Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Univar Solutions Inc. | form8-kearningsreleaseq220.htm |

| EX-99.1 - EXHIBIT 99.1 - Univar Solutions Inc. | ex991-enr_q22018.htm |

Second Quarter 2018 Earnings Call August 1, 2018

Forward-Looking Statements This presentation includes certain statements relating to future events and our intentions, beliefs, expectations, and predictions for the future which are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that the forward-looking information presented in this presentation is not a guarantee of future events or results, and that actual events or results may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "outlook," "guidance," “may,” “plan,” “seek,” “comfortable with,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negatives or variations of these terms. Forward-looking information contained in this presentation is made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward- looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Regulation G: Non-GAAP Measures The information presented herein regarding certain unaudited non-GAAP measures does not conform to generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Univar has included this non- GAAP information to assist in understanding the operating performance of the company and its operating segments. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information related to previous Univar filings with the SEC has been reconciled with reported U.S. GAAP results. 2

Second Quarter 2018 Highlights Solid performance; momentum building Q2 GAAP EPS(1) $0.40 vs. $0.22 prior year Ÿ Reported net income rose 79.2% to $56.1 million vs. $31.3 million in the prior year Q2 Adjusted EPS(1)(2) $0.47 vs. $0.40 prior year Ÿ Adjusted EPS growth of 18% Ÿ Reported adjusted net income of $65.7 million vs. $57.1 million in the prior year Q2 Adjusted EBITDA(1) $173.1 million vs. $158.5 million in 2017 Ÿ 9% Adjusted EBITDA growth driven by execution and mix enrichment Ÿ Healthy performance of the core business Ÿ Sales force execution and strong operating leverage helping to drive improved results Adjusted Operating Cash Flow(1)(3) $201.1 million vs. $162.6 million in 2017 Ÿ Reflects higher Adjusted EBITDA performance and improvement in working capital levels (1) Variances to Q2 2017. (2) Adjusted Net Income / Diluted Weighted Average Shares Outstanding. Adjusted net income excludes the same items as Adjusted EBITDA, except for stock-based compensation expense and non-operating retirement benefits. (3) Adjusted EBITDA plus cash flows from changes in accounts receivable, inventory, and accounts payable, less capital expenditures. 3

Balance Sheet Highlights Deleveraging on-track LTM ended June 30, ($ in millions) 2018 2017 Y/Y Net Debt (1) $2,549.4 $2,692.4 ($143.0) Leverage (2) 4.0x 4.7x (0.7x) Interest Coverage (3) 4.9x 4.1x 0.8x Return on Assets Deployed (4) 24.4% 21.0% 340 bps (1) Net Debt defined as Total Debt (Long term debt, inclusive of debt discount and unamortized debt issuance costs, plus short term financing) less cash and cash equivalents. (2) Net Debt divided by last 12 months (LTM) of Adjusted EBITDA. (3) Interest coverage defined as LTM Adjusted EBITDA / LTM Cash Interest (net of interest income). (4) LTM Earnings before Interest, Taxes and Amortization (EBITA) divided by trailing 13 month average of net PP&E plus net working capital (accounts receivable plus inventory less accounts payable). 4

