Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | q218tweetfinal.htm |

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq2x2018.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq2x2018xex991.htm |

Exhibit 99.2 Shareholder Letter Q2 2018 July 2018 31, Zendesk Shareholder Letter Q2 2018 - 1

In the second quarter, we reached a major Introduction milestone in our strategic priority to mature our We finished the first half of 2018 ahead of our omnichannel offering, with the worldwide launch expectations, both in our financial results and in of The Zendesk Suite, our new omnichannel our progress across our key priorities for the year. bundle. Adoption of the Suite has quickly Revenue growth for both the first half of the year exceeded our initial plans, and we believe has put and the second quarter was 39% and accelerated us in an even stronger position competitively with year over year. This growth was driven by both small and midsized businesses that, since our Mikkel Svane new customers adopting our products and founding, have been a core part of our business. CEO existing customers expanding their use of them. We also announced Zendesk Connect, which Our land-and-expand strategy drove dollar-based enables proactive customer engagement. This, net expansion rates of 120% and 119% in the first we believe, is the future of customer experience. and second quarters of 2018, respectively. Our revenue growth was strong across regions and across both large enterprise customers and small and midsized customers. $141.9M The strong start to the year reflects the global, Q2 2018 Revenue broad appeal of our products as organizations of all sizes seek to transform their businesses to Elena Gomez focus on customer experiences. The rapid pace 39% CFO of change in customer expectations and behavior Q2 Y/Y Revenue Growth is requiring companies to focus on innovation within their customer interactions. Our customer service and engagement platform helps them be Note: All results and guidance in this letter are based on the new revenue recognition standard ASC 606. the company their customers want them to be by delivering the best customer experiences. Marc Cabi Strategy & IR Zendesk Shareholder Letter Q2 2018 - 2

Through the quarter, we continued our momentum upmarket. Second Quarter of 2018 The percentage of our Support MRR from customers with (in thousands, except per share data) Three Months Ended 100 or more Support agents was 38%, up three percentage June 30, points compared to a year ago. We continued to expand the GAAP results 2018 2017 enterprise offering of our products by launching features *As Adjusted specific to enterprise needs: workflow and collaboration. We Revenue $ 141,882 $ 102,096 also expanded our enterprise sales strategy and improved Gross profit 97,722 71,433 our sales execution. We see growing opportunity to expand Gross margin 68.9% 70.0% Operating loss $ (33,597) $ (27,465) with our larger customers, as well as reach new enterprise Operating margin -23.7% -26.9% customers. In the second quarter, we closed over 60% more Net loss $ (34,366) $ (26,267) deals with an average annual contract value of $50,000 or Net loss per share, basic and diluted $ (0.33) $ (0.26) more compared to a year ago. We are committed to building for the future as we aim to Non-GAAP results Non-GAAP gross profit $ 102,460 $ 75,089 become a multi-billion dollar revenue company. To that end, we Non-GAAP gross margin 72.2% 73.5% hired our first Chief People Officer, InaMarie Johnson, in June to Non-GAAP operating loss $ (2,019) $ (3,277) lead our employee engagement and development for our next Non-GAAP operating margin -1.4% -3.2% stage of growth. Meanwhile, we made our biggest investment Non-GAAP net income (loss) $ 3,142 $ (2,079) in an office outside the U.S. with the opening in July of our Non-GAAP net income (loss) per share, basic and diluted $ 0.03 $ (0.02) new EMEA headquarters in Dublin. Both moves are part of our ongoing focus on employee success and culture as a company with more than 2,300 employees worldwide as of the end of the second quarter. *Adjusted to reflect the adoption of ASC 606. Zendesk Shareholder Letter Q2 2018 - 3

Omnichannel Zendesk Connect Delivering omnichannel solutions to our To take customer experience to the next level, customers is a key priority in 2018. By unifying we introduced Zendesk Connect. We believe communication channels in a single solution, we it represents the next generation of customer intend to make it easier for our customers and experience by enabling proactive and predictive prospects to adopt multiple Zendesk products engagement so companies can get ahead of their more quickly and to create a frictionless service customers’ needs and questions. experience for their customers. Zendesk Connect helps companies predict The Zendesk Suite customer needs and proactively reach out to them in a personalized manner to solve In May, we significantly enhanced our a problem, help drive customer loyalty and omnichannel offering with the launch of retention, or introduce new products and services The Zendesk Suite. The Zendesk Suite is that address a customer’s needs. Connect our comprehensive omnichannel bundle, leverages customer data and brings together bringing together our Support, Guide, Talk, previous customer actions, support history, and and Chat products so companies can have user preferences to provide companies with a seamless, integrated conversations with their more cohesive, comprehensive customer context. customers regardless of the communication This aggregated view helps customer support channel. The Suite elevates our competitive teams scale customer communications with position, particularly among small and automated messages tailored to a customer’s midsized businesses, and makes the buying, usage and preferences. implementation, and user experience much easier for our customers. It enables them to jumpstart We’ve seen our early Connect customers their omnichannel strategy and scale their use Connect to proactively reach out to their operations with less cost and complexity. customers in a personalized manner. For example, a home meal delivery company has We believe our omnichannel solution will drive successfully used Connect to drive a lift in substantial global growth in our business and are post-cancellation winbacks using personalized encouraged by the early results and feedback. email campaigns. While it’s still early, our initial findings show Suite customers purchasing more agent seats and adopting more products than the average Zendesk customer. Zendesk Shareholder Letter Q2 2018 - 4

Enterprise Momentum Our enterprise momentum continues with strong revenue growth and a bright outlook. Our growth in enterprise is being driven by a combination of factors. Market demand We’re working for modern software served in the cloud is expanding, and companies are using our our magic products as part of the transformation of their businesses to provide better customer May 2018 Gartner Magic Quadrant experiences. At the same time, we have expanded our offering of products and features for the CRM Customer Engagement Center for larger enterprises and demonstrated their ability to scale for complex use cases while maintaining our ability to be agile, flexible, and easy to implement. In the past year, we launched three enterprise versions of our products: Guide, Chat, and Talk. More recently in June, we introduced new enterprise workflow and collaboration tools to help larger customers deliver better customer experiences at scale. We introduced Side Conversations, which enables customer service agents to collaborate with anyone, internal or external, to resolve customer issues. Additionally, we launched Skills-based Routing and Contextual Workspaces, which automatically direct each request to the right agent and In May, our efforts in enterprise were then update that agent’s view to give the most relevant information based on the nature again recognized by Gartner. For of the request. These enhancements help Zendesk’s larger enterprise customers be more the third year in a row, Gartner Inc. agile and responsive, despite having large, diverse, and geographically distributed teams. named Zendesk a Leader in the Magic Quadrant for the CRM Customer We also recently announced a Zendesk integration with Slack and its new Actions feature. Engagement Center. The integration enables anyone in an organization working in Slack to use Actions to be alerted about new and updated Zendesk tickets, and to create and comment on tickets directly from Slack. Our investments in improving our go-to-market capabilities are also driving considerable Gartner does not endorse any vendor, product or service depicted in its research publications, and does growth. We are focused on hiring sales expertise to pursue new opportunities with not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not larger enterprises. We are delivering a growing number of larger and more complex use be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose. cases across existing and new customers. Supporting our efforts to increase success with enterprise customers, we have further expanded our capabilities in both pre-sales technical consulting as well as a broader set of professional services. During the second quarter of 2018, our revenue from professional services continued to grow at a faster rate than overall revenue growth year over year. Zendesk Shareholder Letter Q2 2018 - 5

