDIX © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 34

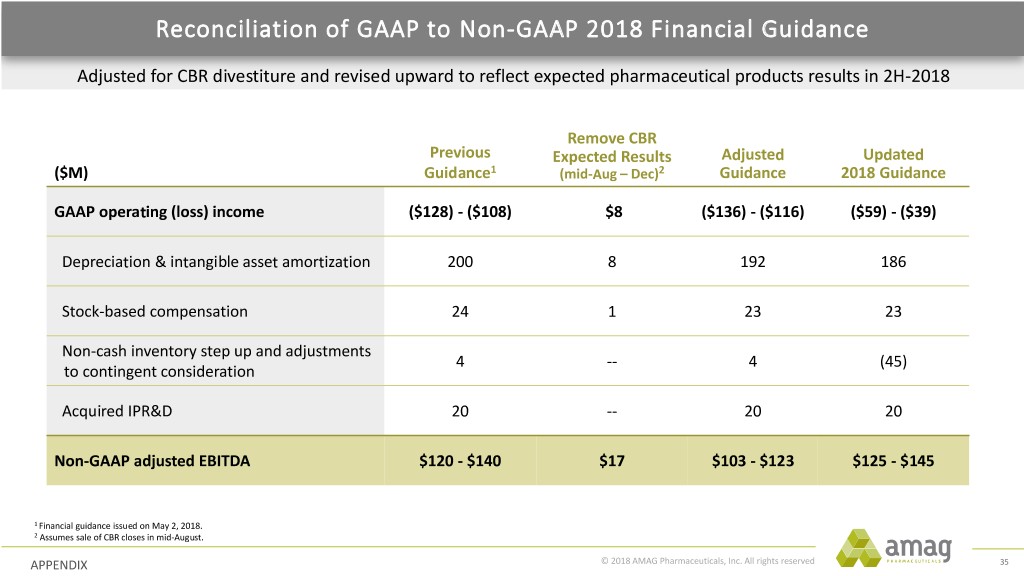

Reconciliation of GAAP to Non-GAAP 2018 Financial Guidance Adjusted for CBR divestiture and revised upward to reflect expected pharmaceutical products results in 2H-2018 Remove CBR Previous Expected Results Adjusted Updated ($M) Guidance1 (mid-Aug – Dec)2 Guidance 2018 Guidance GAAP operating (loss) income ($128) - ($108) $8 ($136) - ($116) ($59) - ($39) Depreciation & intangible asset amortization 200 8 192 186 Stock-based compensation 24 1 23 23 Non-cash inventory step up and adjustments 4 -- 4 (45) to contingent consideration Acquired IPR&D 20 -- 20 20 Non-GAAP adjusted EBITDA $120 - $140 $17 $103 - $123 $125 - $145 1 Financial guidance issued on May 2, 2018. 2 Assumes sale of CBR closes in mid-August. APPENDIX © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 35

Q2-2018 Financial Results August 2, 2018 © 2018 AMAG Pharmaceuticals, Inc. All rights reserved 36