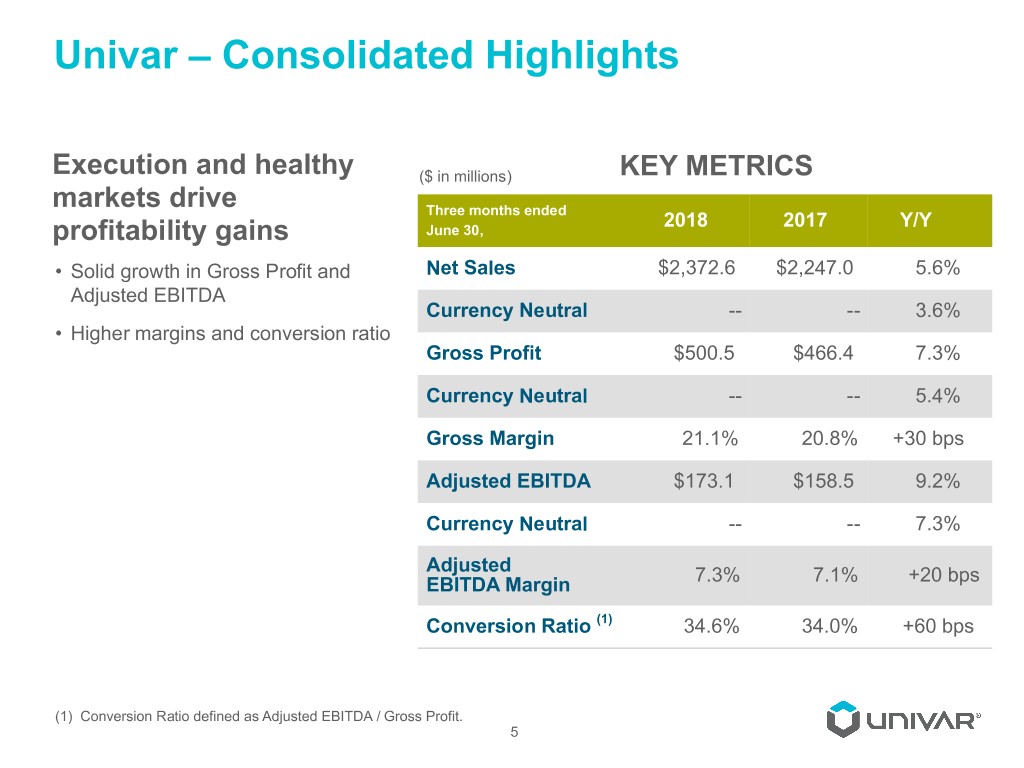

Univar – Consolidated Highlights Execution and healthy ($ in millions) KEY METRICS markets drive Three months ended 2018 2017 Y/Y profitability gains June 30, • Solid growth in Gross Profit and Net Sales $2,372.6 $2,247.0 5.6% Adjusted EBITDA Currency Neutral -- -- 3.6% • Higher margins and conversion ratio Gross Profit $500.5 $466.4 7.3% Currency Neutral -- -- 5.4% Gross Margin 21.1% 20.8% +30 bps Adjusted EBITDA $173.1 $158.5 9.2% Currency Neutral -- -- 7.3% Adjusted EBITDA Margin 7.3% 7.1% +20 bps Conversion Ratio (1) 34.6% 34.0% +60 bps (1) Conversion Ratio defined as Adjusted EBITDA / Gross Profit. 5

USA – Highlights USA transformation gains ($ in millions) KEY METRICS traction Three months ended 2018 2017 Y/Y • Sales force execution improving June 30, • Capturing higher freight costs Net Sales $1,309.8 $1,191.1 10.0% • Product mix impact on margins Gross Profit $290.8 $275.7 5.5% Gross Margin 22.2% 23.1% -90 bps Adjusted EBITDA $97.2 $91.8 5.9% Adjusted EBITDA Margin 7.4% 7.7% -30 bps 6

CANADA – Highlights Strength in Industrial ($ in millions) KEY METRICS Chemicals offset by Three months ended 2018 2017 Y/Y weakness in Ag June 30, • Strength in Coatings and Personal Care Net Sales $450.9 $492.4 (8.4)% growth markets Currency Neutral -- -- (12.1)% • Double-digit Adjusted EBITDA growth in Industrial Chemicals Gross Profit $68.9 $67.5 2.1% • Weather-related drop in Ag market Currency Neutral -- -- (1.9)% demand Gross Margin 15.3% 13.7% +160 bps Adjusted EBITDA $34.6 $36.5 (5.2)% Currency Neutral -- -- (8.8)% Adjusted EBITDA Margin 7.7% 7.4% +30 bps 7

EMEA – Highlights Strong growth continues ($ in millions) KEY METRICS • Gains in Focused Industries and Three months ended 2018 2017 Y/Y favorable mix drive 17% Adjusted June 30, EBITDA growth Net Sales $511.9 $463.7 10.4% • Gross profit margin, Adjusted EBITDA margin, and conversion ratio rise Currency Neutral -- -- 3.7% • Sales force execution continues to Gross Profit $118.2 $104.7 12.9% improve Currency Neutral -- -- 5.7% Gross Margin 23.1% 22.6% +50 bps Adjusted EBITDA $40.1 $34.2 17.3% Currency Neutral -- -- 10.5% Adjusted EBITDA Margin 7.8% 7.4% +40 bps 8