ZENDESK PRESENTS Our solutions-based approach is driving further multi-product adoption in larger enterprises. We’re encouraging sales teams to sign longer contracts The Future with customers, and using Named Account Executives more often to build of Customer deeper relationships with our largest customers. Finally, our advances into the enterprise have garnered the interest of channel partners and Experience systems integrators (SI). In 2018, we have launched investments to develop relationships with SI and channel partners and will continue to grow that opportunity over the next two years. Future of Customer Experience Events We launched our newest event series during the quarter, called Future of Customer Experience, to provide a more intimate and localized conference for our customers and prospects in our key regions worldwide. The events complement our upmarket and omnichannel goals by allowing us to tie our newest product launches with customer experience trends. We held our largest event so far in the series in May in New York, where we highlighted our Zendesk Suite and Zendesk Connect launches, and continued in London in June with the unveiling of our newest enterprise offerings. Other Future of Customer Experience conferences were held in Mexico City, Dallas, and Chicago. We’ve attracted more than 2,400 attendees so far, with events coming next to Sao Paulo, Singapore, and Melbourne in August and to Tokyo in October. Zendesk Shareholder Letter Q2 2018 - 6

Timeline % of Support MRR from Paid Customer Accounts with 100+ Support Agents Employee Count Timeline not to scale. Zendesk Shareholder Letter Q2 2018 - 7

Scaling for the Future Data Center Transitions Leadership Finally, we are progressing with our transition from co-located data centers to cloud infrastructure. We are scaling our company for the future by We’re now at the stage where we’ve started investing in our people, product infrastructure, moving some of our largest customers. We and processes. Hiring, developing, and retaining anticipate completing the full transition by the end talented employees is critical to our growth, and of this year. Our investments in cloud services- we sought a leader for our first Chief People based infrastructure ensure Zendesk maintains Officer who has deep experience helping large flexibility and agility as it scales to meet the companies scale. InaMarie is a strategic and requirements of our largest customers. visionary leader with a 24-year track record in growing large global teams. Most recently she was Senior Vice President and Chief Human Resources Officer at Plantronics, and held earlier leadership roles at UTi Worldwide and Honeywell. InaMarie will oversee Zendesk’s human resources, talent acquisition, and workplace experience functions. EMEA Headquarters In July, we made our biggest investment in an office outside the U.S. with the opening of our new EMEA headquarters in Dublin. Since establishing a presence in Dublin in 2012, Zendesk has quickly become one of the fastest growing technology companies in that InaMarie Johnson region. The Dublin office is a regional hub for Chief People Officer product development and plays a central role in Zendesk’s global business strategy. In addition to sales and operational functions, the Dublin team spearheads Zendesk Talk and mobile products. Zendesk is a global company with 15 offices around the world. Zendesk Shareholder Letter Q2 2018 - 8

Customers Among the customers to join or expand with us recently are: AfterPay- An Australian-based retail payments company that facilitates commerce between retail merchants and their end-customers Bread of Life* - A Houston-based non-profit that provides assistance to thousands of citizens affected by Hurricane Harvey Casio - A leading manufacturer of consumer electronics products and business equipment solutions Groupe UP - Provides vouchers, cards, web platforms, and mobile applications focusing on employee benefits and public and social program management Hahn Air Lines GmbH - A German airline and a leading provider of distribution services for air, rail, and shuttle partners Henry Schein - A Fortune 500 provider of healthcare products and services to office-based dental, animal health, and medical practitioners Hungerstation - One of the largest online food delivery platforms in Saudi Arabia and Bahrain IDEX - A publicly-traded company engaged in the development, design, and manufacture of fluidics systems and specially engineered products Millicom International Cellular SA / tigo - An international telecommunications and media company serving over 50 million customers across Latin America and Africa Netflix - A top internet entertainment service that provides subscribers access to TV series, documentaries, and feature films across a wide variety of genres and languages Southern Phone Company - One of Australia’s leading providers of mobile phone, home phone, and broadband services Yandex Taxi - A major taxi booking service in Moscow and other cities across Russia and other countries. Zomato - A restaurant search and discovery app that provides information on one million restaurants across 23 countries *Bread of Life is a Zendesk sponsored account Zendesk Shareholder Letter Q2 2018 - 9

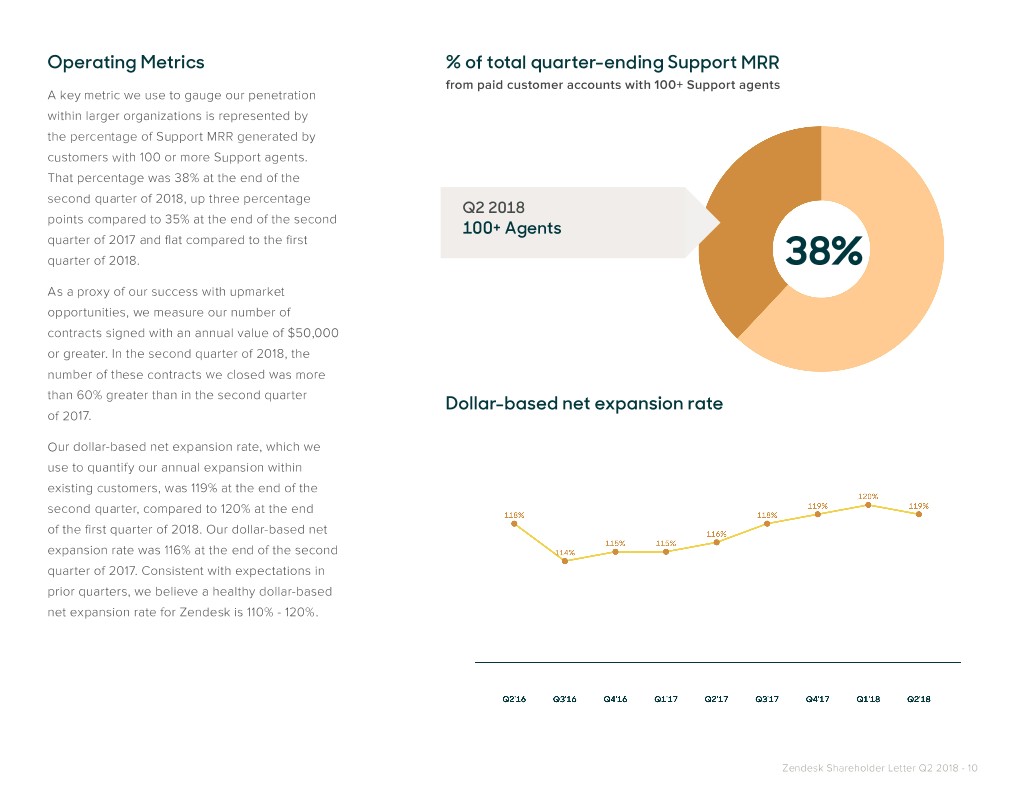

Operating Metrics % of total quarter-ending Support MRR from paid customer accounts with 100+ Support agents A key metric we use to gauge our penetration within larger organizations is represented by the percentage of Support MRR generated by customers with 100 or more Support agents. That percentage was 38% at the end of the second quarter of 2018, up three percentage Q2 2018 points compared to 35% at the end of the second 100+ Agents quarter of 2017 and flat compared to the first quarter of 2018. 38% As a proxy of our success with upmarket opportunities, we measure our number of contracts signed with an annual value of $50,000 or greater. In the second quarter of 2018, the number of these contracts we closed was more than 60% greater than in the second quarter Dollar-based net expansion rate of 2017. Our dollar-based net expansion rate, which we use to quantify our annual expansion within existing customers, was 119% at the end of the second quarter, compared to 120% at the end of the first quarter of 2018. Our dollar-based net expansion rate was 116% at the end of the second quarter of 2017. Consistent with expectations in prior quarters, we believe a healthy dollar-based net expansion rate for Zendesk is 110% - 120%. Zendesk Shareholder Letter Q2 2018 - 10

Community and Culture Corporate social responsibility (CSR) has long been an important part of Zendesk’s culture and brand, and we believe it is gaining even more significance to our business. We view CSR as a critical way to build greater Bread of Life, Inc. is a Houston based non-profit that provides empathy among our employees and increase their engagement both with assistance to thousands of citizens affected by Hurricane Harvey in our community and their work. We focus our community volunteering 2017. In the aftermath of the hurricane, Bread of Life has used Zendesk on addressing poverty, bridging the digital divide, and building diverse to steadfastly help thousands of people get the assistance they and inclusive communities. In addition to helping others, we believe that desperately need. Their agents use Zendesk Support to process the volunteering in our communities can provide employees new perspective various requests from FEMA and the Red Cross, and to communicate and the ability to develop creative solutions for diverse situations and the availability of items that have been donated by organizations people. At Zendesk, we celebrate diversity and inclusion, and recognize that around the country. So far, agents have been able to quickly, we serve a global base of diverse customers. effectively, and empathically process greater than 4000 requests for 2200 people. In the second quarter, Zendesk employees invested more than 3,000 hours in community engagement and volunteering through Zendesk programs. Zendesk renewed its commitment to this organization in 2018. We In addition to volunteering in our local communities, we also volunteered provided new features and products such as Guide and the web in communities where we host Future of Customer Experience events. For widget along with the expertise on implementing and using them. By example, while in Chicago for our event, we volunteered with Year Up, an implementing a robust self-service offering, Bread of Life has been organization helping young adults gain the necessary skills for employment. able to scale, while maintaining outstanding support. Employees offered their expertise to young job seekers to help them on their career path. As part of the launch of Dublin as our EMEA headquarters, Zendesk launched a new program with Teen-Turn to provide internship opportunities for young women. Teen-Turn provides teen girls the opportunity to gain hands-on technology experience through after-school activities and through two-week summer work placements in technology career environments. In the month of June, we celebrated Pride month. We continue our tradition of participating in Pride festivities with nearly all of our global offices taking part in local events. Additionally, The Zendesk Neighbor Foundation provided grants to the Gay Men’s Chorus in San Francisco, Dublin, and London. Zendesk Shareholder Letter Q2 2018 - 11

Select Financial Measures (In millions, except per share data) Three Months Ended June 30 March 31 June 30 Comments 2018 2018 2017 *As Adjusted GAAP results Strong results across regions and balanced growth between SMB and enterprise drove solid revenue growth of 39%. Revenue $ 141.9 $ 129.8 $ 102.1 Introduction of Zendesk Suite was received positively and its initial performance indicates strong demand. Gross margin for 2018 will continue to be negatively Gross margin 68.9% 69.9% 70.0% impacted--by approximately 100bps--as we transition services from our co-located data centers to cloud infrastructure. We anticipate completing the migration by year end. Operating loss $ (33.6) $ (33.6) $ (27.5) Improved approximately 220 bps q/q and 320 bps y/y largely Operating margin -23.7% -25.9% -26.9% due to scale as revenue growth outpaced operating expense growth and more than offset gross margin pressures. Non-GAAP results Gross margin for 2018 will continue to be negatively impacted--by approximately 100bps--as we transition services Non-GAAP gross margin 72.2% 73.2% 73.5% from our co-located data centers to cloud infrastructure. We anticipate completing the migration by year end. Optimization of cloud infractructure in 2019 is a key priority. Non-GAAP operating loss $ (2.0) $ (3.0) $ (3.3) Improved approximately 90 bps q/q and 180 bps y/y largely Non-GAAP operating margin -1.4% -2.3% -3.2% due to scale as revenue growth outpaced operating expense growth and more than offset declines in gross margin. *All numbers reflect ASC 606. *Quarter-over-quarter comparisons (q/q) are for the three months ended June 30, 2018 compared to the three months ended March 31, 2018. *Year-over-year comparisons (y/y) are for the three months ended June 30, 2018 compared to the three months ended June 30, 2017. Zendesk Shareholder Letter Q2 2018 - 12

Select Financial Measures (In millions, except per share data) Three Months Ended June 30 Comments June 30 March 31 2018 2018 2017 *As Adjusted Other financial measures Net cash provided by operating activities $ 23.7 $ 16.2 $ 10.3 Net cash provided by operating activities, less purchases of Free cash flow (non-GAAP) $ 8.7 $ 7.1 $ 4.3 property and equipment and internal-use software development costs. Increased in 2018 largely due to issuance of $575 million in Cash and cash equivalents $ 492.8 $ 609.2 $ 102.8 convertible notes, net of issuance costs. Increased in 2018 driven by purchases of marketable securities, Marketable securities $ 380.3 $ 250.5 $ 206.0 funded primarily by proceeds from convertible notes noted above. Non-GAAP results exclude the following Increased q/q and y/y largely due to higher headcount, higher stock Share-based compensation and related expenses $ 30.2 $ 29.2 $ 22.3 price, and timing of awards. Amortization of purchased intangibles $ 0.7 $ 0.7 $ 1.0 *All numbers reflect ASC 606. *Quarter-over-quarter comparisons (q/q) are for the three months ended June 30, 2018 compared to the three months ended March 31, 2018. *Year-over-year comparisons (y/y) are for the three months ended June 30, 2018 compared to the three months ended June 30, 2017. Zendesk Shareholder Letter Q2 2018 - 13