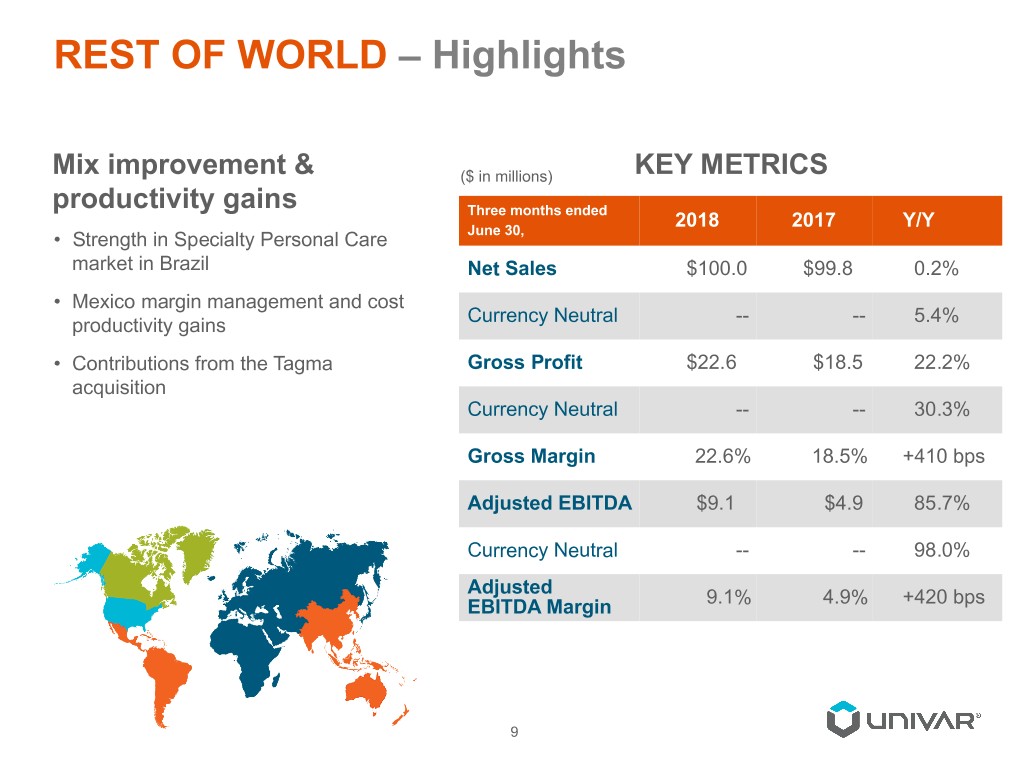

REST OF WORLD – Highlights Mix improvement & ($ in millions) KEY METRICS productivity gains Three months ended 2018 2017 Y/Y • Strength in Specialty Personal Care June 30, market in Brazil Net Sales $100.0 $99.8 0.2% • Mexico margin management and cost Currency Neutral -- -- 5.4% productivity gains • Contributions from the Tagma Gross Profit $22.6 $18.5 22.2% acquisition Currency Neutral -- -- 30.3% Gross Margin 22.6% 18.5% +410 bps Adjusted EBITDA $9.1 $4.9 85.7% Currency Neutral -- -- 98.0% Adjusted EBITDA Margin 9.1% 4.9% +420 bps 9

Cash Flow Highlights Three months ended June 30, ($ in millions) 2018 2017 Y/Y Adjusted Operating Cash Flow (1) $201.1 $162.6 23.7 % Net Working Capital $56.9 $21.8 161.0 % Capital Expenditures (2) ($28.9) ($17.7) 63.3 % Cash Taxes ($22.9) ($6.9) 231.9 % Cash Interest (net) ($24.3) ($24.8) (2.0)% Pension Contribution ($9.0) ($8.2) 9.8 % Acquisitions ($11.5) $— NM (1) Adjusted Operating Cash Flow equals Adjusted EBITDA plus cash flows from changes in trade accounts receivable, inventory, and trade accounts payable, less capital expenditures. (2) Excludes additions from capital leases. 10