Guidance We have not reconciled free cash flow guidance to net cash from operating For the quarter ending September 30, 2018, we expect to report: activities for the full year 2018 because we do not provide guidance on the • Revenue in the range of $150.0-152.0 million reconciling items between net cash from operating activities and free cash • GAAP operating income (loss) in the range of $(31.0) - (33.0) million, which flow, as a result of the uncertainty regarding, and the potential variability includes share-based compensation and related expenses of approximate- of, these items. The actual amount of such reconciling items will have a ly $33.7 million, amortization of purchased intangibles of approximately significant impact on our free cash flow and, accordingly, a reconciliation of $0.7 million, and acquisition-related expenses of approximately $0.6 million net cash from operating activities to free cash flow for the full year 2018 is • Non-GAAP operating income (loss) in the range of $2.0 - 4.0 million, which not available without unreasonable effort. excludes share-based compensation and related expenses of approxi- mately $33.7 million, amortization of purchased intangibles of approximate- Zendesk’s estimates of share-based compensation and related expenses, ly $0.7 million, and acquisition-related expenses of approximately $0.6 amortization of purchased intangibles, acquisition-related expenses, million weighted average shares outstanding, and free cash flow in future periods • Approximately 106.4 million weighted average shares outstanding (basic) assume, among other things, the occurrence of no additional acquisitions, • Approximately 113.2 million weighted average shares outstanding (diluted) investments or restructurings, and no further revisions to share-based compensation and related expenses. For the full year 2018, we expect to report: • Revenue in the range of $582.0-586.0 million • GAAP operating income (loss) in the range of $(130.0) - (135.0) million, which includes share-based compensation and related expenses of ap- proximately $129.7 million, amortization of purchased intangibles of approx- imately $2.7 million, and acquisition-related expenses of approximately $2.6 million • Non-GAAP operating income (loss) in the range of $0.0 - 5.0 million, which excludes share-based compensation and related expenses of approxi- mately $129.7 million, amortization of purchased intangibles of approxi- mately $2.7 million, and acquisition-related expenses of approximately $2.6 million • Approximately 105.8 million weighted average shares outstanding (basic) • Approximately 113.3 million weighted average shares outstanding (diluted) • Free cash flow in the range of $28.0 - 30.0 million Zendesk Shareholder Letter Q2 2018 - 14

Three Months Ended Six Months Ended Condensed consolidated June 30, June 30, statements of operations 2018 2017 2018 2017 *As Adjusted *As Adjusted (In thousands, except per Revenue $141,882 $102,096 $271,673 $195,984 share data; unaudited) Cost of revenue 44,160 30,663 83,216 58,770 Gross profit 97,722 71,433 188,457 137,214 Operating expenses: Research and development 37,624 28,698 74,708 55,154 Sales and marketing 69,450 50,412 134,508 96,681 General and administrative 24,245 19,788 46,452 38,105 Total operating expenses 131,319 98,898 255,668 189,940 Operating loss (33,597) (27,465) (67,211) (52,726) Other income (expense), net Interest income 3,826 827 5,344 1,540 Interest expense (6,289) — (7,053) — Other income (expense), net 27 (319) 272 (814) Total other income (expense), net (2,436) 508 (1,437) 726 Loss before benefit from income taxes (36,033) (26,957) (68,648) (52,000) Benefit from income taxes (1,667) (690) (4,957) (652) Net loss $(34,366) $(26,267) $(63,691) $(51,348) Net loss per share, basic and diluted $(0.33) $(0.26) $(0.61) $(0.52) Weighted-average shares used to compute net loss per share, basic and diluted 105,000 99,506 104,350 98,545 *Adjusted to reflect adoption of ASC 606 Zendesk Shareholder Letter Q2 2018 - 15

June 30, December 31, 2018 2017 *As adjusted Condensed consolidated Assets balance sheets Current assets: Cash and cash equivalents $492,752 $109,370 (In thousands, except par Marketable securities 191,503 137,576 value; unaudited) Accounts receivable, net of allowance for doubtful accounts of $2,478 and $1,252 as of June 30, 2018 and December 31, 2017, 69,419 57,096 respectively Deferred costs 19,335 15,771 Prepaid expenses and other current assets 31,170 24,165 Total current assets 804,179 343,978 Marketable securities, noncurrent 188,770 97,447 Property and equipment, net 69,426 59,157 Deferred costs, noncurrent 20,250 15,395 Goodwill and intangible assets, net 65,647 67,034 Other assets 10,813 8,359 Total assets $1,159,085 $591,370 Liabilities and stockholders’ equity Current liabilities: Accounts payable $14,229 $5,307 Accrued liabilities 39,481 21,876 Accrued compensation and related benefits 33,612 29,017 Deferred revenue 206,456 173,147 Total current liabilities 293,778 229,347 Convertible senior notes, net 446,060 — Deferred revenue, noncurrent 1,504 1,213 Other liabilities 12,877 6,626 Total liabilities 754,219 237,186 Stockholders’ equity: Preferred stock, par value $0.01 per share — — Common stock, par value $0.01 per share 1,056 1,031 Additional paid-in capital 871,343 753,568 Accumulated other comprehensive loss (5,799) (2,372) Accumulated deficit (461,734) (398,043) *Adjusted to reflect adoption of ASC 606 Total stockholders’ equity 404,866 354,184 Total liabilities and stockholders’ equity $1,159,085 $591,370

Three Months Ended June 30, 2018 2017 Condensed consolidated *As adjusted statements of cash flows Cash flows from operating activities (In thousands; unaudited) Net loss $(34,366) $(26,267) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 8,798 8,209 Share-based compensation 28,148 20,945 Amortization of deferred costs 5,020 3,419 Amortization of debt discount and issuance costs 5,930 - Other 2,048 (338) Changes in operating assets and liabilities: Accounts receivable (17,587) (2,303) Prepaid expenses and other current assets (4,061) (2,473) Deferred costs (10,536) (5,507) Other assets and liabilities 2,716 (3,072) Accounts payable 9,214 1,851 Accrued liabilities 590 1,664 Accrued compensation and related benefits 5,091 3,990 Deferred revenue 22,691 10,177 Net cash provided by operating activities 23,696 10,295 Cash flows from investing activities Purchases of property and equipment (13,228) (4,485) Internal-use software development costs (1,817) (1,463) Purchases of marketable securities (170,690) (41,567) Proceeds from maturities of marketable securities 39,317 30,032 Proceeds from sales of marketable securities 1,866 12,141 Cash paid for the acquisition of Outbound, net of cash acquired — (16,470) Net cash used in investing activities (144,552) (21,812) Cash flows from financing activities Issuance costs related to convertible senior notes (570) - Proceeds from exercises of employee stock options 3,554 3,486 Proceeds from employee stock purchase plan 4,853 3,295 Other (3,128) (1,609) Net cash provided by financing activities 4,709 5,172 Effect of exchange rate changes on cash, cash equivalents and restricted cash (1) 81 Net decrease in cash, cash equivalents and restricted cash (116,148) (6,264) Cash, cash equivalents and restricted cash at the beginning of period 610,545 110,776 Cash, cash equivalents and restricted cash at the end of period $494,397 $104,512 *Adjusted to reflect adoption of ASC 606 and ASU 2016-18 Zendesk Shareholder Letter Q2 2018 - 17

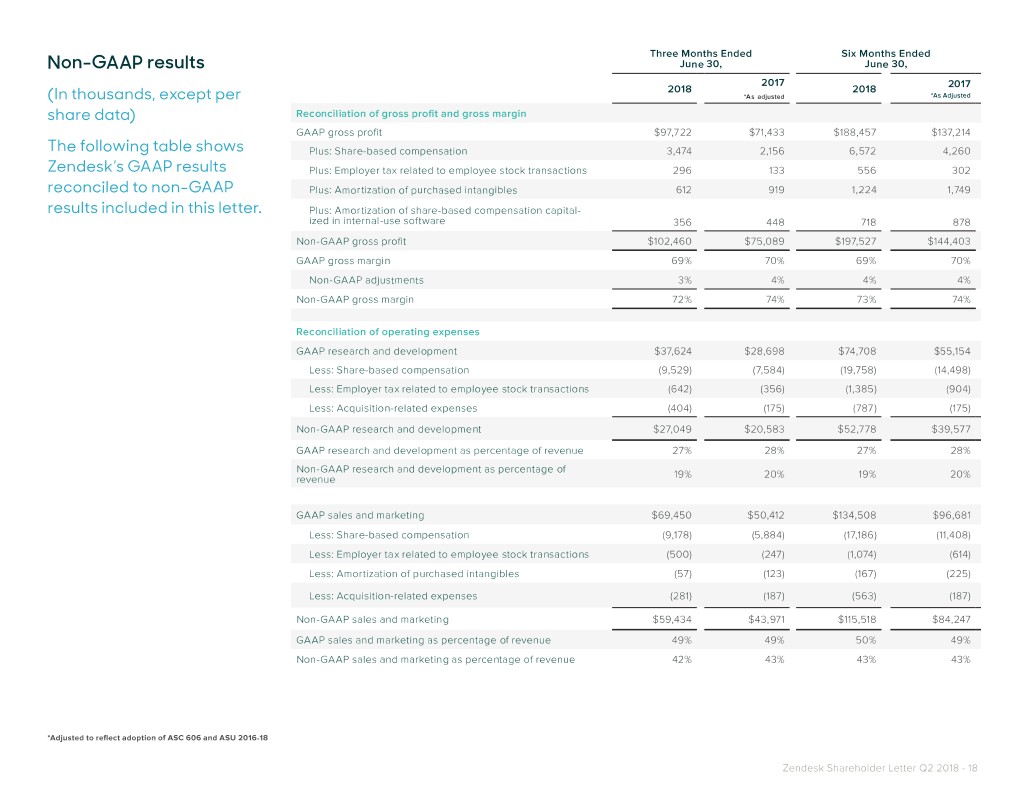

Three Months Ended Six Months Ended Non-GAAP results June 30, June 30, 2017 2018 2018 2017 (In thousands, except per *As adjusted *As Adjusted share data) Reconciliation of gross profit and gross margin GAAP gross profit $97,722 $71,433 $188,457 $137,214 The following table shows Plus: Share-based compensation 3,474 2,156 6,572 4,260 Zendesk’s GAAP results Plus: Employer tax related to employee stock transactions 296 133 556 302 reconciled to non-GAAP Plus: Amortization of purchased intangibles 612 919 1,224 1,749 results included in this letter. Plus: Amortization of share-based compensation capital- ized in internal-use software 356 448 718 878 Non-GAAP gross profit $102,460 $75,089 $197,527 $144,403 GAAP gross margin 69% 70% 69% 70% Non-GAAP adjustments 3% 4% 4% 4% Non-GAAP gross margin 72% 74% 73% 74% Reconciliation of operating expenses GAAP research and development $37,624 $28,698 $74,708 $55,154 Less: Share-based compensation (9,529) (7,584) (19,758) (14,498) Less: Employer tax related to employee stock transactions (642) (356) (1,385) (904) Less: Acquisition-related expenses (404) (175) (787) (175) Non-GAAP research and development $27,049 $20,583 $52,778 $39,577 GAAP research and development as percentage of revenue 27% 28% 27% 28% Non-GAAP research and development as percentage of revenue 19% 20% 19% 20% GAAP sales and marketing $69,450 $50,412 $134,508 $96,681 Less: Share-based compensation (9,178) (5,884) (17,186) (11,408) Less: Employer tax related to employee stock transactions (500) (247) (1,074) (614) Less: Amortization of purchased intangibles (57) (123) (167) (225) Less: Acquisition-related expenses (281) (187) (563) (187) Non-GAAP sales and marketing $59,434 $43,971 $115,518 $84,247 GAAP sales and marketing as percentage of revenue 49% 49% 50% 49% Non-GAAP sales and marketing as percentage of revenue 42% 43% 43% 43% *Adjusted to reflect adoption of ASC 606 and ASU 2016-18 Zendesk Shareholder Letter Q2 2018 - 18