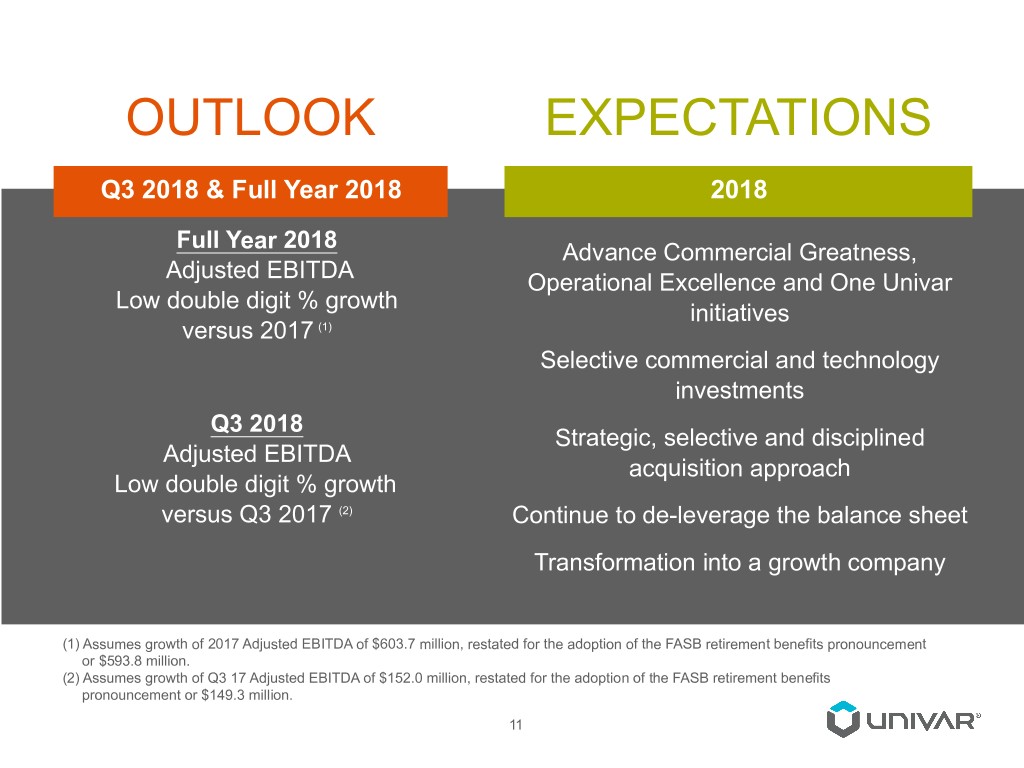

OUTLOOK EXPECTATIONS Q3 2018 & Full Year 2018 2018 Full Year 2018 Advance Commercial Greatness, Adjusted EBITDA Operational Excellence and One Univar Low double digit % growth initiatives versus 2017 (1) Selective commercial and technology investments Q3 2018 Strategic, selective and disciplined Adjusted EBITDA acquisition approach Low double digit % growth versus Q3 2017 (2) Continue to de-leverage the balance sheet Transformation into a growth company (1) Assumes growth of 2017 Adjusted EBITDA of $603.7 million, restated for the adoption of the FASB retirement benefits pronouncement or $593.8 million. (2) Assumes growth of Q3 17 Adjusted EBITDA of $152.0 million, restated for the adoption of the FASB retirement benefits pronouncement or $149.3 million. 11

Full-Year 2018 Guidance Year ended December 31, ($ in millions, except per share data) 2018 2017 Adjusted EPS $1.65 - 1.85 $1.39 low double digit Adjusted EBITDA $593.8 (1) % growth Cash Interest (net) ~($125) ($136.3) Tax Rate on Adjusted EPS ~30% 16.3% Pension Contribution ~($42) ($38.2) Change in Net Working Capital ~($50 - 100) ($52.6) Capital Expenditures ~($115) ($82.7) Debt Amortization ~($17) ($89.2) (1) Restated to reflect the adoption of the FASB retirement benefits pronouncement. Note: Cash inflow +/ Cash outflow - 12

Appendix A - Q2 2018 Adjusted Net Income and Adjusted EBITDA Reconciliation Three months ended June 30, 2018 2017 ($ in millions, except per share data) Amount per share (1) Amount per share (1) Net income $56.1 $0.40 $31.3 $0.22 Other operating expenses, net (excluding $6.7 $0.05 $19.1 $0.14 stock-based compensation) Other income (expense), net (excluding $5.5 $0.04 $11.7 $0.09 non-operating retirement benefits) Benefit from income taxes related to ($3.6 ) ($0.02 ) ($5.0 ) ($0.05 ) reconciling items Other non-recurring tax items $1.0 $— $— $— Adjusted net income $65.7 $0.47 $57.1 $0.40 Stock-based compensation expense $4.3 $5.1 Non-operating retirement benefits ($3.4 ) ($2.4 ) Interest expense, net $32.0 $35.8 Depreciation and amortization $44.7 $50.6 All remaining provision for income taxes $29.8 $12.3 Adjusted EBITDA $173.1 $158.5 (1) Immaterial differences may exist in summation of per share amounts due to rounding. 13

Appendix B - Adjusted Operating Cash Flow Three months ended June 30, ($ in millions) 2018 2017 Adjusted EBITDA $173.1 $158.5 Change in: Trade accounts receivable, net ($110.8) ($179.2) Inventories $28.5 $28.5 Trade accounts payable $139.2 $172.5 Capital expenditures ($28.9) ($17.7) Adjusted operating cash flow $201.1 $162.6 14