(continued...) Three Months Ended Six Months Ended June 30, June 30, Non-GAAP results 2018 2017 2018 2017 (In thousands, except per *As adjusted *As Adjusted share data) GAAP general and administrative $24,245 $19,788 $46,452 $38,105 Less: Share-based compensation (5,967) (5,321) (11,619) (9,883) The following table shows Less: Employer tax related to employee stock transactions (282) (133) (589) (403) Zendesk’s GAAP results Less: Acquisition-related expenses — (522) — (522) reconciled to non-GAAP Non-GAAP general and administrative $17,996 $13,812 $34,244 $27,297 GAAP general and administrative as percentage of revenue 17% 19% 17% 19% results included in this letter. Non-GAAP general and administrative as percentage of revenue 13% 14% 13% 14% Reconciliation of operating loss and operating margin GAAP operating loss $(33,597) $(27,465) $(67,211) $(52,726) Plus: Share-based compensation 28,148 20,945 55,135 40,049 Plus: Employer tax related to employee stock transactions 1,720 869 3,604 2,223 Plus: Amortization of purchased intangibles 669 1,042 1,391 1,974 Plus: Acquisition-related expenses 685 884 1,350 884 Plus: Amortization of share-based compensation capitalized in internal-use software 356 448 718 878 Non-GAAP operating loss $(2,019) $(3,277) $(5,013) $(6,718) GAAP operating margin (24)% (27)% (25)% (27)% Non-GAAP adjustments 23% 24% 23% 24% Non-GAAP operating margin (1)% (3)% (2)% (3)% Reconciliation of net income (loss) GAAP net loss $(34,366) $(26,267) $(63,691) $(51,348) Plus: Share-based compensation 28,148 20,945 55,135 40,049 Plus: Employer tax related to employee stock transactions 1,720 869 3,604 2,223 Plus: Amortization of purchased intangibles 669 1,042 1,391 1,974 Plus: Acquisition-related expenses 685 884 1,350 884 Plus: Amortization of share-based compensation capitalized in internal-use software 356 448 718 878 Plus: Amortization of debt discount and issuance costs 5,930 — 6,650 — Non-GAAP net income (loss) $3,142 $(2,079) $5,157 $(5,340) *Adjusted to reflect adoption of ASC 606 Zendesk Shareholder Letter Q2 2018 - 19

(continued...) Three Months Ended Six Months Ended June 30, June 30, 2018 2017 2018 2017 Non-GAAP results *As Adjusted *As Adjusted (In thousands, except per Reconciliation of net income (loss) per share, basic share data) GAAP net loss per share, basic $(0.33) $(0.26) $(0.61) $(0.52) Non-GAAP adjustments to net loss 0.36 0.24 0.66 0.47 The following table shows Non-GAAP net income (loss) per share, basic $0.03 $(0.02) $0.05 $(0.05) Zendesk’s GAAP results reconciled to non-GAAP Reconciliation of net income (loss) per share, diluted results included GAAP net loss per share, diluted $(0.33) $(0.26) $(0.61) $(0.52) in this letter. Non-GAAP adjustments to net loss 0.36 0.24 0.66 0.47 Non-GAAP net income (loss) per share, diluted $0.03 $(0.02) $0.05 $(0.05) Weighted-average shares used in GAAP per share calculation, 105,000 99,506 104,350 98,545 basic and diluted Weighted-average shares used in non-GAAP per share calculation Basic 105,000 99,506 104,350 98,545 Diluted 111,725 99,506 110,300 98,545 Computation of free cash flow Net cash provided by operating activities $23,696 $10,295 $39,938 $17,577 Less: purchases of property and equipment (13,228) (4,485) (20,036) (9,276) Less: internal-use software development costs (1,817) (1,463) (4,161) (3,315) Free cash flow $8,651 $4,347 $15,741 $4,986 *Adjusted to reflect adoption of ASC 606 Zendesk Shareholder Letter Q2 2018 - 20

About Zendesk About Non-GAAP Financial Measures The best customer experiences are built with Zendesk. Zendesk’s powerful and flexible To provide investors and others with additional information regarding Zendesk’s results, the customer service and engagement platform scales to meet the needs of any business, following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross from startups and small businesses to growth companies and enterprises. Zendesk serves margin, non-GAAP operating expenses, non-GAAP operating income (loss) and operating businesses across a multitude of industries, with more than 125,000 paid customer accounts margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, basic and dilut- offering service and support in more than 30 languages. Headquartered in San Francisco, ed, and free cash flow. Zendesk operates worldwide with 15 offices in North America, Europe, Asia, Australia, and South America. Learn more at www.zendesk.com. Specifically, Zendesk excludes the following from its historical and prospective non-GAAP financial measures, as applicable: Forward-Looking Statements Share-based Compensation and Amortization of Share-based Compensation Capitalized This Shareholder Letter contains forward-looking statements, including, among other things, in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain statements regarding Zendesk’s future financial performance, its continued investment to employees. It is principally aimed at aligning their interests with those of its stockholders grow its business, and progress towards its long-term financial objectives. The words such as and at long-term retention, rather than to address operational performance for any particular “may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases period. As a result, share-based compensation expenses vary for reasons that are generally that denote future expectation or intent regarding Zendesk’s financial results, operations, and unrelated to financial and operational performance in any particular period. other matters are intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer taxes related to its employee stock transactions as an expense that is dependent The outcome of the events described in these forward-looking statements is subject to on its stock price, employee exercise and other award disposition activity, and other factors known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock results, performance, or achievements to differ materially, including (i) adverse changes in transactions vary for reasons that are generally unrelated to financial and operational perfor- general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang- mance in any particular period. ing market dynamics and customer preferences or achieve increased market acceptance of its products; (iii) Zendesk’s ability to effectively expand its sales capabilities, (iv) Zendesk’s Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible ability to effectively market and sell its products to larger enterprises, (v) Zendesk’s expec- assets, including the amortization of the cost associated with an acquired entity’s developed tation that the future growth rate of its revenues will decline, and that, as its costs increase, technology, as items arising from pre-acquisition activities determined at the time of an Zendesk may not be able to generate sufficient revenues to achieve or sustain profitability; acquisition. While these intangible assets are evaluated for impairment regularly, amortization (vi) the market in which Zendesk operates is intensely competitive, and Zendesk may not of the cost of purchased intangibles is an expense that is not typically affected by operations compete effectively; (vii) the development of the market for software as a service business during any particular period. software applications; (viii) Zendesk’s ability to introduce and market new products and to Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transac- support its products on a shared services platform; (ix) Zendesk’s ability to integrate acquired tion costs, integration costs, restructuring costs, and acquisition-related retention payments, businesses and technologies successfully or achieve the expected benefits of such acqui- including amortization of acquisition-related retention payments capitalized in internal-use sitions; (x) Zendesk’s ability to effectively manage its growth and organizational change; (xi) software, as events that are not necessarily reflective of operational performance during breaches in Zendesk’s security measures or unauthorized access to its customers’ data; (xii) a period. In particular, Zendesk believes the consideration of measures that exclude such service interruptions or performance problems associated with Zendesk’s technology and in- expenses can assist in the comparison of operational performance in different periods which frastructure; (xiii) real or perceived errors, failures, or bugs in its products; and (xiv) Zendesk’s may or may not include such expenses. substantial reliance on its customers renewing their subscriptions and purchasing additional Amortization of Debt Discount and Issuance Costs: In March 2018, Zendesk issued $575 subscriptions. million of convertible senior notes due in 2023, which bear interest at an annual fixed rate of The forward-looking statements contained in this press release are also subject to additional 0.25%. The imputed interest rate of the convertible senior notes was approximately 5.26%. risks, uncertainties, and factors, including those more fully described in Zendesk’s filings This is a result of the debt discount recorded for the conversion feature that is required to with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q be separately accounted for as equity, and debt issuance costs, which reduce the carrying for the quarter ended March 31, 2018. Further information on potential risks that could affect value of the convertible debt instrument. The debt discount is amortized as interest expense actual results will be included in the subsequent periodic and current reports and other filings together with the issuance costs of the debt. The expense for the amortization of debt that Zendesk makes with the Securities and Exchange Commission from time to time, includ- discount and debt issuance costs is a non-cash item, and we believe the exclusion of this ing its Quarterly Report on Form 10-Q for the quarter ended June 30, 2018. interest expense will provide for a more useful comparison of our operational performance in Forward-looking statements represent Zendesk’s management’s beliefs and assumptions different periods. only as of the date such statements are made. Zendesk undertakes no obligation to update Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from any forward-looking statements made in this press release to reflect events or circumstances operating activities, less purchases of property and equipment and internal-use software after the date of this press release or to reflect new information or the occurrence of unantici- development costs. Zendesk uses free cash flow, among other measures, to evaluate the pated events, except as required by law. ability of its operations to generate cash that is available for purposes other than capital expenditures and capitalized software development costs. Zendesk believes that informa- tion regarding free cash flow provides investors with an important perspective on the cash available to fund ongoing operations. Zendesk Shareholder Letter Q2 2018 - 21

Zendesk has not reconciled free cash flow guidance to net cash from operating activities for formation that would need to be added or subtracted from the non-GAAP measure to arrive the year ending December 31, 2018 because Zendesk does not provide guidance on the at the most directly comparable GAAP measure. Investors are encouraged to review the re- reconciling items between net cash from operating activities and free cash flow, as a result lated GAAP financial measures and the reconciliation of these non-GAAP financial measures of the uncertainty regarding, and the potential variability of, these items. The actual amount to their most directly comparable GAAP financial measure as detailed above. of such reconciling items will have a significant impact on Zendesk’s free cash flow and, Non-GAAP gross margin for the first quarter of 2018 excludes $3.7 million in share-based accordingly, a reconciliation of net cash from operating activities to free cash flow for the year compensation and related expenses (including $0.4 million of amortization of share-based ending December 31, 2018 is not available without unreasonable effort. compensation capitalized in internal-use software and $0.3 million of employer tax related Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to to employee stock transactions), and $0.6 million of amortization of purchased intangibles. GAAP operating margin for future periods beyond the current fiscal year because Zendesk Non-GAAP operating loss and non-GAAP operating margin for the first quarter of 2018 does not provide guidance on the reconciling items between GAAP operating margin and exclude $29.2 million in share-based compensation and related expenses (including $1.9 non-GAAP operating margin for such periods, as a result of the uncertainty regarding, and million of employer tax related to employee stock transactions and $0.4 million of amortiza- the potential variability of, these items. The actual amount of such reconciling items will have tion of share-based compensation capitalized in internal-use software), $0.7 million of acqui- a significant impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconcili- sition-related expenses, and $0.7 million of amortization of purchased intangibles. Free cash ation of GAAP operating margin to non-GAAP operating margin guidance for such periods is flow for the first quarter of 2018 includes cash used for purchases of property and equipment not available without unreasonable effort. of $6.8 million and internal-use software development costs of $2.3 million. Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include About Operating Metrics adjustments to its expectations for its GAAP gross margin that exclude share-based com- Zendesk reviews a number of operating metrics to evaluate its business, measure per- pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased formance, identify trends, formulate business plans, and make strategic decisions. These intangibles related to developed technology. The share-based compensation and related include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its expenses excluded due to such adjustments are primarily comprised of the share-based other products, dollar-based net expansion rate, monthly recurring revenue represented by compensation and related expenses for employees associated with Zendesk’s infrastructure its churned customers, and the percentage of its monthly recurring revenue from Support and customer experience organization. originating from customers with 100 or more agents on Support. Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP Zendesk defines the number of paid customer accounts at the end of any particular period gross margin for future periods because Zendesk does not provide guidance on the rec- as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the trials, or other free services, (ii) the number of accounts using Chat, exclusive of free trials uncertainty regarding, and the potential variability of, these items. The actual amount of such or other free services, and (iii) the number of accounts on all of its other products, exclusive reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and, of free trials and other free services, each as of the end of the period and as identified by a accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for unique account identifier. In the quarter ended June 30, 2018, Zendesk began to offer an the period is not available without unreasonable effort. omnichannel subscription, which provides access to multiple products through a single paid Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for customer account, Zendesk Suite. All of the Suite paid customer accounts are included in the internal planning and forecasting purposes. Zendesk’s management does not itself, nor does number of accounts on all of Zendesk’s other products and are not included in the number it suggest that investors should, consider such non-GAAP financial measures in isolation of paid customer accounts using Support or Chat. Other than usage of Zendesk’s products from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk through its omnichannel subscription offering, the use of Support, Chat, and Zendesk’s presents such non-GAAP financial measures in reporting its financial results to provide inves- other products requires separate subscriptions and each of these accounts are treated as tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these a separate paid customer account. Existing customers may also expand their utilization of non-GAAP financial measures are useful because they allow for greater transparency with Zendesk’s products by adding new accounts and a single consolidated organization or cus- respect to key metrics used by management in its financial and operational decision-making. tomer may have multiple accounts across each of Zendesk’s products to service separate This allows investors and others to better understand and evaluate Zendesk’s operating subsidiaries, divisions, or work processes. Other than usage of Zendesk’s products through results and future prospects in the same manner as management. its omnichannel subscription offering, each of these accounts is also treated as a separate paid customer account. Zendesk’s management believes it is useful for itself and investors to review, as applicable, both GAAP information that may include items such as share-based compensation and relat- Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase ed expenses, amortization of debt discount and issuance costs, amortization of purchased revenue across its existing customer base through expansion of authorized agents asso- intangibles, and acquisition-related expenses, and the non-GAAP measures that exclude ciated with a paid customer account, upgrades in subscription plans, and the purchase of such information in order to assess the performance of Zendesk’s business and for planning additional products as offset by churn, contraction in authorized agents associated with a and forecasting in subsequent periods. When Zendesk uses such a non-GAAP financial paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net measure with respect to historical periods, it provides a reconciliation of the non-GAAP expansion rate is based upon monthly recurring revenue for a set of paid customer accounts financial measure to the most closely comparable GAAP financial measure. When Zendesk on its products. Monthly recurring revenue for a paid customer account is a legal and con- uses such a non-GAAP financial measure in a forward-looking manner for future periods, tractual determination made by assessing the contractual terms of each paid customer ac- and a reconciliation is not determinable without unreasonable effort, Zendesk provides the count, as of the date of determination, as to the revenue Zendesk expects to generate in the reconciling information that is determinable without unreasonable effort and identifies the in- Zendesk Shareholder Letter Q2 2018 - 22

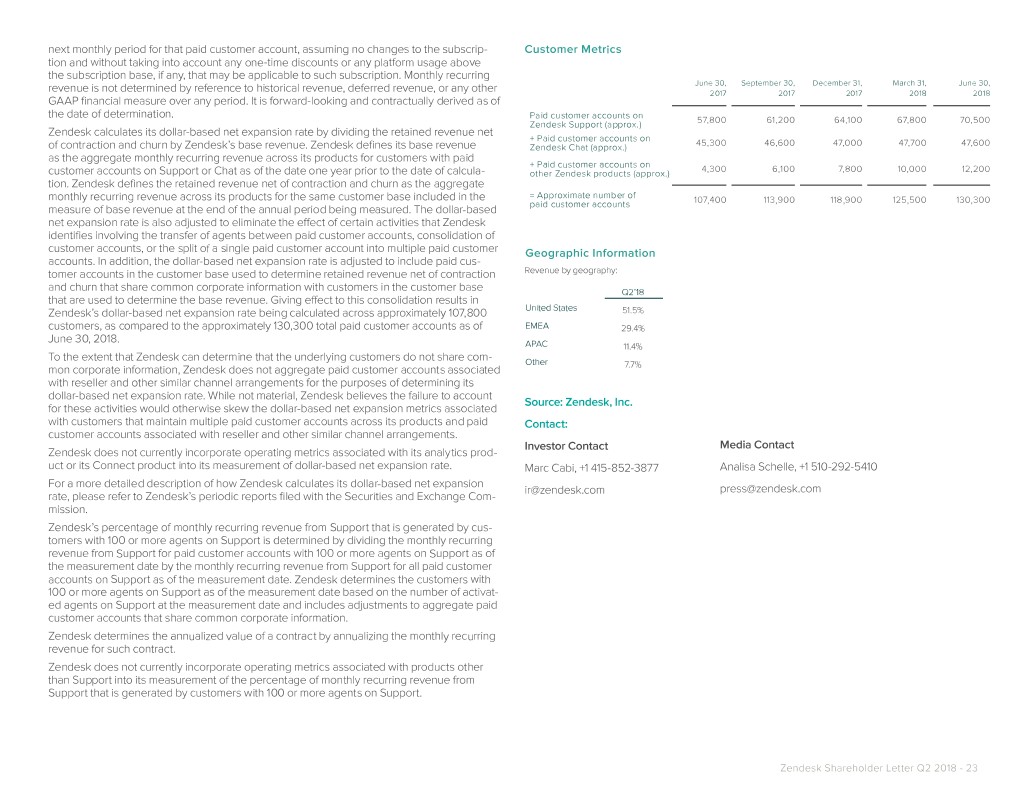

next monthly period for that paid customer account, assuming no changes to the subscrip- Customer Metrics tion and without taking into account any one-time discounts or any platform usage above the subscription base, if any, that may be applicable to such subscription. Monthly recurring June 30, September 30, December 31, March 31, June 30, revenue is not determined by reference to historical revenue, deferred revenue, or any other 2017 2017 2017 2018 2018 GAAP financial measure over any period. It is forward-looking and contractually derived as of the date of determination. Paid customer accounts on Zendesk Support (approx.) 57,800 61,200 64,100 67,800 70,500 Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net + Paid customer accounts on of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue Zendesk Chat (approx.) 45,300 46,600 47,000 47,700 47,600 as the aggregate monthly recurring revenue across its products for customers with paid + Paid customer accounts on 4,300 6,100 7,800 10,000 12,200 customer accounts on Support or Chat as of the date one year prior to the date of calcula- other Zendesk products (approx.) tion. Zendesk defines the retained revenue net of contraction and churn as the aggregate = Approximate number of monthly recurring revenue across its products for the same customer base included in the 107,400 113,900 118,900 125,500 130,300 measure of base revenue at the end of the annual period being measured. The dollar-based paid customer accounts net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk identifies involving the transfer of agents between paid customer accounts, consolidation of customer accounts, or the split of a single paid customer account into multiple paid customer Geographic Information accounts. In addition, the dollar-based net expansion rate is adjusted to include paid cus- tomer accounts in the customer base used to determine retained revenue net of contraction Revenue by geography: and churn that share common corporate information with customers in the customer base Q2’18 that are used to determine the base revenue. Giving effect to this consolidation results in Zendesk’s dollar-based net expansion rate being calculated across approximately 107,800 United States 51.5% customers, as compared to the approximately 130,300 total paid customer accounts as of EMEA 29.4% June 30, 2018. APAC 11.4% To the extent that Zendesk can determine that the underlying customers do not share com- Other mon corporate information, Zendesk does not aggregate paid customer accounts associated 7.7% with reseller and other similar channel arrangements for the purposes of determining its dollar-based net expansion rate. While not material, Zendesk believes the failure to account Source: Zendesk, Inc. for these activities would otherwise skew the dollar-based net expansion metrics associated with customers that maintain multiple paid customer accounts across its products and paid Contact: customer accounts associated with reseller and other similar channel arrangements. Investor Contact Media Contact Zendesk does not currently incorporate operating metrics associated with its analytics prod- uct or its Connect product into its measurement of dollar-based net expansion rate. Marc Cabi, +1 415-852-3877 Analisa Schelle, +1 510-292-5410 For a more detailed description of how Zendesk calculates its dollar-based net expansion ir@zendesk.com press@zendesk.com rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Com- mission. Zendesk’s percentage of monthly recurring revenue from Support that is generated by cus- tomers with 100 or more agents on Support is determined by dividing the monthly recurring revenue from Support for paid customer accounts with 100 or more agents on Support as of the measurement date by the monthly recurring revenue from Support for all paid customer accounts on Support as of the measurement date. Zendesk determines the customers with 100 or more agents on Support as of the measurement date based on the number of activat- ed agents on Support at the measurement date and includes adjustments to aggregate paid customer accounts that share common corporate information. Zendesk determines the annualized value of a contract by annualizing the monthly recurring revenue for such contract. Zendesk does not currently incorporate operating metrics associated with products other than Support into its measurement of the percentage of monthly recurring revenue from Support that is generated by customers with 100 or more agents on Support. Zendesk Shareholder Letter Q2 2018 - 23